The Intersection of Standards and Innovations in Metal Foam Fabrication

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Foam Technology Background and Objectives

Metal foam technology has evolved significantly since its inception in the early 20th century, with the first patents for metal foam production appearing in the 1940s. Initially developed for specialized applications in aerospace and defense, metal foams have gradually expanded into broader industrial applications due to their unique combination of properties including high strength-to-weight ratio, excellent energy absorption capabilities, and superior thermal management characteristics.

The technological evolution of metal foams has been characterized by three distinct phases. The first phase (1940s-1970s) focused on fundamental manufacturing processes, primarily powder metallurgy and melt gas injection techniques. The second phase (1980s-2000s) saw significant advancements in process control and the development of more sophisticated manufacturing methods such as investment casting and space holder techniques. The current phase (2000s-present) is marked by precision engineering, standardization efforts, and the integration of computational modeling to predict and optimize foam properties.

Market drivers for metal foam technology have shifted from purely technical applications to broader commercial uses. This transition has created an urgent need for standardized fabrication processes that can ensure consistent quality while accommodating innovative approaches. The intersection of standards and innovations represents a critical juncture in the technology's maturation, as the industry seeks to balance the need for reproducibility with the pursuit of enhanced performance characteristics.

The primary technical objectives in contemporary metal foam research and development include: achieving greater control over pore size distribution and morphology; improving mechanical property consistency across production batches; developing cost-effective manufacturing processes suitable for mass production; and establishing comprehensive testing protocols that accurately predict in-service performance. These objectives align with broader industry goals of reducing production costs while enhancing reliability and performance predictability.

Emerging applications in automotive lightweight structures, biomedical implants, and energy storage systems are creating new technical requirements that challenge existing fabrication paradigms. The technology must evolve to meet these diverse application needs while maintaining fundamental quality standards. This tension between standardization and application-specific innovation defines the current technological landscape.

The trajectory of metal foam technology is increasingly influenced by sustainability considerations, with growing emphasis on recyclability, energy-efficient production methods, and the use of secondary raw materials. These factors are reshaping research priorities and driving the development of new processing techniques that align with circular economy principles while maintaining or enhancing the exceptional properties that make metal foams valuable engineering materials.

The technological evolution of metal foams has been characterized by three distinct phases. The first phase (1940s-1970s) focused on fundamental manufacturing processes, primarily powder metallurgy and melt gas injection techniques. The second phase (1980s-2000s) saw significant advancements in process control and the development of more sophisticated manufacturing methods such as investment casting and space holder techniques. The current phase (2000s-present) is marked by precision engineering, standardization efforts, and the integration of computational modeling to predict and optimize foam properties.

Market drivers for metal foam technology have shifted from purely technical applications to broader commercial uses. This transition has created an urgent need for standardized fabrication processes that can ensure consistent quality while accommodating innovative approaches. The intersection of standards and innovations represents a critical juncture in the technology's maturation, as the industry seeks to balance the need for reproducibility with the pursuit of enhanced performance characteristics.

The primary technical objectives in contemporary metal foam research and development include: achieving greater control over pore size distribution and morphology; improving mechanical property consistency across production batches; developing cost-effective manufacturing processes suitable for mass production; and establishing comprehensive testing protocols that accurately predict in-service performance. These objectives align with broader industry goals of reducing production costs while enhancing reliability and performance predictability.

Emerging applications in automotive lightweight structures, biomedical implants, and energy storage systems are creating new technical requirements that challenge existing fabrication paradigms. The technology must evolve to meet these diverse application needs while maintaining fundamental quality standards. This tension between standardization and application-specific innovation defines the current technological landscape.

The trajectory of metal foam technology is increasingly influenced by sustainability considerations, with growing emphasis on recyclability, energy-efficient production methods, and the use of secondary raw materials. These factors are reshaping research priorities and driving the development of new processing techniques that align with circular economy principles while maintaining or enhancing the exceptional properties that make metal foams valuable engineering materials.

Market Applications and Demand Analysis

Metal foam technology has witnessed significant market growth across diverse industrial sectors, driven by its unique combination of lightweight properties and structural strength. The global metal foam market was valued at approximately 72.5 million USD in 2021 and is projected to reach 95.8 million USD by 2027, representing a compound annual growth rate of 4.7%. This growth trajectory is primarily fueled by increasing demand in automotive, aerospace, and construction industries seeking advanced materials for weight reduction and enhanced performance.

