Electroless Nickel Coatings in Oil and Gas Equipment

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Electroless Nickel Technology Evolution and Objectives

Electroless nickel plating technology has evolved significantly since its inception in the mid-20th century. The process was first developed in 1944 by Abner Brenner and Grace Riddell at the National Bureau of Standards, who discovered that nickel could be deposited onto a substrate without the use of electrical current. This breakthrough laid the foundation for what would become a critical surface treatment technology across multiple industries, particularly in oil and gas equipment manufacturing.

The 1950s and 1960s witnessed the initial commercial applications of electroless nickel coatings, primarily focusing on decorative purposes and basic corrosion protection. During this period, the technology was characterized by relatively simple bath compositions and limited understanding of the relationship between plating parameters and coating properties.

The 1970s marked a significant advancement with the introduction of composite electroless nickel coatings, incorporating particles such as silicon carbide and PTFE to enhance wear resistance and lubricity. This innovation expanded the application scope of electroless nickel in oil and gas equipment, where components frequently face extreme mechanical stress and abrasive environments.

By the 1980s and 1990s, researchers had developed a deeper understanding of the microstructure-property relationships in electroless nickel deposits. This period saw the refinement of high-phosphorus nickel coatings (10-12% P), which demonstrated superior corrosion resistance in aggressive environments containing hydrogen sulfide and carbon dioxide—common challenges in oil and gas operations.

The early 2000s brought increased focus on environmental considerations, with the development of lead-free and cadmium-free electroless nickel baths to comply with stricter regulations. Simultaneously, advancements in nanotechnology began influencing the field, leading to nano-enhanced electroless nickel coatings with improved hardness and wear resistance.

Current technological objectives center on several key areas: enhancing coating performance in ultra-high pressure and high temperature (HPHT) environments as oil and gas exploration moves into more extreme conditions; improving coating adhesion on complex geometries and difficult-to-plate substrates; developing more environmentally sustainable plating processes with reduced water consumption and elimination of harmful chemicals; and creating smart coatings capable of self-healing or indicating wear through embedded sensors or reactive materials.

The industry is also pursuing greater standardization of electroless nickel coating specifications specifically for oil and gas applications, recognizing the unique challenges faced by equipment in this sector. Research efforts are increasingly focused on extending service life and reducing maintenance frequency of critical components, thereby minimizing costly downtime in extraction operations.

The 1950s and 1960s witnessed the initial commercial applications of electroless nickel coatings, primarily focusing on decorative purposes and basic corrosion protection. During this period, the technology was characterized by relatively simple bath compositions and limited understanding of the relationship between plating parameters and coating properties.

The 1970s marked a significant advancement with the introduction of composite electroless nickel coatings, incorporating particles such as silicon carbide and PTFE to enhance wear resistance and lubricity. This innovation expanded the application scope of electroless nickel in oil and gas equipment, where components frequently face extreme mechanical stress and abrasive environments.

By the 1980s and 1990s, researchers had developed a deeper understanding of the microstructure-property relationships in electroless nickel deposits. This period saw the refinement of high-phosphorus nickel coatings (10-12% P), which demonstrated superior corrosion resistance in aggressive environments containing hydrogen sulfide and carbon dioxide—common challenges in oil and gas operations.

The early 2000s brought increased focus on environmental considerations, with the development of lead-free and cadmium-free electroless nickel baths to comply with stricter regulations. Simultaneously, advancements in nanotechnology began influencing the field, leading to nano-enhanced electroless nickel coatings with improved hardness and wear resistance.

Current technological objectives center on several key areas: enhancing coating performance in ultra-high pressure and high temperature (HPHT) environments as oil and gas exploration moves into more extreme conditions; improving coating adhesion on complex geometries and difficult-to-plate substrates; developing more environmentally sustainable plating processes with reduced water consumption and elimination of harmful chemicals; and creating smart coatings capable of self-healing or indicating wear through embedded sensors or reactive materials.

The industry is also pursuing greater standardization of electroless nickel coating specifications specifically for oil and gas applications, recognizing the unique challenges faced by equipment in this sector. Research efforts are increasingly focused on extending service life and reducing maintenance frequency of critical components, thereby minimizing costly downtime in extraction operations.

