Case Study Successful Deployment Of Self Healing Coatings In Industry

AUG 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-Healing Coatings Background and Objectives

Self-healing coatings represent a revolutionary advancement in materials science, emerging from the biomimetic concept of replicating natural healing processes in synthetic materials. Since the early 2000s, this technology has evolved from theoretical research to practical applications across multiple industries. The fundamental principle involves embedding healing agents within coating matrices that activate upon damage, automatically restoring protective properties without human intervention.

The evolution of self-healing coatings has followed three distinct generations. First-generation systems utilized microencapsulated healing agents that release upon rupture. Second-generation approaches incorporated vascular networks for continuous healing agent delivery. The current third-generation systems employ intrinsic self-healing mechanisms through reversible chemical bonds or dynamic supramolecular interactions, eliminating the need for separate healing agents.

Recent technological breakthroughs have significantly enhanced the commercial viability of these coatings. Advancements in nanotechnology have enabled more efficient encapsulation techniques, while polymer chemistry innovations have produced more durable and responsive healing mechanisms. Concurrently, manufacturing processes have evolved to allow cost-effective production at industrial scales.

The primary objective of self-healing coating technology is to extend asset lifespans while reducing maintenance costs and environmental impact. In industrial applications, these coatings aim to provide continuous protection against corrosion, abrasion, and chemical degradation in harsh operating environments. For infrastructure, they offer potential solutions to the trillion-dollar global corrosion problem by autonomously addressing damage before catastrophic failure occurs.

Current research focuses on developing systems with multiple healing cycles, faster healing kinetics, and functionality across wider temperature ranges. Additionally, efforts are underway to create environmentally sustainable formulations with reduced VOC content and bio-based components. The integration of smart functionalities, such as damage sensing and reporting capabilities, represents another frontier in development.

The technology trajectory suggests continued refinement toward more robust, versatile, and economical solutions. As manufacturing scales increase and formulation costs decrease, wider adoption across industries becomes increasingly feasible. The convergence with other advanced materials technologies, including nanomaterials and smart polymers, promises to further accelerate innovation in this field.

The ultimate technological goal remains the development of truly autonomous protective systems that can indefinitely maintain structural integrity with minimal external intervention, effectively mimicking the continuous self-maintenance capabilities observed in biological systems.

The evolution of self-healing coatings has followed three distinct generations. First-generation systems utilized microencapsulated healing agents that release upon rupture. Second-generation approaches incorporated vascular networks for continuous healing agent delivery. The current third-generation systems employ intrinsic self-healing mechanisms through reversible chemical bonds or dynamic supramolecular interactions, eliminating the need for separate healing agents.

Recent technological breakthroughs have significantly enhanced the commercial viability of these coatings. Advancements in nanotechnology have enabled more efficient encapsulation techniques, while polymer chemistry innovations have produced more durable and responsive healing mechanisms. Concurrently, manufacturing processes have evolved to allow cost-effective production at industrial scales.

The primary objective of self-healing coating technology is to extend asset lifespans while reducing maintenance costs and environmental impact. In industrial applications, these coatings aim to provide continuous protection against corrosion, abrasion, and chemical degradation in harsh operating environments. For infrastructure, they offer potential solutions to the trillion-dollar global corrosion problem by autonomously addressing damage before catastrophic failure occurs.

Current research focuses on developing systems with multiple healing cycles, faster healing kinetics, and functionality across wider temperature ranges. Additionally, efforts are underway to create environmentally sustainable formulations with reduced VOC content and bio-based components. The integration of smart functionalities, such as damage sensing and reporting capabilities, represents another frontier in development.

The technology trajectory suggests continued refinement toward more robust, versatile, and economical solutions. As manufacturing scales increase and formulation costs decrease, wider adoption across industries becomes increasingly feasible. The convergence with other advanced materials technologies, including nanomaterials and smart polymers, promises to further accelerate innovation in this field.

The ultimate technological goal remains the development of truly autonomous protective systems that can indefinitely maintain structural integrity with minimal external intervention, effectively mimicking the continuous self-maintenance capabilities observed in biological systems.

