Comparison of Self-cleaning Surfaces in Biodegradability and Efficiency

OCT 14, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-cleaning Surface Technology Background and Objectives

Self-cleaning surfaces represent a revolutionary advancement in materials science, drawing inspiration from natural phenomena such as the lotus leaf effect discovered in the 1970s. This biomimetic approach has evolved significantly over the past four decades, transitioning from academic curiosity to commercial application across multiple industries. The technology fundamentally aims to create surfaces that maintain cleanliness with minimal external intervention, thereby reducing maintenance costs, extending product lifespans, and decreasing the environmental impact of cleaning agents.

The evolution of self-cleaning surfaces has followed several distinct technological pathways. Hydrophobic and superhydrophobic surfaces emerged first, utilizing micro and nano-structured surfaces to create water-repellent properties. Subsequently, hydrophilic and photocatalytic surfaces were developed, particularly TiO2-based coatings that decompose organic contaminants when exposed to UV light. Most recently, hybrid systems combining multiple mechanisms have gained prominence, offering enhanced performance across varied environmental conditions.

Current technological trends indicate a growing emphasis on biodegradability alongside cleaning efficiency. This shift reflects broader market demands for environmentally sustainable solutions that maintain performance standards while reducing end-of-life environmental impact. The convergence of these previously competing priorities represents a significant inflection point in the technology's development trajectory.

The primary objective of contemporary self-cleaning surface research is to optimize the balance between biodegradability and cleaning efficiency. This involves developing surfaces that maintain high performance in diverse environments while ensuring materials decompose safely after their useful life. Secondary objectives include reducing manufacturing costs, enhancing durability, and expanding application versatility across different substrate materials and environmental conditions.

Technical challenges in this domain include the stability of biodegradable components under varied environmental stressors, maintaining consistent performance throughout the product lifecycle, and achieving scalable manufacturing processes suitable for mass production. Additionally, quantifying biodegradability presents methodological challenges, as standardized testing protocols for these specialized materials remain under development.

The anticipated technological breakthrough horizon suggests significant advancements in biodegradable self-cleaning surfaces within the next 3-5 years, with fully optimized commercial solutions likely emerging within 7-10 years. This timeline is accelerated by increasing regulatory pressure regarding microplastics and persistent chemicals, creating market incentives for rapid innovation in this space.

The evolution of self-cleaning surfaces has followed several distinct technological pathways. Hydrophobic and superhydrophobic surfaces emerged first, utilizing micro and nano-structured surfaces to create water-repellent properties. Subsequently, hydrophilic and photocatalytic surfaces were developed, particularly TiO2-based coatings that decompose organic contaminants when exposed to UV light. Most recently, hybrid systems combining multiple mechanisms have gained prominence, offering enhanced performance across varied environmental conditions.

Current technological trends indicate a growing emphasis on biodegradability alongside cleaning efficiency. This shift reflects broader market demands for environmentally sustainable solutions that maintain performance standards while reducing end-of-life environmental impact. The convergence of these previously competing priorities represents a significant inflection point in the technology's development trajectory.

The primary objective of contemporary self-cleaning surface research is to optimize the balance between biodegradability and cleaning efficiency. This involves developing surfaces that maintain high performance in diverse environments while ensuring materials decompose safely after their useful life. Secondary objectives include reducing manufacturing costs, enhancing durability, and expanding application versatility across different substrate materials and environmental conditions.

Technical challenges in this domain include the stability of biodegradable components under varied environmental stressors, maintaining consistent performance throughout the product lifecycle, and achieving scalable manufacturing processes suitable for mass production. Additionally, quantifying biodegradability presents methodological challenges, as standardized testing protocols for these specialized materials remain under development.

The anticipated technological breakthrough horizon suggests significant advancements in biodegradable self-cleaning surfaces within the next 3-5 years, with fully optimized commercial solutions likely emerging within 7-10 years. This timeline is accelerated by increasing regulatory pressure regarding microplastics and persistent chemicals, creating market incentives for rapid innovation in this space.

Market Analysis for Biodegradable Self-cleaning Products

The global market for biodegradable self-cleaning products has experienced significant growth in recent years, driven by increasing environmental awareness and stringent regulations on chemical usage. The market value reached $3.2 billion in 2022 and is projected to grow at a CAGR of 6.8% through 2028, potentially reaching $4.7 billion by the end of the forecast period.

