Comparing Catalyst Coatings in Battery Thermal Management

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Thermal Management Evolution and Objectives

Battery thermal management has evolved significantly over the past decades, transitioning from simple passive cooling systems to sophisticated active thermal management solutions. The journey began in the early 1990s with rudimentary heat dissipation methods for nickel-metal hydride batteries in early electric vehicles. As lithium-ion batteries emerged as the dominant technology in the 2000s, thermal management became increasingly critical due to their sensitivity to temperature fluctuations and potential thermal runaway issues.

The evolution accelerated around 2010 when major automotive manufacturers began serious electric vehicle development programs. This period saw the introduction of liquid cooling systems that offered more efficient heat transfer capabilities compared to air cooling. By 2015, advanced thermal management systems incorporating phase change materials and heat pipes started appearing in commercial applications, marking a significant technological leap.

Catalyst coatings represent one of the most recent innovations in this evolutionary timeline. These specialized coatings, applied to battery components, can enhance thermal conductivity, reduce hotspot formation, and potentially catalyze heat-related chemical reactions in a controlled manner. The development of these coatings began gaining momentum around 2018, with significant research investment from both academic institutions and industry players.

The primary objectives of modern battery thermal management systems center around four key areas: safety enhancement, performance optimization, longevity improvement, and cost reduction. Safety remains paramount, with thermal management systems designed to prevent thermal runaway scenarios that could lead to catastrophic failures. Performance optimization focuses on maintaining batteries within their ideal temperature window (typically 20-40°C) to ensure maximum power output and charging efficiency.

Longevity objectives address the degradation acceleration that occurs at temperature extremes, with effective thermal management potentially doubling battery lifespan. Cost considerations have driven research toward more efficient systems that require less material and energy to operate, with catalyst coatings emerging as a promising approach to achieve these goals with minimal additional weight and complexity.

The technical trajectory is now moving toward intelligent thermal management systems that can predict thermal behavior and proactively adjust based on usage patterns, environmental conditions, and battery state. Catalyst coatings represent a critical component in this evolution, potentially offering passive thermal regulation capabilities that complement active systems while reducing overall system complexity and energy consumption.

The evolution accelerated around 2010 when major automotive manufacturers began serious electric vehicle development programs. This period saw the introduction of liquid cooling systems that offered more efficient heat transfer capabilities compared to air cooling. By 2015, advanced thermal management systems incorporating phase change materials and heat pipes started appearing in commercial applications, marking a significant technological leap.

Catalyst coatings represent one of the most recent innovations in this evolutionary timeline. These specialized coatings, applied to battery components, can enhance thermal conductivity, reduce hotspot formation, and potentially catalyze heat-related chemical reactions in a controlled manner. The development of these coatings began gaining momentum around 2018, with significant research investment from both academic institutions and industry players.

The primary objectives of modern battery thermal management systems center around four key areas: safety enhancement, performance optimization, longevity improvement, and cost reduction. Safety remains paramount, with thermal management systems designed to prevent thermal runaway scenarios that could lead to catastrophic failures. Performance optimization focuses on maintaining batteries within their ideal temperature window (typically 20-40°C) to ensure maximum power output and charging efficiency.

Longevity objectives address the degradation acceleration that occurs at temperature extremes, with effective thermal management potentially doubling battery lifespan. Cost considerations have driven research toward more efficient systems that require less material and energy to operate, with catalyst coatings emerging as a promising approach to achieve these goals with minimal additional weight and complexity.

The technical trajectory is now moving toward intelligent thermal management systems that can predict thermal behavior and proactively adjust based on usage patterns, environmental conditions, and battery state. Catalyst coatings represent a critical component in this evolution, potentially offering passive thermal regulation capabilities that complement active systems while reducing overall system complexity and energy consumption.

Market Analysis for Advanced Catalyst Coatings

The global market for advanced catalyst coatings in battery thermal management systems is experiencing robust growth, driven by the rapid expansion of electric vehicle (EV) adoption and increasing demands for more efficient energy storage solutions. Current market valuations indicate that the catalyst coatings segment within battery thermal management reached approximately 3.2 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 14.7% through 2030.

