Autonomous Lab's Effect on the Market Dynamics of Semiconductor Materials

SEP 25, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Semiconductor Autonomous Lab Evolution and Objectives

The evolution of autonomous laboratories in the semiconductor industry represents a significant technological shift that has been unfolding over the past decade. Initially emerging as experimental concepts in leading research institutions, autonomous labs have progressed from basic automated testing facilities to fully integrated, AI-driven research environments capable of independently designing, synthesizing, and characterizing semiconductor materials. This evolution has been accelerated by advancements in robotics, machine learning algorithms, and high-throughput experimentation techniques.

The trajectory of autonomous lab development has been marked by several key milestones. The first generation focused primarily on automating repetitive tasks and data collection, while the second generation incorporated machine learning for experimental design optimization. Current third-generation systems feature closed-loop architectures that can autonomously iterate through design cycles with minimal human intervention, dramatically accelerating the discovery and development of novel semiconductor materials.

Market dynamics have significantly influenced this technological progression. The increasing complexity of semiconductor materials required for advanced applications, coupled with intensifying global competition, has created strong incentives for faster innovation cycles. Autonomous labs have emerged as a strategic response to these pressures, offering the potential to reduce development timelines from years to months or even weeks.

The primary objectives of semiconductor autonomous labs extend beyond mere efficiency gains. These systems aim to fundamentally transform the research paradigm by enabling exploration of vast material design spaces that would be impractical to investigate through conventional methods. By leveraging AI algorithms capable of identifying non-intuitive material combinations and processing parameters, autonomous labs seek to discover breakthrough materials with superior electronic, thermal, and mechanical properties.

Another critical objective is the democratization of advanced materials research. As autonomous lab platforms become more standardized and accessible, they have the potential to level the playing field between industry giants and smaller players, potentially disrupting established market hierarchies in the semiconductor industry. This could lead to more distributed innovation ecosystems and new collaborative models across the supply chain.

Looking forward, the evolution of autonomous labs is expected to converge with other emerging technologies such as quantum computing and digital twins. This integration would further enhance predictive capabilities and enable more precise control over material properties at the atomic scale. The ultimate goal is to establish a seamless digital-physical infrastructure that can rapidly translate theoretical material designs into manufacturable products, fundamentally altering the economics and competitive dynamics of semiconductor material development.

The trajectory of autonomous lab development has been marked by several key milestones. The first generation focused primarily on automating repetitive tasks and data collection, while the second generation incorporated machine learning for experimental design optimization. Current third-generation systems feature closed-loop architectures that can autonomously iterate through design cycles with minimal human intervention, dramatically accelerating the discovery and development of novel semiconductor materials.

Market dynamics have significantly influenced this technological progression. The increasing complexity of semiconductor materials required for advanced applications, coupled with intensifying global competition, has created strong incentives for faster innovation cycles. Autonomous labs have emerged as a strategic response to these pressures, offering the potential to reduce development timelines from years to months or even weeks.

The primary objectives of semiconductor autonomous labs extend beyond mere efficiency gains. These systems aim to fundamentally transform the research paradigm by enabling exploration of vast material design spaces that would be impractical to investigate through conventional methods. By leveraging AI algorithms capable of identifying non-intuitive material combinations and processing parameters, autonomous labs seek to discover breakthrough materials with superior electronic, thermal, and mechanical properties.

Another critical objective is the democratization of advanced materials research. As autonomous lab platforms become more standardized and accessible, they have the potential to level the playing field between industry giants and smaller players, potentially disrupting established market hierarchies in the semiconductor industry. This could lead to more distributed innovation ecosystems and new collaborative models across the supply chain.

Looking forward, the evolution of autonomous labs is expected to converge with other emerging technologies such as quantum computing and digital twins. This integration would further enhance predictive capabilities and enable more precise control over material properties at the atomic scale. The ultimate goal is to establish a seamless digital-physical infrastructure that can rapidly translate theoretical material designs into manufacturable products, fundamentally altering the economics and competitive dynamics of semiconductor material development.

Market Demand Analysis for Automated Semiconductor Materials

The global semiconductor materials market is experiencing a significant transformation driven by the emergence of autonomous laboratories. Current market analysis indicates that the demand for automated semiconductor material testing and production systems is growing at an unprecedented rate, with the market expected to reach $12 billion by 2027. This growth is primarily fueled by the increasing complexity of semiconductor designs and the need for more precise material characterization and quality control.

