Microcapsule Based Self Healing Coating Formulation Best Practices

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-Healing Coating Technology Evolution and Objectives

Self-healing coatings represent a revolutionary advancement in materials science, emerging from the biomimetic concept of replicating natural healing processes in synthetic materials. The evolution of this technology began in the early 2000s with pioneering work by White et al. at the University of Illinois, who first demonstrated the feasibility of embedding microcapsules containing healing agents within polymer matrices. This breakthrough laid the foundation for subsequent developments in self-healing coating technologies.

The progression of microcapsule-based self-healing coatings has followed a trajectory from basic proof-of-concept to increasingly sophisticated formulations. Early systems relied on single-capsule approaches with limited healing capacity, while contemporary formulations incorporate multiple healing mechanisms and enhanced durability. The technological evolution has been driven by advancements in microencapsulation techniques, polymer chemistry, and surface engineering.

A significant milestone in this evolution was the transition from laboratory curiosities to commercially viable products around 2010-2015, when several major coating manufacturers began incorporating self-healing technologies into their product lines. This commercialization phase coincided with improvements in microcapsule stability, shelf life, and compatibility with various coating matrices.

The current technological landscape features diverse approaches to microcapsule-based self-healing, including urea-formaldehyde encapsulated healing agents, melamine-formaldehyde systems, and silica-based shell structures. Each system offers distinct advantages in terms of triggering mechanisms, healing efficiency, and environmental resistance.

The primary objectives of current research and development efforts in this field include enhancing healing efficiency under diverse environmental conditions, improving the longevity of healing capabilities over multiple damage events, and developing formulations that maintain optimal mechanical properties while incorporating self-healing functionality. Additionally, there is a growing focus on environmentally friendly formulations that eliminate toxic components traditionally used in microcapsule synthesis.

Another critical objective is the standardization of testing protocols to evaluate self-healing performance, as the industry currently lacks universally accepted metrics for quantifying healing efficiency. This standardization would facilitate meaningful comparisons between different formulation approaches and accelerate technological advancement through benchmarking.

Looking forward, the field aims to develop "smart" self-healing coatings that can respond to specific environmental triggers, integrate with IoT systems for remote monitoring, and provide multiple functionalities beyond mere crack repair, such as corrosion inhibition, antimicrobial properties, and self-cleaning capabilities. The ultimate goal remains creating robust, multi-functional coating systems that significantly extend service life while reducing maintenance costs and environmental impact.

The progression of microcapsule-based self-healing coatings has followed a trajectory from basic proof-of-concept to increasingly sophisticated formulations. Early systems relied on single-capsule approaches with limited healing capacity, while contemporary formulations incorporate multiple healing mechanisms and enhanced durability. The technological evolution has been driven by advancements in microencapsulation techniques, polymer chemistry, and surface engineering.

A significant milestone in this evolution was the transition from laboratory curiosities to commercially viable products around 2010-2015, when several major coating manufacturers began incorporating self-healing technologies into their product lines. This commercialization phase coincided with improvements in microcapsule stability, shelf life, and compatibility with various coating matrices.

The current technological landscape features diverse approaches to microcapsule-based self-healing, including urea-formaldehyde encapsulated healing agents, melamine-formaldehyde systems, and silica-based shell structures. Each system offers distinct advantages in terms of triggering mechanisms, healing efficiency, and environmental resistance.

The primary objectives of current research and development efforts in this field include enhancing healing efficiency under diverse environmental conditions, improving the longevity of healing capabilities over multiple damage events, and developing formulations that maintain optimal mechanical properties while incorporating self-healing functionality. Additionally, there is a growing focus on environmentally friendly formulations that eliminate toxic components traditionally used in microcapsule synthesis.

Another critical objective is the standardization of testing protocols to evaluate self-healing performance, as the industry currently lacks universally accepted metrics for quantifying healing efficiency. This standardization would facilitate meaningful comparisons between different formulation approaches and accelerate technological advancement through benchmarking.

Looking forward, the field aims to develop "smart" self-healing coatings that can respond to specific environmental triggers, integrate with IoT systems for remote monitoring, and provide multiple functionalities beyond mere crack repair, such as corrosion inhibition, antimicrobial properties, and self-cleaning capabilities. The ultimate goal remains creating robust, multi-functional coating systems that significantly extend service life while reducing maintenance costs and environmental impact.

