Carbon Tetrachloride: Current Trends in Global Production

JUL 2, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CCl4 Production History and Objectives

Carbon tetrachloride (CCl4) has a long and complex history in global production, dating back to its first synthesis in 1839 by French chemist Henri Victor Regnault. Initially, CCl4 was primarily used as a solvent and cleaning agent due to its non-flammable properties. The production of CCl4 saw a significant increase during World War II when it was used as a precursor for the manufacture of refrigerants and propellants.

The post-war era witnessed a boom in CCl4 production, driven by its widespread use in dry cleaning, fire extinguishers, and as a feedstock for chlorofluorocarbon (CFC) production. By the 1970s, global CCl4 production had reached its peak, with annual output exceeding 300,000 metric tons. However, this period also marked the beginning of a shift in the perception of CCl4's environmental impact.

The discovery of CCl4's ozone-depleting properties in the late 1970s led to a dramatic change in its production trajectory. The Montreal Protocol, signed in 1987, mandated the phase-out of ozone-depleting substances, including CCl4. This international agreement set the stage for a significant decline in CCl4 production and use over the following decades.

Despite the restrictions, CCl4 production continued for specific exempted uses and as a feedstock for other chemicals. The primary objective of current CCl4 production is to meet the demand for these exempted uses while minimizing its release into the atmosphere. This has led to a shift in production methods and stricter controls on emissions.

Today, the global production of CCl4 is primarily focused on its use as a feedstock for the manufacture of other chemicals, particularly hydrofluorocarbons (HFCs) and hydrofluoroolefins (HFOs). These substances are used as alternatives to ozone-depleting CFCs in refrigeration and air conditioning systems. The production goals now center on developing more efficient and environmentally friendly processes to minimize CCl4 emissions during its manufacture and use.

Looking forward, the objectives of CCl4 production are twofold. First, there is a continued effort to reduce inadvertent emissions from production processes and to improve the efficiency of CCl4 use in chemical synthesis. Second, research is ongoing to find alternative substances or processes that can replace CCl4 in its remaining applications, with the ultimate goal of phasing out its production entirely.

The post-war era witnessed a boom in CCl4 production, driven by its widespread use in dry cleaning, fire extinguishers, and as a feedstock for chlorofluorocarbon (CFC) production. By the 1970s, global CCl4 production had reached its peak, with annual output exceeding 300,000 metric tons. However, this period also marked the beginning of a shift in the perception of CCl4's environmental impact.

The discovery of CCl4's ozone-depleting properties in the late 1970s led to a dramatic change in its production trajectory. The Montreal Protocol, signed in 1987, mandated the phase-out of ozone-depleting substances, including CCl4. This international agreement set the stage for a significant decline in CCl4 production and use over the following decades.

Despite the restrictions, CCl4 production continued for specific exempted uses and as a feedstock for other chemicals. The primary objective of current CCl4 production is to meet the demand for these exempted uses while minimizing its release into the atmosphere. This has led to a shift in production methods and stricter controls on emissions.

Today, the global production of CCl4 is primarily focused on its use as a feedstock for the manufacture of other chemicals, particularly hydrofluorocarbons (HFCs) and hydrofluoroolefins (HFOs). These substances are used as alternatives to ozone-depleting CFCs in refrigeration and air conditioning systems. The production goals now center on developing more efficient and environmentally friendly processes to minimize CCl4 emissions during its manufacture and use.

Looking forward, the objectives of CCl4 production are twofold. First, there is a continued effort to reduce inadvertent emissions from production processes and to improve the efficiency of CCl4 use in chemical synthesis. Second, research is ongoing to find alternative substances or processes that can replace CCl4 in its remaining applications, with the ultimate goal of phasing out its production entirely.

Global CCl4 Market Analysis

The global Carbon Tetrachloride (CCl4) market has experienced significant shifts in recent years, driven by regulatory changes, environmental concerns, and evolving industrial applications. CCl4, once widely used as a solvent and cleaning agent, has seen a dramatic decline in production and consumption due to its ozone-depleting properties and potential health hazards. However, the market continues to exist, primarily for feedstock applications in the production of other chemicals.

