Comparison of Metal Foam Fabrication: Aerospace vs Energy Sectors

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Foam Technology Background and Objectives

Metal foam technology has evolved significantly over the past several decades, transitioning from laboratory curiosities to engineered materials with specific applications across multiple industries. The development of metal foams can be traced back to the 1940s, with significant advancements occurring in the 1990s when manufacturing techniques became more refined and commercially viable. These cellular structures combine the inherent properties of metals with the architectural advantages of foams, resulting in materials with exceptional strength-to-weight ratios, energy absorption capabilities, and thermal management characteristics.

The evolution of metal foam technology has been driven by increasing demands for lightweight yet strong materials in high-performance applications. Initially focused on aluminum-based foams, the technology has expanded to include various metal matrices including nickel, copper, steel, titanium, and their alloys. This diversification has enabled tailored solutions for specific industry requirements, particularly in aerospace and energy sectors where performance demands are exceptionally high.

In the aerospace industry, metal foams have been pursued primarily for their weight reduction potential while maintaining structural integrity. The trend toward more fuel-efficient aircraft has accelerated research into these materials for components ranging from structural elements to thermal protection systems. Concurrently, the energy sector has explored metal foams for their thermal conductivity, surface area advantages, and potential in energy storage and conversion applications.

The technological trajectory shows a clear shift from basic manufacturing capability to precision engineering of foam properties. Modern research focuses on controlling pore size distribution, cell wall thickness, and overall foam architecture to achieve specific performance metrics. This precision engineering represents a significant advancement from early production methods that yielded inconsistent and often unpredictable material properties.

The primary objectives of current metal foam technology development include standardizing production methodologies to ensure consistent quality, reducing manufacturing costs to enable broader commercial adoption, and developing application-specific formulations that maximize performance in targeted use cases. Additionally, there is growing interest in hybrid metal foams that incorporate secondary materials or phases to enhance specific properties.

Looking forward, the technology aims to bridge the gap between laboratory demonstrations and industrial-scale production, particularly for advanced applications in aerospace and energy sectors. This includes developing more efficient fabrication techniques that can produce complex geometries with consistent properties, as well as establishing comprehensive material standards and testing protocols to facilitate engineering adoption across industries.

The evolution of metal foam technology has been driven by increasing demands for lightweight yet strong materials in high-performance applications. Initially focused on aluminum-based foams, the technology has expanded to include various metal matrices including nickel, copper, steel, titanium, and their alloys. This diversification has enabled tailored solutions for specific industry requirements, particularly in aerospace and energy sectors where performance demands are exceptionally high.

In the aerospace industry, metal foams have been pursued primarily for their weight reduction potential while maintaining structural integrity. The trend toward more fuel-efficient aircraft has accelerated research into these materials for components ranging from structural elements to thermal protection systems. Concurrently, the energy sector has explored metal foams for their thermal conductivity, surface area advantages, and potential in energy storage and conversion applications.

The technological trajectory shows a clear shift from basic manufacturing capability to precision engineering of foam properties. Modern research focuses on controlling pore size distribution, cell wall thickness, and overall foam architecture to achieve specific performance metrics. This precision engineering represents a significant advancement from early production methods that yielded inconsistent and often unpredictable material properties.

The primary objectives of current metal foam technology development include standardizing production methodologies to ensure consistent quality, reducing manufacturing costs to enable broader commercial adoption, and developing application-specific formulations that maximize performance in targeted use cases. Additionally, there is growing interest in hybrid metal foams that incorporate secondary materials or phases to enhance specific properties.

Looking forward, the technology aims to bridge the gap between laboratory demonstrations and industrial-scale production, particularly for advanced applications in aerospace and energy sectors. This includes developing more efficient fabrication techniques that can produce complex geometries with consistent properties, as well as establishing comprehensive material standards and testing protocols to facilitate engineering adoption across industries.

Market Analysis for Metal Foam Applications

The global metal foam market has experienced significant growth in recent years, with a market value reaching approximately $85 million in 2022 and projected to exceed $115 million by 2028. This growth is primarily driven by increasing demand across various industries, particularly aerospace and energy sectors, which together account for nearly 40% of the total market share.

