Lithium-Sulfur Battery Performance Benchmarks And Practical Targets

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Li-S Battery Evolution and Research Objectives

Lithium-Sulfur (Li-S) battery technology has evolved significantly since its conceptualization in the 1960s, with major breakthroughs occurring in the past two decades. The fundamental chemistry of Li-S batteries, based on the electrochemical reaction between lithium and sulfur, offers a theoretical energy density of 2,600 Wh/kg, which is approximately five times higher than conventional lithium-ion batteries. This remarkable potential has driven continuous research efforts despite persistent challenges.

The evolution of Li-S battery technology can be traced through several key developmental phases. Initial research in the 1960s-1980s established basic principles but faced insurmountable challenges with sulfur's insulating nature and the polysulfide shuttle effect. The 1990s-2000s saw the introduction of carbon-based materials as conductive hosts for sulfur, marking a significant advancement in addressing conductivity issues.

From 2010 onwards, research has intensified with the development of novel cathode architectures, electrolyte formulations, and separator modifications. Notable milestones include the creation of hierarchical carbon structures, functional polymer binders, and advanced electrolyte systems that collectively mitigate polysulfide dissolution and shuttle effects while enhancing cycle life.

Current research objectives focus on achieving practical performance benchmarks that would enable commercial viability. Primary targets include increasing energy density to >400 Wh/kg at the cell level, extending cycle life to >1,000 cycles with <20% capacity fade, improving rate capability to support fast charging, and enhancing operational safety under various environmental conditions.

Specific technical objectives include developing sulfur cathodes with high loading (>5 mg/cm²) and limited volume expansion, designing stable lithium metal anodes with reduced dendrite formation, creating electrolyte systems that minimize polysulfide dissolution while maintaining ionic conductivity, and engineering cell components that enable high volumetric energy density.

The research community has established practical targets for Li-S batteries by 2030, including gravimetric energy density of 500-600 Wh/kg, volumetric energy density of 600-700 Wh/L, cycle life of 1,500+ cycles, and cost reduction to <$100/kWh. These benchmarks represent the threshold for Li-S technology to compete with and potentially replace conventional lithium-ion batteries in applications ranging from electric vehicles to grid storage.

The trajectory of Li-S battery evolution suggests that achieving these targets will require interdisciplinary approaches combining materials science, electrochemistry, and engineering innovations. Recent advancements in nanotechnology and computational modeling have accelerated progress, offering promising pathways toward meeting these ambitious yet necessary performance benchmarks.

The evolution of Li-S battery technology can be traced through several key developmental phases. Initial research in the 1960s-1980s established basic principles but faced insurmountable challenges with sulfur's insulating nature and the polysulfide shuttle effect. The 1990s-2000s saw the introduction of carbon-based materials as conductive hosts for sulfur, marking a significant advancement in addressing conductivity issues.

From 2010 onwards, research has intensified with the development of novel cathode architectures, electrolyte formulations, and separator modifications. Notable milestones include the creation of hierarchical carbon structures, functional polymer binders, and advanced electrolyte systems that collectively mitigate polysulfide dissolution and shuttle effects while enhancing cycle life.

Current research objectives focus on achieving practical performance benchmarks that would enable commercial viability. Primary targets include increasing energy density to >400 Wh/kg at the cell level, extending cycle life to >1,000 cycles with <20% capacity fade, improving rate capability to support fast charging, and enhancing operational safety under various environmental conditions.

Specific technical objectives include developing sulfur cathodes with high loading (>5 mg/cm²) and limited volume expansion, designing stable lithium metal anodes with reduced dendrite formation, creating electrolyte systems that minimize polysulfide dissolution while maintaining ionic conductivity, and engineering cell components that enable high volumetric energy density.