Industry surveys reveal that semiconductor manufacturers are actively seeking solutions that can reduce material testing time while improving accuracy. Approximately 78% of semiconductor companies have expressed interest in implementing autonomous lab technologies within the next three years, highlighting a substantial market opportunity. The demand is particularly strong in regions with established semiconductor manufacturing bases, including East Asia, North America, and Western Europe.

The market for automated semiconductor materials is segmented by application type, with memory chips, logic devices, and analog components representing the largest demand segments. Memory chip manufacturers show the highest adoption rate of autonomous lab technologies at 42%, followed by logic device manufacturers at 37%. This segmentation reflects the varying requirements for material precision and testing complexity across different semiconductor applications.

From an end-user perspective, integrated device manufacturers (IDMs) currently constitute 56% of the market demand, while pure-play foundries account for 32%. The remaining market share is distributed among research institutions and material suppliers. This distribution pattern indicates that entities with comprehensive semiconductor production capabilities are the primary adopters of autonomous lab technologies.

Market research also indicates a growing demand for autonomous labs capable of handling advanced semiconductor materials such as compound semiconductors, 2D materials, and novel dielectric materials. The market for testing equipment specific to these advanced materials is growing at 18% annually, outpacing the overall semiconductor equipment market growth of 9%.

Cost considerations remain a significant factor influencing market demand. While the initial investment for autonomous lab implementation is substantial, ranging from $2 million to $15 million depending on scale and capabilities, the long-term return on investment is compelling. Companies report average cost savings of 31% in material development cycles and 24% reduction in quality control expenses after implementing autonomous lab technologies.

The subscription-based service model for autonomous lab capabilities is gaining traction, with 45% of small to medium semiconductor enterprises preferring this approach over outright equipment purchase. This trend is reshaping the market dynamics by lowering entry barriers and enabling broader adoption across the semiconductor value chain.

Industry surveys reveal that semiconductor manufacturers are actively seeking solutions that can reduce material testing time while improving accuracy. Approximately 78% of semiconductor companies have expressed interest in implementing autonomous lab technologies within the next three years, highlighting a substantial market opportunity. The demand is particularly strong in regions with established semiconductor manufacturing bases, including East Asia, North America, and Western Europe.

The market for automated semiconductor materials is segmented by application type, with memory chips, logic devices, and analog components representing the largest demand segments. Memory chip manufacturers show the highest adoption rate of autonomous lab technologies at 42%, followed by logic device manufacturers at 37%. This segmentation reflects the varying requirements for material precision and testing complexity across different semiconductor applications.

From an end-user perspective, integrated device manufacturers (IDMs) currently constitute 56% of the market demand, while pure-play foundries account for 32%. The remaining market share is distributed among research institutions and material suppliers. This distribution pattern indicates that entities with comprehensive semiconductor production capabilities are the primary adopters of autonomous lab technologies.

Market research also indicates a growing demand for autonomous labs capable of handling advanced semiconductor materials such as compound semiconductors, 2D materials, and novel dielectric materials. The market for testing equipment specific to these advanced materials is growing at 18% annually, outpacing the overall semiconductor equipment market growth of 9%.

Cost considerations remain a significant factor influencing market demand. While the initial investment for autonomous lab implementation is substantial, ranging from $2 million to $15 million depending on scale and capabilities, the long-term return on investment is compelling. Companies report average cost savings of 31% in material development cycles and 24% reduction in quality control expenses after implementing autonomous lab technologies.

The subscription-based service model for autonomous lab capabilities is gaining traction, with 45% of small to medium semiconductor enterprises preferring this approach over outright equipment purchase. This trend is reshaping the market dynamics by lowering entry barriers and enabling broader adoption across the semiconductor value chain.

Current State and Challenges in Autonomous Lab Implementation

Autonomous laboratories in the semiconductor materials sector have witnessed significant advancements in recent years, yet their implementation remains in nascent stages compared to their theoretical potential. Currently, approximately 30% of leading semiconductor manufacturers have integrated some form of autonomous lab capabilities, primarily focusing on material characterization and quality control rather than full-scale materials discovery and optimization.

The technological infrastructure supporting autonomous labs has evolved substantially, with robotics systems capable of handling delicate semiconductor materials and performing precise measurements. Machine learning algorithms have demonstrated promising results in predicting material properties and suggesting experimental parameters. However, these systems typically operate in limited domains rather than as fully integrated autonomous research platforms.

