Analysis of Market Drivers for Metal Foam Fabrication

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Foam Technology Background and Objectives

Metal foam technology represents a revolutionary class of materials that combines the structural properties of metals with the unique characteristics of cellular structures. Emerging in the mid-20th century but gaining significant research momentum in the 1990s, metal foams have evolved from laboratory curiosities to engineered materials with substantial commercial potential. These materials are characterized by their cellular structure containing a high volume fraction of pores, typically ranging from 40% to 98%, resulting in remarkable weight reduction while maintaining many desirable metallic properties.

The technological evolution of metal foams has been driven by advancements in manufacturing processes, including powder metallurgy, melt gas injection, and investment casting techniques. Early development focused primarily on aluminum foams, but research has expanded to include various metals and alloys such as titanium, steel, copper, and nickel-based superalloys, each offering unique property combinations for specific applications.

The primary objective in metal foam fabrication technology is to develop cost-effective, reliable, and scalable manufacturing processes that can produce foams with consistent and predictable properties. Current research aims to overcome challenges in controlling pore size distribution, achieving uniform density, and enhancing mechanical properties while reducing production costs to make these materials commercially viable for mass-market applications.

Metal foam technology intersects with several emerging technological trends, including lightweighting in transportation, energy efficiency in construction, and advanced thermal management in electronics. The growing emphasis on sustainable manufacturing and circular economy principles has also influenced research directions, with increasing focus on recyclability and environmental impact of production processes.

Recent technological breakthroughs include the development of gradient-density foams, hybrid metal-polymer foams, and nano-engineered cellular structures that expand the application possibilities. Computational modeling and simulation tools have significantly advanced the understanding of metal foam behavior, enabling more precise design and optimization of these materials for specific performance requirements.

The global research landscape shows concentrated efforts in regions with strong manufacturing bases, particularly in Germany, Japan, China, and North America. Academic-industrial partnerships have been instrumental in translating fundamental research into practical applications, with automotive and aerospace sectors leading commercial implementation.

Looking forward, metal foam technology aims to bridge the gap between laboratory success and industrial-scale production, with particular emphasis on process standardization, quality control methodologies, and integration with existing manufacturing systems. The ultimate technological goal remains creating customizable cellular metallic materials that can be precisely engineered for specific performance requirements while being economically viable for widespread commercial adoption.

The technological evolution of metal foams has been driven by advancements in manufacturing processes, including powder metallurgy, melt gas injection, and investment casting techniques. Early development focused primarily on aluminum foams, but research has expanded to include various metals and alloys such as titanium, steel, copper, and nickel-based superalloys, each offering unique property combinations for specific applications.

The primary objective in metal foam fabrication technology is to develop cost-effective, reliable, and scalable manufacturing processes that can produce foams with consistent and predictable properties. Current research aims to overcome challenges in controlling pore size distribution, achieving uniform density, and enhancing mechanical properties while reducing production costs to make these materials commercially viable for mass-market applications.

Metal foam technology intersects with several emerging technological trends, including lightweighting in transportation, energy efficiency in construction, and advanced thermal management in electronics. The growing emphasis on sustainable manufacturing and circular economy principles has also influenced research directions, with increasing focus on recyclability and environmental impact of production processes.

Recent technological breakthroughs include the development of gradient-density foams, hybrid metal-polymer foams, and nano-engineered cellular structures that expand the application possibilities. Computational modeling and simulation tools have significantly advanced the understanding of metal foam behavior, enabling more precise design and optimization of these materials for specific performance requirements.

The global research landscape shows concentrated efforts in regions with strong manufacturing bases, particularly in Germany, Japan, China, and North America. Academic-industrial partnerships have been instrumental in translating fundamental research into practical applications, with automotive and aerospace sectors leading commercial implementation.

Looking forward, metal foam technology aims to bridge the gap between laboratory success and industrial-scale production, with particular emphasis on process standardization, quality control methodologies, and integration with existing manufacturing systems. The ultimate technological goal remains creating customizable cellular metallic materials that can be precisely engineered for specific performance requirements while being economically viable for widespread commercial adoption.

