Comparative Market Analysis of Hybrid versus Standard Supercapacitors

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Supercapacitor Technology Evolution and Objectives

Supercapacitors have evolved significantly since their conceptualization in the 1950s, with General Electric engineers first experimenting with porous carbon electrodes. However, it wasn't until the 1990s that commercial applications began to emerge, primarily in memory backup systems. The fundamental technology relies on the electric double-layer capacitance phenomenon, where energy is stored electrostatically at the electrode-electrolyte interface rather than through chemical reactions as in batteries.

Standard supercapacitors, characterized by carbon-based electrodes and organic electrolytes, have dominated the market for decades. These devices offer high power density, rapid charge-discharge capabilities, and exceptional cycle life exceeding 500,000 cycles. However, they suffer from relatively low energy density (typically 5-10 Wh/kg) compared to batteries, limiting their application scope.

The evolution toward hybrid supercapacitors represents a significant technological advancement, combining features of both conventional supercapacitors and batteries. These systems typically incorporate a battery-type electrode (often lithium-doped) with a traditional supercapacitor electrode, enabling higher energy densities while maintaining reasonable power capabilities. The hybrid approach emerged in the early 2000s and has gained substantial research attention over the past decade.

Key technological milestones include the development of lithium-ion capacitors by JM Energy in 2008, which achieved energy densities approaching 20 Wh/kg while maintaining excellent cycle life. More recently, advances in electrode materials such as graphene, metal oxides, and conductive polymers have pushed performance boundaries further, with laboratory prototypes demonstrating energy densities exceeding 50 Wh/kg.

The primary objective of current supercapacitor research focuses on bridging the gap between high-power supercapacitors and high-energy batteries. Hybrid systems aim to occupy this middle ground, providing sufficient energy density for extended operation while maintaining the rapid charge-discharge capabilities essential for applications like regenerative braking in vehicles or grid stabilization.

Future technological trajectories point toward further material innovations, particularly in electrode composition and electrolyte formulations. Research objectives include developing hybrid systems with energy densities approaching 100 Wh/kg while maintaining power densities above 10 kW/kg and cycle life exceeding 100,000 cycles. Additionally, reducing production costs remains critical for broader market adoption, as current hybrid technologies typically command premium prices compared to standard supercapacitors.

Environmental considerations are increasingly shaping research objectives, with emphasis on developing systems using sustainable materials, reducing reliance on rare elements, and ensuring end-of-life recyclability. This aligns with global sustainability initiatives and may provide competitive advantages in environmentally conscious markets.

Standard supercapacitors, characterized by carbon-based electrodes and organic electrolytes, have dominated the market for decades. These devices offer high power density, rapid charge-discharge capabilities, and exceptional cycle life exceeding 500,000 cycles. However, they suffer from relatively low energy density (typically 5-10 Wh/kg) compared to batteries, limiting their application scope.

The evolution toward hybrid supercapacitors represents a significant technological advancement, combining features of both conventional supercapacitors and batteries. These systems typically incorporate a battery-type electrode (often lithium-doped) with a traditional supercapacitor electrode, enabling higher energy densities while maintaining reasonable power capabilities. The hybrid approach emerged in the early 2000s and has gained substantial research attention over the past decade.

Key technological milestones include the development of lithium-ion capacitors by JM Energy in 2008, which achieved energy densities approaching 20 Wh/kg while maintaining excellent cycle life. More recently, advances in electrode materials such as graphene, metal oxides, and conductive polymers have pushed performance boundaries further, with laboratory prototypes demonstrating energy densities exceeding 50 Wh/kg.

The primary objective of current supercapacitor research focuses on bridging the gap between high-power supercapacitors and high-energy batteries. Hybrid systems aim to occupy this middle ground, providing sufficient energy density for extended operation while maintaining the rapid charge-discharge capabilities essential for applications like regenerative braking in vehicles or grid stabilization.

Future technological trajectories point toward further material innovations, particularly in electrode composition and electrolyte formulations. Research objectives include developing hybrid systems with energy densities approaching 100 Wh/kg while maintaining power densities above 10 kW/kg and cycle life exceeding 100,000 cycles. Additionally, reducing production costs remains critical for broader market adoption, as current hybrid technologies typically command premium prices compared to standard supercapacitors.

Environmental considerations are increasingly shaping research objectives, with emphasis on developing systems using sustainable materials, reducing reliance on rare elements, and ensuring end-of-life recyclability. This aligns with global sustainability initiatives and may provide competitive advantages in environmentally conscious markets.

