Research on Metal Foam Fabrication for Sustainable Technologies

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Foam Technology Background and Objectives

Metal foam technology has evolved significantly over the past several decades, transitioning from a laboratory curiosity to a commercially viable material with diverse applications. Initially developed in the 1940s, metal foams gained substantial research attention in the 1990s when manufacturing processes became more refined and cost-effective. These unique materials combine the structural properties of metals with the lightweight characteristics of cellular structures, offering exceptional strength-to-weight ratios, energy absorption capabilities, and thermal management properties.

The evolution of metal foam technology has been driven by increasing demands for lightweight yet strong materials across various industries, including automotive, aerospace, construction, and energy sectors. The global push toward sustainability has further accelerated interest in metal foams, as they offer potential solutions for reducing material usage while maintaining or enhancing performance characteristics. Recent technological advancements have expanded the range of metals and alloys that can be processed into foam structures, including aluminum, titanium, copper, nickel, and their respective alloys.

The primary objective of current metal foam research is to develop more efficient, cost-effective, and environmentally sustainable fabrication methods. Traditional manufacturing techniques such as powder metallurgy, melt gas injection, and investment casting have limitations in terms of process control, reproducibility, and scalability. Emerging technologies aim to overcome these challenges while reducing energy consumption and waste generation during production.

Another critical goal is to enhance the mechanical properties and functional characteristics of metal foams to expand their application range. This includes improving compression strength, fatigue resistance, and thermal conductivity while maintaining the lightweight nature of these materials. Researchers are also focusing on developing multi-functional metal foams that can simultaneously serve structural, thermal, acoustic, and filtration purposes.

The integration of metal foam technology with sustainable practices represents a significant research direction. This includes utilizing recycled metals as raw materials, developing closed-loop manufacturing processes, and designing metal foams for end-of-life recyclability. Additionally, researchers are exploring the potential of metal foams in green technologies such as catalytic converters, heat exchangers for renewable energy systems, and lightweight components for electric vehicles.

The technological trajectory suggests that metal foam fabrication will continue to evolve toward more precise control of pore size, distribution, and connectivity, enabling customized properties for specific applications. Advanced manufacturing techniques, including additive manufacturing and hybrid processes, are expected to play a crucial role in this evolution, offering unprecedented design freedom and material efficiency in metal foam production.

The evolution of metal foam technology has been driven by increasing demands for lightweight yet strong materials across various industries, including automotive, aerospace, construction, and energy sectors. The global push toward sustainability has further accelerated interest in metal foams, as they offer potential solutions for reducing material usage while maintaining or enhancing performance characteristics. Recent technological advancements have expanded the range of metals and alloys that can be processed into foam structures, including aluminum, titanium, copper, nickel, and their respective alloys.

The primary objective of current metal foam research is to develop more efficient, cost-effective, and environmentally sustainable fabrication methods. Traditional manufacturing techniques such as powder metallurgy, melt gas injection, and investment casting have limitations in terms of process control, reproducibility, and scalability. Emerging technologies aim to overcome these challenges while reducing energy consumption and waste generation during production.

Another critical goal is to enhance the mechanical properties and functional characteristics of metal foams to expand their application range. This includes improving compression strength, fatigue resistance, and thermal conductivity while maintaining the lightweight nature of these materials. Researchers are also focusing on developing multi-functional metal foams that can simultaneously serve structural, thermal, acoustic, and filtration purposes.

The integration of metal foam technology with sustainable practices represents a significant research direction. This includes utilizing recycled metals as raw materials, developing closed-loop manufacturing processes, and designing metal foams for end-of-life recyclability. Additionally, researchers are exploring the potential of metal foams in green technologies such as catalytic converters, heat exchangers for renewable energy systems, and lightweight components for electric vehicles.

The technological trajectory suggests that metal foam fabrication will continue to evolve toward more precise control of pore size, distribution, and connectivity, enabling customized properties for specific applications. Advanced manufacturing techniques, including additive manufacturing and hybrid processes, are expected to play a crucial role in this evolution, offering unprecedented design freedom and material efficiency in metal foam production.

Sustainable Applications Market Analysis

The global market for sustainable technologies utilizing metal foam is experiencing significant growth, driven by increasing environmental concerns and regulatory pressures across industries. The market size for metal foam applications in sustainable technologies was valued at approximately $95 million in 2022, with projections indicating a compound annual growth rate of 5.8% through 2030. This growth trajectory is primarily fueled by the exceptional properties of metal foams, including high surface-to-volume ratio, lightweight structure, and excellent thermal conductivity.

