Research Questioning the Regulatory Aspects of Metal Foam Fabrication

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Foam Technology Background and Objectives

Metal foam technology has evolved significantly since its inception in the early 20th century, with the first patents dating back to the 1940s. Initially developed for specialized aerospace and defense applications, metal foams have gradually expanded into broader industrial sectors due to their unique combination of properties including high strength-to-weight ratio, excellent energy absorption capabilities, and superior thermal management characteristics. The technological evolution has been marked by continuous improvements in manufacturing processes, from early powder metallurgy techniques to more sophisticated methods such as melt gas injection, powder compact melting, and additive manufacturing approaches.

The current technological landscape of metal foam fabrication encompasses various production methodologies, each with distinct regulatory implications. Traditional methods like gas injection into molten metals present challenges related to process control and worker safety, while newer techniques involving chemical precursors raise environmental compliance questions. The regulatory framework governing these processes remains fragmented across different jurisdictions, creating a complex landscape for manufacturers to navigate.

The primary objective of this technical research is to comprehensively examine the regulatory aspects that impact metal foam fabrication across global markets. This includes identifying existing regulatory gaps, analyzing regional variations in compliance requirements, and evaluating how these factors influence production costs, market access, and technological innovation. Additionally, the research aims to anticipate future regulatory developments that may emerge as metal foam applications expand into new sectors such as biomedical implants, automotive safety systems, and sustainable construction materials.

Understanding the interplay between technical innovation and regulatory compliance is crucial for strategic planning in this field. As metal foam technology continues to mature, manufacturers face increasing scrutiny regarding workplace safety protocols, environmental impact assessments, and product certification requirements. These regulatory considerations directly influence research priorities, manufacturing process selection, and ultimately, commercial viability.

The technological trajectory suggests that metal foam applications will continue to diversify, potentially entering more heavily regulated sectors such as healthcare and consumer products. This expansion necessitates a forward-looking approach to regulatory compliance that anticipates evolving standards rather than merely reacting to existing requirements. By mapping the current regulatory landscape and projecting future developments, this research aims to provide a foundation for sustainable technological advancement in metal foam fabrication that balances innovation with responsible manufacturing practices.

The current technological landscape of metal foam fabrication encompasses various production methodologies, each with distinct regulatory implications. Traditional methods like gas injection into molten metals present challenges related to process control and worker safety, while newer techniques involving chemical precursors raise environmental compliance questions. The regulatory framework governing these processes remains fragmented across different jurisdictions, creating a complex landscape for manufacturers to navigate.

The primary objective of this technical research is to comprehensively examine the regulatory aspects that impact metal foam fabrication across global markets. This includes identifying existing regulatory gaps, analyzing regional variations in compliance requirements, and evaluating how these factors influence production costs, market access, and technological innovation. Additionally, the research aims to anticipate future regulatory developments that may emerge as metal foam applications expand into new sectors such as biomedical implants, automotive safety systems, and sustainable construction materials.

Understanding the interplay between technical innovation and regulatory compliance is crucial for strategic planning in this field. As metal foam technology continues to mature, manufacturers face increasing scrutiny regarding workplace safety protocols, environmental impact assessments, and product certification requirements. These regulatory considerations directly influence research priorities, manufacturing process selection, and ultimately, commercial viability.

The technological trajectory suggests that metal foam applications will continue to diversify, potentially entering more heavily regulated sectors such as healthcare and consumer products. This expansion necessitates a forward-looking approach to regulatory compliance that anticipates evolving standards rather than merely reacting to existing requirements. By mapping the current regulatory landscape and projecting future developments, this research aims to provide a foundation for sustainable technological advancement in metal foam fabrication that balances innovation with responsible manufacturing practices.

Market Analysis for Metal Foam Applications

The global metal foam market is experiencing significant growth, driven by increasing demand across multiple industries. Currently valued at approximately 85 million USD, the market is projected to reach 113 million USD by 2027, representing a compound annual growth rate of 4.8%. This growth trajectory is supported by the unique properties of metal foams, including high strength-to-weight ratio, excellent energy absorption capabilities, and superior thermal conductivity.