The research community has established practical targets for Li-S batteries by 2030, including gravimetric energy density of 500-600 Wh/kg, volumetric energy density of 600-700 Wh/L, cycle life of 1,500+ cycles, and cost reduction to <$100/kWh. These benchmarks represent the threshold for Li-S technology to compete with and potentially replace conventional lithium-ion batteries in applications ranging from electric vehicles to grid storage.

The trajectory of Li-S battery evolution suggests that achieving these targets will require interdisciplinary approaches combining materials science, electrochemistry, and engineering innovations. Recent advancements in nanotechnology and computational modeling have accelerated progress, offering promising pathways toward meeting these ambitious yet necessary performance benchmarks.

Market Demand Analysis for Next-Generation Energy Storage

The global energy storage market is witnessing unprecedented growth, driven by the increasing adoption of renewable energy sources and the electrification of transportation. Current projections indicate that the energy storage market will reach $546 billion by 2035, with a compound annual growth rate of approximately 20% between 2023 and 2035. Within this expanding landscape, lithium-sulfur (Li-S) batteries represent a promising next-generation technology poised to address critical limitations of conventional lithium-ion batteries.

Market analysis reveals that the demand for high-energy-density storage solutions is accelerating across multiple sectors. The electric vehicle (EV) market, projected to reach 145 million vehicles by 2030, requires batteries with higher energy density to overcome range anxiety—a primary barrier to widespread EV adoption. Li-S batteries, with their theoretical energy density of 2,600 Wh/kg (compared to 250-300 Wh/kg for current lithium-ion technologies), present a compelling solution to this challenge.

Aviation and aerospace industries are emerging as significant potential markets for Li-S technology. The urban air mobility sector, expected to grow to $15 billion by 2030, demands lightweight energy storage solutions that Li-S batteries could provide. Similarly, the drone market, expanding at 25% annually, requires batteries with higher gravimetric energy density to extend flight times and operational capabilities.

Consumer electronics manufacturers are actively seeking battery technologies that can support increasingly power-hungry devices while maintaining or reducing form factors. Market research indicates that 78% of smartphone users identify battery life as a critical purchasing factor, creating substantial demand for advanced energy storage solutions like Li-S batteries.

Grid-scale energy storage represents another substantial market opportunity, with global deployment expected to reach 741 GWh by 2030. The inherent advantages of Li-S batteries—including abundant, low-cost sulfur as a cathode material—position them as potentially cost-effective alternatives to current technologies for stationary storage applications, particularly in regions implementing aggressive renewable energy targets.

Market acceptance of Li-S technology will depend on achieving practical performance benchmarks. Industry surveys indicate that automotive manufacturers require energy densities exceeding 400 Wh/kg, cycle life of at least 1,000 cycles, and costs below $100/kWh to consider mass adoption. Current Li-S prototypes achieve 350-450 Wh/kg but typically demonstrate only 200-300 cycles, highlighting the gap between current capabilities and market requirements.

The economic drivers for Li-S battery development are compelling. Sulfur's abundance and low cost ($0.10-0.30/kg compared to cobalt at $30-45/kg) could potentially reduce battery material costs by 30-40% compared to conventional lithium-ion batteries, addressing the critical cost barriers to energy storage deployment across multiple applications.

Market analysis reveals that the demand for high-energy-density storage solutions is accelerating across multiple sectors. The electric vehicle (EV) market, projected to reach 145 million vehicles by 2030, requires batteries with higher energy density to overcome range anxiety—a primary barrier to widespread EV adoption. Li-S batteries, with their theoretical energy density of 2,600 Wh/kg (compared to 250-300 Wh/kg for current lithium-ion technologies), present a compelling solution to this challenge.

Aviation and aerospace industries are emerging as significant potential markets for Li-S technology. The urban air mobility sector, expected to grow to $15 billion by 2030, demands lightweight energy storage solutions that Li-S batteries could provide. Similarly, the drone market, expanding at 25% annually, requires batteries with higher gravimetric energy density to extend flight times and operational capabilities.