Market Analysis for Microcapsule-Based Self-Healing Coatings

The global market for microcapsule-based self-healing coatings has experienced significant growth in recent years, driven by increasing demand across multiple industries seeking enhanced durability and reduced maintenance costs. The current market size is estimated at approximately $1.2 billion, with projections indicating a compound annual growth rate of 8.7% through 2028.

The automotive sector represents the largest application segment, accounting for roughly 35% of the total market share. This dominance stems from the automotive industry's continuous pursuit of corrosion-resistant coatings that can extend vehicle lifespans while reducing warranty claims. The aerospace industry follows closely behind at 25% market share, where self-healing coatings provide critical protection against extreme environmental conditions.

Marine applications constitute another significant market segment at 18%, where harsh saltwater environments accelerate coating degradation. The construction industry has also begun adopting these technologies more widely, currently representing 15% of the market with substantial growth potential as sustainable building practices gain traction.

Regionally, North America leads the market with approximately 38% share, followed by Europe (32%), Asia-Pacific (24%), and the rest of the world (6%). However, the Asia-Pacific region is experiencing the fastest growth rate, driven by rapid industrialization in China and India, alongside increasing automotive and electronics manufacturing activities.

Consumer demand patterns reveal a growing preference for environmentally friendly formulations with minimal VOC content. This trend has pushed manufacturers toward developing water-based self-healing coating systems that maintain performance while meeting increasingly stringent environmental regulations.

Price sensitivity varies significantly by application sector. While aerospace and high-end automotive segments prioritize performance over cost, construction and general industrial applications remain highly price-sensitive, creating distinct market segments with different formulation requirements.

The competitive landscape features both specialty chemical giants and innovative startups. Established players like BASF, AkzoNobel, and PPG Industries have made significant investments in self-healing coating technologies, while numerous startups have emerged with novel microencapsulation approaches and healing mechanisms.

Market barriers include relatively high production costs compared to conventional coatings, technical challenges in formulation stability, and the need for extensive performance validation. Despite these challenges, the value proposition of reduced maintenance costs and extended service life continues to drive market expansion across multiple industries.

The automotive sector represents the largest application segment, accounting for roughly 35% of the total market share. This dominance stems from the automotive industry's continuous pursuit of corrosion-resistant coatings that can extend vehicle lifespans while reducing warranty claims. The aerospace industry follows closely behind at 25% market share, where self-healing coatings provide critical protection against extreme environmental conditions.

Marine applications constitute another significant market segment at 18%, where harsh saltwater environments accelerate coating degradation. The construction industry has also begun adopting these technologies more widely, currently representing 15% of the market with substantial growth potential as sustainable building practices gain traction.

Regionally, North America leads the market with approximately 38% share, followed by Europe (32%), Asia-Pacific (24%), and the rest of the world (6%). However, the Asia-Pacific region is experiencing the fastest growth rate, driven by rapid industrialization in China and India, alongside increasing automotive and electronics manufacturing activities.

Consumer demand patterns reveal a growing preference for environmentally friendly formulations with minimal VOC content. This trend has pushed manufacturers toward developing water-based self-healing coating systems that maintain performance while meeting increasingly stringent environmental regulations.

Price sensitivity varies significantly by application sector. While aerospace and high-end automotive segments prioritize performance over cost, construction and general industrial applications remain highly price-sensitive, creating distinct market segments with different formulation requirements.

The competitive landscape features both specialty chemical giants and innovative startups. Established players like BASF, AkzoNobel, and PPG Industries have made significant investments in self-healing coating technologies, while numerous startups have emerged with novel microencapsulation approaches and healing mechanisms.

Market barriers include relatively high production costs compared to conventional coatings, technical challenges in formulation stability, and the need for extensive performance validation. Despite these challenges, the value proposition of reduced maintenance costs and extended service life continues to drive market expansion across multiple industries.

Technical Challenges in Microcapsule Formulation

Despite significant advancements in microcapsule-based self-healing coating technology, several technical challenges persist in the formulation process that impede widespread commercial adoption. The primary challenge lies in achieving consistent microcapsule size distribution, as variations significantly affect healing efficiency and coating performance. Current manufacturing processes struggle to maintain uniform capsule dimensions at scale, with standard deviations often exceeding 15% in industrial production settings.

