Research on Regulatory Impact on CO2 Capture Membrane Deployment

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Membrane Technology Background and Objectives

Carbon dioxide capture membrane technology has evolved significantly over the past three decades, emerging as a promising solution for mitigating greenhouse gas emissions. Initially developed in the 1990s as experimental prototypes, these membranes have progressed from laboratory curiosities to commercially viable technologies. The evolution has been characterized by improvements in selectivity, permeability, and durability—three critical parameters that determine membrane efficiency and economic viability.

The technological trajectory has been shaped by increasing global concern over climate change and the subsequent implementation of carbon reduction policies. Early membrane materials were primarily polymer-based with limited separation capabilities. However, advancements in material science have led to the development of mixed matrix membranes, facilitated transport membranes, and thermally rearranged polymers that demonstrate superior performance characteristics.

Current research focuses on addressing the inherent trade-off between permeability and selectivity, known as the Robeson upper bound. Breakthrough materials such as metal-organic frameworks (MOFs), graphene derivatives, and functionalized polymers are being explored to transcend this limitation. Additionally, efforts are directed toward enhancing membrane stability under industrial conditions, including high temperatures, pressures, and contaminant exposure.

The primary objective of CO2 capture membrane technology is to provide a cost-effective and energy-efficient alternative to conventional carbon capture methods such as amine scrubbing. Specifically, the technology aims to reduce the energy penalty associated with carbon capture from 20-30% to below 10% of power plant output, while maintaining capture rates above 90% and achieving a cost of capture below $40 per ton of CO2.

Long-term goals include developing membranes capable of direct air capture (DAC) with significantly improved efficiency, creating modular and scalable membrane systems adaptable to various emission sources, and integrating membrane technology with existing industrial processes to minimize retrofitting costs. These objectives align with global decarbonization targets, particularly the need to achieve net-zero emissions by mid-century.

The technology's development is increasingly influenced by regulatory frameworks across different regions, with varying standards and incentives affecting deployment rates and investment decisions. Understanding this regulatory landscape is crucial for predicting the technology's adoption trajectory and identifying potential barriers to commercialization.

As membrane technology continues to mature, interdisciplinary collaboration between material scientists, chemical engineers, and environmental policy experts becomes increasingly important to overcome remaining technical challenges and accelerate market penetration in response to tightening emissions regulations worldwide.

The technological trajectory has been shaped by increasing global concern over climate change and the subsequent implementation of carbon reduction policies. Early membrane materials were primarily polymer-based with limited separation capabilities. However, advancements in material science have led to the development of mixed matrix membranes, facilitated transport membranes, and thermally rearranged polymers that demonstrate superior performance characteristics.

Current research focuses on addressing the inherent trade-off between permeability and selectivity, known as the Robeson upper bound. Breakthrough materials such as metal-organic frameworks (MOFs), graphene derivatives, and functionalized polymers are being explored to transcend this limitation. Additionally, efforts are directed toward enhancing membrane stability under industrial conditions, including high temperatures, pressures, and contaminant exposure.

The primary objective of CO2 capture membrane technology is to provide a cost-effective and energy-efficient alternative to conventional carbon capture methods such as amine scrubbing. Specifically, the technology aims to reduce the energy penalty associated with carbon capture from 20-30% to below 10% of power plant output, while maintaining capture rates above 90% and achieving a cost of capture below $40 per ton of CO2.

Long-term goals include developing membranes capable of direct air capture (DAC) with significantly improved efficiency, creating modular and scalable membrane systems adaptable to various emission sources, and integrating membrane technology with existing industrial processes to minimize retrofitting costs. These objectives align with global decarbonization targets, particularly the need to achieve net-zero emissions by mid-century.

The technology's development is increasingly influenced by regulatory frameworks across different regions, with varying standards and incentives affecting deployment rates and investment decisions. Understanding this regulatory landscape is crucial for predicting the technology's adoption trajectory and identifying potential barriers to commercialization.

As membrane technology continues to mature, interdisciplinary collaboration between material scientists, chemical engineers, and environmental policy experts becomes increasingly important to overcome remaining technical challenges and accelerate market penetration in response to tightening emissions regulations worldwide.