Energy efficiency applications represent the largest market segment, accounting for nearly 40% of the total market share. Within this segment, heat exchangers and thermal management systems dominate, as industries seek to reduce energy consumption and carbon footprints. The automotive and aerospace sectors are particularly active adopters, implementing metal foam components to achieve weight reduction and improved fuel efficiency.

Environmental remediation applications constitute another rapidly expanding market segment, growing at 7.2% annually. Metal foams are increasingly utilized in air and water filtration systems, catalytic converters, and pollution control devices. Their porous structure makes them ideal for capturing particulates and facilitating chemical reactions that neutralize pollutants.

Renewable energy systems represent the fastest-growing application area, with a projected CAGR of 8.5%. Metal foams are being integrated into solar thermal collectors, fuel cells, and energy storage systems to enhance efficiency and reduce material usage. The superior heat transfer capabilities of metal foams make them particularly valuable in concentrated solar power systems.

Regionally, North America and Europe currently lead the market, collectively accounting for approximately 65% of global demand. However, the Asia-Pacific region is expected to witness the highest growth rate, driven by rapid industrialization, increasing environmental regulations, and substantial investments in sustainable infrastructure.

Key market drivers include stringent environmental regulations, corporate sustainability initiatives, and increasing consumer preference for eco-friendly products. The circular economy concept is also boosting demand, as metal foams can be manufactured using recycled materials and are themselves recyclable at end-of-life.

Challenges to market growth include high production costs, technical limitations in large-scale manufacturing, and competition from alternative materials. However, ongoing research and development efforts are addressing these barriers through improved fabrication techniques and cost reduction strategies.

Energy efficiency applications represent the largest market segment, accounting for nearly 40% of the total market share. Within this segment, heat exchangers and thermal management systems dominate, as industries seek to reduce energy consumption and carbon footprints. The automotive and aerospace sectors are particularly active adopters, implementing metal foam components to achieve weight reduction and improved fuel efficiency.

Environmental remediation applications constitute another rapidly expanding market segment, growing at 7.2% annually. Metal foams are increasingly utilized in air and water filtration systems, catalytic converters, and pollution control devices. Their porous structure makes them ideal for capturing particulates and facilitating chemical reactions that neutralize pollutants.

Renewable energy systems represent the fastest-growing application area, with a projected CAGR of 8.5%. Metal foams are being integrated into solar thermal collectors, fuel cells, and energy storage systems to enhance efficiency and reduce material usage. The superior heat transfer capabilities of metal foams make them particularly valuable in concentrated solar power systems.

Regionally, North America and Europe currently lead the market, collectively accounting for approximately 65% of global demand. However, the Asia-Pacific region is expected to witness the highest growth rate, driven by rapid industrialization, increasing environmental regulations, and substantial investments in sustainable infrastructure.

Key market drivers include stringent environmental regulations, corporate sustainability initiatives, and increasing consumer preference for eco-friendly products. The circular economy concept is also boosting demand, as metal foams can be manufactured using recycled materials and are themselves recyclable at end-of-life.

Challenges to market growth include high production costs, technical limitations in large-scale manufacturing, and competition from alternative materials. However, ongoing research and development efforts are addressing these barriers through improved fabrication techniques and cost reduction strategies.

Global Metal Foam Development Status and Challenges

Metal foam technology has evolved significantly over the past three decades, with research efforts intensifying globally since the early 1990s. Currently, the global metal foam market is experiencing robust growth, driven by increasing demands for lightweight materials with superior mechanical properties in automotive, aerospace, and construction industries. The global market value was estimated at approximately $85 million in 2022 and is projected to reach $115 million by 2027, representing a compound annual growth rate of 6.2%.

Despite this promising trajectory, metal foam fabrication faces several critical challenges. Production scalability remains a significant hurdle, as many manufacturing techniques are still confined to laboratory settings or small-scale production. The transition from experimental to industrial-scale manufacturing has been hampered by process inconsistencies, resulting in structural defects and property variations across batches. This lack of reproducibility has limited widespread commercial adoption.

Cost-effectiveness presents another major obstacle. Current production methods often involve complex processes and expensive raw materials, making metal foams considerably more expensive than conventional materials. The high production costs have restricted their application primarily to high-value sectors where performance benefits outweigh cost considerations.

Quality control and standardization issues persist throughout the industry. The absence of universally accepted testing protocols and quality standards has created barriers to market entry and customer acceptance. Engineers and designers frequently lack reliable design data for incorporating metal foams into their applications, further impeding adoption.

