Scale-up risks in LLZO manufacturing: KPI and QC metrics

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LLZO Manufacturing Evolution and Objectives

Lithium-ion conducting solid electrolytes, particularly Li7La3Zr2O12 (LLZO), have emerged as promising materials for next-generation solid-state batteries due to their high ionic conductivity and stability against lithium metal. The evolution of LLZO manufacturing has undergone significant transformation since its discovery in 2007 by Murugan et al., progressing from laboratory-scale synthesis to pilot production efforts aimed at commercial viability.

Early manufacturing approaches focused primarily on conventional solid-state reaction methods, where precursor materials were mixed and calcined at high temperatures (>1000°C) for extended periods. These methods, while effective for research purposes, presented substantial challenges for industrial scale-up, including poor reproducibility, high energy consumption, and limited control over microstructure.

The technological evolution progressed through several key phases, beginning with optimization of sintering aids (such as Al, Ga, and Ta doping) to stabilize the cubic phase of LLZO at room temperature. Subsequently, advanced synthesis routes emerged, including sol-gel methods, co-precipitation techniques, and flame spray pyrolysis, each offering improved control over particle morphology and reduced processing temperatures.

Recent manufacturing innovations have focused on scalable production methodologies, including tape casting, freeze casting, and various 3D printing approaches. These techniques aim to produce thin, dense LLZO membranes with controlled porosity and grain boundaries - critical factors affecting ionic conductivity and mechanical integrity during battery operation.

The primary objective of current LLZO manufacturing research is to establish robust, cost-effective production processes capable of delivering consistent material quality at industrial scale. This includes developing precise control over stoichiometry, phase purity, and microstructural features that directly impact electrochemical performance.

Key performance indicators (KPIs) guiding this evolution include ionic conductivity (target: >10^-3 S/cm at room temperature), mechanical strength (>100 MPa), thickness uniformity (<10% variation), and manufacturing yield (>90%). Additionally, process economics have become increasingly important, with targets for material cost reduction to <$100/kWh for commercial viability.

Looking forward, the manufacturing trajectory aims to address several critical challenges: reducing sintering temperatures and times, eliminating lithium loss during high-temperature processing, controlling grain boundary resistance, and developing in-line quality control methodologies suitable for mass production environments. The ultimate goal remains establishing manufacturing protocols that can reliably produce LLZO components meeting the stringent requirements of automotive and grid storage applications, where performance consistency and safety are paramount.

Early manufacturing approaches focused primarily on conventional solid-state reaction methods, where precursor materials were mixed and calcined at high temperatures (>1000°C) for extended periods. These methods, while effective for research purposes, presented substantial challenges for industrial scale-up, including poor reproducibility, high energy consumption, and limited control over microstructure.

The technological evolution progressed through several key phases, beginning with optimization of sintering aids (such as Al, Ga, and Ta doping) to stabilize the cubic phase of LLZO at room temperature. Subsequently, advanced synthesis routes emerged, including sol-gel methods, co-precipitation techniques, and flame spray pyrolysis, each offering improved control over particle morphology and reduced processing temperatures.

Recent manufacturing innovations have focused on scalable production methodologies, including tape casting, freeze casting, and various 3D printing approaches. These techniques aim to produce thin, dense LLZO membranes with controlled porosity and grain boundaries - critical factors affecting ionic conductivity and mechanical integrity during battery operation.

The primary objective of current LLZO manufacturing research is to establish robust, cost-effective production processes capable of delivering consistent material quality at industrial scale. This includes developing precise control over stoichiometry, phase purity, and microstructural features that directly impact electrochemical performance.

Key performance indicators (KPIs) guiding this evolution include ionic conductivity (target: >10^-3 S/cm at room temperature), mechanical strength (>100 MPa), thickness uniformity (<10% variation), and manufacturing yield (>90%). Additionally, process economics have become increasingly important, with targets for material cost reduction to <$100/kWh for commercial viability.

Looking forward, the manufacturing trajectory aims to address several critical challenges: reducing sintering temperatures and times, eliminating lithium loss during high-temperature processing, controlling grain boundary resistance, and developing in-line quality control methodologies suitable for mass production environments. The ultimate goal remains establishing manufacturing protocols that can reliably produce LLZO components meeting the stringent requirements of automotive and grid storage applications, where performance consistency and safety are paramount.