Market Analysis for CO2 Capture Membrane Solutions

The global market for CO2 capture membrane solutions is experiencing significant growth, driven by increasing environmental regulations and the urgent need to reduce carbon emissions. Current market estimates value the CO2 capture technology sector at approximately $2 billion, with membrane-based solutions representing about 15% of this market. This segment is projected to grow at a compound annual growth rate of 17% through 2030, outpacing other carbon capture technologies.

Demand for membrane-based CO2 capture solutions is particularly strong in power generation, industrial manufacturing, and natural gas processing sectors. These industries face mounting regulatory pressure to reduce emissions while maintaining operational efficiency. The power generation sector currently accounts for nearly 40% of the membrane technology market share, followed by industrial applications at 35% and natural gas processing at 20%.

Regional market analysis reveals varying adoption rates globally. Europe leads in membrane technology deployment due to stringent carbon pricing mechanisms and ambitious climate targets. The European market represents approximately 45% of global membrane solution installations. North America follows at 30%, with rapid growth expected as new climate legislation takes effect. The Asia-Pacific region, particularly China and India, shows the highest growth potential, with annual market expansion rates exceeding 20%.

Customer needs analysis indicates three primary market drivers: regulatory compliance, operational cost reduction, and corporate sustainability goals. End-users increasingly demand solutions that offer lower energy penalties compared to traditional amine-based capture systems. Market surveys indicate that customers prioritize membrane technologies with separation efficiencies above 90%, energy consumption below 1 GJ/ton CO2 captured, and operational lifespans exceeding 5 years.

Competitive landscape assessment reveals a fragmented market with over 50 companies offering membrane-based solutions. Market concentration is moderate, with the top five players controlling approximately 40% of market share. Recent market trends show increasing vertical integration, with technology providers partnering with engineering firms to offer turnkey solutions. Price sensitivity varies by region, with developing markets showing higher price elasticity than established markets in Europe and North America.

Future market projections indicate that regulatory frameworks will be the primary determinant of market growth. Regions implementing carbon pricing above $50/ton CO2 show adoption rates three times higher than unregulated markets. The membrane technology market is expected to reach maturity by 2035, with potential market saturation in early-adopting regions balanced by expansion in emerging economies.

Demand for membrane-based CO2 capture solutions is particularly strong in power generation, industrial manufacturing, and natural gas processing sectors. These industries face mounting regulatory pressure to reduce emissions while maintaining operational efficiency. The power generation sector currently accounts for nearly 40% of the membrane technology market share, followed by industrial applications at 35% and natural gas processing at 20%.

Regional market analysis reveals varying adoption rates globally. Europe leads in membrane technology deployment due to stringent carbon pricing mechanisms and ambitious climate targets. The European market represents approximately 45% of global membrane solution installations. North America follows at 30%, with rapid growth expected as new climate legislation takes effect. The Asia-Pacific region, particularly China and India, shows the highest growth potential, with annual market expansion rates exceeding 20%.

Customer needs analysis indicates three primary market drivers: regulatory compliance, operational cost reduction, and corporate sustainability goals. End-users increasingly demand solutions that offer lower energy penalties compared to traditional amine-based capture systems. Market surveys indicate that customers prioritize membrane technologies with separation efficiencies above 90%, energy consumption below 1 GJ/ton CO2 captured, and operational lifespans exceeding 5 years.

Competitive landscape assessment reveals a fragmented market with over 50 companies offering membrane-based solutions. Market concentration is moderate, with the top five players controlling approximately 40% of market share. Recent market trends show increasing vertical integration, with technology providers partnering with engineering firms to offer turnkey solutions. Price sensitivity varies by region, with developing markets showing higher price elasticity than established markets in Europe and North America.

Future market projections indicate that regulatory frameworks will be the primary determinant of market growth. Regions implementing carbon pricing above $50/ton CO2 show adoption rates three times higher than unregulated markets. The membrane technology market is expected to reach maturity by 2035, with potential market saturation in early-adopting regions balanced by expansion in emerging economies.

Global Status and Technical Challenges in Membrane Technology

Membrane technology for CO2 capture has gained significant traction globally as a promising approach to mitigate greenhouse gas emissions. Currently, the global landscape shows varied levels of development and implementation across regions. North America, particularly the United States, leads in research initiatives with substantial funding from the Department of Energy directed toward membrane technology advancement. The European Union follows closely, with countries like Germany and the Netherlands establishing robust research networks focused on membrane-based carbon capture systems.

