What Regulations Are Impacting the Hybrid Supercapacitor Industry?

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hybrid Supercapacitor Regulatory Landscape and Development Goals

Hybrid supercapacitors represent a significant advancement in energy storage technology, combining the high energy density of batteries with the rapid charge-discharge capabilities of traditional supercapacitors. The regulatory landscape surrounding this emerging technology has evolved considerably over the past decade, reflecting growing concerns about environmental sustainability, safety standards, and resource management in the energy storage sector.

The development of hybrid supercapacitors can be traced back to the early 2000s, with significant technological breakthroughs occurring around 2010-2015. These innovations coincided with increasing global focus on renewable energy integration and electrification of transportation, creating a favorable environment for advanced energy storage solutions. The technology has since progressed from laboratory prototypes to commercial applications, though widespread adoption remains constrained by various regulatory factors.

Current regulatory frameworks affecting hybrid supercapacitors primarily focus on four key areas: material safety, manufacturing standards, end-of-life management, and performance certification. The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation and RoHS (Restriction of Hazardous Substances) directive have significantly influenced material selection and design parameters, particularly regarding electrolyte compositions and electrode materials.

In North America, UL (Underwriters Laboratories) standards and IEEE (Institute of Electrical and Electronics Engineers) guidelines have established benchmarks for safety testing and performance evaluation. Meanwhile, China has implemented its own set of national standards through GB/T frameworks, which are increasingly influential given the country's dominant position in supercapacitor manufacturing.

The technological trajectory of hybrid supercapacitors is increasingly being shaped by sustainability-focused regulations. The EU Battery Directive's recent amendments and the proposed Battery Regulation aim to establish comprehensive lifecycle management requirements, including carbon footprint declarations, minimum recycled content thresholds, and extended producer responsibility provisions. These regulations, though primarily targeting conventional batteries, are expected to encompass hybrid supercapacitors as their market presence grows.

Development goals for the industry are consequently aligning with these regulatory pressures. Key objectives include reducing dependence on critical raw materials (particularly those identified in the EU's Critical Raw Materials list), improving energy density without compromising cycle life, enhancing thermal stability to meet stringent safety standards, and developing cost-effective recycling technologies that can recover high-value components.

Looking forward, the regulatory landscape is expected to continue evolving toward greater harmonization of international standards, more stringent sustainability requirements, and increased focus on supply chain transparency. Industry stakeholders are actively participating in standards development organizations to ensure that emerging regulations balance innovation enablement with necessary safeguards for public safety and environmental protection.

The development of hybrid supercapacitors can be traced back to the early 2000s, with significant technological breakthroughs occurring around 2010-2015. These innovations coincided with increasing global focus on renewable energy integration and electrification of transportation, creating a favorable environment for advanced energy storage solutions. The technology has since progressed from laboratory prototypes to commercial applications, though widespread adoption remains constrained by various regulatory factors.

Current regulatory frameworks affecting hybrid supercapacitors primarily focus on four key areas: material safety, manufacturing standards, end-of-life management, and performance certification. The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation and RoHS (Restriction of Hazardous Substances) directive have significantly influenced material selection and design parameters, particularly regarding electrolyte compositions and electrode materials.

In North America, UL (Underwriters Laboratories) standards and IEEE (Institute of Electrical and Electronics Engineers) guidelines have established benchmarks for safety testing and performance evaluation. Meanwhile, China has implemented its own set of national standards through GB/T frameworks, which are increasingly influential given the country's dominant position in supercapacitor manufacturing.

The technological trajectory of hybrid supercapacitors is increasingly being shaped by sustainability-focused regulations. The EU Battery Directive's recent amendments and the proposed Battery Regulation aim to establish comprehensive lifecycle management requirements, including carbon footprint declarations, minimum recycled content thresholds, and extended producer responsibility provisions. These regulations, though primarily targeting conventional batteries, are expected to encompass hybrid supercapacitors as their market presence grows.

Development goals for the industry are consequently aligning with these regulatory pressures. Key objectives include reducing dependence on critical raw materials (particularly those identified in the EU's Critical Raw Materials list), improving energy density without compromising cycle life, enhancing thermal stability to meet stringent safety standards, and developing cost-effective recycling technologies that can recover high-value components.

