Comparative Effects of Catalysts on Metal Foam Fabrication

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Catalyst Technology Background and Objectives

Metal foam fabrication has evolved significantly over the past several decades, transitioning from experimental laboratory techniques to industrially viable manufacturing processes. The use of catalysts in metal foam production represents a critical technological advancement that has enabled the creation of highly porous metallic structures with tailored properties. These materials combine the structural integrity of metals with the lightweight characteristics of foams, offering exceptional performance in applications ranging from energy absorption to thermal management.

The historical development of catalyst technology in metal foam fabrication can be traced back to the 1950s, when initial experiments with gas-releasing chemical agents in molten metals were conducted. However, it wasn't until the 1980s and 1990s that significant breakthroughs occurred with the introduction of more sophisticated catalytic systems that could precisely control pore formation and distribution.

Current catalyst technologies for metal foam production can be broadly categorized into three main approaches: gas-releasing chemical agents, space holder methods, and direct foaming techniques. Each approach utilizes different catalytic mechanisms to facilitate the formation of cellular structures within metal matrices. The effectiveness of these catalysts is typically evaluated based on their ability to control foam morphology, pore size distribution, relative density, and mechanical properties of the resultant metal foams.

The global research landscape has witnessed an acceleration in catalyst development for metal foam fabrication over the past decade, with particular emphasis on environmentally friendly formulations that minimize toxic byproducts. This trend aligns with broader sustainability initiatives across manufacturing sectors and represents a significant shift from earlier catalyst systems that often relied on hazardous compounds.

The primary technical objectives in catalyst technology for metal foam fabrication currently focus on achieving greater precision in controlling foam architecture, enhancing process repeatability, reducing production costs, and expanding the range of metals and alloys that can be effectively foamed. Additionally, there is growing interest in developing catalysts that can operate at lower temperatures to reduce energy consumption and minimize undesirable microstructural changes in the base metals.

Looking forward, the field is moving toward multi-functional catalyst systems that not only facilitate foam formation but also impart additional properties to the metal foam, such as enhanced corrosion resistance or specific surface functionalities. The integration of computational modeling with experimental approaches is expected to accelerate catalyst development by enabling more precise prediction of catalyst-metal interactions and resulting foam structures.

The ultimate goal of catalyst technology advancement in this domain is to establish robust, scalable manufacturing processes that can produce metal foams with precisely engineered properties for specific applications, ranging from lightweight structural components in transportation to advanced thermal management systems in electronics and energy storage devices.

The historical development of catalyst technology in metal foam fabrication can be traced back to the 1950s, when initial experiments with gas-releasing chemical agents in molten metals were conducted. However, it wasn't until the 1980s and 1990s that significant breakthroughs occurred with the introduction of more sophisticated catalytic systems that could precisely control pore formation and distribution.

Current catalyst technologies for metal foam production can be broadly categorized into three main approaches: gas-releasing chemical agents, space holder methods, and direct foaming techniques. Each approach utilizes different catalytic mechanisms to facilitate the formation of cellular structures within metal matrices. The effectiveness of these catalysts is typically evaluated based on their ability to control foam morphology, pore size distribution, relative density, and mechanical properties of the resultant metal foams.

The global research landscape has witnessed an acceleration in catalyst development for metal foam fabrication over the past decade, with particular emphasis on environmentally friendly formulations that minimize toxic byproducts. This trend aligns with broader sustainability initiatives across manufacturing sectors and represents a significant shift from earlier catalyst systems that often relied on hazardous compounds.

The primary technical objectives in catalyst technology for metal foam fabrication currently focus on achieving greater precision in controlling foam architecture, enhancing process repeatability, reducing production costs, and expanding the range of metals and alloys that can be effectively foamed. Additionally, there is growing interest in developing catalysts that can operate at lower temperatures to reduce energy consumption and minimize undesirable microstructural changes in the base metals.

Looking forward, the field is moving toward multi-functional catalyst systems that not only facilitate foam formation but also impart additional properties to the metal foam, such as enhanced corrosion resistance or specific surface functionalities. The integration of computational modeling with experimental approaches is expected to accelerate catalyst development by enabling more precise prediction of catalyst-metal interactions and resulting foam structures.

The ultimate goal of catalyst technology advancement in this domain is to establish robust, scalable manufacturing processes that can produce metal foams with precisely engineered properties for specific applications, ranging from lightweight structural components in transportation to advanced thermal management systems in electronics and energy storage devices.