Market Demand Analysis for LLZO Solid Electrolytes

The global market for LLZO (Li7La3Zr2O12) solid electrolytes is experiencing significant growth, driven primarily by the increasing demand for safer and higher energy density batteries. The solid-state battery market, where LLZO serves as a critical component, is projected to reach $8.5 billion by 2027, growing at a CAGR of 34.2% from 2022. This remarkable growth trajectory underscores the strategic importance of LLZO in next-generation energy storage solutions.

Electric vehicle manufacturers represent the largest demand segment for LLZO solid electrolytes. With major automotive companies committing billions to electrification strategies, the need for batteries that offer improved safety, faster charging capabilities, and higher energy density has intensified. Industry forecasts suggest that by 2030, solid-state batteries could capture up to 15% of the EV battery market, creating substantial demand for high-quality LLZO materials.

Consumer electronics constitutes another significant market for LLZO solid electrolytes. Manufacturers are seeking battery technologies that can safely deliver higher energy density in compact form factors. The premium smartphone and wearable device segments are particularly interested in solid-state solutions, with several major electronics companies already investing in research partnerships focused on LLZO implementation.

Grid-scale energy storage represents an emerging application area with considerable growth potential. As renewable energy integration accelerates globally, the demand for safer, longer-lasting storage solutions becomes critical. LLZO-based solid-state batteries could address concerns about thermal runaway risks in large-scale installations, potentially opening a market estimated to reach $12.1 billion by 2025.

Market analysis reveals regional variations in LLZO demand patterns. Asia-Pacific currently dominates manufacturing capacity, with Japan and South Korea leading in patent filings related to LLZO production technologies. North America and Europe are rapidly expanding their domestic production capabilities, driven by supply chain security concerns and governmental initiatives supporting battery technology sovereignty.

The market is increasingly demanding standardized quality metrics for LLZO materials. Battery manufacturers require consistent ionic conductivity (>0.5 mS/cm), phase purity (>98%), and dimensional stability across production batches. These requirements are driving the need for sophisticated quality control systems and in-line monitoring technologies throughout the manufacturing process.

Price sensitivity remains a significant market factor, with current LLZO production costs approximately 5-8 times higher than conventional liquid electrolyte systems. Industry analysts project that economies of scale could reduce this premium to 2-3 times by 2025, contingent upon successful resolution of key manufacturing scale-up challenges.

Electric vehicle manufacturers represent the largest demand segment for LLZO solid electrolytes. With major automotive companies committing billions to electrification strategies, the need for batteries that offer improved safety, faster charging capabilities, and higher energy density has intensified. Industry forecasts suggest that by 2030, solid-state batteries could capture up to 15% of the EV battery market, creating substantial demand for high-quality LLZO materials.

Consumer electronics constitutes another significant market for LLZO solid electrolytes. Manufacturers are seeking battery technologies that can safely deliver higher energy density in compact form factors. The premium smartphone and wearable device segments are particularly interested in solid-state solutions, with several major electronics companies already investing in research partnerships focused on LLZO implementation.

Grid-scale energy storage represents an emerging application area with considerable growth potential. As renewable energy integration accelerates globally, the demand for safer, longer-lasting storage solutions becomes critical. LLZO-based solid-state batteries could address concerns about thermal runaway risks in large-scale installations, potentially opening a market estimated to reach $12.1 billion by 2025.

Market analysis reveals regional variations in LLZO demand patterns. Asia-Pacific currently dominates manufacturing capacity, with Japan and South Korea leading in patent filings related to LLZO production technologies. North America and Europe are rapidly expanding their domestic production capabilities, driven by supply chain security concerns and governmental initiatives supporting battery technology sovereignty.

The market is increasingly demanding standardized quality metrics for LLZO materials. Battery manufacturers require consistent ionic conductivity (>0.5 mS/cm), phase purity (>98%), and dimensional stability across production batches. These requirements are driving the need for sophisticated quality control systems and in-line monitoring technologies throughout the manufacturing process.

Price sensitivity remains a significant market factor, with current LLZO production costs approximately 5-8 times higher than conventional liquid electrolyte systems. Industry analysts project that economies of scale could reduce this premium to 2-3 times by 2025, contingent upon successful resolution of key manufacturing scale-up challenges.