Market Demand Analysis for Energy Storage Solutions

The global energy storage market is experiencing unprecedented growth, driven by the increasing integration of renewable energy sources, electrification of transportation, and the growing need for grid stability. According to recent market research, the global energy storage market is projected to reach $546 billion by 2035, with a compound annual growth rate of approximately 20% between 2023 and 2035. Within this expanding landscape, supercapacitors represent a rapidly growing segment, particularly as traditional battery technologies face limitations in power density and cycle life.

Market demand for supercapacitors is being fueled by several key factors. The automotive sector, especially electric vehicles and hybrid electric vehicles, requires high-power energy storage solutions for regenerative braking systems and power assist functions. This sector alone is expected to consume over 30% of the global supercapacitor production by 2028. Additionally, consumer electronics manufacturers are increasingly incorporating supercapacitors for rapid charging capabilities and extended device lifespans.

The industrial sector presents another significant market opportunity, with applications in renewable energy integration, grid stabilization, and industrial machinery. Wind turbine pitch control systems, for instance, have become a notable application area where supercapacitors' rapid charge-discharge capabilities provide critical advantages over conventional batteries.

When comparing hybrid and standard supercapacitors specifically, market research indicates a growing preference for hybrid technologies. Hybrid supercapacitors, which combine the high energy density of batteries with the high power density of traditional supercapacitors, are seeing demand growth rates approximately 25% higher than their standard counterparts. This trend is particularly pronounced in applications requiring both energy and power performance, such as industrial backup power systems and advanced transportation solutions.

Regional analysis reveals varying adoption patterns. Asia-Pacific currently dominates the supercapacitor market with approximately 45% market share, led by Japan, South Korea, and China, where government initiatives supporting clean energy technologies have accelerated adoption. North America and Europe follow with significant investments in research and development of advanced energy storage technologies, particularly in hybrid supercapacitor solutions.

End-user feedback indicates that while cost remains a barrier to widespread adoption, the total cost of ownership calculations increasingly favor supercapacitors in applications requiring frequent cycling and long operational lifetimes. The premium pricing of hybrid supercapacitors (typically 30-40% higher than standard versions) is increasingly justified by their superior performance metrics and versatility across diverse operating conditions.

Market demand for supercapacitors is being fueled by several key factors. The automotive sector, especially electric vehicles and hybrid electric vehicles, requires high-power energy storage solutions for regenerative braking systems and power assist functions. This sector alone is expected to consume over 30% of the global supercapacitor production by 2028. Additionally, consumer electronics manufacturers are increasingly incorporating supercapacitors for rapid charging capabilities and extended device lifespans.

The industrial sector presents another significant market opportunity, with applications in renewable energy integration, grid stabilization, and industrial machinery. Wind turbine pitch control systems, for instance, have become a notable application area where supercapacitors' rapid charge-discharge capabilities provide critical advantages over conventional batteries.

When comparing hybrid and standard supercapacitors specifically, market research indicates a growing preference for hybrid technologies. Hybrid supercapacitors, which combine the high energy density of batteries with the high power density of traditional supercapacitors, are seeing demand growth rates approximately 25% higher than their standard counterparts. This trend is particularly pronounced in applications requiring both energy and power performance, such as industrial backup power systems and advanced transportation solutions.

Regional analysis reveals varying adoption patterns. Asia-Pacific currently dominates the supercapacitor market with approximately 45% market share, led by Japan, South Korea, and China, where government initiatives supporting clean energy technologies have accelerated adoption. North America and Europe follow with significant investments in research and development of advanced energy storage technologies, particularly in hybrid supercapacitor solutions.

End-user feedback indicates that while cost remains a barrier to widespread adoption, the total cost of ownership calculations increasingly favor supercapacitors in applications requiring frequent cycling and long operational lifetimes. The premium pricing of hybrid supercapacitors (typically 30-40% higher than standard versions) is increasingly justified by their superior performance metrics and versatility across diverse operating conditions.

Current State and Challenges in Supercapacitor Development

Supercapacitor technology has evolved significantly over the past two decades, with global research efforts intensifying since 2010. Currently, standard supercapacitors dominate the commercial market, offering high power density (up to 10,000 W/kg) but limited energy density (typically 5-10 Wh/kg). This fundamental limitation has restricted their application primarily to short-duration power delivery scenarios.

Hybrid supercapacitors represent a technological advancement aimed at bridging the gap between traditional supercapacitors and batteries. These devices combine the high power characteristics of supercapacitors with improved energy storage capabilities, achieving energy densities of 10-50 Wh/kg while maintaining reasonable power performance. The most common hybrid configurations utilize lithium-ion capacitor technology or incorporate pseudocapacitive materials like metal oxides and conductive polymers.

A significant challenge facing both standard and hybrid supercapacitor development is the trade-off between energy density and cycle life. While standard supercapacitors can achieve over 1,000,000 charge-discharge cycles, hybrid variants typically demonstrate reduced cycling stability (50,000-100,000 cycles) due to the incorporation of battery-like materials that undergo more substantial structural changes during operation.