Looking forward, the regulatory landscape is expected to continue evolving toward greater harmonization of international standards, more stringent sustainability requirements, and increased focus on supply chain transparency. Industry stakeholders are actively participating in standards development organizations to ensure that emerging regulations balance innovation enablement with necessary safeguards for public safety and environmental protection.

Market Demand Analysis for Hybrid Supercapacitor Technologies

The global hybrid supercapacitor market is experiencing significant growth driven by increasing demand for efficient energy storage solutions across multiple industries. Current market analysis indicates robust expansion with the market expected to grow at a compound annual growth rate of over 20% through 2030, reflecting the technology's growing adoption in automotive, renewable energy, and consumer electronics sectors.

Transportation and automotive applications represent the largest market segment for hybrid supercapacitors. The rapid development of electric and hybrid vehicles has created substantial demand for energy storage systems that can deliver high power density for acceleration while maintaining energy density for range. Major automotive manufacturers are increasingly incorporating hybrid supercapacitors into their designs to complement traditional battery systems, particularly for regenerative braking systems and power stabilization functions.

The renewable energy sector presents another significant growth opportunity. As solar and wind power installations continue to expand globally, the need for efficient energy storage solutions to manage intermittency issues has become critical. Hybrid supercapacitors offer advantages in grid stabilization applications due to their rapid charge-discharge capabilities and longer cycle life compared to conventional batteries, making them particularly valuable for frequency regulation and peak shaving applications.

Consumer electronics manufacturers are also driving market demand as they seek power solutions that combine fast charging capabilities with improved energy density. The miniaturization trend in electronics has created opportunities for hybrid supercapacitors in wearable devices, smartphones, and portable computing devices where space constraints and charging speed are critical considerations.

Industrial applications represent an emerging market segment with significant growth potential. Manufacturing facilities, particularly those implementing Industry 4.0 technologies, require reliable power backup systems and energy management solutions. Hybrid supercapacitors' ability to handle high power demands and frequent cycling makes them suitable for industrial automation systems and uninterruptible power supplies.

Regional analysis shows Asia-Pacific leading the market, with China, Japan, and South Korea serving as manufacturing hubs and major consumers. North America and Europe follow closely, driven by automotive sector adoption and renewable energy integration initiatives. Developing economies in South America and parts of Asia are showing increased interest as their energy infrastructure modernizes and electric vehicle adoption accelerates.

Market research indicates price sensitivity remains a significant factor influencing adoption rates. While hybrid supercapacitors offer performance advantages, their higher initial cost compared to traditional capacitors or some battery technologies creates adoption barriers in price-sensitive applications. However, as production scales and technology advances, cost trajectories are expected to decline, potentially expanding market penetration across additional sectors.

Transportation and automotive applications represent the largest market segment for hybrid supercapacitors. The rapid development of electric and hybrid vehicles has created substantial demand for energy storage systems that can deliver high power density for acceleration while maintaining energy density for range. Major automotive manufacturers are increasingly incorporating hybrid supercapacitors into their designs to complement traditional battery systems, particularly for regenerative braking systems and power stabilization functions.

The renewable energy sector presents another significant growth opportunity. As solar and wind power installations continue to expand globally, the need for efficient energy storage solutions to manage intermittency issues has become critical. Hybrid supercapacitors offer advantages in grid stabilization applications due to their rapid charge-discharge capabilities and longer cycle life compared to conventional batteries, making them particularly valuable for frequency regulation and peak shaving applications.

Consumer electronics manufacturers are also driving market demand as they seek power solutions that combine fast charging capabilities with improved energy density. The miniaturization trend in electronics has created opportunities for hybrid supercapacitors in wearable devices, smartphones, and portable computing devices where space constraints and charging speed are critical considerations.

Industrial applications represent an emerging market segment with significant growth potential. Manufacturing facilities, particularly those implementing Industry 4.0 technologies, require reliable power backup systems and energy management solutions. Hybrid supercapacitors' ability to handle high power demands and frequent cycling makes them suitable for industrial automation systems and uninterruptible power supplies.

