Self Healing Coating Application On Metal And Polymer Substrates

AUG 29, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-Healing Coating Evolution and Objectives

Self-healing coatings represent a revolutionary advancement in surface protection technology, drawing inspiration from biological systems that can repair damage autonomously. The concept emerged in the early 2000s when researchers began exploring biomimetic approaches to material design. Initially focused on polymeric materials, the field has expanded to encompass various substrate applications, particularly metals and polymers, which constitute the majority of industrial and consumer products requiring protective coatings.

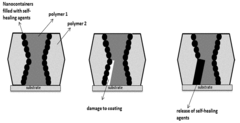

The evolution of self-healing coatings has progressed through several distinct phases. The first generation relied on microencapsulation techniques, where healing agents were contained within microcapsules that would rupture upon damage, releasing the healing material. This approach, pioneered by White et al. in 2001, demonstrated the feasibility of autonomous healing but faced challenges in long-term durability and multiple healing cycles.

The second generation introduced vascular networks inspired by biological circulatory systems, allowing for continuous supply of healing agents. This advancement significantly improved the healing capacity and longevity of the coatings but increased manufacturing complexity. Concurrently, intrinsic self-healing materials emerged, utilizing reversible chemical bonds or physical interactions that could reform after damage without external intervention.

Recent developments have focused on smart triggering mechanisms, where healing responses are activated by specific environmental stimuli such as pH changes, temperature fluctuations, or mechanical stress. This has enabled more targeted and efficient healing processes, particularly important for specialized applications in harsh environments.

The primary objectives of current self-healing coating research for metal and polymer substrates include enhancing durability under extreme conditions, improving healing efficiency and speed, developing environmentally friendly formulations, and reducing production costs for commercial viability. Particular emphasis is placed on corrosion protection for metals and scratch resistance for polymers, as these represent the most common failure modes in respective applications.

Another critical objective is the integration of multifunctionality, where self-healing properties coexist with other desirable characteristics such as antimicrobial activity, thermal regulation, or sensing capabilities. This convergence of functionalities aims to create next-generation smart coatings that can adapt to changing environmental conditions while maintaining protective integrity.

The ultimate goal remains the development of commercially viable self-healing coating systems that can significantly extend the service life of coated products, reduce maintenance costs, and minimize environmental impact through decreased material consumption and waste generation. This aligns with broader sustainability initiatives across industries and represents a promising pathway toward more resilient and resource-efficient material solutions.

The evolution of self-healing coatings has progressed through several distinct phases. The first generation relied on microencapsulation techniques, where healing agents were contained within microcapsules that would rupture upon damage, releasing the healing material. This approach, pioneered by White et al. in 2001, demonstrated the feasibility of autonomous healing but faced challenges in long-term durability and multiple healing cycles.

The second generation introduced vascular networks inspired by biological circulatory systems, allowing for continuous supply of healing agents. This advancement significantly improved the healing capacity and longevity of the coatings but increased manufacturing complexity. Concurrently, intrinsic self-healing materials emerged, utilizing reversible chemical bonds or physical interactions that could reform after damage without external intervention.

Recent developments have focused on smart triggering mechanisms, where healing responses are activated by specific environmental stimuli such as pH changes, temperature fluctuations, or mechanical stress. This has enabled more targeted and efficient healing processes, particularly important for specialized applications in harsh environments.

The primary objectives of current self-healing coating research for metal and polymer substrates include enhancing durability under extreme conditions, improving healing efficiency and speed, developing environmentally friendly formulations, and reducing production costs for commercial viability. Particular emphasis is placed on corrosion protection for metals and scratch resistance for polymers, as these represent the most common failure modes in respective applications.

Another critical objective is the integration of multifunctionality, where self-healing properties coexist with other desirable characteristics such as antimicrobial activity, thermal regulation, or sensing capabilities. This convergence of functionalities aims to create next-generation smart coatings that can adapt to changing environmental conditions while maintaining protective integrity.

The ultimate goal remains the development of commercially viable self-healing coating systems that can significantly extend the service life of coated products, reduce maintenance costs, and minimize environmental impact through decreased material consumption and waste generation. This aligns with broader sustainability initiatives across industries and represents a promising pathway toward more resilient and resource-efficient material solutions.