Market Demand Analysis for Metal Foam Products

The global metal foam market is experiencing significant growth, driven by increasing demand across multiple industries seeking lightweight yet strong materials with unique properties. Current market valuations estimate the metal foam sector at approximately $85 million in 2023, with projections indicating a compound annual growth rate (CAGR) of 4.2% through 2030, potentially reaching $115 million by the end of the forecast period.

Automotive and aerospace industries represent the largest market segments, collectively accounting for over 45% of total metal foam consumption. These sectors primarily utilize metal foams for weight reduction while maintaining structural integrity, crucial for improving fuel efficiency and reducing emissions. The automotive industry specifically has increased metal foam adoption by 18% over the past three years as manufacturers face stricter environmental regulations and consumer demand for more efficient vehicles.

Construction and infrastructure development constitute another rapidly expanding application area, growing at 5.7% annually. Metal foams offer superior thermal insulation, sound dampening, and fire resistance properties that traditional building materials cannot match. The energy absorption capabilities make them particularly valuable in seismic-resistant structures, driving adoption in earthquake-prone regions.

Medical device manufacturing represents an emerging high-value niche, with titanium foams increasingly used for orthopedic implants due to their biocompatibility and bone-like mechanical properties. Though currently representing only 7% of the market, this segment shows the highest growth potential at 9.3% annually, supported by aging populations in developed economies and advances in medical technology.

Regional analysis reveals North America and Europe as the dominant markets, collectively holding 65% market share, though Asia-Pacific demonstrates the fastest growth rate at 6.8% annually. China's manufacturing sector alone has increased metal foam consumption by 22% since 2020, primarily in transportation and industrial applications.

Key market restraints include high production costs and technical challenges in manufacturing consistency. Current production methods result in metal foams costing 3-5 times more than solid metal counterparts, limiting widespread adoption. However, recent manufacturing innovations have reduced production costs by approximately 15% over the past five years, gradually improving market accessibility.

Customer demand patterns indicate growing interest in customized metal foam solutions with specific density, pore size, and mechanical properties tailored to particular applications. This trend toward application-specific metal foams has created new market opportunities for specialized manufacturers who can deliver precision-engineered materials.

Automotive and aerospace industries represent the largest market segments, collectively accounting for over 45% of total metal foam consumption. These sectors primarily utilize metal foams for weight reduction while maintaining structural integrity, crucial for improving fuel efficiency and reducing emissions. The automotive industry specifically has increased metal foam adoption by 18% over the past three years as manufacturers face stricter environmental regulations and consumer demand for more efficient vehicles.

Construction and infrastructure development constitute another rapidly expanding application area, growing at 5.7% annually. Metal foams offer superior thermal insulation, sound dampening, and fire resistance properties that traditional building materials cannot match. The energy absorption capabilities make them particularly valuable in seismic-resistant structures, driving adoption in earthquake-prone regions.

Medical device manufacturing represents an emerging high-value niche, with titanium foams increasingly used for orthopedic implants due to their biocompatibility and bone-like mechanical properties. Though currently representing only 7% of the market, this segment shows the highest growth potential at 9.3% annually, supported by aging populations in developed economies and advances in medical technology.

Regional analysis reveals North America and Europe as the dominant markets, collectively holding 65% market share, though Asia-Pacific demonstrates the fastest growth rate at 6.8% annually. China's manufacturing sector alone has increased metal foam consumption by 22% since 2020, primarily in transportation and industrial applications.

Key market restraints include high production costs and technical challenges in manufacturing consistency. Current production methods result in metal foams costing 3-5 times more than solid metal counterparts, limiting widespread adoption. However, recent manufacturing innovations have reduced production costs by approximately 15% over the past five years, gradually improving market accessibility.

Customer demand patterns indicate growing interest in customized metal foam solutions with specific density, pore size, and mechanical properties tailored to particular applications. This trend toward application-specific metal foams has created new market opportunities for specialized manufacturers who can deliver precision-engineered materials.

Current Status and Technical Challenges in Metal Foam Fabrication

Metal foam fabrication technology has evolved significantly over the past three decades, with major advancements occurring in both production methods and application development. Currently, the global market is witnessing increased adoption across automotive, aerospace, and construction sectors, though widespread implementation remains limited by several technical challenges.