Market Analysis for Metal Foam Applications

The global metal foam market is experiencing robust growth, projected to reach $115.7 billion by 2028, with a compound annual growth rate of 4.2% from 2023. This growth is primarily driven by increasing demand across automotive, aerospace, construction, and biomedical sectors. Metal foams offer unique combinations of properties including lightweight structure, high strength-to-weight ratio, excellent energy absorption, and thermal conductivity, making them increasingly valuable in advanced engineering applications.

In the automotive industry, metal foams are gaining significant traction for crash absorption components, reducing vehicle weight while maintaining safety standards. The aerospace sector utilizes these materials for structural components and thermal management systems, with aluminum foams being particularly favored for their lightweight properties and corrosion resistance.

Construction applications represent another substantial market segment, where metal foams are employed in architectural panels, sound barriers, and fire-resistant structures. The biomedical field has also emerged as a promising growth area, with titanium foams being developed for orthopedic implants due to their biocompatibility and bone-like mechanical properties.

Regionally, North America and Europe currently dominate the metal foam market, accounting for approximately 60% of global consumption. However, the Asia-Pacific region is witnessing the fastest growth rate at 5.7% annually, driven by rapid industrialization in China and India, alongside increasing automotive and aerospace manufacturing activities.

Market analysis reveals that aluminum foams constitute the largest segment at 45% of the total market share, followed by nickel (22%), copper (18%), and titanium (10%) foams. This distribution is directly influenced by the catalysts used in fabrication processes, as different catalysts significantly impact production costs, foam quality, and applicable material types.

The market is experiencing a shift toward more cost-effective and environmentally sustainable production methods. Traditional manufacturing techniques using titanium hydride as a foaming agent are gradually being replaced by newer catalyst systems that offer better control over pore size distribution and structural integrity. This transition is expected to reduce production costs by up to 30% over the next five years, potentially expanding market penetration into previously cost-prohibitive applications.

Customer demand increasingly focuses on customized metal foams with application-specific properties, creating opportunities for manufacturers who can efficiently tailor catalyst systems to produce foams with precise characteristics. This trend toward specialization is projected to fragment the market further, with specialized producers capturing premium segments while larger manufacturers focus on standardized products for mass markets.

In the automotive industry, metal foams are gaining significant traction for crash absorption components, reducing vehicle weight while maintaining safety standards. The aerospace sector utilizes these materials for structural components and thermal management systems, with aluminum foams being particularly favored for their lightweight properties and corrosion resistance.

Construction applications represent another substantial market segment, where metal foams are employed in architectural panels, sound barriers, and fire-resistant structures. The biomedical field has also emerged as a promising growth area, with titanium foams being developed for orthopedic implants due to their biocompatibility and bone-like mechanical properties.

Regionally, North America and Europe currently dominate the metal foam market, accounting for approximately 60% of global consumption. However, the Asia-Pacific region is witnessing the fastest growth rate at 5.7% annually, driven by rapid industrialization in China and India, alongside increasing automotive and aerospace manufacturing activities.

Market analysis reveals that aluminum foams constitute the largest segment at 45% of the total market share, followed by nickel (22%), copper (18%), and titanium (10%) foams. This distribution is directly influenced by the catalysts used in fabrication processes, as different catalysts significantly impact production costs, foam quality, and applicable material types.

The market is experiencing a shift toward more cost-effective and environmentally sustainable production methods. Traditional manufacturing techniques using titanium hydride as a foaming agent are gradually being replaced by newer catalyst systems that offer better control over pore size distribution and structural integrity. This transition is expected to reduce production costs by up to 30% over the next five years, potentially expanding market penetration into previously cost-prohibitive applications.

Customer demand increasingly focuses on customized metal foams with application-specific properties, creating opportunities for manufacturers who can efficiently tailor catalyst systems to produce foams with precise characteristics. This trend toward specialization is projected to fragment the market further, with specialized producers capturing premium segments while larger manufacturers focus on standardized products for mass markets.

Current Challenges in Catalyst-Assisted Metal Foam Production

Despite significant advancements in metal foam fabrication technologies, catalyst-assisted production methods continue to face several critical challenges that impede widespread industrial adoption. The primary obstacle remains catalyst efficiency and selectivity, as current catalytic systems often exhibit inconsistent performance across different metal compositions. This variability leads to unpredictable pore size distribution and structural integrity, particularly when scaling from laboratory to industrial production volumes.

