Electroless Nickel Phosphorus vs Nickel Boron Comparative Study

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EN-P vs Ni-B Coating Technology Background and Objectives

Electroless nickel plating has evolved significantly since its inception in the mid-20th century, becoming a critical surface engineering technology across multiple industries. The development of both Electroless Nickel Phosphorus (EN-P) and Nickel Boron (Ni-B) coatings represents major milestones in this technological evolution, each offering distinct performance characteristics that address specific industrial challenges.

EN-P coatings emerged first in the 1940s, pioneered by Brenner and Riddell, and have since become the industry standard for applications requiring corrosion resistance and uniform deposition on complex geometries. The technology has progressed through several generations, with significant improvements in bath stability, deposition rates, and phosphorus content control, allowing for tailored coating properties ranging from 1-13% phosphorus content.

Ni-B coatings, developed later as an alternative, have gained attention particularly in the last three decades due to their superior hardness and wear resistance properties. The evolution of Ni-B technology has focused on overcoming initial challenges related to bath stability, deposition rates, and cost-effectiveness compared to traditional EN-P processes.

The current technological trajectory shows increasing interest in hybrid and composite coatings that combine the beneficial properties of both systems, as well as environmentally friendly formulations that reduce or eliminate hazardous chemicals traditionally used in these processes. Recent advancements include nano-enhanced versions of both coating types, offering improved performance characteristics.

The primary objective of this comparative study is to provide a comprehensive analysis of EN-P and Ni-B coating technologies, evaluating their respective strengths, limitations, and optimal application scenarios. This includes examining their microstructural properties, mechanical performance, corrosion resistance, thermal behavior, and economic considerations.

Additionally, this study aims to identify emerging trends and potential innovation pathways in both technologies, particularly focusing on environmentally sustainable formulations, enhanced performance characteristics, and cost-effective implementation strategies. The integration of these coatings with advanced manufacturing processes, including additive manufacturing and precision engineering applications, represents a key area of interest.

Furthermore, this research seeks to establish clear selection criteria for industries to determine the most appropriate coating technology based on specific application requirements, operating environments, and performance expectations. This will include detailed case studies across various sectors including automotive, aerospace, electronics, oil and gas, and medical device manufacturing.

By thoroughly examining both established practices and cutting-edge developments in EN-P and Ni-B coating technologies, this study will provide valuable insights for research and development initiatives, process optimization efforts, and strategic technology adoption decisions.

EN-P coatings emerged first in the 1940s, pioneered by Brenner and Riddell, and have since become the industry standard for applications requiring corrosion resistance and uniform deposition on complex geometries. The technology has progressed through several generations, with significant improvements in bath stability, deposition rates, and phosphorus content control, allowing for tailored coating properties ranging from 1-13% phosphorus content.

Ni-B coatings, developed later as an alternative, have gained attention particularly in the last three decades due to their superior hardness and wear resistance properties. The evolution of Ni-B technology has focused on overcoming initial challenges related to bath stability, deposition rates, and cost-effectiveness compared to traditional EN-P processes.

The current technological trajectory shows increasing interest in hybrid and composite coatings that combine the beneficial properties of both systems, as well as environmentally friendly formulations that reduce or eliminate hazardous chemicals traditionally used in these processes. Recent advancements include nano-enhanced versions of both coating types, offering improved performance characteristics.

The primary objective of this comparative study is to provide a comprehensive analysis of EN-P and Ni-B coating technologies, evaluating their respective strengths, limitations, and optimal application scenarios. This includes examining their microstructural properties, mechanical performance, corrosion resistance, thermal behavior, and economic considerations.

Additionally, this study aims to identify emerging trends and potential innovation pathways in both technologies, particularly focusing on environmentally sustainable formulations, enhanced performance characteristics, and cost-effective implementation strategies. The integration of these coatings with advanced manufacturing processes, including additive manufacturing and precision engineering applications, represents a key area of interest.

Furthermore, this research seeks to establish clear selection criteria for industries to determine the most appropriate coating technology based on specific application requirements, operating environments, and performance expectations. This will include detailed case studies across various sectors including automotive, aerospace, electronics, oil and gas, and medical device manufacturing.

By thoroughly examining both established practices and cutting-edge developments in EN-P and Ni-B coating technologies, this study will provide valuable insights for research and development initiatives, process optimization efforts, and strategic technology adoption decisions.