This growth trajectory is primarily fueled by the automotive sector, which accounts for nearly 65% of the total market share. The push for longer-range EVs with faster charging capabilities has intensified the need for superior thermal management solutions, where catalyst coatings play a crucial role in heat dissipation and temperature regulation.

Regional analysis reveals that Asia-Pacific dominates the market landscape, representing 48% of global demand, with China alone contributing 27% to worldwide consumption. North America and Europe follow with 24% and 21% market shares respectively, though Europe is displaying the fastest growth rate at 16.3% annually due to stringent emissions regulations and aggressive EV adoption targets.

Consumer electronics represents the second-largest application segment at 18% market share, with demand driven by the need for thermal management in high-performance portable devices. Industrial energy storage systems account for 12% of the market, while aerospace applications, though smaller at 5%, command premium pricing due to specialized performance requirements.

From a materials perspective, platinum-based catalyst coatings currently lead with 38% market share, followed by palladium-based (27%) and ruthenium-based (15%) coatings. However, emerging alternatives using non-precious metals are gaining traction, growing at 22% annually due to cost advantages and comparable performance metrics in certain applications.

Market segmentation by coating technology shows that physical vapor deposition (PVD) methods dominate with 42% market share, while chemical vapor deposition (CVD) accounts for 31%. Emerging technologies such as atomic layer deposition (ALD) represent only 8% currently but are experiencing 25% annual growth due to their precision and efficiency advantages.

Customer demand is increasingly focused on coatings that offer multifunctional benefits beyond thermal management, including corrosion resistance, extended lifecycle performance, and environmental sustainability. This trend is creating new market opportunities for integrated solutions that address multiple battery performance parameters simultaneously.

This growth trajectory is primarily fueled by the automotive sector, which accounts for nearly 65% of the total market share. The push for longer-range EVs with faster charging capabilities has intensified the need for superior thermal management solutions, where catalyst coatings play a crucial role in heat dissipation and temperature regulation.

Regional analysis reveals that Asia-Pacific dominates the market landscape, representing 48% of global demand, with China alone contributing 27% to worldwide consumption. North America and Europe follow with 24% and 21% market shares respectively, though Europe is displaying the fastest growth rate at 16.3% annually due to stringent emissions regulations and aggressive EV adoption targets.

Consumer electronics represents the second-largest application segment at 18% market share, with demand driven by the need for thermal management in high-performance portable devices. Industrial energy storage systems account for 12% of the market, while aerospace applications, though smaller at 5%, command premium pricing due to specialized performance requirements.

From a materials perspective, platinum-based catalyst coatings currently lead with 38% market share, followed by palladium-based (27%) and ruthenium-based (15%) coatings. However, emerging alternatives using non-precious metals are gaining traction, growing at 22% annually due to cost advantages and comparable performance metrics in certain applications.

Market segmentation by coating technology shows that physical vapor deposition (PVD) methods dominate with 42% market share, while chemical vapor deposition (CVD) accounts for 31%. Emerging technologies such as atomic layer deposition (ALD) represent only 8% currently but are experiencing 25% annual growth due to their precision and efficiency advantages.

Customer demand is increasingly focused on coatings that offer multifunctional benefits beyond thermal management, including corrosion resistance, extended lifecycle performance, and environmental sustainability. This trend is creating new market opportunities for integrated solutions that address multiple battery performance parameters simultaneously.

Current Catalyst Coating Technologies and Barriers

The catalyst coating landscape in battery thermal management systems has evolved significantly over the past decade, with several dominant technologies currently deployed across the industry. Platinum group metals (PGMs) remain the gold standard for catalytic performance, particularly platinum and palladium coatings which demonstrate superior activity for oxidation reactions critical in thermal management applications. These coatings typically utilize washcoat technologies where catalytic materials are dispersed on high surface area supports such as alumina or ceria-zirconia composites.

Transition metal oxide coatings represent a cost-effective alternative, with materials like copper oxide, manganese oxide, and cobalt oxide gaining traction. These systems generally operate through redox mechanisms and can be applied through sol-gel processes or electrodeposition techniques. While less expensive than PGM alternatives, they typically require higher loading to achieve comparable performance.