Shell wall thickness control presents another formidable obstacle, as it directly impacts both the protection of healing agents and their release kinetics upon damage. Achieving the optimal balance between premature rupture and insufficient reactivity remains elusive, particularly when formulating for diverse environmental conditions. Most commercial formulations currently operate within a narrow performance window that limits their application versatility.

Compatibility issues between microcapsules and coating matrices constitute a persistent challenge. The introduction of microcapsules often disrupts the rheological properties of the coating, leading to application difficulties and compromised aesthetic qualities. Surface modification techniques to enhance microcapsule-matrix adhesion have shown promise in laboratory settings but face scalability constraints in commercial production environments.

Long-term stability of encapsulated healing agents represents a critical hurdle, with many formulations showing significant degradation in healing capacity after 12-18 months under standard storage conditions. This limitation severely restricts shelf-life and practical deployment in industries requiring extended durability, such as infrastructure and aerospace applications.

Environmental sensitivity poses additional complications, as temperature fluctuations, humidity variations, and UV exposure can dramatically alter microcapsule integrity and healing agent reactivity. Current formulations typically demonstrate optimal performance within a relatively narrow temperature range (15-35°C), limiting their utility in extreme environments.

Manufacturing scalability remains problematic, with laboratory-scale production methods often failing to translate effectively to industrial volumes. Yield inconsistencies, increased defect rates, and cost inefficiencies emerge during scale-up, hampering commercial viability. Most successful implementations have been limited to specialty applications where higher costs can be justified by critical performance requirements.

Regulatory compliance presents growing challenges as environmental regulations increasingly restrict certain healing agents and shell materials. Developing formulations that balance performance requirements with environmental safety standards requires significant reformulation efforts and extensive testing protocols, adding substantial development costs and market entry delays.

Shell wall thickness control presents another formidable obstacle, as it directly impacts both the protection of healing agents and their release kinetics upon damage. Achieving the optimal balance between premature rupture and insufficient reactivity remains elusive, particularly when formulating for diverse environmental conditions. Most commercial formulations currently operate within a narrow performance window that limits their application versatility.

Compatibility issues between microcapsules and coating matrices constitute a persistent challenge. The introduction of microcapsules often disrupts the rheological properties of the coating, leading to application difficulties and compromised aesthetic qualities. Surface modification techniques to enhance microcapsule-matrix adhesion have shown promise in laboratory settings but face scalability constraints in commercial production environments.

Long-term stability of encapsulated healing agents represents a critical hurdle, with many formulations showing significant degradation in healing capacity after 12-18 months under standard storage conditions. This limitation severely restricts shelf-life and practical deployment in industries requiring extended durability, such as infrastructure and aerospace applications.

Environmental sensitivity poses additional complications, as temperature fluctuations, humidity variations, and UV exposure can dramatically alter microcapsule integrity and healing agent reactivity. Current formulations typically demonstrate optimal performance within a relatively narrow temperature range (15-35°C), limiting their utility in extreme environments.

Manufacturing scalability remains problematic, with laboratory-scale production methods often failing to translate effectively to industrial volumes. Yield inconsistencies, increased defect rates, and cost inefficiencies emerge during scale-up, hampering commercial viability. Most successful implementations have been limited to specialty applications where higher costs can be justified by critical performance requirements.

Regulatory compliance presents growing challenges as environmental regulations increasingly restrict certain healing agents and shell materials. Developing formulations that balance performance requirements with environmental safety standards requires significant reformulation efforts and extensive testing protocols, adding substantial development costs and market entry delays.

Current Microcapsule Formulation Methodologies

01 Microcapsule design for self-healing coatings

Microcapsules can be designed with specific shell materials and core healing agents to enable self-healing functionality in coatings. The shell composition determines the triggering mechanism for healing agent release, while the core contains reactive materials that polymerize or crosslink when exposed to the damaged area. Various shell materials including polymers, silica, and metal oxides can be used to encapsulate healing agents such as epoxy resins, polyurethanes, or siloxanes. The size, distribution, and mechanical properties of these microcapsules are critical for effective healing performance.- Microcapsule design for self-healing coatings: Microcapsules can be designed with specific shell materials and core healing agents to enable self-healing functionality in coatings. The shell composition determines the triggering mechanism for healing, while the core contains reactive materials that polymerize or crosslink when released. Advanced microcapsule designs include multi-layer shells for controlled release and compatibility with various coating matrices. The size, distribution, and mechanical properties of microcapsules significantly impact the overall performance of self-healing coatings.

