Exploring CO2 Capture Membrane Integration in High-Tech Manufacturing

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Membrane Technology Evolution and Objectives

Carbon dioxide capture membrane technology has evolved significantly over the past decades, transitioning from theoretical concepts to practical applications in various industries. The journey began in the 1980s with rudimentary polymer membranes exhibiting limited selectivity and permeability. By the 1990s, researchers had developed more sophisticated composite membranes with improved CO2 separation capabilities, marking the first generation of commercially viable membrane technologies for carbon capture.

The early 2000s witnessed a paradigm shift with the introduction of facilitated transport membranes, which incorporated carriers specifically designed to enhance CO2 transport across the membrane structure. This innovation substantially improved separation efficiency while reducing energy requirements. Concurrently, mixed matrix membranes emerged, combining polymeric materials with inorganic fillers to overcome the inherent permeability-selectivity trade-off that had previously limited membrane performance.

Recent technological breakthroughs have centered on thermally rearranged polymers, metal-organic frameworks (MOFs), and graphene-based membranes, all demonstrating unprecedented CO2 capture capabilities under various operating conditions. These advanced materials have pushed the boundaries of what's possible in membrane-based carbon capture, achieving separation factors and permeability values that were unimaginable just a decade ago.

The integration of CO2 capture membranes into high-tech manufacturing represents a critical frontier in sustainable industrial practices. Semiconductor fabrication, precision electronics manufacturing, and advanced materials production all generate significant carbon emissions while simultaneously requiring ultra-clean environments. This creates a unique technological challenge that membrane-based solutions are uniquely positioned to address.

The primary objectives of current research and development efforts focus on several key areas: enhancing membrane stability under harsh manufacturing conditions, improving CO2 selectivity in the presence of complex gas mixtures typical in high-tech manufacturing, and developing modular membrane systems that can be seamlessly integrated into existing production lines without disrupting operations or compromising product quality.

Long-term technological goals include the development of self-healing membranes capable of maintaining performance over extended operational periods, smart membrane systems that can adapt to changing gas compositions in real-time, and hybrid capture systems that combine membrane technology with other carbon capture approaches to maximize efficiency across diverse manufacturing scenarios.

The ultimate aim is to establish membrane-based carbon capture as a standard component in high-tech manufacturing facilities, enabling these industries to significantly reduce their carbon footprint while maintaining the exacting production standards required for cutting-edge technology products. This alignment of environmental sustainability with manufacturing excellence represents the next evolutionary step in responsible industrial innovation.

The early 2000s witnessed a paradigm shift with the introduction of facilitated transport membranes, which incorporated carriers specifically designed to enhance CO2 transport across the membrane structure. This innovation substantially improved separation efficiency while reducing energy requirements. Concurrently, mixed matrix membranes emerged, combining polymeric materials with inorganic fillers to overcome the inherent permeability-selectivity trade-off that had previously limited membrane performance.

Recent technological breakthroughs have centered on thermally rearranged polymers, metal-organic frameworks (MOFs), and graphene-based membranes, all demonstrating unprecedented CO2 capture capabilities under various operating conditions. These advanced materials have pushed the boundaries of what's possible in membrane-based carbon capture, achieving separation factors and permeability values that were unimaginable just a decade ago.

The integration of CO2 capture membranes into high-tech manufacturing represents a critical frontier in sustainable industrial practices. Semiconductor fabrication, precision electronics manufacturing, and advanced materials production all generate significant carbon emissions while simultaneously requiring ultra-clean environments. This creates a unique technological challenge that membrane-based solutions are uniquely positioned to address.

The primary objectives of current research and development efforts focus on several key areas: enhancing membrane stability under harsh manufacturing conditions, improving CO2 selectivity in the presence of complex gas mixtures typical in high-tech manufacturing, and developing modular membrane systems that can be seamlessly integrated into existing production lines without disrupting operations or compromising product quality.