Current Scale-up Challenges in LLZO Production

The scale-up of LLZO (Li7La3Zr2O12) solid electrolyte manufacturing from laboratory to industrial scale presents significant challenges that impede its commercial viability for solid-state battery applications. Current production methods face several critical bottlenecks that must be addressed to achieve consistent quality at scale.

Raw material variability represents a primary challenge, as the high purity requirements for lithium, lanthanum, and zirconium precursors are difficult to maintain across large batch productions. Even minor impurities can significantly alter the ionic conductivity and mechanical properties of the final LLZO product, leading to performance inconsistencies that are unacceptable for commercial applications.

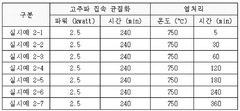

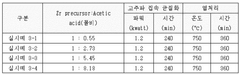

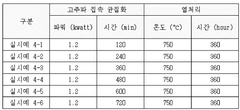

Process control during synthesis presents another major hurdle. The conventional solid-state reaction method requires precise temperature control during calcination and sintering processes, typically at temperatures exceeding 1000°C. As reactor sizes increase, temperature gradients become more pronounced, resulting in compositional inhomogeneity and phase instability across the batch. This challenge is particularly evident in maintaining the cubic phase of LLZO, which offers superior ionic conductivity but is thermodynamically less stable than the tetragonal phase.

Lithium volatilization during high-temperature processing represents a persistent technical barrier. The loss of lithium during sintering becomes more pronounced at industrial scales, leading to stoichiometric deviations that compromise the electrochemical performance of LLZO. Current compensation strategies, such as lithium excess formulations, lack the precision required for large-scale manufacturing.

Densification of LLZO ceramics at scale presents additional complications. Achieving the high relative density (>95%) necessary for optimal ionic conductivity becomes increasingly difficult as component sizes increase. The formation of microcracks and voids during cooling from sintering temperatures is more prevalent in larger components, creating potential failure points in the electrolyte structure.

Quality control methodologies suitable for high-volume production remain underdeveloped. Current analytical techniques like X-ray diffraction and impedance spectroscopy are time-consuming and often destructive, making them impractical for in-line quality monitoring in a production environment. The industry lacks standardized, rapid testing protocols that can effectively identify defective materials before they enter downstream processing.

Equipment scaling also presents significant engineering challenges. The specialized high-temperature furnaces required for LLZO synthesis are difficult to scale while maintaining precise atmosphere control and temperature uniformity. Additionally, the handling of highly reactive lithium-containing materials at industrial scales introduces safety concerns that require robust engineering controls.

Raw material variability represents a primary challenge, as the high purity requirements for lithium, lanthanum, and zirconium precursors are difficult to maintain across large batch productions. Even minor impurities can significantly alter the ionic conductivity and mechanical properties of the final LLZO product, leading to performance inconsistencies that are unacceptable for commercial applications.

Process control during synthesis presents another major hurdle. The conventional solid-state reaction method requires precise temperature control during calcination and sintering processes, typically at temperatures exceeding 1000°C. As reactor sizes increase, temperature gradients become more pronounced, resulting in compositional inhomogeneity and phase instability across the batch. This challenge is particularly evident in maintaining the cubic phase of LLZO, which offers superior ionic conductivity but is thermodynamically less stable than the tetragonal phase.

Lithium volatilization during high-temperature processing represents a persistent technical barrier. The loss of lithium during sintering becomes more pronounced at industrial scales, leading to stoichiometric deviations that compromise the electrochemical performance of LLZO. Current compensation strategies, such as lithium excess formulations, lack the precision required for large-scale manufacturing.

Densification of LLZO ceramics at scale presents additional complications. Achieving the high relative density (>95%) necessary for optimal ionic conductivity becomes increasingly difficult as component sizes increase. The formation of microcracks and voids during cooling from sintering temperatures is more prevalent in larger components, creating potential failure points in the electrolyte structure.

Quality control methodologies suitable for high-volume production remain underdeveloped. Current analytical techniques like X-ray diffraction and impedance spectroscopy are time-consuming and often destructive, making them impractical for in-line quality monitoring in a production environment. The industry lacks standardized, rapid testing protocols that can effectively identify defective materials before they enter downstream processing.

Equipment scaling also presents significant engineering challenges. The specialized high-temperature furnaces required for LLZO synthesis are difficult to scale while maintaining precise atmosphere control and temperature uniformity. Additionally, the handling of highly reactive lithium-containing materials at industrial scales introduces safety concerns that require robust engineering controls.