Material compatibility presents another significant hurdle, with many high-performance catalysts demonstrating excellent results with noble metals but substantially reduced effectiveness with more economical alternatives such as aluminum or titanium alloys. This limitation creates a cost-benefit dilemma for manufacturers seeking to optimize both performance and production expenses.

Catalyst deactivation and poisoning mechanisms continue to plague long-term production stability. Many catalytic systems experience rapid degradation under the high-temperature conditions required for metal foam processing, necessitating frequent replacement and causing production interruptions. Additionally, trace impurities in raw materials can irreversibly poison catalyst active sites, dramatically reducing catalytic efficiency without clear warning indicators.

Process control precision represents a persistent challenge, as the relationship between catalyst concentration, reaction temperature, and foam formation kinetics remains incompletely understood. This knowledge gap makes it difficult to develop robust process control algorithms that can adapt to variations in raw material quality or environmental conditions.

Environmental and safety concerns have also emerged as significant barriers. Several highly effective catalysts contain toxic components that pose handling risks and generate hazardous waste streams requiring specialized disposal procedures. Regulatory compliance adds another layer of complexity, with increasingly stringent emissions standards limiting the use of volatile organic compounds often employed as catalyst carriers or activators.

Scalability issues further complicate industrial implementation, as many catalyst systems that perform admirably in laboratory settings fail to maintain consistent performance when scaled to production volumes. The heat and mass transfer limitations in larger reaction vessels often create heterogeneous catalyst distribution, resulting in structural inconsistencies throughout the final metal foam product.

Cost considerations remain paramount, with high-performance catalysts often representing a significant portion of production expenses. The economic viability of catalyst recovery and recycling systems has not yet been conclusively demonstrated at industrial scales, creating uncertainty in long-term operational cost projections for manufacturers considering adoption of these technologies.

Material compatibility presents another significant hurdle, with many high-performance catalysts demonstrating excellent results with noble metals but substantially reduced effectiveness with more economical alternatives such as aluminum or titanium alloys. This limitation creates a cost-benefit dilemma for manufacturers seeking to optimize both performance and production expenses.

Catalyst deactivation and poisoning mechanisms continue to plague long-term production stability. Many catalytic systems experience rapid degradation under the high-temperature conditions required for metal foam processing, necessitating frequent replacement and causing production interruptions. Additionally, trace impurities in raw materials can irreversibly poison catalyst active sites, dramatically reducing catalytic efficiency without clear warning indicators.

Process control precision represents a persistent challenge, as the relationship between catalyst concentration, reaction temperature, and foam formation kinetics remains incompletely understood. This knowledge gap makes it difficult to develop robust process control algorithms that can adapt to variations in raw material quality or environmental conditions.

Environmental and safety concerns have also emerged as significant barriers. Several highly effective catalysts contain toxic components that pose handling risks and generate hazardous waste streams requiring specialized disposal procedures. Regulatory compliance adds another layer of complexity, with increasingly stringent emissions standards limiting the use of volatile organic compounds often employed as catalyst carriers or activators.

Scalability issues further complicate industrial implementation, as many catalyst systems that perform admirably in laboratory settings fail to maintain consistent performance when scaled to production volumes. The heat and mass transfer limitations in larger reaction vessels often create heterogeneous catalyst distribution, resulting in structural inconsistencies throughout the final metal foam product.

Cost considerations remain paramount, with high-performance catalysts often representing a significant portion of production expenses. The economic viability of catalyst recovery and recycling systems has not yet been conclusively demonstrated at industrial scales, creating uncertainty in long-term operational cost projections for manufacturers considering adoption of these technologies.

