Commercialization Case Studies And IP Landscape For Lithium-Sulfur

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Li-S Battery Evolution and Objectives

Lithium-Sulfur (Li-S) batteries have emerged as a promising next-generation energy storage technology, with a theoretical energy density of 2600 Wh/kg, significantly surpassing the 387 Wh/kg limit of conventional lithium-ion batteries. The evolution of Li-S battery technology can be traced back to the 1960s when the first conceptual designs were proposed, though meaningful progress only began in the early 2000s with advancements in materials science and nanotechnology.

The developmental trajectory of Li-S batteries has been characterized by three distinct phases. The initial phase (2000-2010) focused on fundamental research, establishing the basic electrochemical principles and identifying the polysulfide shuttle effect as a critical challenge. The second phase (2010-2018) witnessed significant improvements in cathode materials, with the introduction of carbon-sulfur composites and the development of functional separators to mitigate polysulfide dissolution.

The current phase (2018-present) represents an acceleration toward commercialization, with enhanced focus on practical aspects such as cycle life extension, rate capability improvement, and manufacturing scalability. This evolution has been driven by the growing demand for high-energy-density storage solutions in electric vehicles, aerospace applications, and portable electronics, where conventional lithium-ion technology is approaching its theoretical limits.

The primary technical objectives for Li-S battery development center around addressing four fundamental challenges. First, overcoming the insulating nature of sulfur through advanced conductive frameworks and nanostructured composites. Second, mitigating the polysulfide shuttle effect via functional interlayers, modified separators, and electrolyte engineering. Third, controlling the substantial volume expansion (approximately 80%) during lithiation through flexible electrode designs and robust binders.

Fourth, enhancing the poor cycle life, which currently limits commercial viability, through protective coatings for lithium anodes and stable solid electrolyte interfaces. Recent research indicates that achieving 500+ stable cycles at practical loading conditions represents a critical threshold for commercial adoption in specific market segments.

The long-term objective is to develop Li-S batteries with energy densities exceeding 500 Wh/kg at the cell level, cycle life beyond 1000 cycles, and production costs below $100/kWh. These targets align with the projected requirements for next-generation electric vehicles and grid storage applications by 2030, positioning Li-S technology as a potential successor to conventional lithium-ion batteries in applications where energy density is paramount.

Industry projections suggest that achieving these objectives could enable Li-S batteries to capture up to 5% of the global battery market by 2030, representing a $15-20 billion opportunity. The technology roadmap indicates that initial commercial applications will likely emerge in niche sectors such as aerospace and military applications, where the premium for high energy density justifies higher costs and shorter cycle life.

The developmental trajectory of Li-S batteries has been characterized by three distinct phases. The initial phase (2000-2010) focused on fundamental research, establishing the basic electrochemical principles and identifying the polysulfide shuttle effect as a critical challenge. The second phase (2010-2018) witnessed significant improvements in cathode materials, with the introduction of carbon-sulfur composites and the development of functional separators to mitigate polysulfide dissolution.

The current phase (2018-present) represents an acceleration toward commercialization, with enhanced focus on practical aspects such as cycle life extension, rate capability improvement, and manufacturing scalability. This evolution has been driven by the growing demand for high-energy-density storage solutions in electric vehicles, aerospace applications, and portable electronics, where conventional lithium-ion technology is approaching its theoretical limits.

The primary technical objectives for Li-S battery development center around addressing four fundamental challenges. First, overcoming the insulating nature of sulfur through advanced conductive frameworks and nanostructured composites. Second, mitigating the polysulfide shuttle effect via functional interlayers, modified separators, and electrolyte engineering. Third, controlling the substantial volume expansion (approximately 80%) during lithiation through flexible electrode designs and robust binders.

Fourth, enhancing the poor cycle life, which currently limits commercial viability, through protective coatings for lithium anodes and stable solid electrolyte interfaces. Recent research indicates that achieving 500+ stable cycles at practical loading conditions represents a critical threshold for commercial adoption in specific market segments.

The long-term objective is to develop Li-S batteries with energy densities exceeding 500 Wh/kg at the cell level, cycle life beyond 1000 cycles, and production costs below $100/kWh. These targets align with the projected requirements for next-generation electric vehicles and grid storage applications by 2030, positioning Li-S technology as a potential successor to conventional lithium-ion batteries in applications where energy density is paramount.

Industry projections suggest that achieving these objectives could enable Li-S batteries to capture up to 5% of the global battery market by 2030, representing a $15-20 billion opportunity. The technology roadmap indicates that initial commercial applications will likely emerge in niche sectors such as aerospace and military applications, where the premium for high energy density justifies higher costs and shorter cycle life.

Market Analysis for Li-S Battery Adoption

The lithium-sulfur (Li-S) battery market is experiencing significant growth potential due to the technology's promising energy density advantages over conventional lithium-ion batteries. Current market projections indicate that the global Li-S battery market could reach $2.1 billion by 2030, with a compound annual growth rate exceeding 30% from 2023 to 2030. This growth trajectory is primarily driven by increasing demands for high-energy-density storage solutions in aerospace, defense, and electric vehicle applications.

Market segmentation analysis reveals that the transportation sector, particularly electric vehicles and aviation, represents the largest potential market for Li-S batteries. The automotive industry's shift toward electrification creates substantial demand for batteries with higher energy density and lower weight profiles, precisely where Li-S technology offers competitive advantages. Aviation and aerospace sectors show particular interest due to the critical weight-to-energy ratio benefits that Li-S batteries provide.

Consumer electronics represents another significant market segment, though adoption faces more barriers due to cycle life limitations. The stationary energy storage market presents a long-term opportunity, especially as cycle life improvements make Li-S more viable for grid applications.

Regional market analysis indicates that Asia-Pacific, particularly China, South Korea, and Japan, leads in Li-S battery development and potential market adoption, accounting for approximately 45% of global research activities and commercial initiatives. North America follows with strong research programs and startup ecosystems focused on Li-S technology, while Europe demonstrates growing interest through targeted funding programs and industrial partnerships.

Market adoption barriers remain significant, with cycle life limitations being the primary technical obstacle. Current Li-S batteries typically achieve 200-500 cycles before significant capacity degradation, compared to 1,000+ cycles for commercial lithium-ion batteries. This limitation restricts immediate adoption in applications requiring long service life.