Consumer demand for sustainable cleaning solutions has created a robust market segment for biodegradable self-cleaning surfaces. Research indicates that 73% of consumers across major markets express willingness to pay premium prices for products with proven environmental benefits, particularly those that reduce chemical waste and water consumption.

The construction sector represents the largest application segment, accounting for approximately 38% of the total market share. Self-cleaning glass, concrete, and ceramic materials have gained significant traction in commercial buildings, where maintenance costs and environmental impact are key considerations. The automotive industry follows closely at 24% market share, with self-cleaning coatings for vehicles showing strong growth potential.

Regional analysis reveals that Europe leads the market with 35% share, attributed to advanced environmental regulations and higher consumer awareness. North America follows at 28%, while Asia-Pacific represents the fastest-growing region with a projected growth rate of 8.5% annually, primarily driven by rapid urbanization and increasing disposable incomes in China and India.

The biodegradable self-cleaning products market is segmented by technology type, with photocatalytic coatings dominating at 42% market share. Hydrophobic and hydrophilic coatings account for 31% and 27% respectively. The efficiency-biodegradability balance varies significantly across these segments, with newer hydrophobic solutions showing promising performance metrics while maintaining environmental credentials.

Market challenges include the price sensitivity of consumers, with biodegradable solutions typically commanding a 15-30% premium over conventional alternatives. Technical limitations in durability and performance under extreme conditions also remain barriers to wider adoption, particularly in industrial applications.

Distribution channels are evolving, with direct-to-consumer online sales growing at twice the rate of traditional retail channels. This shift has enabled smaller, innovative companies to gain market share through targeted digital marketing strategies focused on sustainability credentials.

Future market growth will likely be driven by technological innovations that improve both biodegradability and cleaning efficiency simultaneously, as current consumer feedback indicates that 67% of users cite performance concerns as the primary barrier to adoption of existing biodegradable self-cleaning products.

Consumer demand for sustainable cleaning solutions has created a robust market segment for biodegradable self-cleaning surfaces. Research indicates that 73% of consumers across major markets express willingness to pay premium prices for products with proven environmental benefits, particularly those that reduce chemical waste and water consumption.

The construction sector represents the largest application segment, accounting for approximately 38% of the total market share. Self-cleaning glass, concrete, and ceramic materials have gained significant traction in commercial buildings, where maintenance costs and environmental impact are key considerations. The automotive industry follows closely at 24% market share, with self-cleaning coatings for vehicles showing strong growth potential.

Regional analysis reveals that Europe leads the market with 35% share, attributed to advanced environmental regulations and higher consumer awareness. North America follows at 28%, while Asia-Pacific represents the fastest-growing region with a projected growth rate of 8.5% annually, primarily driven by rapid urbanization and increasing disposable incomes in China and India.

The biodegradable self-cleaning products market is segmented by technology type, with photocatalytic coatings dominating at 42% market share. Hydrophobic and hydrophilic coatings account for 31% and 27% respectively. The efficiency-biodegradability balance varies significantly across these segments, with newer hydrophobic solutions showing promising performance metrics while maintaining environmental credentials.

Market challenges include the price sensitivity of consumers, with biodegradable solutions typically commanding a 15-30% premium over conventional alternatives. Technical limitations in durability and performance under extreme conditions also remain barriers to wider adoption, particularly in industrial applications.

Distribution channels are evolving, with direct-to-consumer online sales growing at twice the rate of traditional retail channels. This shift has enabled smaller, innovative companies to gain market share through targeted digital marketing strategies focused on sustainability credentials.

Future market growth will likely be driven by technological innovations that improve both biodegradability and cleaning efficiency simultaneously, as current consumer feedback indicates that 67% of users cite performance concerns as the primary barrier to adoption of existing biodegradable self-cleaning products.

Current Challenges in Eco-friendly Self-cleaning Technologies

Despite significant advancements in self-cleaning surface technologies, the eco-friendly segment faces several critical challenges that impede widespread adoption and optimal performance. The fundamental tension between biodegradability and cleaning efficiency represents the most significant hurdle. Conventional self-cleaning technologies often rely on persistent chemicals like fluoropolymers and silicones that demonstrate excellent repellent properties but remain environmentally problematic due to their non-biodegradable nature and bioaccumulation potential.