Comparative Analysis of Current Catalyst Solutions

01 Catalyst effects on metal foam porosity and structure

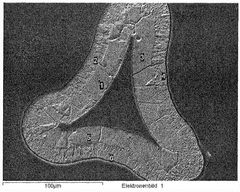

Catalysts play a crucial role in controlling the porosity and structural characteristics of metal foams during fabrication. Different catalysts can influence pore size distribution, cell wall thickness, and overall foam morphology. By selecting specific catalysts, manufacturers can tailor the foam's density, specific surface area, and mechanical properties to meet application requirements. The catalyst type and concentration directly impact the gas evolution rate during foaming processes, which determines the final foam structure.- Catalyst-assisted metal foam production methods: Various catalysts can be employed to facilitate the production of metal foams, enhancing the formation of porous structures. These catalysts typically promote gas evolution reactions that create bubbles within the molten metal, resulting in foam formation. The catalyst selection depends on the base metal and desired foam properties, with common catalysts including titanium hydride, calcium carbonate, and certain metal oxides. These catalysts help control pore size, distribution, and overall foam stability during the manufacturing process.

- Effect of catalysts on metal foam microstructure: Catalysts significantly influence the microstructural characteristics of metal foams, including cell size, wall thickness, and density distribution. By controlling catalyst concentration and activation temperature, manufacturers can tailor the foam's internal architecture. Catalysts can promote uniform nucleation of gas bubbles, resulting in homogeneous cell structures. The catalyst type and processing conditions determine whether the foam develops open or closed cell morphology, which directly impacts mechanical properties and functional performance of the final product.

- Novel catalytic systems for advanced metal foam fabrication: Innovative catalytic systems have been developed to enhance metal foam production processes. These include multi-component catalyst mixtures, nanostructured catalysts, and catalyst delivery systems that provide precise control over foam formation. Some advanced approaches involve temperature-responsive catalysts that activate at specific stages of the manufacturing process. These novel systems enable the production of metal foams with gradient porosity, functionally graded properties, or hierarchical structures that combine macro, micro, and nano-scale porosity for specialized applications.

- Catalyst influence on metal foam mechanical properties: The choice of catalyst directly affects the mechanical properties of the resulting metal foam. Catalysts that promote uniform cell structure typically yield foams with consistent mechanical behavior, while those creating variable cell sizes can produce foams with location-specific properties. The catalyst's effect on cell wall thickness and integrity influences the foam's compressive strength, energy absorption capacity, and deformation behavior. By selecting appropriate catalysts and controlling their activity, manufacturers can engineer metal foams with tailored mechanical responses for specific loading conditions.

- Environmental and efficiency aspects of catalysts in metal foam production: The environmental impact and production efficiency of metal foam manufacturing are significantly influenced by catalyst selection. Modern catalytic approaches focus on reducing toxic emissions, minimizing waste, and improving energy efficiency during foam production. Some catalysts enable lower processing temperatures, reducing energy consumption and carbon footprint. Recyclable catalysts and those derived from sustainable sources are gaining importance in environmentally conscious manufacturing. Additionally, certain catalysts can accelerate production rates, improving manufacturing throughput while maintaining or enhancing foam quality.

02 Noble metal catalysts for specialized foam applications

Noble metals such as platinum, palladium, and gold serve as effective catalysts in metal foam fabrication for specialized applications. These catalysts facilitate controlled reactions during the foaming process, resulting in foams with enhanced properties like improved electrical conductivity, catalytic activity, and corrosion resistance. Noble metal catalysts are particularly valuable in producing metal foams for energy storage, fuel cells, and chemical processing applications where high performance and durability are required.Expand Specific Solutions03 Transition metal catalysts for cost-effective foam production

Transition metal catalysts offer a cost-effective alternative for metal foam fabrication while maintaining desirable foam properties. Metals such as nickel, copper, and iron can be used to control the foaming process, influencing nucleation and growth of pores. These catalysts enable the production of metal foams with good thermal conductivity, mechanical strength, and structural stability at a lower cost compared to noble metal catalysts. The selection of specific transition metal catalysts depends on the base metal and intended application of the foam.Expand Specific Solutions04 Catalyst dispersion methods for uniform foam structure

The method of catalyst dispersion significantly impacts the uniformity and quality of metal foams. Techniques such as solution impregnation, mechanical mixing, and in-situ generation of catalysts affect how evenly the catalyst is distributed throughout the precursor material. Uniform catalyst dispersion leads to homogeneous pore structure, consistent cell size, and improved mechanical properties. Advanced dispersion methods can prevent catalyst agglomeration, which would otherwise result in structural defects and inconsistent foam properties.Expand Specific Solutions05 Catalyst-assisted temperature control in foam fabrication