Regional analysis shows Asia-Pacific leading the market, with China, Japan, and South Korea serving as manufacturing hubs and major consumers. North America and Europe follow closely, driven by automotive sector adoption and renewable energy integration initiatives. Developing economies in South America and parts of Asia are showing increased interest as their energy infrastructure modernizes and electric vehicle adoption accelerates.

Market research indicates price sensitivity remains a significant factor influencing adoption rates. While hybrid supercapacitors offer performance advantages, their higher initial cost compared to traditional capacitors or some battery technologies creates adoption barriers in price-sensitive applications. However, as production scales and technology advances, cost trajectories are expected to decline, potentially expanding market penetration across additional sectors.

Global Regulatory Challenges and Technical Barriers

The hybrid supercapacitor industry faces a complex regulatory landscape that varies significantly across global markets. In the European Union, the implementation of REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations has created substantial compliance challenges for manufacturers utilizing specific electrolyte materials. These regulations require extensive documentation and testing of chemical components, increasing development costs by an estimated 15-20% for new hybrid supercapacitor products.

Environmental regulations present another significant barrier, particularly RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives. These frameworks mandate strict limitations on hazardous materials and establish end-of-life recycling requirements that directly impact hybrid supercapacitor design and material selection. Manufacturers must now demonstrate 85% recyclability for their products in the EU market.

In North America, regulatory fragmentation between federal and state-level requirements creates compliance complexity. California's Proposition 65 and various state-level chemical restriction laws require different labeling and material composition standards, forcing manufacturers to either create market-specific products or design to the most stringent requirements across all jurisdictions.

Transportation regulations pose critical challenges for the industry, with UN38.3 testing requirements for lithium-containing devices creating classification ambiguity for hybrid supercapacitors. The International Air Transport Association (IATA) and Department of Transportation (DOT) regulations classify certain hybrid supercapacitors as dangerous goods, significantly increasing shipping costs and logistics complexity.

Safety certification standards vary substantially between markets, with UL standards in North America, CE marking in Europe, and CCC certification in China each requiring separate testing protocols. This regulatory divergence creates market entry barriers estimated at $50,000-100,000 per major market region for comprehensive certification.

Intellectual property protection presents both regulatory and technical barriers, with patent landscapes becoming increasingly complex. Major manufacturers have established extensive patent portfolios covering electrolyte formulations, electrode materials, and manufacturing processes, creating potential infringement risks for new market entrants and smaller innovators.

Energy efficiency regulations are emerging as a new challenge, with the EU's Ecodesign Directive and similar frameworks in other regions beginning to establish minimum performance requirements for energy storage systems. These regulations may necessitate redesigns to improve charge-discharge efficiency and reduce self-discharge rates in hybrid supercapacitor technologies.

Environmental regulations present another significant barrier, particularly RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives. These frameworks mandate strict limitations on hazardous materials and establish end-of-life recycling requirements that directly impact hybrid supercapacitor design and material selection. Manufacturers must now demonstrate 85% recyclability for their products in the EU market.

In North America, regulatory fragmentation between federal and state-level requirements creates compliance complexity. California's Proposition 65 and various state-level chemical restriction laws require different labeling and material composition standards, forcing manufacturers to either create market-specific products or design to the most stringent requirements across all jurisdictions.

Transportation regulations pose critical challenges for the industry, with UN38.3 testing requirements for lithium-containing devices creating classification ambiguity for hybrid supercapacitors. The International Air Transport Association (IATA) and Department of Transportation (DOT) regulations classify certain hybrid supercapacitors as dangerous goods, significantly increasing shipping costs and logistics complexity.

Safety certification standards vary substantially between markets, with UL standards in North America, CE marking in Europe, and CCC certification in China each requiring separate testing protocols. This regulatory divergence creates market entry barriers estimated at $50,000-100,000 per major market region for comprehensive certification.

Intellectual property protection presents both regulatory and technical barriers, with patent landscapes becoming increasingly complex. Major manufacturers have established extensive patent portfolios covering electrolyte formulations, electrode materials, and manufacturing processes, creating potential infringement risks for new market entrants and smaller innovators.