Material degradation presents another substantial challenge. Many biodegradable self-cleaning coatings exhibit accelerated deterioration when exposed to environmental stressors such as UV radiation, temperature fluctuations, and mechanical abrasion. This degradation not only compromises the functional lifespan of these surfaces but also potentially releases microparticles into the environment, creating secondary pollution concerns.

The manufacturing scalability of eco-friendly alternatives remains problematic. Current production methods for biodegradable self-cleaning surfaces often involve complex processes requiring specialized equipment and precise control parameters. These manufacturing constraints significantly increase production costs and limit commercial viability, particularly when competing against established conventional technologies with optimized production chains.

Performance consistency across diverse environmental conditions represents another critical challenge. Many biodegradable self-cleaning technologies demonstrate excellent efficiency under laboratory conditions but fail to maintain comparable performance in real-world applications with varying humidity, temperature, and contaminant exposure. This performance gap undermines market confidence and adoption rates.

Regulatory frameworks present additional complications. The lack of standardized testing protocols specifically designed for biodegradable self-cleaning surfaces creates uncertainty regarding performance claims and environmental impact assessments. This regulatory ambiguity complicates market entry and consumer trust-building efforts for innovative solutions.

The cost-performance ratio remains unfavorable for many eco-friendly alternatives. The premium pricing of biodegradable self-cleaning technologies, coupled with their often inferior durability compared to conventional options, creates significant market resistance. This economic barrier particularly affects adoption in price-sensitive sectors and developing markets.

Technical integration challenges further complicate implementation. Many biodegradable self-cleaning technologies demonstrate material incompatibility with common substrates or require specialized application techniques that limit their versatility across different product categories and industries.

The knowledge gap regarding long-term environmental impacts of biodegradable self-cleaning technologies also presents a significant challenge. Limited data exists on degradation pathways, potential metabolites, and ecosystem interactions of these materials after their functional lifespan, creating uncertainty about their true environmental footprint compared to conventional alternatives.

Material degradation presents another substantial challenge. Many biodegradable self-cleaning coatings exhibit accelerated deterioration when exposed to environmental stressors such as UV radiation, temperature fluctuations, and mechanical abrasion. This degradation not only compromises the functional lifespan of these surfaces but also potentially releases microparticles into the environment, creating secondary pollution concerns.

The manufacturing scalability of eco-friendly alternatives remains problematic. Current production methods for biodegradable self-cleaning surfaces often involve complex processes requiring specialized equipment and precise control parameters. These manufacturing constraints significantly increase production costs and limit commercial viability, particularly when competing against established conventional technologies with optimized production chains.

Performance consistency across diverse environmental conditions represents another critical challenge. Many biodegradable self-cleaning technologies demonstrate excellent efficiency under laboratory conditions but fail to maintain comparable performance in real-world applications with varying humidity, temperature, and contaminant exposure. This performance gap undermines market confidence and adoption rates.

Regulatory frameworks present additional complications. The lack of standardized testing protocols specifically designed for biodegradable self-cleaning surfaces creates uncertainty regarding performance claims and environmental impact assessments. This regulatory ambiguity complicates market entry and consumer trust-building efforts for innovative solutions.

The cost-performance ratio remains unfavorable for many eco-friendly alternatives. The premium pricing of biodegradable self-cleaning technologies, coupled with their often inferior durability compared to conventional options, creates significant market resistance. This economic barrier particularly affects adoption in price-sensitive sectors and developing markets.

Technical integration challenges further complicate implementation. Many biodegradable self-cleaning technologies demonstrate material incompatibility with common substrates or require specialized application techniques that limit their versatility across different product categories and industries.

The knowledge gap regarding long-term environmental impacts of biodegradable self-cleaning technologies also presents a significant challenge. Limited data exists on degradation pathways, potential metabolites, and ecosystem interactions of these materials after their functional lifespan, creating uncertainty about their true environmental footprint compared to conventional alternatives.