Market Demand Analysis for Self-Healing Coating Solutions

The global market for self-healing coating solutions has witnessed significant growth in recent years, driven by increasing demand across multiple industrial sectors. Current market analysis indicates that the self-healing coatings market is expanding at a compound annual growth rate of approximately 25% and is projected to reach $8.2 billion by 2026. This remarkable growth trajectory is primarily fueled by the rising need for sustainable and long-lasting protective solutions in industries facing severe corrosion and wear challenges.

The automotive sector represents one of the largest markets for self-healing coatings, with manufacturers seeking advanced solutions to enhance vehicle durability and aesthetic appeal. Consumer preference for scratch-resistant and long-lasting automotive finishes has created substantial demand, particularly in premium vehicle segments where appearance preservation is highly valued.

Infrastructure and construction industries have emerged as another significant market segment, particularly for applications in bridges, pipelines, and high-value architectural structures. The ability of self-healing coatings to extend maintenance intervals and reduce lifecycle costs resonates strongly with infrastructure asset managers facing budget constraints and increasing service life expectations.

Marine and offshore industries demonstrate perhaps the most urgent market need, as these environments present extreme corrosion challenges with high maintenance costs. Field data indicates that self-healing coatings can reduce maintenance frequency by up to 40% in marine applications, representing substantial operational savings and extended asset lifespans.

Aerospace applications represent a premium market segment with stringent performance requirements. The demand for lightweight, durable coating solutions that can withstand extreme temperature variations and environmental exposure continues to drive innovation in specialized self-healing formulations for this sector.

Consumer electronics manufacturers have also shown increasing interest in self-healing coatings, particularly for smartphone and tablet surfaces. Market research indicates that scratch resistance ranks among the top five features consumers consider when purchasing electronic devices, creating significant market pull for these technologies.

Regional market analysis reveals that North America and Europe currently lead in adoption rates, driven by stringent environmental regulations and higher willingness to invest in premium protective solutions. However, the Asia-Pacific region is experiencing the fastest growth rate, with China and Japan making substantial investments in self-healing coating technologies for their manufacturing and infrastructure sectors.

Market surveys indicate that end-users are willing to pay a premium of 15-30% for coatings with proven self-healing capabilities, provided that performance claims are substantiated by credible case studies and warranty offerings. This price elasticity varies significantly by application, with higher tolerance for premium pricing in sectors where downtime costs are substantial.

The automotive sector represents one of the largest markets for self-healing coatings, with manufacturers seeking advanced solutions to enhance vehicle durability and aesthetic appeal. Consumer preference for scratch-resistant and long-lasting automotive finishes has created substantial demand, particularly in premium vehicle segments where appearance preservation is highly valued.

Infrastructure and construction industries have emerged as another significant market segment, particularly for applications in bridges, pipelines, and high-value architectural structures. The ability of self-healing coatings to extend maintenance intervals and reduce lifecycle costs resonates strongly with infrastructure asset managers facing budget constraints and increasing service life expectations.

Marine and offshore industries demonstrate perhaps the most urgent market need, as these environments present extreme corrosion challenges with high maintenance costs. Field data indicates that self-healing coatings can reduce maintenance frequency by up to 40% in marine applications, representing substantial operational savings and extended asset lifespans.

Aerospace applications represent a premium market segment with stringent performance requirements. The demand for lightweight, durable coating solutions that can withstand extreme temperature variations and environmental exposure continues to drive innovation in specialized self-healing formulations for this sector.

Consumer electronics manufacturers have also shown increasing interest in self-healing coatings, particularly for smartphone and tablet surfaces. Market research indicates that scratch resistance ranks among the top five features consumers consider when purchasing electronic devices, creating significant market pull for these technologies.

Regional market analysis reveals that North America and Europe currently lead in adoption rates, driven by stringent environmental regulations and higher willingness to invest in premium protective solutions. However, the Asia-Pacific region is experiencing the fastest growth rate, with China and Japan making substantial investments in self-healing coating technologies for their manufacturing and infrastructure sectors.