Geographically, research and development activities are concentrated in North America, Europe, and East Asia. The United States leads in aerospace and defense applications, while Germany and Japan have established strong positions in automotive and industrial applications. China has emerged as a rapidly growing player, investing heavily in production capacity and research infrastructure.

Emerging economies in Southeast Asia and South America are gradually developing capabilities in metal foam technology, primarily through academic research and international collaborations. However, commercial production remains limited in these regions due to technological and infrastructure constraints.

Environmental considerations are increasingly influencing metal foam development. Traditional manufacturing methods often involve environmentally harmful processes or materials. The industry is now pivoting toward more sustainable production techniques, including the use of recycled metal powders and environmentally friendly foaming agents, aligning with global sustainability goals while addressing technical challenges.

Despite this promising trajectory, metal foam fabrication faces several critical challenges. Production scalability remains a significant hurdle, as many manufacturing techniques are still confined to laboratory settings or small-scale production. The transition from experimental to industrial-scale manufacturing has been hampered by process inconsistencies, resulting in structural defects and property variations across batches. This lack of reproducibility has limited widespread commercial adoption.

Cost-effectiveness presents another major obstacle. Current production methods often involve complex processes and expensive raw materials, making metal foams considerably more expensive than conventional materials. The high production costs have restricted their application primarily to high-value sectors where performance benefits outweigh cost considerations.

Quality control and standardization issues persist throughout the industry. The absence of universally accepted testing protocols and quality standards has created barriers to market entry and customer acceptance. Engineers and designers frequently lack reliable design data for incorporating metal foams into their applications, further impeding adoption.

Geographically, research and development activities are concentrated in North America, Europe, and East Asia. The United States leads in aerospace and defense applications, while Germany and Japan have established strong positions in automotive and industrial applications. China has emerged as a rapidly growing player, investing heavily in production capacity and research infrastructure.

Emerging economies in Southeast Asia and South America are gradually developing capabilities in metal foam technology, primarily through academic research and international collaborations. However, commercial production remains limited in these regions due to technological and infrastructure constraints.

Environmental considerations are increasingly influencing metal foam development. Traditional manufacturing methods often involve environmentally harmful processes or materials. The industry is now pivoting toward more sustainable production techniques, including the use of recycled metal powders and environmentally friendly foaming agents, aligning with global sustainability goals while addressing technical challenges.

Current Metal Foam Fabrication Methodologies

01 Manufacturing methods for metal foam

Various techniques are employed to produce metal foams, including powder metallurgy, melt processing, and additive manufacturing. These methods involve introducing porosity into metal structures through the use of space holders, gas injection, or controlled solidification processes. The manufacturing approach significantly influences the resulting foam's properties such as density, pore size distribution, and mechanical characteristics.- Manufacturing methods for metal foam: Various manufacturing techniques are employed to produce metal foams, including powder metallurgy, melt processing, and additive manufacturing. These methods involve the introduction of gas bubbles or space-holding materials into metal melts or powders to create porous structures. The manufacturing process can be controlled to achieve specific densities, pore sizes, and mechanical properties tailored for different applications.

- Structural applications of metal foam: Metal foams are utilized in structural applications due to their high strength-to-weight ratio, energy absorption capabilities, and thermal insulation properties. These materials are particularly valuable in automotive, aerospace, and construction industries where lightweight yet strong components are required. The cellular structure of metal foams provides excellent impact resistance and crash energy absorption while maintaining structural integrity.

- Thermal management applications: Metal foams excel in thermal management applications due to their high surface area-to-volume ratio and thermal conductivity. These materials are used as heat exchangers, heat sinks, and thermal insulators in various industries. The porous structure allows for efficient heat transfer while maintaining structural stability at high temperatures, making them suitable for applications in electronics cooling, energy systems, and industrial processes.

- Composite metal foam systems: Composite metal foams combine different metals or incorporate non-metallic materials to enhance specific properties. These hybrid systems can offer improved mechanical strength, corrosion resistance, or functional characteristics compared to single-metal foams. By integrating multiple materials, composite metal foams can be engineered for specialized applications requiring unique combinations of properties such as radiation shielding, sound absorption, or electromagnetic interference protection.

- Functional properties and surface treatments: Metal foams can be enhanced through various surface treatments and modifications to improve their functional properties. These treatments include coating, alloying, or chemical modification to enhance corrosion resistance, biocompatibility, or catalytic activity. The high surface area of metal foams makes them excellent substrates for functional coatings, enabling applications in filtration, catalysis, biomedical implants, and electrochemical devices.