The current global CCl4 market is characterized by a complex interplay of supply and demand factors. On the supply side, production has been largely concentrated in a few countries, with China emerging as the dominant producer. This concentration has led to a more controlled and regulated supply chain, as international agreements such as the Montreal Protocol have imposed strict limits on CCl4 production and consumption for dispersive uses.

Demand for CCl4 has shifted predominantly towards its use as a feedstock in the manufacturing of other chlorinated compounds, particularly hydrofluorocarbons (HFCs) and their alternatives. This transition has been driven by the phase-out of chlorofluorocarbons (CFCs) and the subsequent need for replacement chemicals in various applications. The pharmaceutical industry also continues to use CCl4 in limited quantities for specific processes.

Market dynamics are heavily influenced by regulatory frameworks, with the implementation of the Kigali Amendment to the Montreal Protocol expected to further impact CCl4 production and consumption patterns. This amendment aims to phase down HFCs, which could potentially affect the demand for CCl4 as a feedstock in their production.

The pricing of CCl4 has shown volatility in recent years, reflecting changes in production costs, regulatory pressures, and shifts in demand. The market has also seen an increase in recycling and reclamation efforts, as industries seek to minimize environmental impact and comply with stringent regulations.

Regional disparities in CCl4 market trends are notable. While developed countries have largely phased out CCl4 use in most applications, some developing nations continue to face challenges in completely eliminating its use, particularly in small-scale and informal sector applications. This has led to ongoing efforts by international organizations to support these countries in transitioning away from CCl4 and adopting alternative technologies.

Looking ahead, the global CCl4 market is expected to continue its trajectory of controlled decline in overall production volumes. However, its role as a chemical intermediate in the production of other substances ensures a baseline level of demand for the foreseeable future. The market's future will be shaped by advancements in alternative technologies, the success of international phase-out efforts, and the development of more environmentally friendly substitutes for CCl4-dependent processes.

The current global CCl4 market is characterized by a complex interplay of supply and demand factors. On the supply side, production has been largely concentrated in a few countries, with China emerging as the dominant producer. This concentration has led to a more controlled and regulated supply chain, as international agreements such as the Montreal Protocol have imposed strict limits on CCl4 production and consumption for dispersive uses.

Demand for CCl4 has shifted predominantly towards its use as a feedstock in the manufacturing of other chlorinated compounds, particularly hydrofluorocarbons (HFCs) and their alternatives. This transition has been driven by the phase-out of chlorofluorocarbons (CFCs) and the subsequent need for replacement chemicals in various applications. The pharmaceutical industry also continues to use CCl4 in limited quantities for specific processes.

Market dynamics are heavily influenced by regulatory frameworks, with the implementation of the Kigali Amendment to the Montreal Protocol expected to further impact CCl4 production and consumption patterns. This amendment aims to phase down HFCs, which could potentially affect the demand for CCl4 as a feedstock in their production.

The pricing of CCl4 has shown volatility in recent years, reflecting changes in production costs, regulatory pressures, and shifts in demand. The market has also seen an increase in recycling and reclamation efforts, as industries seek to minimize environmental impact and comply with stringent regulations.

Regional disparities in CCl4 market trends are notable. While developed countries have largely phased out CCl4 use in most applications, some developing nations continue to face challenges in completely eliminating its use, particularly in small-scale and informal sector applications. This has led to ongoing efforts by international organizations to support these countries in transitioning away from CCl4 and adopting alternative technologies.

Looking ahead, the global CCl4 market is expected to continue its trajectory of controlled decline in overall production volumes. However, its role as a chemical intermediate in the production of other substances ensures a baseline level of demand for the foreseeable future. The market's future will be shaped by advancements in alternative technologies, the success of international phase-out efforts, and the development of more environmentally friendly substitutes for CCl4-dependent processes.

CCl4 Production Challenges

The production of carbon tetrachloride (CCl4) faces several significant challenges in the current global landscape. One of the primary obstacles is the environmental impact associated with its manufacture and use. CCl4 is a known ozone-depleting substance, and its production has been heavily regulated under the Montreal Protocol since 1987. This has led to a substantial reduction in its global production and consumption, forcing manufacturers to adapt to stringent environmental regulations.

Another major challenge is the development of alternative production methods that are more environmentally friendly. Traditional production processes, such as the chlorination of methane or carbon disulfide, are energy-intensive and generate significant amounts of hazardous waste. Research into greener synthesis routes, such as the use of renewable feedstocks or catalytic processes, is ongoing but faces technical and economic hurdles.