Energy efficiency regulations are emerging as a new challenge, with the EU's Ecodesign Directive and similar frameworks in other regions beginning to establish minimum performance requirements for energy storage systems. These regulations may necessitate redesigns to improve charge-discharge efficiency and reduce self-discharge rates in hybrid supercapacitor technologies.

Current Regulatory Compliance Solutions

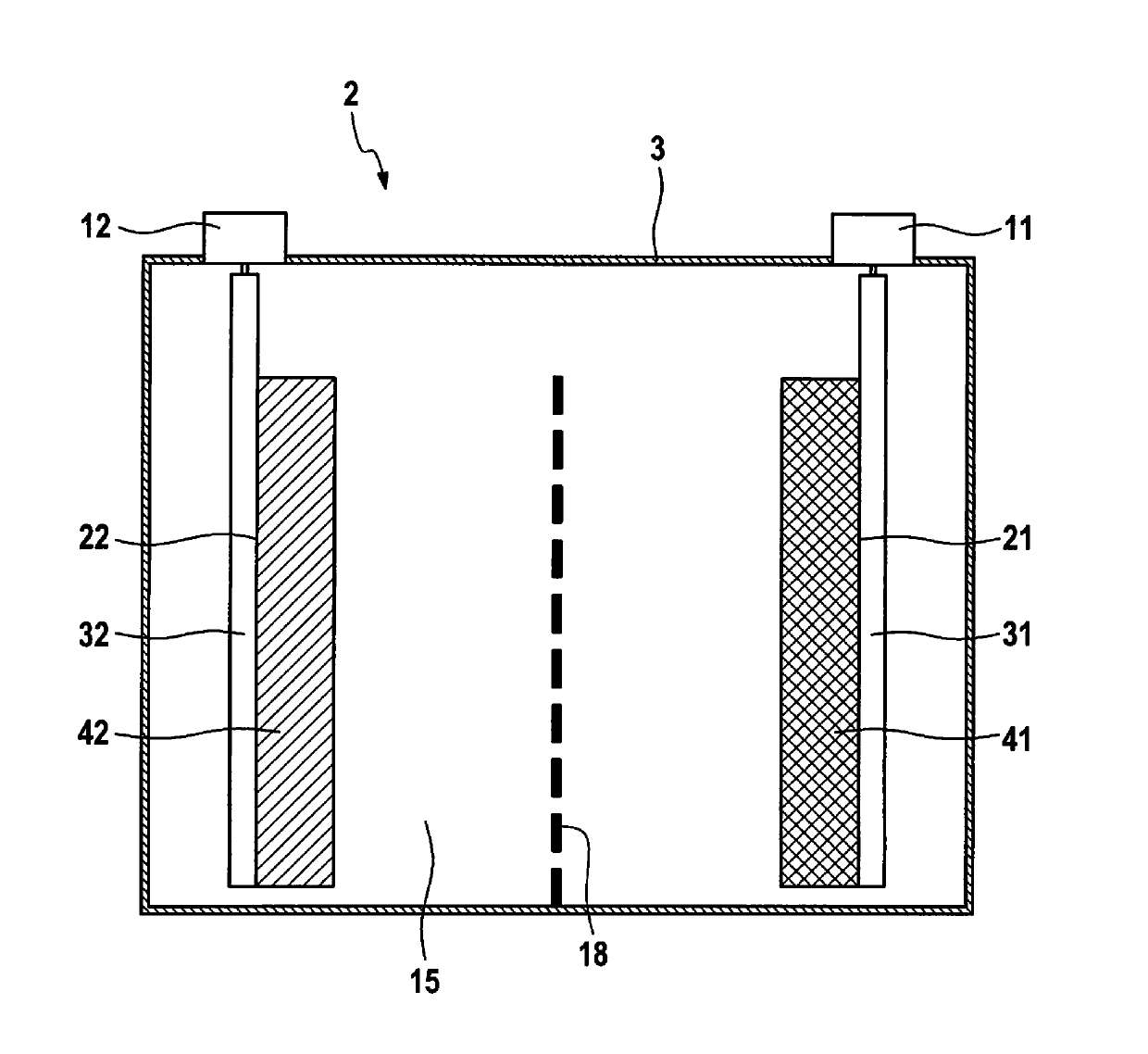

01 Electrode materials for hybrid supercapacitors

Various electrode materials can be used in hybrid supercapacitors to enhance energy density and performance. These materials include carbon-based materials, metal oxides, and conductive polymers. The combination of different electrode materials allows for the creation of hybrid systems that leverage both battery-type and capacitor-type energy storage mechanisms, resulting in improved energy density while maintaining high power density and cycle life.- Electrode materials for hybrid supercapacitors: Various materials can be used as electrodes in hybrid supercapacitors to enhance energy density and performance. These include carbon-based materials, metal oxides, and conductive polymers. The combination of different electrode materials allows for both faradaic and non-faradaic energy storage mechanisms, resulting in devices with higher energy density than conventional supercapacitors while maintaining good power density. The selection and optimization of these electrode materials significantly impact the overall performance of hybrid supercapacitors.

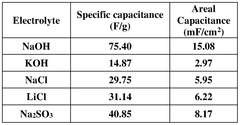

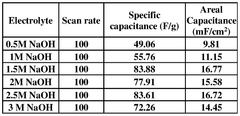

- Electrolyte compositions for hybrid supercapacitors: Electrolyte compositions play a crucial role in determining the performance of hybrid supercapacitors. Various electrolyte formulations, including aqueous, organic, and ionic liquid-based electrolytes, can be used to optimize the operating voltage window, ionic conductivity, and electrochemical stability. Advanced electrolyte designs incorporate additives to enhance the interface between the electrode and electrolyte, improving charge transfer and cycling stability. The choice of electrolyte significantly affects the energy density, power capability, and operational temperature range of hybrid supercapacitors.

- Integration of hybrid supercapacitors with energy systems: Hybrid supercapacitors can be integrated with various energy systems to provide efficient energy storage and power management solutions. These systems include renewable energy sources, electric vehicles, and grid storage applications. The integration involves designing appropriate power electronics interfaces, control systems, and thermal management to optimize the performance of the hybrid supercapacitors within the overall system. Such integrated systems benefit from the high power density and long cycle life of hybrid supercapacitors, complementing other energy storage technologies like batteries.