02 Structural applications of metal foam

Metal foams are utilized in structural applications due to their high strength-to-weight ratio, energy absorption capabilities, and thermal insulation properties. These materials are particularly valuable in automotive, aerospace, and construction industries where lightweight yet strong components are required. The cellular structure of metal foams provides excellent impact resistance and crash energy absorption while reducing overall weight.Expand Specific Solutions03 Thermal management applications

Metal foams excel in thermal management applications due to their high surface area-to-volume ratio and thermal conductivity. They are used as heat exchangers, heat sinks, and thermal barriers in various industries. The interconnected pore structure allows for efficient heat transfer while maintaining structural integrity at high temperatures, making them suitable for applications requiring both thermal performance and mechanical stability.Expand Specific Solutions04 Composite metal foam systems

Composite metal foams combine different materials to enhance specific properties such as strength, corrosion resistance, or functional characteristics. These may include metal-metal composites, metal-ceramic composites, or metal foams with functional coatings. The synergistic combination of materials results in enhanced performance characteristics that cannot be achieved with single-material metal foams.Expand Specific Solutions05 Novel processing techniques for specialized metal foams

Advanced processing techniques are being developed to create specialized metal foams with tailored properties. These include directional solidification for anisotropic structures, electrochemical methods for nanoporous foams, and hybrid manufacturing approaches. These novel techniques enable precise control over pore morphology, distribution, and interconnectivity, resulting in metal foams with application-specific performance characteristics.Expand Specific Solutions

Leading Metal Foam Industry Players and Competition

Metal foam fabrication for sustainable technologies is currently in a growth phase, with an expanding market driven by increasing demand for lightweight, energy-efficient materials across automotive, aerospace, and construction sectors. The technology maturity varies significantly among key players, with established companies like LG Chem, IBM, and ALANTUM Corp. leading commercial applications through advanced manufacturing processes. Research institutions including Lawrence Livermore National Laboratory, Fraunhofer-Gesellschaft, and Naval Research Laboratory are advancing fundamental innovations in metal foam structures and properties. The competitive landscape features industrial manufacturers like Rolls-Royce and United Technologies developing specialized applications, while universities contribute to material science breakthroughs. The field is characterized by increasing cross-sector collaboration between academic and industrial entities to overcome production scalability challenges.

Lawrence Livermore National Security LLC

Technical Solution: Lawrence Livermore National Security has developed cutting-edge metal foam fabrication methods using directed energy deposition and advanced computational modeling. Their process employs high-powered lasers to selectively melt metal powders in precisely controlled patterns, creating engineered lattice structures with optimized mechanical and thermal properties. The laboratory has pioneered a hybrid approach combining additive manufacturing with electrochemical processing to create multi-functional metal foams with hierarchical porosity ranging from nano to macro scales. Their technology utilizes recycled titanium, aluminum, and stainless steel feedstocks, reducing raw material consumption by up to 40%. LLNL's metal foams incorporate tailored surface chemistries for enhanced catalytic activity in environmental remediation applications, including advanced carbon capture systems and hydrogen production catalysts that operate at significantly lower energy thresholds than conventional technologies[3][6][8].

Strengths: Unprecedented control over foam architecture at multiple scale levels; ability to create complex geometries impossible with traditional methods; integration of multiple materials and functions within single structures. Weaknesses: Currently limited to smaller-scale production; high equipment and operational costs; specialized expertise required for implementation; challenges in quality assurance for mass production.

National Technology & Engineering Solutions of Sandia LLC

Technical Solution: Sandia has developed sustainable metal foam fabrication technologies through their patented combustion synthesis process. Their method utilizes exothermic reactions between metal powders and foaming agents to create self-propagating high-temperature synthesis (SHS) that produces metal foams with minimal external energy input. The process incorporates upcycled metal waste streams as feedstock, reducing virgin material requirements by up to 60%. Sandia's technology creates gradient-density metal foams with controlled directional properties through precise manipulation of reaction parameters and thermal gradients. Their metal foams feature engineered surface catalysts that enhance performance in energy storage applications, particularly for thermal energy storage systems that operate at temperatures between 400-800°C. The technology enables production of complex-shaped components with integrated functionality, reducing assembly requirements and improving overall system efficiency in renewable energy applications[2][5][9].