Market Applications and Demand Analysis for EN-P and Ni-B Coatings

The global market for electroless plating has been experiencing steady growth, with the combined market value for electroless nickel coatings exceeding $2 billion annually. Within this segment, Electroless Nickel Phosphorus (EN-P) coatings currently dominate approximately 85% of the market share, while Nickel Boron (Ni-B) coatings represent a smaller but rapidly growing segment at around 15%.

The automotive industry remains the largest consumer of EN-P coatings, particularly for components requiring high wear resistance and corrosion protection such as fuel systems, brake components, and transmission parts. The consistent demand from this sector is driven by stringent performance requirements and the need for longer component lifespans. Market research indicates that automotive applications account for approximately 30% of all EN-P coating usage globally.

Aerospace and defense sectors represent premium markets for both coating technologies, with particular emphasis on EN-P coatings for critical components where failure is not an option. The higher cost of application in these sectors is offset by the exceptional performance requirements and safety standards. These industries value the uniform coating thickness on complex geometries that electroless plating provides.

The electronics industry has shown increasing demand for both coating types, with EN-P being preferred for electromagnetic interference (EMI) shielding and printed circuit board applications. Meanwhile, Ni-B coatings are gaining traction in semiconductor manufacturing equipment due to their superior hardness and wear resistance in high-temperature environments.

Oil and gas applications represent a growing market segment for both coating types, with particular emphasis on corrosion resistance in harsh environments. The ability of these coatings to protect components exposed to hydrogen sulfide, carbon dioxide, and saltwater makes them invaluable in this industry, which is willing to pay premium prices for extended equipment life.

Regional market analysis reveals that Asia-Pacific, particularly China and India, represents the fastest-growing market for both coating technologies, driven by rapid industrialization and manufacturing growth. North America and Europe maintain stable demand, primarily from established automotive and aerospace sectors.

Recent market trends indicate growing interest in environmentally friendly coating alternatives, as regulatory pressure on traditional electroless nickel baths containing lead and cadmium increases. This has accelerated research into more sustainable formulations for both EN-P and Ni-B coatings, creating new market opportunities for companies that can develop effective green alternatives.

The medical device industry represents an emerging high-value market for both coating types, with particular interest in Ni-B coatings due to their antimicrobial properties. The premium pricing in this sector reflects the stringent regulatory requirements and the critical nature of medical applications.

The automotive industry remains the largest consumer of EN-P coatings, particularly for components requiring high wear resistance and corrosion protection such as fuel systems, brake components, and transmission parts. The consistent demand from this sector is driven by stringent performance requirements and the need for longer component lifespans. Market research indicates that automotive applications account for approximately 30% of all EN-P coating usage globally.

Aerospace and defense sectors represent premium markets for both coating technologies, with particular emphasis on EN-P coatings for critical components where failure is not an option. The higher cost of application in these sectors is offset by the exceptional performance requirements and safety standards. These industries value the uniform coating thickness on complex geometries that electroless plating provides.

The electronics industry has shown increasing demand for both coating types, with EN-P being preferred for electromagnetic interference (EMI) shielding and printed circuit board applications. Meanwhile, Ni-B coatings are gaining traction in semiconductor manufacturing equipment due to their superior hardness and wear resistance in high-temperature environments.

Oil and gas applications represent a growing market segment for both coating types, with particular emphasis on corrosion resistance in harsh environments. The ability of these coatings to protect components exposed to hydrogen sulfide, carbon dioxide, and saltwater makes them invaluable in this industry, which is willing to pay premium prices for extended equipment life.

Regional market analysis reveals that Asia-Pacific, particularly China and India, represents the fastest-growing market for both coating technologies, driven by rapid industrialization and manufacturing growth. North America and Europe maintain stable demand, primarily from established automotive and aerospace sectors.

Recent market trends indicate growing interest in environmentally friendly coating alternatives, as regulatory pressure on traditional electroless nickel baths containing lead and cadmium increases. This has accelerated research into more sustainable formulations for both EN-P and Ni-B coatings, creating new market opportunities for companies that can develop effective green alternatives.

The medical device industry represents an emerging high-value market for both coating types, with particular interest in Ni-B coatings due to their antimicrobial properties. The premium pricing in this sector reflects the stringent regulatory requirements and the critical nature of medical applications.