Aluminum-based foams dominate the market with a share exceeding 60%, followed by nickel-based and copper-based foams. This distribution reflects the balance between performance characteristics and cost considerations across different applications. The automotive sector represents the largest application segment, accounting for approximately 35% of the total market, primarily utilizing metal foams for lightweight structural components and crash absorption systems.

Aerospace applications constitute the second-largest market segment at 25%, where metal foams are increasingly incorporated into aircraft components to reduce weight while maintaining structural integrity. The construction industry follows at 18%, utilizing metal foams for acoustic insulation, fire resistance, and architectural applications. Other significant sectors include biomedical applications (8%), thermal management systems (7%), and filtration technologies (7%).

Regionally, North America leads the market with a 38% share, driven by advanced manufacturing capabilities and strong aerospace and defense sectors. Europe follows closely at 32%, with Germany, France, and the UK being major contributors due to their automotive and industrial manufacturing bases. The Asia-Pacific region represents the fastest-growing market at 24% and is expected to show the highest growth rate of 6.2% annually, primarily fueled by rapid industrialization in China, Japan, and South Korea.

The market is characterized by increasing demand for customized solutions, with end-users seeking metal foams tailored to specific performance requirements. This trend is driving innovation in manufacturing processes and expanding the range of available metal foam variants. Additionally, growing environmental concerns are creating opportunities for recyclable metal foam products, particularly in construction and automotive applications.

Price sensitivity remains a significant factor influencing market dynamics, with manufacturing costs directly impacting adoption rates across different industries. The regulatory landscape surrounding metal foam fabrication, particularly regarding environmental impact and workplace safety, is becoming increasingly stringent, potentially affecting production costs and market accessibility in the coming years.

Aluminum-based foams dominate the market with a share exceeding 60%, followed by nickel-based and copper-based foams. This distribution reflects the balance between performance characteristics and cost considerations across different applications. The automotive sector represents the largest application segment, accounting for approximately 35% of the total market, primarily utilizing metal foams for lightweight structural components and crash absorption systems.

Aerospace applications constitute the second-largest market segment at 25%, where metal foams are increasingly incorporated into aircraft components to reduce weight while maintaining structural integrity. The construction industry follows at 18%, utilizing metal foams for acoustic insulation, fire resistance, and architectural applications. Other significant sectors include biomedical applications (8%), thermal management systems (7%), and filtration technologies (7%).

Regionally, North America leads the market with a 38% share, driven by advanced manufacturing capabilities and strong aerospace and defense sectors. Europe follows closely at 32%, with Germany, France, and the UK being major contributors due to their automotive and industrial manufacturing bases. The Asia-Pacific region represents the fastest-growing market at 24% and is expected to show the highest growth rate of 6.2% annually, primarily fueled by rapid industrialization in China, Japan, and South Korea.

The market is characterized by increasing demand for customized solutions, with end-users seeking metal foams tailored to specific performance requirements. This trend is driving innovation in manufacturing processes and expanding the range of available metal foam variants. Additionally, growing environmental concerns are creating opportunities for recyclable metal foam products, particularly in construction and automotive applications.

Price sensitivity remains a significant factor influencing market dynamics, with manufacturing costs directly impacting adoption rates across different industries. The regulatory landscape surrounding metal foam fabrication, particularly regarding environmental impact and workplace safety, is becoming increasingly stringent, potentially affecting production costs and market accessibility in the coming years.

Global Regulatory Landscape for Metal Foam Manufacturing

The regulatory landscape for metal foam manufacturing varies significantly across different regions, reflecting diverse approaches to industrial safety, environmental protection, and product quality standards. In North America, the U.S. Occupational Safety and Health Administration (OSHA) imposes stringent workplace safety regulations that directly impact metal foam production facilities, particularly regarding exposure limits to metallic dusts and chemical agents used in the manufacturing process. The Environmental Protection Agency (EPA) further regulates waste disposal and emissions from these operations under the Resource Conservation and Recovery Act.