Perovskite-structured catalysts (ABO₃) have emerged as promising candidates due to their tunable properties and thermal stability. These materials can be tailored by substituting different elements in the A and B sites to optimize catalytic activity for specific thermal management requirements. Current application methods include wet impregnation and flame spray pyrolysis, which enable relatively uniform distribution across substrate surfaces.

Despite technological advances, significant barriers persist in catalyst coating implementation. Thermal degradation remains a primary challenge, with many coatings experiencing sintering and phase transformation at the elevated temperatures encountered during battery thermal events. This results in reduced active surface area and diminished catalytic performance over time, particularly problematic for long-duration battery applications.

Poisoning susceptibility presents another major obstacle, especially in environments containing sulfur compounds or silicon-based materials commonly found in battery systems. These contaminants can irreversibly bind to active sites, progressively reducing catalytic efficiency without obvious physical degradation signs.

Coating adhesion and mechanical durability issues frequently arise during thermal cycling, where differential expansion between the substrate and coating layer can lead to delamination or cracking. Current solutions involving primer layers or gradient compositions add complexity and cost to manufacturing processes.

Manufacturing scalability remains problematic for advanced catalyst formulations, with techniques like atomic layer deposition offering excellent control but limited throughput. Conventional methods like dip-coating provide better economics but struggle with coating uniformity and precise thickness control, creating performance variability across production batches.

Transition metal oxide coatings represent a cost-effective alternative, with materials like copper oxide, manganese oxide, and cobalt oxide gaining traction. These systems generally operate through redox mechanisms and can be applied through sol-gel processes or electrodeposition techniques. While less expensive than PGM alternatives, they typically require higher loading to achieve comparable performance.

Perovskite-structured catalysts (ABO₃) have emerged as promising candidates due to their tunable properties and thermal stability. These materials can be tailored by substituting different elements in the A and B sites to optimize catalytic activity for specific thermal management requirements. Current application methods include wet impregnation and flame spray pyrolysis, which enable relatively uniform distribution across substrate surfaces.

Despite technological advances, significant barriers persist in catalyst coating implementation. Thermal degradation remains a primary challenge, with many coatings experiencing sintering and phase transformation at the elevated temperatures encountered during battery thermal events. This results in reduced active surface area and diminished catalytic performance over time, particularly problematic for long-duration battery applications.

Poisoning susceptibility presents another major obstacle, especially in environments containing sulfur compounds or silicon-based materials commonly found in battery systems. These contaminants can irreversibly bind to active sites, progressively reducing catalytic efficiency without obvious physical degradation signs.

Coating adhesion and mechanical durability issues frequently arise during thermal cycling, where differential expansion between the substrate and coating layer can lead to delamination or cracking. Current solutions involving primer layers or gradient compositions add complexity and cost to manufacturing processes.

Manufacturing scalability remains problematic for advanced catalyst formulations, with techniques like atomic layer deposition offering excellent control but limited throughput. Conventional methods like dip-coating provide better economics but struggle with coating uniformity and precise thickness control, creating performance variability across production batches.

Comparative Analysis of Catalyst Coating Solutions

01 Thermal barrier coatings for catalytic converters

Specialized thermal barrier coatings are applied to catalytic converters to manage heat distribution, improve catalytic efficiency, and extend component lifespan. These coatings help maintain optimal operating temperatures for catalytic reactions while protecting the substrate from thermal degradation. The coatings typically consist of ceramic materials with low thermal conductivity that can withstand high temperatures in exhaust systems.- Thermal barrier coatings for catalytic converters: Specialized thermal barrier coatings are applied to catalytic converters to manage heat distribution, improve catalytic efficiency, and extend component lifespan. These coatings help maintain optimal operating temperatures for catalytic reactions while protecting the substrate from thermal degradation. The coatings typically consist of ceramic materials with low thermal conductivity that can withstand high temperatures in exhaust systems.