Market surveys indicate that end-users are willing to pay a premium of 15-30% for coatings with proven self-healing capabilities, provided that performance claims are substantiated by credible case studies and warranty offerings. This price elasticity varies significantly by application, with higher tolerance for premium pricing in sectors where downtime costs are substantial.

Technical Challenges and Global Development Status

Self-healing coatings represent a significant advancement in materials science, yet their widespread industrial adoption faces several technical challenges. One primary obstacle is the limited durability of self-healing mechanisms under extreme industrial conditions. While laboratory tests show promising results, real-world environments involving temperature fluctuations, chemical exposure, and mechanical stress often compromise healing efficiency. For instance, many encapsulation-based systems lose functionality after repeated healing cycles or when exposed to temperatures exceeding 200°C, which is common in aerospace and automotive applications.

Scale-up manufacturing presents another substantial hurdle. Laboratory-scale production methods for self-healing coatings often involve complex processes that are difficult to translate to industrial-scale production. The incorporation of healing agents while maintaining uniform distribution and preventing premature activation during the manufacturing process requires sophisticated equipment and precise control systems, significantly increasing production costs.

Globally, self-healing coating development shows distinct regional patterns. North America leads in research output, with the United States accounting for approximately 35% of patents in this field. The European Union follows closely, with particular strength in environmentally friendly self-healing solutions, driven by stringent regulations. Germany, the Netherlands, and Belgium host several specialized research centers focused exclusively on smart coating technologies.

Asia has emerged as a rapidly growing hub, with China investing heavily in self-healing coating research since 2015. Japanese companies excel in automotive applications, while South Korean research focuses on consumer electronics protection. The Asia-Pacific region is projected to experience the fastest growth rate in self-healing coating adoption over the next decade.

Standardization remains problematic across all regions. The lack of universally accepted testing protocols and performance metrics makes it difficult to compare different self-healing technologies objectively. This absence of standardization impedes regulatory approval processes and slows commercial adoption.

Recent technological breakthroughs have addressed some challenges. Multi-stimuli responsive systems that can heal under various triggers (light, heat, pH changes) show improved versatility. Advancements in nanotechnology have enabled the development of more stable microcapsules and vascular networks that can withstand industrial processing conditions while maintaining healing capabilities.

Despite these innovations, the cost-performance ratio remains a significant barrier to widespread implementation. Current self-healing coating systems can cost 3-5 times more than conventional protective coatings, limiting their application to high-value assets where failure costs substantially outweigh preventive maintenance expenses.

Scale-up manufacturing presents another substantial hurdle. Laboratory-scale production methods for self-healing coatings often involve complex processes that are difficult to translate to industrial-scale production. The incorporation of healing agents while maintaining uniform distribution and preventing premature activation during the manufacturing process requires sophisticated equipment and precise control systems, significantly increasing production costs.

Globally, self-healing coating development shows distinct regional patterns. North America leads in research output, with the United States accounting for approximately 35% of patents in this field. The European Union follows closely, with particular strength in environmentally friendly self-healing solutions, driven by stringent regulations. Germany, the Netherlands, and Belgium host several specialized research centers focused exclusively on smart coating technologies.

Asia has emerged as a rapidly growing hub, with China investing heavily in self-healing coating research since 2015. Japanese companies excel in automotive applications, while South Korean research focuses on consumer electronics protection. The Asia-Pacific region is projected to experience the fastest growth rate in self-healing coating adoption over the next decade.

Standardization remains problematic across all regions. The lack of universally accepted testing protocols and performance metrics makes it difficult to compare different self-healing technologies objectively. This absence of standardization impedes regulatory approval processes and slows commercial adoption.

Recent technological breakthroughs have addressed some challenges. Multi-stimuli responsive systems that can heal under various triggers (light, heat, pH changes) show improved versatility. Advancements in nanotechnology have enabled the development of more stable microcapsules and vascular networks that can withstand industrial processing conditions while maintaining healing capabilities.

Despite these innovations, the cost-performance ratio remains a significant barrier to widespread implementation. Current self-healing coating systems can cost 3-5 times more than conventional protective coatings, limiting their application to high-value assets where failure costs substantially outweigh preventive maintenance expenses.