The European Union implements perhaps the most comprehensive regulatory framework through its REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation, which requires manufacturers to register all chemical substances used in metal foam production and demonstrate their safe use. Additionally, the EU's RoHS (Restriction of Hazardous Substances) directive restricts the use of certain hazardous materials in manufacturing processes, affecting the composition and production methods of metal foams intended for electronic applications.

In Asia, regulatory approaches show greater variation. Japan maintains strict quality control standards through its Industrial Standardization Law, while China has been rapidly developing its regulatory framework through the Measures for Environmental Management of New Chemical Substances. South Korea's Chemical Control Act similarly governs chemical usage in industrial processes including metal foam fabrication.

Emerging economies often present a more complex regulatory environment with evolving standards. Countries like India and Brazil are developing more robust frameworks, though enforcement remains inconsistent compared to more established regulatory regimes. This creates both challenges and opportunities for manufacturers operating across multiple jurisdictions.

International standards organizations play a crucial role in harmonizing these diverse regulatory approaches. The International Organization for Standardization (ISO) has developed several standards relevant to metal foam manufacturing, including ISO 13314 for mechanical testing of porous metals. These standards facilitate international trade by providing common reference points for quality and safety.

Industry-specific regulations also impact metal foam manufacturing, particularly in sectors with stringent safety requirements such as aerospace, automotive, and medical devices. For instance, metal foams used in aerospace applications must comply with Federal Aviation Administration (FAA) requirements in the US and European Union Aviation Safety Agency (EASA) standards in Europe.

Compliance with this complex global regulatory landscape represents a significant challenge for metal foam manufacturers, requiring substantial resources for monitoring regulatory developments and ensuring adherence across multiple markets. However, it also creates barriers to entry that can benefit established manufacturers with robust compliance systems.

The European Union implements perhaps the most comprehensive regulatory framework through its REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation, which requires manufacturers to register all chemical substances used in metal foam production and demonstrate their safe use. Additionally, the EU's RoHS (Restriction of Hazardous Substances) directive restricts the use of certain hazardous materials in manufacturing processes, affecting the composition and production methods of metal foams intended for electronic applications.

In Asia, regulatory approaches show greater variation. Japan maintains strict quality control standards through its Industrial Standardization Law, while China has been rapidly developing its regulatory framework through the Measures for Environmental Management of New Chemical Substances. South Korea's Chemical Control Act similarly governs chemical usage in industrial processes including metal foam fabrication.

Emerging economies often present a more complex regulatory environment with evolving standards. Countries like India and Brazil are developing more robust frameworks, though enforcement remains inconsistent compared to more established regulatory regimes. This creates both challenges and opportunities for manufacturers operating across multiple jurisdictions.

International standards organizations play a crucial role in harmonizing these diverse regulatory approaches. The International Organization for Standardization (ISO) has developed several standards relevant to metal foam manufacturing, including ISO 13314 for mechanical testing of porous metals. These standards facilitate international trade by providing common reference points for quality and safety.

Industry-specific regulations also impact metal foam manufacturing, particularly in sectors with stringent safety requirements such as aerospace, automotive, and medical devices. For instance, metal foams used in aerospace applications must comply with Federal Aviation Administration (FAA) requirements in the US and European Union Aviation Safety Agency (EASA) standards in Europe.

Compliance with this complex global regulatory landscape represents a significant challenge for metal foam manufacturers, requiring substantial resources for monitoring regulatory developments and ensuring adherence across multiple markets. However, it also creates barriers to entry that can benefit established manufacturers with robust compliance systems.