Market Analysis for Self-Healing Protective Solutions

The global market for self-healing protective coatings has experienced significant growth in recent years, driven by increasing demand across multiple industries seeking enhanced durability and reduced maintenance costs. Current market valuations indicate the self-healing coatings sector reached approximately 1.5 billion USD in 2022, with projections suggesting a compound annual growth rate of 8-10% through 2030.

Metal substrates represent the largest application segment, accounting for nearly 60% of the market share. This dominance stems from widespread implementation in automotive, aerospace, and infrastructure sectors where corrosion protection delivers substantial economic benefits. The polymer substrates segment, while smaller, is demonstrating faster growth rates of 12-15% annually as new applications emerge in consumer electronics, medical devices, and specialized industrial equipment.

Regional analysis reveals North America and Europe currently lead market adoption, collectively representing over 65% of global consumption. However, the Asia-Pacific region, particularly China, Japan, and South Korea, is experiencing the most rapid market expansion due to increasing industrial production and infrastructure development. These emerging markets are expected to account for over 40% of global demand by 2028.

Industry-specific demand patterns show automotive and transportation sectors as primary consumers, utilizing self-healing coatings to extend vehicle lifespans and reduce warranty claims. The marine industry represents another significant market, where harsh saltwater environments accelerate corrosion and necessitate advanced protective solutions. Building and construction applications are growing rapidly as architects and developers recognize long-term cost benefits despite higher initial investment.

Consumer willingness to pay premium prices for self-healing technologies varies significantly by sector. Industrial applications demonstrate stronger price tolerance, with purchasing decisions driven by total cost of ownership calculations rather than initial acquisition costs. Consumer markets remain more price-sensitive, though this is gradually changing as product awareness increases.

Market challenges include relatively high production costs compared to conventional coatings, limited awareness among potential end-users, and technical limitations regarding healing capacity under extreme conditions. Additionally, regulatory frameworks regarding novel chemical compounds used in some self-healing formulations present market entry barriers in certain regions.

Competitive landscape analysis reveals a market dominated by specialty chemical companies and coating manufacturers, with increasing interest from major materials science corporations seeking diversification opportunities. Strategic partnerships between research institutions and industrial players are accelerating commercialization timelines and expanding application possibilities.

Metal substrates represent the largest application segment, accounting for nearly 60% of the market share. This dominance stems from widespread implementation in automotive, aerospace, and infrastructure sectors where corrosion protection delivers substantial economic benefits. The polymer substrates segment, while smaller, is demonstrating faster growth rates of 12-15% annually as new applications emerge in consumer electronics, medical devices, and specialized industrial equipment.

Regional analysis reveals North America and Europe currently lead market adoption, collectively representing over 65% of global consumption. However, the Asia-Pacific region, particularly China, Japan, and South Korea, is experiencing the most rapid market expansion due to increasing industrial production and infrastructure development. These emerging markets are expected to account for over 40% of global demand by 2028.

Industry-specific demand patterns show automotive and transportation sectors as primary consumers, utilizing self-healing coatings to extend vehicle lifespans and reduce warranty claims. The marine industry represents another significant market, where harsh saltwater environments accelerate corrosion and necessitate advanced protective solutions. Building and construction applications are growing rapidly as architects and developers recognize long-term cost benefits despite higher initial investment.

Consumer willingness to pay premium prices for self-healing technologies varies significantly by sector. Industrial applications demonstrate stronger price tolerance, with purchasing decisions driven by total cost of ownership calculations rather than initial acquisition costs. Consumer markets remain more price-sensitive, though this is gradually changing as product awareness increases.

Market challenges include relatively high production costs compared to conventional coatings, limited awareness among potential end-users, and technical limitations regarding healing capacity under extreme conditions. Additionally, regulatory frameworks regarding novel chemical compounds used in some self-healing formulations present market entry barriers in certain regions.

Competitive landscape analysis reveals a market dominated by specialty chemical companies and coating manufacturers, with increasing interest from major materials science corporations seeking diversification opportunities. Strategic partnerships between research institutions and industrial players are accelerating commercialization timelines and expanding application possibilities.

Technical Barriers in Substrate Compatibility

The application of self-healing coatings on different substrate materials presents significant technical challenges, particularly when considering the diverse properties of metals and polymers. One of the primary barriers is the adhesion mechanism, which varies substantially between these substrate types. Metals typically form chemical or electrostatic bonds with coating materials, while polymers often rely on mechanical interlocking or weaker van der Waals forces. This fundamental difference necessitates distinct formulation approaches for each substrate type.