Cost remains a critical barrier to widespread adoption, with current production expenses for hybrid supercapacitors approximately 30-50% higher than standard variants. This cost differential stems from more complex manufacturing processes and specialized materials requirements. Material sustainability and supply chain security present additional challenges, particularly for hybrid systems that may incorporate rare earth elements or lithium.

Geographically, research leadership in standard supercapacitor technology is distributed among the United States, China, Japan, and South Korea, with China dominating in manufacturing capacity. For hybrid supercapacitors, Japan maintains technological leadership through companies like JM Energy and Asahi Kasei, while Chinese and South Korean firms are rapidly advancing their capabilities through substantial R&D investments.

Technical standardization represents another significant challenge, with inconsistent testing protocols and performance metrics complicating direct comparisons between different supercapacitor technologies. This lack of standardization has slowed market adoption and created barriers to entry for emerging technologies.

Environmental considerations are increasingly influencing development trajectories, with researchers focusing on reducing reliance on toxic electrolytes and developing more sustainable electrode materials. Hybrid supercapacitors face particular scrutiny regarding end-of-life recycling processes, which are generally more complex than those for standard carbon-based supercapacitors.

Hybrid supercapacitors represent a technological advancement aimed at bridging the gap between traditional supercapacitors and batteries. These devices combine the high power characteristics of supercapacitors with improved energy storage capabilities, achieving energy densities of 10-50 Wh/kg while maintaining reasonable power performance. The most common hybrid configurations utilize lithium-ion capacitor technology or incorporate pseudocapacitive materials like metal oxides and conductive polymers.

A significant challenge facing both standard and hybrid supercapacitor development is the trade-off between energy density and cycle life. While standard supercapacitors can achieve over 1,000,000 charge-discharge cycles, hybrid variants typically demonstrate reduced cycling stability (50,000-100,000 cycles) due to the incorporation of battery-like materials that undergo more substantial structural changes during operation.

Cost remains a critical barrier to widespread adoption, with current production expenses for hybrid supercapacitors approximately 30-50% higher than standard variants. This cost differential stems from more complex manufacturing processes and specialized materials requirements. Material sustainability and supply chain security present additional challenges, particularly for hybrid systems that may incorporate rare earth elements or lithium.

Geographically, research leadership in standard supercapacitor technology is distributed among the United States, China, Japan, and South Korea, with China dominating in manufacturing capacity. For hybrid supercapacitors, Japan maintains technological leadership through companies like JM Energy and Asahi Kasei, while Chinese and South Korean firms are rapidly advancing their capabilities through substantial R&D investments.

Technical standardization represents another significant challenge, with inconsistent testing protocols and performance metrics complicating direct comparisons between different supercapacitor technologies. This lack of standardization has slowed market adoption and created barriers to entry for emerging technologies.

Environmental considerations are increasingly influencing development trajectories, with researchers focusing on reducing reliance on toxic electrolytes and developing more sustainable electrode materials. Hybrid supercapacitors face particular scrutiny regarding end-of-life recycling processes, which are generally more complex than those for standard carbon-based supercapacitors.

Standard vs Hybrid Supercapacitor Technical Solutions

01 Market analysis and forecasting for supercapacitors

Market analysis and forecasting methods for supercapacitors examine current trends and future growth potential in both hybrid and standard types. These analyses include evaluation of market size, growth rates, and competitive positioning. Forecasting models incorporate factors such as technological advancements, adoption rates across industries, and regional market differences to predict future market performance and investment opportunities in the supercapacitor sector.- Market analysis and forecasting for supercapacitors: Market analysis and forecasting methods for supercapacitors examine current trends and future growth potential in both hybrid and standard types. These analyses include evaluation of market size, growth rates, and competitive positioning. Forecasting models incorporate factors such as technological advancements, adoption rates across industries, and regional market differences to predict future market performance and investment opportunities in the supercapacitor sector.

- Energy management systems utilizing supercapacitors: Energy management systems incorporate supercapacitors to optimize power distribution and storage in various applications. These systems leverage the rapid charge/discharge capabilities of both hybrid and standard supercapacitors to enhance energy efficiency and provide power stabilization. The integration of supercapacitors in energy management solutions has shown market growth due to increasing demand for reliable energy storage solutions in renewable energy systems, electric vehicles, and grid applications.

- Financial trading and investment strategies for supercapacitor technologies: Financial trading and investment strategies specific to the supercapacitor market segment provide frameworks for evaluating investment opportunities in this growing sector. These strategies include methods for assessing company valuations, technological advantages, and market positioning of firms developing or manufacturing supercapacitor technologies. Investment approaches consider factors such as technological differentiation between hybrid and standard types, manufacturing scalability, and potential market applications to determine optimal investment allocations.