- Healing mechanisms in microcapsule-based coatings: Self-healing coatings utilize various mechanisms to repair damage, including polymerization, crosslinking, and solvent-assisted healing. When damage occurs, microcapsules rupture and release healing agents that flow into cracks and solidify. Some systems employ catalyst-containing microcapsules that trigger polymerization of surrounding matrix materials. Advanced systems incorporate multiple healing cycles through renewable mechanisms or staged release of different healing agents, providing extended protection against repeated damage events.

- Environmental responsiveness in self-healing systems: Self-healing coatings can be designed to respond to specific environmental triggers such as temperature changes, pH shifts, mechanical stress, or UV radiation. Thermally responsive microcapsules release healing agents at predetermined temperatures, while pH-sensitive shells respond to acidic or alkaline conditions. Some systems incorporate UV-triggered release mechanisms for outdoor applications. These environmentally responsive features enable autonomous healing without external intervention, making them particularly valuable for applications in remote or inaccessible locations.

- Integration of microcapsules with coating matrices: Successful integration of microcapsules into coating matrices requires careful consideration of compatibility, dispersion, and adhesion factors. Surface modification of microcapsules can improve their dispersion and adhesion within the coating matrix. Optimized loading percentages balance healing capacity with coating mechanical properties, as excessive microcapsule content can compromise strength and durability. Advanced formulation techniques include gradient distribution of microcapsules to concentrate healing capacity in areas most prone to damage while maintaining overall coating performance.

- Application-specific self-healing coating formulations: Self-healing coatings can be tailored for specific applications such as automotive finishes, marine coatings, aerospace materials, and infrastructure protection. Corrosion-resistant formulations incorporate corrosion inhibitors within microcapsules to provide both healing and active protection. Abrasion-resistant variants combine self-healing with hardening agents to restore surface integrity after scratching. High-temperature applications utilize specialized microcapsules with thermal stability and healing agents that remain effective under extreme conditions. These application-specific formulations address unique challenges in different industrial sectors.

02 Healing mechanisms and chemistry

Self-healing coatings utilize various chemical mechanisms to repair damage. These include polymerization reactions triggered by environmental factors (oxygen, moisture, heat), ring-opening polymerization of cyclic monomers, and condensation reactions. Some systems employ multi-component healing chemistry where separate microcapsules contain complementary reactants that mix upon rupture. Others use latent catalysts that activate when exposed to specific conditions. The healing chemistry must be compatible with the coating matrix while providing sufficient mechanical properties after curing.Expand Specific Solutions03 Integration of microcapsules into coating matrices

Successful integration of microcapsules into coating formulations requires careful consideration of compatibility between the capsule shell and the coating matrix. Techniques include surface modification of microcapsules to improve dispersion, optimizing microcapsule loading percentages to balance healing capacity with coating integrity, and developing application methods that prevent premature rupture during coating application. The distribution of microcapsules throughout the coating thickness affects healing efficiency, with gradient distributions sometimes preferred for specific applications.Expand Specific Solutions04 Multi-functional self-healing coatings

Advanced self-healing coating systems combine healing functionality with additional protective properties. These include corrosion inhibition through the incorporation of corrosion inhibitors within microcapsules, antimicrobial properties by encapsulating biocides or antimicrobial agents, and enhanced UV resistance through the addition of UV absorbers or stabilizers. Some systems also incorporate flame retardants or hydrophobic agents to create multi-functional protective coatings that can heal while providing multiple forms of protection against environmental damage.Expand Specific Solutions05 Smart triggering mechanisms for controlled healing

Smart self-healing coatings employ sophisticated triggering mechanisms to control the release of healing agents. These include pH-responsive microcapsules that rupture in response to the acidic environment of corrosion sites, temperature-sensitive shells that release healing agents at specific temperature thresholds, and mechanically responsive systems that rupture precisely under certain stress levels. Some advanced systems use electromagnetic or light-triggered release mechanisms. These smart triggering approaches ensure that healing agents are released only when and where needed, improving efficiency and extending the coating's service life.Expand Specific Solutions