Cost factors present a complex picture. While sulfur as a cathode material offers substantial raw material cost advantages over cobalt and nickel, current manufacturing processes for Li-S batteries remain specialized and expensive. Market analysis suggests that economies of scale could reduce production costs by 60-70% over the next five years, potentially making Li-S batteries cost-competitive with advanced lithium-ion technologies.

Consumer perception and industry readiness also influence market adoption timelines. The battery industry's established infrastructure is optimized for lithium-ion production, requiring significant investment to transition to Li-S manufacturing at scale. Market forecasts suggest initial commercial adoption in niche high-value applications, with broader market penetration expected after 2025 as technical limitations are addressed.

Market segmentation analysis reveals that the transportation sector, particularly electric vehicles and aviation, represents the largest potential market for Li-S batteries. The automotive industry's shift toward electrification creates substantial demand for batteries with higher energy density and lower weight profiles, precisely where Li-S technology offers competitive advantages. Aviation and aerospace sectors show particular interest due to the critical weight-to-energy ratio benefits that Li-S batteries provide.

Consumer electronics represents another significant market segment, though adoption faces more barriers due to cycle life limitations. The stationary energy storage market presents a long-term opportunity, especially as cycle life improvements make Li-S more viable for grid applications.

Regional market analysis indicates that Asia-Pacific, particularly China, South Korea, and Japan, leads in Li-S battery development and potential market adoption, accounting for approximately 45% of global research activities and commercial initiatives. North America follows with strong research programs and startup ecosystems focused on Li-S technology, while Europe demonstrates growing interest through targeted funding programs and industrial partnerships.

Market adoption barriers remain significant, with cycle life limitations being the primary technical obstacle. Current Li-S batteries typically achieve 200-500 cycles before significant capacity degradation, compared to 1,000+ cycles for commercial lithium-ion batteries. This limitation restricts immediate adoption in applications requiring long service life.

Cost factors present a complex picture. While sulfur as a cathode material offers substantial raw material cost advantages over cobalt and nickel, current manufacturing processes for Li-S batteries remain specialized and expensive. Market analysis suggests that economies of scale could reduce production costs by 60-70% over the next five years, potentially making Li-S batteries cost-competitive with advanced lithium-ion technologies.

Consumer perception and industry readiness also influence market adoption timelines. The battery industry's established infrastructure is optimized for lithium-ion production, requiring significant investment to transition to Li-S manufacturing at scale. Market forecasts suggest initial commercial adoption in niche high-value applications, with broader market penetration expected after 2025 as technical limitations are addressed.

Technical Barriers and Global Development Status

Despite the promising theoretical energy density of lithium-sulfur (Li-S) batteries, several significant technical barriers have hindered their widespread commercialization. The primary challenge remains the "polysulfide shuttle effect," where soluble lithium polysulfides dissolve in the electrolyte during cycling, causing active material loss, reduced coulombic efficiency, and accelerated capacity fading. This phenomenon has proven particularly difficult to overcome in practical applications.

Another critical barrier is the substantial volume expansion (approximately 80%) that sulfur undergoes during lithium insertion, leading to mechanical stress and eventual electrode degradation. This expansion compromises the structural integrity of the cathode and contributes to poor cycle life in commercial prototypes.

The low electrical conductivity of sulfur (5×10^-30 S/cm) presents additional challenges, necessitating conductive additives that reduce the overall energy density of the battery system. Furthermore, the slow reaction kinetics at the sulfur cathode results in limited rate capability, making Li-S batteries less suitable for high-power applications.

Globally, research and development efforts are distributed across major technology hubs. North America leads in fundamental research, with institutions like Stanford University and Pacific Northwest National Laboratory focusing on novel electrolyte formulations and sulfur host materials. The United States holds approximately 35% of Li-S battery patents globally.

In Asia, China has emerged as the dominant force in Li-S battery development, with companies like OXIS Energy China and research at Tsinghua University advancing practical applications. South Korea and Japan also maintain significant research programs, with Samsung and Toyota among the key industrial players. Collectively, Asian countries account for nearly 50% of global Li-S battery patents.

European development is centered in the United Kingdom and Germany, where companies like OXIS Energy (before its 2021 bankruptcy) and Fraunhofer Institute have made substantial contributions to Li-S technology. The European Union has funded several large-scale research initiatives through Horizon 2020 programs, focusing on materials innovation and manufacturing processes.

Current technology readiness level (TRL) assessments place Li-S batteries at TRL 5-6, indicating validation in relevant environments but still requiring significant development before full commercial deployment. While laboratory cells have demonstrated energy densities exceeding 400 Wh/kg, commercial prototypes typically achieve 250-350 Wh/kg with limited cycle life (typically 100-300 cycles), significantly below the 1,000+ cycles required for most commercial applications.

Another critical barrier is the substantial volume expansion (approximately 80%) that sulfur undergoes during lithium insertion, leading to mechanical stress and eventual electrode degradation. This expansion compromises the structural integrity of the cathode and contributes to poor cycle life in commercial prototypes.

The low electrical conductivity of sulfur (5×10^-30 S/cm) presents additional challenges, necessitating conductive additives that reduce the overall energy density of the battery system. Furthermore, the slow reaction kinetics at the sulfur cathode results in limited rate capability, making Li-S batteries less suitable for high-power applications.

Globally, research and development efforts are distributed across major technology hubs. North America leads in fundamental research, with institutions like Stanford University and Pacific Northwest National Laboratory focusing on novel electrolyte formulations and sulfur host materials. The United States holds approximately 35% of Li-S battery patents globally.

In Asia, China has emerged as the dominant force in Li-S battery development, with companies like OXIS Energy China and research at Tsinghua University advancing practical applications. South Korea and Japan also maintain significant research programs, with Samsung and Toyota among the key industrial players. Collectively, Asian countries account for nearly 50% of global Li-S battery patents.

European development is centered in the United Kingdom and Germany, where companies like OXIS Energy (before its 2021 bankruptcy) and Fraunhofer Institute have made substantial contributions to Li-S technology. The European Union has funded several large-scale research initiatives through Horizon 2020 programs, focusing on materials innovation and manufacturing processes.

Current technology readiness level (TRL) assessments place Li-S batteries at TRL 5-6, indicating validation in relevant environments but still requiring significant development before full commercial deployment. While laboratory cells have demonstrated energy densities exceeding 400 Wh/kg, commercial prototypes typically achieve 250-350 Wh/kg with limited cycle life (typically 100-300 cycles), significantly below the 1,000+ cycles required for most commercial applications.

