Llzo compared with sulfide electrolytes: safety and cost lenses

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LLZO and Sulfide Electrolytes Background and Objectives

Solid-state electrolytes have emerged as promising alternatives to conventional liquid electrolytes in lithium-ion batteries, offering enhanced safety and electrochemical stability. Among these, garnet-type Li7La3Zr2O12 (LLZO) and sulfide-based electrolytes represent two leading categories that have attracted significant research attention over the past decade. The evolution of these materials marks a critical advancement in addressing the inherent limitations of traditional battery technologies.

LLZO, first reported by Murugan et al. in 2007, belongs to the oxide-based solid electrolyte family with a garnet crystal structure. Its development trajectory has been characterized by continuous efforts to enhance ionic conductivity through elemental doping and microstructural engineering. The material has progressed from initial conductivities of 10^-4 S/cm to current values approaching 10^-3 S/cm at room temperature, demonstrating steady improvement in performance metrics.

Sulfide electrolytes, including Li2S-P2S5 glass-ceramics and thio-LISICON derivatives, have followed a parallel but distinct development path. These materials gained prominence in the early 2000s through pioneering work at Toyota Research Institute, with significant breakthroughs in the 2010s leading to superionic conductors like Li10GeP2S12 (LGPS) with conductivities exceeding 10^-2 S/cm at room temperature.

The primary technical objective in comparing these electrolyte systems is to establish a comprehensive framework for evaluating their relative merits specifically from safety and economic perspectives. Safety considerations include thermal stability, chemical reactivity with electrode materials, mechanical properties, and behavior under abuse conditions. Cost factors encompass raw material availability, synthesis complexity, processing requirements, and scalability potential.

Understanding these materials within their historical context reveals divergent approaches to solving similar challenges. While LLZO offers exceptional thermal and chemical stability with moderate ionic conductivity, sulfide electrolytes provide superior ionic transport properties but present greater challenges in terms of air sensitivity and processing requirements.

The technological trajectory suggests continued refinement of both material systems, with increasing focus on addressing their respective limitations. For LLZO, research aims to improve room-temperature conductivity and reduce interfacial resistance, while sulfide electrolyte development focuses on enhancing environmental stability and reducing production costs. This comparative analysis seeks to identify optimal application scenarios for each electrolyte type based on their inherent safety profiles and economic viability.

LLZO, first reported by Murugan et al. in 2007, belongs to the oxide-based solid electrolyte family with a garnet crystal structure. Its development trajectory has been characterized by continuous efforts to enhance ionic conductivity through elemental doping and microstructural engineering. The material has progressed from initial conductivities of 10^-4 S/cm to current values approaching 10^-3 S/cm at room temperature, demonstrating steady improvement in performance metrics.

Sulfide electrolytes, including Li2S-P2S5 glass-ceramics and thio-LISICON derivatives, have followed a parallel but distinct development path. These materials gained prominence in the early 2000s through pioneering work at Toyota Research Institute, with significant breakthroughs in the 2010s leading to superionic conductors like Li10GeP2S12 (LGPS) with conductivities exceeding 10^-2 S/cm at room temperature.

The primary technical objective in comparing these electrolyte systems is to establish a comprehensive framework for evaluating their relative merits specifically from safety and economic perspectives. Safety considerations include thermal stability, chemical reactivity with electrode materials, mechanical properties, and behavior under abuse conditions. Cost factors encompass raw material availability, synthesis complexity, processing requirements, and scalability potential.

Understanding these materials within their historical context reveals divergent approaches to solving similar challenges. While LLZO offers exceptional thermal and chemical stability with moderate ionic conductivity, sulfide electrolytes provide superior ionic transport properties but present greater challenges in terms of air sensitivity and processing requirements.

The technological trajectory suggests continued refinement of both material systems, with increasing focus on addressing their respective limitations. For LLZO, research aims to improve room-temperature conductivity and reduce interfacial resistance, while sulfide electrolyte development focuses on enhancing environmental stability and reducing production costs. This comparative analysis seeks to identify optimal application scenarios for each electrolyte type based on their inherent safety profiles and economic viability.

Market Demand Analysis for Solid-State Battery Electrolytes

The global solid-state battery market is experiencing significant growth, driven by increasing demand for safer, higher energy density power solutions across multiple industries. Market research indicates that the solid-state battery market is projected to reach $8.5 billion by 2027, with a compound annual growth rate of 34.2% from 2020. This remarkable growth trajectory is primarily fueled by the automotive sector's shift toward electrification, where solid-state batteries represent a promising next-generation technology.