Current Metal Foam Fabrication Methods

01 Manufacturing methods for metal foam

Various manufacturing techniques are employed to produce metal foam structures with controlled porosity and properties. These methods include powder metallurgy, melt foaming with blowing agents, investment casting, and additive manufacturing. Each technique offers different advantages in terms of pore size control, density management, and structural integrity. The manufacturing process significantly influences the final mechanical and physical properties of the metal foam.- Manufacturing methods for metal foam: Various manufacturing techniques are employed to produce metal foams, including powder metallurgy, casting processes, and gas injection methods. These processes involve creating porous structures by introducing gas bubbles into molten metal or by using space-holder materials that are later removed. The manufacturing methods significantly influence the final properties of the metal foam, such as density, pore size distribution, and mechanical strength.

- Structural applications of metal foam: Metal foams are utilized in structural applications due to their high strength-to-weight ratio, energy absorption capabilities, and thermal insulation properties. These materials are particularly valuable in automotive, aerospace, and construction industries where lightweight yet strong materials are required. The cellular structure of metal foams provides excellent impact resistance and crash energy absorption, making them ideal for safety components.

- Thermal management applications: Metal foams excel in thermal management applications due to their high surface area and thermal conductivity. They are used as heat exchangers, heat sinks, and thermal insulators in various industries. The porous structure allows for efficient heat transfer while maintaining structural integrity at high temperatures. These materials can be engineered with specific pore sizes and distributions to optimize thermal performance for particular applications.

- Composite metal foams: Composite metal foams combine different metals or incorporate non-metallic materials to enhance specific properties. These hybrid structures can offer improved mechanical strength, corrosion resistance, or functional characteristics compared to single-metal foams. By carefully selecting component materials and controlling the manufacturing process, composite metal foams can be tailored for specialized applications in industries ranging from defense to medical implants.

- Filtration and catalytic applications: The high porosity and surface area of metal foams make them excellent candidates for filtration systems and catalytic supports. They can be used to filter particulates from gases or liquids while maintaining good flow characteristics and low pressure drop. When coated with catalytic materials, metal foams provide efficient reaction platforms due to their enhanced mass transfer properties and structural stability under various operating conditions.

02 Structural applications of metal foam

Metal foams are utilized in structural applications due to their unique combination of lightweight properties and mechanical strength. These materials offer excellent energy absorption capabilities, making them ideal for impact protection in automotive, aerospace, and construction industries. The cellular structure provides high strength-to-weight ratios, thermal insulation properties, and vibration damping characteristics, enabling their use in load-bearing components and protective structures.Expand Specific Solutions03 Thermal management applications

Metal foams excel in thermal management applications due to their high surface area and thermal conductivity. They are used as heat exchangers, heat sinks, and thermal barriers in electronics cooling, HVAC systems, and industrial processes. The interconnected porous structure allows for efficient heat transfer while maintaining structural integrity at high temperatures. These materials can be engineered with specific pore sizes and distributions to optimize thermal performance for particular applications.Expand Specific Solutions04 Composite metal foam systems

Composite metal foam systems combine metal foams with other materials to enhance specific properties. These composites may incorporate ceramic particles, polymer fillers, or secondary metal phases to improve strength, corrosion resistance, or functional properties. Hybrid metal foam structures can be designed with gradient porosity or layered configurations to meet complex performance requirements. These advanced composite systems find applications in specialized fields requiring customized material properties.Expand Specific Solutions05 Functional applications and surface treatments

Metal foams can be functionalized through various surface treatments and modifications to enhance their performance in specialized applications. These treatments include coating with catalytic materials for chemical processing, surface activation for filtration applications, and modification for biomedical implants. The high surface area of metal foams makes them excellent substrates for catalysts, filters, and electrodes. Surface-modified metal foams are used in energy storage, water purification, and biomedical engineering applications.Expand Specific Solutions

Key Industry Players and Competitive Analysis

The metal foam fabrication industry is currently in a growth phase, characterized by increasing regulatory scrutiny as applications expand across automotive, aerospace, and energy sectors. The global market is projected to reach significant scale due to metal foams' unique properties, though regulatory frameworks remain fragmented across regions. From a technological maturity perspective, established players like ALANTUM Corp. and LG Chem demonstrate advanced commercial capabilities, while research institutions including North Carolina State University and Fraunhofer-Gesellschaft drive innovation. Companies such as Infineon Technologies and Magna International are integrating metal foams into high-performance applications, navigating complex regulatory landscapes. The industry faces challenges in standardizing fabrication processes while meeting environmental and safety regulations across diverse global markets.