Current Self-Healing Coating Implementation Strategies

01 Microcapsule-based self-healing mechanisms

Self-healing coatings can be formulated with microcapsules containing healing agents that are released when the coating is damaged. When the microcapsules rupture due to mechanical damage, the healing agent flows into the crack and polymerizes, effectively repairing the damage. This approach provides autonomous healing without external intervention and can significantly extend the service life of coatings in various applications.- Microcapsule-based self-healing mechanisms: Self-healing coatings can be formulated with microcapsules containing healing agents that are released when the coating is damaged. When the microcapsules rupture due to mechanical damage, the healing agent flows into the crack and polymerizes, effectively repairing the damage. This approach provides autonomous healing without external intervention and can significantly extend the service life of coatings in various applications.

- Polymer-based self-healing systems: Polymer-based self-healing systems utilize intrinsic or extrinsic healing mechanisms to repair damage. These systems may incorporate dynamic covalent bonds, supramolecular interactions, or shape memory polymers that can restore the coating's integrity after damage. The polymers can flow and reconnect broken networks when triggered by temperature, pH, or other stimuli, providing multiple healing cycles and improved durability for protective coatings.

- Nanoparticle-enhanced self-healing coatings: Incorporating nanoparticles into coating formulations can enhance self-healing properties through various mechanisms. Nanoparticles can serve as reservoirs for healing agents, catalyze healing reactions, or provide reinforcement to the healed areas. Materials such as silica nanoparticles, carbon nanotubes, or metal oxide nanoparticles can be functionalized to improve compatibility with the coating matrix and enhance the overall self-healing efficiency and mechanical properties.

- Bio-inspired self-healing coating technologies: Bio-inspired approaches mimic natural healing processes found in biological systems to develop advanced self-healing coatings. These technologies may incorporate vascular networks similar to blood vessels, enzyme-catalyzed healing mechanisms, or biomimetic materials that respond to environmental stimuli. Such bio-inspired systems can provide continuous healing capability and adapt to various damage scenarios, making them suitable for demanding applications in harsh environments.

- Multi-functional self-healing coating systems: Multi-functional self-healing coating systems combine self-healing properties with additional functionalities such as corrosion inhibition, antimicrobial activity, or thermal regulation. These advanced coatings utilize synergistic combinations of healing mechanisms and functional additives to provide comprehensive protection. The integration of multiple functions in a single coating system offers enhanced performance and extended service life for applications in aerospace, automotive, and infrastructure protection.

02 Polymer-based self-healing systems

Polymer-based self-healing systems utilize intrinsic healing properties of certain polymers or polymer networks. These systems can include thermoplastic polymers that heal through molecular diffusion when heated, or dynamic covalent bonds that can reform after breaking. Some systems incorporate shape memory polymers that can return to their original state after deformation, effectively closing cracks and restoring the coating's integrity.Expand Specific Solutions03 Nanoparticle-enhanced self-healing coatings

Incorporating nanoparticles into coating formulations can enhance self-healing properties. Nanoparticles such as silica, graphene, or metal oxides can improve mechanical properties while facilitating healing mechanisms. Some nanoparticles act as reservoirs for healing agents, while others participate in the healing process by forming new bonds or networks when damage occurs. These advanced materials provide improved durability and extended service life for protective coatings.Expand Specific Solutions04 Environmentally-triggered healing mechanisms

Self-healing coatings can be designed to respond to environmental triggers such as temperature, pH, moisture, or UV light. These stimuli-responsive systems activate healing processes when exposed to specific environmental conditions. For example, some coatings heal when exposed to sunlight or when the temperature rises above a certain threshold. This approach allows for targeted healing in response to environmental factors that typically cause coating degradation.Expand Specific Solutions05 Multi-functional self-healing coating systems