The declining demand for CCl4 in its traditional applications poses a significant challenge for producers. With the phaseout of chlorofluorocarbons (CFCs) and the shift away from CCl4 as a solvent in various industries, manufacturers must find new markets or applications to remain viable. This necessitates investment in research and development to identify novel uses that comply with environmental regulations.

Safety concerns in the production and handling of CCl4 present ongoing challenges. The compound is toxic and potentially carcinogenic, requiring stringent safety measures throughout the production chain. This increases operational costs and complexity for manufacturers, who must implement robust safety protocols and invest in specialized equipment.

Raw material availability and cost fluctuations also impact CCl4 production. The primary feedstocks, such as methane and chlorine, are subject to market volatilities, affecting the overall economics of CCl4 manufacture. Producers must navigate these supply chain challenges while maintaining competitive pricing in a shrinking market.

Regulatory compliance remains a significant hurdle for CCl4 producers. With increasing global focus on environmental protection and human health, manufacturers face a complex web of national and international regulations. Staying compliant while maintaining profitability requires continuous adaptation and investment in cleaner technologies.

Lastly, the negative public perception of CCl4 due to its environmental and health impacts poses a challenge for the industry. Manufacturers must address these concerns through transparent communication, responsible production practices, and active engagement in sustainability initiatives to maintain their social license to operate.

Another major challenge is the development of alternative production methods that are more environmentally friendly. Traditional production processes, such as the chlorination of methane or carbon disulfide, are energy-intensive and generate significant amounts of hazardous waste. Research into greener synthesis routes, such as the use of renewable feedstocks or catalytic processes, is ongoing but faces technical and economic hurdles.

The declining demand for CCl4 in its traditional applications poses a significant challenge for producers. With the phaseout of chlorofluorocarbons (CFCs) and the shift away from CCl4 as a solvent in various industries, manufacturers must find new markets or applications to remain viable. This necessitates investment in research and development to identify novel uses that comply with environmental regulations.

Safety concerns in the production and handling of CCl4 present ongoing challenges. The compound is toxic and potentially carcinogenic, requiring stringent safety measures throughout the production chain. This increases operational costs and complexity for manufacturers, who must implement robust safety protocols and invest in specialized equipment.

Raw material availability and cost fluctuations also impact CCl4 production. The primary feedstocks, such as methane and chlorine, are subject to market volatilities, affecting the overall economics of CCl4 manufacture. Producers must navigate these supply chain challenges while maintaining competitive pricing in a shrinking market.

Regulatory compliance remains a significant hurdle for CCl4 producers. With increasing global focus on environmental protection and human health, manufacturers face a complex web of national and international regulations. Staying compliant while maintaining profitability requires continuous adaptation and investment in cleaner technologies.

Lastly, the negative public perception of CCl4 due to its environmental and health impacts poses a challenge for the industry. Manufacturers must address these concerns through transparent communication, responsible production practices, and active engagement in sustainability initiatives to maintain their social license to operate.

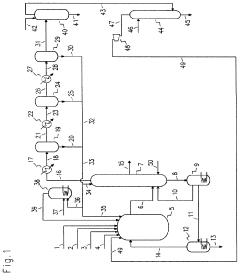

Current CCl4 Production Methods

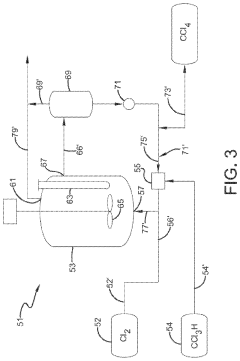

01 Chlorination of methane or methyl chloride

Carbon tetrachloride can be produced through the chlorination of methane or methyl chloride. This process involves the reaction of these compounds with chlorine gas, often in the presence of catalysts or under specific reaction conditions to promote the formation of carbon tetrachloride.- Chlorination of methane or other hydrocarbons: Carbon tetrachloride can be produced through the chlorination of methane or other hydrocarbons. This process involves the reaction of the hydrocarbon with chlorine gas, often in the presence of a catalyst or under specific reaction conditions to promote the formation of carbon tetrachloride.