Consumer electronics manufacturers are actively seeking battery technologies that can support increasingly power-hungry devices while maintaining or reducing form factors. Market research indicates that 78% of smartphone users identify battery life as a critical purchasing factor, creating substantial demand for advanced energy storage solutions like Li-S batteries.

Grid-scale energy storage represents another substantial market opportunity, with global deployment expected to reach 741 GWh by 2030. The inherent advantages of Li-S batteries—including abundant, low-cost sulfur as a cathode material—position them as potentially cost-effective alternatives to current technologies for stationary storage applications, particularly in regions implementing aggressive renewable energy targets.

Market acceptance of Li-S technology will depend on achieving practical performance benchmarks. Industry surveys indicate that automotive manufacturers require energy densities exceeding 400 Wh/kg, cycle life of at least 1,000 cycles, and costs below $100/kWh to consider mass adoption. Current Li-S prototypes achieve 350-450 Wh/kg but typically demonstrate only 200-300 cycles, highlighting the gap between current capabilities and market requirements.

The economic drivers for Li-S battery development are compelling. Sulfur's abundance and low cost ($0.10-0.30/kg compared to cobalt at $30-45/kg) could potentially reduce battery material costs by 30-40% compared to conventional lithium-ion batteries, addressing the critical cost barriers to energy storage deployment across multiple applications.

Technical Challenges and Global Development Status

Lithium-sulfur (Li-S) batteries face significant technical challenges despite their theoretical advantages over conventional lithium-ion batteries. The primary obstacle remains the "shuttle effect," where soluble polysulfide intermediates migrate between electrodes during cycling, causing rapid capacity fading and shortened battery life. Current Li-S batteries typically demonstrate only 300-500 cycles before significant degradation occurs, compared to 1,000+ cycles for commercial lithium-ion batteries.

Volume expansion presents another critical challenge, with sulfur cathodes experiencing up to 80% expansion during lithium insertion, leading to mechanical stress and electrode disintegration. This expansion contributes to poor cycle stability and safety concerns in practical applications. Additionally, the insulating nature of sulfur (5×10^-30 S/cm) and its discharge products (Li₂S) necessitates high carbon content in electrodes, reducing the overall energy density advantage.

The low Coulombic efficiency of Li-S systems, typically 80-95% compared to >99% for commercial lithium-ion batteries, represents a significant barrier to commercialization. This inefficiency stems primarily from the irreversible loss of active material through side reactions and the formation of electrically isolated sulfur species.

Globally, research institutions and companies across North America, Europe, and Asia are actively addressing these challenges. The United States, through ARPA-E programs, has invested significantly in Li-S technology development, focusing on novel electrolytes and protective coatings for lithium anodes. European efforts, particularly through Horizon 2020 initiatives, concentrate on sustainable manufacturing processes and materials for Li-S batteries.

China leads in terms of patent filings and commercial development, with companies like OXIS Energy (UK, before bankruptcy), Sion Power (US), and CATL (China) making significant strides. Japan and South Korea maintain strong positions in fundamental research, particularly in electrolyte formulations and separator technologies.

Current performance benchmarks show commercial Li-S cells delivering specific energies of 350-400 Wh/kg, still below the theoretical maximum of 2,600 Wh/kg. Cycle life remains limited to 300-500 cycles under optimal conditions, with significant capacity degradation after 100 cycles in practical applications. Operating temperature ranges (-20°C to 60°C) are narrower than conventional lithium-ion batteries, limiting application scenarios.

The technology readiness level (TRL) for Li-S batteries currently stands at 5-6, indicating validation in relevant environments but not yet ready for full commercial deployment. Practical targets for commercialization include achieving 500+ stable cycles with less than 20% capacity fade, improving Coulombic efficiency to >98%, and developing manufacturing processes compatible with existing battery production infrastructure.