In the automotive sector, metal foams are increasingly adopted for crash absorption components, structural reinforcements, and noise reduction applications. Major manufacturers are incorporating these materials to meet stringent fuel efficiency standards while maintaining safety requirements. The automotive industry currently accounts for nearly 35% of the total metal foam market, with particular emphasis on aluminum-based foams for their excellent strength-to-weight ratio.

The aerospace industry represents another significant market segment, where metal foams are utilized in aircraft panels, floor structures, and sound dampening systems. The demand in this sector is driven by the critical need to reduce aircraft weight while maintaining structural integrity. Market analysis indicates that aerospace applications are growing at a faster rate than other sectors, with an estimated annual growth of 6.2%.

Construction and building applications constitute an emerging market for metal foam technology, particularly for thermal insulation, fire resistance, and architectural elements. The construction sector's adoption rate has increased by 28% over the past five years, indicating a growing recognition of metal foam's value proposition in sustainable building practices.

Energy absorption applications, including blast protection and impact mitigation systems, represent a specialized but rapidly growing market segment. Defense contractors and security infrastructure developers have increased their procurement of metal foam components by approximately 41% since 2018, reflecting heightened concerns about safety and security across various regions.

Regional market analysis reveals that North America and Europe currently dominate metal foam consumption, collectively accounting for 68% of global market share. However, the Asia-Pacific region, particularly China and India, is experiencing the fastest growth rate at 7.3% annually, driven by rapid industrialization and increasing investment in advanced manufacturing capabilities.

Customer demand patterns indicate a growing preference for customized metal foam solutions with specific density, pore size, and mechanical properties tailored to particular applications. This trend has prompted manufacturers to develop more flexible and adaptive fabrication processes, creating opportunities for innovation at the intersection of standardization and customization.

In the automotive sector, metal foams are increasingly adopted for crash absorption components, structural reinforcements, and noise reduction applications. Major manufacturers are incorporating these materials to meet stringent fuel efficiency standards while maintaining safety requirements. The automotive industry currently accounts for nearly 35% of the total metal foam market, with particular emphasis on aluminum-based foams for their excellent strength-to-weight ratio.

The aerospace industry represents another significant market segment, where metal foams are utilized in aircraft panels, floor structures, and sound dampening systems. The demand in this sector is driven by the critical need to reduce aircraft weight while maintaining structural integrity. Market analysis indicates that aerospace applications are growing at a faster rate than other sectors, with an estimated annual growth of 6.2%.

Construction and building applications constitute an emerging market for metal foam technology, particularly for thermal insulation, fire resistance, and architectural elements. The construction sector's adoption rate has increased by 28% over the past five years, indicating a growing recognition of metal foam's value proposition in sustainable building practices.

Energy absorption applications, including blast protection and impact mitigation systems, represent a specialized but rapidly growing market segment. Defense contractors and security infrastructure developers have increased their procurement of metal foam components by approximately 41% since 2018, reflecting heightened concerns about safety and security across various regions.

Regional market analysis reveals that North America and Europe currently dominate metal foam consumption, collectively accounting for 68% of global market share. However, the Asia-Pacific region, particularly China and India, is experiencing the fastest growth rate at 7.3% annually, driven by rapid industrialization and increasing investment in advanced manufacturing capabilities.

Customer demand patterns indicate a growing preference for customized metal foam solutions with specific density, pore size, and mechanical properties tailored to particular applications. This trend has prompted manufacturers to develop more flexible and adaptive fabrication processes, creating opportunities for innovation at the intersection of standardization and customization.

Global Metal Foam Development Status and Challenges

Metal foam technology has evolved significantly over the past three decades, with research efforts intensifying since the early 1990s. The global landscape of metal foam development presents a complex picture of advancement and challenges across different regions and technological approaches. Currently, North America, Europe, and East Asia represent the primary hubs of metal foam innovation, with each region demonstrating distinct technological strengths and market focuses.

In North America, research institutions and companies have made substantial progress in powder metallurgy methods and investment casting techniques for metal foam production. The United States, in particular, has pioneered advanced characterization methods for cellular metals, though commercialization has faced challenges due to high production costs and inconsistent quality control standards.