- Technological advancements driving market growth: Technological innovations in supercapacitor design and materials are significant drivers of market performance. Advancements include improved energy density in hybrid supercapacitors, enhanced cycle life in standard types, and development of new electrode materials and electrolytes. These technological improvements have expanded application possibilities and market penetration across industries such as automotive, electronics, and renewable energy, contributing to overall market growth and competitive differentiation among manufacturers.

- Application-specific market segments for supercapacitors: The supercapacitor market is segmented by application areas, each showing different performance metrics and growth patterns. Key application segments include automotive systems, consumer electronics, industrial equipment, and renewable energy storage. Market analysis shows varying adoption rates and performance requirements across these segments, with hybrid supercapacitors gaining traction in applications requiring higher energy density, while standard types dominate in high-power, rapid-cycling applications. Understanding these segment-specific dynamics is crucial for market performance assessment.

02 Energy management systems utilizing supercapacitors

Energy management systems incorporate supercapacitors to optimize power distribution and storage capabilities. These systems leverage the rapid charge-discharge characteristics of both hybrid and standard supercapacitors to enhance grid stability, manage peak loads, and improve energy efficiency. The integration of supercapacitors in these systems represents a growing market segment with applications in renewable energy integration, smart grids, and industrial power management.Expand Specific Solutions03 Automotive and transportation applications of supercapacitors

The automotive and transportation sectors represent significant market opportunities for supercapacitors. Both hybrid and standard supercapacitors are being integrated into electric and hybrid vehicles for regenerative braking systems, start-stop functions, and power stabilization. The market performance in this segment is driven by increasing demand for fuel efficiency, electrification of transportation, and the need for reliable energy storage solutions with high power density and long cycle life.Expand Specific Solutions04 Financial trading and investment strategies for supercapacitor markets

Financial trading and investment strategies specific to the supercapacitor market involve analyzing stock performance of companies manufacturing or utilizing supercapacitor technologies. These strategies include portfolio management approaches that consider the growth potential of different supercapacitor technologies, market entry timing, and risk assessment. Investment frameworks evaluate both established players and emerging startups in the supercapacitor value chain to identify profitable opportunities in this evolving market.Expand Specific Solutions05 Technological advancements impacting supercapacitor market growth

Technological innovations are significantly influencing the market performance of supercapacitors. Advancements in materials science, manufacturing processes, and design configurations are improving energy density, power density, and cost-effectiveness of both hybrid and standard supercapacitors. These technological developments are expanding application possibilities and driving market growth across multiple industries, from consumer electronics to industrial equipment and renewable energy systems.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The hybrid supercapacitor market is currently in a growth phase, positioned between early adoption and mainstream commercialization, with an estimated market size of $500-700 million and projected CAGR of 20-25% through 2030. Technologically, hybrid supercapacitors are advancing rapidly, with key players demonstrating varying maturity levels. Industry leaders like Robert Bosch GmbH and Samsung Electro Mechanics have achieved commercial-scale production, while innovative companies such as Nanotech Energy, Superdielectrics, and VINATECH are driving next-generation developments. Academic institutions including Tsinghua University and California Institute of Technology are contributing fundamental research breakthroughs. The competitive landscape is diversifying as traditional capacitor manufacturers compete with automotive suppliers and specialized energy storage startups, indicating the technology's expanding cross-industry applications.