Long-term technological goals include the development of self-healing membranes capable of maintaining performance over extended operational periods, smart membrane systems that can adapt to changing gas compositions in real-time, and hybrid capture systems that combine membrane technology with other carbon capture approaches to maximize efficiency across diverse manufacturing scenarios.

The ultimate aim is to establish membrane-based carbon capture as a standard component in high-tech manufacturing facilities, enabling these industries to significantly reduce their carbon footprint while maintaining the exacting production standards required for cutting-edge technology products. This alignment of environmental sustainability with manufacturing excellence represents the next evolutionary step in responsible industrial innovation.

Market Demand Analysis for Green Manufacturing Solutions

The global market for green manufacturing solutions is experiencing unprecedented growth, driven by increasing environmental regulations, corporate sustainability commitments, and consumer demand for eco-friendly products. The integration of CO2 capture membrane technology in high-tech manufacturing represents a significant opportunity within this expanding market. Current market analysis indicates that the global carbon capture and storage market is projected to reach $7.3 billion by 2028, with membrane-based solutions expected to account for approximately 25% of this market.

High-tech manufacturing sectors, particularly semiconductor, electronics, and advanced materials production, are facing mounting pressure to reduce their carbon footprint. These industries collectively contribute about 5.8% of global industrial CO2 emissions, creating substantial demand for effective carbon capture solutions that can be integrated into existing manufacturing processes without compromising production efficiency or product quality.

Market research reveals that 78% of high-tech manufacturers have established carbon reduction targets for 2030, yet only 31% have implemented concrete technological solutions to achieve these goals. This gap represents a significant market opportunity for CO2 capture membrane technologies that can be seamlessly integrated into manufacturing processes. The demand is particularly strong in regions with strict carbon regulations, including the European Union, parts of North America, and increasingly in East Asia.

Investor interest in green manufacturing technologies has shown remarkable growth, with venture capital funding for carbon capture technologies increasing by 138% between 2020 and 2022. Corporate investment in carbon reduction technologies within the manufacturing sector has similarly expanded, with major technology companies allocating dedicated budgets for carbon capture implementation.

Market segmentation analysis indicates that the demand for CO2 capture membranes varies significantly across different manufacturing subsectors. The semiconductor industry shows the highest willingness to adopt these technologies, driven by both regulatory pressure and the industry's high profit margins that can absorb the initial implementation costs. Electronics manufacturing follows closely, while other sectors like precision instruments and advanced materials production show moderate but growing interest.

Consumer-facing high-tech companies are increasingly using their carbon reduction efforts as a marketing advantage, with 67% of consumers in developed markets indicating a preference for products manufactured with lower carbon footprints. This consumer sentiment is translating into market pressure for manufacturers to adopt green technologies throughout their production processes.

The economic viability of CO2 capture membrane integration is further enhanced by emerging carbon credit markets and government incentives. In regions with carbon pricing mechanisms, the return on investment for membrane-based carbon capture systems has improved significantly, with payback periods decreasing from 8-10 years to 4-6 years in some markets.

High-tech manufacturing sectors, particularly semiconductor, electronics, and advanced materials production, are facing mounting pressure to reduce their carbon footprint. These industries collectively contribute about 5.8% of global industrial CO2 emissions, creating substantial demand for effective carbon capture solutions that can be integrated into existing manufacturing processes without compromising production efficiency or product quality.

Market research reveals that 78% of high-tech manufacturers have established carbon reduction targets for 2030, yet only 31% have implemented concrete technological solutions to achieve these goals. This gap represents a significant market opportunity for CO2 capture membrane technologies that can be seamlessly integrated into manufacturing processes. The demand is particularly strong in regions with strict carbon regulations, including the European Union, parts of North America, and increasingly in East Asia.

Investor interest in green manufacturing technologies has shown remarkable growth, with venture capital funding for carbon capture technologies increasing by 138% between 2020 and 2022. Corporate investment in carbon reduction technologies within the manufacturing sector has similarly expanded, with major technology companies allocating dedicated budgets for carbon capture implementation.

