Cost Modeling For Li-S Versus Li-Ion At Scale

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Li-S vs Li-Ion Battery Technology Background and Objectives

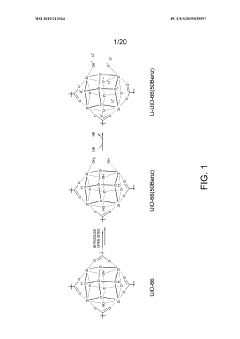

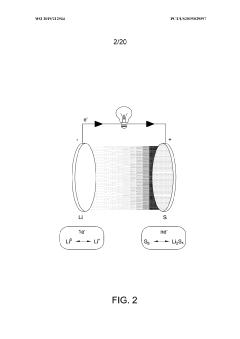

Lithium-sulfur (Li-S) batteries have emerged as a promising alternative to conventional lithium-ion (Li-ion) batteries, particularly for applications requiring high energy density and reduced weight. The evolution of battery technology has been driven by increasing demands for energy storage solutions across various sectors including electric vehicles, consumer electronics, and grid storage systems. Li-S technology represents a significant branch in this evolutionary tree, offering theoretical energy densities up to 2,600 Wh/kg compared to Li-ion's 350-400 Wh/kg.

The development of Li-S batteries dates back to the 1960s, but significant progress has only been made in the past two decades due to advances in materials science and nanotechnology. The technology leverages sulfur's abundance, low cost, and environmental friendliness as a cathode material, paired with lithium metal anodes. This combination theoretically enables higher energy storage capabilities while potentially reducing production costs compared to traditional Li-ion batteries that rely on expensive transition metals like cobalt and nickel.

Current Li-ion technology dominates the market due to its established manufacturing processes, reliability, and continuous incremental improvements. However, it faces fundamental limitations in energy density and cost reduction potential. The technical evolution trajectory suggests that Li-S batteries could overcome these limitations, particularly as manufacturing scales increase and technical challenges are addressed.

The primary technical objectives for Li-S battery development include extending cycle life beyond 1,000 cycles, improving rate capability, mitigating the "shuttle effect" (polysulfide dissolution), and enhancing overall system stability. These objectives align with broader industry goals of developing more sustainable, higher-performing energy storage solutions that can support the transition to renewable energy and electrified transportation.

Cost modeling at scale represents a critical aspect of this technology assessment, as theoretical advantages must translate to practical economic benefits to drive widespread adoption. Initial analyses suggest that Li-S batteries could achieve significantly lower costs per kilowatt-hour at scale due to less expensive raw materials, simpler cell designs, and potentially streamlined manufacturing processes.

The global research landscape shows accelerating interest in Li-S technology, with significant contributions from academic institutions, national laboratories, and private companies. Patent filings related to Li-S technology have increased by approximately 300% over the past decade, indicating growing recognition of its potential commercial value and technological importance in the energy storage ecosystem.

This technical assessment aims to comprehensively evaluate the current state and future prospects of Li-S battery technology compared to Li-ion, with particular emphasis on cost structures at manufacturing scale and the technical pathways to commercial viability.

The development of Li-S batteries dates back to the 1960s, but significant progress has only been made in the past two decades due to advances in materials science and nanotechnology. The technology leverages sulfur's abundance, low cost, and environmental friendliness as a cathode material, paired with lithium metal anodes. This combination theoretically enables higher energy storage capabilities while potentially reducing production costs compared to traditional Li-ion batteries that rely on expensive transition metals like cobalt and nickel.

Current Li-ion technology dominates the market due to its established manufacturing processes, reliability, and continuous incremental improvements. However, it faces fundamental limitations in energy density and cost reduction potential. The technical evolution trajectory suggests that Li-S batteries could overcome these limitations, particularly as manufacturing scales increase and technical challenges are addressed.

The primary technical objectives for Li-S battery development include extending cycle life beyond 1,000 cycles, improving rate capability, mitigating the "shuttle effect" (polysulfide dissolution), and enhancing overall system stability. These objectives align with broader industry goals of developing more sustainable, higher-performing energy storage solutions that can support the transition to renewable energy and electrified transportation.