Market Demand Analysis for Corrosion-Resistant Coatings

The global market for corrosion-resistant coatings in oil and gas equipment has experienced significant growth, driven by increasing exploration activities in harsh environments and the need to extend asset lifecycles. The market value for specialized protective coatings in the oil and gas sector reached approximately $3.5 billion in 2022, with electroless nickel coatings representing a growing segment estimated at $580 million. Industry analysts project a compound annual growth rate of 4.7% for this specific coating technology through 2028.

Offshore operations present particularly demanding conditions where equipment faces constant exposure to saltwater, hydrogen sulfide, and carbon dioxide—all highly corrosive elements that significantly reduce equipment lifespan. Electroless nickel coatings have emerged as a preferred solution due to their uniform deposition properties and excellent corrosion resistance, even on complex geometries where traditional coating methods struggle to provide consistent coverage.

The Middle East and North America currently represent the largest markets for these specialized coatings, collectively accounting for over 60% of global demand. This regional concentration aligns with the high concentration of oil and gas activities in these areas, particularly in deep-water operations where equipment failure costs are exponentially higher. The Asia-Pacific region, however, is showing the fastest growth rate at approximately 6.2% annually, driven by increased exploration activities in countries like China, Malaysia, and Indonesia.

End-user surveys indicate that maintenance cost reduction remains the primary driver for adoption of advanced coating technologies. Companies report average maintenance cost reductions of 15-20% when implementing electroless nickel coatings on critical components, with some operations extending maintenance intervals by up to 40% compared to conventional coating alternatives.

The market is increasingly demanding coatings that can withstand higher temperatures and pressures as exploration moves into more extreme environments. Current electroless nickel formulations typically offer temperature resistance up to 650°C, but industry requirements are pushing toward 800°C for certain deep-well applications. This performance gap represents a significant market opportunity for coating technology innovation.

Regulatory factors are also influencing market dynamics, with environmental regulations increasingly restricting the use of certain chemicals in coating processes. The industry is responding with greater investment in environmentally compliant formulations, with "green" electroless nickel solutions seeing 25% higher adoption rates in regions with stringent environmental regulations.

Offshore operations present particularly demanding conditions where equipment faces constant exposure to saltwater, hydrogen sulfide, and carbon dioxide—all highly corrosive elements that significantly reduce equipment lifespan. Electroless nickel coatings have emerged as a preferred solution due to their uniform deposition properties and excellent corrosion resistance, even on complex geometries where traditional coating methods struggle to provide consistent coverage.

The Middle East and North America currently represent the largest markets for these specialized coatings, collectively accounting for over 60% of global demand. This regional concentration aligns with the high concentration of oil and gas activities in these areas, particularly in deep-water operations where equipment failure costs are exponentially higher. The Asia-Pacific region, however, is showing the fastest growth rate at approximately 6.2% annually, driven by increased exploration activities in countries like China, Malaysia, and Indonesia.

End-user surveys indicate that maintenance cost reduction remains the primary driver for adoption of advanced coating technologies. Companies report average maintenance cost reductions of 15-20% when implementing electroless nickel coatings on critical components, with some operations extending maintenance intervals by up to 40% compared to conventional coating alternatives.

The market is increasingly demanding coatings that can withstand higher temperatures and pressures as exploration moves into more extreme environments. Current electroless nickel formulations typically offer temperature resistance up to 650°C, but industry requirements are pushing toward 800°C for certain deep-well applications. This performance gap represents a significant market opportunity for coating technology innovation.

Regulatory factors are also influencing market dynamics, with environmental regulations increasingly restricting the use of certain chemicals in coating processes. The industry is responding with greater investment in environmentally compliant formulations, with "green" electroless nickel solutions seeing 25% higher adoption rates in regions with stringent environmental regulations.

Current Status and Technical Barriers in Electroless Nickel

Electroless nickel (EN) plating technology has evolved significantly over the past decades, establishing itself as a critical surface treatment method in oil and gas equipment manufacturing. Currently, the global market for EN coatings in this sector is estimated at approximately $1.2 billion, with a compound annual growth rate of 4.5%. The technology has reached maturity in conventional applications but continues to evolve for specialized high-performance requirements.

The current state-of-the-art EN coatings typically offer corrosion resistance in H2S environments up to 120°C and can withstand pressures up to 15,000 psi in downhole applications. Medium-phosphorus (6-9% P) and high-phosphorus (>10% P) variants dominate the market, with the latter preferred for severe corrosive environments common in oil and gas operations. Recent advancements have focused on nano-composite EN coatings incorporating particles such as SiC, Al2O3, and PTFE to enhance wear resistance and reduce friction.