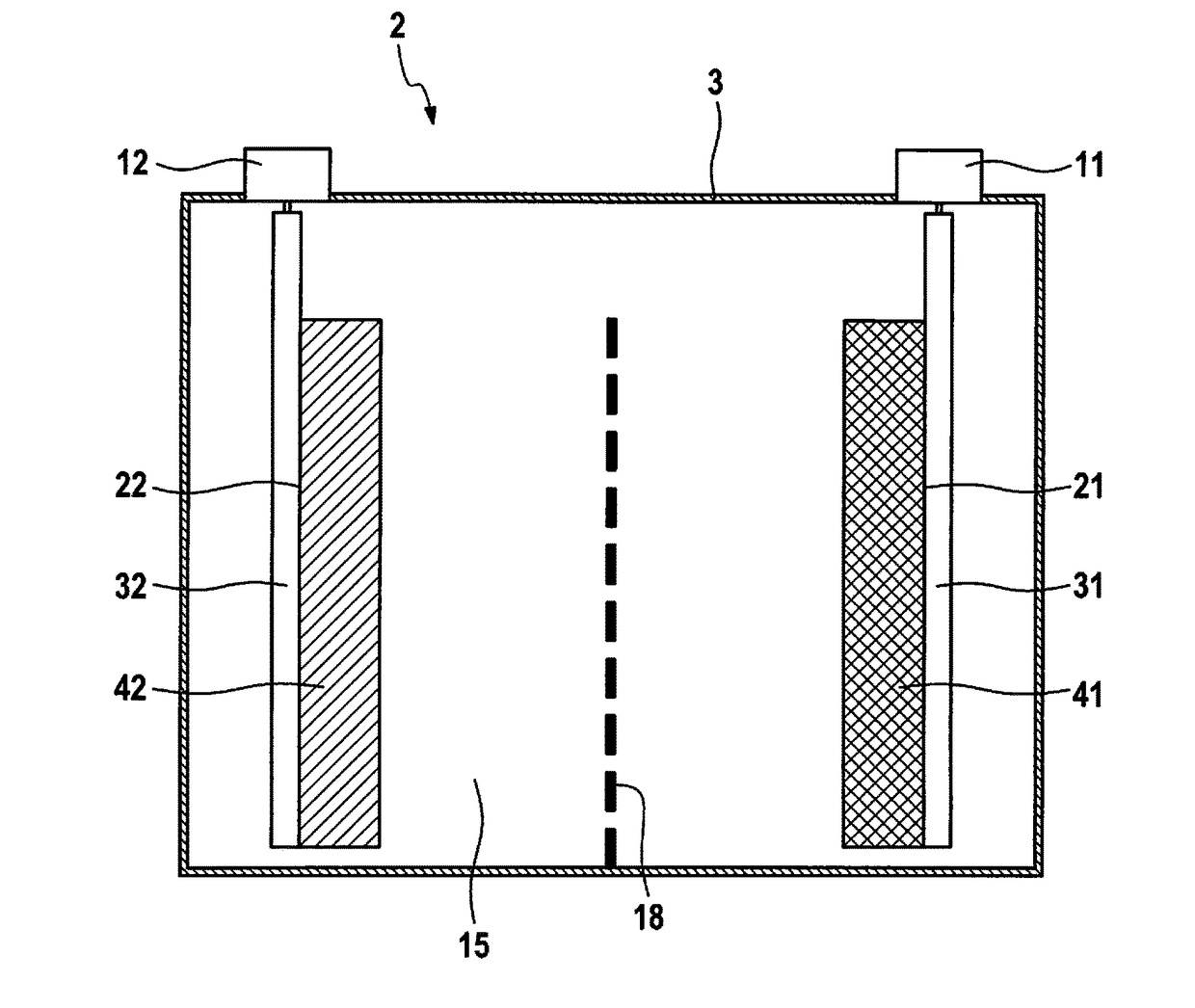

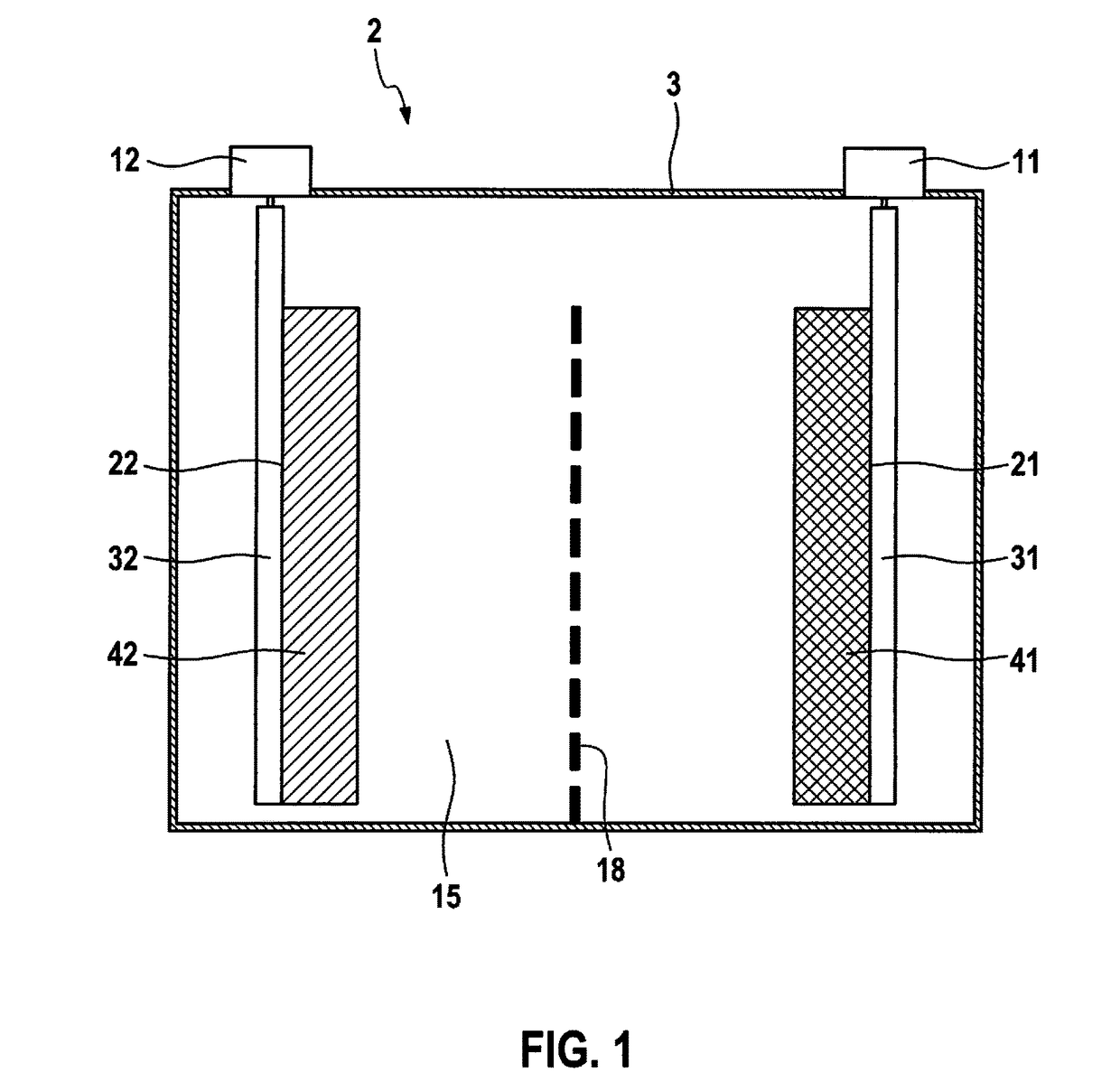

Shanghai Aowei Technology Development Co., Ltd.

Technical Solution: Shanghai Aowei has developed advanced hybrid supercapacitor systems specifically optimized for high-power transportation applications. Their technology combines elements of traditional supercapacitors with battery-like characteristics through the use of specialized carbon-based materials and proprietary electrolyte formulations. Aowei's hybrid supercapacitors feature asymmetric electrode designs with activated carbon positive electrodes and lithium-doped carbon negative electrodes, enabling higher operating voltages and energy densities compared to conventional symmetric supercapacitors. The company has pioneered large-format hybrid supercapacitor modules capable of delivering both high power (up to 10 kW/kg) and improved energy density (15-20 Wh/kg), making them particularly suitable for transportation applications requiring rapid charge/discharge cycles. Their manufacturing process incorporates automated assembly techniques and rigorous quality control measures to ensure consistent performance and reliability across large production volumes.

Strengths: Proven track record in commercial transportation applications, particularly in rapid charging electric buses and trams. Robust thermal management systems enable reliable operation in demanding environments. Weaknesses: Energy density still significantly lower than lithium-ion batteries, limiting application in longer-range electric vehicles. Higher initial cost compared to standard supercapacitors may limit adoption in price-sensitive markets.

VINATECH Co., Ltd.