Leading Companies in Self-Healing Coating Industry

The microcapsule-based self-healing coating market is currently in a growth phase, with increasing adoption across industries like automotive, construction, and marine applications. The global market size for smart coatings, including self-healing technologies, is projected to reach $15-20 billion by 2025, growing at 20% CAGR. Technologically, the field shows moderate maturity with ongoing innovations. Leading academic institutions (Nanyang Technological University, Johns Hopkins University, HKUST) are driving fundamental research, while commercial players represent diverse segments: established coating manufacturers (Tata Steel, China Petroleum & Chemical Corp.), specialized coating developers (NO CORROSION LLC, Jiangsu Jinling Special Paint), and automotive/industrial companies (GM Global Technology, NSK Ltd.) focusing on application-specific formulations. The collaboration between research institutions and industry partners is accelerating commercialization of these advanced coating technologies.

Nanyang Technological University

Technical Solution: Nanyang Technological University (NTU) has developed advanced microcapsule-based self-healing coating formulations using urea-formaldehyde (UF) and melamine-formaldehyde (MF) shell materials to encapsulate various healing agents. Their approach focuses on optimizing shell thickness and mechanical properties to ensure controlled release of healing agents upon coating damage. NTU researchers have pioneered the use of environmentally-friendly core materials such as linseed oil and tung oil that polymerize upon exposure to oxygen when released from ruptured microcapsules[1]. They've also developed dual-component healing systems where separate microcapsules containing epoxy resin and hardener components are incorporated into the coating matrix, allowing for more robust healing mechanisms. Their formulations typically achieve healing efficiencies of 85-95% in corrosion protection, with microcapsule loading optimized at 10-15 wt% to balance self-healing capability with coating mechanical integrity[2].

Strengths: Superior encapsulation efficiency with precisely controlled shell thickness and permeability. Advanced dual-component healing systems provide more complete restoration of coating properties. Weaknesses: Higher production costs compared to conventional coatings. Potential shelf-life limitations of reactive components in microcapsules over extended storage periods.

Council of Scientific & Industrial Research

Technical Solution: The Council of Scientific & Industrial Research (CSIR) has developed proprietary microcapsule-based self-healing coating formulations utilizing polysulfone and polyurethane shell materials with enhanced mechanical stability. Their approach incorporates multi-walled carbon nanotubes (MWCNTs) into the microcapsule shell structure, significantly improving rupture strength while maintaining appropriate brittleness for damage-triggered release[3]. CSIR's formulations employ specialized healing agents including siloxane-modified epoxy resins that provide both healing capability and improved hydrophobicity to the restored areas. Their manufacturing process utilizes a modified in-situ polymerization technique that achieves narrower size distribution (typically 50-150 μm) and higher encapsulation efficiency (>90%) compared to conventional methods[4]. CSIR has optimized dispersion techniques to prevent microcapsule agglomeration in coating matrices, using functionalized silica nanoparticles as dispersing agents to maintain uniform distribution throughout the coating, resulting in more consistent self-healing performance across the protected surface.

Strengths: Enhanced mechanical stability of microcapsules through carbon nanotube reinforcement. Superior dispersion technology prevents agglomeration issues common in microcapsule-loaded coatings. Weaknesses: Complex manufacturing process increases production costs. Carbon nanotube incorporation raises potential environmental and regulatory concerns in some markets.