Despite widespread adoption, several significant technical barriers persist. Adhesion failure remains a critical issue, particularly on complex geometries and when coating thickness exceeds 50 μm. This problem is exacerbated in high-temperature applications where thermal expansion coefficient mismatches between the substrate and coating create internal stresses. Industry data indicates that approximately 15% of EN coating failures in oil and gas equipment are attributed to adhesion issues.

Bath stability presents another major challenge, with conventional EN solutions typically maintaining optimal deposition rates for only 6-8 metal turnovers before requiring replacement. This limitation significantly impacts production efficiency and increases waste generation. The presence of sulfur compounds in oil and gas environments also accelerates coating degradation through sulfidation mechanisms, particularly at temperatures above 90°C.

Hydrogen embrittlement induced during the plating process poses a serious risk to high-strength steel components commonly used in critical oil and gas applications. Current post-plating heat treatment protocols (typically 190-200°C for 2-4 hours) only partially mitigate this risk, with residual hydrogen potentially causing delayed cracking failures.

The uniformity of coating thickness on complex internal surfaces, such as valve bodies and pump components, remains problematic with conventional EN processes. Variations exceeding ±20% have been documented in deep recesses and blind holes, compromising performance in these critical areas. Additionally, current EN formulations struggle to maintain consistent phosphorus content throughout the coating thickness, resulting in non-uniform corrosion resistance profiles.

Environmental and regulatory constraints are increasingly limiting the use of traditional EN chemistry. Nickel compounds are classified as carcinogenic, while hypophosphite-based reducing agents contribute to high phosphorus loads in wastewater. The industry faces mounting pressure to develop more sustainable alternatives while maintaining or improving performance characteristics.

The current state-of-the-art EN coatings typically offer corrosion resistance in H2S environments up to 120°C and can withstand pressures up to 15,000 psi in downhole applications. Medium-phosphorus (6-9% P) and high-phosphorus (>10% P) variants dominate the market, with the latter preferred for severe corrosive environments common in oil and gas operations. Recent advancements have focused on nano-composite EN coatings incorporating particles such as SiC, Al2O3, and PTFE to enhance wear resistance and reduce friction.

Despite widespread adoption, several significant technical barriers persist. Adhesion failure remains a critical issue, particularly on complex geometries and when coating thickness exceeds 50 μm. This problem is exacerbated in high-temperature applications where thermal expansion coefficient mismatches between the substrate and coating create internal stresses. Industry data indicates that approximately 15% of EN coating failures in oil and gas equipment are attributed to adhesion issues.

Bath stability presents another major challenge, with conventional EN solutions typically maintaining optimal deposition rates for only 6-8 metal turnovers before requiring replacement. This limitation significantly impacts production efficiency and increases waste generation. The presence of sulfur compounds in oil and gas environments also accelerates coating degradation through sulfidation mechanisms, particularly at temperatures above 90°C.

Hydrogen embrittlement induced during the plating process poses a serious risk to high-strength steel components commonly used in critical oil and gas applications. Current post-plating heat treatment protocols (typically 190-200°C for 2-4 hours) only partially mitigate this risk, with residual hydrogen potentially causing delayed cracking failures.

The uniformity of coating thickness on complex internal surfaces, such as valve bodies and pump components, remains problematic with conventional EN processes. Variations exceeding ±20% have been documented in deep recesses and blind holes, compromising performance in these critical areas. Additionally, current EN formulations struggle to maintain consistent phosphorus content throughout the coating thickness, resulting in non-uniform corrosion resistance profiles.

Environmental and regulatory constraints are increasingly limiting the use of traditional EN chemistry. Nickel compounds are classified as carcinogenic, while hypophosphite-based reducing agents contribute to high phosphorus loads in wastewater. The industry faces mounting pressure to develop more sustainable alternatives while maintaining or improving performance characteristics.