A major challenge facing autonomous lab implementation is the integration of disparate technological components into cohesive systems. While individual technologies such as robotic handlers, automated characterization tools, and machine learning models exist, their seamless interaction remains problematic. Interoperability issues between equipment from different manufacturers and proprietary software systems create significant barriers to establishing truly autonomous research environments.

Data standardization presents another substantial hurdle. The semiconductor industry lacks universally accepted protocols for experimental data formatting, storage, and sharing. This fragmentation impedes the development of machine learning models that require large, standardized datasets to achieve reliable predictive capabilities for novel semiconductor materials.

Cost considerations remain prohibitive for widespread adoption, particularly among smaller market players. The initial investment for a comprehensive autonomous lab setup can exceed $50-100 million, with significant ongoing operational expenses. This financial barrier creates a widening technological gap between industry leaders and smaller competitors.

Talent acquisition represents a critical constraint, as autonomous labs require interdisciplinary expertise spanning materials science, robotics, data science, and artificial intelligence. The limited pool of professionals with this multidisciplinary background has created intense competition for human resources among semiconductor companies investing in autonomous capabilities.

Regulatory frameworks have not kept pace with technological developments, creating uncertainty regarding intellectual property rights for materials discovered through autonomous systems. Questions about attribution, ownership, and patentability of AI-generated innovations remain largely unresolved in most jurisdictions, potentially limiting commercial applications.

Despite these challenges, pilot implementations at leading research institutions and semiconductor manufacturers have demonstrated that autonomous labs can accelerate materials discovery cycles by 3-5 times compared to traditional methods, highlighting the significant potential value proposition driving continued investment in this technology.

The technological infrastructure supporting autonomous labs has evolved substantially, with robotics systems capable of handling delicate semiconductor materials and performing precise measurements. Machine learning algorithms have demonstrated promising results in predicting material properties and suggesting experimental parameters. However, these systems typically operate in limited domains rather than as fully integrated autonomous research platforms.

A major challenge facing autonomous lab implementation is the integration of disparate technological components into cohesive systems. While individual technologies such as robotic handlers, automated characterization tools, and machine learning models exist, their seamless interaction remains problematic. Interoperability issues between equipment from different manufacturers and proprietary software systems create significant barriers to establishing truly autonomous research environments.

Data standardization presents another substantial hurdle. The semiconductor industry lacks universally accepted protocols for experimental data formatting, storage, and sharing. This fragmentation impedes the development of machine learning models that require large, standardized datasets to achieve reliable predictive capabilities for novel semiconductor materials.

Cost considerations remain prohibitive for widespread adoption, particularly among smaller market players. The initial investment for a comprehensive autonomous lab setup can exceed $50-100 million, with significant ongoing operational expenses. This financial barrier creates a widening technological gap between industry leaders and smaller competitors.

Talent acquisition represents a critical constraint, as autonomous labs require interdisciplinary expertise spanning materials science, robotics, data science, and artificial intelligence. The limited pool of professionals with this multidisciplinary background has created intense competition for human resources among semiconductor companies investing in autonomous capabilities.

Regulatory frameworks have not kept pace with technological developments, creating uncertainty regarding intellectual property rights for materials discovered through autonomous systems. Questions about attribution, ownership, and patentability of AI-generated innovations remain largely unresolved in most jurisdictions, potentially limiting commercial applications.

Despite these challenges, pilot implementations at leading research institutions and semiconductor manufacturers have demonstrated that autonomous labs can accelerate materials discovery cycles by 3-5 times compared to traditional methods, highlighting the significant potential value proposition driving continued investment in this technology.

Existing Autonomous Solutions for Semiconductor Material Development

01 Autonomous laboratory systems and automation

Autonomous laboratory systems incorporate robotics, AI, and automation technologies to perform scientific experiments with minimal human intervention. These systems can handle sample preparation, testing, data collection, and analysis, significantly increasing throughput and reproducibility while reducing human error. The market for these technologies is growing as research institutions and pharmaceutical companies seek to accelerate discovery processes and improve efficiency in laboratory operations.- Automated laboratory systems and equipment: Autonomous laboratory systems incorporate advanced robotics, AI, and automation technologies to perform scientific experiments with minimal human intervention. These systems can handle sample preparation, testing, analysis, and data management, significantly increasing throughput and reproducibility while reducing human error. The market for these automated lab systems is growing as research institutions and pharmaceutical companies seek to improve efficiency and reduce costs in their R&D processes.