The production landscape is characterized by a dichotomy between laboratory-scale research and industrial-scale manufacturing. While research institutions have demonstrated numerous fabrication techniques, only a handful have achieved commercial viability. Primary production methods include powder metallurgy, melt gas injection, investment casting, and additive manufacturing approaches, each with distinct advantages and limitations regarding pore size control, structural integrity, and cost-effectiveness.

A significant technical challenge facing metal foam fabrication is process repeatability and quality control. The stochastic nature of foam formation makes it difficult to produce consistent cellular structures with predictable mechanical properties. This variability creates obstacles for engineering applications requiring precise performance specifications and reliable quality assurance protocols.

Cost remains a major barrier to widespread adoption. Current production methods, particularly for high-quality closed-cell aluminum foams, involve complex multi-stage processes with substantial material waste and energy consumption. The specialized equipment and expertise required further elevate production costs, making metal foams economically viable only for high-value applications where traditional materials cannot meet performance requirements.

Another critical challenge is the limited understanding of structure-property relationships in metal foams. Despite extensive research, the complex interplay between processing parameters, resultant microstructure, and mechanical behavior is not fully characterized. This knowledge gap hinders the development of tailored foams with optimized properties for specific applications.

Geographically, metal foam technology development is concentrated in industrialized regions, with significant research clusters in North America, Western Europe, and East Asia. Germany, Japan, and the United States lead in patent filings and commercial applications, while emerging economies like China are rapidly increasing research investment in this field.

Environmental considerations present both challenges and opportunities. While metal foams offer potential sustainability benefits through weight reduction and improved energy efficiency in applications, their production processes often involve environmentally problematic chemicals and significant energy consumption. Developing greener fabrication methods represents an important frontier for future research.

The production landscape is characterized by a dichotomy between laboratory-scale research and industrial-scale manufacturing. While research institutions have demonstrated numerous fabrication techniques, only a handful have achieved commercial viability. Primary production methods include powder metallurgy, melt gas injection, investment casting, and additive manufacturing approaches, each with distinct advantages and limitations regarding pore size control, structural integrity, and cost-effectiveness.

A significant technical challenge facing metal foam fabrication is process repeatability and quality control. The stochastic nature of foam formation makes it difficult to produce consistent cellular structures with predictable mechanical properties. This variability creates obstacles for engineering applications requiring precise performance specifications and reliable quality assurance protocols.

Cost remains a major barrier to widespread adoption. Current production methods, particularly for high-quality closed-cell aluminum foams, involve complex multi-stage processes with substantial material waste and energy consumption. The specialized equipment and expertise required further elevate production costs, making metal foams economically viable only for high-value applications where traditional materials cannot meet performance requirements.

Another critical challenge is the limited understanding of structure-property relationships in metal foams. Despite extensive research, the complex interplay between processing parameters, resultant microstructure, and mechanical behavior is not fully characterized. This knowledge gap hinders the development of tailored foams with optimized properties for specific applications.

Geographically, metal foam technology development is concentrated in industrialized regions, with significant research clusters in North America, Western Europe, and East Asia. Germany, Japan, and the United States lead in patent filings and commercial applications, while emerging economies like China are rapidly increasing research investment in this field.

Environmental considerations present both challenges and opportunities. While metal foams offer potential sustainability benefits through weight reduction and improved energy efficiency in applications, their production processes often involve environmentally problematic chemicals and significant energy consumption. Developing greener fabrication methods represents an important frontier for future research.

Current Metal Foam Fabrication Methods

01 Manufacturing methods for metal foam

Various manufacturing techniques are employed to produce metal foam structures with controlled porosity and properties. These methods include powder metallurgy processes, melt foaming with blowing agents, space holder methods, and additive manufacturing approaches. The manufacturing process significantly influences the resulting foam's density, pore size distribution, and mechanical properties. Advanced techniques allow for the creation of gradient structures and customized foam architectures tailored for specific applications.- Manufacturing methods for metal foam: Various manufacturing techniques are employed to produce metal foams, including powder metallurgy, casting processes, and gas injection methods. These processes involve creating porous structures by introducing gas bubbles or space-holding materials into molten metal or metal powder mixtures. The resulting metal foams have controlled porosity and density, which can be tailored for specific applications. Advanced manufacturing methods may include the use of 3D printing technologies or template-based approaches to achieve precise pore structures.