Mainstream Electroless Nickel Coating Solutions

01 Composition and formulation of electroless nickel plating baths

Electroless nickel plating baths typically contain nickel salts, reducing agents, complexing agents, stabilizers, and pH adjusters. The specific composition affects the properties of the resulting coating, such as hardness, corrosion resistance, and phosphorus content. Optimizing these formulations can lead to improved coating performance for various industrial applications.- Composition and formulation of electroless nickel plating baths: Electroless nickel plating baths typically contain nickel salts, reducing agents, complexing agents, stabilizers, and pH adjusters. The composition can be optimized to achieve specific coating properties such as hardness, corrosion resistance, and uniformity. Different formulations may include hypophosphite-based solutions, boron-based solutions, or specialized additives to enhance deposition rate and coating quality.

- Surface preparation and pretreatment methods: Proper surface preparation is critical for successful electroless nickel coating adhesion. This includes cleaning, degreasing, etching, and activation steps to ensure uniform deposition. Pretreatment methods may involve acid cleaning, alkaline cleaning, mechanical abrasion, or specialized chemical treatments depending on the substrate material. The quality of surface preparation directly impacts coating adhesion, uniformity, and overall performance.

- Nickel-phosphorus and nickel-boron coating compositions: Electroless nickel coatings can be classified based on their alloying elements, primarily phosphorus or boron. Nickel-phosphorus coatings can be low (1-5%), medium (5-9%), or high (>9%) phosphorus content, each offering different properties. Nickel-boron coatings typically contain 0.5-5% boron. The phosphorus or boron content significantly affects hardness, corrosion resistance, magnetic properties, and thermal stability of the coating.

- Post-treatment and heat treatment processes: Post-deposition treatments can significantly enhance the properties of electroless nickel coatings. Heat treatment at various temperatures can increase hardness through precipitation hardening, improve wear resistance, and modify other mechanical properties. Other post-treatments include passivation, sealing, or application of topcoats to enhance corrosion protection. The temperature and duration of heat treatment must be carefully controlled to achieve desired properties without compromising coating integrity.

- Advanced applications and composite coatings: Electroless nickel coatings can be enhanced with the incorporation of particles such as silicon carbide, diamond, PTFE, or other materials to create composite coatings with specialized properties. These composite coatings offer improved wear resistance, self-lubricating properties, or enhanced hardness. Advanced applications include electronics, aerospace components, automotive parts, and chemical processing equipment where specific performance characteristics are required.

02 Surface preparation and pretreatment methods

Proper surface preparation is critical for successful electroless nickel coating adhesion. This includes cleaning, degreasing, etching, and activation steps to ensure uniform deposition. Specialized pretreatment methods for different substrate materials (metals, plastics, ceramics) can significantly improve coating quality and bonding strength.Expand Specific Solutions03 Composite and multi-layer electroless nickel coatings

Advanced electroless nickel coatings incorporate particles or multiple layers to enhance specific properties. These include nickel-phosphorus-particle composites, gradient coatings with varying phosphorus content, and multi-layer systems combining different metal alloys. Such composite structures can provide superior wear resistance, hardness, and corrosion protection compared to conventional coatings.Expand Specific Solutions04 Post-treatment and heat treatment processes

Post-deposition treatments significantly influence the final properties of electroless nickel coatings. Heat treatment at various temperatures can transform the amorphous structure to crystalline, increasing hardness and wear resistance. Other post-treatments include passivation, sealing, and application of topcoats to enhance corrosion resistance and durability in harsh environments.Expand Specific Solutions05 Specialized electroless nickel coatings for specific applications

Electroless nickel coatings are tailored for specific industrial applications through modifications in composition and processing. These include high-phosphorus coatings for superior corrosion resistance in chemical processing, low-phosphorus or nickel-boron coatings for enhanced hardness in wear applications, and specialized formulations for electronics, automotive components, and aerospace parts that require precise thickness control and uniform deposition on complex geometries.Expand Specific Solutions

Leading Companies in Electroless Nickel Coating Industry

The electroless nickel coating market in the oil and gas equipment sector is currently in a growth phase, with increasing demand driven by corrosion resistance requirements in harsh environments. Major players include Baker Hughes, ExxonMobil Technology & Engineering, and Shengli Oilfield Jindao Industrial, who are advancing coating technologies for downhole tools and offshore equipment. The market is characterized by moderate technological maturity, with ongoing R&D from specialized surface treatment companies like MacDermid Enthone, Atotech, and Coventya focusing on improving coating performance and environmental compliance. Research institutions such as Guangxi University and EMPA are contributing to technical innovations, while oil majors like Eni SpA are implementing these solutions across their equipment portfolios.