Current Commercialization Approaches

01 Electrode materials for lithium-sulfur batteries

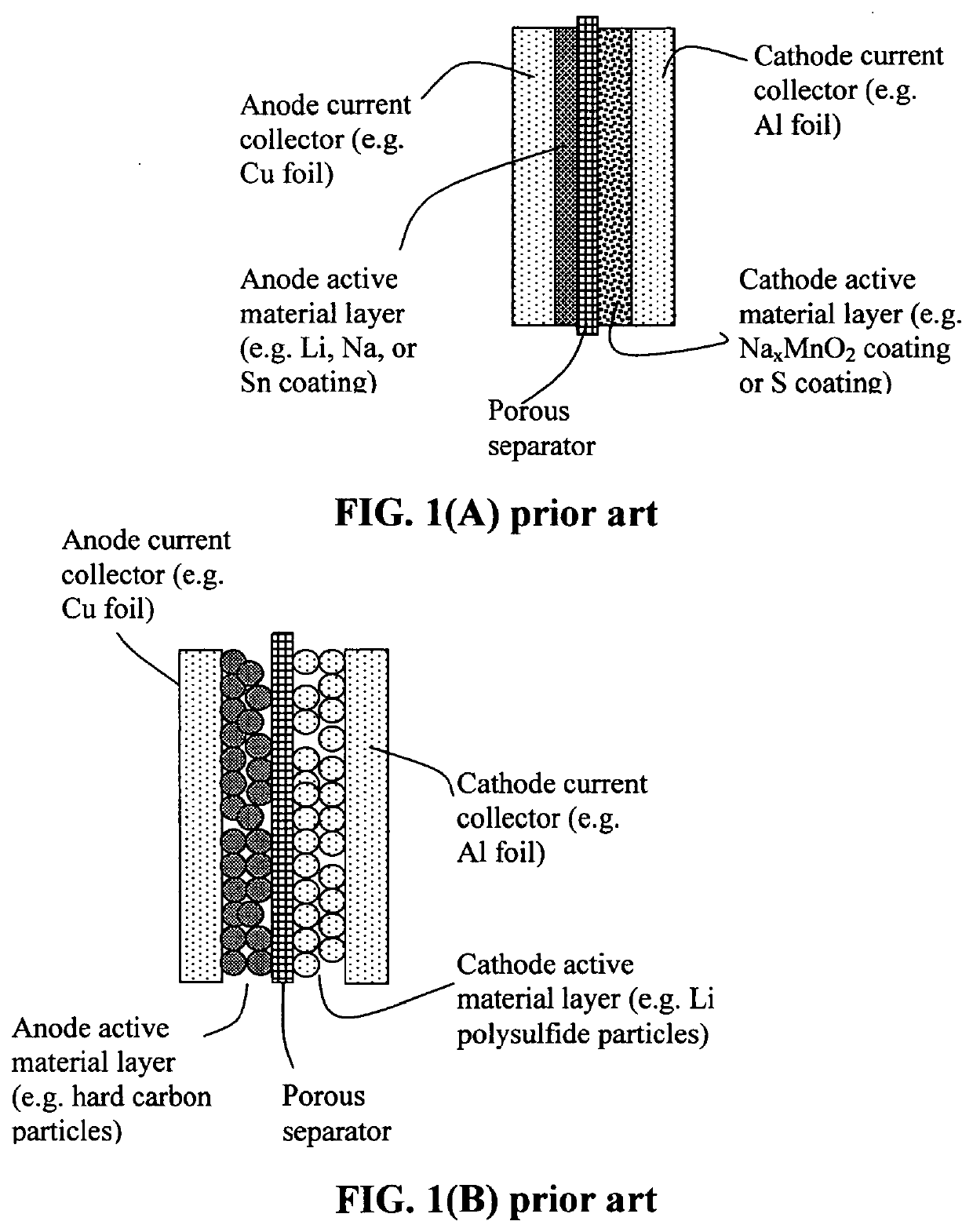

Various electrode materials can be used in lithium-sulfur batteries to improve performance. These materials include carbon-based structures, metal oxides, and composite materials that can enhance conductivity and provide physical confinement for sulfur. The electrode materials help to address issues such as the shuttle effect and volume expansion during cycling, thereby improving the overall efficiency and lifespan of the battery.- Electrode materials for lithium-sulfur batteries: Various electrode materials can be used in lithium-sulfur batteries to improve performance. These materials include carbon-based structures, metal oxides, and composite materials that can enhance conductivity and provide better sulfur utilization. The electrode materials play a crucial role in addressing challenges such as the shuttle effect and volume expansion during cycling, thereby improving the overall battery performance and cycle life.

- Electrolyte compositions for lithium-sulfur batteries: Specialized electrolyte formulations can significantly improve the performance of lithium-sulfur batteries. These electrolytes often contain additives that suppress the dissolution of polysulfides, enhance ionic conductivity, and form stable interfaces with the electrodes. The composition of the electrolyte affects the battery's capacity retention, cycling stability, and rate capability by controlling the chemical reactions and transport processes within the cell.

- Sulfur cathode structures and compositions: Advanced cathode structures and compositions are designed to accommodate sulfur and its reaction products effectively. These designs often involve encapsulating sulfur within porous hosts, creating core-shell structures, or using conductive polymers to improve electron transport. The cathode architecture aims to contain polysulfides, provide sufficient space for volume changes, and maintain electrical contact throughout cycling, thereby enhancing capacity and cycle life.