Within the solid-state battery ecosystem, electrolytes constitute a critical component, with LLZO (Li7La3Zr2O12) and sulfide-based materials emerging as leading candidates. Consumer electronics manufacturers are increasingly interested in these technologies due to their potential to deliver higher energy density and improved safety compared to conventional lithium-ion batteries with liquid electrolytes.

The automotive industry represents the largest market segment for solid-state batteries, with major manufacturers including Toyota, BMW, and Volkswagen investing heavily in this technology. These companies view solid-state batteries as essential for extending electric vehicle range beyond 500 kilometers while simultaneously addressing safety concerns associated with conventional lithium-ion batteries.

Safety considerations are driving significant market demand for solid-state electrolytes. Traditional lithium-ion batteries with liquid electrolytes pose fire and explosion risks due to their flammability. Both LLZO and sulfide electrolytes offer substantial safety improvements, though in different ways. LLZO provides superior thermal stability and non-flammability, while sulfide electrolytes, despite their reactivity with moisture, eliminate the risk of thermal runaway when properly encapsulated.

Cost sensitivity varies across market segments. While consumer electronics can absorb premium pricing for enhanced performance and safety, the automotive sector requires cost parity with existing technologies for mass adoption. Currently, manufacturing costs for both LLZO and sulfide electrolytes remain significantly higher than liquid alternatives, with LLZO facing challenges in sintering processes and sulfide electrolytes requiring strictly controlled production environments.

Regional market analysis reveals distinct preferences. Asian markets, particularly Japan and South Korea, have demonstrated greater interest in sulfide-based technologies, with companies like Toyota and Samsung leading development efforts. North American and European markets show more balanced research interests between oxide-based systems like LLZO and sulfide alternatives, with significant investment flowing into both technologies.

Market forecasts suggest that whichever electrolyte technology can first achieve the optimal balance between safety, performance, and cost will likely dominate the solid-state battery landscape. Currently, the market appears to be bifurcating, with premium applications favoring the safety advantages of LLZO despite higher costs, while mass-market applications explore sulfide systems for their potentially lower manufacturing complexity.

Within the solid-state battery ecosystem, electrolytes constitute a critical component, with LLZO (Li7La3Zr2O12) and sulfide-based materials emerging as leading candidates. Consumer electronics manufacturers are increasingly interested in these technologies due to their potential to deliver higher energy density and improved safety compared to conventional lithium-ion batteries with liquid electrolytes.

The automotive industry represents the largest market segment for solid-state batteries, with major manufacturers including Toyota, BMW, and Volkswagen investing heavily in this technology. These companies view solid-state batteries as essential for extending electric vehicle range beyond 500 kilometers while simultaneously addressing safety concerns associated with conventional lithium-ion batteries.

Safety considerations are driving significant market demand for solid-state electrolytes. Traditional lithium-ion batteries with liquid electrolytes pose fire and explosion risks due to their flammability. Both LLZO and sulfide electrolytes offer substantial safety improvements, though in different ways. LLZO provides superior thermal stability and non-flammability, while sulfide electrolytes, despite their reactivity with moisture, eliminate the risk of thermal runaway when properly encapsulated.

Cost sensitivity varies across market segments. While consumer electronics can absorb premium pricing for enhanced performance and safety, the automotive sector requires cost parity with existing technologies for mass adoption. Currently, manufacturing costs for both LLZO and sulfide electrolytes remain significantly higher than liquid alternatives, with LLZO facing challenges in sintering processes and sulfide electrolytes requiring strictly controlled production environments.

Regional market analysis reveals distinct preferences. Asian markets, particularly Japan and South Korea, have demonstrated greater interest in sulfide-based technologies, with companies like Toyota and Samsung leading development efforts. North American and European markets show more balanced research interests between oxide-based systems like LLZO and sulfide alternatives, with significant investment flowing into both technologies.

Market forecasts suggest that whichever electrolyte technology can first achieve the optimal balance between safety, performance, and cost will likely dominate the solid-state battery landscape. Currently, the market appears to be bifurcating, with premium applications favoring the safety advantages of LLZO despite higher costs, while mass-market applications explore sulfide systems for their potentially lower manufacturing complexity.