In the aerospace sector, metal foams are increasingly utilized for lightweight structural components, thermal management systems, and impact absorption applications. The industry's push toward fuel efficiency and reduced emissions has accelerated the adoption of metal foams, as they offer weight reduction of up to 70% compared to solid metal counterparts while maintaining structural integrity. Major aerospace manufacturers have reported 15-20% improvement in fuel efficiency when incorporating metal foam components in aircraft design.

The energy sector presents a different but equally promising market landscape for metal foams. Applications range from heat exchangers and battery electrodes to catalytic supports and filtration systems. The renewable energy segment, particularly solar thermal and fuel cell technologies, has emerged as a significant growth driver, with an annual growth rate of approximately 18% for metal foam components. Energy storage solutions utilizing metal foams have demonstrated up to 30% higher efficiency compared to conventional materials.

Regional analysis reveals that North America currently leads the metal foam market with approximately 35% market share, followed by Europe (28%) and Asia-Pacific (25%). However, the Asia-Pacific region is experiencing the fastest growth rate due to rapid industrialization and increasing aerospace and energy infrastructure investments in countries like China, India, and South Korea.

Market segmentation by manufacturing method indicates that powder metallurgy processes dominate with 45% market share, followed by melt gas injection (25%) and casting methods (20%). The choice of manufacturing method significantly impacts cost structures and application suitability, with aerospace applications typically favoring precision methods despite higher costs, while energy applications often prioritize cost-effectiveness for larger-scale production.

Customer demand patterns show distinct differences between the two sectors. Aerospace customers prioritize certification, reliability, and performance consistency, often willing to pay premium prices for specialized metal foam solutions. Energy sector customers, while also concerned with performance, typically place greater emphasis on scalability, cost-effectiveness, and long-term durability under various operating conditions.

Future market projections indicate continued growth in both sectors, with the aerospace market for metal foams expected to grow at 12% annually and the energy sector at 15% through 2028. Emerging applications in hydrogen storage, carbon capture, and advanced thermal management systems represent significant new market opportunities that could reshape the competitive landscape.

In the aerospace sector, metal foams are increasingly utilized for lightweight structural components, thermal management systems, and impact absorption applications. The industry's push toward fuel efficiency and reduced emissions has accelerated the adoption of metal foams, as they offer weight reduction of up to 70% compared to solid metal counterparts while maintaining structural integrity. Major aerospace manufacturers have reported 15-20% improvement in fuel efficiency when incorporating metal foam components in aircraft design.

The energy sector presents a different but equally promising market landscape for metal foams. Applications range from heat exchangers and battery electrodes to catalytic supports and filtration systems. The renewable energy segment, particularly solar thermal and fuel cell technologies, has emerged as a significant growth driver, with an annual growth rate of approximately 18% for metal foam components. Energy storage solutions utilizing metal foams have demonstrated up to 30% higher efficiency compared to conventional materials.

Regional analysis reveals that North America currently leads the metal foam market with approximately 35% market share, followed by Europe (28%) and Asia-Pacific (25%). However, the Asia-Pacific region is experiencing the fastest growth rate due to rapid industrialization and increasing aerospace and energy infrastructure investments in countries like China, India, and South Korea.

Market segmentation by manufacturing method indicates that powder metallurgy processes dominate with 45% market share, followed by melt gas injection (25%) and casting methods (20%). The choice of manufacturing method significantly impacts cost structures and application suitability, with aerospace applications typically favoring precision methods despite higher costs, while energy applications often prioritize cost-effectiveness for larger-scale production.

Customer demand patterns show distinct differences between the two sectors. Aerospace customers prioritize certification, reliability, and performance consistency, often willing to pay premium prices for specialized metal foam solutions. Energy sector customers, while also concerned with performance, typically place greater emphasis on scalability, cost-effectiveness, and long-term durability under various operating conditions.

Future market projections indicate continued growth in both sectors, with the aerospace market for metal foams expected to grow at 12% annually and the energy sector at 15% through 2028. Emerging applications in hydrogen storage, carbon capture, and advanced thermal management systems represent significant new market opportunities that could reshape the competitive landscape.