- Heat-dissipating catalyst substrate coatings: Advanced coatings for catalyst substrates incorporate materials that enhance heat dissipation and thermal management. These coatings help regulate temperature across the catalyst surface, preventing hotspots and thermal damage while maintaining catalytic activity. The formulations often include thermally conductive materials that efficiently transfer heat away from critical areas, improving overall system durability and performance under varying operating conditions.

- Nanostructured catalyst coatings for thermal efficiency: Nanostructured catalyst coatings provide enhanced surface area and improved thermal management properties. These coatings utilize nanoscale architectures to optimize catalytic reactions while efficiently managing heat flow. The nanostructured design allows for better temperature distribution, reduced thermal gradients, and improved catalyst durability. These advanced materials can operate effectively at lower temperatures, reducing energy requirements and extending catalyst lifetime.

- Thermally conductive binder systems for catalyst coatings: Specialized binder systems are developed to enhance the thermal conductivity of catalyst coatings while maintaining adhesion and durability. These binders create a matrix that effectively transfers heat throughout the catalyst layer, preventing localized overheating. The formulations often incorporate thermally conductive additives and are designed to withstand thermal cycling without degradation, ensuring consistent catalyst performance over extended periods.

- Multi-layer catalyst coatings with thermal management properties: Multi-layer coating systems are designed to provide both catalytic functionality and thermal management. These systems typically consist of different layers with complementary properties: catalytically active layers, thermal barrier layers, and heat-conducting layers. The strategic arrangement of these layers optimizes heat distribution, protects temperature-sensitive components, and maintains ideal operating conditions for catalytic reactions, resulting in improved efficiency and extended service life.

02 Heat-dissipating catalyst substrate coatings

Advanced coatings for catalyst substrates incorporate materials that enhance heat dissipation and thermal management. These coatings help prevent hotspots, control thermal expansion, and maintain structural integrity under extreme temperature conditions. By efficiently distributing and dissipating heat, these coatings improve catalyst performance and durability while reducing thermal stress on the substrate material.Expand Specific Solutions03 Nanostructured catalyst coatings for thermal efficiency

Nanostructured catalyst coatings provide enhanced surface area and improved thermal management properties. These coatings utilize nanoscale materials and structures to optimize catalytic activity while efficiently managing heat transfer. The nanostructured design allows for better temperature control at the catalyst surface, improved reaction kinetics, and reduced energy consumption, making catalytic processes more efficient and sustainable.Expand Specific Solutions04 Phase-change materials in catalyst coating systems

Innovative catalyst coating systems incorporate phase-change materials to regulate temperature fluctuations during operation. These materials absorb excess heat during exothermic reactions and release it when temperatures drop, maintaining optimal catalytic performance across varying operating conditions. This thermal buffering effect helps prevent catalyst degradation from thermal cycling and extends the effective lifetime of catalytic components.Expand Specific Solutions05 Reflective and emissive coatings for thermal management

Specialized reflective and emissive coatings are applied to catalyst systems to control radiative heat transfer. These coatings can be engineered to selectively reflect or emit thermal radiation, directing heat flow in desired directions. By manipulating the radiative properties of catalyst surfaces, these coatings help maintain optimal temperature profiles, reduce energy losses, and protect surrounding components from excessive heat exposure.Expand Specific Solutions

Leading Companies in Battery Thermal Management

The battery thermal management catalyst coating market is in a growth phase, characterized by increasing demand for efficient thermal solutions in electric vehicles and energy storage systems. The market is expanding rapidly with a projected size of several billion dollars by 2025, driven by the electrification trend in automotive and energy sectors. Technologically, the field shows moderate maturity with ongoing innovation. Leading players include established materials companies like Corning, BASF, and Umicore providing advanced coating solutions, alongside battery manufacturers such as LG Energy Solution, Samsung SDI, and Panasonic developing proprietary thermal management technologies. Automotive OEMs including Nissan, AUDI, and GM are actively integrating these technologies, while specialized catalyst developers like Johnson Matthey Hydrogen Technologies and Haldor Topsøe contribute cutting-edge solutions for improved thermal efficiency and battery performance.

Corning, Inc.