Volume expansion presents another critical challenge, with sulfur cathodes experiencing up to 80% expansion during lithium insertion, leading to mechanical stress and electrode disintegration. This expansion contributes to poor cycle stability and safety concerns in practical applications. Additionally, the insulating nature of sulfur (5×10^-30 S/cm) and its discharge products (Li₂S) necessitates high carbon content in electrodes, reducing the overall energy density advantage.

The low Coulombic efficiency of Li-S systems, typically 80-95% compared to >99% for commercial lithium-ion batteries, represents a significant barrier to commercialization. This inefficiency stems primarily from the irreversible loss of active material through side reactions and the formation of electrically isolated sulfur species.

Globally, research institutions and companies across North America, Europe, and Asia are actively addressing these challenges. The United States, through ARPA-E programs, has invested significantly in Li-S technology development, focusing on novel electrolytes and protective coatings for lithium anodes. European efforts, particularly through Horizon 2020 initiatives, concentrate on sustainable manufacturing processes and materials for Li-S batteries.

China leads in terms of patent filings and commercial development, with companies like OXIS Energy (UK, before bankruptcy), Sion Power (US), and CATL (China) making significant strides. Japan and South Korea maintain strong positions in fundamental research, particularly in electrolyte formulations and separator technologies.

Current performance benchmarks show commercial Li-S cells delivering specific energies of 350-400 Wh/kg, still below the theoretical maximum of 2,600 Wh/kg. Cycle life remains limited to 300-500 cycles under optimal conditions, with significant capacity degradation after 100 cycles in practical applications. Operating temperature ranges (-20°C to 60°C) are narrower than conventional lithium-ion batteries, limiting application scenarios.

The technology readiness level (TRL) for Li-S batteries currently stands at 5-6, indicating validation in relevant environments but not yet ready for full commercial deployment. Practical targets for commercialization include achieving 500+ stable cycles with less than 20% capacity fade, improving Coulombic efficiency to >98%, and developing manufacturing processes compatible with existing battery production infrastructure.

Current Performance Benchmarking Methodologies

01 Energy density and capacity benchmarks

Lithium-sulfur batteries are known for their high theoretical energy density and capacity, which significantly exceed those of conventional lithium-ion batteries. Performance benchmarks typically measure the specific capacity (mAh/g), energy density (Wh/kg), and power density (W/kg). These metrics are crucial for evaluating the practical applications of lithium-sulfur batteries, particularly in electric vehicles and portable electronics where high energy storage is required.- Energy density and capacity benchmarks: Lithium-sulfur batteries are known for their high theoretical energy density and capacity compared to conventional lithium-ion batteries. Performance benchmarks typically measure the specific energy (Wh/kg) and specific capacity (mAh/g), with state-of-the-art lithium-sulfur cells demonstrating values approaching 500 Wh/kg and 1200 mAh/g respectively. These metrics are critical for evaluating the potential of lithium-sulfur technology for applications requiring high energy storage in lightweight packages.

- Cycle life and capacity retention: A key performance benchmark for lithium-sulfur batteries is cycle life and capacity retention over extended cycling. Current benchmarks evaluate how well cells maintain their initial capacity after hundreds or thousands of charge-discharge cycles. Advanced lithium-sulfur batteries aim to achieve at least 80% capacity retention after 500 cycles, though this remains challenging due to polysulfide shuttling and electrode degradation mechanisms. Various electrolyte formulations and cathode structures are being developed to improve this critical performance metric.

- Rate capability and power performance: Rate capability benchmarks measure how lithium-sulfur batteries perform under different charge and discharge rates. Standard testing protocols evaluate capacity retention when cycling at various C-rates (from C/20 to 2C or higher). High-performance lithium-sulfur batteries should maintain reasonable capacity (>60%) even at higher rates (>1C) compared to slow charging conditions. This benchmark is particularly important for applications requiring both high energy density and power delivery capabilities.