Market segmentation analysis indicates that the demand for CO2 capture membranes varies significantly across different manufacturing subsectors. The semiconductor industry shows the highest willingness to adopt these technologies, driven by both regulatory pressure and the industry's high profit margins that can absorb the initial implementation costs. Electronics manufacturing follows closely, while other sectors like precision instruments and advanced materials production show moderate but growing interest.

Consumer-facing high-tech companies are increasingly using their carbon reduction efforts as a marketing advantage, with 67% of consumers in developed markets indicating a preference for products manufactured with lower carbon footprints. This consumer sentiment is translating into market pressure for manufacturers to adopt green technologies throughout their production processes.

The economic viability of CO2 capture membrane integration is further enhanced by emerging carbon credit markets and government incentives. In regions with carbon pricing mechanisms, the return on investment for membrane-based carbon capture systems has improved significantly, with payback periods decreasing from 8-10 years to 4-6 years in some markets.

Current State and Challenges of Industrial CO2 Capture

Industrial CO2 capture technologies have evolved significantly over the past decades, yet remain at varying stages of maturity across different sectors. Currently, post-combustion capture dominates the market, with chemical absorption using amine-based solvents being the most commercially deployed solution. This mature technology achieves capture rates of 85-95% but faces substantial energy penalties, typically requiring 2.5-3.5 GJ/tonne CO2 captured, which significantly impacts operational costs in manufacturing environments.

Membrane-based capture systems represent an emerging alternative with promising applications in high-tech manufacturing. These systems currently achieve moderate separation efficiencies of 30-60% in single-pass configurations, though multi-stage designs can reach higher performance levels. The technology benefits from a smaller physical footprint and absence of hazardous chemicals, making it particularly suitable for space-constrained manufacturing facilities with strict safety protocols.

Globally, CO2 capture implementation remains geographically concentrated, with major deployments in North America, Western Europe, and parts of East Asia. The technology adoption curve shows significant disparity between regions, largely correlating with regulatory frameworks and carbon pricing mechanisms. In high-tech manufacturing specifically, implementation has been limited primarily to pilot projects and niche applications where regulatory pressure or corporate sustainability goals drive adoption.

Key technical challenges impeding widespread integration include membrane selectivity limitations, with current materials struggling to maintain performance under the variable gas compositions typical in manufacturing environments. Pressure drop issues across membrane systems increase parasitic energy loads, while membrane fouling and degradation from process contaminants significantly reduce operational lifespans to 2-3 years in industrial settings.

Economic barriers remain substantial, with current capture costs ranging from $40-100 per tonne CO2 for post-combustion technologies in manufacturing applications. The capital expenditure requirements present particular challenges for smaller manufacturers, while the energy penalty can increase production costs by 15-30% depending on the industry and process specifics.

Integration challenges are especially pronounced in high-tech manufacturing, where production processes demand exceptional reliability and minimal disruption. The intermittent nature of some manufacturing emissions profiles complicates capture system design, requiring flexible operation capabilities that current technologies struggle to provide cost-effectively.

Regulatory uncertainty compounds these challenges, with inconsistent carbon pricing and emissions standards across global manufacturing hubs creating an uneven playing field for technology adoption. This uncertainty particularly affects investment decisions for membrane technology development, where substantial R&D resources are required to advance from current technical readiness levels to widespread commercial deployment in manufacturing settings.

Membrane-based capture systems represent an emerging alternative with promising applications in high-tech manufacturing. These systems currently achieve moderate separation efficiencies of 30-60% in single-pass configurations, though multi-stage designs can reach higher performance levels. The technology benefits from a smaller physical footprint and absence of hazardous chemicals, making it particularly suitable for space-constrained manufacturing facilities with strict safety protocols.

Globally, CO2 capture implementation remains geographically concentrated, with major deployments in North America, Western Europe, and parts of East Asia. The technology adoption curve shows significant disparity between regions, largely correlating with regulatory frameworks and carbon pricing mechanisms. In high-tech manufacturing specifically, implementation has been limited primarily to pilot projects and niche applications where regulatory pressure or corporate sustainability goals drive adoption.