Surface energy compatibility represents another critical challenge. Metals generally exhibit high surface energy, promoting good wetting and adhesion with many coating formulations. In contrast, polymers, especially polyolefins like polyethylene and polypropylene, possess low surface energy, resulting in poor wetting characteristics. This disparity often requires surface modification techniques such as plasma treatment or chemical primers when developing universal self-healing coating systems.

Thermal expansion coefficient mismatch between substrates and coating materials creates significant stress at the interface during temperature fluctuations. Metals typically have lower coefficients of thermal expansion compared to polymers, which can lead to coating delamination or cracking during thermal cycling. Self-healing mechanisms must account for these differential movements to maintain coating integrity over time.

Electrochemical interactions present unique challenges for metal substrates. Corrosion processes can interfere with self-healing mechanisms, particularly in systems relying on ion exchange or redox reactions. Conversely, polymers may experience degradation through UV exposure or oxidation, requiring different protective strategies. A universal self-healing coating must address these substrate-specific degradation pathways.

The mechanical properties of the substrate significantly influence coating performance. Metals generally provide rigid support, while polymers may flex, stretch, or creep under load. Self-healing coatings must accommodate these substrate behaviors while maintaining their restorative capabilities. Formulations that perform well on rigid metal surfaces often fail when applied to flexible polymer substrates due to excessive cracking during deformation.

Chemical compatibility issues arise from interactions between substrate materials and healing agents. Certain catalysts or healing components may react adversely with specific substrate materials, potentially accelerating degradation rather than providing protection. For instance, acidic healing agents might corrode metal substrates while having minimal effect on polymers. Developing chemically compatible systems that remain effective across diverse substrate materials represents a significant technical hurdle.

Manufacturing integration presents additional challenges, as coating application methods must be compatible with existing production processes for both metal and polymer components. The development of universal self-healing coating systems requires innovative approaches that bridge these substrate-specific technical barriers.

Surface energy compatibility represents another critical challenge. Metals generally exhibit high surface energy, promoting good wetting and adhesion with many coating formulations. In contrast, polymers, especially polyolefins like polyethylene and polypropylene, possess low surface energy, resulting in poor wetting characteristics. This disparity often requires surface modification techniques such as plasma treatment or chemical primers when developing universal self-healing coating systems.

Thermal expansion coefficient mismatch between substrates and coating materials creates significant stress at the interface during temperature fluctuations. Metals typically have lower coefficients of thermal expansion compared to polymers, which can lead to coating delamination or cracking during thermal cycling. Self-healing mechanisms must account for these differential movements to maintain coating integrity over time.

Electrochemical interactions present unique challenges for metal substrates. Corrosion processes can interfere with self-healing mechanisms, particularly in systems relying on ion exchange or redox reactions. Conversely, polymers may experience degradation through UV exposure or oxidation, requiring different protective strategies. A universal self-healing coating must address these substrate-specific degradation pathways.

The mechanical properties of the substrate significantly influence coating performance. Metals generally provide rigid support, while polymers may flex, stretch, or creep under load. Self-healing coatings must accommodate these substrate behaviors while maintaining their restorative capabilities. Formulations that perform well on rigid metal surfaces often fail when applied to flexible polymer substrates due to excessive cracking during deformation.

Chemical compatibility issues arise from interactions between substrate materials and healing agents. Certain catalysts or healing components may react adversely with specific substrate materials, potentially accelerating degradation rather than providing protection. For instance, acidic healing agents might corrode metal substrates while having minimal effect on polymers. Developing chemically compatible systems that remain effective across diverse substrate materials represents a significant technical hurdle.

Manufacturing integration presents additional challenges, as coating application methods must be compatible with existing production processes for both metal and polymer components. The development of universal self-healing coating systems requires innovative approaches that bridge these substrate-specific technical barriers.

Current Self-Healing Mechanisms for Different Substrates

01 Microcapsule-based self-healing coatings

Self-healing coatings can be formulated using microcapsules containing healing agents that are released when the coating is damaged. When the microcapsules rupture due to mechanical damage, the healing agent flows into the crack and polymerizes, restoring the coating's integrity. These systems typically include encapsulated healing agents, catalysts, and polymeric matrices designed to provide autonomous repair capabilities without external intervention.- Microcapsule-based self-healing coatings: Self-healing coatings can be formulated using microcapsules containing healing agents that are released when the coating is damaged. When the microcapsules rupture due to mechanical damage, they release healing agents that flow into the damaged area and polymerize or solidify, effectively repairing the coating. This technology is particularly useful for protecting surfaces from corrosion and extending the lifespan of coated materials.