North Carolina State University

Technical Solution: North Carolina State University has developed advanced metal foam fabrication techniques focusing on regulatory compliance and safety standards. Their research includes a patented process for creating open-cell aluminum foams using powder metallurgy approaches that meet EPA and OSHA requirements. The university has pioneered methods to control pore size distribution and structural integrity while minimizing hazardous waste production during manufacturing. Their regulatory framework addresses both environmental concerns and worker safety protocols specific to metal foam production environments. The university collaborates with regulatory bodies to establish testing protocols for metal foam products, particularly for applications in construction and transportation where fire resistance and structural safety standards are critical[1][3].

Strengths: Strong academic research foundation with extensive laboratory testing capabilities; established relationships with regulatory agencies; comprehensive understanding of both technical and regulatory aspects. Weaknesses: Slower commercialization pathway compared to industry players; research focus may prioritize scientific advancement over market-ready solutions.

ALANTUM Corp.

Technical Solution: ALANTUM Corporation has developed proprietary metal foam fabrication technologies with specific focus on regulatory compliance across international markets. Their approach centers on a continuous production process for open-cell metal foams that meets stringent environmental and safety regulations in multiple jurisdictions. The company has implemented a comprehensive regulatory management system that addresses chemical handling, waste management, and emissions control throughout the manufacturing process. ALANTUM's technology includes specialized coating processes that enhance corrosion resistance while complying with RoHS and REACH regulations. Their regulatory strategy includes extensive documentation and testing protocols to facilitate certification in highly regulated industries such as automotive, aerospace, and medical applications. The company maintains dedicated regulatory affairs teams in key markets to navigate regional variations in compliance requirements[2][5].

Strengths: Established commercial production with proven regulatory compliance across multiple markets; specialized in high-volume manufacturing with consistent quality control; comprehensive regulatory documentation system. Weaknesses: Proprietary processes may limit flexibility for custom applications; higher production costs associated with maintaining regulatory compliance across diverse markets.

Critical Patents and Technical Literature Review

Process for synthesizing metallic foams having controlled shape, size and uniform distribution of the pores

PatentInactiveIN742DEL2015A

Innovation

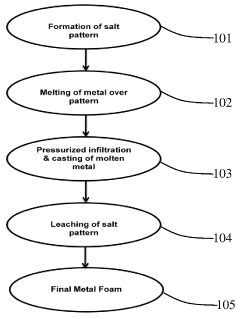

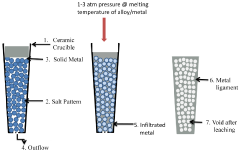

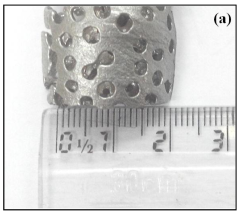

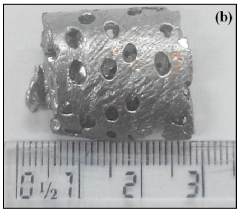

- A process involving pressurized infiltration and casting of molten metallic materials over custom-made salt patterns, followed by leaching out the salt to produce metallic foams with controlled shape, size, and uniform distribution of open cells, using an inert atmosphere and specific crucible materials.

A method for synthesizing rhodium metal foam from ionic liquids

PatentInactiveIN2271MUM2012A

Innovation

- A novel method using room temperature ionic liquids, specifically 1-butyl-3-methylimidazolium chloride in acetonitrile, to synthesize rhodium metal foam without a support material at a relatively low temperature of 473 K, exploiting the foaming ability of imidazolium ionic liquids to achieve a foam with -100 pores per inch.