Cost modeling at scale represents a critical aspect of this technology assessment, as theoretical advantages must translate to practical economic benefits to drive widespread adoption. Initial analyses suggest that Li-S batteries could achieve significantly lower costs per kilowatt-hour at scale due to less expensive raw materials, simpler cell designs, and potentially streamlined manufacturing processes.

The global research landscape shows accelerating interest in Li-S technology, with significant contributions from academic institutions, national laboratories, and private companies. Patent filings related to Li-S technology have increased by approximately 300% over the past decade, indicating growing recognition of its potential commercial value and technological importance in the energy storage ecosystem.

This technical assessment aims to comprehensively evaluate the current state and future prospects of Li-S battery technology compared to Li-ion, with particular emphasis on cost structures at manufacturing scale and the technical pathways to commercial viability.

Market Demand Analysis for Next-Generation Battery Technologies

The global battery market is experiencing a significant shift towards next-generation technologies, driven by increasing demands for higher energy density, longer lifespan, and more sustainable solutions. Lithium-sulfur (Li-S) batteries have emerged as a promising alternative to conventional lithium-ion (Li-ion) batteries, particularly for applications requiring high energy density and reduced weight.

Market research indicates that the energy storage market is projected to grow at a compound annual growth rate of over 20% through 2030, with advanced battery technologies playing a crucial role in this expansion. The electric vehicle (EV) segment represents the largest potential market for next-generation batteries, with global EV sales continuing to accelerate and expected to reach 30% of total vehicle sales by 2030.

Consumer electronics manufacturers are actively seeking battery technologies that can extend device operation time while reducing weight and volume. This sector presents an immediate opportunity for Li-S batteries, which theoretically offer up to five times the energy density of traditional Li-ion batteries.

Aerospace and defense industries have expressed strong interest in Li-S technology due to its favorable weight-to-energy ratio. These sectors are willing to adopt premium-priced solutions that deliver significant performance advantages, creating early market opportunities for Li-S batteries despite potentially higher initial costs.

Grid storage applications represent another substantial market segment, projected to grow exponentially as renewable energy integration increases. While cost sensitivity is higher in this sector, the potential for Li-S batteries to offer lower lifetime costs through extended cycle life and reduced maintenance could drive adoption as manufacturing scales.

Market surveys indicate that battery cost remains the primary barrier to wider adoption of electric vehicles and renewable energy storage solutions. Currently, Li-ion battery packs have reached approximately $130/kWh, with industry targets aiming for $100/kWh to achieve price parity with internal combustion vehicles. For Li-S technology to compete effectively, manufacturing scale must enable comparable or better pricing while delivering superior performance characteristics.

Regional analysis shows Asia-Pacific leading battery manufacturing capacity, with China dominating the supply chain. However, significant investments in North America and Europe aim to establish regional battery production capabilities, creating potential entry points for new technologies like Li-S batteries that could disrupt established manufacturing paradigms.

Customer willingness to pay premiums for batteries offering tangible benefits varies by segment, with high-performance applications demonstrating greater price flexibility than mass-market consumer products. This segmentation suggests a staged market entry strategy for Li-S technology, beginning with premium applications before expanding to cost-sensitive markets as manufacturing scale improves economics.

Market research indicates that the energy storage market is projected to grow at a compound annual growth rate of over 20% through 2030, with advanced battery technologies playing a crucial role in this expansion. The electric vehicle (EV) segment represents the largest potential market for next-generation batteries, with global EV sales continuing to accelerate and expected to reach 30% of total vehicle sales by 2030.

Consumer electronics manufacturers are actively seeking battery technologies that can extend device operation time while reducing weight and volume. This sector presents an immediate opportunity for Li-S batteries, which theoretically offer up to five times the energy density of traditional Li-ion batteries.

Aerospace and defense industries have expressed strong interest in Li-S technology due to its favorable weight-to-energy ratio. These sectors are willing to adopt premium-priced solutions that deliver significant performance advantages, creating early market opportunities for Li-S batteries despite potentially higher initial costs.