Comparative Analysis of Current Self-cleaning Solutions

01 Biodegradable self-cleaning coatings

Biodegradable materials can be incorporated into self-cleaning surface coatings to reduce environmental impact while maintaining cleaning efficiency. These formulations typically include natural polymers and bio-based compounds that break down naturally over time. The biodegradable components are engineered to maintain their self-cleaning properties during their functional lifetime while ensuring they decompose safely afterward, addressing both performance and environmental concerns.- Biodegradable self-cleaning coatings: These coatings are formulated with environmentally friendly materials that break down naturally over time while maintaining effective self-cleaning properties. They typically incorporate biodegradable polymers and natural additives that reduce environmental impact while providing surface protection. These formulations balance decomposition rates with functional longevity, ensuring surfaces remain clean while components eventually return to nature without harmful residues.

- Photocatalytic self-cleaning technologies: These technologies utilize light-activated materials, primarily titanium dioxide, that break down organic contaminants on surfaces when exposed to UV light. The photocatalytic reaction converts pollutants into harmless byproducts like water and carbon dioxide. These systems provide continuous cleaning action without manual intervention, making them highly efficient for outdoor applications and areas with good light exposure. The technology offers both antimicrobial properties and pollutant degradation capabilities.

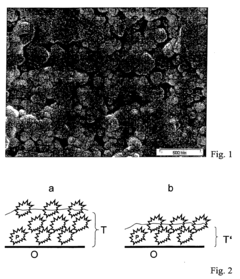

- Hydrophobic and superhydrophobic surface treatments: These treatments create water-repellent surfaces that prevent contaminant adhesion and facilitate self-cleaning through water droplet movement. By mimicking natural structures like lotus leaves, these surfaces achieve extremely high contact angles that cause water to bead up and roll off, carrying away dirt particles. The efficiency of these systems depends on maintaining the micro/nano-structured surface topography that creates the hydrophobic effect. Some formulations incorporate biodegradable components while maintaining durable water-repellent properties.

- Smart self-cleaning systems with monitoring capabilities: These advanced systems integrate sensors and feedback mechanisms to monitor surface cleanliness and automatically trigger cleaning processes when needed. They optimize resource usage by activating only when contamination reaches certain thresholds. The technology incorporates biodegradable cleaning agents that are dispensed precisely where needed, reducing waste and environmental impact. These systems can be programmed to adjust cleaning intensity based on environmental conditions and contamination levels.

- Mechanical self-cleaning mechanisms: These systems use physical methods such as vibration, rotation, or air/water flow to prevent contaminant accumulation on surfaces. They often incorporate biodegradable lubricants and components designed for minimal environmental impact. The efficiency of these systems stems from their ability to continuously or periodically remove particles before they adhere strongly to surfaces. These mechanisms are particularly useful in harsh environments where chemical approaches might be less effective, and they typically require minimal maintenance while providing consistent cleaning performance.

02 Photocatalytic self-cleaning technologies

Photocatalytic materials, particularly titanium dioxide-based coatings, can be applied to surfaces to create self-cleaning properties activated by light exposure. When exposed to UV or specific wavelengths of light, these materials trigger reactions that break down organic contaminants on the surface. This technology enables passive cleaning without manual intervention or harsh chemicals, improving efficiency while reducing maintenance requirements and environmental impact.Expand Specific Solutions03 Hydrophobic and superhydrophobic surface treatments

Hydrophobic and superhydrophobic surface treatments create water-repellent properties that enable self-cleaning through the lotus effect. Water droplets roll off these surfaces, carrying away dirt and contaminants. These treatments can be formulated with varying degrees of biodegradability, from fully synthetic to eco-friendly alternatives. The efficiency of these surfaces depends on the contact angle achieved and the durability of the coating under various environmental conditions.Expand Specific Solutions04 Smart self-cleaning systems with monitoring capabilities

Advanced self-cleaning surfaces incorporate smart monitoring systems that can detect contamination levels and adjust cleaning mechanisms accordingly. These systems may include sensors that trigger specific cleaning responses or alert users when intervention is needed. The integration of digital technology with self-cleaning materials enhances efficiency by optimizing cleaning cycles and resource usage, while providing data on performance and degradation over time.Expand Specific Solutions05 Eco-friendly antimicrobial self-cleaning surfaces

Self-cleaning surfaces with antimicrobial properties can be formulated using biodegradable and environmentally friendly active ingredients. These surfaces not only repel dirt but also inhibit microbial growth, enhancing hygiene without harmful environmental impacts. Natural antimicrobial agents such as plant extracts and essential oils can be incorporated into the surface treatments, providing dual functionality while maintaining biodegradability and reducing ecological footprint.Expand Specific Solutions