Current Scale-up Solutions and Methodologies

01 Composition and synthesis parameters for LLZO

The composition and synthesis parameters of LLZO significantly impact its performance as a solid electrolyte. Key parameters include the ratio of lithium, lanthanum, and zirconium, dopant concentrations, sintering temperature, and duration. Controlling these parameters during synthesis ensures the formation of cubic phase LLZO with optimal ionic conductivity. Quality control metrics focus on phase purity, grain size distribution, and elemental composition to ensure consistent performance in battery applications.- Composition and synthesis parameters for LLZO: The composition and synthesis parameters of LLZO significantly impact its performance. Key parameters include the ratio of lithium, lanthanum, and zirconium, sintering temperature, sintering time, and cooling rate. Controlling these parameters during synthesis ensures the formation of cubic phase LLZO with optimal ionic conductivity. Quality control metrics focus on phase purity, crystal structure, and elemental composition to ensure consistent material properties.

- Ionic conductivity measurement and optimization: Ionic conductivity is a critical KPI for LLZO solid electrolytes. Measurement techniques include electrochemical impedance spectroscopy (EIS) and direct current methods. Quality control metrics focus on conductivity values at different temperatures, activation energy, and stability over time. Optimization strategies include doping with elements like aluminum or gallium, controlling grain boundary resistance, and minimizing impurities to achieve conductivity values above 10^-4 S/cm at room temperature.

- Mechanical properties and structural stability testing: Mechanical properties and structural stability are important KPIs for LLZO in battery applications. Testing methods include hardness measurements, fracture toughness evaluation, and thermal expansion coefficient determination. Quality control metrics focus on density, porosity, grain size, and resistance to moisture and air exposure. Ensuring consistent mechanical properties is essential for preventing dendrite penetration and maintaining long-term electrochemical performance in solid-state batteries.

- Interfacial stability and electrochemical performance: Interfacial stability between LLZO and electrodes is a critical KPI for solid-state battery applications. Testing methods include cyclic voltammetry, galvanostatic cycling, and impedance analysis of full cells. Quality control metrics focus on interfacial resistance, chemical compatibility with electrode materials, and stability during cycling. Strategies to improve interfacial properties include surface modifications, buffer layers, and optimized processing conditions to ensure consistent electrochemical performance.

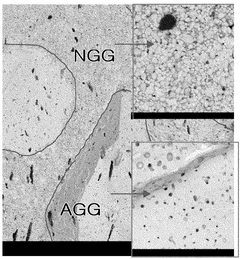

- Advanced characterization techniques for LLZO quality control: Advanced characterization techniques are essential for comprehensive quality control of LLZO materials. These include X-ray diffraction (XRD) for phase identification, scanning electron microscopy (SEM) for microstructure analysis, transmission electron microscopy (TEM) for atomic-scale defects, and nuclear magnetic resonance (NMR) for lithium dynamics. Additional techniques include Raman spectroscopy, thermal analysis, and in-situ characterization methods. These techniques provide quantitative metrics for material homogeneity, defect concentration, and structural stability.

02 Structural and morphological characterization techniques

Various characterization techniques are employed to evaluate the quality of LLZO materials. X-ray diffraction (XRD) is used to confirm cubic phase formation and assess phase purity. Scanning electron microscopy (SEM) and transmission electron microscopy (TEM) analyze grain size, morphology, and boundary characteristics. Raman spectroscopy and FTIR help identify structural defects and impurities. These techniques provide critical KPIs for LLZO quality assessment, including crystallinity, phase composition, and microstructural features.Expand Specific Solutions03 Electrochemical performance metrics for LLZO

Electrochemical performance metrics are crucial KPIs for evaluating LLZO quality. These include ionic conductivity measurements at various temperatures, activation energy calculations, and electrochemical impedance spectroscopy (EIS) analysis. Critical quality control parameters include area-specific resistance, interfacial stability with electrode materials, and cycling performance in full cells. These metrics help assess the suitability of LLZO for solid-state battery applications and ensure consistent performance across production batches.Expand Specific Solutions04 Manufacturing process control and optimization

Manufacturing process control for LLZO production involves monitoring and optimizing various parameters to ensure consistent quality. Key process indicators include powder homogeneity, particle size distribution, sintering profile accuracy, and density measurements. Advanced process control systems monitor temperature gradients, atmosphere composition, and cooling rates during production. Statistical process control methods are implemented to identify variations and maintain tight quality control over critical parameters that affect LLZO performance in battery applications.Expand Specific Solutions05 Defect analysis and quality improvement strategies