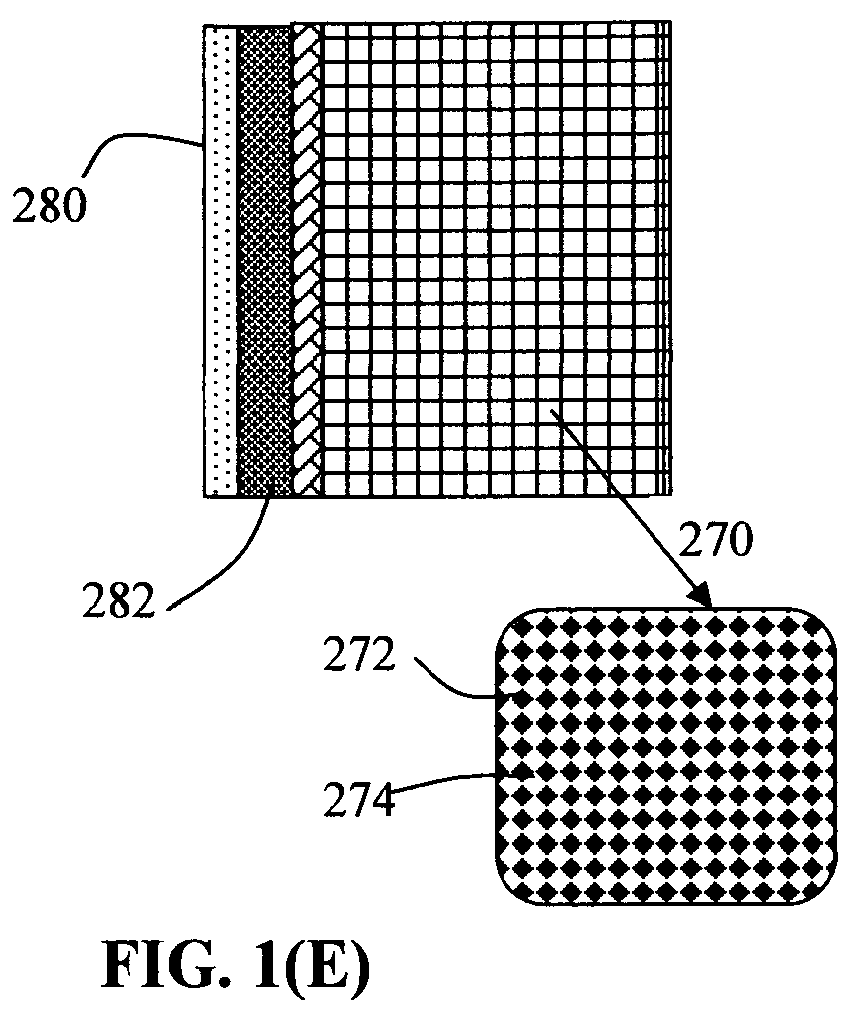

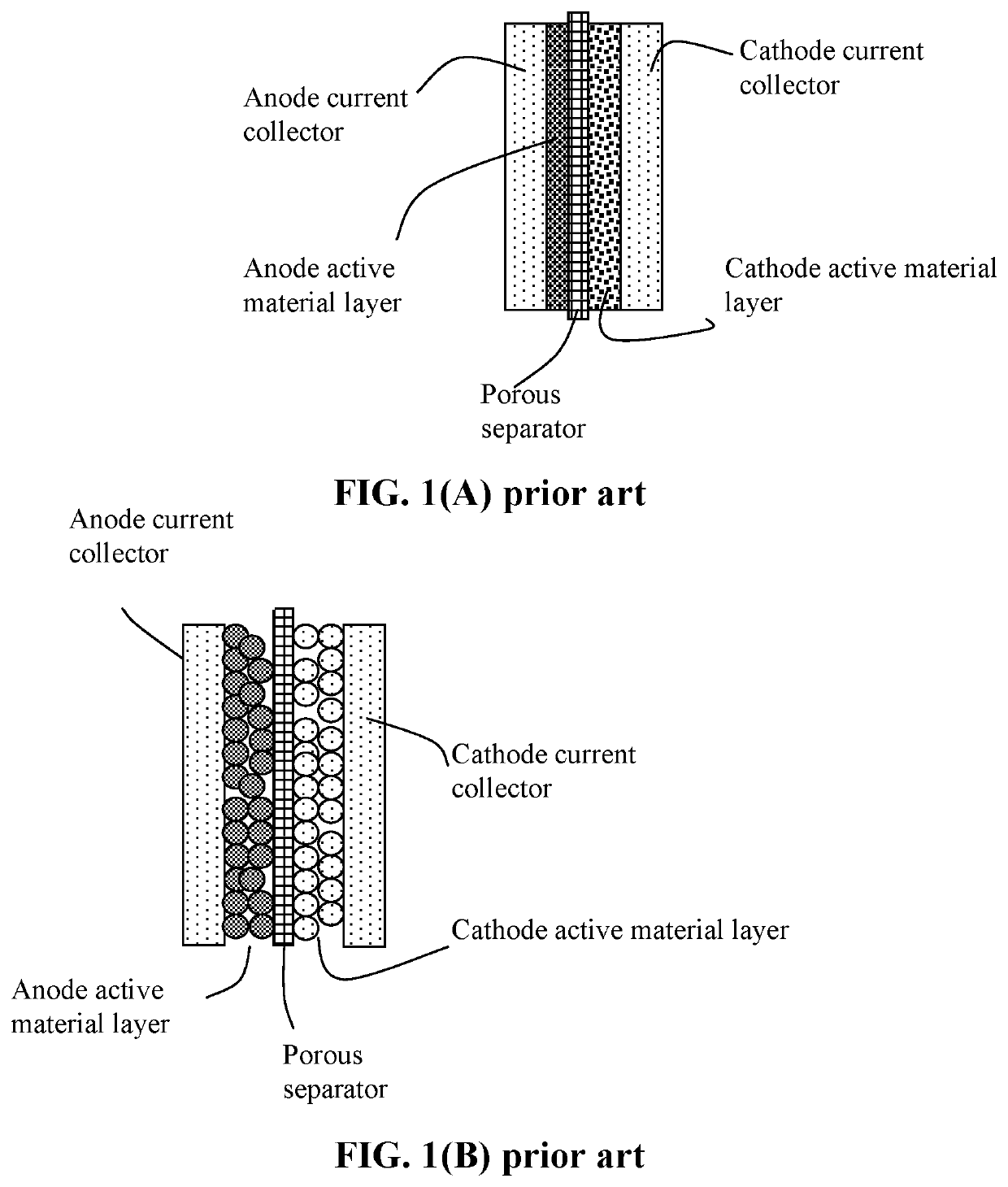

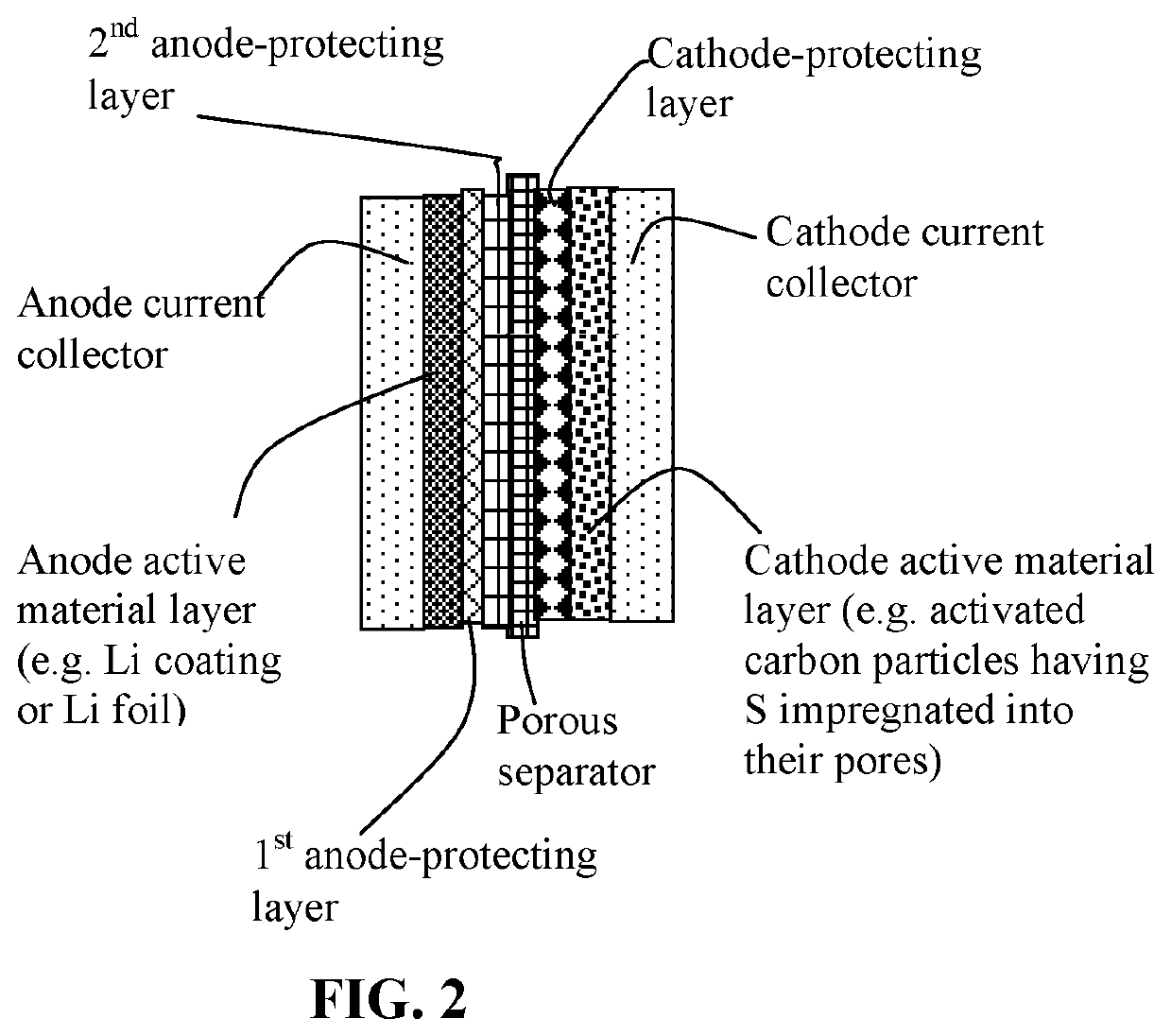

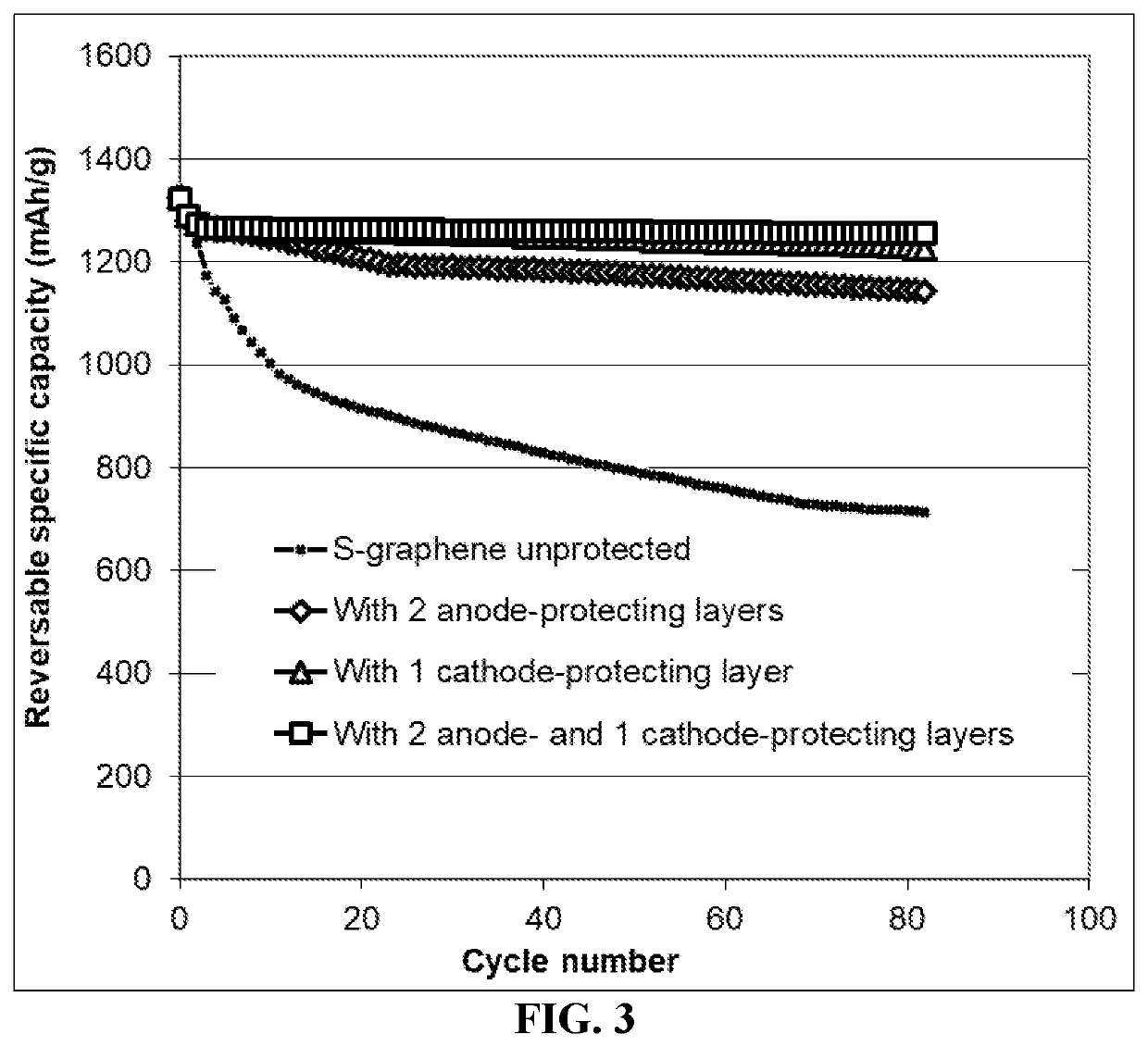

- Protective layers and interfaces for lithium anodes: Protective layers and interface engineering for lithium anodes can prevent unwanted reactions with polysulfides and electrolytes. These protective strategies include artificial solid electrolyte interphase formation, coating