Atotech Deutschland GmbH & Co. KG

Technical Solution: Atotech has developed the Nichem® series of electroless nickel coating solutions specifically engineered for extreme oil and gas environments. Their technology features a multi-layer approach with graduated phosphorus content (ranging from 5% to 12%) to optimize both hardness and corrosion resistance properties[2]. The company's proprietary bath stabilization technology enables extended bath life (up to 10 metal turnovers) while maintaining consistent deposition rates and coating quality, resulting in more cost-effective production for oil and gas components[4]. Atotech has pioneered advanced pre-treatment processes that enable superior adhesion on difficult substrates including various steel alloys, stainless steels, and non-ferrous metals commonly used in oil and gas equipment[6]. Their latest innovation includes the incorporation of nano-ceramic particles into the nickel-phosphorus matrix, creating composite coatings with enhanced wear resistance (up to 30% improvement in Taber abrasion tests) while maintaining excellent corrosion protection in environments containing H2S, CO2, and chlorides[8].

Strengths: Exceptional bath stability and consistency for high-volume production; excellent adhesion on diverse substrate materials; superior combination of wear and corrosion resistance; environmentally compliant formulations meeting global regulations. Weaknesses: Requires specialized equipment and precise process control; higher initial implementation cost; more complex waste treatment requirements compared to conventional plating processes.

Tubacex Upstream Technologies SA

Technical Solution: Tubacex Upstream Technologies has developed specialized electroless nickel coating solutions for tubular products used in extreme oil and gas environments. Their proprietary TUBACOAT™ technology applies uniform electroless nickel coatings to the internal surfaces of long, small-diameter tubes and complex tubular assemblies, achieving consistent thickness (±3μm) even in tubes exceeding 12 meters in length[1]. The company employs a high-phosphorus (10-12%) formulation specifically engineered to resist sulfide stress cracking and chloride pitting in sour oil and gas environments, with demonstrated corrosion rates below 0.002 mm/year in NACE TM0177 testing[3]. Tubacex has also pioneered a hybrid coating system that combines electroless nickel base layers with specialized top coatings to provide both corrosion protection and reduced friction (coefficient of friction <0.15) for applications involving fluid flow, such as production tubing and flow control equipment[5]. Their latest innovation includes the development of heat-treated electroless nickel coatings that maintain hardness values above 800 HV even after exposure to temperatures up to 300°C, addressing the needs of high-temperature/high-pressure (HTHP) well applications[7].

Strengths: Unmatched capability for coating internal surfaces of long tubular products; excellent corrosion resistance in sour service environments; superior high-temperature performance; reduced friction properties for improved flow efficiency. Weaknesses: Higher cost compared to conventional tubular products; longer processing time for thick coatings; potential for hydrogen embrittlement in high-strength steel substrates without proper post-treatment.

Key Patents and Technical Innovations in Electroless Nickel

Coated oil and gas well production devices

PatentActiveEP2398994A1

Innovation

- Coating oil and gas well production devices with amorphous alloys, heat-treated electroless or electroplated nickel-phosphorous composites, graphite, MoS2, WS2, fullerene-based composites, boride-based cermets, quasicrystalline materials, diamond-based materials, diamond-like-carbon (DLC), and boron nitride to reduce friction, wear, and corrosion, and prevent deposits.

Electroless nickel alloy plating baths, a method for deposition of nickel alloys, nickel alloy deposits and uses of such formed nickel alloy deposits

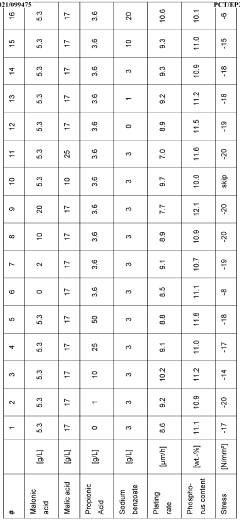

PatentWO2021099475A1

Innovation

- An electroless nickel alloy plating bath comprising nickel ions, molybdenum or copper ions, and hypophosphite as reducing agents, along with specific complexing agents like malonic acid, tartaric acid, and benzoic acid, which stabilize the bath and enhance deposition properties.