Current Fabrication Challenges Across Sectors

Metal foam fabrication faces distinct challenges across aerospace and energy sectors, stemming from their divergent application requirements and operating environments. In aerospace applications, weight reduction is paramount, necessitating ultra-lightweight foams with exceptional strength-to-weight ratios. This creates significant manufacturing challenges in achieving uniform cell structures while maintaining structural integrity under extreme mechanical loads and temperature variations experienced during flight.

The aerospace sector demands precise control over pore size distribution and connectivity, which current manufacturing methods struggle to deliver consistently at scale. Production techniques like powder metallurgy and investment casting often result in unpredictable cellular architectures when attempting to create the complex geometries required for aerospace components. Additionally, the need for certification and compliance with stringent aviation safety standards imposes rigorous quality control requirements that increase production costs and limit innovation cycles.

Conversely, energy sector applications prioritize thermal management, corrosion resistance, and long-term durability under constant operational conditions. Metal foams used in heat exchangers, catalytic converters, and energy storage systems must withstand aggressive chemical environments while maintaining thermal conductivity properties. The challenge lies in developing cost-effective fabrication methods that can produce large-volume metal foams with consistent properties throughout the structure.

Both sectors face common challenges in joining and integration. Connecting metal foams to solid structures without compromising the foam's properties remains problematic, with conventional welding techniques often causing localized collapse of the cellular structure. Surface finishing and quality control present additional hurdles, as non-destructive testing methods for internal defect detection in metal foams remain limited in effectiveness.

Material selection presents another significant challenge. Aerospace applications typically require titanium or aluminum-based foams for their lightweight properties, while energy applications often need nickel, copper, or steel-based foams for thermal conductivity and corrosion resistance. Each material system presents unique processing difficulties during foam fabrication, requiring specialized equipment and expertise.

Scalability remains a critical bottleneck across both sectors. Laboratory-scale production techniques often fail to translate effectively to industrial-scale manufacturing, resulting in inconsistent properties and increased defect rates. This scaling challenge is particularly acute for advanced fabrication methods like additive manufacturing of metal foams, where build volume limitations and process parameter optimization become increasingly complex at larger scales.

Cost considerations differ markedly between sectors, with aerospace willing to absorb higher production costs for performance benefits, while energy applications require more economical solutions to remain commercially viable. This economic disparity influences research directions and technology adoption rates, creating parallel but distinct development pathways for metal foam fabrication technologies.

The aerospace sector demands precise control over pore size distribution and connectivity, which current manufacturing methods struggle to deliver consistently at scale. Production techniques like powder metallurgy and investment casting often result in unpredictable cellular architectures when attempting to create the complex geometries required for aerospace components. Additionally, the need for certification and compliance with stringent aviation safety standards imposes rigorous quality control requirements that increase production costs and limit innovation cycles.

Conversely, energy sector applications prioritize thermal management, corrosion resistance, and long-term durability under constant operational conditions. Metal foams used in heat exchangers, catalytic converters, and energy storage systems must withstand aggressive chemical environments while maintaining thermal conductivity properties. The challenge lies in developing cost-effective fabrication methods that can produce large-volume metal foams with consistent properties throughout the structure.

Both sectors face common challenges in joining and integration. Connecting metal foams to solid structures without compromising the foam's properties remains problematic, with conventional welding techniques often causing localized collapse of the cellular structure. Surface finishing and quality control present additional hurdles, as non-destructive testing methods for internal defect detection in metal foams remain limited in effectiveness.

Material selection presents another significant challenge. Aerospace applications typically require titanium or aluminum-based foams for their lightweight properties, while energy applications often need nickel, copper, or steel-based foams for thermal conductivity and corrosion resistance. Each material system presents unique processing difficulties during foam fabrication, requiring specialized equipment and expertise.

Scalability remains a critical bottleneck across both sectors. Laboratory-scale production techniques often fail to translate effectively to industrial-scale manufacturing, resulting in inconsistent properties and increased defect rates. This scaling challenge is particularly acute for advanced fabrication methods like additive manufacturing of metal foams, where build volume limitations and process parameter optimization become increasingly complex at larger scales.