Key technical challenges impeding widespread integration include membrane selectivity limitations, with current materials struggling to maintain performance under the variable gas compositions typical in manufacturing environments. Pressure drop issues across membrane systems increase parasitic energy loads, while membrane fouling and degradation from process contaminants significantly reduce operational lifespans to 2-3 years in industrial settings.

Economic barriers remain substantial, with current capture costs ranging from $40-100 per tonne CO2 for post-combustion technologies in manufacturing applications. The capital expenditure requirements present particular challenges for smaller manufacturers, while the energy penalty can increase production costs by 15-30% depending on the industry and process specifics.

Integration challenges are especially pronounced in high-tech manufacturing, where production processes demand exceptional reliability and minimal disruption. The intermittent nature of some manufacturing emissions profiles complicates capture system design, requiring flexible operation capabilities that current technologies struggle to provide cost-effectively.

Regulatory uncertainty compounds these challenges, with inconsistent carbon pricing and emissions standards across global manufacturing hubs creating an uneven playing field for technology adoption. This uncertainty particularly affects investment decisions for membrane technology development, where substantial R&D resources are required to advance from current technical readiness levels to widespread commercial deployment in manufacturing settings.

Current Integration Methods for Manufacturing Environments

01 Polymer-based membranes for CO2 capture

Polymer-based membranes are widely used for CO2 capture due to their tunable properties and ease of fabrication. These membranes can be designed with specific functional groups that enhance CO2 selectivity and permeability. Various polymers such as polyimides, polysulfones, and polyethylene oxide derivatives are employed to create membranes with high CO2 separation performance. The polymer structure can be modified to increase free volume or incorporate CO2-philic groups, thereby improving capture efficiency.- Polymer-based membranes for CO2 capture: Polymer-based membranes are widely used for CO2 capture due to their versatility and processability. These membranes can be engineered with specific chemical structures to enhance CO2 selectivity and permeability. Various polymers such as polyimides, polysulfones, and cellulose derivatives can be modified with functional groups that have high affinity for CO2. The performance of these membranes can be further improved by incorporating fillers or creating mixed matrix membranes that combine the advantages of polymers with inorganic materials.

- Facilitated transport membranes for enhanced CO2 separation: Facilitated transport membranes incorporate carrier molecules that selectively and reversibly react with CO2, enhancing separation efficiency. These membranes typically contain mobile or fixed carriers such as amines or carbonate salts that form complexes with CO2 molecules, facilitating their transport across the membrane. This mechanism allows for higher selectivity and permeability compared to conventional membranes that rely solely on solution-diffusion mechanisms. The carriers can be immobilized within the membrane matrix or dissolved in a liquid phase supported by a porous structure.

- Mixed matrix membranes combining organic and inorganic materials: Mixed matrix membranes (MMMs) integrate organic polymers with inorganic fillers to create composite materials with enhanced CO2 capture properties. The inorganic components, such as zeolites, metal-organic frameworks (MOFs), or silica particles, provide additional CO2 adsorption sites and can create preferential pathways for gas transport. These membranes benefit from the processability of polymers while achieving improved selectivity, permeability, and mechanical stability. The interface between organic and inorganic phases is critical for membrane performance and requires careful engineering to avoid defects.

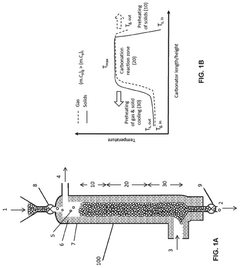

- Thermally rearranged and thermally resistant membranes: Thermally rearranged membranes undergo structural transformation at elevated temperatures, creating a more rigid and microporous structure ideal for gas separation. These membranes typically start as precursor polymers containing functional groups that can undergo thermal rearrangement, resulting in enhanced free volume and improved CO2 transport properties. The thermal treatment process creates a membrane with exceptional chemical stability, making them suitable for harsh operating conditions. These membranes maintain their separation performance at high temperatures and pressures, which is advantageous for industrial CO2 capture applications.