Current Status and Challenges in Solid Electrolyte Development

The development of solid electrolytes represents a critical frontier in advancing battery technology, with LLZO (Li7La3Zr2O12) and sulfide-based materials emerging as leading candidates. Currently, both electrolyte types have achieved ionic conductivities comparable to or exceeding those of liquid electrolytes, with sulfide electrolytes demonstrating conductivities up to 10^-2 S/cm at room temperature, while LLZO typically exhibits values in the 10^-4 to 10^-3 S/cm range.

From a safety perspective, LLZO offers superior stability in ambient conditions, showing minimal reactivity with moisture and air. In contrast, sulfide electrolytes present significant challenges due to their hydrolytic instability, generating toxic H2S gas upon contact with moisture. This instability necessitates stringent manufacturing controls and specialized handling protocols for sulfide-based systems, substantially increasing production complexity and costs.

Cost analysis reveals that LLZO production involves high-temperature sintering processes (>1000°C) requiring expensive equipment and substantial energy inputs. The raw materials for LLZO, particularly lanthanum and zirconium compounds, represent significant cost factors. Sulfide electrolytes typically require lower processing temperatures but demand high-purity precursors and inert processing environments, creating different but equally challenging cost structures.

Manufacturing scalability presents divergent challenges for both materials. LLZO faces difficulties in achieving consistent, dense ceramics without cracks or voids that compromise performance. The sintering process often results in lithium volatilization, requiring precise composition control. Sulfide electrolytes, while easier to process into dense layers via cold pressing, demand completely water-free manufacturing environments, presenting significant industrial scale-up barriers.

Interface stability remains a critical challenge for both electrolyte types. LLZO exhibits relatively stable interfaces with lithium metal but often suffers from high interfacial resistance. Sulfide electrolytes generally form lower-resistance interfaces with electrode materials but may undergo undesirable electrochemical decomposition at operating voltages, forming interphases that can either enhance or degrade long-term performance.

Recent research has focused on composite approaches combining the advantages of both materials, such as LLZO-polymer or sulfide-polymer hybrids. These composites aim to mitigate the brittleness of ceramic electrolytes while maintaining high ionic conductivity. Additionally, surface modification strategies are being explored to enhance interfacial compatibility and stability, particularly for LLZO interfaces with lithium metal anodes.

The regulatory landscape increasingly favors safer battery technologies, potentially accelerating LLZO development despite its higher processing costs, while environmental considerations regarding sulfide electrolyte production and disposal present additional challenges that may impact their long-term commercial viability.

From a safety perspective, LLZO offers superior stability in ambient conditions, showing minimal reactivity with moisture and air. In contrast, sulfide electrolytes present significant challenges due to their hydrolytic instability, generating toxic H2S gas upon contact with moisture. This instability necessitates stringent manufacturing controls and specialized handling protocols for sulfide-based systems, substantially increasing production complexity and costs.

Cost analysis reveals that LLZO production involves high-temperature sintering processes (>1000°C) requiring expensive equipment and substantial energy inputs. The raw materials for LLZO, particularly lanthanum and zirconium compounds, represent significant cost factors. Sulfide electrolytes typically require lower processing temperatures but demand high-purity precursors and inert processing environments, creating different but equally challenging cost structures.

Manufacturing scalability presents divergent challenges for both materials. LLZO faces difficulties in achieving consistent, dense ceramics without cracks or voids that compromise performance. The sintering process often results in lithium volatilization, requiring precise composition control. Sulfide electrolytes, while easier to process into dense layers via cold pressing, demand completely water-free manufacturing environments, presenting significant industrial scale-up barriers.

Interface stability remains a critical challenge for both electrolyte types. LLZO exhibits relatively stable interfaces with lithium metal but often suffers from high interfacial resistance. Sulfide electrolytes generally form lower-resistance interfaces with electrode materials but may undergo undesirable electrochemical decomposition at operating voltages, forming interphases that can either enhance or degrade long-term performance.

Recent research has focused on composite approaches combining the advantages of both materials, such as LLZO-polymer or sulfide-polymer hybrids. These composites aim to mitigate the brittleness of ceramic electrolytes while maintaining high ionic conductivity. Additionally, surface modification strategies are being explored to enhance interfacial compatibility and stability, particularly for LLZO interfaces with lithium metal anodes.