Cost considerations differ markedly between sectors, with aerospace willing to absorb higher production costs for performance benefits, while energy applications require more economical solutions to remain commercially viable. This economic disparity influences research directions and technology adoption rates, creating parallel but distinct development pathways for metal foam fabrication technologies.

Current Fabrication Methods Comparison

01 Manufacturing methods for metal foam

Various manufacturing techniques are employed to produce metal foam structures with controlled porosity and properties. These methods include powder metallurgy processes, melt foaming with blowing agents, investment casting, and additive manufacturing approaches. Each technique offers different advantages in terms of pore size control, density management, and structural integrity of the resulting metal foam. The manufacturing process significantly influences the mechanical properties and application suitability of the final product.- Manufacturing methods for metal foam: Various techniques are employed to produce metal foams, including powder metallurgy, melt processing, and additive manufacturing. These methods involve introducing porosity into metal structures through the use of space holders, gas injection, or controlled solidification processes. The manufacturing approach significantly influences the resulting foam's properties such as density, pore size distribution, and mechanical characteristics.

- Structural applications of metal foam: Metal foams are utilized in structural applications due to their high strength-to-weight ratio and energy absorption capabilities. These materials are particularly valuable in automotive, aerospace, and construction industries where lightweight yet strong components are required. The cellular structure of metal foams provides excellent impact resistance and crash energy absorption while maintaining structural integrity.

- Thermal management applications: Metal foams excel in thermal management applications due to their high surface area-to-volume ratio and thermal conductivity. These materials are used in heat exchangers, heat sinks, and thermal energy storage systems. The interconnected porous structure allows for efficient heat transfer while maintaining structural stability at elevated temperatures, making them ideal for applications requiring both thermal performance and mechanical strength.

- Functional properties and surface treatments: Metal foams can be enhanced through various surface treatments and modifications to improve specific functional properties. These treatments include coating with catalytic materials, surface oxidation for improved corrosion resistance, or functionalization for specific chemical interactions. The high surface area of metal foams makes them excellent substrates for catalytic applications, filtration systems, and electrochemical devices.

- Composite metal foam systems: Composite metal foam systems combine metal foams with other materials to create hybrid structures with enhanced properties. These composites may incorporate polymers, ceramics, or different metal alloys to achieve specific performance characteristics. Applications include ballistic protection, vibration damping, and multi-functional components where the synergistic combination of materials provides superior performance compared to single-material solutions.

02 Structural applications of metal foam

Metal foams are utilized in various structural applications due to their unique combination of lightweight properties and mechanical strength. These materials are particularly valuable in automotive, aerospace, and construction industries where weight reduction without compromising structural integrity is crucial. Metal foams provide excellent energy absorption capabilities, making them ideal for crash protection systems and impact-resistant structures. Their high strength-to-weight ratio enables design of lightweight yet robust components.Expand Specific Solutions03 Thermal management applications

Metal foams exhibit exceptional thermal properties that make them suitable for heat exchange and thermal management applications. The open-cell structure provides large surface area-to-volume ratios, enhancing heat transfer efficiency. These materials are used in heat sinks, heat exchangers, and thermal insulation systems. The porous structure allows for efficient fluid flow while maintaining good thermal conductivity, making metal foams particularly valuable in cooling systems for electronics and industrial processes.Expand Specific Solutions04 Composite metal foam systems

Composite metal foam systems combine metal foams with other materials to enhance specific properties or functionalities. These composites may incorporate polymers, ceramics, or different metal alloys to create hybrid structures with tailored characteristics. Applications include radiation shielding, ballistic protection, and specialized filtration systems. The synergistic combination of materials can result in enhanced mechanical properties, improved corrosion resistance, or specialized functional capabilities beyond what traditional metal foams can provide.Expand Specific Solutions05 Functional properties and specialized applications