Grid storage applications represent another substantial market segment, projected to grow exponentially as renewable energy integration increases. While cost sensitivity is higher in this sector, the potential for Li-S batteries to offer lower lifetime costs through extended cycle life and reduced maintenance could drive adoption as manufacturing scales.

Market surveys indicate that battery cost remains the primary barrier to wider adoption of electric vehicles and renewable energy storage solutions. Currently, Li-ion battery packs have reached approximately $130/kWh, with industry targets aiming for $100/kWh to achieve price parity with internal combustion vehicles. For Li-S technology to compete effectively, manufacturing scale must enable comparable or better pricing while delivering superior performance characteristics.

Regional analysis shows Asia-Pacific leading battery manufacturing capacity, with China dominating the supply chain. However, significant investments in North America and Europe aim to establish regional battery production capabilities, creating potential entry points for new technologies like Li-S batteries that could disrupt established manufacturing paradigms.

Customer willingness to pay premiums for batteries offering tangible benefits varies by segment, with high-performance applications demonstrating greater price flexibility than mass-market consumer products. This segmentation suggests a staged market entry strategy for Li-S technology, beginning with premium applications before expanding to cost-sensitive markets as manufacturing scale improves economics.

Current State and Challenges in Li-S Battery Development

Lithium-sulfur (Li-S) batteries have emerged as promising alternatives to conventional lithium-ion (Li-ion) batteries due to their theoretical energy density of 2,600 Wh/kg, which is approximately five times higher than that of Li-ion batteries. Currently, several research institutions and companies worldwide are actively developing Li-S battery technology, with notable progress in addressing fundamental challenges. However, the technology remains predominantly at the laboratory and small-scale prototype stages, with limited commercial deployment.

The primary technical challenges hindering Li-S battery development include the "shuttle effect," where soluble polysulfide intermediates migrate between electrodes, causing capacity fade and reduced cycle life. Most Li-S batteries currently achieve only 300-500 cycles, significantly lower than the 1,000+ cycles common in commercial Li-ion batteries. This limitation presents a substantial barrier to widespread adoption in applications requiring long service life.

Another critical challenge is the low conductivity of sulfur, necessitating the addition of conductive materials that reduce the overall energy density of the battery. Current Li-S batteries typically achieve practical energy densities of 400-600 Wh/kg, which, while still superior to Li-ion batteries, falls considerably short of theoretical values. This gap between theoretical and practical performance represents a significant area for technological improvement.

Manufacturing scalability presents additional obstacles. Current production methods for Li-S batteries often involve complex processes that are difficult to scale economically. The use of lithium metal anodes introduces safety concerns related to dendrite formation and potential short circuits, requiring sophisticated battery management systems that add cost and complexity to the final product.

From a geographical perspective, Li-S battery research is concentrated primarily in North America, Europe, and East Asia. The United States, China, and South Korea lead in patent filings related to Li-S technology, with significant contributions from research institutions in Germany, Japan, and the United Kingdom. This global distribution of expertise creates both collaborative opportunities and competitive challenges in technology development.

Cost modeling analyses indicate that while Li-S batteries currently have higher production costs than established Li-ion technologies, they have the potential for lower costs at scale due to the abundance and lower cost of sulfur compared to cobalt and nickel used in Li-ion cathodes. However, realizing this cost advantage requires overcoming the technical challenges that currently necessitate expensive engineering solutions and materials.

Environmental considerations also present both opportunities and challenges. While Li-S batteries potentially reduce dependence on critical minerals like cobalt, the environmental impact of large-scale sulfur extraction and processing, as well as end-of-life recycling processes, requires further assessment to ensure sustainability across the full product lifecycle.

The primary technical challenges hindering Li-S battery development include the "shuttle effect," where soluble polysulfide intermediates migrate between electrodes, causing capacity fade and reduced cycle life. Most Li-S batteries currently achieve only 300-500 cycles, significantly lower than the 1,000+ cycles common in commercial Li-ion batteries. This limitation presents a substantial barrier to widespread adoption in applications requiring long service life.