Current Technical Status and Challenges in Electroless Nickel Coatings

Electroless nickel plating technology has evolved significantly over the past decades, with nickel-phosphorus (Ni-P) and nickel-boron (Ni-B) emerging as the two predominant variants in industrial applications. Currently, Ni-P coatings dominate the market with approximately 70% share of electroless nickel applications globally, while Ni-B coatings account for roughly 15-20% with growing adoption rates.

The global electroless nickel coating market reached approximately $1.8 billion in 2022 and is projected to grow at a CAGR of 5.7% through 2028. This growth is primarily driven by increasing demands from automotive, electronics, aerospace, and chemical processing industries seeking superior corrosion resistance and uniform coating thickness on complex geometries.

Technologically, Ni-P coatings have reached maturity with well-established processing parameters and performance characteristics. These coatings are typically categorized by phosphorus content: low (2-5%), medium (6-9%), and high (10-13%), each offering distinct properties. High phosphorus coatings excel in corrosion resistance and are widely used in chemical processing equipment, while medium and low phosphorus variants provide better wear resistance and magnetic properties.

Ni-B technology, though less mature, has been gaining significant attention due to superior hardness (up to 750 HV as-deposited) compared to Ni-P (450-500 HV), and exceptional wear resistance. Recent advancements have improved Ni-B bath stability and deposition rates, addressing historical limitations that restricted widespread adoption.

Despite progress, several technical challenges persist in electroless nickel coating technologies. Bath stability remains a critical issue, particularly for Ni-B systems where spontaneous decomposition can occur without proper stabilizers. Waste treatment presents environmental concerns, as both processes generate effluents containing heavy metals and reducing agents that require specialized disposal methods.

Deposition rate optimization continues to challenge manufacturers, with typical rates of 10-25 μm/hour for Ni-P and slightly lower for Ni-B coatings. This relatively slow process increases production costs and limits throughput in high-volume applications. Additionally, adhesion to certain substrates, particularly aluminum alloys and some steels, requires specialized pre-treatment processes that add complexity to manufacturing operations.

Geographical distribution of technology development shows concentration in North America, Europe, and East Asia, with China emerging as the fastest-growing market. Japan and Germany lead in technical innovations for Ni-B coatings, while the United States maintains leadership in specialized high-performance Ni-P applications for aerospace and defense sectors.

The global electroless nickel coating market reached approximately $1.8 billion in 2022 and is projected to grow at a CAGR of 5.7% through 2028. This growth is primarily driven by increasing demands from automotive, electronics, aerospace, and chemical processing industries seeking superior corrosion resistance and uniform coating thickness on complex geometries.

Technologically, Ni-P coatings have reached maturity with well-established processing parameters and performance characteristics. These coatings are typically categorized by phosphorus content: low (2-5%), medium (6-9%), and high (10-13%), each offering distinct properties. High phosphorus coatings excel in corrosion resistance and are widely used in chemical processing equipment, while medium and low phosphorus variants provide better wear resistance and magnetic properties.

Ni-B technology, though less mature, has been gaining significant attention due to superior hardness (up to 750 HV as-deposited) compared to Ni-P (450-500 HV), and exceptional wear resistance. Recent advancements have improved Ni-B bath stability and deposition rates, addressing historical limitations that restricted widespread adoption.

Despite progress, several technical challenges persist in electroless nickel coating technologies. Bath stability remains a critical issue, particularly for Ni-B systems where spontaneous decomposition can occur without proper stabilizers. Waste treatment presents environmental concerns, as both processes generate effluents containing heavy metals and reducing agents that require specialized disposal methods.

Deposition rate optimization continues to challenge manufacturers, with typical rates of 10-25 μm/hour for Ni-P and slightly lower for Ni-B coatings. This relatively slow process increases production costs and limits throughput in high-volume applications. Additionally, adhesion to certain substrates, particularly aluminum alloys and some steels, requires specialized pre-treatment processes that add complexity to manufacturing operations.

Geographical distribution of technology development shows concentration in North America, Europe, and East Asia, with China emerging as the fastest-growing market. Japan and Germany lead in technical innovations for Ni-B coatings, while the United States maintains leadership in specialized high-performance Ni-P applications for aerospace and defense sectors.