Metal foams possess unique functional properties that enable specialized applications across various industries. These include acoustic damping, electromagnetic shielding, catalytic support structures, and filtration media. The controllable porosity and surface characteristics allow for customization to specific requirements. Advanced metal foams are being developed with enhanced properties such as self-healing capabilities, stimuli-responsive behavior, and biocompatibility for medical applications. These specialized metal foams address specific technical challenges in fields ranging from chemical processing to biomedical engineering.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The metal foam fabrication market is currently in a growth phase, with increasing applications across aerospace and energy sectors. The market is expanding due to rising demand for lightweight, high-strength materials with excellent thermal properties. Technologically, the field shows varying maturity levels between sectors, with aerospace applications generally more advanced. Key players shaping the competitive landscape include ALANTUM Corp. and its European subsidiary, which have established commercial-scale production capabilities, alongside research-driven organizations like Fraunhofer-Gesellschaft and Naval Research Laboratory. Major industrial players such as RTX Corp., Siemens Energy, and SGL Carbon are integrating metal foam technologies into their product portfolios, while academic institutions like North Carolina State University and École Polytechnique Fédérale de Lausanne continue to drive fundamental innovations in fabrication techniques.

ALANTUM Corp.

Technical Solution: ALANTUM Corp. has developed proprietary metal foam fabrication technologies specifically tailored for both aerospace and energy applications. Their core technology involves a unique sintering process of metal powder slurries on polyurethane foam templates, creating open-cell metal foams with controlled pore sizes ranging from 450-5000μm. For aerospace applications, ALANTUM produces nickel-chromium and Inconel-based foams that maintain structural integrity at temperatures up to 1100°C while offering 85-95% porosity. Their aerospace metal foams undergo specialized surface treatments to enhance oxidation resistance and thermal stability. In the energy sector, ALANTUM has pioneered copper and nickel-based foams optimized for fuel cells and batteries, featuring nano-coated surfaces that increase catalytic activity by up to 300% compared to traditional materials. Their patented electrodeposition process allows precise control of foam thickness (0.2-5mm) while maintaining uniform density distribution, critical for aerospace weight requirements and energy storage efficiency.

Strengths: Superior control over pore structure and size distribution; excellent high-temperature performance; established manufacturing scale for industrial applications; proprietary surface treatment technologies. Weaknesses: Higher production costs compared to some competing methods; limited flexibility in creating gradient porosity structures; energy-intensive manufacturing process requiring specialized equipment.

Siemens Energy AG

Technical Solution: Siemens Energy AG has developed specialized metal foam fabrication technologies primarily for energy sector applications with adaptations for aerospace thermal management systems. Their core approach utilizes a combination of investment casting and directional solidification techniques to create nickel-chromium and iron-aluminum alloy foams with controlled porosity (60-85%) and directional pore structures. For energy applications, Siemens has pioneered metal foams optimized for high-temperature (up to 950°C) gas turbine components, featuring thermal barrier coatings that extend operational life by 30-40% compared to conventional materials. Their energy-focused foams incorporate catalytic materials within the pore structure, enhancing reaction efficiency in fuel cells and hydrogen production systems by up to 45%. In aerospace applications, Siemens has adapted their energy-sector foam technology to create lightweight heat exchangers with thermal conductivity 3-4 times higher than traditional materials while reducing weight by 50-60%. Their manufacturing process allows for the integration of cooling channels directly within foam structures, creating multifunctional components that serve both structural and thermal management purposes.

Strengths: Exceptional high-temperature performance; advanced directional porosity control; integrated multifunctionality; established large-scale production capabilities for energy components. Weaknesses: Higher manufacturing complexity than some competing methods; limited flexibility in creating complex geometries; relatively higher material costs; optimization primarily focused on energy rather than aerospace applications.

Critical Patents and Technical Innovations

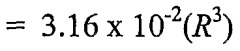

Metal foam comprising hollow metal spheres and solid matrix and methods of preparation thereof

PatentWO2006083375A2

Innovation

- Composite metal foams comprising hollow metallic spheres and a solid metal matrix, prepared through methods like powder metallurgy and casting, where the spaces around the spheres are filled with a metal matrix-forming material to create a uniformly packed and strong foam structure.