- Temperature performance and stability: Temperature performance benchmarks evaluate lithium-sulfur battery operation across a wide temperature range, typically from -40°C to 60°C. Metrics include capacity retention, internal resistance changes, and self-discharge rates at various temperatures. Advanced lithium-sulfur systems aim to maintain stable performance across broader temperature ranges than conventional lithium-ion batteries, with particular emphasis on low-temperature operation where lithium-sulfur chemistry can potentially outperform other battery technologies.

- Sulfur utilization and loading benchmarks: Sulfur utilization and loading are critical benchmarks for practical lithium-sulfur batteries. These metrics measure how effectively the active sulfur material participates in electrochemical reactions and how much sulfur can be loaded into the cathode while maintaining good performance. State-of-the-art cells aim for sulfur utilization above 70% of theoretical capacity and high sulfur loadings (>5 mg/cm²) to achieve commercially viable energy densities. Various carbon host materials and cathode architectures are being developed to optimize these parameters.

02 Cycle life and stability performance

The cycle life of lithium-sulfur batteries is a critical benchmark that measures how many charge-discharge cycles the battery can undergo before its capacity falls below a certain threshold (typically 80% of initial capacity). Stability performance evaluates the battery's resistance to capacity fading, which is often caused by the shuttle effect and polysulfide dissolution. Various electrolyte compositions and cathode structures are designed to improve these performance metrics.Expand Specific Solutions03 Rate capability and charging performance

Rate capability benchmarks assess how well lithium-sulfur batteries perform under different charge and discharge rates. This includes measuring capacity retention at various C-rates and evaluating the battery's ability to deliver power quickly when needed. Fast charging performance is particularly important for practical applications and is often limited by sulfur's poor conductivity and the slow kinetics of the conversion reactions.Expand Specific Solutions04 Temperature performance and safety benchmarks

Temperature performance benchmarks evaluate how lithium-sulfur batteries operate across different temperature ranges, which is crucial for applications in varying environmental conditions. Safety benchmarks include thermal stability, resistance to thermal runaway, and behavior under abuse conditions. These metrics are essential for commercial viability and often involve testing the battery's response to overcharging, short-circuiting, and physical damage.Expand Specific Solutions05 Sulfur utilization and loading benchmarks

Sulfur utilization efficiency measures how much of the theoretical capacity of sulfur is actually achieved in practical cells. Sulfur loading benchmarks evaluate the amount of active material that can be incorporated into the cathode while maintaining good performance. High sulfur loading is desirable for increasing energy density, but it often comes with challenges such as poor electron/ion transport and increased polysulfide shuttling. These benchmarks are critical for bridging the gap between laboratory cells and commercial applications.Expand Specific Solutions

Key Industry Players and Research Institutions

Lithium-Sulfur battery technology is currently in the early growth phase of development, with a global market projected to reach $1.4 billion by 2028. The competitive landscape features established battery manufacturers like LG Energy Solution and Samsung SDI investing in R&D alongside specialized players such as Sion Power, which leads with its proprietary Licerion® technology offering energy densities up to 500 Wh/kg. Technical maturity varies significantly across competitors, with commercial viability challenges still being addressed. Academic institutions including Central South University, Beijing Institute of Technology, and Cornell University are advancing fundamental research, while companies like Gelion Technologies and Guangdong Bangpu focus on practical implementation challenges such as cycle stability and manufacturing scalability. The technology promises significant performance improvements over lithium-ion batteries but requires further development to meet commercial targets.

LG Energy Solution Ltd.