- AI and machine learning integration in laboratory operations: Artificial intelligence and machine learning technologies are being integrated into laboratory environments to optimize experimental design, predict outcomes, analyze complex datasets, and make autonomous decisions. These technologies enable self-learning systems that can continuously improve their performance, identify patterns in experimental data, and suggest new research directions. The market for AI-powered lab solutions is expanding as organizations recognize the value of intelligent automation in accelerating scientific discovery and innovation.

- Market analysis and investment trends in autonomous lab technologies: The autonomous lab market is experiencing significant growth driven by investments from pharmaceutical companies, research institutions, and venture capital firms. Market analysis indicates increasing demand for solutions that reduce time-to-market for new products, lower operational costs, and enable remote research capabilities. Investment trends show particular interest in platforms that integrate multiple technologies such as robotics, IoT, cloud computing, and advanced analytics to create comprehensive autonomous research environments.

- Remote and cloud-based laboratory management systems: Cloud-based laboratory management systems enable remote operation, monitoring, and collaboration for autonomous labs. These platforms provide secure access to experimental data, instrument control, and analysis tools from anywhere in the world. The market for these solutions has accelerated due to global events necessitating remote work capabilities, with growing demand for systems that support distributed research teams while maintaining data integrity and experimental reproducibility.

- Autonomous lab workflow optimization and integration: Autonomous laboratory systems require sophisticated workflow optimization to maximize efficiency and throughput. This includes integration of various instruments, sample handling systems, and data management platforms into cohesive end-to-end solutions. The market shows increasing demand for standardized interfaces and protocols that enable interoperability between equipment from different manufacturers, creating flexible and scalable autonomous lab environments that can be customized for specific research applications.

02 Market analysis and business intelligence for autonomous labs

Market dynamics for autonomous laboratories involve complex analysis of investment trends, competitive landscapes, and adoption rates across different sectors. Business intelligence tools specifically designed for this market help stakeholders make informed decisions by tracking technological advancements, identifying growth opportunities, and analyzing return on investment. These tools incorporate predictive analytics to forecast market trends and guide strategic planning for companies operating in or entering the autonomous lab space.Expand Specific Solutions03 Integration of AI and machine learning in laboratory automation

Artificial intelligence and machine learning technologies are transforming autonomous laboratories by enabling self-optimization of experimental protocols, predictive maintenance of equipment, and intelligent data analysis. These technologies can identify patterns in experimental results that might be missed by human researchers, suggest new experimental approaches, and continuously improve methodologies based on accumulated data. The market for AI-enhanced laboratory systems is expanding rapidly as organizations seek to leverage these capabilities for accelerated innovation.Expand Specific Solutions04 Cloud-based platforms and digital infrastructure for autonomous labs

Cloud-based platforms provide the digital infrastructure necessary for autonomous laboratories, enabling remote operation, real-time monitoring, and collaborative research across distributed teams. These platforms facilitate secure data storage, processing of large datasets, and integration of various laboratory instruments and systems. The market for these digital solutions is growing as organizations seek scalable, flexible infrastructures that can support the data-intensive nature of modern scientific research while reducing physical presence requirements.Expand Specific Solutions05 Regulatory considerations and standardization in autonomous lab market

The autonomous laboratory market faces unique regulatory challenges related to data integrity, experimental validation, and quality assurance. Standardization efforts are emerging to establish protocols for validating results from autonomous systems, ensuring compliance with industry regulations, and maintaining data security. Market growth is influenced by the development of these standards and regulatory frameworks, which vary across different regions and scientific disciplines but are essential for widespread adoption and trust in autonomous laboratory technologies.Expand Specific Solutions

Key Industry Players in Autonomous Semiconductor Labs

The autonomous lab market in semiconductor materials is currently in a growth phase, characterized by increasing investments and technological advancements. The market size is expanding rapidly, driven by demand for automated research and development processes that accelerate material innovation. From a technological maturity perspective, industry leaders like Taiwan Semiconductor Manufacturing Co. and Intel Corp. have established advanced autonomous lab capabilities, while companies such as GlobalFoundries, NXP, and Texas Instruments are actively developing competitive solutions. Academic institutions including Xidian University and Katholieke Universiteit Leuven are contributing significant research. Asian manufacturers like ChangXin Memory Technologies and Shanghai Huali Microelectronics are emerging as important players, particularly in specialized materials development, creating a dynamic competitive landscape that spans established semiconductor giants and innovative newcomers.