Environmental Impact and Sustainability Considerations

The environmental impact of electroless nickel coating processes in oil and gas equipment applications has become increasingly significant as the industry faces stricter regulations and sustainability demands. Traditional electroless nickel plating processes utilize chemicals such as nickel sulfate, sodium hypophosphite, and various complexing agents that can pose environmental hazards if not properly managed. The release of these chemicals into water systems can lead to ecological damage and potential human health risks, necessitating comprehensive waste treatment protocols.

Recent advancements have focused on developing more environmentally friendly electroless nickel formulations. Low-phosphorus and mid-phosphorus nickel coatings have been reformulated to reduce hazardous components while maintaining performance characteristics. Several manufacturers have introduced nickel plating solutions free from lead, cadmium, and other heavy metals that were previously common in stabilizer additives, significantly reducing the environmental footprint of these processes.

Water consumption represents another critical environmental consideration. Conventional electroless nickel plating requires substantial water usage for rinsing and processing. Innovative closed-loop water systems and advanced filtration technologies have emerged, enabling water recycling rates of up to 80% in modern facilities. These systems not only conserve water but also minimize the discharge of contaminated effluent, addressing both resource conservation and pollution prevention objectives.

Energy efficiency improvements have transformed the sustainability profile of electroless nickel coating operations. Traditional heating methods for maintaining plating baths at optimal temperatures (typically 85-95°C) consumed significant energy. The implementation of high-efficiency heat exchangers, insulated plating tanks, and precise temperature control systems has reduced energy consumption by 30-40% in state-of-the-art facilities, directly lowering carbon emissions associated with the coating process.

Life cycle assessment (LCA) studies comparing electroless nickel coatings with alternative surface treatments have demonstrated notable sustainability advantages. The extended service life of nickel-coated components in harsh oil and gas environments—often 3-5 times longer than uncoated parts—reduces the environmental impact associated with manufacturing replacement components. This longevity factor is increasingly recognized as a key sustainability metric when evaluating coating technologies.

Regulatory compliance frameworks continue to evolve globally, with particular focus on REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) in Europe and similar initiatives in other regions. Forward-thinking coating providers are proactively reformulating their processes to meet anticipated regulatory requirements, often exceeding current standards. This approach not only ensures business continuity but positions environmentally optimized electroless nickel coatings as preferred solutions for sustainable oil and gas operations.

Recent advancements have focused on developing more environmentally friendly electroless nickel formulations. Low-phosphorus and mid-phosphorus nickel coatings have been reformulated to reduce hazardous components while maintaining performance characteristics. Several manufacturers have introduced nickel plating solutions free from lead, cadmium, and other heavy metals that were previously common in stabilizer additives, significantly reducing the environmental footprint of these processes.

Water consumption represents another critical environmental consideration. Conventional electroless nickel plating requires substantial water usage for rinsing and processing. Innovative closed-loop water systems and advanced filtration technologies have emerged, enabling water recycling rates of up to 80% in modern facilities. These systems not only conserve water but also minimize the discharge of contaminated effluent, addressing both resource conservation and pollution prevention objectives.

Energy efficiency improvements have transformed the sustainability profile of electroless nickel coating operations. Traditional heating methods for maintaining plating baths at optimal temperatures (typically 85-95°C) consumed significant energy. The implementation of high-efficiency heat exchangers, insulated plating tanks, and precise temperature control systems has reduced energy consumption by 30-40% in state-of-the-art facilities, directly lowering carbon emissions associated with the coating process.

Life cycle assessment (LCA) studies comparing electroless nickel coatings with alternative surface treatments have demonstrated notable sustainability advantages. The extended service life of nickel-coated components in harsh oil and gas environments—often 3-5 times longer than uncoated parts—reduces the environmental impact associated with manufacturing replacement components. This longevity factor is increasingly recognized as a key sustainability metric when evaluating coating technologies.

Regulatory compliance frameworks continue to evolve globally, with particular focus on REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) in Europe and similar initiatives in other regions. Forward-thinking coating providers are proactively reformulating their processes to meet anticipated regulatory requirements, often exceeding current standards. This approach not only ensures business continuity but positions environmentally optimized electroless nickel coatings as preferred solutions for sustainable oil and gas operations.

