Roadmap for LLZO supply chain and industrial adoption

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LLZO Technology Background and Development Goals

Lithium-ion batteries have dominated the energy storage landscape for decades, but their limitations in safety, energy density, and charging speed have driven research into solid-state alternatives. Among these, Li7La3Zr2O12 (LLZO) has emerged as one of the most promising solid electrolyte materials due to its high ionic conductivity, excellent electrochemical stability against lithium metal, and superior thermal stability.

LLZO was first reported in 2007 by Murugan et al., who demonstrated its potential as a solid electrolyte with ionic conductivity approaching 10^-4 S/cm. Subsequent research has focused on improving its conductivity through doping strategies and optimizing synthesis methods. The cubic phase of LLZO, stabilized by aliovalent dopants such as Al, Ga, or Ta, has shown conductivities exceeding 10^-3 S/cm at room temperature, making it commercially viable for solid-state battery applications.

The development trajectory of LLZO technology has been characterized by significant advancements in material synthesis, processing techniques, and interface engineering. Early challenges included high sintering temperatures (>1200°C), poor densification, and grain boundary resistance. Recent innovations have addressed these issues through solution-based synthesis methods, cold sintering processes, and advanced sintering aids.

The global push toward electrification and renewable energy integration has accelerated interest in LLZO technology. Major automotive manufacturers and battery producers have invested heavily in solid-state battery research, with LLZO featuring prominently in their technology roadmaps. The market potential is substantial, with projections suggesting solid-state batteries could capture up to 40% of the energy storage market by 2035.

The primary technical goals for LLZO development include scaling up production from laboratory to industrial quantities, reducing manufacturing costs, improving material consistency, and enhancing interface stability with electrode materials. Current production methods remain largely confined to small-scale academic or pilot facilities, with costs estimated at $1000-2000/kg—far above the target of <$100/kg needed for mass commercialization.

Future development goals focus on establishing robust supply chains for raw materials, particularly lithium and zirconium compounds, developing standardized quality control protocols, and creating scalable manufacturing processes compatible with existing battery production infrastructure. Additionally, research aims to improve LLZO's compatibility with cathode materials and develop effective strategies to mitigate lithium dendrite formation at interfaces.

The technology roadmap must address these challenges sequentially, beginning with material optimization and scaling, followed by interface engineering, and culminating in full cell integration and manufacturing optimization. Success will require collaborative efforts between material scientists, process engineers, and battery manufacturers to translate laboratory achievements into commercially viable products.

LLZO was first reported in 2007 by Murugan et al., who demonstrated its potential as a solid electrolyte with ionic conductivity approaching 10^-4 S/cm. Subsequent research has focused on improving its conductivity through doping strategies and optimizing synthesis methods. The cubic phase of LLZO, stabilized by aliovalent dopants such as Al, Ga, or Ta, has shown conductivities exceeding 10^-3 S/cm at room temperature, making it commercially viable for solid-state battery applications.

The development trajectory of LLZO technology has been characterized by significant advancements in material synthesis, processing techniques, and interface engineering. Early challenges included high sintering temperatures (>1200°C), poor densification, and grain boundary resistance. Recent innovations have addressed these issues through solution-based synthesis methods, cold sintering processes, and advanced sintering aids.

The global push toward electrification and renewable energy integration has accelerated interest in LLZO technology. Major automotive manufacturers and battery producers have invested heavily in solid-state battery research, with LLZO featuring prominently in their technology roadmaps. The market potential is substantial, with projections suggesting solid-state batteries could capture up to 40% of the energy storage market by 2035.

The primary technical goals for LLZO development include scaling up production from laboratory to industrial quantities, reducing manufacturing costs, improving material consistency, and enhancing interface stability with electrode materials. Current production methods remain largely confined to small-scale academic or pilot facilities, with costs estimated at $1000-2000/kg—far above the target of <$100/kg needed for mass commercialization.

Future development goals focus on establishing robust supply chains for raw materials, particularly lithium and zirconium compounds, developing standardized quality control protocols, and creating scalable manufacturing processes compatible with existing battery production infrastructure. Additionally, research aims to improve LLZO's compatibility with cathode materials and develop effective strategies to mitigate lithium dendrite formation at interfaces.