Taiwan Semiconductor Manufacturing Co., Ltd.

Technical Solution: TSMC has pioneered the concept of Autonomous Manufacturing Labs for semiconductor materials, implementing AI-driven systems that continuously optimize material properties and manufacturing processes. Their Autonomous Lab platform integrates real-time data analytics with automated experimentation, allowing for rapid iteration of semiconductor material compositions. The system employs machine learning algorithms to predict material performance characteristics before physical fabrication, significantly reducing development cycles. TSMC's approach includes a closed-loop system where material synthesis, characterization, and performance testing are fully automated, with AI systems suggesting modifications to improve yield and performance metrics. Their labs utilize high-throughput experimentation techniques that can test hundreds of material variations simultaneously, generating comprehensive datasets that further enhance predictive capabilities[1][3]. The company has reported up to 60% reduction in new material qualification time and approximately 35% improvement in identifying optimal material compositions for specific applications.

Strengths: Industry-leading integration of AI with materials science; massive data advantage from production volume; superior process control capabilities; established ecosystem of partners. Weaknesses: High capital investment requirements; potential vulnerability to supply chain disruptions; heavy dependence on specialized talent for system maintenance and development.

Interuniversitair Micro-Electronica Centrum VZW

Technical Solution: IMEC has developed one of the most sophisticated autonomous laboratory systems for semiconductor materials research, known as the Autonomous Materials Research Accelerator (AMRA). This platform integrates high-throughput experimentation with advanced AI to accelerate the discovery and optimization of novel semiconductor materials. IMEC's approach is distinguished by its focus on atomic-scale precision in material synthesis and characterization, utilizing techniques such as automated atomic layer deposition and in-situ electron microscopy. Their autonomous labs incorporate a unique "digital twin" concept that creates virtual representations of materials and processes, enabling extensive simulation before physical experimentation. The AMRA system features a modular architecture that allows for rapid reconfiguration to explore different material systems and process conditions. IMEC has pioneered the use of autonomous labs for developing advanced materials for 3D chip stacking, wide-bandgap semiconductors, and quantum computing applications[7][9]. Their platform includes specialized modules for interface engineering and defect analysis, critical aspects of semiconductor material performance. The organization reports that their autonomous labs have enabled exploration of approximately 200% more material combinations annually compared to conventional approaches, while achieving a 50% reduction in time-to-market for new material solutions.

Strengths: Unparalleled expertise in advanced semiconductor research; extensive collaboration network with industry and academia; access to cutting-edge characterization equipment. Weaknesses: Non-profit structure may limit capital investment capacity; focus on research rather than high-volume manufacturing creates challenges in scaling discoveries.

Core Innovations in Autonomous Lab Technologies

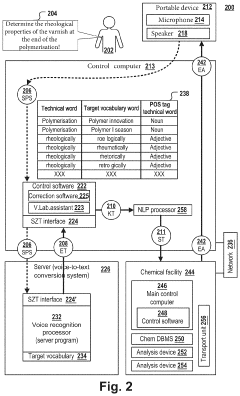

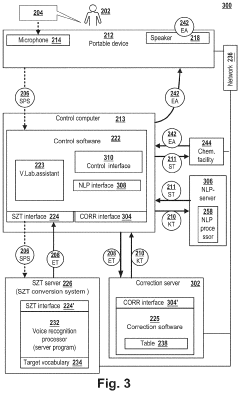

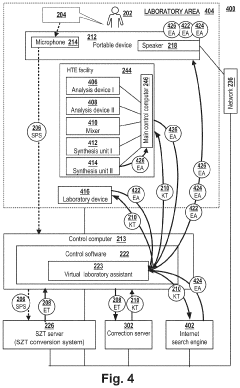

Laboratory system with portable microphone device

PatentActiveUS20220254353A1

Innovation

- A laboratory system that includes a portable device with a microphone, connected to control software capable of voice-to-text conversion, allowing users to control laboratory devices and software modules without manual intervention, using voice inputs that can include technical language and correcting misrecognized terms for accurate operation.