- Structural applications of metal foam: Metal foams are utilized in various structural applications due to their unique combination of lightweight properties and mechanical strength. These materials are particularly valuable in automotive, aerospace, and construction industries where weight reduction without compromising structural integrity is crucial. Metal foams provide excellent energy absorption capabilities, making them ideal for crash protection systems and impact-resistant structures. Their high strength-to-weight ratio enables the design of lightweight yet robust components for transportation and building applications.

- Thermal and acoustic properties of metal foam: Metal foams exhibit exceptional thermal and acoustic properties due to their porous structure. They provide effective heat dissipation and thermal insulation, making them suitable for heat exchangers, thermal management systems, and fire-resistant barriers. The interconnected pore network allows for efficient heat transfer while maintaining structural integrity at high temperatures. Additionally, metal foams demonstrate excellent sound absorption capabilities, reducing noise transmission and vibration. These properties make them valuable in applications requiring both thermal regulation and acoustic dampening.

- Composite metal foams: Composite metal foams incorporate additional materials or phases to enhance specific properties. These may include ceramic particles, carbon fibers, or other metals to improve strength, corrosion resistance, or functional characteristics. The hybrid structures combine the advantages of metal foams with those of the reinforcing materials, resulting in superior performance for specialized applications. Manufacturing techniques for composite metal foams often involve infiltration methods or powder metallurgy approaches that allow precise control over composition and microstructure. These materials can be tailored to meet demanding requirements in extreme environments.

- Functional applications of metal foam: Metal foams serve in various functional applications beyond structural uses, including filtration systems, catalytic supports, and electromagnetic shielding. Their open-cell structure provides high surface area for chemical reactions or fluid flow, making them effective as catalyst carriers or filtration media. Metal foams can also be engineered for specific electromagnetic properties, offering shielding against radiation or serving as electrodes in energy storage devices. Additionally, they find applications in biomedical fields as implant materials due to their biocompatibility and ability to promote tissue integration through controlled porosity.

02 Structural applications of metal foam

Metal foams are utilized in structural applications due to their high strength-to-weight ratio and energy absorption capabilities. These materials are particularly valuable in automotive, aerospace, and construction industries where lightweight yet strong components are required. Metal foams provide excellent impact resistance, vibration damping, and thermal insulation properties. Their cellular structure enables efficient load distribution and crash energy absorption, making them ideal for safety-critical components and protective structures.Expand Specific Solutions03 Thermal management applications of metal foam

Metal foams excel in thermal management applications due to their high surface area-to-volume ratio and thermal conductivity. These materials are used as heat exchangers, heat sinks, and thermal insulators in various industries. The interconnected pore structure allows for efficient heat transfer while maintaining structural integrity at high temperatures. Metal foams can be engineered with specific pore sizes and distributions to optimize thermal performance for particular cooling requirements and operating conditions.Expand Specific Solutions04 Composite metal foam systems

Composite metal foam systems combine metal foams with other materials to enhance specific properties. These hybrid structures may incorporate polymers, ceramics, or different metal alloys to achieve superior performance characteristics. Composite metal foams can offer improved mechanical strength, corrosion resistance, or functional properties like electromagnetic shielding. The integration of multiple materials allows for tailored solutions addressing complex engineering challenges across various industrial applications.Expand Specific Solutions05 Functional properties and specialized applications of metal foam

Metal foams possess unique functional properties that enable specialized applications beyond structural and thermal uses. These include acoustic damping, electromagnetic shielding, filtration, and catalytic support functions. The high surface area and controllable porosity make metal foams excellent substrates for chemical reactions and separation processes. Additionally, biocompatible metal foams are used in medical implants and tissue engineering scaffolds, where their porous structure promotes tissue integration and growth while providing necessary mechanical support.Expand Specific Solutions

Key Industry Players in Metal Foam Manufacturing

The metal foam fabrication market is currently in a growth phase, driven by increasing demand for lightweight materials in automotive, aerospace, and construction sectors. The market size is estimated to be expanding at a CAGR of 4-5%, with significant potential in energy absorption and thermal management applications. Regarding technological maturity, established players like LG Chem, Toyota Motor Corp., RTX Corp., and Siemens Energy are leading commercial applications, while research institutions such as Tsinghua University, North Carolina State University, and Indian Institute of Science are advancing fundamental innovations. Chinese companies like Sinopec and emerging players such as Yuhuan Degu New Material Technology are increasingly contributing to market diversification, particularly in specialized applications requiring customized metal foam properties.