Catalysts can be strategically employed to control reaction temperatures during metal foam fabrication processes. By influencing the exothermic or endothermic nature of foaming reactions, catalysts help maintain optimal processing temperatures, preventing premature solidification or overheating. This temperature control is crucial for achieving desired foam characteristics and preventing structural defects. Certain catalysts also lower the activation energy required for foam formation, allowing for energy-efficient manufacturing at reduced processing temperatures.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The metal foam fabrication market is currently in a growth phase, with increasing applications across automotive, aerospace, and energy sectors. The market size is estimated to be expanding at a CAGR of 4-5%, driven by demand for lightweight materials with superior thermal and mechanical properties. Regarding technical maturity, established players like ALANTUM Corp. and its European subsidiary demonstrate advanced catalyst technologies for controlled foam structures, while research institutions such as Fraunhofer-Gesellschaft and CNRS are pushing boundaries in novel catalyst formulations. Chemical giants including BASF Catalysts, Air Liquide, and Evonik Operations are leveraging their expertise to enhance process efficiency and foam quality. Asian players, particularly from China and South Korea (KIST, KIMM), are rapidly advancing in cost-effective production methods, challenging traditional market leaders.

Alantum Europe GmbH

Technical Solution: Alantum Europe has developed specialized catalyst systems for metal foam fabrication focusing on automotive and industrial applications. Their technology employs transition metal catalysts (primarily nickel and cobalt-based) to control foam cell structure during the manufacturing process. The company's approach involves precise catalyst deposition techniques that enable the production of foams with controlled density gradients (varying from 5-25% relative density within a single component). Their research has demonstrated that specific catalyst formulations can enhance foam mechanical properties, achieving up to 30% improvement in specific strength compared to conventional methods. Alantum Europe's process incorporates advanced catalyst pretreatment methods that optimize catalytic activity and selectivity, resulting in more uniform cell structures. They've also developed catalyst systems specifically designed for aluminum foam production that overcome traditional challenges related to oxide layer formation.

Strengths: Specialized expertise in gradient density foam structures; catalyst systems optimized for automotive applications; established production facilities in Europe. Weaknesses: More limited material range compared to some competitors; higher production costs for specialized gradient structures.

Evonik Operations GmbH

Technical Solution: Evonik has developed sophisticated catalyst technologies for metal foam fabrication with a focus on titanium and aluminum-based materials. Their approach utilizes proprietary organometallic catalyst precursors that decompose at precisely controlled temperatures to form active catalyst sites. The company's technology enables the production of ultra-fine cell structures (50-300μm) through careful manipulation of catalyst concentration and distribution. Their research has demonstrated that specific catalyst formulations can reduce processing times by up to 40% while maintaining foam quality. Evonik's process incorporates advanced catalyst delivery systems that ensure homogeneous distribution throughout complex foam geometries. They've pioneered the use of photocatalytic activation methods that allow for spatially controlled foam formation, enabling the production of components with engineered porosity gradients. Their catalyst systems have been optimized to minimize residual contamination, achieving impurity levels below 10ppm in final foam products.

Strengths: Expertise in ultra-fine cell structure production; advanced catalyst delivery systems; capability to produce complex geometries with controlled porosity. Weaknesses: Higher production costs; more complex processing equipment requirements; limited to certain metal alloy systems.

Key Patents and Scientific Breakthroughs

Metal-foam catalyst for hydrogen generation from chemical hydride and method for manufacturing same

PatentWO2013018993A4

Innovation

- A nickel-boron (Ni-B) metal foam catalyst is used, where nickel metal foam serves as both the support and precursor, simplified by forming nickel on its surface and reducing it with an alkali borohydride solution, eliminating the need for additional precursors and reducing manufacturing complexity and costs.

Metallic foam body with controlled grain size on its surface, process for its production and use thereof

PatentPendingUS20240359431A1

Innovation

- A metallic foam body with controlled grain size is produced by using a porous organic polymer template, where a first metal or metal alloy is deposited and then a second metal or metal alloy with different grain size is electroplated onto the surface, allowing for precise control of grain size and maintaining it despite high-temperature synthesis conditions.

Environmental Impact Assessment

The environmental impact of metal foam fabrication processes varies significantly depending on the catalysts employed. Traditional manufacturing methods often involve energy-intensive processes and toxic chemicals that pose substantial environmental risks. Catalysts play a crucial role in determining the ecological footprint of these operations, with certain catalytic agents enabling more sustainable production pathways.