The technology roadmap must address these challenges sequentially, beginning with material optimization and scaling, followed by interface engineering, and culminating in full cell integration and manufacturing optimization. Success will require collaborative efforts between material scientists, process engineers, and battery manufacturers to translate laboratory achievements into commercially viable products.

Market Demand Analysis for LLZO Materials

The global market for LLZO (Li7La3Zr2O12) materials is experiencing significant growth driven by the increasing demand for solid-state batteries in various applications. The electric vehicle (EV) sector represents the largest market segment, with projections indicating that solid-state batteries could capture up to 25% of the EV battery market by 2030. This transition is fueled by automotive manufacturers' commitments to electrification and the need for safer, higher-energy-density battery solutions that overcome the limitations of conventional lithium-ion batteries.

Consumer electronics constitutes another substantial market for LLZO materials, as manufacturers seek batteries with improved safety profiles and higher energy densities for smartphones, laptops, and wearable devices. The premium segment of these markets shows particular interest in solid-state technology, with major electronics companies investing heavily in research and development partnerships focused on LLZO-based solutions.

Energy storage systems represent an emerging application area with significant growth potential. Grid-scale storage installations and residential energy storage systems are increasingly demanding safer battery technologies with longer cycle life, where LLZO-based solid-state batteries could offer compelling advantages over current technologies.

Market analysis reveals regional variations in LLZO demand patterns. Asia-Pacific, particularly Japan, South Korea, and China, leads in terms of research activity and commercial development, with several major battery manufacturers establishing dedicated solid-state battery production lines. North America and Europe follow closely, with substantial government funding and corporate investments supporting the development of domestic supply chains for critical battery materials including LLZO.

Price sensitivity remains a significant factor affecting market penetration. Current production costs for high-quality LLZO are substantially higher than those for conventional battery separator materials, with estimates suggesting a 3-5x premium. However, economies of scale and manufacturing innovations are expected to reduce this gap significantly over the next five years.

Market forecasts indicate compound annual growth rates exceeding 30% for LLZO materials through 2030, with the total addressable market potentially reaching several billion dollars by mid-decade. This growth trajectory is contingent upon successful resolution of remaining technical challenges, particularly those related to manufacturing scalability and interface stability in commercial battery designs.

Customer requirements are evolving rapidly, with increasing emphasis on material consistency, scalable production capabilities, and demonstrated performance in full-cell configurations. Battery manufacturers are particularly focused on LLZO variants that can be processed at lower temperatures while maintaining high ionic conductivity and mechanical stability.

Consumer electronics constitutes another substantial market for LLZO materials, as manufacturers seek batteries with improved safety profiles and higher energy densities for smartphones, laptops, and wearable devices. The premium segment of these markets shows particular interest in solid-state technology, with major electronics companies investing heavily in research and development partnerships focused on LLZO-based solutions.

Energy storage systems represent an emerging application area with significant growth potential. Grid-scale storage installations and residential energy storage systems are increasingly demanding safer battery technologies with longer cycle life, where LLZO-based solid-state batteries could offer compelling advantages over current technologies.

Market analysis reveals regional variations in LLZO demand patterns. Asia-Pacific, particularly Japan, South Korea, and China, leads in terms of research activity and commercial development, with several major battery manufacturers establishing dedicated solid-state battery production lines. North America and Europe follow closely, with substantial government funding and corporate investments supporting the development of domestic supply chains for critical battery materials including LLZO.

Price sensitivity remains a significant factor affecting market penetration. Current production costs for high-quality LLZO are substantially higher than those for conventional battery separator materials, with estimates suggesting a 3-5x premium. However, economies of scale and manufacturing innovations are expected to reduce this gap significantly over the next five years.

Market forecasts indicate compound annual growth rates exceeding 30% for LLZO materials through 2030, with the total addressable market potentially reaching several billion dollars by mid-decade. This growth trajectory is contingent upon successful resolution of remaining technical challenges, particularly those related to manufacturing scalability and interface stability in commercial battery designs.