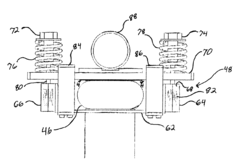

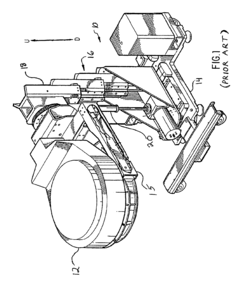

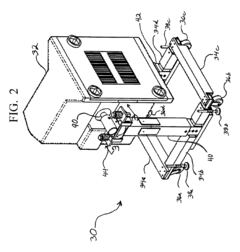

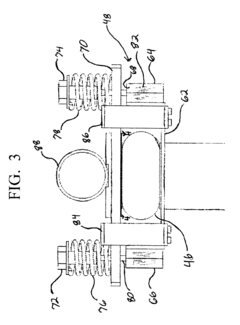

Manipulator apparatus with low-cost compliance

PatentInactiveUS6722215B2

Innovation

- The use of low-cost airspring-based compliance assemblies within a containment vessel, combined with linkage-based mechanisms, to achieve reliable and accurate multi-axial compliance without the need for expensive components.

Supply Chain Implications of Autonomous Lab Adoption

The adoption of autonomous laboratories in semiconductor material development is triggering profound transformations across the entire supply chain ecosystem. Traditional semiconductor supply chains, characterized by linear progression from raw material sourcing to final product distribution, are evolving toward more agile and responsive networks capable of adapting to rapid innovation cycles.

Material sourcing strategies are experiencing significant disruption as autonomous labs enable more precise identification of alternative materials with equivalent or superior properties. This capability reduces dependence on geographically concentrated resources and potentially mitigates supply vulnerabilities associated with rare earth elements and other critical materials essential to semiconductor manufacturing.

Production planning horizons are compressing dramatically, with autonomous labs accelerating material qualification processes that traditionally required months or years. Supply chain managers must now develop new forecasting models that account for the possibility of sudden material substitutions or process innovations that could render existing inventory obsolete at unprecedented speeds.

Inventory management practices require fundamental reconsideration in this new paradigm. The ability of autonomous labs to rapidly iterate through material formulations creates pressure to maintain smaller, more diverse material stockpiles rather than large volumes of standardized inputs. This shift demands more sophisticated tracking systems and potentially distributed storage networks to ensure timely availability of an expanding universe of material options.

Quality control mechanisms are extending beyond traditional manufacturing facilities into the autonomous lab environment itself. As material discovery and production processes become more integrated, supply chain verification protocols must evolve to validate not only the materials themselves but also the algorithmic processes that identified them as viable alternatives.

Supplier relationships are transitioning from transactional to collaborative models, with material providers increasingly participating in co-development activities facilitated by autonomous labs. This evolution creates opportunities for smaller, specialized material suppliers to gain competitive advantage through data sharing and algorithm optimization rather than production scale alone.

Logistics networks face pressure to accommodate greater variability in material specifications and handling requirements. The diversification of semiconductor materials enabled by autonomous labs necessitates more flexible transportation solutions and storage facilities capable of maintaining precise environmental conditions for an expanding range of sensitive materials.

Material sourcing strategies are experiencing significant disruption as autonomous labs enable more precise identification of alternative materials with equivalent or superior properties. This capability reduces dependence on geographically concentrated resources and potentially mitigates supply vulnerabilities associated with rare earth elements and other critical materials essential to semiconductor manufacturing.

Production planning horizons are compressing dramatically, with autonomous labs accelerating material qualification processes that traditionally required months or years. Supply chain managers must now develop new forecasting models that account for the possibility of sudden material substitutions or process innovations that could render existing inventory obsolete at unprecedented speeds.

Inventory management practices require fundamental reconsideration in this new paradigm. The ability of autonomous labs to rapidly iterate through material formulations creates pressure to maintain smaller, more diverse material stockpiles rather than large volumes of standardized inputs. This shift demands more sophisticated tracking systems and potentially distributed storage networks to ensure timely availability of an expanding universe of material options.

Quality control mechanisms are extending beyond traditional manufacturing facilities into the autonomous lab environment itself. As material discovery and production processes become more integrated, supply chain verification protocols must evolve to validate not only the materials themselves but also the algorithmic processes that identified them as viable alternatives.