Another critical challenge is the low conductivity of sulfur, necessitating the addition of conductive materials that reduce the overall energy density of the battery. Current Li-S batteries typically achieve practical energy densities of 400-600 Wh/kg, which, while still superior to Li-ion batteries, falls considerably short of theoretical values. This gap between theoretical and practical performance represents a significant area for technological improvement.

Manufacturing scalability presents additional obstacles. Current production methods for Li-S batteries often involve complex processes that are difficult to scale economically. The use of lithium metal anodes introduces safety concerns related to dendrite formation and potential short circuits, requiring sophisticated battery management systems that add cost and complexity to the final product.

From a geographical perspective, Li-S battery research is concentrated primarily in North America, Europe, and East Asia. The United States, China, and South Korea lead in patent filings related to Li-S technology, with significant contributions from research institutions in Germany, Japan, and the United Kingdom. This global distribution of expertise creates both collaborative opportunities and competitive challenges in technology development.

Cost modeling analyses indicate that while Li-S batteries currently have higher production costs than established Li-ion technologies, they have the potential for lower costs at scale due to the abundance and lower cost of sulfur compared to cobalt and nickel used in Li-ion cathodes. However, realizing this cost advantage requires overcoming the technical challenges that currently necessitate expensive engineering solutions and materials.

Environmental considerations also present both opportunities and challenges. While Li-S batteries potentially reduce dependence on critical minerals like cobalt, the environmental impact of large-scale sulfur extraction and processing, as well as end-of-life recycling processes, requires further assessment to ensure sustainability across the full product lifecycle.

Cost Structure Analysis of Li-S and Li-Ion Production

01 Cost reduction strategies for Li-S batteries

Various approaches to reduce the manufacturing costs of lithium-sulfur batteries include using low-cost sulfur cathode materials, optimizing electrode design, and developing cost-effective electrolyte formulations. These strategies aim to make Li-S batteries more economically competitive while maintaining their high energy density advantages. Innovations in production processes and material selection have shown potential to significantly lower the overall cost of Li-S battery systems.- Cost reduction strategies for Li-S batteries: Various approaches to reduce the manufacturing costs of lithium-sulfur batteries include using low-cost sulfur cathodes, optimizing electrolyte compositions, and developing scalable production methods. These strategies aim to make Li-S batteries more economically competitive while maintaining their high energy density advantages. Innovations in electrode design and sulfur utilization efficiency help minimize material costs while improving battery performance and cycle life.

- Manufacturing cost comparison between Li-S and Li-Ion batteries: Comparative analyses of production costs between lithium-sulfur and lithium-ion batteries reveal that Li-S batteries potentially offer lower material costs due to the abundance and low cost of sulfur compared to transition metals used in Li-ion cathodes. However, current manufacturing processes for Li-S batteries often require specialized equipment and techniques that may offset these material cost advantages. The overall cost structure includes considerations for raw materials, production processes, energy requirements, and economies of scale.

- Economic factors affecting Li-S battery commercialization: The commercialization of lithium-sulfur batteries faces economic challenges related to scaling production, supply chain development, and market competition with established lithium-ion technologies. Investment requirements for manufacturing infrastructure, research and development costs, and the need for specialized materials impact the overall economic viability. Market adoption factors, including consumer price sensitivity and industry acceptance, also influence commercialization strategies and cost structures.

- Cost-effective materials and components for Li-S batteries: Development of cost-effective materials for lithium-sulfur batteries focuses on affordable sulfur hosts, binders, separators, and electrolytes that can improve performance while reducing overall costs. Innovations include carbon-based materials for sulfur immobilization, low-cost polymer electrolytes, and alternative lithium salt formulations. These advancements aim to address the polysulfide shuttle effect and other technical challenges while maintaining economic feasibility for mass production.

- Life cycle cost analysis of Li-S versus Li-Ion batteries: Life cycle cost analyses compare the total ownership costs of lithium-sulfur and lithium-ion batteries, considering initial manufacturing costs, operational expenses, lifespan, and end-of-life recycling. While Li-S batteries may have lower material costs, factors such as cycle life, energy efficiency, and maintenance requirements significantly impact their long-term economic value. The potential for recycling sulfur components and the environmental benefits of Li-S technology also factor into comprehensive cost assessments.