Defect analysis and quality improvement strategies are essential for optimizing LLZO performance. This includes identification and quantification of common defects such as lithium loss, secondary phase formation, and grain boundary impurities. Advanced analytical techniques like neutron diffraction, solid-state NMR, and TOF-SIMS are employed to characterize defect structures. Quality improvement strategies focus on process modifications to minimize defects, including controlled atmosphere processing, dopant optimization, and post-processing treatments to enhance LLZO performance and reliability.Expand Specific Solutions

Key Industry Players in LLZO Supply Chain

The LLZO manufacturing landscape is currently in a transitional phase from research to early commercialization, with market size projected to grow significantly as solid-state batteries gain traction. Technical challenges in scale-up remain substantial, with academic institutions (Beihang University, Zhejiang University, Nanchang University) leading fundamental research while industrial players (Huawei, IBM, Qualcomm) focus on practical implementation. Quality control metrics and key performance indicators are still evolving, with companies like ASML, Siemens, and Boeing contributing manufacturing expertise. The technology maturity varies across applications, with most companies at TRL 4-6, working to overcome issues in consistency, yield, and cost-effectiveness while establishing standardized production protocols for high-volume manufacturing.

Beihang University

Technical Solution: Beihang University has developed a comprehensive approach to LLZO manufacturing scale-up focusing on process optimization and quality control. Their technical solution addresses critical challenges in LLZO production through a modified co-precipitation synthesis method that ensures homogeneous element distribution and precise stoichiometric control. The university's research team has established a controlled sintering protocol utilizing atmosphere management to minimize lithium volatilization while achieving high densification (>96% theoretical) [5]. Their manufacturing process incorporates precise dopant engineering (Ta, Al combinations) to stabilize the cubic phase structure while enhancing mechanical properties. Beihang has established detailed KPIs including ionic conductivity thresholds (>0.6 mS/cm at room temperature), phase purity metrics (>94% cubic phase), and microstructural parameters (controlled grain size distribution with D50 = 8-12 μm). Their quality control system employs multiple characterization techniques including Raman spectroscopy for phase identification, electron microscopy for microstructural analysis, and electrochemical impedance spectroscopy for conductivity mapping across production batches.

Strengths: Strong integration of materials science fundamentals with practical manufacturing considerations; systematic approach to process optimization; established quantifiable metrics for quality assessment. Weaknesses: Limited experience with large-scale industrial production; potential challenges in technology transfer to commercial manufacturing environments; higher material costs compared to conventional liquid electrolyte systems.

Zhejiang University

Technical Solution: Zhejiang University has developed an innovative manufacturing approach for LLZO solid electrolytes focused on scalability and reproducibility. Their technical solution addresses key challenges in LLZO production through a modified solid-state reaction method incorporating nanoscale mixing and controlled atmosphere processing. The university's research team has established a two-stage sintering protocol that achieves high densification (>98% theoretical) while minimizing lithium loss through the use of sacrificial lithium sources and optimized temperature profiles [4]. Their manufacturing process incorporates precise dopant control (Al, Ga, Ta) to stabilize the cubic phase structure essential for high ionic conductivity. Zhejiang University has established comprehensive KPIs including ionic conductivity targets (>0.7 mS/cm at room temperature), mechanical integrity parameters (fracture toughness >1.2 MPa·m1/2), and electrochemical stability metrics (stable against Li metal with <5% capacity fade after 100 cycles). Their quality control system employs multiple characterization techniques including XRD for phase purity assessment, SEM for microstructural analysis, and impedance spectroscopy for conductivity verification.

Strengths: Strong integration of materials science expertise with practical manufacturing considerations; established quantifiable metrics for quality assessment; innovative approaches to addressing lithium volatilization issues. Weaknesses: Potential challenges in scaling laboratory processes to industrial production; higher energy requirements for processing compared to some alternative approaches; limited experience with continuous production methodologies.