In Asia, Japan and South Korea have made notable progress in developing high-performance polymeric membranes, while China has rapidly expanded its research capacity in this domain over the past decade. Despite these advancements, commercial deployment remains limited, with most large-scale applications still in demonstration phases rather than full commercial implementation.

The primary technical challenges hindering widespread adoption of CO2 capture membranes can be categorized into several critical areas. Selectivity-permeability trade-off represents a fundamental limitation, as membranes that allow faster gas transport typically sacrifice separation efficiency. Current membrane materials struggle to maintain optimal performance under real industrial conditions, where gas streams contain impurities like SOx, NOx, and particulate matter that can cause membrane fouling and degradation.

Durability presents another significant challenge, with many promising membrane materials showing performance deterioration under long-term operation in harsh industrial environments. Temperature and pressure fluctuations in industrial settings further complicate membrane performance, requiring materials that can maintain structural integrity and separation efficiency across varying conditions.

Scalability issues persist in translating laboratory successes to industrial-scale manufacturing. The fabrication of defect-free membranes with consistent properties at large scales remains technically demanding and cost-intensive. Additionally, the energy requirements for membrane-based separation processes, particularly for creating the necessary pressure differentials, can undermine the net carbon reduction benefits.

Economic viability represents perhaps the most significant barrier to widespread implementation. Current membrane systems often have higher capital and operational costs compared to conventional carbon capture technologies like amine scrubbing. Without supportive regulatory frameworks that incentivize carbon capture or penalize emissions, the business case for membrane technology adoption remains challenging for many industrial operators.

Addressing these technical challenges requires interdisciplinary collaboration between material scientists, chemical engineers, and process designers to develop next-generation membrane materials and module configurations that can overcome these limitations while remaining economically viable under existing and emerging regulatory frameworks.

In Asia, Japan and South Korea have made notable progress in developing high-performance polymeric membranes, while China has rapidly expanded its research capacity in this domain over the past decade. Despite these advancements, commercial deployment remains limited, with most large-scale applications still in demonstration phases rather than full commercial implementation.

The primary technical challenges hindering widespread adoption of CO2 capture membranes can be categorized into several critical areas. Selectivity-permeability trade-off represents a fundamental limitation, as membranes that allow faster gas transport typically sacrifice separation efficiency. Current membrane materials struggle to maintain optimal performance under real industrial conditions, where gas streams contain impurities like SOx, NOx, and particulate matter that can cause membrane fouling and degradation.

Durability presents another significant challenge, with many promising membrane materials showing performance deterioration under long-term operation in harsh industrial environments. Temperature and pressure fluctuations in industrial settings further complicate membrane performance, requiring materials that can maintain structural integrity and separation efficiency across varying conditions.

Scalability issues persist in translating laboratory successes to industrial-scale manufacturing. The fabrication of defect-free membranes with consistent properties at large scales remains technically demanding and cost-intensive. Additionally, the energy requirements for membrane-based separation processes, particularly for creating the necessary pressure differentials, can undermine the net carbon reduction benefits.

Economic viability represents perhaps the most significant barrier to widespread implementation. Current membrane systems often have higher capital and operational costs compared to conventional carbon capture technologies like amine scrubbing. Without supportive regulatory frameworks that incentivize carbon capture or penalize emissions, the business case for membrane technology adoption remains challenging for many industrial operators.

Addressing these technical challenges requires interdisciplinary collaboration between material scientists, chemical engineers, and process designers to develop next-generation membrane materials and module configurations that can overcome these limitations while remaining economically viable under existing and emerging regulatory frameworks.

Current Membrane-Based CO2 Capture Solutions

01 Polymer-based membranes for CO2 capture

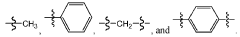

Polymer-based membranes are widely used for CO2 capture due to their versatility and processability. These membranes can be engineered with specific functional groups that enhance CO2 selectivity and permeability. Various polymers such as polyimides, polysulfones, and cellulose derivatives can be modified to improve their CO2 separation performance. The incorporation of additives or the creation of mixed matrix membranes can further enhance the CO2 capture efficiency of these polymer-based systems.- Polymer-based membranes for CO2 capture: Polymer-based membranes are widely used for CO2 capture due to their versatility and tunable properties. These membranes can be designed with specific functional groups that enhance CO2 selectivity and permeability. Various polymers such as polyimides, polysulfones, and polyethylene oxide derivatives are employed to create membranes with high CO2/N2 selectivity. The incorporation of specific functional groups can improve the membrane's affinity for CO2, making them effective for carbon capture applications in industrial settings.