- Polymer-based self-healing systems: Polymer-based self-healing systems utilize intrinsic or extrinsic healing mechanisms to repair damage. These systems may incorporate dynamic covalent bonds, supramolecular interactions, or shape memory polymers that can restore the original structure after damage. The polymers can flow into cracks and reform bonds, providing autonomous healing capabilities without external intervention. These materials are particularly valuable in applications requiring durability and longevity.

- Self-healing coatings with nanoparticles: Nanoparticles can be incorporated into coating formulations to enhance self-healing properties. These nanoparticles, such as silica, graphene, or metal oxides, can improve the mechanical properties of the coating while also participating in the healing process. Some nanoparticles can facilitate the formation of new bonds or act as reinforcing agents in damaged areas. This approach combines the benefits of nanotechnology with self-healing capabilities for advanced coating performance.

- Stimuli-responsive self-healing coatings: Stimuli-responsive self-healing coatings can repair damage in response to external triggers such as heat, light, pH changes, or electrical stimulation. These smart coatings contain materials that can be activated by specific environmental conditions to initiate the healing process. For example, thermally activated systems may use heat to increase polymer mobility and facilitate crack healing, while photo-responsive systems may use UV light to trigger chemical reactions that repair damage.

- Bio-inspired self-healing coating technologies: Bio-inspired approaches to self-healing coatings mimic natural healing processes found in biological systems. These technologies may incorporate vascular networks similar to blood vessels that can deliver healing agents to damaged areas, or they may use biomimetic materials that emulate the self-repair mechanisms of plant or animal tissues. Bio-inspired self-healing coatings often focus on sustainability and may incorporate renewable or biodegradable components for environmentally friendly solutions.

02 Shape memory polymer self-healing coatings

Shape memory polymers can be incorporated into coating formulations to provide self-healing properties. These materials have the ability to return to their original shape after deformation when exposed to specific stimuli such as heat or light. When damage occurs to the coating, the shape memory effect can close cracks and restore the surface integrity. This approach is particularly useful for applications requiring repeated healing cycles and durability under harsh conditions.Expand Specific Solutions03 Self-healing coatings with dynamic chemical bonds

Self-healing coatings can be designed with dynamic chemical bonds that can break and reform under specific conditions. These reversible bonds, such as Diels-Alder adducts, hydrogen bonds, or disulfide linkages, allow the coating to repair damage through molecular rearrangement. When the coating is damaged, these dynamic bonds can reform across the damaged area, restoring the coating's protective properties without the need for additional healing agents.Expand Specific Solutions04 Nanoparticle-enhanced self-healing coatings

Incorporating nanoparticles into coating formulations can enhance self-healing properties. Nanoparticles such as silica, clay, or carbon nanotubes can improve the mechanical properties of the coating while also facilitating the healing process. Some nanoparticles can store and release healing agents, while others can participate in the healing reaction or improve the mobility of polymer chains to facilitate crack closure and healing.Expand Specific Solutions05 Environmentally-triggered self-healing coatings

Self-healing coatings can be designed to respond to environmental triggers such as temperature, pH, moisture, or UV light. These stimuli-responsive coatings contain functional groups or additives that activate the healing process when exposed to specific environmental conditions. For example, moisture-triggered systems may use hydrolysis reactions to generate healing agents, while temperature-responsive systems might utilize phase changes or increased polymer mobility at elevated temperatures to facilitate healing.Expand Specific Solutions

Industry Leaders in Advanced Coating Systems

The self-healing coating market for metal and polymer substrates is currently in a growth phase, with increasing adoption across automotive, aerospace, and infrastructure sectors. The global market size is estimated to reach $4.5 billion by 2027, expanding at a CAGR of approximately 18%. Regarding technical maturity, academic institutions like Jilin University, University of Michigan, and Nanjing University are leading fundamental research, while commercial players demonstrate varying levels of implementation. Companies such as Autonomic Materials have developed specialized microencapsulation technologies, while industrial giants including PPG Industries, Tata Steel, and POSCO Holdings are integrating these innovations into practical applications. Research organizations like CSIR and CSIRO are bridging the gap between laboratory discoveries and industrial implementation through collaborative projects focusing on durability enhancement and cost reduction.