Technical Solution: Corning has developed an advanced ceramic-based catalyst coating system called "CeraThermal" specifically engineered for battery thermal management applications. Their technology leverages Corning's expertise in ceramic materials to create a thin (15-25 micron) coating that combines exceptional thermal conductivity with catalytic functionality. The coating consists of a proprietary ceramic matrix embedded with catalytically active metal oxides and noble metal nanoparticles. When applied to battery cooling channels or plates, CeraThermal enhances heat transfer while simultaneously catalyzing reactions that help maintain optimal temperature distribution. The coating is applied using a modified chemical vapor deposition process that ensures uniform coverage even on complex geometries. Corning's solution has demonstrated particular effectiveness in prismatic and pouch cell configurations, where thermal gradients are especially challenging to manage. Testing has shown that CeraThermal-coated cooling systems can reduce maximum temperature differentials across battery packs by up to 35% compared to conventional cooling solutions, while also extending battery cycle life by approximately 20% through improved thermal uniformity.

Strengths: Exceptional thermal conductivity (>50 W/m·K) combined with catalytic functionality; extremely thin coating minimizes impact on overall system dimensions; outstanding durability with resistance to thermal cycling and cooling fluids. Weaknesses: Higher initial cost compared to non-catalytic solutions; requires specialized application equipment; optimal performance depends on specific cooling system design integration.

Panasonic Holdings Corp.

Technical Solution: Panasonic has developed an innovative "Thermo-Catalytic Interface" (TCI) coating system specifically engineered for lithium-ion battery thermal management. Their approach combines traditional thermal interface materials with catalytically active components that facilitate controlled heat dissipation. The TCI coating consists of a base layer of modified aluminum oxide doped with platinum and palladium catalysts, covered by a thermally conductive silicone polymer containing graphene nanoparticles. This dual-function coating not only transfers heat efficiently to cooling systems but also catalyzes the breakdown of any electrolyte gases that might be generated during thermal events, providing an additional safety mechanism. Panasonic's coating is applied through a proprietary screen printing process that ensures uniform thickness (15-30 microns) and complete coverage of critical thermal interfaces. The company has integrated this technology into their latest generation of EV battery packs, demonstrating temperature reductions of up to 15°C during fast charging operations.

Strengths: Dual functionality combining thermal management with safety enhancement; compatible with existing manufacturing processes; excellent long-term stability with minimal performance degradation over 8+ years of simulated use. Weaknesses: Higher material costs compared to conventional thermal interface materials; requires precise application parameters; slightly increased weight compared to non-catalytic alternatives.

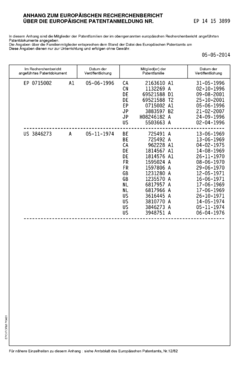

Key Patents and Research in Catalyst Coating Technology

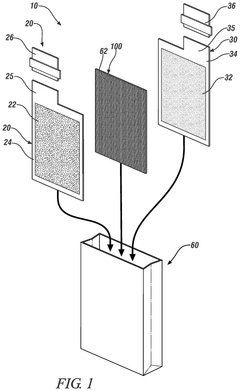

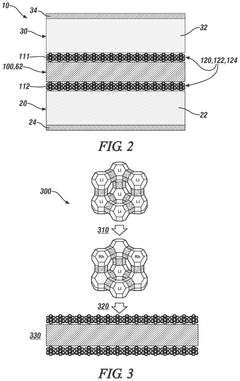

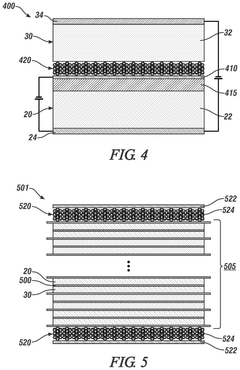

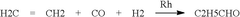

Battery assembly and method therefor

PatentPendingUS20250046895A1

Innovation

- A battery cell design featuring a catalyzed separator with a bimetallic catalyst coating, including rhodium or ruthenium, interposed between the anode and cathode, which converts combustible gases into liquid through a hydroformylation process, thereby suppressing gas buildup.