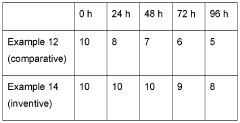

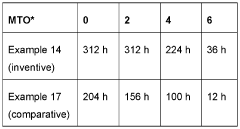

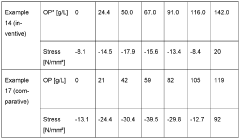

Field Performance Testing and Quality Assurance Methods

Field performance testing of electroless nickel coatings in oil and gas equipment requires rigorous methodologies to ensure reliability under extreme operational conditions. The industry has developed standardized testing protocols that simulate actual field conditions, including high-pressure, high-temperature (HPHT) environments, exposure to hydrogen sulfide (H2S), carbon dioxide (CO2), and various corrosive chemicals commonly encountered in extraction processes.

Accelerated corrosion testing represents a critical component of field performance evaluation, with salt spray testing (ASTM B117) and autoclave testing being widely implemented. These methods expose coated components to intensified corrosive environments to predict long-term performance within compressed timeframes. Additionally, cyclic testing that alternates between different environmental conditions more accurately replicates the variable exposures experienced in actual field operations.

Adhesion testing through methods such as pull-off testing (ASTM D4541) and bend testing evaluates the coating's ability to maintain integrity during mechanical stress. This is particularly important for components subject to frequent handling, installation stresses, or operational vibration. Hardness testing using microhardness techniques provides valuable data on coating durability and wear resistance properties.

Quality assurance for electroless nickel coatings in oil and gas applications follows multi-tiered approaches. Initial bath analysis ensures proper chemical composition and stability of plating solutions. During production, real-time monitoring systems track critical parameters including pH, temperature, and chemical concentrations. Post-production inspection employs both non-destructive and destructive testing methods to verify coating quality.

Non-destructive evaluation techniques include thickness measurement using X-ray fluorescence (XRF) or magnetic induction methods, visual inspection for surface defects, and porosity testing. More advanced techniques such as scanning electron microscopy (SEM) and energy-dispersive X-ray spectroscopy (EDS) provide detailed analysis of coating microstructure and composition.

Statistical process control (SPC) methodologies have been increasingly adopted by coating facilities serving the oil and gas sector. These approaches establish control limits for critical parameters and enable early detection of process drift before it affects product quality. Documentation and traceability systems maintain comprehensive records of bath compositions, process parameters, and test results for each production batch.

Field validation studies comparing laboratory test results with actual performance data have led to continuous refinement of testing protocols. This feedback loop ensures that quality assurance methods evolve to address emerging challenges in increasingly demanding downhole environments, particularly as exploration and production activities extend into more extreme conditions.

Accelerated corrosion testing represents a critical component of field performance evaluation, with salt spray testing (ASTM B117) and autoclave testing being widely implemented. These methods expose coated components to intensified corrosive environments to predict long-term performance within compressed timeframes. Additionally, cyclic testing that alternates between different environmental conditions more accurately replicates the variable exposures experienced in actual field operations.

Adhesion testing through methods such as pull-off testing (ASTM D4541) and bend testing evaluates the coating's ability to maintain integrity during mechanical stress. This is particularly important for components subject to frequent handling, installation stresses, or operational vibration. Hardness testing using microhardness techniques provides valuable data on coating durability and wear resistance properties.

Quality assurance for electroless nickel coatings in oil and gas applications follows multi-tiered approaches. Initial bath analysis ensures proper chemical composition and stability of plating solutions. During production, real-time monitoring systems track critical parameters including pH, temperature, and chemical concentrations. Post-production inspection employs both non-destructive and destructive testing methods to verify coating quality.

Non-destructive evaluation techniques include thickness measurement using X-ray fluorescence (XRF) or magnetic induction methods, visual inspection for surface defects, and porosity testing. More advanced techniques such as scanning electron microscopy (SEM) and energy-dispersive X-ray spectroscopy (EDS) provide detailed analysis of coating microstructure and composition.

Statistical process control (SPC) methodologies have been increasingly adopted by coating facilities serving the oil and gas sector. These approaches establish control limits for critical parameters and enable early detection of process drift before it affects product quality. Documentation and traceability systems maintain comprehensive records of bath compositions, process parameters, and test results for each production batch.

Field validation studies comparing laboratory test results with actual performance data have led to continuous refinement of testing protocols. This feedback loop ensures that quality assurance methods evolve to address emerging challenges in increasingly demanding downhole environments, particularly as exploration and production activities extend into more extreme conditions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!