Technical Solution: VINATECH has pioneered hybrid supercapacitor technology through their VINATech Hybrid Super Capacitor (HSC) series, which combines the advantages of both lithium-ion batteries and traditional supercapacitors. Their approach utilizes activated carbon as the positive electrode and a lithium-doped carbon material as the negative electrode, operating in an organic electrolyte system. This asymmetric design enables their hybrid supercapacitors to achieve energy densities 5-10 times higher than conventional supercapacitors while maintaining excellent power characteristics. The company's manufacturing process incorporates proprietary electrode preparation techniques and electrolyte formulations that optimize the interface between electrode materials and electrolytes, resulting in improved charge transfer kinetics and reduced internal resistance. VINATECH's hybrid supercapacitors operate at higher voltages (up to 3.8V per cell) compared to standard supercapacitors (2.7V), further enhancing energy density capabilities.

Strengths: Significantly higher energy density than standard supercapacitors while maintaining good power density. Wide operating temperature range (-40°C to +65°C) makes them suitable for diverse applications. Weaknesses: Higher self-discharge rates compared to lithium-ion batteries. More complex manufacturing process than standard supercapacitors, potentially affecting cost-effectiveness in mass production.

Core Patents and Innovations in Supercapacitor Technology

Hybrid supercapacitor, including an electrolyte composition, having improved conductivity

PatentInactiveUS20170352498A1

Innovation

- A hybrid supercapacitor design incorporating a liquid electrolyte composition with aprotic organic solvents, conducting salts, and Lewis acid additives that form complex compounds with anions, enhancing ion solvation and reducing charge density, thereby increasing conductivity.