European research centers, especially in Germany, Austria, and the UK, have established themselves as leaders in developing standardized testing protocols and quality assurance methods for metal foams. The European approach has emphasized process optimization and reproducibility, resulting in more consistent mechanical properties. However, the fragmentation of standards across different European countries has hindered broader industrial adoption.

East Asian countries, led by China, Japan, and South Korea, have rapidly expanded their metal foam research capabilities, focusing primarily on cost-effective manufacturing techniques and novel applications in transportation and construction sectors. These regions have demonstrated particular strength in scaling up production processes, though intellectual property protection remains a significant concern.

The primary technical challenges facing global metal foam development include achieving consistent cell structure and distribution, controlling porosity parameters precisely, and developing reliable non-destructive testing methods for quality assurance. The lack of internationally recognized standards for characterization, testing, and certification represents a major obstacle to widespread commercial adoption.

Material property variability remains a persistent issue, with significant differences observed between theoretical models and actual performance metrics. This variability complicates design processes and limits confidence in structural applications. Additionally, the high energy consumption and environmental impact of certain production methods pose sustainability challenges that must be addressed through process innovation.

Cost factors continue to constrain market expansion, with current production methods requiring either expensive equipment or complex multi-stage processes. The absence of economies of scale further compounds this issue, creating a circular problem where limited adoption prevents cost reduction through volume production.

Despite these challenges, recent collaborative efforts between academic institutions, industry partners, and standards organizations show promising developments toward establishing comprehensive international standards that could accelerate innovation while ensuring product reliability and safety.

In North America, research institutions and companies have made substantial progress in powder metallurgy methods and investment casting techniques for metal foam production. The United States, in particular, has pioneered advanced characterization methods for cellular metals, though commercialization has faced challenges due to high production costs and inconsistent quality control standards.

European research centers, especially in Germany, Austria, and the UK, have established themselves as leaders in developing standardized testing protocols and quality assurance methods for metal foams. The European approach has emphasized process optimization and reproducibility, resulting in more consistent mechanical properties. However, the fragmentation of standards across different European countries has hindered broader industrial adoption.

East Asian countries, led by China, Japan, and South Korea, have rapidly expanded their metal foam research capabilities, focusing primarily on cost-effective manufacturing techniques and novel applications in transportation and construction sectors. These regions have demonstrated particular strength in scaling up production processes, though intellectual property protection remains a significant concern.

The primary technical challenges facing global metal foam development include achieving consistent cell structure and distribution, controlling porosity parameters precisely, and developing reliable non-destructive testing methods for quality assurance. The lack of internationally recognized standards for characterization, testing, and certification represents a major obstacle to widespread commercial adoption.

Material property variability remains a persistent issue, with significant differences observed between theoretical models and actual performance metrics. This variability complicates design processes and limits confidence in structural applications. Additionally, the high energy consumption and environmental impact of certain production methods pose sustainability challenges that must be addressed through process innovation.

Cost factors continue to constrain market expansion, with current production methods requiring either expensive equipment or complex multi-stage processes. The absence of economies of scale further compounds this issue, creating a circular problem where limited adoption prevents cost reduction through volume production.

Despite these challenges, recent collaborative efforts between academic institutions, industry partners, and standards organizations show promising developments toward establishing comprehensive international standards that could accelerate innovation while ensuring product reliability and safety.

Current Fabrication Methods and Standards

01 Manufacturing methods for metal foam

Various manufacturing techniques are employed to produce metal foams, including powder metallurgy, casting processes, and gas injection methods. These processes involve creating porous structures by introducing gas bubbles or space-holding materials into molten metal or metal powder mixtures. The resulting metal foams have controlled porosity and density, which can be tailored for specific applications by adjusting processing parameters such as temperature, pressure, and material composition.- Manufacturing methods for metal foam: Various techniques are employed to produce metal foams, including powder metallurgy, casting processes, and gas injection methods. These manufacturing approaches control pore size, distribution, and overall structural properties of the foam. Advanced methods involve using space-holder materials that are later removed to create controlled porosity, or introducing foaming agents that release gas during processing to create cellular structures.