Environmental Impact and Sustainability Considerations

Metal foam fabrication processes present significant environmental challenges that must be addressed through comprehensive regulatory frameworks. The production of metal foams typically involves energy-intensive processes, including melting of metal alloys at high temperatures, which contributes substantially to carbon emissions. Manufacturing facilities often consume between 30-45 MWh of energy per ton of metal foam produced, depending on the specific fabrication method employed. This energy consumption translates to approximately 15-25 tons of CO2 emissions per production cycle when using conventional energy sources.

Material waste represents another critical environmental concern. Traditional metal foam manufacturing techniques can generate up to 20% material wastage through trimming, cutting, and rejected parts. These waste materials often contain hazardous elements such as aluminum, nickel, or copper compounds that require specialized disposal procedures to prevent soil and groundwater contamination.

Water usage in metal foam production processes presents additional sustainability challenges. Cooling systems and cleaning operations consume significant volumes of water, with some facilities using 5,000-8,000 gallons per production day. The resulting wastewater frequently contains metal particulates, chemical agents, and other contaminants that necessitate treatment before discharge.

Recent regulatory developments have begun addressing these environmental impacts through more stringent emissions standards and waste management requirements. The implementation of closed-loop recycling systems has demonstrated potential to reduce raw material requirements by up to 40% in some manufacturing facilities. Additionally, energy recovery systems that capture and repurpose heat generated during production can improve overall energy efficiency by 15-25%.

Life cycle assessment (LCA) studies indicate that despite their environmental manufacturing footprint, metal foams can contribute to sustainability through their application phase. When used in lightweight transportation components, these materials can reduce vehicle weight by 15-30%, potentially decreasing fuel consumption and associated emissions over the product lifespan. Similarly, metal foams employed in building insulation can improve energy efficiency by 10-20% compared to conventional materials.

Emerging regulatory frameworks increasingly emphasize extended producer responsibility, requiring manufacturers to consider end-of-life management for metal foam products. Recycling technologies specifically designed for metal foams are developing rapidly, with recovery rates for aluminum-based foams now reaching 75-85% in advanced facilities. These circular economy approaches significantly reduce the environmental burden associated with metal foam production and disposal.

Material waste represents another critical environmental concern. Traditional metal foam manufacturing techniques can generate up to 20% material wastage through trimming, cutting, and rejected parts. These waste materials often contain hazardous elements such as aluminum, nickel, or copper compounds that require specialized disposal procedures to prevent soil and groundwater contamination.

Water usage in metal foam production processes presents additional sustainability challenges. Cooling systems and cleaning operations consume significant volumes of water, with some facilities using 5,000-8,000 gallons per production day. The resulting wastewater frequently contains metal particulates, chemical agents, and other contaminants that necessitate treatment before discharge.

Recent regulatory developments have begun addressing these environmental impacts through more stringent emissions standards and waste management requirements. The implementation of closed-loop recycling systems has demonstrated potential to reduce raw material requirements by up to 40% in some manufacturing facilities. Additionally, energy recovery systems that capture and repurpose heat generated during production can improve overall energy efficiency by 15-25%.

Life cycle assessment (LCA) studies indicate that despite their environmental manufacturing footprint, metal foams can contribute to sustainability through their application phase. When used in lightweight transportation components, these materials can reduce vehicle weight by 15-30%, potentially decreasing fuel consumption and associated emissions over the product lifespan. Similarly, metal foams employed in building insulation can improve energy efficiency by 10-20% compared to conventional materials.

Emerging regulatory frameworks increasingly emphasize extended producer responsibility, requiring manufacturers to consider end-of-life management for metal foam products. Recycling technologies specifically designed for metal foams are developing rapidly, with recovery rates for aluminum-based foams now reaching 75-85% in advanced facilities. These circular economy approaches significantly reduce the environmental burden associated with metal foam production and disposal.

Safety Standards and Compliance Frameworks

Metal foam fabrication processes are subject to a complex web of regulatory frameworks that vary significantly across jurisdictions. In the United States, the Occupational Safety and Health Administration (OSHA) has established comprehensive guidelines for metalworking facilities, with specific provisions addressing the unique hazards associated with metal foam production. These regulations primarily focus on exposure limits to metal particulates, thermal management requirements, and ventilation standards necessary to mitigate the risks of toxic gas emissions during the manufacturing process.