Tsinghua University

Technical Solution: Tsinghua University has developed cutting-edge metal foam fabrication technologies through their Materials Science and Engineering department. Their research focuses on multi-functional metal foams created through space-holder methods and directional solidification techniques. Tsinghua's approach enables precise control over pore morphology, creating anisotropic structures with aligned pores ranging from 50μm to 5mm. Their metal foams incorporate aluminum, magnesium, and titanium alloys, often with ceramic particle reinforcements to enhance mechanical properties. A significant innovation is their development of functionally graded metal foams with porosity gradients tailored for specific loading conditions. Testing has demonstrated up to 35% improvement in specific strength and 45% enhancement in energy absorption compared to uniform-density foams. Tsinghua researchers have also pioneered surface modification techniques that improve corrosion resistance and biocompatibility, expanding potential applications into medical implants. Their recent work includes developing self-healing metal foams that can partially restore mechanical properties after damage through embedded microcapsules containing reactive healing agents.

Strengths: Highly innovative approaches to foam architecture; excellent research facilities and expertise; strong fundamental understanding of foam mechanics. Weaknesses: Some technologies remain at laboratory scale; commercialization pathways still developing; higher production complexity for advanced foam structures.

Toyota Motor Corp.

Technical Solution: Toyota has developed advanced metal foam fabrication techniques focusing on aluminum-based metal foams for automotive applications. Their proprietary process involves controlled gas injection into molten aluminum alloys with stabilizing ceramic particles to create uniform cellular structures. Toyota's metal foam components are primarily used in crash absorption zones, reducing vehicle weight while maintaining structural integrity. Their research has demonstrated up to 30% weight reduction in certain structural components while improving energy absorption by 25% during impact tests. Toyota has also developed specialized coating technologies to enhance the corrosion resistance of their metal foams, extending durability in harsh automotive environments. Recent advancements include gradient-density foams that provide optimized performance in specific load-bearing applications.

Strengths: Superior quality control in foam structure uniformity; excellent integration with existing automotive manufacturing processes; proven crash-worthiness performance. Weaknesses: Higher production costs compared to conventional materials; limited application beyond automotive sector; requires specialized equipment for mass production.

Core Patents and Technical Literature in Metal Foam Development

Method for manufacturing metal foam

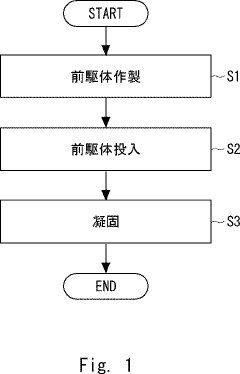

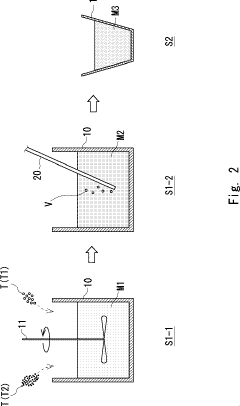

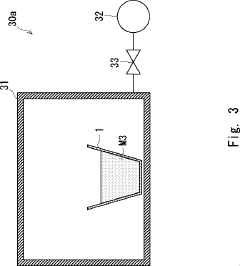

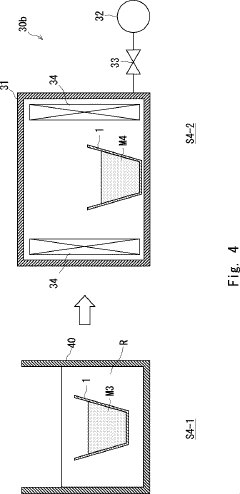

PatentActiveJP2022122172A

Innovation

- A method involving the dissolution of hydrogen in a molten metal-thickener mixture, followed by solidification under reduced pressure to create a metal foam precursor, which is then solidified and heated under vacuum to form a metal foam with controlled pore morphology.