02 Manufacturing cost comparison between Li-S and Li-Ion batteries

Comparative analyses of manufacturing costs between lithium-sulfur and lithium-ion batteries reveal that Li-S batteries can potentially offer cost advantages due to the abundance and low cost of sulfur as a cathode material. However, current Li-S battery production involves higher processing costs and shorter lifespans that offset some of these material cost advantages. The economic viability of Li-S technology depends on overcoming cycle life limitations and scaling up production to achieve economies of scale.Expand Specific Solutions03 Material innovations to improve Li-S battery cost-effectiveness

Novel materials and compositions are being developed to enhance the cost-effectiveness of lithium-sulfur batteries. These innovations include advanced sulfur hosts, protective coatings for lithium anodes, and functional electrolyte additives that improve cycle life while using economical materials. By addressing the polysulfide shuttle effect and lithium dendrite formation with cost-effective solutions, these advancements aim to make Li-S batteries more commercially viable alternatives to conventional lithium-ion batteries.Expand Specific Solutions04 Economic analysis of Li-Ion battery production

Economic analyses of lithium-ion battery production examine factors affecting manufacturing costs, including raw material prices, production scale, and technological advancements. Studies indicate that economies of scale and learning curve effects have contributed to significant cost reductions in Li-ion batteries over time. The cost structure of Li-ion batteries is heavily influenced by cathode materials, which typically account for a substantial portion of the total cell cost. Ongoing research focuses on reducing dependency on expensive metals like cobalt and nickel.Expand Specific Solutions05 Cost projections and market competitiveness

Cost projections for both lithium-sulfur and lithium-ion batteries suggest continuing price declines as technology matures and production scales. While Li-ion batteries currently dominate the market due to established manufacturing infrastructure and proven reliability, Li-S batteries show promise for specific applications where their higher theoretical energy density could provide value despite current cost challenges. The market competitiveness of these battery technologies depends on factors including raw material availability, manufacturing efficiency improvements, and evolving performance requirements across different applications.Expand Specific Solutions

Key Industry Players in Advanced Battery Manufacturing

The lithium-sulfur (Li-S) versus lithium-ion (Li-ion) battery cost modeling landscape is currently in an early growth phase, with the market transitioning from research to commercialization. While Li-ion technology is mature with established manufacturing infrastructure, Li-S batteries represent an emerging technology with promising cost advantages at scale. Key academic institutions (Tianjin University, Fudan University, Colorado School of Mines) are advancing fundamental research, while companies like Lyten, Nanotek Instruments, and BASF are developing commercial applications. Traditional battery manufacturers (Robert Bosch) and energy companies (State Grid) are also investing in this space. The market is projected to grow significantly as Li-S technology addresses current limitations in energy density and manufacturing costs, potentially disrupting the $50+ billion Li-ion market.

Nanotek Instruments, Inc.

Technical Solution: Nanotek Instruments has developed specialized nanomaterial solutions for Li-S battery technology with corresponding cost modeling that demonstrates significant advantages over Li-ion at scale. Their approach centers on proprietary graphene-based host materials for sulfur cathodes that dramatically improve sulfur utilization and cycling stability. Nanotek's cost analysis indicates that their graphene production method, which uses a scalable thermal exfoliation process, can be produced at costs below $10/kg at commercial scale - significantly lower than many competing advanced carbon materials. Their integrated manufacturing model shows that Li-S batteries using their materials could achieve costs approximately 35% lower than conventional Li-ion batteries at equivalent production volumes. Nanotek has developed detailed process flow simulations for their proposed manufacturing approach, identifying key cost drivers and optimization opportunities. Their analysis includes comprehensive material flow accounting that demonstrates reduced energy requirements during manufacturing compared to conventional Li-ion production. The company's modeling also accounts for the simplified recycling process for Li-S batteries, which provides additional end-of-life cost advantages over Li-ion technologies that require complex separation of multiple metals. Nanotek's research indicates that their approach could enable Li-S batteries to achieve both cost and performance advantages in applications requiring high energy density.