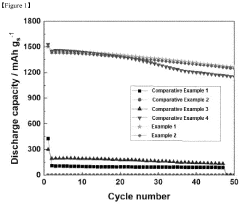

Technical Solution: LG Energy Solution has developed a multi-layered approach to lithium-sulfur battery technology, focusing on practical performance benchmarks rather than just theoretical limits. Their technology utilizes hierarchical porous carbon structures to host sulfur, achieving effective sulfur utilization of 70-75% in practical cells. LG's proprietary electrolyte system incorporates fluorinated additives and lithium salts that form stable interfaces on both electrodes, significantly reducing the polysulfide shuttle effect. Their current generation lithium-sulfur cells demonstrate energy densities of 350-400 Wh/kg at the cell level, with discharge capacities of 1,000-1,100 mAh/g of sulfur. Performance benchmarks show 80% capacity retention after 300 cycles at moderate discharge rates (0.2C-0.5C). LG has established practical targets including operation across -10°C to 45°C, fast charging capabilities (50% in 20 minutes), and cycle life exceeding 500 cycles for consumer electronics applications. Their technology roadmap includes transitioning to semi-solid electrolytes by 2025 to further improve safety and cycle stability.

Strengths: Extensive battery manufacturing expertise and quality control systems; established supply chain for scaled production; advanced electrode manufacturing techniques adaptable to lithium-sulfur chemistry. Weaknesses: Performance degradation at high discharge rates (>1C); temperature sensitivity affecting low-temperature performance; higher initial self-discharge rates compared to conventional lithium-ion batteries.

Samsung SDI Co., Ltd.

Technical Solution: Samsung SDI has developed advanced lithium-sulfur battery technology achieving energy densities of 400-450 Wh/kg in laboratory settings, with practical targets of 350 Wh/kg for commercial applications. Their approach focuses on nanostructured carbon-sulfur composite cathodes with controlled porosity that effectively trap polysulfides and prevent their dissolution. Samsung's proprietary electrolyte formulations incorporate lithium nitrate and other additives that form stable solid-electrolyte interphase layers on both electrodes. Their performance benchmarks demonstrate initial discharge capacities of 1,200 mAh/g with capacity retention of approximately 80% after 200 cycles at 0.5C rate. Samsung has established practical targets including operation across -20°C to 60°C temperature range, fast charging capabilities (60% in 15 minutes), and cycle life exceeding 500 cycles for automotive applications. Their technology roadmap includes integration of solid-state electrolytes to further improve safety and cycle life.

Strengths: Strong manufacturing infrastructure and scale-up capabilities; comprehensive battery management systems optimized for lithium-sulfur chemistry; advanced nanostructured carbon materials for sulfur immobilization. Weaknesses: Lower practical energy density compared to theoretical limits; capacity fading still occurs after extended cycling; higher production costs compared to their established lithium-ion manufacturing.

Critical Patents and Scientific Breakthroughs

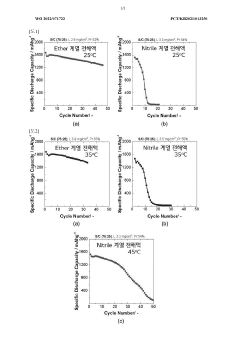

Lithium-sulfur battery having high energy density

PatentWO2022071722A1

Innovation

- A lithium-sulfur battery employing a sparing solvating electrolyte system with a fluorine-based ether compound and a glyme-based solvent, combined with a lithium salt, and a high specific surface area carbon material in the positive electrode, which suppresses polysulfide dissolution and maintains stability without nitrile-based solvents, enhancing sulfur utilization and battery performance.

Lithium-sulfur battery with improved lifespan performance

PatentPendingEP4280336A1

Innovation

- A lithium-sulfur battery design incorporating a fluorine-based ether solvent, a glyme-based solvent, and lithium bis(pentafluoroethanesulfonyl) imide in the electrolyte, combined with a high specific surface area carbon material at the positive electrode, to suppress polysulfide leaching and enhance electrochemical stability, thereby improving coulombic efficiency and extending battery life.

Material Supply Chain Analysis

The lithium-sulfur battery supply chain presents unique challenges and opportunities compared to conventional lithium-ion batteries. Sulfur, the primary cathode material, offers significant advantages as an abundant, low-cost resource with global distribution. Unlike cobalt and nickel used in traditional lithium-ion batteries, sulfur is widely available as a byproduct of petroleum refining and natural gas processing, reducing geopolitical supply risks.