The regulatory landscape increasingly favors safer battery technologies, potentially accelerating LLZO development despite its higher processing costs, while environmental considerations regarding sulfide electrolyte production and disposal present additional challenges that may impact their long-term commercial viability.

Comparative Analysis of LLZO and Sulfide Electrolyte Solutions

01 Safety concerns of sulfide solid electrolytes

Sulfide-based solid electrolytes present significant safety challenges due to their reactivity with moisture, potentially generating toxic hydrogen sulfide gas. These materials require careful handling in controlled environments to prevent degradation and ensure worker safety. Various approaches to mitigate these risks include protective coatings, encapsulation techniques, and modified manufacturing processes that minimize exposure to ambient conditions.- Safety considerations for sulfide solid electrolytes: Sulfide solid electrolytes present safety challenges due to their reactivity with moisture, potentially generating toxic hydrogen sulfide gas. Various approaches have been developed to mitigate these safety concerns, including surface coatings, encapsulation techniques, and moisture-resistant formulations. These safety measures are crucial for the practical implementation of sulfide electrolytes in commercial battery applications, as they help prevent hazardous gas generation and improve handling safety during manufacturing and use.

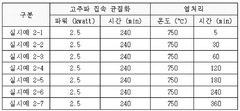

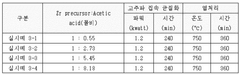

- Cost reduction strategies for LLZO electrolytes: Manufacturing garnet-type LLZO (Li7La3Zr2O12) electrolytes traditionally involves expensive processing methods and high-temperature sintering, resulting in high production costs. Recent innovations focus on cost reduction through simplified synthesis routes, lower sintering temperatures, and alternative precursor materials. These approaches aim to make LLZO electrolytes more economically viable for large-scale battery production while maintaining their excellent ionic conductivity and electrochemical stability properties.

- Composite electrolytes combining LLZO and sulfide materials: Hybrid or composite electrolytes that combine the advantages of both LLZO and sulfide materials have been developed to overcome the limitations of each type. These composites aim to balance the high ionic conductivity of sulfides with the stability and safety of LLZO. By creating these hybrid structures, researchers have achieved improved electrochemical performance, enhanced mechanical properties, and better interfacial stability with electrode materials, while potentially reducing overall costs and safety concerns.

- Manufacturing processes affecting safety and cost: Novel manufacturing processes have been developed to address both safety and cost challenges associated with solid electrolytes. These include scalable production methods, environmentally friendly synthesis routes, and techniques that reduce energy consumption during fabrication. Advanced processing methods such as cold sintering, solution-based approaches, and mechanochemical synthesis can significantly lower production costs while improving safety by reducing exposure to reactive materials and hazardous conditions during manufacturing.

- Interface engineering for improved performance and safety: Interface engineering between solid electrolytes and electrodes is critical for both safety and cost-effectiveness. Poor interfaces can lead to increased resistance, reduced battery performance, and potential safety hazards. Various approaches have been developed to optimize these interfaces, including buffer layers, surface modifications, and specialized coatings. These techniques improve the electrochemical stability of the system, enhance cycling performance, and reduce degradation mechanisms that could lead to safety issues, ultimately contributing to longer battery life and reduced lifetime costs.

02 Cost-effective production of LLZO electrolytes

Manufacturing garnet-type LLZO (Li7La3Zr2O12) electrolytes traditionally involves expensive high-temperature sintering processes and costly raw materials. Recent innovations focus on reducing production costs through optimized synthesis routes, lower sintering temperatures, and alternative precursor materials. These advancements include sol-gel methods, solution-based processing, and doping strategies that maintain ionic conductivity while decreasing manufacturing expenses.Expand Specific Solutions03 Comparative performance between LLZO and sulfide electrolytes

LLZO offers superior chemical stability and safety compared to sulfide electrolytes, while sulfides generally provide higher ionic conductivity at room temperature. The performance trade-offs between these electrolyte types involve considerations of mechanical properties, interfacial resistance, and compatibility with electrode materials. Hybrid approaches combining beneficial properties of both electrolyte types are being developed to optimize overall battery performance.Expand Specific Solutions04 Manufacturing scalability and industrial implementation

Scaling up production of solid electrolytes from laboratory to industrial levels presents significant challenges. For LLZO, these include controlling grain boundary resistance and achieving consistent quality in large batches. Sulfide electrolytes face challenges with moisture sensitivity during mass production. Recent innovations focus on continuous manufacturing processes, quality control protocols, and equipment modifications that enable cost-effective large-scale production while maintaining performance characteristics.Expand Specific Solutions05 Interface engineering for improved electrolyte performance