Strengths: Specialized expertise in nanomaterials that directly addresses key Li-S performance limitations; Scalable manufacturing processes for advanced carbon materials that maintain cost advantages; Integrated approach to material design and manufacturing process development. Weaknesses: Limited large-scale manufacturing experience compared to established battery manufacturers; Remaining challenges in electrolyte formulation that affect cycle life; Higher complexity in quality control for nanomaterials compared to conventional battery materials.

Robert Bosch GmbH

Technical Solution: Bosch has developed a sophisticated cost modeling framework for comparing Li-S and Li-ion technologies across different automotive and industrial applications. Their approach integrates manufacturing process simulation with performance modeling to evaluate total cost of ownership rather than just initial production costs. Bosch's analysis indicates that while Li-S batteries currently have higher manufacturing complexity, the raw material cost advantage (particularly the elimination of cobalt and nickel) could enable a 20-25% reduction in cell-level costs at volumes above 5 GWh annually. Their modeling incorporates detailed analysis of production equipment requirements, showing that Li-S manufacturing requires approximately 15% higher capital investment for equivalent capacity compared to Li-ion, primarily due to specialized handling requirements for sulfur and lithium metal. Bosch has also developed a proprietary electrolyte formulation that extends Li-S cycle life while maintaining cost advantages. Their cost projections account for regional energy prices, labor costs, and regulatory environments across potential manufacturing locations, providing a global perspective on optimal production strategies. The company's analysis suggests that Li-S technology could be particularly cost-effective for commercial vehicles and stationary storage applications where energy density requirements favor the Li-S chemistry's theoretical advantages.

Strengths: Comprehensive manufacturing expertise across the entire battery production process; Integration of cost modeling with practical automotive requirements and specifications; Strong understanding of scaling factors that affect production economics. Weaknesses: Higher initial capital costs for manufacturing equipment compared to established Li-ion production; Current Li-S formulations still face cycle life limitations that affect lifetime cost calculations; Technology readiness level remains lower than established Li-ion manufacturing processes.

Critical Patents and Innovations in Li-S Technology

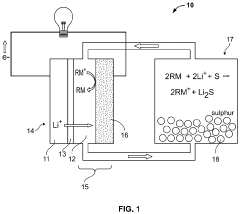

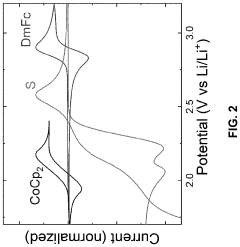

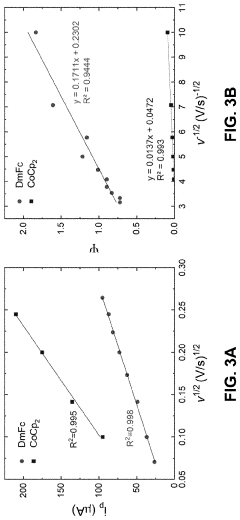

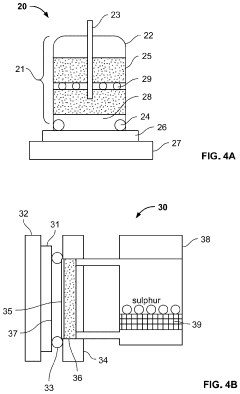

Mediated Metal-Sulfur Flow Battery for Grid-Scale Energy Storage

PatentActiveUS20230033611A1

Innovation

- A mediated metal-sulfur flow battery design that uses a catholyte reservoir with redox mediators to facilitate redox reactions between sulfur and a metal anode, eliminating the need for ion-selective membranes and conductive carbons, and employing a stable solid electrolyte interphase (SEI) to prevent dendritic growth and enhance sulfur utilization.