- Manufacturing processes for hybrid supercapacitors: Advanced manufacturing techniques are employed to produce high-performance hybrid supercapacitors. These processes include specialized coating methods for electrode materials, assembly techniques for cell components, and packaging technologies to ensure reliability and safety. Innovations in manufacturing focus on improving consistency, reducing costs, and enabling mass production while maintaining high quality. Novel approaches include roll-to-roll processing, 3D printing of components, and environmentally friendly production methods that minimize the use of harmful chemicals and reduce waste.

- Performance enhancement strategies for hybrid supercapacitors: Various strategies can be employed to enhance the performance of hybrid supercapacitors. These include structural engineering of electrode materials to increase surface area and facilitate ion transport, surface modification to improve electrode-electrolyte interactions, and development of novel cell designs to optimize space utilization and reduce internal resistance. Additional approaches involve the use of nanomaterials and hierarchical structures to enhance charge storage capabilities, as well as the incorporation of redox-active species to increase energy density while maintaining high power capability and long cycle life.

02 Electrolyte compositions for hybrid supercapacitors

Electrolyte compositions play a crucial role in determining the performance of hybrid supercapacitors. Various electrolyte formulations, including aqueous, organic, and ionic liquid-based electrolytes, can be used to optimize the operating voltage window, ionic conductivity, and electrochemical stability. The choice of electrolyte affects the energy density, power capability, and temperature range of operation for hybrid supercapacitor systems.Expand Specific Solutions03 Integration of hybrid supercapacitors in energy storage systems

Hybrid supercapacitors can be integrated into larger energy storage systems to provide both high power and energy density capabilities. These integrated systems often combine supercapacitors with batteries or other energy sources to create complementary energy storage solutions. Such hybrid systems can be used in applications requiring both high power bursts and sustained energy delivery, such as renewable energy integration, grid stabilization, and electric vehicles.Expand Specific Solutions04 Manufacturing processes for hybrid supercapacitors