Electrodes for electrochemical cells

PatentInactiveUS20100134954A1

Innovation

- A hybrid supercapacitor design featuring a high-performance porous redox electrode with a significantly higher double layer electrode to redox electrode thickness ratio, ranging from 9:1 to 100:1, utilizing mesoporous materials like nickel or nickel oxides, and a double layer electrode made from materials such as carbon, which enhances volumetric charge storage capacity and maintains a constant voltage output.

Cost-Performance Analysis of Competing Technologies

When comparing hybrid and standard supercapacitors from a cost-performance perspective, several critical factors emerge that influence market adoption and technological competitiveness. Standard supercapacitors typically offer lower initial acquisition costs, with prices ranging from $0.01 to $0.02 per farad for conventional models. This pricing structure has historically provided them with a significant market advantage, particularly in cost-sensitive applications where energy density requirements are moderate.

Hybrid supercapacitors, conversely, command premium pricing—often 30-50% higher than their standard counterparts—due to their advanced materials and manufacturing complexity. However, this cost differential must be evaluated against their superior performance metrics. Hybrid models demonstrate energy densities of 10-15 Wh/kg compared to 5-7 Wh/kg for standard versions, effectively doubling capacity in similar form factors.

Lifecycle cost analysis reveals compelling advantages for hybrid technologies. With cycle lifespans exceeding 500,000 cycles versus 100,000-300,000 for standard models, the amortized cost per cycle significantly favors hybrid solutions in long-term deployments. This extended operational lifespan translates to reduced replacement frequency and lower maintenance costs, particularly valuable in difficult-to-access installations.

Power density comparisons further differentiate these technologies, with hybrid supercapacitors delivering 10-15 kW/kg versus 2-5 kW/kg for standard versions. This performance advantage enables applications requiring rapid charge/discharge cycles that would be unattainable with conventional models, opening new market segments despite higher initial investments.

Temperature performance represents another critical differentiator. Standard supercapacitors typically operate effectively between -40°C and 65°C, while hybrid variants maintain functionality across -40°C to 85°C ranges. This expanded operational envelope justifies premium pricing in extreme environment applications such as aerospace, military, and certain industrial contexts.

Market sensitivity analysis indicates price elasticity varies significantly by application sector. Consumer electronics demonstrates high price sensitivity with minimal tolerance for premium solutions, while industrial automation, renewable energy storage, and automotive sectors exhibit greater willingness to absorb higher costs when performance advantages align with operational requirements.

Recent manufacturing innovations are gradually narrowing the cost gap, with production scaling and material science advancements reducing hybrid supercapacitor premiums to approximately 20-30% above standard versions, compared to 40-60% differentials observed five years ago. This trend suggests approaching price parity may accelerate market penetration for hybrid technologies across broader application categories.

Hybrid supercapacitors, conversely, command premium pricing—often 30-50% higher than their standard counterparts—due to their advanced materials and manufacturing complexity. However, this cost differential must be evaluated against their superior performance metrics. Hybrid models demonstrate energy densities of 10-15 Wh/kg compared to 5-7 Wh/kg for standard versions, effectively doubling capacity in similar form factors.

Lifecycle cost analysis reveals compelling advantages for hybrid technologies. With cycle lifespans exceeding 500,000 cycles versus 100,000-300,000 for standard models, the amortized cost per cycle significantly favors hybrid solutions in long-term deployments. This extended operational lifespan translates to reduced replacement frequency and lower maintenance costs, particularly valuable in difficult-to-access installations.

Power density comparisons further differentiate these technologies, with hybrid supercapacitors delivering 10-15 kW/kg versus 2-5 kW/kg for standard versions. This performance advantage enables applications requiring rapid charge/discharge cycles that would be unattainable with conventional models, opening new market segments despite higher initial investments.

Temperature performance represents another critical differentiator. Standard supercapacitors typically operate effectively between -40°C and 65°C, while hybrid variants maintain functionality across -40°C to 85°C ranges. This expanded operational envelope justifies premium pricing in extreme environment applications such as aerospace, military, and certain industrial contexts.

Market sensitivity analysis indicates price elasticity varies significantly by application sector. Consumer electronics demonstrates high price sensitivity with minimal tolerance for premium solutions, while industrial automation, renewable energy storage, and automotive sectors exhibit greater willingness to absorb higher costs when performance advantages align with operational requirements.

Recent manufacturing innovations are gradually narrowing the cost gap, with production scaling and material science advancements reducing hybrid supercapacitor premiums to approximately 20-30% above standard versions, compared to 40-60% differentials observed five years ago. This trend suggests approaching price parity may accelerate market penetration for hybrid technologies across broader application categories.