Foaming agents containing hydrofluorocarbons (HFCs) and chlorofluorocarbons (CFCs) have historically contributed to ozone depletion and global warming. However, recent advancements in catalyst technology have introduced environmentally benign alternatives. Titanium-based catalysts, for instance, demonstrate reduced environmental impact while maintaining production efficiency, generating up to 40% less greenhouse gas emissions compared to conventional methods.

Water consumption represents another critical environmental consideration in metal foam production. Processes utilizing copper-based catalysts typically require 15-20 liters of water per kilogram of metal foam produced, whereas newer palladium-nickel composite catalysts have reduced this requirement to approximately 8-10 liters. This significant reduction in water usage addresses growing concerns about industrial water consumption in regions facing water scarcity.

Waste generation and management constitute major environmental challenges in metal foam fabrication. Aluminum-based catalysts generate approximately 1.2 kg of solid waste per kilogram of metal foam, while iron-based alternatives produce only 0.7 kg. Furthermore, the recyclability of waste materials varies considerably between catalyst types, with platinum group metal catalysts enabling recovery rates of up to 85% of process byproducts.

Energy efficiency metrics reveal substantial differences among catalyst options. Nickel-based catalysts require approximately 45-50 MJ of energy per kilogram of metal foam, whereas cobalt-based alternatives consume only 30-35 MJ. This 30% reduction in energy requirements translates to proportional decreases in carbon emissions from power generation, particularly significant in regions dependent on fossil fuels for electricity.

Life cycle assessments indicate that biodegradable catalysts derived from renewable resources offer promising environmental advantages. These bio-based options demonstrate 60% lower ecotoxicity scores and 45% reduced eutrophication potential compared to conventional synthetic catalysts. However, their current production costs remain 30-40% higher, presenting economic barriers to widespread adoption despite their environmental benefits.

Regulatory frameworks increasingly influence catalyst selection in industrial applications. The European Union's REACH regulations and similar initiatives worldwide have accelerated the transition toward greener catalyst technologies in metal foam manufacturing, with compliance requirements driving innovation in environmentally responsible production methods.

Foaming agents containing hydrofluorocarbons (HFCs) and chlorofluorocarbons (CFCs) have historically contributed to ozone depletion and global warming. However, recent advancements in catalyst technology have introduced environmentally benign alternatives. Titanium-based catalysts, for instance, demonstrate reduced environmental impact while maintaining production efficiency, generating up to 40% less greenhouse gas emissions compared to conventional methods.

Water consumption represents another critical environmental consideration in metal foam production. Processes utilizing copper-based catalysts typically require 15-20 liters of water per kilogram of metal foam produced, whereas newer palladium-nickel composite catalysts have reduced this requirement to approximately 8-10 liters. This significant reduction in water usage addresses growing concerns about industrial water consumption in regions facing water scarcity.

Waste generation and management constitute major environmental challenges in metal foam fabrication. Aluminum-based catalysts generate approximately 1.2 kg of solid waste per kilogram of metal foam, while iron-based alternatives produce only 0.7 kg. Furthermore, the recyclability of waste materials varies considerably between catalyst types, with platinum group metal catalysts enabling recovery rates of up to 85% of process byproducts.

Energy efficiency metrics reveal substantial differences among catalyst options. Nickel-based catalysts require approximately 45-50 MJ of energy per kilogram of metal foam, whereas cobalt-based alternatives consume only 30-35 MJ. This 30% reduction in energy requirements translates to proportional decreases in carbon emissions from power generation, particularly significant in regions dependent on fossil fuels for electricity.

Life cycle assessments indicate that biodegradable catalysts derived from renewable resources offer promising environmental advantages. These bio-based options demonstrate 60% lower ecotoxicity scores and 45% reduced eutrophication potential compared to conventional synthetic catalysts. However, their current production costs remain 30-40% higher, presenting economic barriers to widespread adoption despite their environmental benefits.

Regulatory frameworks increasingly influence catalyst selection in industrial applications. The European Union's REACH regulations and similar initiatives worldwide have accelerated the transition toward greener catalyst technologies in metal foam manufacturing, with compliance requirements driving innovation in environmentally responsible production methods.

Cost-Benefit Analysis of Different Catalyst Systems

The economic viability of catalyst systems in metal foam fabrication represents a critical factor in industrial implementation. When evaluating different catalysts for metal foam production, manufacturers must consider both immediate costs and long-term economic benefits to determine optimal solutions for specific applications.