Council of Scientific & Industrial Research

Technical Solution: The Council of Scientific & Industrial Research (CSIR) has developed comprehensive self-healing coating technologies for metal and polymer protection through their Advanced Materials and Processes Research Institute. Their approach focuses on environmentally sustainable formulations using bio-inspired healing mechanisms. For metal substrates, CSIR has pioneered sol-gel derived hybrid coatings incorporating encapsulated linseed oil and corrosion inhibitors that provide active protection upon damage. Their research demonstrates significant reduction in corrosion rates (>85%) compared to conventional protective coatings. For polymer substrates, they've developed shape memory polymer-based coatings that utilize thermal triggering to restore damaged surfaces. A notable innovation is their graphene oxide-reinforced self-healing nanocomposite coatings that combine mechanical strength with healing capabilities. CSIR has also developed conductive self-healing coatings for electronic applications on polymer substrates, where electrical functionality is restored alongside physical integrity. Their technologies emphasize cost-effective manufacturing processes suitable for industrial scale-up, with particular focus on applications in harsh environmental conditions typical in developing economies. Recent advancements include the incorporation of nanoclays and halloysite nanotubes as environmentally friendly carriers for healing agents.

Strengths: Strong focus on environmentally sustainable formulations; cost-effective approaches suitable for wide-scale implementation; comprehensive research covering multiple healing mechanisms; solutions designed for harsh environmental conditions. Weaknesses: Some technologies still in laboratory development phase; potential challenges in technology transfer to industry; healing efficiency may be lower than more expensive commercial alternatives.

Solvay Specialty Polymers Italy SpA

Technical Solution: Solvay has developed advanced self-healing coating systems based on their proprietary fluoropolymer and specialty polymer technologies. Their approach for metal substrates utilizes supramolecular chemistry with dynamic non-covalent bonds (hydrogen bonding, π-π stacking, and metal-ligand coordination) that can repeatedly break and reform in response to damage. For high-performance applications, Solvay has engineered fluoropolymer-based self-healing coatings that combine exceptional chemical resistance with healing capabilities, particularly valuable for aggressive industrial environments. Their metal protection systems incorporate intelligent corrosion inhibition through ion-exchange mechanisms, where damaged areas trigger the release of protective agents. For polymer substrates, Solvay has developed compatible self-healing formulations that maintain strong adhesion while providing surface restoration properties. A significant innovation is their thermally-activated self-healing system that utilizes the company's high-performance polymers with precisely engineered glass transition temperatures, allowing healing to occur at specific temperature ranges without compromising ambient performance. Solvay has successfully implemented these technologies in aerospace, oil and gas, and chemical processing industries, where their coatings provide extended service life under extreme conditions.

Strengths: Exceptional chemical and temperature resistance combined with healing properties; integration with high-performance polymer systems; solutions for extreme operating environments; strong industrial implementation record. Weaknesses: Higher cost compared to conventional systems; some formulations require external energy input (heat) for healing activation; potential limitations in healing larger mechanical damages.

Key Patents in Self-Healing Coating Formulations

Self-healing coatings from recycled polymer blends

PatentInactiveUS9796857B2

Innovation

- Development of self-healing coatings incorporating nanocontainers filled with self-healing agents, such as Janus particles and corrosion inhibitors, that release agents to heal cracks and inhibit corrosion, improving the mixing of polymers and enhancing the coating's durability.

Self-healing coating layer based on metal organic framework material and preparation method of self-healing coating layer

PatentInactiveCN112552789A

Innovation

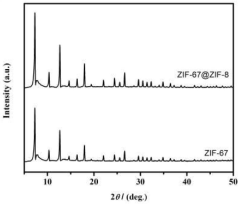

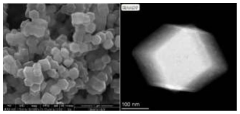

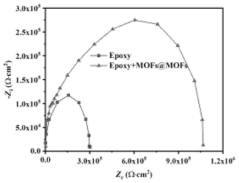

- Using a core-shell structure based on metal organic framework materials, a core-shell structure metal organic framework material is formed by mixing cobalt nitrate methanol and 2-methylimidazole methanol, combined with zinc nitrate methanol, and combined with epoxy resin, dispersant and curing agent Combined, an epoxy resin-based self-healing coating was prepared.