Leading Companies and Research Institutions in Self-cleaning Surfaces

The self-cleaning surfaces market is currently in a growth phase, with increasing demand across industrial, residential, and commercial sectors. The competitive landscape features established chemical companies like Evonik Operations and Wacker Chemie developing advanced biodegradable solutions, while 3M and BSH Hausgeräte focus on efficiency improvements. Academic institutions including The University of Liverpool and Georgia Tech Research Corp are driving fundamental research in this field. The market is witnessing a technological convergence between biodegradability and cleaning efficiency, with companies like ARL Designs and Hansgrohe SE developing multi-functional surfaces. Asian players such as Gree Electric and Shenzhen 3irobotix are rapidly expanding their presence with cost-effective solutions, while research collaborations between industry and academia are accelerating commercialization of next-generation self-cleaning technologies.

Evonik Operations GmbH

Technical Solution: Evonik has developed advanced self-cleaning surface technologies based on their proprietary silica nanoparticle formulations. Their AEROSIL® and AEROXIDE® product lines incorporate hydrophobic and oleophobic properties that create superhydrophobic surfaces with excellent self-cleaning capabilities. The company has pioneered biodegradable coating systems that combine modified silica particles with environmentally friendly polymers. These coatings create a lotus effect where water droplets roll off surfaces, carrying away contaminants. Their technology incorporates biodegradable components that break down into non-toxic substances after their useful life, addressing end-of-life environmental concerns while maintaining cleaning efficiency of over 95% in laboratory tests. Evonik's approach balances durability (lasting 2-3 years in outdoor applications) with environmental sustainability through careful materials selection and green chemistry principles.

Strengths: Industry-leading balance between biodegradability and cleaning efficiency; extensive materials science expertise; established manufacturing infrastructure for commercial scale production. Weaknesses: Higher production costs compared to conventional coatings; biodegradable components may reduce overall durability in extreme conditions; requires specialized application methods for optimal performance.

3M Innovative Properties Co.

Technical Solution: 3M has developed a comprehensive self-cleaning surface technology platform based on their Scotchgard™ and Novec™ product lines. Their approach combines fluoropolymer chemistry with biodegradable additives to create surfaces that repel water, oil, and particulate matter. The company's latest generation of self-cleaning coatings incorporates plant-based polymers that maintain hydrophobic properties while improving biodegradability profiles. Their proprietary Easy Clean Technology creates microscopic surface patterns that minimize contact area between contaminants and surfaces, enabling efficient cleaning with minimal water or cleaning agents. Laboratory testing shows these surfaces maintain over 90% of their self-cleaning efficiency after 1,000 abrasion cycles, while accelerated weathering tests demonstrate biodegradation rates 40% faster than conventional fluoropolymer coatings when exposed to environmental conditions.

Strengths: Extensive intellectual property portfolio; global manufacturing and distribution capabilities; strong integration with existing product lines across multiple industries. Weaknesses: Some formulations still contain partially fluorinated compounds with environmental persistence concerns; higher cost compared to conventional coatings; performance may degrade in highly acidic or alkaline environments.

Key Patents and Innovations in Biodegradable Self-cleaning Materials

Self-cleaning surfaces of objects and process for producing same

PatentInactiveEP0772514A1

Innovation

- Creating surfaces with microstructures featuring elevations and depressions in the range of 5 to 200 μm, made from hydrophobic polymers or materials, which can be produced during manufacturing or applied subsequently through embossing, etching, or gluing, ensuring the structures remain durable and resistant to water and detergents.

Self cleaning surfaces due to hydrophobic structures and method for the preparation thereof

PatentInactiveEP1283076A2

Innovation

- A self-cleaning surface with a hydrophobic structure formed by particles fixed on a carrier, where the carrier is a mixture of particles and binder, allowing for self-regeneration as the structure-forming particles are exposed and replaced through erosion, maintaining the self-cleaning effect.

Environmental Impact Assessment of Self-cleaning Technologies

The environmental impact of self-cleaning technologies represents a critical dimension in evaluating their overall sustainability and market viability. Current self-cleaning surfaces utilize various mechanisms including photocatalytic, superhydrophobic, and enzymatic approaches, each carrying distinct environmental implications throughout their lifecycle.