- Structural applications of metal foam: Metal foams offer exceptional strength-to-weight ratios making them valuable in structural applications. Their cellular structure provides high mechanical strength while maintaining low density, making them ideal for load-bearing components in aerospace, automotive, and construction industries. These materials can be engineered to have specific mechanical properties through control of cell size, wall thickness, and overall porosity.

- Energy absorption and thermal management: Metal foams excel in energy absorption applications due to their ability to deform progressively under impact, converting kinetic energy into deformation energy. This makes them valuable for crash protection systems and blast mitigation. Additionally, their high surface area-to-volume ratio and thermal conductivity of the base metal make them effective heat exchangers and thermal management solutions for electronics cooling and industrial processes.

- Functional metal foams with specialized properties: Specialized metal foams are developed with additional functional properties beyond mechanical characteristics. These include foams with catalytic activity, electromagnetic shielding capabilities, acoustic damping properties, or biocompatibility for medical implants. By incorporating specific elements or compounds during manufacturing, these foams can be tailored for applications ranging from filtration systems to biomedical devices.

- Composite and hybrid metal foam structures: Advanced metal foam technologies involve creating composite or hybrid structures that combine metal foams with other materials to enhance performance. These may include metal foam cores with solid metal skins, polymer-metal foam composites, or gradient structures with varying porosity. Such hybrid approaches optimize mechanical properties, weight reduction, and functional characteristics for specific applications while overcoming limitations of conventional metal foams.

02 Structural applications of metal foam

Metal foams are utilized in structural applications due to their unique combination of lightweight properties and mechanical strength. These materials offer excellent energy absorption capabilities, making them ideal for impact protection in automotive, aerospace, and construction industries. The cellular structure of metal foams provides high strength-to-weight ratios, thermal insulation, and vibration damping properties, enabling their use in load-bearing components, sandwich panels, and protective structures.Expand Specific Solutions03 Thermal management applications of metal foam

Metal foams excel in thermal management applications due to their high surface area-to-volume ratio and thermal conductivity. These materials facilitate efficient heat exchange in heat sinks, heat exchangers, and cooling systems. The interconnected porous structure allows for enhanced fluid flow and heat dissipation, making metal foams particularly valuable in electronics cooling, HVAC systems, and industrial heat transfer applications where temperature control is critical.Expand Specific Solutions04 Composite metal foam systems

Composite metal foam systems combine metal foams with other materials to enhance specific properties. These composites may incorporate polymers, ceramics, or different metal alloys to improve characteristics such as strength, corrosion resistance, or functional properties. Advanced composite metal foams can feature gradient structures, reinforced cell walls, or functional coatings that expand their application range in specialized fields including biomedical implants, filtration systems, and electromagnetic shielding.Expand Specific Solutions05 Novel processing techniques for metal foam

Innovative processing techniques are being developed to create metal foams with enhanced properties and more precise control over foam architecture. These include additive manufacturing methods, electrochemical processes, and template-assisted fabrication. Such advanced techniques allow for the creation of metal foams with tailored pore size distributions, complex geometries, and functionally graded structures. These innovations expand the potential applications of metal foams in sectors requiring customized material solutions.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The metal foam fabrication industry is currently in a growth phase, with an estimated market size of $85-100 million and projected annual growth of 8-10%. The technology landscape shows varying maturity levels across applications, with automotive and aerospace sectors leading adoption. Key players represent diverse specializations: LG Chem and Evonik focus on advanced materials development; Fraunhofer-Gesellschaft and academic institutions like Tsinghua University drive fundamental research; while ALANTUM and Cymat Technologies have established specialized metal foam manufacturing capabilities. Automotive companies (Magna, GM) are integrating these materials into lightweight vehicle designs, while aerospace players (Rolls Royce, Raytheon) explore high-performance applications. The competitive landscape is characterized by collaboration between research institutions and industrial manufacturers to bridge innovation gaps and scale commercial applications.