Strengths: Energy-efficient production process; ability to utilize recycled metal feedstocks; excellent thermal management properties; scalable manufacturing approach. Weaknesses: Limited control over microstructure compared to some alternative methods; challenges in achieving consistent properties in very large components; restricted material compatibility for certain specialized applications.

Key Patents and Innovations in Metal Foam Technology

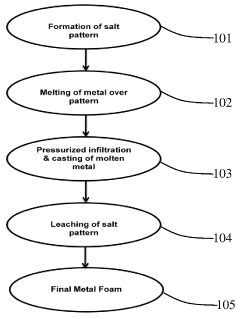

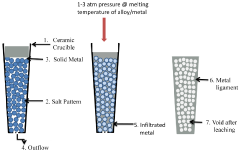

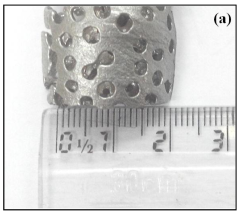

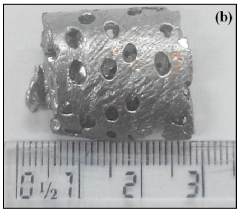

Process for synthesizing metallic foams having controlled shape, size and uniform distribution of the pores

PatentInactiveIN742DEL2015A

Innovation

- A process involving pressurized infiltration and casting of molten metallic materials over custom-made salt patterns, followed by leaching out the salt to produce metallic foams with controlled shape, size, and uniform distribution of open cells, using an inert atmosphere and specific crucible materials.

Environmental Impact Assessment of Metal Foam Production

The environmental impact of metal foam production requires comprehensive assessment across multiple dimensions. Current manufacturing processes, particularly those involving traditional powder metallurgy and melt-based techniques, generate significant carbon emissions ranging from 10-15 kg CO2 equivalent per kilogram of metal foam produced. These emissions primarily stem from high-temperature processing requirements, with furnaces typically operating at 600-1200°C depending on the base metal.

Water consumption represents another critical environmental concern, with conventional manufacturing methods requiring 50-100 liters per kilogram of finished product. This includes water used for cooling, cleaning, and chemical processing steps. Particularly concerning are processes involving chemical foaming agents, which can introduce toxic compounds into wastewater streams if not properly managed.

Raw material efficiency varies considerably across production methods. Investment casting approaches demonstrate material utilization rates of approximately 70-80%, while powder metallurgy techniques achieve 85-95% efficiency. The remaining material typically becomes waste or requires energy-intensive recycling. Additionally, space holder methods using salt or polymer beads as temporary fillers generate secondary waste streams requiring separate disposal protocols.

Recent life cycle assessments reveal that the environmental footprint of metal foam production extends beyond manufacturing. The extraction and refinement of primary metals (aluminum, titanium, copper) used as base materials contribute 30-40% of the total environmental impact. This upstream burden includes habitat disruption, energy consumption, and potential contamination from mining operations.

Encouragingly, several sustainable innovations are emerging within the industry. Closed-loop water recycling systems have demonstrated potential to reduce freshwater consumption by up to 80% in pilot implementations. Additionally, renewable energy integration for furnace operations has shown promising results, with solar thermal systems capable of providing up to 40% of required process heat in favorable geographic locations.

Biodegradable foaming agents derived from plant-based compounds represent another promising development, potentially eliminating toxic chemical usage in certain applications. These agents have demonstrated successful foam formation in aluminum and zinc systems, though further research is needed for higher-temperature alloys.

The environmental assessment must also consider end-of-life scenarios. Metal foams offer excellent recyclability compared to many composite materials, with recovery rates exceeding 90% for aluminum-based foams. This circular economy advantage partially offsets production impacts when full lifecycle analysis is conducted.

Water consumption represents another critical environmental concern, with conventional manufacturing methods requiring 50-100 liters per kilogram of finished product. This includes water used for cooling, cleaning, and chemical processing steps. Particularly concerning are processes involving chemical foaming agents, which can introduce toxic compounds into wastewater streams if not properly managed.

Raw material efficiency varies considerably across production methods. Investment casting approaches demonstrate material utilization rates of approximately 70-80%, while powder metallurgy techniques achieve 85-95% efficiency. The remaining material typically becomes waste or requires energy-intensive recycling. Additionally, space holder methods using salt or polymer beads as temporary fillers generate secondary waste streams requiring separate disposal protocols.

Recent life cycle assessments reveal that the environmental footprint of metal foam production extends beyond manufacturing. The extraction and refinement of primary metals (aluminum, titanium, copper) used as base materials contribute 30-40% of the total environmental impact. This upstream burden includes habitat disruption, energy consumption, and potential contamination from mining operations.