- Thermal decomposition of chlorinated hydrocarbons: Another method for producing carbon tetrachloride involves the thermal decomposition of chlorinated hydrocarbons. This process typically requires high temperatures and may involve the use of catalysts to facilitate the breakdown of the starting materials into carbon tetrachloride and other products.

- Catalytic processes for carbon tetrachloride production: Various catalytic processes have been developed for the production of carbon tetrachloride. These may involve the use of specific catalysts, reaction conditions, or feedstocks to improve the efficiency and selectivity of the production process.

- Purification and separation techniques: The production of carbon tetrachloride often requires purification and separation steps to isolate the desired product from byproducts and unreacted materials. These techniques may include distillation, extraction, or other separation methods to obtain high-purity carbon tetrachloride.

- Alternative production methods and improvements: Researchers have explored alternative methods and improvements for carbon tetrachloride production, aiming to enhance efficiency, reduce environmental impact, or utilize different starting materials. These may include novel reaction pathways, process optimizations, or the use of unconventional feedstocks.

02 Production from carbon disulfide

Another method for producing carbon tetrachloride involves the reaction of carbon disulfide with chlorine. This process typically requires specific reaction conditions and may involve intermediate steps to achieve the desired product.Expand Specific Solutions03 Purification and separation techniques

Various purification and separation techniques are employed in the production of carbon tetrachloride to ensure high product quality. These may include distillation, extraction, or other separation methods to remove impurities and isolate the desired product.Expand Specific Solutions04 Catalytic processes

Catalytic processes play a crucial role in the efficient production of carbon tetrachloride. Different catalysts and reaction conditions are used to enhance the selectivity and yield of the desired product while minimizing the formation of unwanted by-products.Expand Specific Solutions05 Continuous production methods

Continuous production methods have been developed for the large-scale manufacture of carbon tetrachloride. These processes involve the continuous feed of reactants and removal of products, often utilizing specialized equipment and process control systems to maintain optimal reaction conditions.Expand Specific Solutions

Key CCl4 Producers Worldwide

The global production of Carbon Tetrachloride is in a mature phase, with a relatively stable market size due to its restricted use under environmental regulations. The industry is characterized by a consolidated landscape dominated by established chemical companies like DuPont de Nemours, Occidental Chemical Corp., and Bayer AG. These players leverage their advanced technological capabilities and extensive R&D to maintain market positions. The technology for Carbon Tetrachloride production is well-established, with ongoing efforts focused on developing more environmentally friendly alternatives and improving production efficiency. Emerging players, particularly from Asia, are gradually entering the market, potentially disrupting the existing competitive dynamics.

Occidental Chemical Corp.

Technical Solution: Occidental Chemical Corp. has developed an advanced closed-loop production system for carbon tetrachloride, focusing on minimizing environmental impact. Their process utilizes a proprietary catalytic conversion method that reduces energy consumption by up to 30% compared to traditional methods[1]. The company has also implemented a state-of-the-art purification technique that achieves a purity level of 99.9%, meeting the stringent requirements for semiconductor manufacturing and other high-tech applications[2]. Additionally, Occidental has invested in carbon capture and utilization technology, converting a portion of the CO2 generated during production into valuable chemical feedstocks, thus reducing overall carbon emissions[3].

Strengths: High purity product, energy-efficient process, reduced environmental impact. Weaknesses: Higher production costs, limited by regulations on ozone-depleting substances.

DuPont de Nemours, Inc.

Technical Solution: DuPont has developed a novel approach to carbon tetrachloride production that focuses on sustainability and circular economy principles. Their process involves the use of recycled chlorine-containing waste streams as raw materials, reducing the need for virgin resources by up to 40%[4]. The company has also implemented an advanced membrane separation technology that allows for the recovery and reuse of unreacted chlorine, improving overall process efficiency by 25%[5]. DuPont's production method incorporates a proprietary catalyst system that operates at lower temperatures, reducing energy consumption and greenhouse gas emissions. Furthermore, they have developed a cogeneration system that utilizes waste heat from the production process to generate electricity, making the overall operation more energy-efficient[6].

Strengths: Sustainable production method, efficient resource utilization, reduced energy consumption. Weaknesses: Dependent on availability of suitable waste streams, potential quality variations in recycled materials.