The interfaces between solid electrolytes and electrodes significantly impact battery safety, cost, and performance. Engineering approaches to improve these interfaces include surface modifications, buffer layers, and composite structures. For LLZO, treatments to reduce lithium dendrite formation at interfaces are crucial, while sulfide electrolytes benefit from strategies that minimize interfacial resistance and prevent chemical degradation. These interface engineering techniques can extend battery lifetime and enhance safety profiles.Expand Specific Solutions

Key Industry Players in Solid Electrolyte Manufacturing

The solid-state electrolyte market is in an early growth phase, with LLZO (lithium lanthanum zirconium oxide) and sulfide electrolytes emerging as key technologies for next-generation batteries. The global market is projected to reach $500+ million by 2025, driven by EV adoption. From a safety perspective, LLZO offers superior thermal stability and non-flammability compared to sulfide electrolytes, which can release toxic H2S gas when exposed to moisture. However, sulfides demonstrate higher ionic conductivity at room temperature. Cost analysis reveals LLZO faces manufacturing challenges due to high sintering temperatures, while companies like QuantumScape, Toyota, and LG Energy Solution are advancing sulfide electrolyte production processes to reduce costs. Research institutions including Argonne National Laboratory and University of Michigan are actively developing solutions to address these technical barriers.

Uchicago Argonne LLC

Technical Solution: Argonne National Laboratory has developed comprehensive research programs comparing LLZO and sulfide electrolytes, with particular emphasis on safety characterization and cost modeling for commercial implementation. Their approach leverages advanced characterization techniques including synchrotron X-ray analysis to understand structural and interfacial properties of both electrolyte systems. For LLZO, Argonne has pioneered atomic layer deposition (ALD) coating techniques to improve interfacial stability with cathode materials while developing lower-temperature processing routes to reduce manufacturing costs. Their sulfide electrolyte research focuses on argyrodite-type Li₆PS₅Cl materials with ionic conductivities exceeding 5×10⁻³ S/cm at room temperature. Argonne has developed sophisticated techno-economic models that account for raw material costs, processing requirements, and manufacturing scale to provide comprehensive cost comparisons between LLZO and sulfide approaches, while their safety testing protocols include calorimetry, gas evolution analysis, and abuse testing under controlled conditions.

Strengths: World-class characterization capabilities; sophisticated modeling tools for performance and cost prediction; strong connections to both academic and industrial partners. Weaknesses: Limited direct manufacturing experience; focus on pre-commercial research rather than product development; challenges in technology transfer to industry partners.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a comprehensive approach to solid-state electrolytes, investigating both LLZO and sulfide systems. Their research focuses on a comparative analysis of garnet-type LLZO structures versus sulfide-based solid electrolytes, particularly examining safety and manufacturing cost trade-offs. For LLZO systems, they've developed proprietary sintering techniques to address the high processing temperatures (>1000°C) that contribute to manufacturing costs. Their sulfide electrolyte program focuses on Li₃PS₄-based materials with enhanced ionic conductivity (>10⁻³ S/cm at room temperature) while addressing the moisture sensitivity issues through protective coating technologies. LG has implemented pilot production lines for both electrolyte types, allowing direct comparison of manufacturing parameters and safety performance under standardized conditions.

Strengths: Extensive manufacturing expertise; established supply chain relationships; comprehensive testing infrastructure for safety validation. Weaknesses: Higher production costs for LLZO compared to sulfide systems; moisture sensitivity challenges with sulfide electrolytes requiring additional protective measures; complex integration with existing battery production lines.

Critical Safety and Cost Performance Assessment

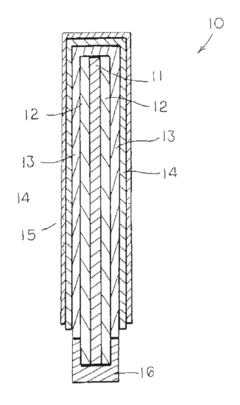

Amorphous ionically conductive metal oxides and sol gel method of preparation

PatentInactiveUS9356317B2

Innovation

- Development of an amorphous lithium lanthanum zirconium oxide (LLZO) electrolyte medium, which is ionically conductive, non-aqueous, non-liquid, and stable with lithium, synthesized through a sol-gel process using alkoxides and alcohol-based solvents, allowing for thin-film formation and compatibility with lithium electrodes.