Environmental Impact Assessment

Self-healing coatings represent a significant advancement in sustainable materials science, with their environmental impact requiring thorough assessment across their entire lifecycle. These innovative coatings substantially extend the service life of metal and polymer substrates, thereby reducing the frequency of replacement and associated resource consumption. This longevity factor translates directly into decreased raw material extraction, manufacturing energy requirements, and waste generation over time.

The production phase of self-healing coatings presents mixed environmental considerations. While some formulations incorporate bio-based components and environmentally friendly catalysts, others rely on synthetic polymers and potentially hazardous chemical agents. Microcapsule-based systems, for instance, may utilize volatile organic compounds (VOCs) during manufacturing, contributing to air quality concerns. However, industry trends show increasing adoption of water-based formulations and renewable raw materials, progressively reducing the environmental footprint of production processes.

During application and use phases, self-healing coatings demonstrate notable environmental advantages. Their autonomous repair capabilities minimize the need for maintenance interventions involving additional chemical products. Modern formulations increasingly feature low-VOC or zero-VOC compositions, addressing historical concerns about air pollution from conventional coating systems. Furthermore, advanced self-healing mechanisms provide enhanced protection against corrosion and degradation, preventing contamination of surrounding environments with substrate materials or conventional coating fragments.

End-of-life considerations reveal both challenges and opportunities. Some self-healing coating systems incorporate non-biodegradable components that persist in the environment, potentially contributing to microplastic pollution when applied to polymer substrates. However, research directions increasingly focus on developing biodegradable healing agents and environmentally benign trigger mechanisms to address these concerns.

Quantitative lifecycle assessment (LCA) studies indicate that despite potentially higher initial environmental impacts during production, self-healing coatings typically demonstrate net environmental benefits when considering their extended functional lifespan. Research by Dutta et al. (2020) showed that metal substrates protected with self-healing coatings reduced overall carbon footprint by 30-45% compared to conventional protective systems requiring regular maintenance and replacement.

Regulatory frameworks worldwide are evolving to address novel materials like self-healing coatings, with particular attention to potential leaching of healing agents into aquatic environments and long-term ecological effects. The European Chemical Agency's recent guidelines specifically address smart coating technologies, establishing testing protocols for environmental fate assessment of autonomously released healing components.

The production phase of self-healing coatings presents mixed environmental considerations. While some formulations incorporate bio-based components and environmentally friendly catalysts, others rely on synthetic polymers and potentially hazardous chemical agents. Microcapsule-based systems, for instance, may utilize volatile organic compounds (VOCs) during manufacturing, contributing to air quality concerns. However, industry trends show increasing adoption of water-based formulations and renewable raw materials, progressively reducing the environmental footprint of production processes.

During application and use phases, self-healing coatings demonstrate notable environmental advantages. Their autonomous repair capabilities minimize the need for maintenance interventions involving additional chemical products. Modern formulations increasingly feature low-VOC or zero-VOC compositions, addressing historical concerns about air pollution from conventional coating systems. Furthermore, advanced self-healing mechanisms provide enhanced protection against corrosion and degradation, preventing contamination of surrounding environments with substrate materials or conventional coating fragments.

End-of-life considerations reveal both challenges and opportunities. Some self-healing coating systems incorporate non-biodegradable components that persist in the environment, potentially contributing to microplastic pollution when applied to polymer substrates. However, research directions increasingly focus on developing biodegradable healing agents and environmentally benign trigger mechanisms to address these concerns.

Quantitative lifecycle assessment (LCA) studies indicate that despite potentially higher initial environmental impacts during production, self-healing coatings typically demonstrate net environmental benefits when considering their extended functional lifespan. Research by Dutta et al. (2020) showed that metal substrates protected with self-healing coatings reduced overall carbon footprint by 30-45% compared to conventional protective systems requiring regular maintenance and replacement.

Regulatory frameworks worldwide are evolving to address novel materials like self-healing coatings, with particular attention to potential leaching of healing agents into aquatic environments and long-term ecological effects. The European Chemical Agency's recent guidelines specifically address smart coating technologies, establishing testing protocols for environmental fate assessment of autonomously released healing components.

Durability Testing Methodologies

Durability testing methodologies for self-healing coatings on metal and polymer substrates require comprehensive evaluation protocols that simulate real-world conditions while providing quantifiable metrics for performance assessment. These methodologies must address the unique challenges posed by different substrate materials and their interaction with self-healing mechanisms.