Comparative Analysis of EN-P and Ni-B Coating Solutions

01 Composition and properties of electroless nickel phosphorus coatings

Electroless nickel phosphorus coatings are characterized by their specific composition and phosphorus content, which directly influences their properties. These coatings typically contain varying percentages of phosphorus (low, medium, or high), affecting hardness, corrosion resistance, and wear resistance. The phosphorus content can be controlled through bath composition and operating parameters, resulting in either crystalline or amorphous structures depending on the phosphorus percentage. These coatings offer excellent uniformity even on complex geometries and can be heat-treated to enhance hardness.- Composition and properties of electroless nickel phosphorus coatings: Electroless nickel phosphorus coatings are characterized by their specific composition and phosphorus content, which directly influences their properties. These coatings typically contain varying percentages of phosphorus, which affects hardness, corrosion resistance, and wear resistance. High phosphorus content generally provides better corrosion resistance while lower phosphorus content offers increased hardness. The microstructure of these coatings can be amorphous or crystalline depending on the phosphorus content and post-treatment processes.

- Composition and properties of electroless nickel boron coatings: Electroless nickel boron coatings offer distinct properties compared to their phosphorus counterparts. These coatings typically contain boron as the reducing agent instead of phosphorus, resulting in different mechanical and chemical properties. Nickel boron coatings generally exhibit higher hardness and wear resistance in the as-deposited state compared to nickel phosphorus coatings. They also provide good solderability and electrical conductivity, making them suitable for electronic applications. The boron content typically ranges from 0.1% to 5% by weight, with higher boron content generally resulting in increased hardness.

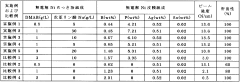

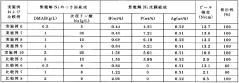

- Deposition processes and bath formulations: The deposition process for electroless nickel coatings involves specific bath formulations and operating conditions. These baths typically contain a nickel source (such as nickel sulfate or nickel chloride), a reducing agent (sodium hypophosphite for Ni-P or sodium borohydride for Ni-B), complexing agents, stabilizers, and pH adjusters. The bath temperature, pH, and concentration of components significantly affect the deposition rate and coating properties. Various additives can be incorporated to enhance specific properties or to control the deposition process. The process parameters need careful control to ensure uniform coating thickness and consistent properties.

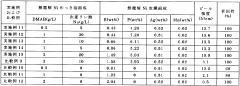

- Heat treatment and performance enhancement: Heat treatment significantly affects the properties of electroless nickel coatings. For nickel phosphorus coatings, heat treatment at temperatures between 300-400°C transforms the amorphous structure to crystalline, resulting in increased hardness. For nickel boron coatings, heat treatment can also enhance hardness and wear resistance. However, excessive heat treatment temperatures can lead to embrittlement or reduced corrosion resistance. The optimal heat treatment parameters depend on the specific coating composition and the desired properties for the intended application. Post-deposition treatments can also include surface modifications to enhance specific properties.

- Applications and comparative advantages: Electroless nickel phosphorus and nickel boron coatings find applications across various industries due to their unique properties. These applications include automotive components, aerospace parts, oil and gas equipment, electronics, and chemical processing equipment. Nickel phosphorus coatings are preferred for applications requiring superior corrosion resistance, while nickel boron coatings are chosen for applications demanding higher hardness and wear resistance. The selection between these coating types depends on specific requirements such as operating environment, mechanical demands, and cost considerations. Composite coatings incorporating particles like silicon carbide or diamond can further enhance specific properties for specialized applications.

02 Composition and properties of electroless nickel boron coatings

Electroless nickel boron coatings are formulated with boron-containing reducing agents instead of phosphorus compounds. These coatings typically contain 0.1-10% boron, providing superior hardness compared to nickel phosphorus coatings even without heat treatment. Nickel boron deposits exhibit excellent wear resistance, lubricity, and solderability. The boron content affects the microstructure, with higher boron percentages typically resulting in more amorphous structures. These coatings are particularly valuable in applications requiring extreme hardness and wear resistance.Expand Specific Solutions03 Bath formulations and deposition processes

The deposition process for electroless nickel coatings involves specific bath formulations containing nickel salts, reducing agents (sodium hypophosphite for Ni-P or borohydrides/amine boranes for Ni-B), complexing agents, stabilizers, and pH buffers. The bath parameters including temperature (typically 80-95°C), pH (4.5-6 for Ni-P, 12-14 for Ni-B), and agitation significantly influence coating quality. The process requires proper surface preparation through cleaning, activation, and catalyzation steps to ensure uniform deposition. Continuous monitoring and replenishment of bath components are essential to maintain consistent coating properties.Expand Specific Solutions04 Post-treatment and heat treatment processes