Various manufacturing techniques are employed to produce hybrid supercapacitors with optimized performance characteristics. These processes include electrode preparation methods, assembly techniques, and packaging approaches that affect the final device performance. Advanced manufacturing methods such as roll-to-roll processing, 3D printing, and nanomaterial synthesis can be used to enhance the energy density, power capability, and cycle life of hybrid supercapacitors while potentially reducing production costs.Expand Specific Solutions05 Novel architectures and designs for hybrid supercapacitors

Innovative architectures and designs for hybrid supercapacitors focus on optimizing the interface between different components and improving overall device performance. These designs include asymmetric configurations, interdigitated electrodes, and hierarchical structures that maximize active material utilization and ion transport. Novel architectures can address limitations in conventional designs by enhancing energy density while maintaining high power capability and extending cycle life.Expand Specific Solutions

Key Industry Players and Compliance Strategies

The hybrid supercapacitor industry is currently in a growth phase, with regulations significantly shaping its competitive landscape. Environmental regulations, particularly in Europe and Asia, are driving major players like Robert Bosch GmbH, Samsung Electro Mechanics, and Shanghai Aowei Technology to develop more sustainable energy storage solutions. Safety standards and material restrictions are influencing R&D directions, with companies like Shenzhen Capchem and Nanotek Instruments focusing on compliance-oriented innovations. The market is experiencing increased collaboration between industry and academic institutions, as evidenced by partnerships involving Central South University, Penn State Research Foundation, and Commissariat à l'énergie atomique. Technical standardization efforts are creating both barriers to entry and opportunities for established players, while regional regulatory differences are shaping global market strategies and supply chain configurations.

Robert Bosch GmbH

Technical Solution: Robert Bosch has developed advanced hybrid supercapacitor technologies that comply with European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations and RoHS (Restriction of Hazardous Substances) directives. Their approach focuses on environmentally friendly electrolytes that eliminate toxic materials like acetonitrile while maintaining performance. Bosch's hybrid supercapacitors incorporate lithium-ion battery technology with supercapacitor characteristics, resulting in energy storage devices that meet the stringent safety standards required by the automotive industry. Their designs specifically address the European Commission's End-of-Life Vehicle Directive by ensuring recyclability exceeding 85% and incorporating design features that facilitate easy disassembly and material recovery at end-of-life.

Strengths: Strong compliance with European regulations gives Bosch competitive advantage in EU markets. Their automotive-grade safety certifications and established supply chain enable rapid deployment. Weaknesses: Higher production costs associated with regulatory compliance may impact price competitiveness in less regulated markets. Their focus on automotive applications may limit versatility in other sectors.

Shanghai Aowei Technology Development Co., Ltd.

Technical Solution: Shanghai Aowei has developed hybrid supercapacitor technologies specifically designed to comply with China's evolving energy storage regulations. Their approach focuses on meeting the requirements of China's Energy Storage Safety Standards (GB/T 36558-2018) and the national policies promoting new energy vehicles. Aowei's hybrid supercapacitors utilize lithium titanate anodes combined with activated carbon cathodes to achieve high power density while maintaining safety standards. The company has implemented manufacturing processes that align with China's environmental protection regulations, particularly focusing on reducing harmful emissions and waste during production. Their products are designed to meet China's increasingly stringent recycling requirements, with systems in place for the collection and processing of end-of-life components in accordance with the national circular economy initiatives.

Strengths: Strong understanding of and compliance with China's regulatory framework gives them advantage in the domestic market. Their established relationships with Chinese electric vehicle manufacturers provide stable demand. Weaknesses: Limited international certification may restrict global market expansion. Their technology may require adaptation to meet different regulatory standards in Western markets.

Critical Patents and Standards in Regulatory Frameworks

Hybrid supercapacitor, including an electrolyte composition, having improved conductivity

PatentInactiveUS10269507B2

Innovation

- A hybrid supercapacitor design incorporating a liquid electrolyte composition with aprotic organic solvents, conducting salts, and Lewis acid additives that form complex compounds with anions, enhancing ion solvation and reducing charge density to increase conductivity.