Critical KPIs and QC Metrics for LLZO Production

Lithium lanthanum zirconium oxide-based ceramic, method for producing same, and all-solid-state lithium secondary battery including same

PatentWO2024210435A1

Innovation

- A two-step sintering method is employed to manufacture dense LLZO-based ceramics with controlled grain sizes, involving a first sintering step at 1050-1400°C for 10 seconds to 1 hour and a second step at 1000-1300°C for 10 minutes to 24 hours, incorporating metal oxide powders like La2O3, Sm2O3, and Gd2O3 to suppress abnormal grain growth and achieve high relative density and ionic conductivity.

Lithium lanthanum zirconium oxide solid electrolyte prepared using high-frequency focused homogenization synthesis method, and preparation method therefor

PatentWO2025075419A1

Innovation

- The development of a lithium lanthanum zirconium oxide (LLZO) solid electrolyte with a cubic normal structure, achieved through homogeneous synthesis in a high-frequency furnace, which enhances ion conductivity and stability while eliminating the risks associated with liquid electrolytes.

Risk Mitigation Strategies for LLZO Scale-up

To effectively mitigate risks associated with LLZO manufacturing scale-up, a comprehensive strategy framework must be established. This framework should address both technical and operational challenges while maintaining consistent quality metrics throughout the production expansion process.

Implementing robust in-process monitoring systems represents a critical first line of defense against quality deviations. These systems should continuously track key parameters such as temperature uniformity, atmospheric conditions, and material composition during synthesis and sintering stages. Real-time data collection enables immediate corrective actions before defects propagate through production batches.

Statistical process control methodologies tailored specifically for ceramic electrolyte manufacturing provide essential quantitative tools for risk management. By establishing control limits for critical quality attributes like ionic conductivity, density, and phase purity, manufacturers can quickly identify process drift and implement corrective measures before specification limits are breached.

Design of Experiments (DoE) approaches should be employed during the transition from laboratory to industrial scale. This systematic methodology helps identify critical process parameters and their interactions, allowing for the development of robust manufacturing protocols that maintain consistent quality across different production volumes and equipment configurations.

Supply chain diversification represents another crucial risk mitigation strategy. Establishing relationships with multiple suppliers for critical raw materials ensures production continuity even when individual vendors experience disruptions. Additionally, implementing rigorous supplier qualification processes with standardized quality requirements helps maintain consistent input material specifications.

Staged scale-up protocols offer a measured approach to production expansion. By incrementally increasing batch sizes and validating quality at each stage, manufacturers can identify scale-dependent issues early and develop appropriate solutions before committing to full-scale production. This approach minimizes financial exposure while maximizing learning opportunities.

Cross-functional teams comprising materials scientists, process engineers, and quality specialists should be established to oversee scale-up activities. These integrated teams can rapidly address emerging challenges through collaborative problem-solving, leveraging diverse expertise to develop comprehensive solutions that address both technical and operational aspects of manufacturing risks.

Automated documentation systems that maintain detailed records of process parameters, material characteristics, and quality test results provide essential traceability throughout the manufacturing lifecycle. These systems support root cause analysis when deviations occur and facilitate continuous improvement initiatives by identifying patterns and trends across production batches.

Implementing robust in-process monitoring systems represents a critical first line of defense against quality deviations. These systems should continuously track key parameters such as temperature uniformity, atmospheric conditions, and material composition during synthesis and sintering stages. Real-time data collection enables immediate corrective actions before defects propagate through production batches.

Statistical process control methodologies tailored specifically for ceramic electrolyte manufacturing provide essential quantitative tools for risk management. By establishing control limits for critical quality attributes like ionic conductivity, density, and phase purity, manufacturers can quickly identify process drift and implement corrective measures before specification limits are breached.

Design of Experiments (DoE) approaches should be employed during the transition from laboratory to industrial scale. This systematic methodology helps identify critical process parameters and their interactions, allowing for the development of robust manufacturing protocols that maintain consistent quality across different production volumes and equipment configurations.

Supply chain diversification represents another crucial risk mitigation strategy. Establishing relationships with multiple suppliers for critical raw materials ensures production continuity even when individual vendors experience disruptions. Additionally, implementing rigorous supplier qualification processes with standardized quality requirements helps maintain consistent input material specifications.

Staged scale-up protocols offer a measured approach to production expansion. By incrementally increasing batch sizes and validating quality at each stage, manufacturers can identify scale-dependent issues early and develop appropriate solutions before committing to full-scale production. This approach minimizes financial exposure while maximizing learning opportunities.