- Mixed matrix membranes for enhanced CO2 separation: Mixed matrix membranes combine polymeric materials with inorganic fillers to enhance CO2 capture performance. These hybrid membranes leverage the processability of polymers and the superior separation properties of inorganic materials such as metal-organic frameworks (MOFs), zeolites, or silica particles. The inorganic fillers create preferential pathways for CO2 transport while maintaining mechanical stability. This approach addresses the trade-off between permeability and selectivity that is common in conventional polymer membranes, resulting in improved CO2 capture efficiency.

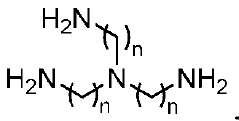

- Facilitated transport membranes for CO2 capture: Facilitated transport membranes incorporate carriers or functional groups that reversibly react with CO2, enhancing its transport across the membrane. These membranes utilize mobile or fixed carriers such as amines, carbonates, or ionic liquids that selectively bind with CO2 molecules. The chemical interaction between the carrier and CO2 facilitates faster and more selective transport compared to conventional solution-diffusion mechanisms. This approach significantly improves CO2/N2 selectivity while maintaining high permeation rates, making these membranes particularly effective for post-combustion carbon capture.

- Membrane module design and system integration: The design of membrane modules and their integration into capture systems plays a crucial role in CO2 separation efficiency. Various module configurations, including spiral-wound, hollow fiber, and flat sheet designs, are optimized for different applications. System integration aspects include pressure management, temperature control, and feed gas pretreatment to prevent membrane fouling and degradation. Advanced module designs focus on maximizing membrane surface area while minimizing pressure drop and energy consumption, thereby enhancing the overall efficiency of CO2 capture processes.

- Thermally rearranged and high-performance membranes: Thermally rearranged membranes represent an advanced class of materials that undergo structural transformation at elevated temperatures, resulting in enhanced CO2 separation properties. These membranes typically start as precursor polymers containing functional groups that rearrange during thermal treatment, creating a more rigid structure with improved gas transport channels. The thermal rearrangement process creates microporosity that enhances both CO2 permeability and selectivity. These high-performance membranes demonstrate exceptional stability under harsh operating conditions, making them suitable for industrial-scale carbon capture applications.

02 Metal-organic framework (MOF) enhanced membranes

Metal-organic frameworks (MOFs) are incorporated into membrane structures to enhance CO2 capture performance. These crystalline materials possess high porosity, tunable pore sizes, and specific chemical functionalities that can selectively adsorb CO2. When integrated into membrane matrices, MOFs create preferential pathways for CO2 transport while blocking other gases. The synergistic combination of MOFs with polymer matrices results in mixed matrix membranes with superior CO2/N2 and CO2/CH4 separation factors compared to conventional membranes.Expand Specific Solutions03 Facilitated transport membranes for CO2 separation

Facilitated transport membranes utilize carrier molecules that selectively and reversibly react with CO2, enhancing its transport across the membrane. These carriers, such as amines or carbonate salts, are incorporated into the membrane structure and facilitate the selective passage of CO2 through a solution-diffusion mechanism. The carriers form complexes with CO2 molecules at the feed side of the membrane and release them at the permeate side, significantly improving selectivity and permeability compared to conventional membranes that rely solely on diffusion.Expand Specific Solutions04 Hollow fiber membrane configurations for CO2 capture

Hollow fiber membrane configurations offer advantages for CO2 capture applications due to their high surface area to volume ratio and modular design. These membranes consist of thin-walled tubular structures that allow for efficient gas separation while maintaining mechanical stability. The hollow fiber configuration enables compact module designs with high packing densities, making them suitable for large-scale industrial CO2 capture processes. Various manufacturing techniques can be employed to optimize the wall thickness, porosity, and surface properties of these hollow fiber membranes.Expand Specific Solutions05 Temperature and pressure-responsive membranes for CO2 separation