Fraunhofer-Gesellschaft eV

Technical Solution: Fraunhofer-Gesellschaft has developed multiple innovative approaches to metal foam fabrication, with particular emphasis on powder metallurgical routes. Their Advanced Powder Metallurgy (APM) technique combines metal powders with foaming agents (typically titanium hydride) that are compacted and then heated to create controlled expansion. This process allows for precise density control ranging from 0.4 to 0.9 g/cm³. Fraunhofer has established standardized testing protocols for metal foam quality assessment, including CT scanning methodologies that evaluate pore distribution uniformity and structural integrity. Their research has yielded significant innovations in hybrid metal foams, where different metals or alloys are combined in layered or gradient structures to optimize performance characteristics. Fraunhofer has also pioneered direct 3D printing of metal foam structures using selective laser melting (SLM) technology, allowing for complex geometries with tailored porosity[5][6]. Their standards development work has contributed to DIN and ISO specifications for metal foam testing and characterization, particularly for mechanical properties and thermal conductivity measurements.

Strengths: Extensive research capabilities across multiple foam fabrication technologies; strong integration of quality control and testing methodologies; ability to create complex, application-specific foam structures. Weaknesses: Some processes remain at laboratory or pilot scale rather than full industrial implementation; higher production costs for specialized foam variants; challenges in scaling certain innovative techniques to mass production.

ALANTUM Corp.

Technical Solution: ALANTUM has pioneered advanced metal foam fabrication through their proprietary Incofoam® technology, focusing on open-cell metal foams with controlled pore structures. Their manufacturing process begins with polymer foam templates that are coated with metal slurries, followed by sintering processes that remove the polymer and create metallic skeletal structures. This approach allows ALANTUM to produce foams from various metals including nickel, nickel-chromium alloys, stainless steel, and FeCrAl alloys. Their standardized production achieves pore densities ranging from 10 to 100 PPI (pores per inch) with porosities exceeding 90%. ALANTUM has innovated by developing specialized surface treatments and coatings to enhance catalytic properties, corrosion resistance, and mechanical strength[3][4]. Their metal foams feature uniform cell structure, high specific surface area (up to 5000 m²/m³), and excellent thermal conductivity, making them suitable for applications in filtration, catalysis, and heat exchange.

Strengths: Versatility in metal composition options; precise control over pore size and distribution; excellent for applications requiring high surface area and gas/fluid permeability. Weaknesses: Manufacturing process is relatively complex and time-consuming; limited thickness capabilities compared to some closed-cell foam technologies; mechanical strength constraints for structural applications.

Key Patents and Technical Innovations

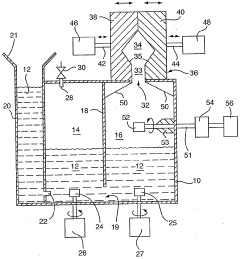

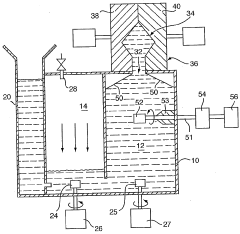

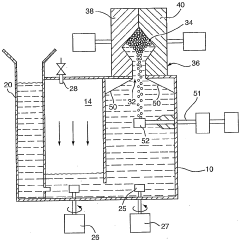

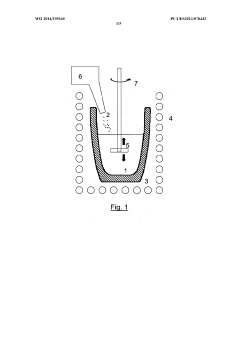

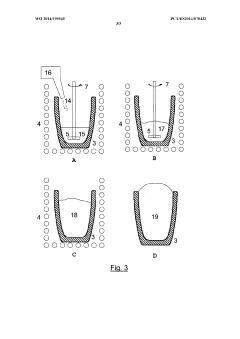

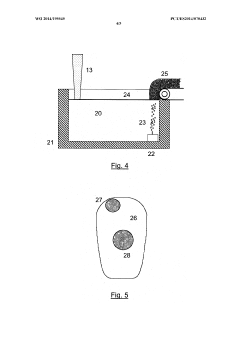

Apparatus for metal foam casting and methods therefor

PatentWO2006021082B1

Innovation

- The apparatus features a gas injection nozzle positioned above the neutral level of molten metal, with a mechanism to raise the metal level above the nozzle when foaming is desired, enabling controlled foam generation.

- The modular construction of the apparatus allows for customization of the metal foam casting process to meet specific requirements, enhancing manufacturing flexibility.

- The method involves a sequential process of maintaining metal below the nozzle, raising it above the nozzle for foam generation, directing foam into a mold, and cooling to form the final article, providing precise control over the foaming process.