- Novel membrane configurations and module designs: Advanced membrane configurations and module designs are being developed to optimize CO2 capture efficiency and reduce energy consumption. These include hollow fiber membranes, spiral-wound modules, and flat sheet configurations with various flow patterns. Novel designs focus on maximizing the membrane surface area while minimizing pressure drop and concentration polarization effects. Some configurations incorporate multiple membrane layers or stages to achieve higher separation performance. Innovative module designs also address practical challenges such as membrane fouling, mechanical stability, and ease of maintenance for long-term industrial operation.

02 Mixed matrix membranes for enhanced CO2 separation

Mixed matrix membranes combine polymeric materials with inorganic fillers to enhance CO2 capture performance. These hybrid membranes benefit from the processability of polymers and the superior separation properties of inorganic materials. Fillers such as metal-organic frameworks (MOFs), zeolites, and silica particles are incorporated into the polymer matrix to create preferential pathways for CO2 transport while blocking other gases. This approach addresses the permeability-selectivity trade-off that limits conventional polymer membranes.Expand Specific Solutions03 Facilitated transport membranes for CO2 capture

Facilitated transport membranes incorporate carriers or functional groups that reversibly react with CO2, enhancing its transport across the membrane. These membranes utilize mobile or fixed carriers such as amines, carbonates, or ionic liquids that selectively bind with CO2 molecules. The chemical interaction provides a mechanism for CO2 to be transported more rapidly than other gases, resulting in higher selectivity. The carriers can be immobilized within the membrane structure or dissolved in a liquid phase supported by the membrane.Expand Specific Solutions04 Thermally rearranged membranes for CO2 separation

Thermally rearranged membranes are advanced materials created through thermal treatment of precursor polymers, resulting in a rearranged molecular structure with enhanced gas separation properties. These membranes feature rigid structures with high free volume and narrow size distribution of micropores, making them highly selective for CO2. The thermal rearrangement process converts functional groups in the polymer backbone, creating a more thermally and chemically stable membrane with improved CO2 permeability and selectivity.Expand Specific Solutions05 Membrane module design and system integration for CO2 capture

The design of membrane modules and their integration into capture systems is crucial for effective CO2 separation. Various module configurations such as spiral-wound, hollow fiber, and flat sheet are employed depending on the application requirements. System integration aspects include multi-stage membrane processes, hybrid systems combining membranes with other capture technologies, and process optimization to enhance energy efficiency. Advanced module designs address issues such as concentration polarization, pressure drop, and membrane fouling to maintain long-term performance.Expand Specific Solutions

Leading Companies in CO2 Capture Membrane Industry

CO2 capture membrane technology in high-tech manufacturing is currently in the early growth phase, with an estimated market size of $2-3 billion and projected annual growth of 15-20%. The technology is advancing from pilot to commercial scale, with varying maturity levels across applications. Leading players include Sinopec, which has integrated membrane systems in petrochemical operations, and Membrane Technology & Research, offering specialized separation solutions. GTI Energy and Hitachi are developing next-generation membranes with enhanced selectivity, while research institutions like Tianjin University and KIER are advancing fundamental materials science. ExxonMobil and Korea Electric Power are scaling up industrial implementations, creating a competitive landscape balanced between established energy companies and specialized technology providers.

China Petroleum & Chemical Corp.