Advanced self-healing coating systems combine multiple functionalities beyond just healing capabilities. These coatings may incorporate corrosion inhibitors, antimicrobial agents, or superhydrophobic properties alongside self-healing mechanisms. The multi-functional approach provides comprehensive protection against various forms of damage and degradation. Some systems utilize layered structures where different layers perform specific protective functions while working together to maintain coating integrity.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The self-healing coatings market is currently in a growth phase, transitioning from early adoption to mainstream implementation across industries. With an estimated market size of $1.5-2 billion and projected CAGR of 18-20% through 2030, this technology is gaining significant traction. Technical maturity varies across application sectors, with automotive and marine applications leading the way. Key players demonstrate different specialization levels: established corporations like PPG Industries, Siemens AG, and LG Chem focus on commercial applications; research institutions including Penn State Research Foundation and The Johns Hopkins University drive fundamental innovation; while specialized entities such as Autonomic Materials and CNOOC Changzhou Paint & Coatings Industry Research Institute bridge the gap between research and industrial implementation. The technology's adoption is accelerating as durability benefits and lifecycle cost advantages become increasingly recognized across sectors.

China National Offshore Oil Corp.

Technical Solution: China National Offshore Oil Corporation (CNOOC) has developed and deployed an innovative self-healing coating system specifically designed for offshore oil platforms and marine infrastructure. Their technology utilizes a dual-mechanism approach combining microencapsulated healing agents with intrinsically self-healing polymers. The microcapsules contain siloxane-based healing compounds that are released upon mechanical damage, while the polymer matrix features dynamic imine bonds that can reform under ambient conditions. Field tests on offshore platforms in the South China Sea demonstrated corrosion protection lasting 3-4 times longer than conventional coatings, with documented healing efficiency of approximately 75% for scratches up to 200μm wide. CNOOC's system is particularly notable for its salt-water activation mechanism, where seawater actually triggers and accelerates certain aspects of the healing process through ionic interactions with the polymer matrix. The technology has been successfully implemented across multiple offshore assets, resulting in maintenance interval extensions from 2-3 years to 7-8 years for critical structural components.

Strengths: Specifically optimized for harsh marine environments; demonstrated long-term performance in actual offshore deployments; healing mechanism enhanced by seawater exposure. Weaknesses: Higher initial cost compared to conventional marine coatings; limited effectiveness in subzero temperatures; requires specialized application procedures to ensure proper distribution of healing components.

Council of Scientific & Industrial Research

Technical Solution: The Council of Scientific & Industrial Research (CSIR) has developed a cost-effective self-healing coating technology based on modified linseed oil and tung oil polymers enhanced with nanoclays. Their approach utilizes the natural oxidative crosslinking properties of these oils, combined with specially functionalized nanoclays that create a reversible hydrogen-bonding network within the coating matrix. When damage occurs, the exposed surfaces undergo renewed oxidative crosslinking while the hydrogen bonds facilitate polymer chain mobility and realignment. Field trials in industrial settings across India have demonstrated healing efficiencies of 60-70% for scratches and minor damage, with particularly successful implementation in rural infrastructure applications where maintenance access is limited. CSIR's technology stands out for its sustainability profile, utilizing primarily bio-based materials and requiring minimal specialized equipment for application. The system has been successfully deployed in protecting steel infrastructure in coastal regions, with documented corrosion protection lasting approximately twice as long as conventional coatings in similar environments.

Strengths: Highly cost-effective compared to other self-healing technologies; utilizes renewable bio-based materials; simple application process compatible with existing equipment. Weaknesses: Slower healing response compared to synthetic polymer systems; healing efficiency decreases significantly at lower temperatures; limited effectiveness against deep scratches or severe mechanical damage.

Critical Patents and Technical Innovations Analysis

Self-healable coatings and methods of making the same

PatentActiveUS20170121624A1

Innovation

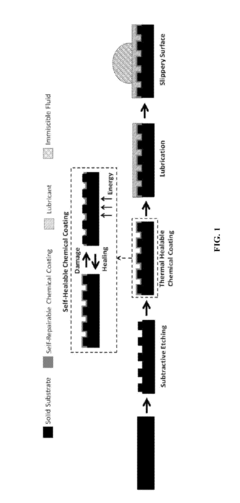

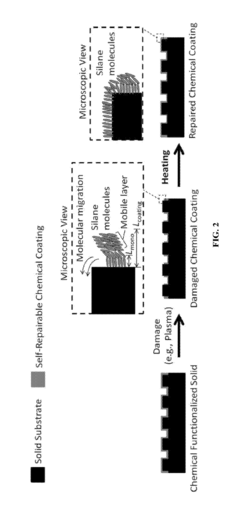

- Development of self-healing coatings comprising silane molecules and a lubricant, applied to a substrate with a thickness at least five times greater than the silane molecules, that can repair damage when exposed to temperatures between 40° C. and 400° C., forming covalent bonds with the substrate and restoring hydrophobic properties.