The lithium component of Li-S batteries faces similar supply constraints as conventional lithium-ion technologies. Global lithium production is concentrated in Australia, Chile, Argentina, and China, with emerging sources in North America and Africa. Recent market analyses indicate lithium demand could increase by 400-500% by 2030, potentially creating bottlenecks for all lithium-based battery technologies.

Carbon materials, essential for Li-S battery electrodes, represent another critical supply chain component. High-quality carbon substrates (carbon nanotubes, graphene, porous carbon) require specialized manufacturing capabilities currently concentrated in East Asia. Diversification of these supply chains remains a strategic priority for Western manufacturers seeking to establish domestic Li-S battery production.

Electrolyte components for Li-S batteries often include lithium salts (LiTFSI, LiFSI) and specialized solvents that face more restricted supply chains than conventional battery electrolytes. The limited number of qualified suppliers for these specialty chemicals creates potential vulnerabilities in scaling production.

Manufacturing infrastructure presents another supply chain consideration. Current battery gigafactories are optimized for lithium-ion production, requiring significant retooling for Li-S manufacturing. Companies like OXIS Energy and Sion Power have established pilot production facilities, but large-scale manufacturing capacity remains limited compared to conventional battery technologies.

Recycling infrastructure represents both a challenge and opportunity. While sulfur recovery is theoretically straightforward, commercial-scale recycling processes for Li-S batteries remain underdeveloped. Establishing closed-loop material recovery systems will be essential for long-term sustainability, particularly as performance benchmarks drive increased market adoption.

Supply chain resilience for Li-S battery technology will require strategic investments in diversified material sourcing, domestic manufacturing capabilities, and recycling infrastructure to support the performance targets necessary for commercial viability across transportation and energy storage applications.

The lithium component of Li-S batteries faces similar supply constraints as conventional lithium-ion technologies. Global lithium production is concentrated in Australia, Chile, Argentina, and China, with emerging sources in North America and Africa. Recent market analyses indicate lithium demand could increase by 400-500% by 2030, potentially creating bottlenecks for all lithium-based battery technologies.

Carbon materials, essential for Li-S battery electrodes, represent another critical supply chain component. High-quality carbon substrates (carbon nanotubes, graphene, porous carbon) require specialized manufacturing capabilities currently concentrated in East Asia. Diversification of these supply chains remains a strategic priority for Western manufacturers seeking to establish domestic Li-S battery production.

Electrolyte components for Li-S batteries often include lithium salts (LiTFSI, LiFSI) and specialized solvents that face more restricted supply chains than conventional battery electrolytes. The limited number of qualified suppliers for these specialty chemicals creates potential vulnerabilities in scaling production.

Manufacturing infrastructure presents another supply chain consideration. Current battery gigafactories are optimized for lithium-ion production, requiring significant retooling for Li-S manufacturing. Companies like OXIS Energy and Sion Power have established pilot production facilities, but large-scale manufacturing capacity remains limited compared to conventional battery technologies.

Recycling infrastructure represents both a challenge and opportunity. While sulfur recovery is theoretically straightforward, commercial-scale recycling processes for Li-S batteries remain underdeveloped. Establishing closed-loop material recovery systems will be essential for long-term sustainability, particularly as performance benchmarks drive increased market adoption.

Supply chain resilience for Li-S battery technology will require strategic investments in diversified material sourcing, domestic manufacturing capabilities, and recycling infrastructure to support the performance targets necessary for commercial viability across transportation and energy storage applications.

Environmental Impact and Sustainability Assessment

Lithium-sulfur (Li-S) batteries represent a significant advancement in energy storage technology, offering theoretical energy densities up to five times higher than conventional lithium-ion batteries. However, their environmental impact and sustainability profile must be thoroughly assessed to determine their true value in addressing global energy challenges.