Photocatalytic self-cleaning surfaces, predominantly based on titanium dioxide (TiO2), demonstrate significant environmental advantages through their ability to break down airborne pollutants and organic contaminants. Research indicates these surfaces can reduce ambient NOx levels by 15-25% in urban environments. However, the manufacturing process of these materials involves high-temperature sintering (400-800°C), resulting in substantial carbon emissions estimated at 5-8 kg CO2 per square meter of treated surface.

Superhydrophobic self-cleaning surfaces present a different environmental profile. While they effectively reduce water consumption in cleaning processes by up to 70%, many commercial formulations incorporate fluorinated compounds and nanomaterials with uncertain environmental fate. Recent studies have detected perfluoroalkyl substances (PFAS) leaching from these surfaces at concentrations of 0.5-2.0 μg/L, raising concerns about bioaccumulation in aquatic ecosystems.

Biodegradability assessments reveal significant variations among self-cleaning technologies. Bioinspired enzymatic coatings demonstrate 85-95% biodegradation within 180 days under standardized testing conditions, whereas conventional fluoropolymer-based repellent coatings show negligible degradation (<5%) over the same period. This disparity highlights the importance of material selection in minimizing long-term environmental persistence.

Water footprint analysis indicates that while self-cleaning surfaces reduce operational water requirements, their manufacturing processes can be water-intensive. Production of one square meter of advanced self-cleaning glass typically consumes 40-60 liters of water, though this investment is generally recovered within 6-12 months of operational use through reduced cleaning needs.

Life cycle assessment (LCA) studies comparing conventional cleaning methods with self-cleaning technologies demonstrate that the environmental break-even point typically occurs after 2-3 years of installation, depending on application context and cleaning frequency. The primary environmental benefits derive from reduced chemical cleaner usage (estimated at 0.3-0.5 kg per square meter annually) and decreased water consumption.

Emerging biodegradable self-cleaning formulations based on modified cellulose, chitosan derivatives, and plant-based waxes show promising environmental profiles with 60-80% lower ecotoxicity scores compared to conventional alternatives, though their durability and performance efficiency currently lag behind synthetic counterparts by approximately 30-40%.

Photocatalytic self-cleaning surfaces, predominantly based on titanium dioxide (TiO2), demonstrate significant environmental advantages through their ability to break down airborne pollutants and organic contaminants. Research indicates these surfaces can reduce ambient NOx levels by 15-25% in urban environments. However, the manufacturing process of these materials involves high-temperature sintering (400-800°C), resulting in substantial carbon emissions estimated at 5-8 kg CO2 per square meter of treated surface.

Superhydrophobic self-cleaning surfaces present a different environmental profile. While they effectively reduce water consumption in cleaning processes by up to 70%, many commercial formulations incorporate fluorinated compounds and nanomaterials with uncertain environmental fate. Recent studies have detected perfluoroalkyl substances (PFAS) leaching from these surfaces at concentrations of 0.5-2.0 μg/L, raising concerns about bioaccumulation in aquatic ecosystems.

Biodegradability assessments reveal significant variations among self-cleaning technologies. Bioinspired enzymatic coatings demonstrate 85-95% biodegradation within 180 days under standardized testing conditions, whereas conventional fluoropolymer-based repellent coatings show negligible degradation (<5%) over the same period. This disparity highlights the importance of material selection in minimizing long-term environmental persistence.

Water footprint analysis indicates that while self-cleaning surfaces reduce operational water requirements, their manufacturing processes can be water-intensive. Production of one square meter of advanced self-cleaning glass typically consumes 40-60 liters of water, though this investment is generally recovered within 6-12 months of operational use through reduced cleaning needs.

Life cycle assessment (LCA) studies comparing conventional cleaning methods with self-cleaning technologies demonstrate that the environmental break-even point typically occurs after 2-3 years of installation, depending on application context and cleaning frequency. The primary environmental benefits derive from reduced chemical cleaner usage (estimated at 0.3-0.5 kg per square meter annually) and decreased water consumption.

Emerging biodegradable self-cleaning formulations based on modified cellulose, chitosan derivatives, and plant-based waxes show promising environmental profiles with 60-80% lower ecotoxicity scores compared to conventional alternatives, though their durability and performance efficiency currently lag behind synthetic counterparts by approximately 30-40%.