Customer requirements are evolving rapidly, with increasing emphasis on material consistency, scalable production capabilities, and demonstrated performance in full-cell configurations. Battery manufacturers are particularly focused on LLZO variants that can be processed at lower temperatures while maintaining high ionic conductivity and mechanical stability.

Global LLZO Development Status and Challenges

The global landscape of LLZO (Li7La3Zr2O12) development presents a complex picture of significant progress alongside persistent challenges. Currently, research institutions in North America, Europe, and East Asia lead LLZO development, with the United States, Japan, China, and Germany emerging as primary innovation hubs. Academic research has outpaced industrial implementation, creating a noticeable gap between laboratory achievements and commercial applications.

Material synthesis represents a fundamental challenge, as current production methods struggle with scalability, consistency, and cost-effectiveness. Traditional solid-state reaction methods produce LLZO with varying quality, while solution-based approaches offer better homogeneity but face scaling limitations. The industry has yet to establish standardized manufacturing protocols that can reliably produce high-quality LLZO at commercial scales.

Interface engineering remains another critical obstacle. The high interfacial resistance between LLZO and electrodes significantly impairs battery performance. Despite numerous proposed solutions—including buffer layers, surface modifications, and pressure application—none has emerged as definitively superior for industrial adoption, hampering commercialization efforts.

Raw material supply chains present additional complications. Lithium and zirconium resources are geographically concentrated, creating potential supply vulnerabilities. Lanthanum, while more widely distributed, faces competition from other high-tech applications. These supply constraints contribute to price volatility and uncertainty for manufacturers considering LLZO adoption.

Manufacturing infrastructure represents perhaps the most significant barrier to widespread LLZO implementation. Current battery production facilities are optimized for liquid electrolyte systems, requiring substantial retooling for solid-state electrolyte production. The capital expenditure required for this transition creates hesitancy among established manufacturers to commit fully to LLZO technology.

Quality control and characterization methodologies also remain underdeveloped. The industry lacks standardized testing protocols for evaluating LLZO performance, stability, and safety at scale. This absence of unified standards complicates comparative assessments and slows regulatory approval processes.

Despite these challenges, recent advancements in sintering techniques, interface engineering, and computational modeling suggest pathways toward solutions. Several pilot production facilities have demonstrated improved LLZO synthesis methods, while collaborative efforts between academic institutions and industry partners are addressing interface stability issues. These developments indicate that while significant obstacles remain, the trajectory of LLZO development continues to move toward eventual commercial viability.

Material synthesis represents a fundamental challenge, as current production methods struggle with scalability, consistency, and cost-effectiveness. Traditional solid-state reaction methods produce LLZO with varying quality, while solution-based approaches offer better homogeneity but face scaling limitations. The industry has yet to establish standardized manufacturing protocols that can reliably produce high-quality LLZO at commercial scales.

Interface engineering remains another critical obstacle. The high interfacial resistance between LLZO and electrodes significantly impairs battery performance. Despite numerous proposed solutions—including buffer layers, surface modifications, and pressure application—none has emerged as definitively superior for industrial adoption, hampering commercialization efforts.

Raw material supply chains present additional complications. Lithium and zirconium resources are geographically concentrated, creating potential supply vulnerabilities. Lanthanum, while more widely distributed, faces competition from other high-tech applications. These supply constraints contribute to price volatility and uncertainty for manufacturers considering LLZO adoption.

Manufacturing infrastructure represents perhaps the most significant barrier to widespread LLZO implementation. Current battery production facilities are optimized for liquid electrolyte systems, requiring substantial retooling for solid-state electrolyte production. The capital expenditure required for this transition creates hesitancy among established manufacturers to commit fully to LLZO technology.

Quality control and characterization methodologies also remain underdeveloped. The industry lacks standardized testing protocols for evaluating LLZO performance, stability, and safety at scale. This absence of unified standards complicates comparative assessments and slows regulatory approval processes.

Despite these challenges, recent advancements in sintering techniques, interface engineering, and computational modeling suggest pathways toward solutions. Several pilot production facilities have demonstrated improved LLZO synthesis methods, while collaborative efforts between academic institutions and industry partners are addressing interface stability issues. These developments indicate that while significant obstacles remain, the trajectory of LLZO development continues to move toward eventual commercial viability.