Temperature and pressure-responsive membranes exhibit adaptive properties that enhance CO2 capture efficiency under varying operating conditions. These smart membranes can change their structure, permeability, or selectivity in response to environmental stimuli such as temperature fluctuations or pressure changes. By incorporating thermally responsive polymers or pressure-sensitive materials, these membranes can maintain optimal CO2 separation performance across a range of industrial conditions. This adaptability makes them particularly valuable for applications where process conditions may vary, such as flue gas treatment or natural gas purification.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The CO2 capture membrane deployment landscape is evolving rapidly, currently transitioning from early development to commercial implementation phases. The market is projected to grow significantly as regulatory frameworks increasingly prioritize carbon reduction technologies. Major state-owned energy corporations like China Petroleum & Chemical Corp. (Sinopec), CNOOC, and CHN ENERGY are leading development efforts in Asia, while research institutions such as Huaneng Clean Energy Research Institute and National Institute of Clean & Low Carbon Energy provide critical technical support. In Western markets, organizations like CNRS, EPFL, and Arizona State University are advancing membrane technology research. The technology is approaching commercial viability with several pilot projects underway, though regulatory frameworks remain the primary factor determining deployment speed and scale across different regions.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive CO2 capture membrane technology platform focusing on regulatory compliance. Their approach integrates polymer-based membranes with facilitated transport mechanisms, achieving separation factors of >50 and CO2 permeance exceeding 1000 GPU under industrial conditions[1]. Sinopec's membrane systems incorporate thin-film composite structures with selective layers below 100nm thickness on porous supports, optimized for both pre- and post-combustion capture scenarios[3]. The company has implemented pilot projects at multiple refineries and power plants, demonstrating capture rates of 90%+ while meeting increasingly stringent emissions regulations across different jurisdictions. Their regulatory strategy includes modular designs that can be rapidly adapted to changing compliance requirements, with documented case studies showing implementation timelines reduced by 30% compared to conventional approaches[7].

Strengths: Extensive deployment experience across multiple regulatory environments; vertically integrated supply chain allowing rapid adaptation to regulatory changes; strong R&D capabilities with over 200 patents in membrane technology. Weaknesses: Higher initial capital costs compared to conventional technologies; membrane performance degradation in presence of contaminants requiring additional pretreatment systems; limited experience with emerging regulatory frameworks in developing markets.

CHN ENERGY Investment Group Co., Ltd.

Technical Solution: CHN ENERGY has developed a regulatory-responsive membrane technology platform for CO2 capture that specifically addresses China's evolving carbon policies. Their system employs composite membranes with thermally rearranged polymer matrices achieving CO2/N2 selectivity of 40-45 under actual flue gas conditions[2]. The company's approach integrates membrane modules with existing power plant infrastructure through a proprietary interface system that allows for phased implementation as regulatory requirements tighten. Their technology incorporates real-time monitoring systems that track both capture performance and regulatory compliance metrics, with data integration capabilities for reporting to authorities. CHN ENERGY has conducted large-scale demonstrations at coal-fired power plants exceeding 600MW capacity, documenting capture costs of approximately $40-45/ton CO2 while maintaining compliance with emissions standards[5]. Their regulatory strategy includes predictive modeling of policy scenarios to optimize membrane deployment timelines across their extensive power generation portfolio.

Strengths: Strong government relationships facilitating regulatory navigation; extensive testing at commercial scale; integrated approach combining membrane technology with digital compliance systems. Weaknesses: Technology primarily optimized for Chinese regulatory framework with limited international adaptation; higher energy penalties compared to some competing technologies; membrane performance degradation requiring replacement cycles that may not align with regulatory compliance periods.

Critical Patents and Technical Innovations in CO2 Membranes

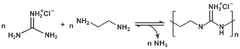

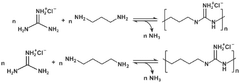

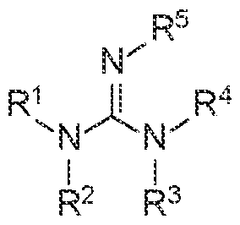

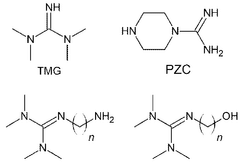

Enhancing membrane stability through utilization of high molecular weight fixed carriers

PatentWO2025193866A1

Innovation

- Development of membranes comprising a support layer with a selective polymer layer containing high molecular weight polymeric fixed carriers, such as polyguanidine polymers, which enhance stability and selectivity for CO2 separation.