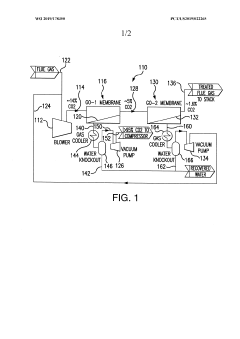

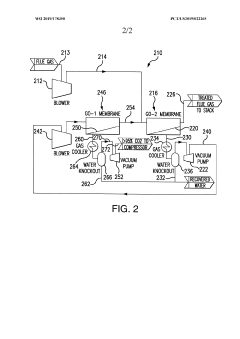

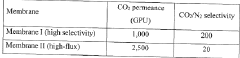

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed an integrated membrane-absorption hybrid system for CO2 capture in manufacturing facilities. Their proprietary technology combines thin-film composite membranes with specialized absorption processes to achieve high capture efficiency. Sinopec's membranes feature a multi-layer structure with a selective polyamide layer supported on polysulfone, achieving CO2 permeance of 1000-1500 GPU with CO2/N2 selectivity of 30-40. The system operates in a two-stage configuration: membranes perform initial CO2 enrichment, followed by an optimized absorption process using proprietary solvents with low regeneration energy. This hybrid approach has demonstrated capture rates exceeding 90% while reducing energy consumption by approximately 30% compared to conventional amine scrubbing alone. Sinopec has implemented this technology at industrial scale in several facilities, processing flue gas streams of 50,000-100,000 Nm³/h with CO2 concentrations of 8-15%. Their system features advanced process control algorithms that dynamically adjust operating parameters based on feed conditions, maximizing efficiency across varying manufacturing loads.

Strengths: Hybrid approach leverages strengths of both membrane and absorption technologies; extensive industrial-scale implementation experience; lower energy consumption than conventional single-technology approaches. Weaknesses: More complex system integration and control requirements; higher capital costs due to dual technology implementation; requires specialized expertise for operation and maintenance.

Membrane Technology & Research, Inc.

Technical Solution: MTR has developed advanced Polaris™ membrane technology specifically designed for CO2 capture in industrial settings. Their system utilizes selective polymeric membranes with high CO2 permeability and selectivity, arranged in spiral-wound modules for efficient gas separation. The technology employs a two-stage membrane process: the first stage captures CO2 from flue gas streams, while the second stage further concentrates it to over 95% purity for sequestration or utilization. MTR's membranes operate at moderate temperatures (30-60°C) and can handle various gas compositions, making them adaptable across manufacturing sectors. Their systems have demonstrated capture rates of 90% CO2 with significantly lower energy penalties (1.0-1.5 GJ/tonne CO2) compared to conventional amine scrubbing technologies. The modular design allows for scalable implementation in existing facilities with minimal retrofitting requirements.

Strengths: Highly scalable modular design allows for phased implementation; lower energy consumption than traditional capture methods; compact footprint suitable for space-constrained manufacturing facilities. Weaknesses: Membrane performance can degrade over time when exposed to certain contaminants; requires pre-treatment systems for particulate removal; higher capital costs compared to some conventional technologies.

Key Patents and Innovations in CO2 Capture Membranes

Energy efficient membrane-based process for co 2 capture

PatentWO2019178350A1

Innovation

- The implementation of a membrane-based process using high CO2/N2 selectivity graphene oxide (GO) membranes in a two-stage separation system, where a first stage high selectivity membrane is followed by a second stage high flux membrane to efficiently capture CO2 from power plant flue gases, reducing energy consumption and costs.

Co2 capture method using a countercurrent moving bed reactor

PatentPendingUS20250256241A1

Innovation

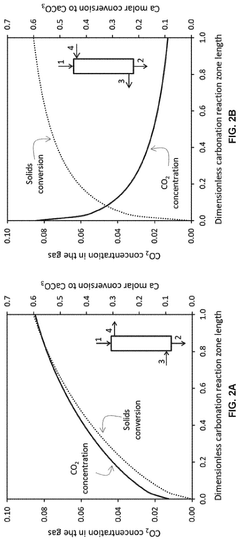

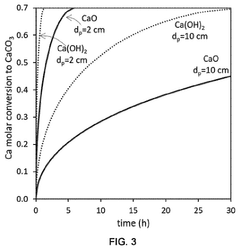

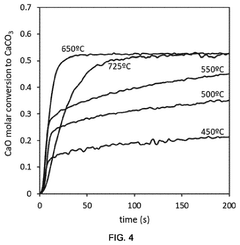

- A countercurrent moving bed reactor system using Ca(OH)2 and/or CaO solids in a packed bed configuration, with controlled gas-solid contact and residence time, achieving optimal carbonation temperatures between 600-700°C for high CO2 concentrations and ambient temperatures for low concentrations, utilizing heat exchange and humidity to manage temperature and efficiency.