Current LLZO Production and Processing Solutions

01 LLZO raw material production and processing

Various methods for producing and processing LLZO raw materials are disclosed, including synthesis techniques, powder preparation, and material processing. These methods focus on creating high-quality LLZO materials with controlled properties for battery applications. The processes involve specific temperature treatments, chemical compositions, and processing steps to ensure the desired crystal structure and performance characteristics of LLZO as a solid electrolyte material.- LLZO raw material production and processing: Various methods for producing and processing LLZO raw materials are documented, including synthesis techniques, purification processes, and quality control measures. These methods focus on creating high-quality LLZO powder with controlled particle size, morphology, and purity for use in battery applications. The processing techniques include solid-state reactions, sol-gel methods, and specialized heat treatments to achieve the desired crystal structure and properties.

- LLZO-based solid electrolyte manufacturing: Manufacturing processes for LLZO-based solid electrolytes involve specialized techniques to create dense, ion-conductive materials suitable for solid-state batteries. These processes include sintering methods, composite formation approaches, and techniques to control grain boundaries and interfaces. The manufacturing methods aim to enhance ionic conductivity while maintaining mechanical stability and electrochemical performance of the solid electrolyte.

- Supply chain integration and optimization: Integration and optimization of the LLZO supply chain involves coordinating raw material sourcing, production processes, and distribution networks. This includes strategies for securing critical materials, managing production capacity, and establishing reliable supplier relationships. Supply chain optimization focuses on reducing costs, minimizing environmental impact, and ensuring consistent quality throughout the production process.

- LLZO application in battery technology: LLZO is applied in various battery technologies, particularly as a solid electrolyte in lithium-ion batteries. The material's high ionic conductivity, chemical stability against lithium metal, and mechanical properties make it valuable for next-generation energy storage solutions. Applications include all-solid-state batteries, hybrid electrolyte systems, and specialized battery designs for electric vehicles and grid storage.

- Scaling and commercialization challenges: Scaling and commercialization of LLZO technology face several challenges, including cost-effective mass production, quality consistency, and integration with existing manufacturing infrastructure. These challenges involve developing economical synthesis routes, establishing reliable testing protocols, and creating industry standards. Overcoming these barriers requires collaborative efforts between material suppliers, battery manufacturers, and end-users to establish a robust commercial ecosystem.

02 LLZO-based solid electrolyte manufacturing

Manufacturing techniques for LLZO-based solid electrolytes are described, including methods to improve ionic conductivity, mechanical properties, and stability. These techniques involve specific formulations, doping strategies, and processing conditions to enhance the performance of LLZO as a solid-state electrolyte. The manufacturing processes address challenges such as densification, grain boundary resistance, and interface stability to create high-performance solid electrolytes for lithium batteries.Expand Specific Solutions03 LLZO supply chain integration and optimization

Methods for optimizing and integrating the LLZO supply chain are presented, including strategies for scaling production, reducing costs, and ensuring material quality consistency. These approaches involve coordination between raw material suppliers, manufacturers, and end-users to establish efficient production and distribution networks. Supply chain optimization techniques address challenges in sourcing rare earth materials, managing production capacity, and meeting growing demand for LLZO in battery applications.Expand Specific Solutions04 LLZO application in solid-state batteries

Applications of LLZO in solid-state battery technologies are described, focusing on integration methods, interface engineering, and performance enhancement. These applications leverage LLZO's properties as a solid electrolyte to improve battery safety, energy density, and cycle life. The integration techniques address challenges such as electrode-electrolyte interfaces, lithium dendrite suppression, and electrochemical stability to create high-performance solid-state batteries for various applications.Expand Specific Solutions05 LLZO material quality control and testing

Methods for quality control and testing of LLZO materials throughout the supply chain are presented, including characterization techniques, performance evaluation, and standardization approaches. These methods ensure consistency and reliability of LLZO materials for battery applications. The quality control processes involve specific testing protocols for crystal structure, ionic conductivity, impurity levels, and electrochemical performance to verify that LLZO materials meet the required specifications for solid electrolyte applications.Expand Specific Solutions