Lithium lanthanum zirconium oxide solid electrolyte prepared using high-frequency focused homogenization synthesis method, and preparation method therefor

PatentWO2025075419A1

Innovation

- The development of a lithium lanthanum zirconium oxide (LLZO) solid electrolyte with a cubic normal structure, achieved through homogeneous synthesis in a high-frequency furnace, which enhances ion conductivity and stability while eliminating the risks associated with liquid electrolytes.

Environmental Impact and Sustainability Considerations

The environmental impact of solid-state electrolytes represents a critical dimension in evaluating their long-term viability for next-generation battery technologies. LLZO (Li7La3Zr2O12) and sulfide electrolytes present distinctly different environmental profiles throughout their lifecycle, from raw material extraction to end-of-life management.

LLZO electrolytes contain lanthanum and zirconium, rare earth elements whose mining operations are associated with significant environmental disruption, including soil degradation, water pollution, and habitat destruction. The extraction processes typically consume substantial energy and water resources, while generating considerable waste material. However, the oxide-based nature of LLZO provides inherent stability that potentially extends battery lifespan, thereby reducing replacement frequency and associated environmental impacts.

Sulfide electrolytes, conversely, primarily utilize more abundant elements like sulfur, phosphorus, and silicon, potentially reducing mining-related environmental damage. Their synthesis processes generally require lower temperatures compared to oxide electrolytes, translating to reduced energy consumption during manufacturing. This energy efficiency advantage represents a significant sustainability benefit when considering large-scale production scenarios.

Recycling considerations reveal further distinctions between these electrolyte technologies. LLZO's chemical stability makes it potentially more amenable to recycling processes, with the recovery of valuable elements like lanthanum presenting economic incentives for end-of-life processing. Sulfide electrolytes pose unique recycling challenges due to their reactivity with moisture, potentially requiring specialized handling protocols that increase recycling complexity and cost.

Carbon footprint assessments across the full lifecycle indicate that sulfide electrolytes may offer advantages in manufacturing-phase emissions due to lower processing temperatures. However, if their reactivity leads to shorter battery lifespans or more frequent replacements, this initial advantage could be negated by increased lifecycle emissions.

Water usage patterns differ significantly between these technologies. LLZO production typically demands greater water resources during both mining and manufacturing phases. Sulfide electrolytes generally require less water during production but may present greater risks of water contamination if improperly handled during disposal due to their reactivity.

Future sustainability improvements for both electrolyte types will likely focus on developing less resource-intensive synthesis methods, improving material efficiency, and establishing specialized recycling infrastructure. Advances in green chemistry approaches may particularly benefit sulfide electrolyte production by reducing hazardous waste generation while maintaining performance characteristics.

LLZO electrolytes contain lanthanum and zirconium, rare earth elements whose mining operations are associated with significant environmental disruption, including soil degradation, water pollution, and habitat destruction. The extraction processes typically consume substantial energy and water resources, while generating considerable waste material. However, the oxide-based nature of LLZO provides inherent stability that potentially extends battery lifespan, thereby reducing replacement frequency and associated environmental impacts.

Sulfide electrolytes, conversely, primarily utilize more abundant elements like sulfur, phosphorus, and silicon, potentially reducing mining-related environmental damage. Their synthesis processes generally require lower temperatures compared to oxide electrolytes, translating to reduced energy consumption during manufacturing. This energy efficiency advantage represents a significant sustainability benefit when considering large-scale production scenarios.

Recycling considerations reveal further distinctions between these electrolyte technologies. LLZO's chemical stability makes it potentially more amenable to recycling processes, with the recovery of valuable elements like lanthanum presenting economic incentives for end-of-life processing. Sulfide electrolytes pose unique recycling challenges due to their reactivity with moisture, potentially requiring specialized handling protocols that increase recycling complexity and cost.

Carbon footprint assessments across the full lifecycle indicate that sulfide electrolytes may offer advantages in manufacturing-phase emissions due to lower processing temperatures. However, if their reactivity leads to shorter battery lifespans or more frequent replacements, this initial advantage could be negated by increased lifecycle emissions.