Supercapacitor comprising nanostructure of a metal-chalcogen compound

PatentWO2024209476A1

Innovation

- A hybrid supercapacitor design incorporating a first electrode with a carbon-based material and a nanostructure of a metal-chalcogen compound, such as Cu, V, Ni, Fe, Mn, and Sn, combined with a second electrode featuring a similar carbon-based material and nanostructure, utilizing electrolytes like KOH or NaOH, to enhance energy storage capabilities.

Environmental Impact Assessment Requirements

Environmental impact assessment (EIA) requirements are becoming increasingly stringent for the hybrid supercapacitor industry, reflecting growing global concerns about sustainability and environmental protection. These assessments evaluate the potential environmental consequences of manufacturing processes, material sourcing, and end-of-life disposal of hybrid supercapacitors.

In the European Union, the Environmental Impact Assessment Directive (2014/52/EU) mandates comprehensive environmental evaluations for industrial facilities, including those producing energy storage technologies. Manufacturers must demonstrate minimal environmental impact across the entire product lifecycle before receiving approval for new production facilities or significant expansions.

The United States Environmental Protection Agency (EPA) enforces similar requirements through the National Environmental Policy Act (NEPA), requiring federal agencies to assess environmental effects before approving projects that might significantly impact the environment. This directly affects hybrid supercapacitor manufacturers seeking federal contracts or operating on federal lands.

China, a major player in the supercapacitor market, has strengthened its environmental regulations through the Environmental Protection Law and the Environmental Impact Assessment Law. These regulations impose strict requirements on manufacturers regarding waste management, emissions control, and resource conservation throughout the production process.

Material-specific regulations present additional challenges for the industry. The use of certain electrolytes, activated carbons, and metal oxides in hybrid supercapacitors triggers specific assessment requirements. For instance, regulations concerning heavy metals and toxic substances require manufacturers to evaluate potential soil and water contamination risks during production and disposal phases.

Water usage and wastewater management represent another critical aspect of environmental impact assessments. Production processes for hybrid supercapacitors often involve significant water consumption and generate wastewater containing various chemicals. Regulatory frameworks increasingly demand detailed water management plans and treatment protocols.

Carbon footprint considerations have gained prominence in recent EIA requirements. Manufacturers must now calculate and report the greenhouse gas emissions associated with their production processes, energy consumption, and transportation activities. This trend aligns with global climate commitments and affects both operational permits and market access.

End-of-life management has emerged as a focal point in environmental assessments. Regulations increasingly incorporate extended producer responsibility principles, requiring manufacturers to develop and implement recycling programs for their products. The EU's Waste Electrical and Electronic Equipment (WEEE) Directive exemplifies this approach, mandating collection and environmentally sound disposal of electronic waste, including energy storage devices.

In the European Union, the Environmental Impact Assessment Directive (2014/52/EU) mandates comprehensive environmental evaluations for industrial facilities, including those producing energy storage technologies. Manufacturers must demonstrate minimal environmental impact across the entire product lifecycle before receiving approval for new production facilities or significant expansions.

The United States Environmental Protection Agency (EPA) enforces similar requirements through the National Environmental Policy Act (NEPA), requiring federal agencies to assess environmental effects before approving projects that might significantly impact the environment. This directly affects hybrid supercapacitor manufacturers seeking federal contracts or operating on federal lands.

China, a major player in the supercapacitor market, has strengthened its environmental regulations through the Environmental Protection Law and the Environmental Impact Assessment Law. These regulations impose strict requirements on manufacturers regarding waste management, emissions control, and resource conservation throughout the production process.

Material-specific regulations present additional challenges for the industry. The use of certain electrolytes, activated carbons, and metal oxides in hybrid supercapacitors triggers specific assessment requirements. For instance, regulations concerning heavy metals and toxic substances require manufacturers to evaluate potential soil and water contamination risks during production and disposal phases.

Water usage and wastewater management represent another critical aspect of environmental impact assessments. Production processes for hybrid supercapacitors often involve significant water consumption and generate wastewater containing various chemicals. Regulatory frameworks increasingly demand detailed water management plans and treatment protocols.