Method of producing metal foam bodies of Zn-alloys

PatentInactiveEP1422303A1

Innovation

- The production of zinc-based metal foams involves cold-pressing alloys with 2-16% aluminum, adding up to 4% copper, magnesium, manganese, and titanium, and incorporating overspray powders with oxide skins, which are then compacted using an extruder before foaming, and using suitable blowing agents like zirconium hydride to enhance mechanical stability and corrosion resistance.

Cost-Benefit Analysis of Metal Foam Applications

The economic viability of metal foam applications requires thorough cost-benefit analysis across various industry sectors. Initial production costs for metal foam components typically exceed those of conventional materials by 30-50%, primarily due to specialized manufacturing processes and equipment requirements. However, this cost premium must be evaluated against lifecycle benefits that often yield significant returns on investment.

In automotive applications, metal foam components demonstrate 15-25% weight reduction compared to solid metal counterparts, translating to fuel efficiency improvements of 2-4% in conventional vehicles and extended range in electric vehicles. The energy absorption capabilities of metal foam structures reduce secondary costs associated with collision damage by approximately 20%, while potentially decreasing insurance premiums through enhanced safety ratings.

Aerospace implementations show even more compelling economics, with weight savings valued at $500-1,000 per kilogram over aircraft lifetime operation. Despite higher upfront costs, the fuel savings and increased payload capacity generate ROI periods of 3-5 years for commercial aircraft applications. Military aerospace applications prioritize performance benefits over cost considerations, making metal foams particularly attractive despite premium pricing.

Building construction applications present mixed economic outcomes. While metal foam insulation panels reduce energy consumption by 15-30% compared to traditional materials, the extended payback periods of 7-10 years have limited widespread adoption. However, in high-value applications such as fire-resistant structures, the cost premium is justified by significant risk reduction and potential insurance savings.

Industrial heat exchangers utilizing metal foams demonstrate 30-40% improved thermal efficiency compared to conventional designs, reducing operational energy costs and associated carbon emissions. The compact design enabled by metal foam structures also reduces material requirements by up to 25%, partially offsetting higher material costs.

Medical applications represent the highest value-to-cost ratio, with patient outcomes and reduced complication rates justifying premium pricing for metal foam implants. The enhanced osseointegration properties reduce secondary procedures by approximately 30%, generating healthcare system savings that far outweigh the 2-3x cost premium of metal foam implants.

Market analysis indicates that cost-sensitive industries require production scale increases of 5-10x current volumes to achieve price parity with conventional materials. Technological advancements in manufacturing processes, particularly in powder metallurgy and additive manufacturing, are projected to reduce production costs by 15-20% annually over the next five years, significantly improving the cost-benefit equation across all application sectors.

In automotive applications, metal foam components demonstrate 15-25% weight reduction compared to solid metal counterparts, translating to fuel efficiency improvements of 2-4% in conventional vehicles and extended range in electric vehicles. The energy absorption capabilities of metal foam structures reduce secondary costs associated with collision damage by approximately 20%, while potentially decreasing insurance premiums through enhanced safety ratings.

Aerospace implementations show even more compelling economics, with weight savings valued at $500-1,000 per kilogram over aircraft lifetime operation. Despite higher upfront costs, the fuel savings and increased payload capacity generate ROI periods of 3-5 years for commercial aircraft applications. Military aerospace applications prioritize performance benefits over cost considerations, making metal foams particularly attractive despite premium pricing.

Building construction applications present mixed economic outcomes. While metal foam insulation panels reduce energy consumption by 15-30% compared to traditional materials, the extended payback periods of 7-10 years have limited widespread adoption. However, in high-value applications such as fire-resistant structures, the cost premium is justified by significant risk reduction and potential insurance savings.

Industrial heat exchangers utilizing metal foams demonstrate 30-40% improved thermal efficiency compared to conventional designs, reducing operational energy costs and associated carbon emissions. The compact design enabled by metal foam structures also reduces material requirements by up to 25%, partially offsetting higher material costs.