Water usage patterns differ significantly between these technologies. LLZO production typically demands greater water resources during both mining and manufacturing phases. Sulfide electrolytes generally require less water during production but may present greater risks of water contamination if improperly handled during disposal due to their reactivity.

Future sustainability improvements for both electrolyte types will likely focus on developing less resource-intensive synthesis methods, improving material efficiency, and establishing specialized recycling infrastructure. Advances in green chemistry approaches may particularly benefit sulfide electrolyte production by reducing hazardous waste generation while maintaining performance characteristics.

Manufacturing Scalability and Production Challenges

The manufacturing scalability of solid electrolytes represents a critical factor in determining their commercial viability for next-generation batteries. LLZO (Li7La3Zr2O12) and sulfide electrolytes present distinctly different challenges in terms of production processes and scale-up potential.

LLZO manufacturing typically requires high-temperature sintering processes (>1000°C) that consume significant energy and time. This energy-intensive production contributes substantially to manufacturing costs and carbon footprint. The sintering process also introduces challenges in maintaining consistent material properties across large batches, as temperature gradients can lead to non-uniform crystallization and density variations.

Sulfide electrolytes, conversely, can be produced at lower temperatures, often below 200°C, resulting in reduced energy consumption and potentially faster production cycles. However, they demand stringent moisture-free environments throughout the manufacturing process due to their high reactivity with water. This necessitates specialized equipment and handling protocols that increase production complexity and cost.

From a raw material perspective, LLZO contains lanthanum and zirconium, which face supply chain constraints and geopolitical considerations. The limited availability of these elements may impact long-term scalability and price stability. Sulfide electrolytes typically utilize more abundant elements, though high-purity lithium sulfide remains expensive and challenging to source consistently.

Production yield represents another significant challenge. LLZO synthesis often suffers from batch-to-batch variations and defect formation during sintering, reducing effective yield. Sulfide electrolytes, while potentially offering higher yields due to lower processing temperatures, face challenges in maintaining consistent composition and preventing contamination during handling.

Equipment compatibility also differs significantly between these electrolyte types. LLZO production can leverage modified versions of existing ceramic manufacturing infrastructure, whereas sulfide electrolyte production requires specialized moisture-free processing equipment that may necessitate substantial capital investment for scale-up.

The thickness control and uniformity of the final electrolyte layer present additional manufacturing challenges. LLZO, being mechanically robust, can be processed to thinner dimensions through established ceramic processing techniques, though achieving uniform sub-100μm layers remains difficult. Sulfide electrolytes offer potentially easier processing to thin layers but face challenges in maintaining mechanical integrity during cell assembly due to their brittle nature.

LLZO manufacturing typically requires high-temperature sintering processes (>1000°C) that consume significant energy and time. This energy-intensive production contributes substantially to manufacturing costs and carbon footprint. The sintering process also introduces challenges in maintaining consistent material properties across large batches, as temperature gradients can lead to non-uniform crystallization and density variations.

Sulfide electrolytes, conversely, can be produced at lower temperatures, often below 200°C, resulting in reduced energy consumption and potentially faster production cycles. However, they demand stringent moisture-free environments throughout the manufacturing process due to their high reactivity with water. This necessitates specialized equipment and handling protocols that increase production complexity and cost.

From a raw material perspective, LLZO contains lanthanum and zirconium, which face supply chain constraints and geopolitical considerations. The limited availability of these elements may impact long-term scalability and price stability. Sulfide electrolytes typically utilize more abundant elements, though high-purity lithium sulfide remains expensive and challenging to source consistently.

Production yield represents another significant challenge. LLZO synthesis often suffers from batch-to-batch variations and defect formation during sintering, reducing effective yield. Sulfide electrolytes, while potentially offering higher yields due to lower processing temperatures, face challenges in maintaining consistent composition and preventing contamination during handling.

Equipment compatibility also differs significantly between these electrolyte types. LLZO production can leverage modified versions of existing ceramic manufacturing infrastructure, whereas sulfide electrolyte production requires specialized moisture-free processing equipment that may necessitate substantial capital investment for scale-up.

The thickness control and uniformity of the final electrolyte layer present additional manufacturing challenges. LLZO, being mechanically robust, can be processed to thinner dimensions through established ceramic processing techniques, though achieving uniform sub-100μm layers remains difficult. Sulfide electrolytes offer potentially easier processing to thin layers but face challenges in maintaining mechanical integrity during cell assembly due to their brittle nature.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!