Key Industry Players in LLZO Supply Chain

The LLZO (Lithium Lanthanum Zirconium Oxide) supply chain is currently in an early growth phase, with the market expanding as solid-state battery technology advances toward commercial viability. The global market size remains relatively modest but is projected to grow significantly as automotive and energy storage applications increase demand. Technologically, LLZO development shows varying maturity levels across the ecosystem, with companies like QuantumScape, Materion Corp., and 6K Inc. leading materials innovation, while established players such as Bayer AG, LG Electronics, and QUALCOMM are investing in integration capabilities. Academic institutions including Arizona State University and Indian Institute of Technology Roorkee are contributing fundamental research, creating a collaborative environment between industry and academia that is accelerating the path toward industrial adoption.

Korea Institute of Ceramic Engineering & Technology

Technical Solution: The Korea Institute of Ceramic Engineering & Technology (KICET) has developed a comprehensive LLZO supply chain solution focused on scalable synthesis methods and industrial applications. Their approach centers on a modified sol-gel process that enables production of high-purity LLZO powders with controlled particle size distribution (typically 0.5-5μm) and enhanced sinterability. KICET has optimized doping strategies using tantalum and aluminum to stabilize the cubic phase of LLZO at room temperature, achieving ionic conductivities exceeding 0.8 mS/cm. Their industrial adoption roadmap includes a three-phase implementation: (1) pilot-scale production of LLZO powders (currently operational with capacity of ~10kg/month), (2) establishment of intermediate-scale manufacturing (100-500kg/month by 2024), and (3) full commercial production exceeding 1 ton/month by 2026. KICET has developed specialized sintering protocols that reduce processing temperatures from traditional 1200°C to approximately 900°C, significantly lowering production energy requirements and costs. Their technology transfer program has already established partnerships with three Korean battery manufacturers to accelerate industrial implementation.

Strengths: Advanced synthesis techniques produce high-quality LLZO with excellent ionic conductivity and phase stability. Strong government backing and established industry partnerships facilitate technology transfer. Weaknesses: Current production scale remains limited compared to commercial requirements, and international expansion of the supply chain faces logistical and regulatory challenges.

Materion Corp.

Technical Solution: Materion has developed a comprehensive LLZO (Li7La3Zr2O12) supply chain solution focusing on high-purity precursor materials and scalable manufacturing processes. Their approach includes proprietary synthesis methods for producing phase-pure cubic LLZO with controlled dopant concentrations (Al, Ta, Ga) to optimize ionic conductivity. Materion's vertical integration strategy encompasses raw material sourcing, powder processing, and sintering optimization to produce dense LLZO pellets and thin films suitable for solid-state battery applications. The company has established pilot-scale production facilities capable of producing kilogram quantities of LLZO powder with consistent quality and performance characteristics. Their roadmap includes scaling to multi-ton production capacity by 2025 to meet growing demand from battery manufacturers. Materion has also developed specialized handling protocols to address LLZO's moisture sensitivity and has created quality control systems to ensure batch-to-batch consistency in lithium content, phase purity, and microstructure.

Strengths: Vertical integration from raw materials to finished components provides supply chain security and quality control. Established expertise in advanced materials manufacturing enables rapid scaling. Weaknesses: Higher production costs compared to liquid electrolytes may limit initial market penetration, and the technology requires further optimization for thin-film applications in next-generation batteries.

Critical Patents and Technical Innovations in LLZO

Lithium lanthanum zirconium oxide (LLZO) powder

PatentWO2020223374A1

Innovation

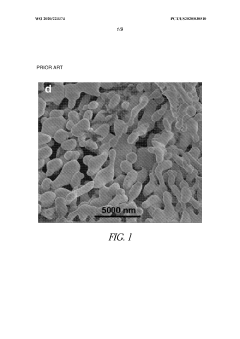

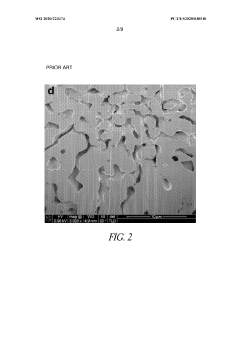

- A method involving microwave plasma processing to produce LLZO powder with a narrow size distribution, spherical morphology, and controlled stoichiometry, which allows for high-density sintering and improved ionic conductivity by creating particles with a crystalline or amorphous structure, enabling efficient packing and reduced porosity.