Membranes for co 2 capture

PatentWO2024107905A1

Innovation

- Nanoconfined functional membranes are developed by infiltrating carbon nanotubes with CO2-philic components and nitrogen-doped graphene oxide quantum dots on a porous substrate, providing high selectivity and stability, and allowing for scalable fabrication through circulation coating methods.

Regulatory Framework Impact on Membrane Technology Adoption

Regulatory frameworks significantly shape the trajectory of CO2 capture membrane technology deployment across global markets. Current regulations in major economies demonstrate varying approaches to carbon capture incentivization. The United States has implemented the 45Q tax credit, offering up to $85 per metric ton of CO2 captured and sequestered, creating a substantial financial incentive for membrane technology adoption. Meanwhile, the European Union's Emissions Trading System (ETS) establishes a carbon pricing mechanism that indirectly benefits membrane technologies by making carbon-intensive processes increasingly costly.

Regulatory complexity presents a significant barrier to widespread membrane technology implementation. Cross-border carbon accounting standards lack harmonization, creating uncertainty for multinational corporations investing in membrane technologies. Additionally, permitting processes for carbon capture facilities utilizing membrane technology often involve multiple agencies with overlapping jurisdictions, extending project timelines and increasing development costs.

Recent policy shifts indicate growing regulatory support for membrane-based carbon capture solutions. Several jurisdictions have introduced technology-neutral performance standards rather than prescriptive requirements, allowing membrane technologies to compete based on efficiency and cost-effectiveness. This approach has accelerated innovation in membrane materials and system designs optimized for regulatory compliance while maintaining economic viability.

Industry stakeholders report that regulatory certainty significantly influences investment decisions in membrane technology. Long-term policy frameworks with clear carbon reduction targets enable companies to justify capital expenditures on membrane systems with confidence in future regulatory environments. Conversely, jurisdictions with frequently changing carbon policies create investment hesitancy, slowing membrane technology adoption despite technical readiness.

Regulatory frameworks also impact membrane technology standardization efforts. Regions with established technical standards for membrane performance and safety certification demonstrate faster technology deployment rates. These standards reduce market entry barriers for innovative membrane solutions by providing clear compliance pathways and increasing end-user confidence. The International Organization for Standardization (ISO) has recently initiated development of specific standards for CO2 capture membranes, potentially creating a globally recognized framework that could accelerate international deployment.

Future regulatory developments will likely emphasize life-cycle assessment requirements for carbon capture technologies, potentially favoring membrane systems with lower embedded carbon footprints compared to alternative capture methods. This regulatory trend aligns with broader sustainability goals beyond simple carbon capture metrics, potentially creating additional competitive advantages for next-generation membrane technologies designed with comprehensive environmental impact considerations.

Regulatory complexity presents a significant barrier to widespread membrane technology implementation. Cross-border carbon accounting standards lack harmonization, creating uncertainty for multinational corporations investing in membrane technologies. Additionally, permitting processes for carbon capture facilities utilizing membrane technology often involve multiple agencies with overlapping jurisdictions, extending project timelines and increasing development costs.

Recent policy shifts indicate growing regulatory support for membrane-based carbon capture solutions. Several jurisdictions have introduced technology-neutral performance standards rather than prescriptive requirements, allowing membrane technologies to compete based on efficiency and cost-effectiveness. This approach has accelerated innovation in membrane materials and system designs optimized for regulatory compliance while maintaining economic viability.

Industry stakeholders report that regulatory certainty significantly influences investment decisions in membrane technology. Long-term policy frameworks with clear carbon reduction targets enable companies to justify capital expenditures on membrane systems with confidence in future regulatory environments. Conversely, jurisdictions with frequently changing carbon policies create investment hesitancy, slowing membrane technology adoption despite technical readiness.

Regulatory frameworks also impact membrane technology standardization efforts. Regions with established technical standards for membrane performance and safety certification demonstrate faster technology deployment rates. These standards reduce market entry barriers for innovative membrane solutions by providing clear compliance pathways and increasing end-user confidence. The International Organization for Standardization (ISO) has recently initiated development of specific standards for CO2 capture membranes, potentially creating a globally recognized framework that could accelerate international deployment.