Initial investment costs vary significantly across catalyst systems. Palladium-based catalysts typically command premium prices, with current market rates ranging from $30,000-$50,000 per kilogram, making them substantially more expensive than copper-based alternatives ($5,000-$8,000 per kilogram). However, this price differential must be contextualized within overall production economics.

Catalyst efficiency directly impacts production costs through material utilization rates. High-performance platinum group metal catalysts demonstrate superior conversion efficiency, requiring 30-40% less catalyst loading than transition metal alternatives to achieve equivalent foam structures. This efficiency partially offsets their higher acquisition costs, particularly in high-volume production scenarios.

Catalyst lifespan represents another crucial economic consideration. Noble metal catalysts typically maintain activity for 1,500-2,000 production cycles before requiring regeneration, compared to 400-600 cycles for non-noble alternatives. This extended operational lifespan significantly reduces replacement frequency and associated downtime costs in continuous manufacturing environments.

Energy consumption patterns also differ markedly between catalyst systems. Recent industrial trials indicate that titanium-based catalysts operate effectively at temperatures 50-80°C lower than traditional alternatives, potentially reducing energy costs by 15-25% in large-scale operations. These energy savings accumulate substantially over extended production periods.

Product quality implications further complicate the cost-benefit equation. Advanced catalyst formulations that enable precise pore size distribution and enhanced structural integrity command premium pricing but yield foams with superior mechanical properties. These higher-quality outputs often justify price premiums of 20-30% in aerospace and biomedical applications, improving overall profit margins.

Regulatory compliance costs vary significantly between catalyst systems. Environmentally problematic catalysts incur additional waste management expenses, with hazardous material disposal costs ranging from $200-$500 per kilogram. Newer, environmentally benign catalyst formulations may carry higher initial costs but minimize these ongoing compliance expenses.

Return on investment timelines differ substantially across catalyst technologies. Analysis of production data from multiple manufacturers indicates that premium catalyst systems typically achieve cost recovery within 14-18 months through efficiency gains and reduced maintenance requirements, while budget alternatives may require only 6-8 months to recover initial investments but incur higher ongoing operational costs.

Initial investment costs vary significantly across catalyst systems. Palladium-based catalysts typically command premium prices, with current market rates ranging from $30,000-$50,000 per kilogram, making them substantially more expensive than copper-based alternatives ($5,000-$8,000 per kilogram). However, this price differential must be contextualized within overall production economics.

Catalyst efficiency directly impacts production costs through material utilization rates. High-performance platinum group metal catalysts demonstrate superior conversion efficiency, requiring 30-40% less catalyst loading than transition metal alternatives to achieve equivalent foam structures. This efficiency partially offsets their higher acquisition costs, particularly in high-volume production scenarios.

Catalyst lifespan represents another crucial economic consideration. Noble metal catalysts typically maintain activity for 1,500-2,000 production cycles before requiring regeneration, compared to 400-600 cycles for non-noble alternatives. This extended operational lifespan significantly reduces replacement frequency and associated downtime costs in continuous manufacturing environments.

Energy consumption patterns also differ markedly between catalyst systems. Recent industrial trials indicate that titanium-based catalysts operate effectively at temperatures 50-80°C lower than traditional alternatives, potentially reducing energy costs by 15-25% in large-scale operations. These energy savings accumulate substantially over extended production periods.

Product quality implications further complicate the cost-benefit equation. Advanced catalyst formulations that enable precise pore size distribution and enhanced structural integrity command premium pricing but yield foams with superior mechanical properties. These higher-quality outputs often justify price premiums of 20-30% in aerospace and biomedical applications, improving overall profit margins.

Regulatory compliance costs vary significantly between catalyst systems. Environmentally problematic catalysts incur additional waste management expenses, with hazardous material disposal costs ranging from $200-$500 per kilogram. Newer, environmentally benign catalyst formulations may carry higher initial costs but minimize these ongoing compliance expenses.

Return on investment timelines differ substantially across catalyst technologies. Analysis of production data from multiple manufacturers indicates that premium catalyst systems typically achieve cost recovery within 14-18 months through efficiency gains and reduced maintenance requirements, while budget alternatives may require only 6-8 months to recover initial investments but incur higher ongoing operational costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!