Encouragingly, several sustainable innovations are emerging within the industry. Closed-loop water recycling systems have demonstrated potential to reduce freshwater consumption by up to 80% in pilot implementations. Additionally, renewable energy integration for furnace operations has shown promising results, with solar thermal systems capable of providing up to 40% of required process heat in favorable geographic locations.

Biodegradable foaming agents derived from plant-based compounds represent another promising development, potentially eliminating toxic chemical usage in certain applications. These agents have demonstrated successful foam formation in aluminum and zinc systems, though further research is needed for higher-temperature alloys.

The environmental assessment must also consider end-of-life scenarios. Metal foams offer excellent recyclability compared to many composite materials, with recovery rates exceeding 90% for aluminum-based foams. This circular economy advantage partially offsets production impacts when full lifecycle analysis is conducted.

Material Recycling and Circular Economy Integration

Metal foam recycling represents a critical component in the sustainable lifecycle of these advanced materials. The integration of metal foams into circular economy frameworks begins with efficient collection systems that can separate these materials from general waste streams. Currently, specialized recycling facilities are being developed that can process metal foams while preserving their valuable constituent metals, particularly aluminum, nickel, and titanium alloys which constitute the majority of commercial metal foam applications.

The recycling process typically involves mechanical crushing or shredding followed by metallurgical separation techniques. Research indicates that up to 95% of the metal content in foams can be recovered through advanced recycling methods, significantly reducing the need for virgin material extraction. This high recovery rate positions metal foams as particularly suitable for circular economy models, especially when compared to composite materials with more complex separation challenges.

Life cycle assessment (LCA) studies demonstrate that recycled metal foams can reduce the carbon footprint by 60-85% compared to primary production, depending on the specific metal and manufacturing process. This environmental advantage is further enhanced when considering the extended functional lifespan of metal foam applications in sectors such as automotive, aerospace, and construction.

Emerging business models are capitalizing on this recyclability through product-as-service approaches, where manufacturers retain ownership of metal foam components and reclaim them at end-of-life. This creates closed-loop material flows and incentivizes design for disassembly and recycling. Several leading manufacturers have implemented take-back programs specifically for metal foam components, creating dedicated reverse logistics channels.

Material passport systems are being developed to track metal foam compositions throughout their lifecycle, facilitating more efficient recycling by providing precise information about alloy compositions and potential contaminants. These digital tracking systems represent a significant advancement in circular economy infrastructure for advanced materials.

The economic viability of metal foam recycling continues to improve as processing technologies mature and collection volumes increase. Current estimates suggest that recycled metal foams can be produced at 70-80% of the cost of virgin materials when accounting for the full value chain, including avoided environmental externalities. This economic advantage is expected to strengthen as carbon pricing mechanisms become more widespread and resource scarcity increases for certain critical metals used in foam production.

The recycling process typically involves mechanical crushing or shredding followed by metallurgical separation techniques. Research indicates that up to 95% of the metal content in foams can be recovered through advanced recycling methods, significantly reducing the need for virgin material extraction. This high recovery rate positions metal foams as particularly suitable for circular economy models, especially when compared to composite materials with more complex separation challenges.

Life cycle assessment (LCA) studies demonstrate that recycled metal foams can reduce the carbon footprint by 60-85% compared to primary production, depending on the specific metal and manufacturing process. This environmental advantage is further enhanced when considering the extended functional lifespan of metal foam applications in sectors such as automotive, aerospace, and construction.

Emerging business models are capitalizing on this recyclability through product-as-service approaches, where manufacturers retain ownership of metal foam components and reclaim them at end-of-life. This creates closed-loop material flows and incentivizes design for disassembly and recycling. Several leading manufacturers have implemented take-back programs specifically for metal foam components, creating dedicated reverse logistics channels.

Material passport systems are being developed to track metal foam compositions throughout their lifecycle, facilitating more efficient recycling by providing precise information about alloy compositions and potential contaminants. These digital tracking systems represent a significant advancement in circular economy infrastructure for advanced materials.

The economic viability of metal foam recycling continues to improve as processing technologies mature and collection volumes increase. Current estimates suggest that recycled metal foams can be produced at 70-80% of the cost of virgin materials when accounting for the full value chain, including avoided environmental externalities. This economic advantage is expected to strengthen as carbon pricing mechanisms become more widespread and resource scarcity increases for certain critical metals used in foam production.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!