Key Patents in Microcapsule-Based Self-Healing Systems

One-component waterborne self-healing epoxy formulation

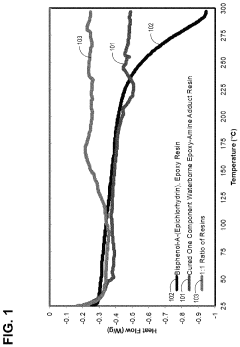

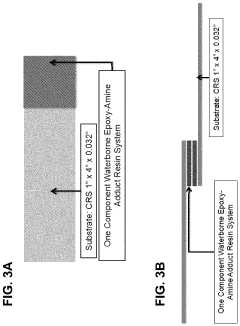

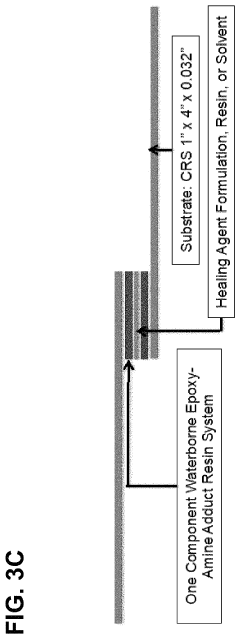

PatentActiveUS11613668B2

Innovation

- A one-component waterborne epoxy-amine adduct resin system combined with a microencapsulated healing agent, which includes an epoxy resin, a polar aprotic solvent, and an alkoxysilane, that upon application and curing, forms a self-healing coating that maintains adhesion and corrosion resistance by releasing the healing agent at sites of damage to promote cross-linking and entanglement of oligomeric components.

Self-healing material comprising microcapsule, method for self-healing using the same

PatentInactiveKR1020130051127A

Innovation

- Multi-layer encapsulation system with microcapsules surrounded by nanocapsules, enabling repeated self-healing capability for multiple micro-cracks.

- Two-stage healing process where first microcapsules and then nanocapsules burst upon crack formation, extending the self-healing lifetime of the coating.

- Integration of adhesive material and catalyst in a hierarchical capsule system that maintains healing potential after initial damage repair.

Environmental Impact and Sustainability Considerations

The environmental impact of microcapsule-based self-healing coatings represents a critical consideration in their development and application. These innovative coatings offer significant sustainability advantages through extended product lifecycles, reducing the frequency of reapplication and associated resource consumption. By autonomously repairing minor damage, these coatings minimize waste generation and decrease the environmental footprint associated with conventional maintenance procedures.

Material selection for microcapsules presents both challenges and opportunities from an environmental perspective. Biodegradable shell materials such as modified cellulose, polylactic acid (PLA), and protein-based polymers are increasingly being incorporated into formulations to address end-of-life concerns. These materials ensure that when the coating eventually degrades, it leaves minimal persistent environmental residues compared to traditional petroleum-based alternatives.

Volatile Organic Compound (VOC) emissions remain a significant concern in coating technologies. Research indicates that self-healing formulations can be designed with water-based systems or high-solid content approaches that substantially reduce VOC emissions during application and curing processes. Recent advancements have demonstrated up to 70% reduction in VOCs compared to conventional coating systems while maintaining self-healing functionality.

Life Cycle Assessment (LCA) studies of microcapsule-based coatings reveal complex sustainability profiles. While the production of specialized microcapsules may initially require more energy and resources than conventional coatings, this investment is typically offset by extended service life and reduced maintenance requirements. Comprehensive LCA analyses suggest net positive environmental outcomes when considering the full product lifecycle, particularly in harsh environmental applications where frequent recoating would otherwise be necessary.

Regulatory compliance represents another dimension of environmental consideration. Formulations must increasingly meet stringent global standards regarding hazardous substances, such as REACH in Europe and similar frameworks in other regions. Manufacturers are developing microcapsule systems that eliminate substances of very high concern (SVHCs) while maintaining performance characteristics, ensuring market access and environmental safety simultaneously.

End-of-life management strategies for these coatings are evolving alongside advances in formulation. Research into triggerable degradation mechanisms allows for controlled breakdown of coating systems when their useful life concludes. Some innovative approaches incorporate enzymes or photocatalytic materials that accelerate decomposition under specific conditions, facilitating more effective recycling or safer disposal of coated substrates.

Material selection for microcapsules presents both challenges and opportunities from an environmental perspective. Biodegradable shell materials such as modified cellulose, polylactic acid (PLA), and protein-based polymers are increasingly being incorporated into formulations to address end-of-life concerns. These materials ensure that when the coating eventually degrades, it leaves minimal persistent environmental residues compared to traditional petroleum-based alternatives.

Volatile Organic Compound (VOC) emissions remain a significant concern in coating technologies. Research indicates that self-healing formulations can be designed with water-based systems or high-solid content approaches that substantially reduce VOC emissions during application and curing processes. Recent advancements have demonstrated up to 70% reduction in VOCs compared to conventional coating systems while maintaining self-healing functionality.

Life Cycle Assessment (LCA) studies of microcapsule-based coatings reveal complex sustainability profiles. While the production of specialized microcapsules may initially require more energy and resources than conventional coatings, this investment is typically offset by extended service life and reduced maintenance requirements. Comprehensive LCA analyses suggest net positive environmental outcomes when considering the full product lifecycle, particularly in harsh environmental applications where frequent recoating would otherwise be necessary.