The environmental advantages of Li-S batteries are substantial when compared to traditional lithium-ion technologies. Sulfur, the primary cathode material, is an abundant by-product of petroleum refining processes, effectively transforming an industrial waste product into a valuable resource. This abundance translates to reduced mining impacts and lower resource depletion concerns compared to cobalt, nickel, and manganese used in conventional batteries.

Life cycle assessment (LCA) studies indicate that Li-S batteries potentially have a 20-30% lower carbon footprint during manufacturing than lithium-ion counterparts. This reduction stems primarily from the simplified cathode production process and decreased reliance on energy-intensive metal extraction operations. However, these environmental benefits are partially offset by the current manufacturing inefficiencies and shorter cycle life of Li-S batteries.

Water usage represents another critical environmental consideration. Preliminary data suggests Li-S battery production may require 15-25% less water than conventional lithium-ion manufacturing processes. This advantage becomes increasingly significant as water scarcity affects more regions globally, particularly in lithium-producing areas like South America's "Lithium Triangle."

End-of-life management presents both challenges and opportunities for Li-S technology. The sulfur components are theoretically easier to recycle than complex metal oxides, with some research indicating recovery rates exceeding 90% under optimal conditions. However, the lithium metal anode and electrolyte components still present recycling challenges similar to conventional batteries.

Safety considerations also factor into sustainability assessments. While Li-S batteries eliminate cobalt-related toxicity concerns, they introduce different safety challenges related to lithium metal anodes and potential hydrogen sulfide formation during failure modes. These risks necessitate robust battery management systems and protective designs that may increase manufacturing complexity.

Looking forward, the sustainability profile of Li-S batteries will likely improve as manufacturing scales and efficiencies increase. Current benchmarks suggest that achieving 500+ stable cycles at commercial scales could position Li-S batteries as environmentally superior to lithium-ion across most impact categories. Research priorities should therefore focus on extending cycle life while maintaining the inherent environmental advantages of sulfur-based chemistry.

The environmental advantages of Li-S batteries are substantial when compared to traditional lithium-ion technologies. Sulfur, the primary cathode material, is an abundant by-product of petroleum refining processes, effectively transforming an industrial waste product into a valuable resource. This abundance translates to reduced mining impacts and lower resource depletion concerns compared to cobalt, nickel, and manganese used in conventional batteries.

Life cycle assessment (LCA) studies indicate that Li-S batteries potentially have a 20-30% lower carbon footprint during manufacturing than lithium-ion counterparts. This reduction stems primarily from the simplified cathode production process and decreased reliance on energy-intensive metal extraction operations. However, these environmental benefits are partially offset by the current manufacturing inefficiencies and shorter cycle life of Li-S batteries.

Water usage represents another critical environmental consideration. Preliminary data suggests Li-S battery production may require 15-25% less water than conventional lithium-ion manufacturing processes. This advantage becomes increasingly significant as water scarcity affects more regions globally, particularly in lithium-producing areas like South America's "Lithium Triangle."

End-of-life management presents both challenges and opportunities for Li-S technology. The sulfur components are theoretically easier to recycle than complex metal oxides, with some research indicating recovery rates exceeding 90% under optimal conditions. However, the lithium metal anode and electrolyte components still present recycling challenges similar to conventional batteries.

Safety considerations also factor into sustainability assessments. While Li-S batteries eliminate cobalt-related toxicity concerns, they introduce different safety challenges related to lithium metal anodes and potential hydrogen sulfide formation during failure modes. These risks necessitate robust battery management systems and protective designs that may increase manufacturing complexity.

Looking forward, the sustainability profile of Li-S batteries will likely improve as manufacturing scales and efficiencies increase. Current benchmarks suggest that achieving 500+ stable cycles at commercial scales could position Li-S batteries as environmentally superior to lithium-ion across most impact categories. Research priorities should therefore focus on extending cycle life while maintaining the inherent environmental advantages of sulfur-based chemistry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!