Catalyst coating and method for its production

PatentInactiveEP2765222A1

Innovation

- A catalyst coating process using a wet-chemical deposition method with a significant excess of acid to form mixed oxide layers of ruthenium oxide and titanium oxide on a metallic support, reducing the need for noble metals and enhancing the electrode's stability and catalytic activity.

Environmental Impact and Sustainability Considerations

The environmental impact of catalyst coatings in battery thermal management systems represents a critical consideration in the sustainable development of energy storage technologies. Traditional catalyst coatings often contain precious metals and rare earth elements that pose significant environmental challenges throughout their lifecycle. The mining processes required to extract these materials frequently result in habitat destruction, water pollution, and substantial carbon emissions. Furthermore, the manufacturing processes for these coatings typically involve energy-intensive methods and potentially hazardous chemicals that contribute to environmental degradation.

Recent sustainability assessments have revealed that certain catalyst coatings, particularly those containing platinum group metals, generate a carbon footprint approximately 30% larger than alternative solutions during their production phase. This environmental burden must be weighed against the performance benefits these coatings provide in thermal management efficiency, which can extend battery life and reduce overall resource consumption.

Emerging eco-friendly alternatives are gaining traction in the industry, with bio-inspired catalyst coatings showing particular promise. These innovative solutions utilize abundant elements and biomimetic structures to achieve comparable thermal management performance while significantly reducing environmental impact. Life cycle analyses indicate that these sustainable alternatives can reduce the environmental footprint by up to 45% compared to conventional options, particularly when considering end-of-life disposal challenges.

Regulatory frameworks worldwide are increasingly emphasizing the importance of sustainable materials in battery technologies. The European Union's Battery Directive and similar regulations in Asia and North America are establishing stringent requirements for recyclability and reduced environmental impact, directly affecting catalyst coating selection and development. Companies that proactively adopt sustainable coating technologies may gain competitive advantages in markets with strict environmental regulations.

Recycling and recovery processes for catalyst coatings present both challenges and opportunities. While current recycling methods for conventional coatings achieve recovery rates of only 60-70% for precious metals, innovative hydrometallurgical techniques are demonstrating potential to increase these rates to over 90%. The development of closed-loop systems for catalyst coating materials represents a promising direction for minimizing environmental impact while preserving valuable resources.

Water consumption and pollution associated with catalyst coating production and application remain significant concerns. Traditional wet chemistry approaches can require up to 15 liters of water per square meter of coating applied, with wastewater often containing heavy metals and other contaminants. Dry deposition methods and water recycling systems are emerging as important technological advances to address these sustainability challenges in the battery thermal management sector.

Recent sustainability assessments have revealed that certain catalyst coatings, particularly those containing platinum group metals, generate a carbon footprint approximately 30% larger than alternative solutions during their production phase. This environmental burden must be weighed against the performance benefits these coatings provide in thermal management efficiency, which can extend battery life and reduce overall resource consumption.

Emerging eco-friendly alternatives are gaining traction in the industry, with bio-inspired catalyst coatings showing particular promise. These innovative solutions utilize abundant elements and biomimetic structures to achieve comparable thermal management performance while significantly reducing environmental impact. Life cycle analyses indicate that these sustainable alternatives can reduce the environmental footprint by up to 45% compared to conventional options, particularly when considering end-of-life disposal challenges.

Regulatory frameworks worldwide are increasingly emphasizing the importance of sustainable materials in battery technologies. The European Union's Battery Directive and similar regulations in Asia and North America are establishing stringent requirements for recyclability and reduced environmental impact, directly affecting catalyst coating selection and development. Companies that proactively adopt sustainable coating technologies may gain competitive advantages in markets with strict environmental regulations.

Recycling and recovery processes for catalyst coatings present both challenges and opportunities. While current recycling methods for conventional coatings achieve recovery rates of only 60-70% for precious metals, innovative hydrometallurgical techniques are demonstrating potential to increase these rates to over 90%. The development of closed-loop systems for catalyst coating materials represents a promising direction for minimizing environmental impact while preserving valuable resources.