Regulatory compliance represents another dimension of environmental consideration. Formulations must increasingly meet stringent global standards regarding hazardous substances, such as REACH in Europe and similar frameworks in other regions. Manufacturers are developing microcapsule systems that eliminate substances of very high concern (SVHCs) while maintaining performance characteristics, ensuring market access and environmental safety simultaneously.

End-of-life management strategies for these coatings are evolving alongside advances in formulation. Research into triggerable degradation mechanisms allows for controlled breakdown of coating systems when their useful life concludes. Some innovative approaches incorporate enzymes or photocatalytic materials that accelerate decomposition under specific conditions, facilitating more effective recycling or safer disposal of coated substrates.

Durability Testing and Performance Metrics

The durability testing of microcapsule-based self-healing coatings requires comprehensive evaluation protocols to ensure reliable performance in real-world applications. Standard accelerated aging tests, including UV exposure (ASTM G154), salt spray testing (ASTM B117), and thermal cycling, provide critical data on coating longevity. These tests typically run for 1,000-5,000 hours, simulating years of environmental exposure in condensed timeframes.

Performance metrics for self-healing coatings extend beyond conventional coating evaluations. Healing efficiency, calculated as the percentage of recovered mechanical or barrier properties after damage, serves as a primary quantitative measure. Advanced techniques such as electrochemical impedance spectroscopy (EIS) enable real-time monitoring of barrier property restoration, while mechanical testing assesses the recovery of structural integrity post-healing.

Scratch resistance recovery testing employs standardized methods like the pencil hardness test (ASTM D3363) and nano-indentation to quantify healing performance. These tests typically involve creating controlled damage, allowing a specified healing period (24-72 hours), and then measuring property restoration. Industry benchmarks suggest that high-performance self-healing coatings should demonstrate at least 85% recovery of barrier properties within 48 hours of damage occurrence.

Environmental resilience testing examines healing capability across various conditions, as temperature and humidity significantly impact healing kinetics. Optimal healing typically occurs between 20-35°C and 40-70% relative humidity, with performance metrics tracking healing efficiency across these ranges. Multiple healing cycle testing further evaluates the coating's capacity for repeated self-repair, with premium formulations maintaining at least 70% healing efficiency after five damage-healing cycles.

Long-term stability assessment involves monitoring microcapsule integrity and reactivity over time. Shelf-life testing protocols typically span 12-24 months, with periodic evaluation of healing performance. Successful formulations maintain at least 80% of their initial healing capacity after one year of storage under controlled conditions. These comprehensive testing protocols and performance metrics provide standardized frameworks for evaluating and comparing different microcapsule-based self-healing coating formulations.

Performance metrics for self-healing coatings extend beyond conventional coating evaluations. Healing efficiency, calculated as the percentage of recovered mechanical or barrier properties after damage, serves as a primary quantitative measure. Advanced techniques such as electrochemical impedance spectroscopy (EIS) enable real-time monitoring of barrier property restoration, while mechanical testing assesses the recovery of structural integrity post-healing.

Scratch resistance recovery testing employs standardized methods like the pencil hardness test (ASTM D3363) and nano-indentation to quantify healing performance. These tests typically involve creating controlled damage, allowing a specified healing period (24-72 hours), and then measuring property restoration. Industry benchmarks suggest that high-performance self-healing coatings should demonstrate at least 85% recovery of barrier properties within 48 hours of damage occurrence.

Environmental resilience testing examines healing capability across various conditions, as temperature and humidity significantly impact healing kinetics. Optimal healing typically occurs between 20-35°C and 40-70% relative humidity, with performance metrics tracking healing efficiency across these ranges. Multiple healing cycle testing further evaluates the coating's capacity for repeated self-repair, with premium formulations maintaining at least 70% healing efficiency after five damage-healing cycles.

Long-term stability assessment involves monitoring microcapsule integrity and reactivity over time. Shelf-life testing protocols typically span 12-24 months, with periodic evaluation of healing performance. Successful formulations maintain at least 80% of their initial healing capacity after one year of storage under controlled conditions. These comprehensive testing protocols and performance metrics provide standardized frameworks for evaluating and comparing different microcapsule-based self-healing coating formulations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!