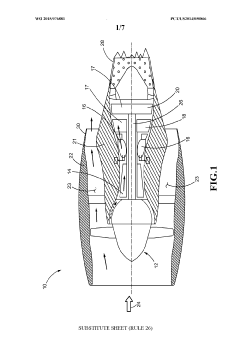

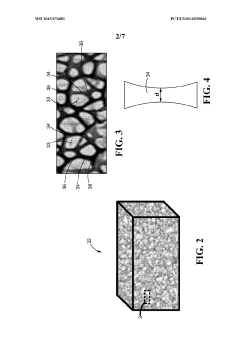

Method for fabricating metal foams having ligament diameters below one micron

PatentWO2015076881A1

Innovation

- A method involving an aerogel containing a polymer and nanoparticles is exposed to a reducing condition at an elevated temperature for a controlled reaction time to produce metal foams with ligament diameters below one micron, using hydrogen gas in an inert atmosphere, and pyrolyzing the polymer while partially reducing the nanoparticles.

Cross-Sector Technology Transfer Potential

The aerospace and energy sectors have developed distinct approaches to metal foam fabrication, yet significant opportunities exist for cross-pollination of technologies and methodologies between these industries. The aerospace sector's emphasis on lightweight, high-strength materials has driven innovations in precision manufacturing of metal foams with consistent cell structures and superior mechanical properties. These advances could be transferred to energy applications where weight reduction would enhance efficiency in transportation of energy components or improve performance of mobile energy systems.

Conversely, the energy sector's focus on cost-effective, large-scale production methods offers valuable insights for aerospace manufacturers seeking to reduce production costs. Energy sector innovations in thermal management and energy absorption could be adapted for aerospace applications, particularly in heat shields and crash protection systems. The durability enhancements developed for harsh energy environments could improve aerospace components exposed to extreme conditions.

Manufacturing processes represent another area ripe for technology transfer. The energy sector's advancements in continuous production methods could help aerospace manufacturers scale up production while maintaining quality. Meanwhile, aerospace's precision control techniques could enable energy sector producers to create more specialized metal foams for specific applications like advanced heat exchangers or catalytic substrates.

Material composition innovations also present transfer opportunities. Aerospace's development of multi-metal and functionally graded foams could benefit energy applications requiring performance gradients across components. Energy sector work on corrosion-resistant alloys could enhance aerospace components operating in challenging environments.

Testing and quality assurance methodologies developed in the highly regulated aerospace industry could strengthen reliability in energy applications, while the energy sector's accelerated life testing approaches could streamline aerospace qualification processes. Computational modeling techniques developed in either sector could cross-fertilize, improving design optimization across industries.

For successful technology transfer, collaborative research initiatives between aerospace and energy stakeholders should be established, potentially through joint industry projects or government-sponsored programs. Knowledge-sharing platforms and cross-sector standardization efforts would facilitate adoption of best practices across industries, ultimately accelerating innovation in metal foam technology for both sectors.

Conversely, the energy sector's focus on cost-effective, large-scale production methods offers valuable insights for aerospace manufacturers seeking to reduce production costs. Energy sector innovations in thermal management and energy absorption could be adapted for aerospace applications, particularly in heat shields and crash protection systems. The durability enhancements developed for harsh energy environments could improve aerospace components exposed to extreme conditions.

Manufacturing processes represent another area ripe for technology transfer. The energy sector's advancements in continuous production methods could help aerospace manufacturers scale up production while maintaining quality. Meanwhile, aerospace's precision control techniques could enable energy sector producers to create more specialized metal foams for specific applications like advanced heat exchangers or catalytic substrates.

Material composition innovations also present transfer opportunities. Aerospace's development of multi-metal and functionally graded foams could benefit energy applications requiring performance gradients across components. Energy sector work on corrosion-resistant alloys could enhance aerospace components operating in challenging environments.

Testing and quality assurance methodologies developed in the highly regulated aerospace industry could strengthen reliability in energy applications, while the energy sector's accelerated life testing approaches could streamline aerospace qualification processes. Computational modeling techniques developed in either sector could cross-fertilize, improving design optimization across industries.