Lithium-sulfur and sodium-sulfur battery cathodes

PatentWO2019212944A1

Innovation

- Incorporating defected metal organic framework (MOF) moieties with structural and compositional defects that capture lithium or sodium ions and polysulfides, enhancing conductivity and stability, thereby improving charge retention and cycle life.

Supply Chain Considerations for Scaling Li-S Production

The scaling of Lithium-Sulfur (Li-S) battery production presents unique supply chain challenges compared to the established Lithium-Ion (Li-Ion) ecosystem. The sulfur cathode material offers a significant cost advantage, being an abundant by-product of petroleum refining at approximately $0.10-0.30/kg, compared to traditional cathode materials like NMC (Nickel-Manganese-Cobalt) at $20-40/kg. This fundamental material cost difference creates a compelling economic incentive for large-scale Li-S adoption.

However, the Li-S supply chain currently lacks the maturity and infrastructure of Li-Ion manufacturing networks. While sulfur is widely available, specialized carbon hosts and electrolyte additives required for Li-S batteries have limited supplier bases. The production of carbon-sulfur composite cathodes demands new manufacturing processes and equipment that differ significantly from conventional Li-Ion cathode production lines, necessitating substantial capital investment for scaled manufacturing.

Lithium metal anodes, often preferred in Li-S systems for their higher energy density, introduce additional supply chain complexities. The handling of lithium metal requires stringent safety protocols and specialized equipment due to its reactivity with moisture and air. This increases manufacturing complexity and requires dedicated facilities with controlled environments, adding to production costs that must be factored into scaling models.

Electrolyte supply represents another critical consideration. Li-S batteries typically require specialized electrolyte formulations with additives to mitigate polysulfide shuttle effects. These formulations often include lithium nitrate and other compounds that have more limited production capacity than standard Li-Ion electrolytes, potentially creating supply bottlenecks during rapid scaling phases.

Geographic distribution of raw materials also impacts scaling economics. While sulfur is globally abundant, other components like lithium metal and specialized carbon materials may have more concentrated supply sources, introducing geopolitical and logistical factors into cost modeling. Transportation costs and supply security must be evaluated when comparing Li-S to Li-Ion at scale.

The recycling infrastructure represents a final critical consideration. Current Li-Ion recycling processes are not directly transferable to Li-S batteries due to their different chemistry. Developing efficient Li-S recycling methods will be essential for long-term cost competitiveness and environmental sustainability, particularly as production volumes increase and end-of-life batteries accumulate.

However, the Li-S supply chain currently lacks the maturity and infrastructure of Li-Ion manufacturing networks. While sulfur is widely available, specialized carbon hosts and electrolyte additives required for Li-S batteries have limited supplier bases. The production of carbon-sulfur composite cathodes demands new manufacturing processes and equipment that differ significantly from conventional Li-Ion cathode production lines, necessitating substantial capital investment for scaled manufacturing.

Lithium metal anodes, often preferred in Li-S systems for their higher energy density, introduce additional supply chain complexities. The handling of lithium metal requires stringent safety protocols and specialized equipment due to its reactivity with moisture and air. This increases manufacturing complexity and requires dedicated facilities with controlled environments, adding to production costs that must be factored into scaling models.

Electrolyte supply represents another critical consideration. Li-S batteries typically require specialized electrolyte formulations with additives to mitigate polysulfide shuttle effects. These formulations often include lithium nitrate and other compounds that have more limited production capacity than standard Li-Ion electrolytes, potentially creating supply bottlenecks during rapid scaling phases.

Geographic distribution of raw materials also impacts scaling economics. While sulfur is globally abundant, other components like lithium metal and specialized carbon materials may have more concentrated supply sources, introducing geopolitical and logistical factors into cost modeling. Transportation costs and supply security must be evaluated when comparing Li-S to Li-Ion at scale.

The recycling infrastructure represents a final critical consideration. Current Li-Ion recycling processes are not directly transferable to Li-S batteries due to their different chemistry. Developing efficient Li-S recycling methods will be essential for long-term cost competitiveness and environmental sustainability, particularly as production volumes increase and end-of-life batteries accumulate.