Carbon footprint considerations have gained prominence in recent EIA requirements. Manufacturers must now calculate and report the greenhouse gas emissions associated with their production processes, energy consumption, and transportation activities. This trend aligns with global climate commitments and affects both operational permits and market access.

End-of-life management has emerged as a focal point in environmental assessments. Regulations increasingly incorporate extended producer responsibility principles, requiring manufacturers to develop and implement recycling programs for their products. The EU's Waste Electrical and Electronic Equipment (WEEE) Directive exemplifies this approach, mandating collection and environmentally sound disposal of electronic waste, including energy storage devices.

Cross-Border Trade Regulations and Market Access

Cross-border trade regulations significantly impact the hybrid supercapacitor industry, creating a complex landscape for manufacturers and distributors operating internationally. The regulatory environment varies considerably across regions, with major markets like the EU, North America, and Asia implementing distinct frameworks that affect import/export activities, tariffs, and compliance requirements.

Tariff structures represent a primary challenge, with hybrid supercapacitors often facing classification ambiguity between energy storage devices and electronic components. This classification discrepancy can result in varying duty rates ranging from 2.7% to 8.5% depending on the importing country's interpretation. The US-China trade tensions have particularly affected this sector, with additional tariffs of up to 25% imposed on Chinese-manufactured energy storage components since 2018.

Technical standards harmonization presents another significant barrier to market access. The International Electrotechnical Commission (IEC) has established standards for supercapacitors (IEC 62391), but hybrid variants often fall into regulatory gaps. The EU's emphasis on the EN 62576 standard differs from China's GB/T 25916 requirements, creating compliance challenges for manufacturers seeking multi-market distribution.

Environmental regulations further complicate cross-border trade, with the EU's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) directives imposing strict controls on materials commonly used in hybrid supercapacitors. Japan and South Korea have implemented similar but not identical restrictions, necessitating product modifications for different markets.

Customs procedures and documentation requirements vary substantially across jurisdictions, with particular complexity surrounding the lithium content in certain hybrid supercapacitor designs. These components may trigger special handling requirements under dangerous goods regulations, requiring additional certifications and shipping declarations that increase compliance costs and delivery timeframes.

Recent regulatory developments include the EU's Carbon Border Adjustment Mechanism, which will likely impact the industry by imposing carbon-related import fees on energy storage components manufactured in regions with less stringent environmental standards. Similarly, the US Infrastructure Investment and Jobs Act contains provisions favoring domestically produced energy storage solutions, potentially creating new market access barriers for international suppliers.

Tariff structures represent a primary challenge, with hybrid supercapacitors often facing classification ambiguity between energy storage devices and electronic components. This classification discrepancy can result in varying duty rates ranging from 2.7% to 8.5% depending on the importing country's interpretation. The US-China trade tensions have particularly affected this sector, with additional tariffs of up to 25% imposed on Chinese-manufactured energy storage components since 2018.

Technical standards harmonization presents another significant barrier to market access. The International Electrotechnical Commission (IEC) has established standards for supercapacitors (IEC 62391), but hybrid variants often fall into regulatory gaps. The EU's emphasis on the EN 62576 standard differs from China's GB/T 25916 requirements, creating compliance challenges for manufacturers seeking multi-market distribution.

Environmental regulations further complicate cross-border trade, with the EU's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) directives imposing strict controls on materials commonly used in hybrid supercapacitors. Japan and South Korea have implemented similar but not identical restrictions, necessitating product modifications for different markets.

Customs procedures and documentation requirements vary substantially across jurisdictions, with particular complexity surrounding the lithium content in certain hybrid supercapacitor designs. These components may trigger special handling requirements under dangerous goods regulations, requiring additional certifications and shipping declarations that increase compliance costs and delivery timeframes.

Recent regulatory developments include the EU's Carbon Border Adjustment Mechanism, which will likely impact the industry by imposing carbon-related import fees on energy storage components manufactured in regions with less stringent environmental standards. Similarly, the US Infrastructure Investment and Jobs Act contains provisions favoring domestically produced energy storage solutions, potentially creating new market access barriers for international suppliers.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!