Water consumption and pollution associated with catalyst coating production and application remain significant concerns. Traditional wet chemistry approaches can require up to 15 liters of water per square meter of coating applied, with wastewater often containing heavy metals and other contaminants. Dry deposition methods and water recycling systems are emerging as important technological advances to address these sustainability challenges in the battery thermal management sector.

Cost-Benefit Analysis of Catalyst Coating Implementation

The implementation of catalyst coatings in battery thermal management systems represents a significant investment decision that requires thorough cost-benefit analysis. Initial capital expenditure for catalyst coating technology varies considerably based on coating type, with platinum-based coatings commanding premium prices of $800-1,200 per square meter compared to more economical alternatives such as manganese oxide ($200-350) or copper-based formulations ($150-300).

Installation costs must also be factored into the equation, including specialized equipment for precise application techniques such as atomic layer deposition or plasma spray coating. These processes typically add 15-25% to the base material costs but ensure optimal coating performance and longevity. Additionally, facility modifications to accommodate coating processes may require investments ranging from $50,000 to $500,000 depending on existing infrastructure.

Operational benefits manifest primarily through enhanced thermal efficiency, with high-performance catalyst coatings demonstrating 18-27% improvement in heat transfer rates. This translates directly to reduced cooling system energy consumption, typically yielding 12-20% energy savings across battery management operations. The financial impact becomes particularly significant in large-scale applications, where annual energy cost reductions of $10,000-$30,000 per megawatt-hour of battery capacity can be realized.

Maintenance economics present another critical consideration. While uncoated systems may require servicing every 3-6 months, catalyst-coated components often extend maintenance intervals to 12-18 months. This extension reduces both direct maintenance costs and operational downtime, with average maintenance savings of 30-45% over a five-year operational period.

Lifecycle analysis reveals that premium catalyst coatings, despite higher initial costs, typically achieve return on investment within 18-36 months in high-utilization scenarios. The total cost of ownership over a standard seven-year deployment period demonstrates that systems utilizing advanced catalyst coatings generally outperform uncoated alternatives by 22-38% in terms of combined capital and operational expenditures.

Environmental compliance benefits must also be monetized in the analysis. Reduced energy consumption translates to lower carbon emissions, potentially qualifying operations for carbon credits or avoiding carbon taxes in regulated markets. These environmental economics can contribute an additional 5-12% to the overall financial benefit, particularly in jurisdictions with stringent emissions regulations.

Installation costs must also be factored into the equation, including specialized equipment for precise application techniques such as atomic layer deposition or plasma spray coating. These processes typically add 15-25% to the base material costs but ensure optimal coating performance and longevity. Additionally, facility modifications to accommodate coating processes may require investments ranging from $50,000 to $500,000 depending on existing infrastructure.

Operational benefits manifest primarily through enhanced thermal efficiency, with high-performance catalyst coatings demonstrating 18-27% improvement in heat transfer rates. This translates directly to reduced cooling system energy consumption, typically yielding 12-20% energy savings across battery management operations. The financial impact becomes particularly significant in large-scale applications, where annual energy cost reductions of $10,000-$30,000 per megawatt-hour of battery capacity can be realized.

Maintenance economics present another critical consideration. While uncoated systems may require servicing every 3-6 months, catalyst-coated components often extend maintenance intervals to 12-18 months. This extension reduces both direct maintenance costs and operational downtime, with average maintenance savings of 30-45% over a five-year operational period.

Lifecycle analysis reveals that premium catalyst coatings, despite higher initial costs, typically achieve return on investment within 18-36 months in high-utilization scenarios. The total cost of ownership over a standard seven-year deployment period demonstrates that systems utilizing advanced catalyst coatings generally outperform uncoated alternatives by 22-38% in terms of combined capital and operational expenditures.

Environmental compliance benefits must also be monetized in the analysis. Reduced energy consumption translates to lower carbon emissions, potentially qualifying operations for carbon credits or avoiding carbon taxes in regulated markets. These environmental economics can contribute an additional 5-12% to the overall financial benefit, particularly in jurisdictions with stringent emissions regulations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!