the lithium with polymers or inorganic materials, and using interlayers between the anode and separator. Such approaches help to stabilize the lithium anode, prevent dendrite formation, and extend the battery's cycle life by reducing side reactions.

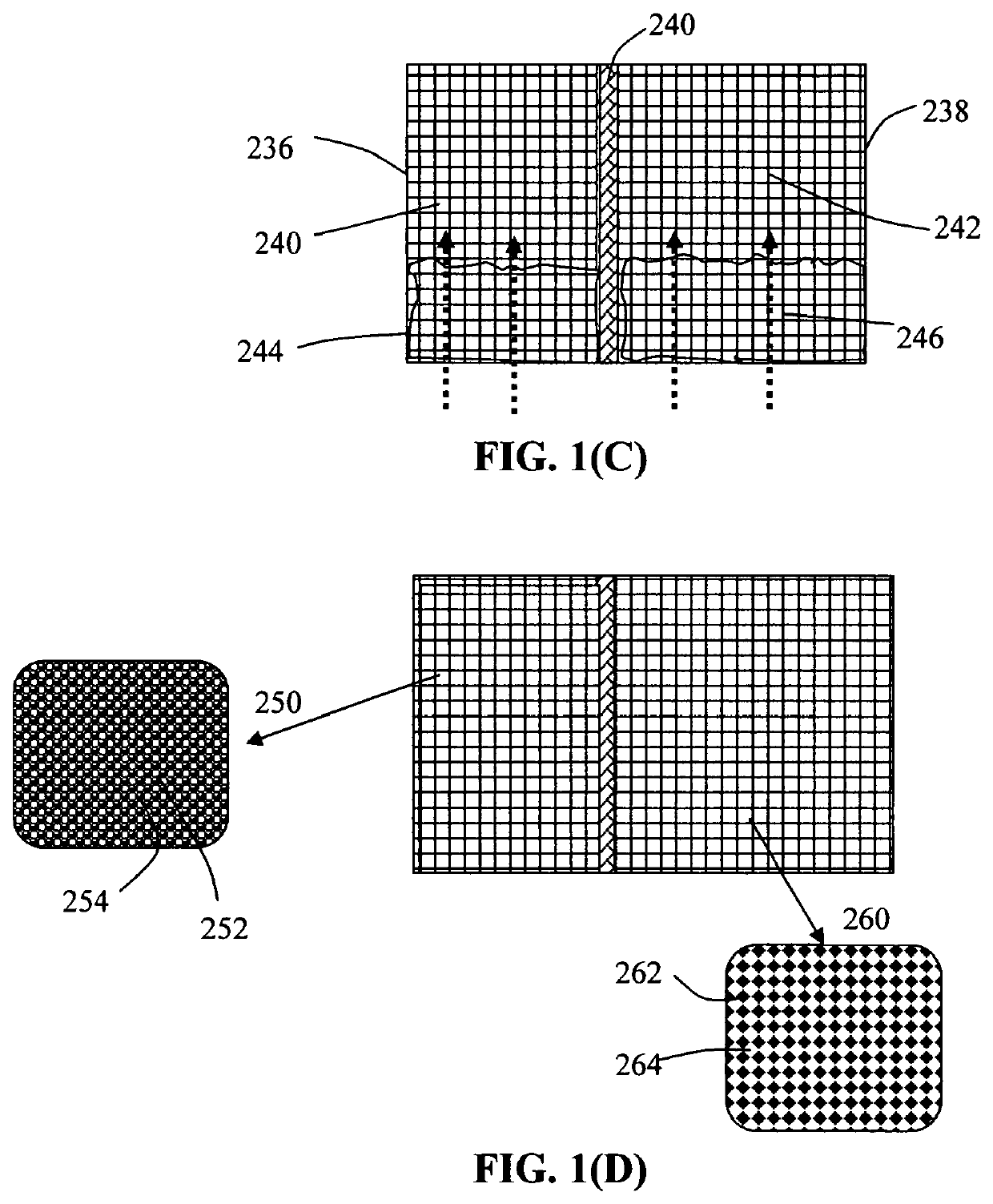

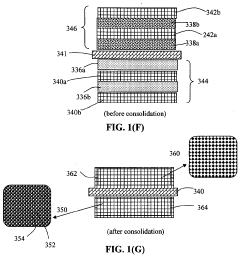

- Novel cell designs and manufacturing methods: Innovative cell designs and manufacturing methods can address the unique challenges of lithium-sulfur batteries. These approaches include new cell configurations, advanced assembly techniques, and specialized manufacturing processes that optimize the spatial arrangement of components. Novel designs may incorporate features like interlayers, gradient structures, or 3D architectures to improve ion transport, contain active materials, and enhance overall battery performance and safety.