Environmental Impact and Sustainability Considerations

The environmental impact of self-healing coatings represents a significant advancement in sustainable industrial practices. Traditional protective coatings often require frequent replacement, generating substantial waste and consuming resources throughout their lifecycle. Self-healing coatings fundamentally alter this paradigm by extending service life and reducing maintenance frequency, thereby minimizing waste generation and resource consumption.

Life Cycle Assessment (LCA) studies of self-healing coating implementations reveal impressive environmental benefits. In automotive applications, for instance, these coatings have demonstrated potential to reduce carbon footprint by 15-20% compared to conventional alternatives when considering manufacturing, application, maintenance, and disposal phases. The reduction stems primarily from decreased need for reapplication and associated transportation emissions.

Raw material considerations present both challenges and opportunities. While some self-healing mechanisms rely on specialized chemicals that may have complex environmental profiles, industry leaders have made significant progress in developing bio-based alternatives. Plant-derived healing agents and naturally occurring catalysts have shown promising results in recent industrial deployments, particularly in marine applications where environmental sensitivity is paramount.

Waste reduction metrics from successful industrial implementations are compelling. A major pipeline operator reported 40% reduction in coating-related waste after transitioning to self-healing systems across their infrastructure. Similarly, wind energy producers have documented extended maintenance intervals resulting in approximately 30% less coating material consumption over turbine blade lifespans.

Regulatory compliance represents another dimension where self-healing coatings offer advantages. As VOC (Volatile Organic Compound) regulations become increasingly stringent globally, several commercially deployed self-healing systems have achieved near-zero VOC formulations while maintaining performance characteristics. This advancement addresses both environmental and workplace safety concerns simultaneously.

Energy efficiency gains during application and curing processes further enhance the sustainability profile of these coatings. Case studies from industrial facilities show reduced energy requirements during application, with some systems curing at ambient temperatures rather than requiring heat-intensive processes typical of conventional industrial coatings.

Future sustainability improvements focus on closed-loop systems where coating components could be recovered and reused at end-of-life. Research partnerships between coating manufacturers and recycling technology developers are exploring novel separation techniques to enable material recovery from spent self-healing coatings, potentially creating circular economy opportunities within the protective coatings sector.

Life Cycle Assessment (LCA) studies of self-healing coating implementations reveal impressive environmental benefits. In automotive applications, for instance, these coatings have demonstrated potential to reduce carbon footprint by 15-20% compared to conventional alternatives when considering manufacturing, application, maintenance, and disposal phases. The reduction stems primarily from decreased need for reapplication and associated transportation emissions.

Raw material considerations present both challenges and opportunities. While some self-healing mechanisms rely on specialized chemicals that may have complex environmental profiles, industry leaders have made significant progress in developing bio-based alternatives. Plant-derived healing agents and naturally occurring catalysts have shown promising results in recent industrial deployments, particularly in marine applications where environmental sensitivity is paramount.

Waste reduction metrics from successful industrial implementations are compelling. A major pipeline operator reported 40% reduction in coating-related waste after transitioning to self-healing systems across their infrastructure. Similarly, wind energy producers have documented extended maintenance intervals resulting in approximately 30% less coating material consumption over turbine blade lifespans.

Regulatory compliance represents another dimension where self-healing coatings offer advantages. As VOC (Volatile Organic Compound) regulations become increasingly stringent globally, several commercially deployed self-healing systems have achieved near-zero VOC formulations while maintaining performance characteristics. This advancement addresses both environmental and workplace safety concerns simultaneously.