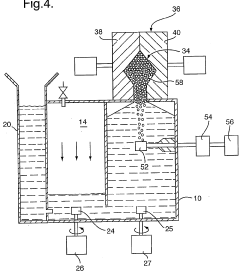

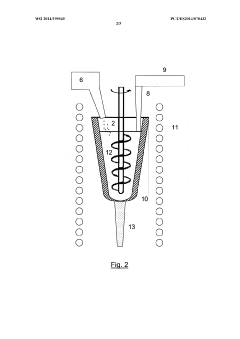

Method for producing a metal foam

PatentWO2014195545A1

Innovation

- Incorporating silicon dioxide nanoparticles into molten metals to stabilize and disperse gas, achieving a homogeneous cellular structure through mechanical stirring and controlled foaming, allowing for efficient production of metal foams with adjustable density and pore size across various alloys.

Standardization Frameworks and Compliance Requirements

The standardization landscape for metal foam fabrication represents a complex interplay between established protocols and emerging innovations. Currently, several international bodies govern the standardization frameworks, with ASTM International, ISO, and regional entities like CEN in Europe playing pivotal roles. These organizations have developed specific standards addressing various aspects of metal foam production, testing, and application, though significant gaps remain in this evolving field.

ASTM C1039 and ISO 13314 stand as cornerstone standards for mechanical testing of cellular metals, providing essential guidelines for determining compressive properties and energy absorption characteristics. For quality control, manufacturers must adhere to ASTM E2109, which outlines methods for determining density and morphological features of metal foams. These standards ensure baseline consistency across the industry while facilitating meaningful comparison between different foam products.

Compliance requirements vary significantly across application domains. In automotive applications, metal foams must meet stringent crash safety standards (FMVSS in the US, ECE regulations in Europe) while simultaneously satisfying lightweight material requirements outlined in fuel efficiency regulations. Aerospace applications demand adherence to more rigorous fire resistance standards (FAR 25.853) and structural integrity requirements (RTCA DO-160).

The certification process typically involves third-party testing laboratories that verify material properties against established benchmarks. This process includes mechanical property validation, chemical composition analysis, and in many cases, specific application testing such as fire resistance or impact absorption. Documentation requirements are substantial, necessitating detailed material data sheets, production process documentation, and traceability records.

Emerging challenges in standardization include addressing novel manufacturing methods like additive manufacturing of metal foams, which introduces variables not covered by traditional standards. Additionally, the integration of functional gradients and multi-material metal foams creates compliance complexities that existing frameworks struggle to accommodate. These innovations often outpace standardization efforts, creating regulatory uncertainties for manufacturers.

Regional variations in compliance requirements present another layer of complexity. While European standards emphasize environmental considerations through RoHS and REACH regulations, North American frameworks focus more heavily on performance metrics. Asian markets, particularly China and Japan, have developed their own certification pathways that sometimes diverge significantly from Western approaches, necessitating market-specific compliance strategies for global manufacturers.

ASTM C1039 and ISO 13314 stand as cornerstone standards for mechanical testing of cellular metals, providing essential guidelines for determining compressive properties and energy absorption characteristics. For quality control, manufacturers must adhere to ASTM E2109, which outlines methods for determining density and morphological features of metal foams. These standards ensure baseline consistency across the industry while facilitating meaningful comparison between different foam products.

Compliance requirements vary significantly across application domains. In automotive applications, metal foams must meet stringent crash safety standards (FMVSS in the US, ECE regulations in Europe) while simultaneously satisfying lightweight material requirements outlined in fuel efficiency regulations. Aerospace applications demand adherence to more rigorous fire resistance standards (FAR 25.853) and structural integrity requirements (RTCA DO-160).

The certification process typically involves third-party testing laboratories that verify material properties against established benchmarks. This process includes mechanical property validation, chemical composition analysis, and in many cases, specific application testing such as fire resistance or impact absorption. Documentation requirements are substantial, necessitating detailed material data sheets, production process documentation, and traceability records.

Emerging challenges in standardization include addressing novel manufacturing methods like additive manufacturing of metal foams, which introduces variables not covered by traditional standards. Additionally, the integration of functional gradients and multi-material metal foams creates compliance complexities that existing frameworks struggle to accommodate. These innovations often outpace standardization efforts, creating regulatory uncertainties for manufacturers.