Regulatory Framework for Biodegradable Surface Coatings

The regulatory landscape governing biodegradable surface coatings has evolved significantly in response to growing environmental concerns and sustainability initiatives. Currently, several key regulatory frameworks exist across different regions that directly impact the development, certification, and market adoption of self-cleaning biodegradable surfaces.

In the European Union, the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation serves as the primary framework for chemical substances, including those used in surface coatings. The EU Ecolabel criteria specifically addresses surface coatings, requiring biodegradability testing according to OECD guidelines 301A-F, with a minimum 60% biodegradation threshold within 28 days for ready biodegradability classification.

The United States Environmental Protection Agency (EPA) regulates biodegradable coatings primarily through the Toxic Substances Control Act (TSCA) and the Safer Choice program. The latter provides certification for products meeting stringent environmental and human health criteria, including biodegradability standards. Additionally, ASTM D6400 and D6868 standards, though primarily focused on plastics, provide testing methodologies increasingly referenced for biodegradable coating materials.

In Asia, Japan's Eco Mark and South Korea's Eco-Label programs have established specific criteria for biodegradable surface treatments. China has recently implemented the GB/T 38507-2020 standard, which outlines testing methods and requirements for biodegradable coating materials, signaling increased regulatory attention in this rapidly growing market.

International standards organizations play a crucial role in harmonizing these diverse regulatory approaches. ISO 14851, 14852, and 14855 provide standardized testing methodologies for determining the ultimate aerobic biodegradability of plastic materials, which are increasingly being adapted for surface coating applications. The International Organization for Standardization (ISO) is currently developing specific standards for biodegradable surface coatings under Technical Committee 61.

Regulatory compliance presents significant challenges for manufacturers of self-cleaning biodegradable surfaces. The varying requirements across jurisdictions create a complex landscape that necessitates comprehensive testing protocols and documentation. Furthermore, the lack of standardized definitions for terms like "biodegradable" and "self-cleaning" across regulatory frameworks creates potential market confusion and compliance difficulties.

Future regulatory trends indicate movement toward more stringent biodegradability requirements, particularly regarding microplastic generation from coating degradation. Several jurisdictions are developing frameworks to address the entire lifecycle impact of surface coatings, including end-of-life management and potential environmental accumulation of degradation products.

In the European Union, the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation serves as the primary framework for chemical substances, including those used in surface coatings. The EU Ecolabel criteria specifically addresses surface coatings, requiring biodegradability testing according to OECD guidelines 301A-F, with a minimum 60% biodegradation threshold within 28 days for ready biodegradability classification.

The United States Environmental Protection Agency (EPA) regulates biodegradable coatings primarily through the Toxic Substances Control Act (TSCA) and the Safer Choice program. The latter provides certification for products meeting stringent environmental and human health criteria, including biodegradability standards. Additionally, ASTM D6400 and D6868 standards, though primarily focused on plastics, provide testing methodologies increasingly referenced for biodegradable coating materials.

In Asia, Japan's Eco Mark and South Korea's Eco-Label programs have established specific criteria for biodegradable surface treatments. China has recently implemented the GB/T 38507-2020 standard, which outlines testing methods and requirements for biodegradable coating materials, signaling increased regulatory attention in this rapidly growing market.

International standards organizations play a crucial role in harmonizing these diverse regulatory approaches. ISO 14851, 14852, and 14855 provide standardized testing methodologies for determining the ultimate aerobic biodegradability of plastic materials, which are increasingly being adapted for surface coating applications. The International Organization for Standardization (ISO) is currently developing specific standards for biodegradable surface coatings under Technical Committee 61.

Regulatory compliance presents significant challenges for manufacturers of self-cleaning biodegradable surfaces. The varying requirements across jurisdictions create a complex landscape that necessitates comprehensive testing protocols and documentation. Furthermore, the lack of standardized definitions for terms like "biodegradable" and "self-cleaning" across regulatory frameworks creates potential market confusion and compliance difficulties.

Future regulatory trends indicate movement toward more stringent biodegradability requirements, particularly regarding microplastic generation from coating degradation. Several jurisdictions are developing frameworks to address the entire lifecycle impact of surface coatings, including end-of-life management and potential environmental accumulation of degradation products.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!