02 Electrolyte compositions for lithium-sulfur batteries

Specialized electrolyte compositions can significantly enhance the performance of lithium-sulfur batteries. These electrolytes may include additives that suppress the dissolution of polysulfides, improve ionic conductivity, or form stable solid-electrolyte interfaces. By optimizing the electrolyte composition, issues such as self-discharge and capacity fading can be mitigated, leading to improved cycling stability and longer battery life.Expand Specific Solutions03 Protective layers and interlayers in lithium-sulfur batteries

Incorporating protective layers and interlayers in lithium-sulfur batteries can help prevent polysulfide shuttling and protect the lithium anode from degradation. These layers can be made from various materials including polymers, ceramics, or composite structures. By effectively blocking polysulfide migration while allowing lithium ion transport, these protective structures enhance the coulombic efficiency and cycle life of the batteries.Expand Specific Solutions04 Nanostructured sulfur cathodes

Nanostructured sulfur cathodes offer improved performance in lithium-sulfur batteries by providing better sulfur utilization and accommodating volume changes during cycling. These cathodes may incorporate sulfur into nanoporous structures, encapsulate sulfur in nanoparticles, or use sulfur-polymer composites. The nanostructured design helps to contain polysulfides within the cathode, improve electronic conductivity, and enhance the rate capability of the battery.Expand Specific Solutions05 Manufacturing methods for lithium-sulfur battery components

Various manufacturing methods can be employed to produce high-performance components for lithium-sulfur batteries. These methods include solution processing, melt diffusion, chemical vapor deposition, and electrospinning techniques. Advanced manufacturing approaches can help to achieve uniform sulfur distribution, create optimized pore structures, and establish intimate contact between sulfur and conductive additives, resulting in batteries with higher energy density and better cycling performance.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The lithium-sulfur battery market is currently in an early commercialization phase, characterized by rapid technological advancement and growing market potential due to its theoretical energy density advantages over lithium-ion batteries. The global market size is projected to expand significantly as companies overcome key technical challenges including sulfur cathode stability and polysulfide shuttle effect. Leading players demonstrate varying levels of technical maturity, with established battery manufacturers like LG Energy Solution, CATL, and BYD focusing on commercial viability, while academic institutions (MIT, Cornell, Johns Hopkins) drive fundamental research. Companies like DuPont and FMC contribute materials expertise. The competitive landscape shows a strategic balance between battery giants with manufacturing capabilities and specialized technology developers addressing specific performance limitations through innovative approaches to electrolyte design and sulfur utilization.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed advanced lithium-sulfur battery technology featuring a proprietary carbon-sulfur composite cathode structure that effectively addresses the "shuttle effect" - a major challenge in Li-S batteries. Their approach incorporates a hierarchical porous carbon framework that physically confines sulfur while providing electrical conductivity. The company has implemented a specialized electrolyte system with lithium nitrate additives that forms a stable solid electrolyte interphase (SEI) on the lithium anode, significantly reducing polysulfide shuttling. Their commercial prototypes have demonstrated energy densities exceeding 400 Wh/kg, nearly double that of conventional lithium-ion batteries. LG has filed numerous patents covering cathode materials, electrolyte formulations, and cell design specifically for Li-S technology, positioning themselves as a leader in potential mass production[1][3].

Strengths: Superior energy density compared to Li-ion batteries; established manufacturing infrastructure that can be adapted for Li-S production; strong IP portfolio covering key components. Weaknesses: Still facing challenges with cycle life limitations compared to conventional batteries; higher production costs currently limit mass commercialization; requires further optimization for fast-charging capabilities.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has pioneered a comprehensive approach to lithium-sulfur battery commercialization through their multi-layer protection strategy for sulfur cathodes. Their technology employs a core-shell nanostructured sulfur host material that effectively contains polysulfides while maintaining high sulfur utilization. CATL has developed a proprietary functional separator with a polysulfide-blocking interlayer that significantly reduces shuttle effect. Their electrolyte formulation includes novel additives that stabilize the lithium metal anode interface while enhancing ionic conductivity. CATL's pilot production line has demonstrated Li-S cells with energy densities of 450-500 Wh/kg and improved cycle stability of over 500 cycles at 80% capacity retention. The company holds strategic patents on manufacturing processes that enable scalable production of high-loading sulfur cathodes, positioning them for potential early commercialization[2][5].

Strengths: Industry-leading energy density achievements; strong manufacturing expertise that can scale to mass production; comprehensive patent portfolio covering materials and processes. Weaknesses: Higher initial production costs compared to conventional lithium-ion batteries; still working to improve low-temperature performance; requires specialized handling during manufacturing due to sulfur reactivity.

Critical Patents and Technical Innovations

Production process for alkali metal-sulfur batteries having high volumetric and gravimetric energy densities

PatentPendingUS20200343593A1

Innovation

- The development of an alkali metal-sulfur battery design featuring a high cathode active material mass loading, thick cathodes, and a conductive porous structure as current collectors, allowing for high sulfur utilization and improved cycle life, with sulfur bonded to pore walls or confined by carbon or graphite materials, and the use of a pre-sulfurization method to deposit nano-scaled sulfur particles for enhanced performance.

Lithium-sulfur battery containing two anode-protecting layers

PatentActiveUS20190386296A1

Innovation

- The implementation of an alkali metal-sulfur cell design featuring a sulfur-carbon hybrid cathode and a dual anode-protecting layer system, comprising a thin electron-conducting layer and an elastomer layer with high tensile elastic strain, to prevent dendrite formation and enhance sulfur utilization.

IP Strategy and Protection Framework

In the rapidly evolving landscape of lithium-sulfur (Li-S) battery technology, establishing a robust IP strategy and protection framework is crucial for companies seeking to commercialize these innovations. The current IP landscape for Li-S batteries is characterized by a complex web of patents covering various aspects from cathode materials to electrolyte compositions and cell designs.

For companies entering this space, a multi-layered IP protection approach is recommended. This begins with comprehensive patent mapping to identify white spaces and potential infringement risks. Strategic patent filing should focus not only on core technologies but also on manufacturing processes and application-specific implementations, creating a defensive perimeter around key innovations.

Freedom-to-operate (FTO) analyses have become increasingly important as the Li-S battery field matures. Companies must conduct thorough FTO assessments before significant R&D investments to avoid costly litigation or licensing negotiations later. Notable examples include OXIS Energy's extensive patent portfolio, which created significant barriers for competitors before the company's assets were acquired by Johnson Matthey.