Lithium lanthanum zirconium oxide (LLZO) materials

PatentWO2023009380A2

Innovation

- A process involving heating a multiphase material comprising lithium carbonate in the presence of hydrogen gas at a temperature below its melting point, followed by further heating to crystallize lithium lanthanum zirconium oxide (LLZO) particles, utilizing a microwave plasma process to control particle size and reduce lithium loss.

Supply Chain Resilience and Risk Mitigation Strategies

The LLZO supply chain faces significant vulnerabilities due to its complex nature and reliance on critical raw materials. Lithium, zirconium, and lanthanum sources are geographically concentrated, creating potential bottlenecks during geopolitical tensions or trade disruptions. To mitigate these risks, a multi-faceted approach to supply chain resilience is essential for sustainable industrial adoption.

Diversification of material sources represents a primary strategy, with companies establishing relationships with multiple suppliers across different geographical regions. This approach reduces dependency on single sources and minimizes the impact of regional disruptions. Leading battery manufacturers are increasingly investing in direct mining partnerships to secure preferential access to critical materials.

Strategic stockpiling has emerged as another crucial risk mitigation measure. Organizations maintaining buffer inventories of critical LLZO components can continue production during temporary supply disruptions. The optimal stockpile size requires balancing carrying costs against disruption risks, with most industry leaders targeting 3-6 month reserves of critical materials.

Vertical integration strategies are gaining traction among major players in the solid-state battery ecosystem. By controlling multiple stages of the supply chain—from raw material extraction to component manufacturing—companies can reduce external dependencies and gain greater visibility into potential disruptions. Tesla and Samsung SDI have made significant investments in this direction.

Advanced supply chain monitoring technologies utilizing AI and blockchain are revolutionizing risk management approaches. These systems provide real-time visibility into material flows, supplier performance, and potential disruptions. Early warning capabilities allow for proactive rather than reactive responses to supply chain challenges.

Collaborative industry initiatives are forming to address systemic supply chain vulnerabilities. Consortia like the International Battery Materials Association are developing shared standards, certification processes, and emergency response protocols. These collaborative efforts enhance the entire ecosystem's resilience against major disruptions.

Regulatory engagement strategies are becoming increasingly important as governments recognize battery materials as strategically critical. Companies actively participating in policy development can help shape favorable frameworks for material sourcing, recycling, and trade. This engagement also provides early insights into regulatory changes that might impact supply chains.

Diversification of material sources represents a primary strategy, with companies establishing relationships with multiple suppliers across different geographical regions. This approach reduces dependency on single sources and minimizes the impact of regional disruptions. Leading battery manufacturers are increasingly investing in direct mining partnerships to secure preferential access to critical materials.

Strategic stockpiling has emerged as another crucial risk mitigation measure. Organizations maintaining buffer inventories of critical LLZO components can continue production during temporary supply disruptions. The optimal stockpile size requires balancing carrying costs against disruption risks, with most industry leaders targeting 3-6 month reserves of critical materials.

Vertical integration strategies are gaining traction among major players in the solid-state battery ecosystem. By controlling multiple stages of the supply chain—from raw material extraction to component manufacturing—companies can reduce external dependencies and gain greater visibility into potential disruptions. Tesla and Samsung SDI have made significant investments in this direction.

Advanced supply chain monitoring technologies utilizing AI and blockchain are revolutionizing risk management approaches. These systems provide real-time visibility into material flows, supplier performance, and potential disruptions. Early warning capabilities allow for proactive rather than reactive responses to supply chain challenges.

Collaborative industry initiatives are forming to address systemic supply chain vulnerabilities. Consortia like the International Battery Materials Association are developing shared standards, certification processes, and emergency response protocols. These collaborative efforts enhance the entire ecosystem's resilience against major disruptions.