Future regulatory developments will likely emphasize life-cycle assessment requirements for carbon capture technologies, potentially favoring membrane systems with lower embedded carbon footprints compared to alternative capture methods. This regulatory trend aligns with broader sustainability goals beyond simple carbon capture metrics, potentially creating additional competitive advantages for next-generation membrane technologies designed with comprehensive environmental impact considerations.

Economic Viability and Commercialization Pathways

The economic viability of CO2 capture membrane technologies remains a critical factor in their widespread deployment. Current cost estimates for membrane-based carbon capture range from $40-80 per ton of CO2 captured, which still exceeds the economically viable threshold for many industries without additional incentives. This cost structure presents a significant barrier to commercialization despite the technical advantages membranes offer over traditional capture methods.

Regulatory frameworks significantly influence the economic equation through carbon pricing mechanisms, tax incentives, and direct subsidies. Regions with established carbon markets or carbon taxes above $50/ton create environments where membrane technologies approach economic viability. The European Union's Emissions Trading System and Canada's carbon pricing framework exemplify regulatory structures that enhance the business case for membrane deployment.

Commercialization pathways for CO2 capture membranes typically follow a staged approach. Initial deployment often targets niche applications where conventional technologies struggle, such as offshore platforms with space constraints or facilities with low-pressure flue gas streams. These early adopters provide crucial operational data and revenue streams while technology costs decrease through scaling and learning effects.

Strategic partnerships between technology developers and industrial end-users have emerged as a successful commercialization model. These collaborations often involve risk-sharing arrangements where technology providers maintain ownership of the capture equipment while industrial partners pay for the service of CO2 removal, reducing capital expenditure barriers for adopters.

Public-private partnerships have also accelerated commercialization timelines. Programs like the U.S. Department of Energy's Carbon Capture Program and the EU Innovation Fund provide critical funding for pilot and demonstration projects that bridge the "valley of death" between laboratory success and commercial viability. These initiatives have shortened commercialization timelines from 15-20 years to potentially 7-10 years for promising membrane technologies.

The integration of membrane technologies into existing carbon utilization and storage infrastructure represents another pathway to economic viability. By connecting capture technologies to established CO2 markets such as enhanced oil recovery operations or emerging utilization sectors like concrete curing and synthetic fuel production, membrane developers can access immediate revenue streams while broader markets develop.

Future economic viability will likely depend on continued regulatory support coupled with technological improvements that reduce membrane costs and increase performance. Analysts project that with sustained R&D investment and supportive policy frameworks, membrane-based capture costs could fall below $30/ton by 2030, making the technology competitive across a much broader range of applications and geographical markets.

Regulatory frameworks significantly influence the economic equation through carbon pricing mechanisms, tax incentives, and direct subsidies. Regions with established carbon markets or carbon taxes above $50/ton create environments where membrane technologies approach economic viability. The European Union's Emissions Trading System and Canada's carbon pricing framework exemplify regulatory structures that enhance the business case for membrane deployment.

Commercialization pathways for CO2 capture membranes typically follow a staged approach. Initial deployment often targets niche applications where conventional technologies struggle, such as offshore platforms with space constraints or facilities with low-pressure flue gas streams. These early adopters provide crucial operational data and revenue streams while technology costs decrease through scaling and learning effects.

Strategic partnerships between technology developers and industrial end-users have emerged as a successful commercialization model. These collaborations often involve risk-sharing arrangements where technology providers maintain ownership of the capture equipment while industrial partners pay for the service of CO2 removal, reducing capital expenditure barriers for adopters.

Public-private partnerships have also accelerated commercialization timelines. Programs like the U.S. Department of Energy's Carbon Capture Program and the EU Innovation Fund provide critical funding for pilot and demonstration projects that bridge the "valley of death" between laboratory success and commercial viability. These initiatives have shortened commercialization timelines from 15-20 years to potentially 7-10 years for promising membrane technologies.

The integration of membrane technologies into existing carbon utilization and storage infrastructure represents another pathway to economic viability. By connecting capture technologies to established CO2 markets such as enhanced oil recovery operations or emerging utilization sectors like concrete curing and synthetic fuel production, membrane developers can access immediate revenue streams while broader markets develop.

Future economic viability will likely depend on continued regulatory support coupled with technological improvements that reduce membrane costs and increase performance. Analysts project that with sustained R&D investment and supportive policy frameworks, membrane-based capture costs could fall below $30/ton by 2030, making the technology competitive across a much broader range of applications and geographical markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!