For successful technology transfer, collaborative research initiatives between aerospace and energy stakeholders should be established, potentially through joint industry projects or government-sponsored programs. Knowledge-sharing platforms and cross-sector standardization efforts would facilitate adoption of best practices across industries, ultimately accelerating innovation in metal foam technology for both sectors.

Sustainability and Environmental Impact Assessment

The environmental impact of metal foam fabrication processes varies significantly between aerospace and energy sectors, with sustainability considerations becoming increasingly critical for both industries. In aerospace applications, the lightweight nature of metal foams contributes to fuel efficiency and reduced emissions throughout the aircraft lifecycle. However, the production processes often involve energy-intensive methods and potentially hazardous materials, particularly when using titanium and aluminum alloys specific to aerospace requirements.

The energy sector's metal foam fabrication, while sharing some environmental challenges, demonstrates different sustainability profiles. Energy applications typically utilize copper, nickel, and iron-based foams that require less stringent quality control but often involve larger production volumes. This scale difference creates opportunities for more efficient resource utilization but also presents waste management challenges that differ from aerospace manufacturing.

Life cycle assessment (LCA) studies reveal that aerospace metal foam production generates approximately 15-20% higher carbon emissions per unit volume compared to energy sector applications. This disparity stems primarily from the aerospace industry's more rigorous quality control processes and higher purity material requirements. However, these initial environmental costs may be offset by the operational benefits of weight reduction in aircraft over their service life.

Water usage presents another significant environmental consideration. Powder metallurgy approaches common in aerospace typically consume 40-60% less water than the casting methods frequently employed in energy sector applications. This advantage is partially counterbalanced by the higher energy intensity of powder processing and the specialized waste treatment requirements for the chemicals used in aerospace-grade foam production.

Material recovery and recycling capabilities also differ markedly between sectors. Energy sector metal foams, particularly those used in heat exchangers and catalytic applications, demonstrate recycling rates of 65-75%, while aerospace metal foams achieve only 40-50% recovery rates due to complex alloy compositions and contamination concerns. This recycling gap represents a significant opportunity for sustainability improvement in aerospace applications.

Emerging technologies are addressing these sustainability challenges through innovations like solvent-free processing, renewable energy integration in manufacturing, and design for disassembly approaches. Both sectors are increasingly adopting circular economy principles, though regulatory frameworks and industry standards for environmental performance remain more developed in the energy sector than in aerospace manufacturing.

The energy sector's metal foam fabrication, while sharing some environmental challenges, demonstrates different sustainability profiles. Energy applications typically utilize copper, nickel, and iron-based foams that require less stringent quality control but often involve larger production volumes. This scale difference creates opportunities for more efficient resource utilization but also presents waste management challenges that differ from aerospace manufacturing.

Life cycle assessment (LCA) studies reveal that aerospace metal foam production generates approximately 15-20% higher carbon emissions per unit volume compared to energy sector applications. This disparity stems primarily from the aerospace industry's more rigorous quality control processes and higher purity material requirements. However, these initial environmental costs may be offset by the operational benefits of weight reduction in aircraft over their service life.

Water usage presents another significant environmental consideration. Powder metallurgy approaches common in aerospace typically consume 40-60% less water than the casting methods frequently employed in energy sector applications. This advantage is partially counterbalanced by the higher energy intensity of powder processing and the specialized waste treatment requirements for the chemicals used in aerospace-grade foam production.

Material recovery and recycling capabilities also differ markedly between sectors. Energy sector metal foams, particularly those used in heat exchangers and catalytic applications, demonstrate recycling rates of 65-75%, while aerospace metal foams achieve only 40-50% recovery rates due to complex alloy compositions and contamination concerns. This recycling gap represents a significant opportunity for sustainability improvement in aerospace applications.

Emerging technologies are addressing these sustainability challenges through innovations like solvent-free processing, renewable energy integration in manufacturing, and design for disassembly approaches. Both sectors are increasingly adopting circular economy principles, though regulatory frameworks and industry standards for environmental performance remain more developed in the energy sector than in aerospace manufacturing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!