The European Union employs a more integrated approach through its REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation, which requires manufacturers to document and disclose all chemical substances used in metal foam production. Additionally, the EU's Machinery Directive 2006/42/EC imposes stringent safety requirements on equipment used in metal foam fabrication, emphasizing risk assessment and hazard mitigation strategies throughout the production lifecycle.

International standards organizations have developed specialized frameworks applicable to metal foam manufacturing. ISO 13577 addresses industrial furnaces and associated processing equipment, while ISO 15614 covers the qualification of welding procedures often employed in metal foam fabrication. These standards establish baseline requirements for process validation, quality control, and safety protocols that manufacturers must implement to achieve certification.

Environmental compliance represents another critical regulatory dimension. The EPA in the United States and the European Environment Agency impose strict limitations on effluents, emissions, and waste disposal practices associated with metal foam production. These regulations are particularly relevant given the potential environmental impact of chemical foaming agents and metallic waste byproducts generated during manufacturing.

Industry-specific standards have emerged to address the unique characteristics of metal foam applications. For aerospace applications, SAE International has developed specialized standards for metal foam components, while ASTM International provides testing methodologies (ASTM E2935) specifically designed to evaluate the mechanical properties and structural integrity of metal foams under various conditions.

Compliance verification mechanisms vary across regulatory frameworks but typically involve third-party certification, regular facility inspections, and documentation requirements. Manufacturers must maintain detailed records of material composition, process parameters, and quality control measures to demonstrate adherence to applicable standards. Non-compliance can result in significant penalties, including production shutdowns, financial sanctions, and potential liability for damages resulting from safety incidents.

The regulatory landscape continues to evolve as metal foam applications expand into new sectors. Recent developments include the introduction of specialized standards for biomedical applications of metal foams and enhanced requirements for recyclability and sustainable manufacturing practices, reflecting growing environmental concerns within the industry.

The European Union employs a more integrated approach through its REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation, which requires manufacturers to document and disclose all chemical substances used in metal foam production. Additionally, the EU's Machinery Directive 2006/42/EC imposes stringent safety requirements on equipment used in metal foam fabrication, emphasizing risk assessment and hazard mitigation strategies throughout the production lifecycle.

International standards organizations have developed specialized frameworks applicable to metal foam manufacturing. ISO 13577 addresses industrial furnaces and associated processing equipment, while ISO 15614 covers the qualification of welding procedures often employed in metal foam fabrication. These standards establish baseline requirements for process validation, quality control, and safety protocols that manufacturers must implement to achieve certification.

Environmental compliance represents another critical regulatory dimension. The EPA in the United States and the European Environment Agency impose strict limitations on effluents, emissions, and waste disposal practices associated with metal foam production. These regulations are particularly relevant given the potential environmental impact of chemical foaming agents and metallic waste byproducts generated during manufacturing.

Industry-specific standards have emerged to address the unique characteristics of metal foam applications. For aerospace applications, SAE International has developed specialized standards for metal foam components, while ASTM International provides testing methodologies (ASTM E2935) specifically designed to evaluate the mechanical properties and structural integrity of metal foams under various conditions.

Compliance verification mechanisms vary across regulatory frameworks but typically involve third-party certification, regular facility inspections, and documentation requirements. Manufacturers must maintain detailed records of material composition, process parameters, and quality control measures to demonstrate adherence to applicable standards. Non-compliance can result in significant penalties, including production shutdowns, financial sanctions, and potential liability for damages resulting from safety incidents.

The regulatory landscape continues to evolve as metal foam applications expand into new sectors. Recent developments include the introduction of specialized standards for biomedical applications of metal foams and enhanced requirements for recyclability and sustainable manufacturing practices, reflecting growing environmental concerns within the industry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!