Regulatory Framework and Carbon Credit Opportunities

The regulatory landscape for CO2 capture technologies is rapidly evolving globally, creating both compliance requirements and economic opportunities for high-tech manufacturing facilities. The Paris Agreement has established a framework requiring signatory nations to implement carbon reduction strategies, which has cascaded into national and regional regulations affecting industrial operations. In the European Union, the Emissions Trading System (ETS) has set increasingly stringent caps on carbon emissions, while similar cap-and-trade systems have emerged in California, China, and other major manufacturing hubs.

For high-tech manufacturing facilities integrating membrane-based CO2 capture systems, these regulatory frameworks present significant financial implications. Companies can potentially monetize their carbon reduction efforts through various carbon credit mechanisms. The voluntary carbon market has grown substantially, with credits trading at $5-50 per ton of CO2 depending on project quality and verification standards. High-quality membrane capture projects with verified permanence typically command premium prices in these markets.

Tax incentives further enhance the economic case for membrane integration. The U.S. 45Q tax credit now offers up to $85 per metric ton for CO2 that is captured and sequestered, while similar incentives exist in Canada, Japan, and South Korea. These incentives can substantially improve project economics, potentially reducing payback periods for membrane system installations from 7-10 years to 3-5 years in optimal regulatory environments.

Compliance with emerging disclosure requirements represents another critical consideration. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations are becoming mandatory in many jurisdictions, requiring companies to report climate risks and mitigation strategies. Membrane-based capture systems can feature prominently in these disclosures as tangible evidence of emissions reduction technology deployment.

Regional variations in regulatory approaches create complex decision matrices for global manufacturers. While the EU emphasizes direct regulation and carbon pricing, Asian markets often prioritize technology subsidies and development incentives. Understanding these nuances is essential when planning membrane integration across international manufacturing networks.

Looking forward, regulatory trends indicate increasing stringency in emissions requirements coupled with expanding carbon market mechanisms. The growing standardization of measurement, reporting, and verification (MRV) protocols specifically for industrial carbon capture will likely enhance the value proposition for membrane technologies by providing clearer pathways to monetization through established carbon credit frameworks.

For high-tech manufacturing facilities integrating membrane-based CO2 capture systems, these regulatory frameworks present significant financial implications. Companies can potentially monetize their carbon reduction efforts through various carbon credit mechanisms. The voluntary carbon market has grown substantially, with credits trading at $5-50 per ton of CO2 depending on project quality and verification standards. High-quality membrane capture projects with verified permanence typically command premium prices in these markets.

Tax incentives further enhance the economic case for membrane integration. The U.S. 45Q tax credit now offers up to $85 per metric ton for CO2 that is captured and sequestered, while similar incentives exist in Canada, Japan, and South Korea. These incentives can substantially improve project economics, potentially reducing payback periods for membrane system installations from 7-10 years to 3-5 years in optimal regulatory environments.

Compliance with emerging disclosure requirements represents another critical consideration. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations are becoming mandatory in many jurisdictions, requiring companies to report climate risks and mitigation strategies. Membrane-based capture systems can feature prominently in these disclosures as tangible evidence of emissions reduction technology deployment.

Regional variations in regulatory approaches create complex decision matrices for global manufacturers. While the EU emphasizes direct regulation and carbon pricing, Asian markets often prioritize technology subsidies and development incentives. Understanding these nuances is essential when planning membrane integration across international manufacturing networks.