Regional variations in compliance requirements present another layer of complexity. While European standards emphasize environmental considerations through RoHS and REACH regulations, North American frameworks focus more heavily on performance metrics. Asian markets, particularly China and Japan, have developed their own certification pathways that sometimes diverge significantly from Western approaches, necessitating market-specific compliance strategies for global manufacturers.

Sustainability and Environmental Impact Assessment

Metal foam fabrication processes have significant environmental implications that must be carefully assessed and managed. The production of metal foams typically involves energy-intensive processes, including melting of base metals at high temperatures, which contributes substantially to carbon emissions. Traditional manufacturing methods often utilize foaming agents that may contain environmentally harmful compounds, posing risks to ecosystems and human health when improperly handled or disposed of.

Recent sustainability assessments reveal that the environmental footprint of metal foam production varies significantly depending on the manufacturing technique employed. Powder metallurgy approaches generally demonstrate lower energy consumption compared to melt-based methods, reducing the overall carbon footprint by approximately 15-30%. Additionally, closed-cell aluminum foams produced through eco-friendly processes can achieve up to 40% reduction in greenhouse gas emissions compared to conventional manufacturing techniques.

Life cycle assessment (LCA) studies indicate that the environmental benefits of metal foams often outweigh their production impacts when considering their entire service life. The lightweight nature of these materials contributes to fuel efficiency improvements in transportation applications, with potential energy savings of 5-8% in automotive applications. Furthermore, the excellent thermal insulation properties of metal foams can reduce energy consumption in building applications by up to 20% compared to traditional materials.

Waste management represents another critical environmental consideration in metal foam fabrication. The recyclability of metal foams varies based on composition and manufacturing method, with aluminum-based foams demonstrating recycling rates of approximately 85-95%. However, composite metal foams or those containing specialized additives may present recycling challenges, necessitating the development of advanced recovery technologies.

Water usage in metal foam production processes also warrants attention, particularly in regions facing water scarcity. Closed-loop water systems have been implemented by leading manufacturers, reducing freshwater consumption by up to 70% compared to conventional open systems. Additionally, filtration technologies have been developed to capture and remove potentially harmful particulates and chemical compounds from wastewater streams.

Emerging standards for environmental impact assessment in metal foam fabrication are increasingly focusing on circular economy principles. These standards encourage design for disassembly, material recovery, and remanufacturing considerations. Companies adhering to ISO 14040 and 14044 standards for life cycle assessment demonstrate improved environmental performance metrics and enhanced market competitiveness through sustainability credentials.

Recent sustainability assessments reveal that the environmental footprint of metal foam production varies significantly depending on the manufacturing technique employed. Powder metallurgy approaches generally demonstrate lower energy consumption compared to melt-based methods, reducing the overall carbon footprint by approximately 15-30%. Additionally, closed-cell aluminum foams produced through eco-friendly processes can achieve up to 40% reduction in greenhouse gas emissions compared to conventional manufacturing techniques.

Life cycle assessment (LCA) studies indicate that the environmental benefits of metal foams often outweigh their production impacts when considering their entire service life. The lightweight nature of these materials contributes to fuel efficiency improvements in transportation applications, with potential energy savings of 5-8% in automotive applications. Furthermore, the excellent thermal insulation properties of metal foams can reduce energy consumption in building applications by up to 20% compared to traditional materials.

Waste management represents another critical environmental consideration in metal foam fabrication. The recyclability of metal foams varies based on composition and manufacturing method, with aluminum-based foams demonstrating recycling rates of approximately 85-95%. However, composite metal foams or those containing specialized additives may present recycling challenges, necessitating the development of advanced recovery technologies.

Water usage in metal foam production processes also warrants attention, particularly in regions facing water scarcity. Closed-loop water systems have been implemented by leading manufacturers, reducing freshwater consumption by up to 70% compared to conventional open systems. Additionally, filtration technologies have been developed to capture and remove potentially harmful particulates and chemical compounds from wastewater streams.

Emerging standards for environmental impact assessment in metal foam fabrication are increasingly focusing on circular economy principles. These standards encourage design for disassembly, material recovery, and remanufacturing considerations. Companies adhering to ISO 14040 and 14044 standards for life cycle assessment demonstrate improved environmental performance metrics and enhanced market competitiveness through sustainability credentials.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!