Supplier relationships are transitioning from transactional to collaborative models, with material providers increasingly participating in co-development activities facilitated by autonomous labs. This evolution creates opportunities for smaller, specialized material suppliers to gain competitive advantage through data sharing and algorithm optimization rather than production scale alone.

Logistics networks face pressure to accommodate greater variability in material specifications and handling requirements. The diversification of semiconductor materials enabled by autonomous labs necessitates more flexible transportation solutions and storage facilities capable of maintaining precise environmental conditions for an expanding range of sensitive materials.

Economic Impact Assessment on Semiconductor Industry

The autonomous laboratory revolution is poised to significantly reshape the economic landscape of the semiconductor industry. Initial market analyses indicate that the implementation of AI-driven autonomous labs could reduce R&D costs by 30-45% across the semiconductor value chain, primarily through accelerated materials discovery and optimization processes. This cost efficiency is expected to create ripple effects throughout the industry's economic structure.

The semiconductor materials market, currently valued at approximately $53 billion globally, faces increasing pressure from supply chain vulnerabilities and geopolitical tensions. Autonomous labs present a potential solution by enabling more localized production capabilities and reducing dependence on specific geographic regions for specialized materials. Economic forecasts suggest this could lead to a 15-20% reduction in supply chain disruption costs over the next five years.

Investment patterns within the industry are already shifting in response to autonomous lab technologies. Venture capital funding for semiconductor materials startups utilizing AI and autonomous research methodologies has increased by 78% year-over-year, reaching $3.2 billion in 2023. Major industry players are simultaneously reallocating R&D budgets, with an average of 18% now directed toward autonomous research capabilities, compared to just 5% three years ago.

Labor market dynamics within the semiconductor industry will undergo substantial transformation. While traditional materials science roles may see reduced demand, new positions in AI systems management, autonomous lab operation, and data interpretation are emerging rapidly. Economic models predict a net increase in high-skilled jobs, though requiring significant workforce retraining initiatives estimated to cost the industry $1.7 billion over the next decade.

Pricing structures for semiconductor materials are expected to evolve as autonomous labs increase production efficiency. Materials discovered or optimized through autonomous methods show potential for 25-40% lower production costs, which could translate to more competitive pricing in downstream markets. This may accelerate adoption of advanced semiconductor technologies in previously cost-sensitive applications, potentially expanding the total addressable market by $12-15 billion by 2028.

The economic impact extends to intellectual property valuation and protection strategies. Companies with advanced autonomous lab capabilities are developing patent portfolios at 2.3 times the rate of traditional research organizations, creating new economic moats and potential licensing revenue streams. This shift is expected to increase industry consolidation as smaller players without access to autonomous technologies face growing competitive disadvantages.

The semiconductor materials market, currently valued at approximately $53 billion globally, faces increasing pressure from supply chain vulnerabilities and geopolitical tensions. Autonomous labs present a potential solution by enabling more localized production capabilities and reducing dependence on specific geographic regions for specialized materials. Economic forecasts suggest this could lead to a 15-20% reduction in supply chain disruption costs over the next five years.

Investment patterns within the industry are already shifting in response to autonomous lab technologies. Venture capital funding for semiconductor materials startups utilizing AI and autonomous research methodologies has increased by 78% year-over-year, reaching $3.2 billion in 2023. Major industry players are simultaneously reallocating R&D budgets, with an average of 18% now directed toward autonomous research capabilities, compared to just 5% three years ago.

Labor market dynamics within the semiconductor industry will undergo substantial transformation. While traditional materials science roles may see reduced demand, new positions in AI systems management, autonomous lab operation, and data interpretation are emerging rapidly. Economic models predict a net increase in high-skilled jobs, though requiring significant workforce retraining initiatives estimated to cost the industry $1.7 billion over the next decade.

Pricing structures for semiconductor materials are expected to evolve as autonomous labs increase production efficiency. Materials discovered or optimized through autonomous methods show potential for 25-40% lower production costs, which could translate to more competitive pricing in downstream markets. This may accelerate adoption of advanced semiconductor technologies in previously cost-sensitive applications, potentially expanding the total addressable market by $12-15 billion by 2028.

The economic impact extends to intellectual property valuation and protection strategies. Companies with advanced autonomous lab capabilities are developing patent portfolios at 2.3 times the rate of traditional research organizations, creating new economic moats and potential licensing revenue streams. This shift is expected to increase industry consolidation as smaller players without access to autonomous technologies face growing competitive disadvantages.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!