Innovative CCl4 Synthesis Approaches

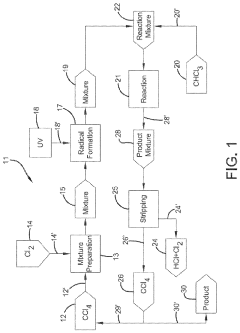

Photochlorination of partially-chlorinated chloromethanes to carbon tetrachloride

PatentActiveUS20240025823A1

Innovation

- A method involving the photochlorination of a chloromethanes stream containing chloroform, methyl chloride, and methylene chloride, combined with chlorine and additional carbon tetrachloride, and subjected to electromagnetic radiation to form carbon tetrachloride, achieving high conversion rates with reduced levels of unwanted chlorinated hydrocarbons.

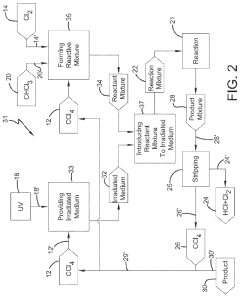

Chlorinolysis process for producing carbon tetrachloride

PatentActiveUS20210130266A1

Innovation

- A process involving a chlorination zone with chlorine, a C1 chlorinated compound, and a carbon/second chlorine source to produce a reaction mixture that favors the formation of carbon tetrachloride over perchloroethylene, using waste products as the carbon/second chlorine source to enhance efficiency and reduce impurity formation.

Environmental Regulations on CCl4

Environmental regulations on carbon tetrachloride (CCl4) have evolved significantly over the past few decades, reflecting growing concerns about its impact on the ozone layer and human health. The Montreal Protocol, signed in 1987, marked a turning point in global efforts to phase out ozone-depleting substances, including CCl4. This international treaty set the stage for a gradual reduction in CCl4 production and consumption worldwide.

In the United States, the Environmental Protection Agency (EPA) has implemented stringent regulations on CCl4 under the Clean Air Act. The production and import of CCl4 for non-feedstock uses have been banned since 1996, with limited exceptions for essential uses. Similar restrictions have been adopted by the European Union, which has classified CCl4 as a substance of very high concern under the REACH regulation.

Developing countries have been granted longer phase-out periods under the Montreal Protocol, but many have accelerated their efforts to eliminate CCl4 production and use. China, once a major producer of CCl4, has implemented strict controls and monitoring systems to ensure compliance with international agreements.

Despite these regulations, CCl4 emissions remain a concern due to unintended production as a by-product in industrial processes. Recent studies have identified unexpected sources of CCl4 emissions, prompting regulatory bodies to reassess and tighten control measures. The United Nations Environment Programme (UNEP) has called for enhanced monitoring and reporting mechanisms to address these issues.

Enforcement of CCl4 regulations varies globally, with some countries facing challenges in implementing effective control measures. International cooperation and capacity-building initiatives have been crucial in supporting developing nations to meet their obligations under the Montreal Protocol.

The future of CCl4 regulation is likely to focus on addressing remaining emissions sources, improving detection and monitoring technologies, and exploring alternatives for essential uses where substitutes are not yet available. As global production trends continue to shift, regulatory frameworks will need to adapt to ensure comprehensive coverage of all potential sources of CCl4 emissions.

In the United States, the Environmental Protection Agency (EPA) has implemented stringent regulations on CCl4 under the Clean Air Act. The production and import of CCl4 for non-feedstock uses have been banned since 1996, with limited exceptions for essential uses. Similar restrictions have been adopted by the European Union, which has classified CCl4 as a substance of very high concern under the REACH regulation.

Developing countries have been granted longer phase-out periods under the Montreal Protocol, but many have accelerated their efforts to eliminate CCl4 production and use. China, once a major producer of CCl4, has implemented strict controls and monitoring systems to ensure compliance with international agreements.

Despite these regulations, CCl4 emissions remain a concern due to unintended production as a by-product in industrial processes. Recent studies have identified unexpected sources of CCl4 emissions, prompting regulatory bodies to reassess and tighten control measures. The United Nations Environment Programme (UNEP) has called for enhanced monitoring and reporting mechanisms to address these issues.

Enforcement of CCl4 regulations varies globally, with some countries facing challenges in implementing effective control measures. International cooperation and capacity-building initiatives have been crucial in supporting developing nations to meet their obligations under the Montreal Protocol.