Cross-functional teams comprising materials scientists, process engineers, and quality specialists should be established to oversee scale-up activities. These integrated teams can rapidly address emerging challenges through collaborative problem-solving, leveraging diverse expertise to develop comprehensive solutions that address both technical and operational aspects of manufacturing risks.

Automated documentation systems that maintain detailed records of process parameters, material characteristics, and quality test results provide essential traceability throughout the manufacturing lifecycle. These systems support root cause analysis when deviations occur and facilitate continuous improvement initiatives by identifying patterns and trends across production batches.

Economic Feasibility of Large-scale LLZO Production

The economic feasibility of large-scale LLZO production represents a critical consideration for commercial implementation of this promising solid electrolyte material. Current manufacturing processes for LLZO (Li7La3Zr2O12) remain predominantly laboratory-scale, with significant cost barriers impeding industrial adoption.

Production economics analysis reveals that raw material costs constitute approximately 60-70% of total LLZO manufacturing expenses. Lithium and lanthanum compounds represent the most significant cost drivers, with their market volatility directly impacting production economics. Zirconium costs, while substantial, have demonstrated greater price stability over recent years.

Capital expenditure requirements for establishing commercial-scale LLZO production facilities are estimated between $50-100 million USD, depending on targeted annual production capacity. This includes specialized high-temperature sintering equipment, precision mixing systems, and advanced quality control infrastructure necessary for consistent production of high-performance LLZO.

Energy consumption presents another significant economic consideration. The high-temperature sintering processes (typically 1100-1200°C) required for LLZO densification contribute substantially to operational costs. Energy efficiency improvements through process optimization could potentially reduce these expenses by 15-25%, according to recent pilot-scale demonstrations.

Yield rates represent a critical economic factor, with current manufacturing processes achieving approximately 70-85% yields at pilot scale. Improving yield rates to >90% would significantly enhance economic viability. Material recovery systems for recycling production waste could further improve cost structures, particularly for lithium-containing compounds.

Scale economies analysis indicates that production costs could decrease by 30-40% when scaling from pilot (100kg/month) to commercial production (10+ tons/month). However, this assumes successful resolution of current technical challenges in maintaining consistent material quality at larger batch sizes.

Market pricing analysis suggests that LLZO production costs must decrease below $300/kg to enable competitive solid-state battery manufacturing. Current production costs range from $500-800/kg at pilot scale, indicating significant cost reduction requirements before widespread commercial adoption becomes economically viable.

Return on investment calculations indicate that large-scale LLZO production facilities would require 5-7 years to achieve profitability under current market conditions, representing a significant barrier to immediate commercial implementation without strategic partnerships or government incentives supporting initial capital investments.

Production economics analysis reveals that raw material costs constitute approximately 60-70% of total LLZO manufacturing expenses. Lithium and lanthanum compounds represent the most significant cost drivers, with their market volatility directly impacting production economics. Zirconium costs, while substantial, have demonstrated greater price stability over recent years.

Capital expenditure requirements for establishing commercial-scale LLZO production facilities are estimated between $50-100 million USD, depending on targeted annual production capacity. This includes specialized high-temperature sintering equipment, precision mixing systems, and advanced quality control infrastructure necessary for consistent production of high-performance LLZO.

Energy consumption presents another significant economic consideration. The high-temperature sintering processes (typically 1100-1200°C) required for LLZO densification contribute substantially to operational costs. Energy efficiency improvements through process optimization could potentially reduce these expenses by 15-25%, according to recent pilot-scale demonstrations.

Yield rates represent a critical economic factor, with current manufacturing processes achieving approximately 70-85% yields at pilot scale. Improving yield rates to >90% would significantly enhance economic viability. Material recovery systems for recycling production waste could further improve cost structures, particularly for lithium-containing compounds.

Scale economies analysis indicates that production costs could decrease by 30-40% when scaling from pilot (100kg/month) to commercial production (10+ tons/month). However, this assumes successful resolution of current technical challenges in maintaining consistent material quality at larger batch sizes.

Market pricing analysis suggests that LLZO production costs must decrease below $300/kg to enable competitive solid-state battery manufacturing. Current production costs range from $500-800/kg at pilot scale, indicating significant cost reduction requirements before widespread commercial adoption becomes economically viable.

Return on investment calculations indicate that large-scale LLZO production facilities would require 5-7 years to achieve profitability under current market conditions, representing a significant barrier to immediate commercial implementation without strategic partnerships or government incentives supporting initial capital investments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!