Medical applications represent the highest value-to-cost ratio, with patient outcomes and reduced complication rates justifying premium pricing for metal foam implants. The enhanced osseointegration properties reduce secondary procedures by approximately 30%, generating healthcare system savings that far outweigh the 2-3x cost premium of metal foam implants.

Market analysis indicates that cost-sensitive industries require production scale increases of 5-10x current volumes to achieve price parity with conventional materials. Technological advancements in manufacturing processes, particularly in powder metallurgy and additive manufacturing, are projected to reduce production costs by 15-20% annually over the next five years, significantly improving the cost-benefit equation across all application sectors.

Sustainability and Environmental Impact of Metal Foam Production

The environmental impact of metal foam production has become increasingly significant as sustainability concerns drive market evolution. Metal foam manufacturing processes vary considerably in their ecological footprint, with traditional methods often involving energy-intensive heating and chemical processes that generate substantial carbon emissions. However, the industry is witnessing a paradigm shift toward greener production techniques, including powder metallurgy approaches that minimize waste and reduce energy consumption by up to 30% compared to conventional casting methods.

Lifecycle assessment studies indicate that metal foams offer significant sustainability advantages during their use phase, particularly in transportation applications where their lightweight properties contribute to fuel efficiency improvements of 5-8% in automotive and aerospace sectors. This translates to substantial carbon emission reductions over product lifespans, often offsetting the initial production footprint within 2-3 years of operation.

Water usage represents another critical environmental consideration, with closed-loop cooling systems now being implemented by leading manufacturers to reduce consumption by approximately 65% compared to open systems. Additionally, the integration of recycled metal feedstock into production processes has gained traction, with some producers achieving incorporation rates of up to 40% recycled content without compromising structural integrity or performance characteristics.

Regulatory frameworks are increasingly influencing production practices, with the European Union's Circular Economy Action Plan and similar initiatives in North America establishing stringent guidelines for manufacturing waste and end-of-life product management. These regulations have catalyzed innovation in recyclability, with new metal foam designs featuring improved disassembly capabilities and material separation for more efficient resource recovery.

Emerging technologies such as additive manufacturing for metal foams promise further sustainability improvements through precise material deposition that can reduce waste by up to 90% compared to subtractive manufacturing processes. These technologies also enable more complex geometries that optimize material usage while maintaining or enhancing functional properties.

The industry is also addressing concerns regarding potentially hazardous stabilizing agents and foaming chemicals by developing bio-based alternatives derived from renewable resources. These innovations not only reduce environmental toxicity but also decrease dependence on petrochemical derivatives, aligning production processes with broader sustainability objectives and meeting growing market demand for environmentally responsible materials.

Lifecycle assessment studies indicate that metal foams offer significant sustainability advantages during their use phase, particularly in transportation applications where their lightweight properties contribute to fuel efficiency improvements of 5-8% in automotive and aerospace sectors. This translates to substantial carbon emission reductions over product lifespans, often offsetting the initial production footprint within 2-3 years of operation.

Water usage represents another critical environmental consideration, with closed-loop cooling systems now being implemented by leading manufacturers to reduce consumption by approximately 65% compared to open systems. Additionally, the integration of recycled metal feedstock into production processes has gained traction, with some producers achieving incorporation rates of up to 40% recycled content without compromising structural integrity or performance characteristics.

Regulatory frameworks are increasingly influencing production practices, with the European Union's Circular Economy Action Plan and similar initiatives in North America establishing stringent guidelines for manufacturing waste and end-of-life product management. These regulations have catalyzed innovation in recyclability, with new metal foam designs featuring improved disassembly capabilities and material separation for more efficient resource recovery.

Emerging technologies such as additive manufacturing for metal foams promise further sustainability improvements through precise material deposition that can reduce waste by up to 90% compared to subtractive manufacturing processes. These technologies also enable more complex geometries that optimize material usage while maintaining or enhancing functional properties.

The industry is also addressing concerns regarding potentially hazardous stabilizing agents and foaming chemicals by developing bio-based alternatives derived from renewable resources. These innovations not only reduce environmental toxicity but also decrease dependence on petrochemical derivatives, aligning production processes with broader sustainability objectives and meeting growing market demand for environmentally responsible materials.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!