Cross-licensing agreements represent another vital component of IP strategy in this sector. The technical complexity of Li-S batteries often requires integration of multiple patented technologies. Companies like Sion Power and PolyPlus have successfully leveraged their IP portfolios to establish strategic partnerships with larger manufacturers, enabling commercialization while protecting their core innovations.

Trade secret protection complements patent strategies, particularly for manufacturing processes that are difficult to reverse-engineer. Companies must implement robust internal protocols to safeguard proprietary information, including employee confidentiality agreements and compartmentalized knowledge management systems.

Geographic considerations also play a crucial role in IP strategy development. While North America and Europe have historically dominated Li-S battery patents, China has emerged as a major player with rapidly increasing patent filings. Companies must adapt their IP strategies to account for regional differences in patent law and enforcement mechanisms.

The timing of IP disclosures requires careful management, balancing the need for patent protection against the advantages of publication for defensive purposes. Strategic provisional patent applications can provide temporary protection while allowing companies to refine their technologies before committing to full patent filings.

For companies entering this space, a multi-layered IP protection approach is recommended. This begins with comprehensive patent mapping to identify white spaces and potential infringement risks. Strategic patent filing should focus not only on core technologies but also on manufacturing processes and application-specific implementations, creating a defensive perimeter around key innovations.

Freedom-to-operate (FTO) analyses have become increasingly important as the Li-S battery field matures. Companies must conduct thorough FTO assessments before significant R&D investments to avoid costly litigation or licensing negotiations later. Notable examples include OXIS Energy's extensive patent portfolio, which created significant barriers for competitors before the company's assets were acquired by Johnson Matthey.

Cross-licensing agreements represent another vital component of IP strategy in this sector. The technical complexity of Li-S batteries often requires integration of multiple patented technologies. Companies like Sion Power and PolyPlus have successfully leveraged their IP portfolios to establish strategic partnerships with larger manufacturers, enabling commercialization while protecting their core innovations.

Trade secret protection complements patent strategies, particularly for manufacturing processes that are difficult to reverse-engineer. Companies must implement robust internal protocols to safeguard proprietary information, including employee confidentiality agreements and compartmentalized knowledge management systems.

Geographic considerations also play a crucial role in IP strategy development. While North America and Europe have historically dominated Li-S battery patents, China has emerged as a major player with rapidly increasing patent filings. Companies must adapt their IP strategies to account for regional differences in patent law and enforcement mechanisms.

The timing of IP disclosures requires careful management, balancing the need for patent protection against the advantages of publication for defensive purposes. Strategic provisional patent applications can provide temporary protection while allowing companies to refine their technologies before committing to full patent filings.

Supply Chain Challenges and Material Sourcing

The commercialization of lithium-sulfur (Li-S) batteries faces significant supply chain challenges that differ substantially from those of conventional lithium-ion batteries. Sulfur, while abundant and inexpensive as a raw material, requires specific processing to meet battery-grade specifications. The global sulfur market is primarily driven by petroleum refining byproducts, creating an interesting dynamic where battery manufacturers must compete with established industries like agriculture and chemical manufacturing for refined sulfur resources.

Lithium supply chains present their own complexities. Although lithium resources are geographically concentrated in the "Lithium Triangle" of South America and Australia, the processing capacity is dominated by China, creating potential geopolitical vulnerabilities. For Li-S technology specifically, the high-purity lithium metal required for anodes demands specialized production capabilities that are currently limited in scale compared to the lithium carbonate and hydroxide supply chains established for conventional batteries.

Carbon materials, essential for the cathode structure in Li-S batteries, represent another critical supply chain consideration. Advanced carbon materials like graphene, carbon nanotubes, and mesoporous carbons are required to address the polysulfide shuttle effect, but these materials often have limited production capacity and high costs. The manufacturing processes for these specialized carbons remain energy-intensive and technically demanding, creating potential bottlenecks as production scales.

Electrolyte components for Li-S batteries present perhaps the most acute supply challenge. These batteries typically require specialized electrolyte additives and lithium salts that are not widely produced at commercial scale. Many of these materials are currently manufactured only for research purposes, with limited suppliers globally and at costs prohibitive for mass production.

The transition from laboratory to commercial scale also reveals significant material sourcing challenges. Consistency in material properties becomes critical at scale, yet many suppliers of specialized Li-S battery materials lack the quality control systems and production capacity to meet automotive or grid storage requirements. This has led to vertical integration efforts by some battery developers, who are investing in their own material production capabilities to secure supply.

Recycling infrastructure represents another gap in the Li-S battery supply chain. While the theoretical recyclability of Li-S batteries is promising due to the value of recovered lithium and the simplicity of sulfur, commercial recycling processes specifically optimized for these batteries remain underdeveloped compared to lithium-ion recycling pathways.

Lithium supply chains present their own complexities. Although lithium resources are geographically concentrated in the "Lithium Triangle" of South America and Australia, the processing capacity is dominated by China, creating potential geopolitical vulnerabilities. For Li-S technology specifically, the high-purity lithium metal required for anodes demands specialized production capabilities that are currently limited in scale compared to the lithium carbonate and hydroxide supply chains established for conventional batteries.

Carbon materials, essential for the cathode structure in Li-S batteries, represent another critical supply chain consideration. Advanced carbon materials like graphene, carbon nanotubes, and mesoporous carbons are required to address the polysulfide shuttle effect, but these materials often have limited production capacity and high costs. The manufacturing processes for these specialized carbons remain energy-intensive and technically demanding, creating potential bottlenecks as production scales.

Electrolyte components for Li-S batteries present perhaps the most acute supply challenge. These batteries typically require specialized electrolyte additives and lithium salts that are not widely produced at commercial scale. Many of these materials are currently manufactured only for research purposes, with limited suppliers globally and at costs prohibitive for mass production.

The transition from laboratory to commercial scale also reveals significant material sourcing challenges. Consistency in material properties becomes critical at scale, yet many suppliers of specialized Li-S battery materials lack the quality control systems and production capacity to meet automotive or grid storage requirements. This has led to vertical integration efforts by some battery developers, who are investing in their own material production capabilities to secure supply.

Recycling infrastructure represents another gap in the Li-S battery supply chain. While the theoretical recyclability of Li-S batteries is promising due to the value of recovered lithium and the simplicity of sulfur, commercial recycling processes specifically optimized for these batteries remain underdeveloped compared to lithium-ion recycling pathways.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!