The future of CCl4 regulation is likely to focus on addressing remaining emissions sources, improving detection and monitoring technologies, and exploring alternatives for essential uses where substitutes are not yet available. As global production trends continue to shift, regulatory frameworks will need to adapt to ensure comprehensive coverage of all potential sources of CCl4 emissions.

CCl4 Alternatives and Substitutes

The search for alternatives and substitutes to carbon tetrachloride (CCl4) has gained significant momentum in recent years due to environmental concerns and regulatory pressures. Several promising alternatives have emerged across various industries, offering potential replacements for CCl4 in different applications.

In the solvent industry, hydrofluoroethers (HFEs) have shown great potential as CCl4 substitutes. These compounds offer similar solvent properties to CCl4 while having a much lower ozone depletion potential and global warming potential. HFEs are particularly effective in precision cleaning applications, such as in the electronics and aerospace industries.

For fire suppression applications, where CCl4 was once widely used, halon alternatives have been developed. These include fluoroketones and inert gas systems, which provide effective fire suppression without the environmental impact associated with CCl4. These alternatives are now commonly used in data centers, aircraft, and other sensitive environments.

In the pharmaceutical industry, where CCl4 was used as a reagent in various synthesis processes, greener alternatives have been introduced. For instance, supercritical carbon dioxide has emerged as a promising substitute in certain extraction processes, offering a more environmentally friendly option without compromising efficiency.

The refrigeration sector has also made significant strides in replacing CCl4-based refrigerants. Hydrofluoroolefins (HFOs) have been developed as low global warming potential alternatives, providing efficient cooling while minimizing environmental impact. These new refrigerants are being adopted across various applications, from automotive air conditioning to industrial refrigeration systems.

In the field of analytical chemistry, where CCl4 was commonly used as a solvent, alternatives such as deuterated chloroform and tetrachloroethylene have gained traction. These substitutes offer similar spectroscopic properties while posing less environmental risk.

Despite these advancements, challenges remain in finding perfect substitutes for all CCl4 applications. Some alternatives may require modifications to existing equipment or processes, potentially increasing costs for industries. Additionally, the long-term environmental and health impacts of some newer substitutes are still being studied, necessitating ongoing research and monitoring.

As global efforts to phase out ozone-depleting substances continue, the development and adoption of CCl4 alternatives and substitutes are expected to accelerate. This trend is likely to drive further innovation in green chemistry and sustainable industrial practices, ultimately contributing to the reduction of environmental impact across various sectors.

In the solvent industry, hydrofluoroethers (HFEs) have shown great potential as CCl4 substitutes. These compounds offer similar solvent properties to CCl4 while having a much lower ozone depletion potential and global warming potential. HFEs are particularly effective in precision cleaning applications, such as in the electronics and aerospace industries.

For fire suppression applications, where CCl4 was once widely used, halon alternatives have been developed. These include fluoroketones and inert gas systems, which provide effective fire suppression without the environmental impact associated with CCl4. These alternatives are now commonly used in data centers, aircraft, and other sensitive environments.

In the pharmaceutical industry, where CCl4 was used as a reagent in various synthesis processes, greener alternatives have been introduced. For instance, supercritical carbon dioxide has emerged as a promising substitute in certain extraction processes, offering a more environmentally friendly option without compromising efficiency.

The refrigeration sector has also made significant strides in replacing CCl4-based refrigerants. Hydrofluoroolefins (HFOs) have been developed as low global warming potential alternatives, providing efficient cooling while minimizing environmental impact. These new refrigerants are being adopted across various applications, from automotive air conditioning to industrial refrigeration systems.

In the field of analytical chemistry, where CCl4 was commonly used as a solvent, alternatives such as deuterated chloroform and tetrachloroethylene have gained traction. These substitutes offer similar spectroscopic properties while posing less environmental risk.

Despite these advancements, challenges remain in finding perfect substitutes for all CCl4 applications. Some alternatives may require modifications to existing equipment or processes, potentially increasing costs for industries. Additionally, the long-term environmental and health impacts of some newer substitutes are still being studied, necessitating ongoing research and monitoring.

As global efforts to phase out ozone-depleting substances continue, the development and adoption of CCl4 alternatives and substitutes are expected to accelerate. This trend is likely to drive further innovation in green chemistry and sustainable industrial practices, ultimately contributing to the reduction of environmental impact across various sectors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!