Environmental Impact and Sustainability Comparison

The environmental footprint of battery technologies represents a critical factor in their long-term viability, particularly as the world transitions toward sustainable energy systems. When comparing Lithium-Sulfur (Li-S) and Lithium-Ion (Li-Ion) batteries at scale, several environmental considerations emerge that significantly impact their sustainability profiles.

Li-S batteries demonstrate notable environmental advantages in raw material sourcing. Sulfur, a primary component, is abundantly available as a byproduct of petroleum refining processes, effectively repurposing what would otherwise be industrial waste. This contrasts with Li-Ion batteries that rely heavily on cobalt and nickel, materials associated with significant mining impacts including habitat destruction, water pollution, and in some regions, problematic labor practices.

The manufacturing energy requirements for Li-S batteries potentially offer another environmental advantage. Preliminary studies suggest that Li-S cell production may consume 20-30% less energy than conventional Li-Ion manufacturing processes when scaled to gigafactory levels. This reduced energy intensity translates directly to lower carbon emissions during the production phase, particularly important in regions where manufacturing energy comes from fossil fuel sources.

End-of-life considerations reveal further distinctions between these technologies. Li-S batteries contain fewer toxic components than many Li-Ion variants, potentially simplifying recycling processes. Current research indicates that sulfur recovery from spent Li-S cells could achieve rates exceeding 90% with appropriate recycling infrastructure, compared to the 50-70% material recovery typical in current Li-Ion recycling operations.

Water usage patterns differ significantly between these technologies as well. Li-S manufacturing processes are estimated to require approximately 40% less process water than comparable Li-Ion production, a critical sustainability factor in water-stressed regions where battery manufacturing facilities might be located.

Carbon footprint analyses across full lifecycle assessments suggest Li-S technology could offer 15-25% reduction in greenhouse gas emissions compared to conventional Li-Ion batteries when produced at equivalent scales. This advantage stems from both the reduced energy intensity in manufacturing and the lower environmental impact of raw material extraction.

However, these environmental benefits must be balanced against current limitations in Li-S technology longevity. The shorter cycle life of present Li-S batteries may necessitate more frequent replacement, potentially offsetting some environmental advantages unless durability improvements materialize through ongoing research efforts.

Li-S batteries demonstrate notable environmental advantages in raw material sourcing. Sulfur, a primary component, is abundantly available as a byproduct of petroleum refining processes, effectively repurposing what would otherwise be industrial waste. This contrasts with Li-Ion batteries that rely heavily on cobalt and nickel, materials associated with significant mining impacts including habitat destruction, water pollution, and in some regions, problematic labor practices.

The manufacturing energy requirements for Li-S batteries potentially offer another environmental advantage. Preliminary studies suggest that Li-S cell production may consume 20-30% less energy than conventional Li-Ion manufacturing processes when scaled to gigafactory levels. This reduced energy intensity translates directly to lower carbon emissions during the production phase, particularly important in regions where manufacturing energy comes from fossil fuel sources.

End-of-life considerations reveal further distinctions between these technologies. Li-S batteries contain fewer toxic components than many Li-Ion variants, potentially simplifying recycling processes. Current research indicates that sulfur recovery from spent Li-S cells could achieve rates exceeding 90% with appropriate recycling infrastructure, compared to the 50-70% material recovery typical in current Li-Ion recycling operations.

Water usage patterns differ significantly between these technologies as well. Li-S manufacturing processes are estimated to require approximately 40% less process water than comparable Li-Ion production, a critical sustainability factor in water-stressed regions where battery manufacturing facilities might be located.

Carbon footprint analyses across full lifecycle assessments suggest Li-S technology could offer 15-25% reduction in greenhouse gas emissions compared to conventional Li-Ion batteries when produced at equivalent scales. This advantage stems from both the reduced energy intensity in manufacturing and the lower environmental impact of raw material extraction.

However, these environmental benefits must be balanced against current limitations in Li-S technology longevity. The shorter cycle life of present Li-S batteries may necessitate more frequent replacement, potentially offsetting some environmental advantages unless durability improvements materialize through ongoing research efforts.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!