Accelerated weathering tests represent a cornerstone of durability assessment, typically employing UV exposure chambers, temperature cycling, and humidity control to compress years of environmental exposure into weeks or months. For metal substrates, salt spray testing according to ASTM B117 remains essential, while modified versions incorporating cyclic wet/dry conditions provide more realistic corrosion scenarios. Polymer substrates require additional consideration of UV degradation effects, often tested through QUV accelerated weathering systems.

Mechanical durability testing forms another critical component, with scratch resistance tests (ASTM D7027/ISO 19252) being particularly relevant for self-healing coatings. These tests must be adapted to evaluate not only the initial damage resistance but also the healing efficiency after damage occurs. Micro-indentation and nano-indentation techniques offer quantitative measurements of coating hardness and elastic recovery, providing insights into the mechanical properties before and after healing cycles.

Chemical resistance testing protocols typically involve immersion tests in various solvents, acids, bases, and industrial fluids relevant to the intended application environment. For automotive applications, resistance to gasoline, brake fluid, and windshield washer fluid is evaluated, while marine applications focus on saltwater immersion and biofouling resistance. These tests must be conducted both before damage and after healing to assess the restoration of chemical barrier properties.

Adhesion testing methodologies, including cross-cut (ASTM D3359) and pull-off tests (ASTM D4541), are essential for evaluating the coating-substrate interface stability throughout multiple healing cycles. This is particularly important for polymer substrates where thermal expansion differences between coating and substrate can compromise adhesion during healing processes that involve temperature changes.

Specialized testing for self-healing functionality includes controlled damage infliction followed by monitored healing periods under defined conditions. Techniques such as electrochemical impedance spectroscopy (EIS) provide quantitative data on barrier restoration for metal substrates, while optical transparency recovery measurements may be more relevant for polymer applications. Standardized healing efficiency metrics typically include the percentage of property restoration (mechanical, barrier, aesthetic) compared to the original undamaged state.

Long-term performance validation remains challenging, with most accelerated tests requiring correlation with real-world exposure data. Field testing in relevant environments, though time-consuming, provides the most reliable validation of laboratory predictions and helps establish acceleration factors for laboratory tests.

Accelerated weathering tests represent a cornerstone of durability assessment, typically employing UV exposure chambers, temperature cycling, and humidity control to compress years of environmental exposure into weeks or months. For metal substrates, salt spray testing according to ASTM B117 remains essential, while modified versions incorporating cyclic wet/dry conditions provide more realistic corrosion scenarios. Polymer substrates require additional consideration of UV degradation effects, often tested through QUV accelerated weathering systems.

Mechanical durability testing forms another critical component, with scratch resistance tests (ASTM D7027/ISO 19252) being particularly relevant for self-healing coatings. These tests must be adapted to evaluate not only the initial damage resistance but also the healing efficiency after damage occurs. Micro-indentation and nano-indentation techniques offer quantitative measurements of coating hardness and elastic recovery, providing insights into the mechanical properties before and after healing cycles.

Chemical resistance testing protocols typically involve immersion tests in various solvents, acids, bases, and industrial fluids relevant to the intended application environment. For automotive applications, resistance to gasoline, brake fluid, and windshield washer fluid is evaluated, while marine applications focus on saltwater immersion and biofouling resistance. These tests must be conducted both before damage and after healing to assess the restoration of chemical barrier properties.

Adhesion testing methodologies, including cross-cut (ASTM D3359) and pull-off tests (ASTM D4541), are essential for evaluating the coating-substrate interface stability throughout multiple healing cycles. This is particularly important for polymer substrates where thermal expansion differences between coating and substrate can compromise adhesion during healing processes that involve temperature changes.

Specialized testing for self-healing functionality includes controlled damage infliction followed by monitored healing periods under defined conditions. Techniques such as electrochemical impedance spectroscopy (EIS) provide quantitative data on barrier restoration for metal substrates, while optical transparency recovery measurements may be more relevant for polymer applications. Standardized healing efficiency metrics typically include the percentage of property restoration (mechanical, barrier, aesthetic) compared to the original undamaged state.

Long-term performance validation remains challenging, with most accelerated tests requiring correlation with real-world exposure data. Field testing in relevant environments, though time-consuming, provides the most reliable validation of laboratory predictions and helps establish acceleration factors for laboratory tests.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!