Regulatory engagement strategies are becoming increasingly important as governments recognize battery materials as strategically critical. Companies actively participating in policy development can help shape favorable frameworks for material sourcing, recycling, and trade. This engagement also provides early insights into regulatory changes that might impact supply chains.

Sustainability and Environmental Impact Assessment

The sustainability assessment of LLZO (Li7La3Zr2O12) supply chains reveals significant environmental challenges that must be addressed for widespread industrial adoption. Life cycle analyses indicate that LLZO production generates considerable carbon emissions, primarily from high-temperature calcination processes requiring temperatures above 1000°C for extended periods. This energy-intensive manufacturing contributes substantially to the overall environmental footprint of solid-state batteries incorporating LLZO electrolytes.

Resource extraction presents another critical concern, particularly regarding lithium and zirconium mining operations. Current lithium extraction methods consume vast quantities of water—approximately 500,000 gallons per ton of lithium—creating water scarcity issues in ecologically sensitive regions like the South American Lithium Triangle. Zirconium mining similarly generates substantial land disruption and habitat fragmentation, with restoration efforts often falling short of returning ecosystems to their original state.

Waste management throughout the LLZO supply chain requires immediate attention. Chemical processing of raw materials produces acidic and alkaline waste streams containing heavy metals and other contaminants. Without proper treatment, these byproducts pose serious risks to local water systems and soil quality. Additionally, end-of-life considerations for LLZO-based products remain underdeveloped, with recycling infrastructure lagging behind production capacity.

Several promising sustainability initiatives are emerging across the industry. Advanced manufacturing techniques, including microwave-assisted synthesis and solution-based processing, demonstrate potential for reducing energy consumption by 30-40% compared to conventional methods. Closed-loop water systems in lithium extraction facilities have shown water usage reductions of up to 70% in pilot projects, though implementation at scale remains challenging.

Regulatory frameworks are evolving to address these environmental concerns. The European Union's Battery Directive revision specifically targets solid-state battery materials, imposing stricter carbon footprint disclosure requirements and establishing recycled content mandates. Similar regulations are under consideration in North America and parts of Asia, signaling a global shift toward more sustainable LLZO supply chains.

For successful industrial adoption, LLZO manufacturers must prioritize sustainability through comprehensive environmental management systems, transparent reporting practices, and investment in cleaner production technologies. The industry's long-term viability depends on balancing performance advantages with environmental responsibility throughout the entire product lifecycle.

Resource extraction presents another critical concern, particularly regarding lithium and zirconium mining operations. Current lithium extraction methods consume vast quantities of water—approximately 500,000 gallons per ton of lithium—creating water scarcity issues in ecologically sensitive regions like the South American Lithium Triangle. Zirconium mining similarly generates substantial land disruption and habitat fragmentation, with restoration efforts often falling short of returning ecosystems to their original state.

Waste management throughout the LLZO supply chain requires immediate attention. Chemical processing of raw materials produces acidic and alkaline waste streams containing heavy metals and other contaminants. Without proper treatment, these byproducts pose serious risks to local water systems and soil quality. Additionally, end-of-life considerations for LLZO-based products remain underdeveloped, with recycling infrastructure lagging behind production capacity.

Several promising sustainability initiatives are emerging across the industry. Advanced manufacturing techniques, including microwave-assisted synthesis and solution-based processing, demonstrate potential for reducing energy consumption by 30-40% compared to conventional methods. Closed-loop water systems in lithium extraction facilities have shown water usage reductions of up to 70% in pilot projects, though implementation at scale remains challenging.

Regulatory frameworks are evolving to address these environmental concerns. The European Union's Battery Directive revision specifically targets solid-state battery materials, imposing stricter carbon footprint disclosure requirements and establishing recycled content mandates. Similar regulations are under consideration in North America and parts of Asia, signaling a global shift toward more sustainable LLZO supply chains.

For successful industrial adoption, LLZO manufacturers must prioritize sustainability through comprehensive environmental management systems, transparent reporting practices, and investment in cleaner production technologies. The industry's long-term viability depends on balancing performance advantages with environmental responsibility throughout the entire product lifecycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!