Environmental Impact and Sustainability Considerations

The environmental footprint of energy storage technologies has become increasingly critical as global sustainability initiatives gain momentum. When comparing hybrid and standard supercapacitors, several key environmental factors emerge that significantly influence their market adoption and long-term viability.

Standard supercapacitors typically utilize activated carbon electrodes derived from coconut shells or synthetic carbons, which generally have lower environmental impact during production compared to battery technologies. However, hybrid supercapacitors incorporate battery-type electrodes that often contain metals like lithium, nickel, or lead, potentially increasing their manufacturing environmental burden.

Life cycle assessment (LCA) studies indicate that hybrid supercapacitors may offer environmental advantages through their extended operational lifespan—often 5-10 times longer than conventional batteries—despite potentially higher initial production impacts. This longevity translates to reduced waste generation and resource consumption over time, particularly in applications requiring frequent charge-discharge cycles.

Energy efficiency represents another critical environmental consideration. Hybrid supercapacitors typically demonstrate 85-95% round-trip efficiency compared to 70-85% for many battery technologies, resulting in lower energy losses during operation. This efficiency differential becomes particularly significant in renewable energy integration applications, where energy conservation directly impacts overall system sustainability.

End-of-life management presents distinct challenges and opportunities. Standard supercapacitors contain fewer toxic materials, making recycling processes potentially simpler. Conversely, hybrid variants may require more sophisticated recycling protocols due to their composite nature and battery-type electrode materials. Current recycling infrastructure remains underdeveloped for both technologies, though several companies have initiated specialized recovery programs.

Carbon footprint analyses reveal that the manufacturing phase accounts for approximately 60-70% of lifetime emissions for both technologies. However, hybrid supercapacitors' extended operational life and higher energy density may result in lower lifetime carbon emissions per stored kWh when deployed in appropriate applications. This advantage becomes particularly pronounced in renewable energy storage scenarios, where the technology can displace fossil fuel-based generation.

Water usage during manufacturing represents another environmental consideration, with hybrid supercapacitors typically requiring 30-40% more process water than standard variants due to additional electrode production steps. This factor becomes increasingly relevant in water-stressed regions where manufacturing facilities operate.

As regulatory frameworks evolve globally, sustainability considerations will likely become more formalized market drivers. The EU's Battery Directive revision and similar initiatives worldwide are beginning to incorporate supercapacitor technologies into regulatory frameworks, potentially creating market advantages for designs with superior environmental profiles.

Standard supercapacitors typically utilize activated carbon electrodes derived from coconut shells or synthetic carbons, which generally have lower environmental impact during production compared to battery technologies. However, hybrid supercapacitors incorporate battery-type electrodes that often contain metals like lithium, nickel, or lead, potentially increasing their manufacturing environmental burden.

Life cycle assessment (LCA) studies indicate that hybrid supercapacitors may offer environmental advantages through their extended operational lifespan—often 5-10 times longer than conventional batteries—despite potentially higher initial production impacts. This longevity translates to reduced waste generation and resource consumption over time, particularly in applications requiring frequent charge-discharge cycles.

Energy efficiency represents another critical environmental consideration. Hybrid supercapacitors typically demonstrate 85-95% round-trip efficiency compared to 70-85% for many battery technologies, resulting in lower energy losses during operation. This efficiency differential becomes particularly significant in renewable energy integration applications, where energy conservation directly impacts overall system sustainability.

End-of-life management presents distinct challenges and opportunities. Standard supercapacitors contain fewer toxic materials, making recycling processes potentially simpler. Conversely, hybrid variants may require more sophisticated recycling protocols due to their composite nature and battery-type electrode materials. Current recycling infrastructure remains underdeveloped for both technologies, though several companies have initiated specialized recovery programs.

Carbon footprint analyses reveal that the manufacturing phase accounts for approximately 60-70% of lifetime emissions for both technologies. However, hybrid supercapacitors' extended operational life and higher energy density may result in lower lifetime carbon emissions per stored kWh when deployed in appropriate applications. This advantage becomes particularly pronounced in renewable energy storage scenarios, where the technology can displace fossil fuel-based generation.

Water usage during manufacturing represents another environmental consideration, with hybrid supercapacitors typically requiring 30-40% more process water than standard variants due to additional electrode production steps. This factor becomes increasingly relevant in water-stressed regions where manufacturing facilities operate.

As regulatory frameworks evolve globally, sustainability considerations will likely become more formalized market drivers. The EU's Battery Directive revision and similar initiatives worldwide are beginning to incorporate supercapacitor technologies into regulatory frameworks, potentially creating market advantages for designs with superior environmental profiles.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!