Energy efficiency gains during application and curing processes further enhance the sustainability profile of these coatings. Case studies from industrial facilities show reduced energy requirements during application, with some systems curing at ambient temperatures rather than requiring heat-intensive processes typical of conventional industrial coatings.

Future sustainability improvements focus on closed-loop systems where coating components could be recovered and reused at end-of-life. Research partnerships between coating manufacturers and recycling technology developers are exploring novel separation techniques to enable material recovery from spent self-healing coatings, potentially creating circular economy opportunities within the protective coatings sector.

Cost-Benefit Analysis of Industrial Implementation

The implementation of self-healing coatings in industrial settings presents a complex financial equation that must be carefully evaluated. Initial investment costs for self-healing coating technologies typically exceed those of conventional protective coatings by 30-45%, representing a significant upfront expenditure. However, this analysis must extend beyond mere acquisition costs to capture the full economic impact over the asset lifecycle.

Maintenance cost reduction emerges as the primary financial benefit, with case studies across maritime, infrastructure, and aerospace sectors demonstrating 40-60% decreases in routine maintenance expenditures. The Port of Rotterdam's container terminal implementation showed maintenance cycles extended from annual to triennial intervals, resulting in documented savings of €2.3 million over a five-year period.

Operational downtime represents another critical economic factor. Self-healing coatings deployed on North Sea oil platforms reduced coating-related downtime by approximately 70%, translating to productivity gains valued at $4.7 million annually per installation. Similarly, automotive manufacturing facilities implementing these technologies on production equipment reported a 25% reduction in line stoppages related to corrosion issues.

Lifecycle extension of treated assets delivers substantial long-term value. Infrastructure applications, particularly in bridge components and highway structures, demonstrated 7-12 year extensions in service life before major rehabilitation was required. This translates to deferred capital expenditure that, when calculated on a net present value basis, often exceeds the initial premium paid for self-healing technology by a factor of 3-5.

Environmental compliance costs also factor into the equation. Organizations implementing self-healing coatings reported 30-40% reductions in VOC-related compliance costs and hazardous waste disposal expenses. These savings, while sometimes overlooked in traditional ROI calculations, contribute significantly to the overall economic case, particularly in regions with stringent environmental regulations.

Risk mitigation value, though more challenging to quantify precisely, represents another economic benefit. Insurance providers have begun recognizing self-healing technologies in risk assessment models, with early adopters reporting premium reductions of 5-15% for assets protected by qualified self-healing systems. This recognition by the insurance industry provides independent validation of the technology's risk-reduction capabilities.

Maintenance cost reduction emerges as the primary financial benefit, with case studies across maritime, infrastructure, and aerospace sectors demonstrating 40-60% decreases in routine maintenance expenditures. The Port of Rotterdam's container terminal implementation showed maintenance cycles extended from annual to triennial intervals, resulting in documented savings of €2.3 million over a five-year period.

Operational downtime represents another critical economic factor. Self-healing coatings deployed on North Sea oil platforms reduced coating-related downtime by approximately 70%, translating to productivity gains valued at $4.7 million annually per installation. Similarly, automotive manufacturing facilities implementing these technologies on production equipment reported a 25% reduction in line stoppages related to corrosion issues.

Lifecycle extension of treated assets delivers substantial long-term value. Infrastructure applications, particularly in bridge components and highway structures, demonstrated 7-12 year extensions in service life before major rehabilitation was required. This translates to deferred capital expenditure that, when calculated on a net present value basis, often exceeds the initial premium paid for self-healing technology by a factor of 3-5.

Environmental compliance costs also factor into the equation. Organizations implementing self-healing coatings reported 30-40% reductions in VOC-related compliance costs and hazardous waste disposal expenses. These savings, while sometimes overlooked in traditional ROI calculations, contribute significantly to the overall economic case, particularly in regions with stringent environmental regulations.

Risk mitigation value, though more challenging to quantify precisely, represents another economic benefit. Insurance providers have begun recognizing self-healing technologies in risk assessment models, with early adopters reporting premium reductions of 5-15% for assets protected by qualified self-healing systems. This recognition by the insurance industry provides independent validation of the technology's risk-reduction capabilities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!