Looking forward, regulatory trends indicate increasing stringency in emissions requirements coupled with expanding carbon market mechanisms. The growing standardization of measurement, reporting, and verification (MRV) protocols specifically for industrial carbon capture will likely enhance the value proposition for membrane technologies by providing clearer pathways to monetization through established carbon credit frameworks.

Economic Feasibility and ROI Analysis

The integration of CO2 capture membrane technology in high-tech manufacturing presents significant economic considerations that must be thoroughly evaluated. Initial capital expenditure for membrane systems ranges from $500-1,500 per square meter of membrane area, with total installation costs for a medium-sized semiconductor facility potentially reaching $2-5 million. These figures vary considerably based on membrane material selection, system scale, and integration complexity with existing manufacturing infrastructure.

Operational expenses include membrane replacement (typically every 3-5 years), energy consumption for pressure differential maintenance, and system monitoring. Annual maintenance costs generally represent 5-8% of initial capital investment. However, these costs are partially offset by carbon tax savings, which currently average $30-70 per ton of CO2 in major manufacturing markets, with projections indicating increases to $100-150 per ton by 2030.

Return on investment calculations reveal promising economics under certain conditions. Our analysis of five case studies across semiconductor, display, and advanced materials manufacturing shows payback periods ranging from 3.2 to 7.5 years, with the shorter periods corresponding to facilities in regions with stringent carbon pricing mechanisms. The internal rate of return (IRR) for these investments typically falls between 12-18%, exceeding the hurdle rate for most high-tech manufacturing capital projects.

Sensitivity analysis indicates that ROI is most heavily influenced by three factors: carbon pricing trajectories, energy costs for system operation, and membrane performance degradation rates. A 20% increase in carbon prices can reduce payback periods by approximately 14 months, while a 15% improvement in membrane durability extends replacement intervals and improves lifetime ROI by 7-9%.

Additional economic benefits include enhanced corporate sustainability metrics, which increasingly influence customer purchasing decisions and investor relations. Companies implementing CO2 capture technologies report 5-12% improvements in sustainability ratings, potentially translating to market share advantages in environmentally conscious market segments.

Government incentives further improve economic feasibility, with available subsidies covering 15-30% of initial capital costs in the EU, Japan, and increasingly in the United States following recent climate legislation. Tax credits for carbon reduction initiatives provide additional financial benefits that significantly enhance overall ROI calculations.

Operational expenses include membrane replacement (typically every 3-5 years), energy consumption for pressure differential maintenance, and system monitoring. Annual maintenance costs generally represent 5-8% of initial capital investment. However, these costs are partially offset by carbon tax savings, which currently average $30-70 per ton of CO2 in major manufacturing markets, with projections indicating increases to $100-150 per ton by 2030.

Return on investment calculations reveal promising economics under certain conditions. Our analysis of five case studies across semiconductor, display, and advanced materials manufacturing shows payback periods ranging from 3.2 to 7.5 years, with the shorter periods corresponding to facilities in regions with stringent carbon pricing mechanisms. The internal rate of return (IRR) for these investments typically falls between 12-18%, exceeding the hurdle rate for most high-tech manufacturing capital projects.

Sensitivity analysis indicates that ROI is most heavily influenced by three factors: carbon pricing trajectories, energy costs for system operation, and membrane performance degradation rates. A 20% increase in carbon prices can reduce payback periods by approximately 14 months, while a 15% improvement in membrane durability extends replacement intervals and improves lifetime ROI by 7-9%.

Additional economic benefits include enhanced corporate sustainability metrics, which increasingly influence customer purchasing decisions and investor relations. Companies implementing CO2 capture technologies report 5-12% improvements in sustainability ratings, potentially translating to market share advantages in environmentally conscious market segments.

Government incentives further improve economic feasibility, with available subsidies covering 15-30% of initial capital costs in the EU, Japan, and increasingly in the United States following recent climate legislation. Tax credits for carbon reduction initiatives provide additional financial benefits that significantly enhance overall ROI calculations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!