Post-deposition treatments significantly enhance the properties of electroless nickel coatings. Heat treatment at temperatures between 300-400°C increases the hardness of Ni-P coatings by forming nickel phosphide precipitates, while temperatures above 400°C may cause crystallization and reduced corrosion resistance. For Ni-B coatings, heat treatment at 350-400°C optimizes hardness through the formation of nickel boride phases. Additional post-treatments include passivation to improve corrosion resistance, sealing to reduce porosity, and application of topcoats for specific functional requirements.Expand Specific Solutions05 Applications and performance comparisons

Electroless nickel phosphorus and nickel boron coatings serve diverse industrial applications based on their unique properties. Ni-P coatings are widely used in aerospace, automotive, electronics, and chemical processing industries due to their excellent corrosion resistance and uniform thickness. Ni-B coatings are preferred for applications requiring superior hardness and wear resistance, such as precision components, molds, and cutting tools. The selection between these coating types depends on specific requirements: Ni-P offers better corrosion protection and ductility, while Ni-B provides superior hardness, wear resistance, and electrical conductivity.Expand Specific Solutions

Leading Manufacturers and Research Institutions in Electroless Plating

The electroless nickel phosphorus vs nickel boron market is in a growth phase, with increasing demand driven by automotive, aerospace, and electronics applications. The market size is expanding due to superior corrosion resistance and hardness properties of these coatings. Technologically, electroless nickel phosphorus is more mature and widely adopted, while nickel boron is gaining traction for specialized applications. Key players include United Technologies, BASF, Atotech Deutschland, and Surface Technologies GmbH, who are investing in R&D to enhance coating performance. Academic institutions like Xiamen University and Central South University are collaborating with industry leaders to advance coating technologies, focusing on environmental sustainability and improved mechanical properties.

Atotech Deutschland GmbH & Co. KG

Technical Solution: Atotech has developed advanced electroless nickel phosphorus (ENP) coating solutions with precise phosphorus content control (low: 1-5%, medium: 5-9%, high: >9%) for targeted performance characteristics. Their ENIG (Electroless Nickel Immersion Gold) process combines ENP with gold finishing for superior corrosion resistance and solderability in electronics. For automotive and industrial applications, they've engineered specialized ENP formulations with enhanced wear resistance and uniform thickness distribution on complex geometries. Their proprietary stabilizer systems extend bath life while maintaining consistent deposition rates (15-25 μm/h). Atotech has also developed nickel boron coatings with boron content ranging from 0.1-5% for applications requiring higher hardness (up to 900 HV) and superior wear resistance compared to traditional ENP coatings[1][2].

Strengths: Industry-leading expertise in both ENP and nickel boron technologies with precise control over phosphorus/boron content; comprehensive solutions for multiple industries including electronics, automotive, and industrial applications. Weaknesses: Their high-performance coatings often require more complex processing equipment and higher implementation costs compared to standard plating solutions.

BASF Corp.

Technical Solution: BASF has pioneered advanced electroless nickel phosphorus (ENP) coating technologies through their Cathoguard® product line, focusing on automotive and industrial applications. Their ENP formulations feature precisely controlled phosphorus content (2-14%) to deliver tailored performance characteristics. For high-corrosion environments, BASF has developed high-phosphorus (10-14% P) coatings with exceptional salt spray resistance (>1000 hours). Their medium-phosphorus (6-9% P) solutions balance corrosion protection with wear resistance. BASF has also innovated in nickel boron technology, creating specialized coatings with boron content of 0.5-5% that achieve hardness values up to 950 HV after heat treatment at 400°C. Their proprietary stabilizer systems maintain consistent deposition rates (15-20 μm/h) while extending bath life significantly beyond industry standards. BASF's comparative studies have demonstrated that their nickel boron coatings offer superior wear resistance in high-abrasion applications, while their ENP coatings provide better overall corrosion protection[3][4].

Strengths: Extensive R&D capabilities allowing for customized coating solutions; global manufacturing and technical support network; comprehensive quality control systems ensuring consistent coating performance. Weaknesses: Their high-performance coating solutions typically command premium pricing; some formulations may require specialized waste treatment processes to meet environmental regulations.

Key Patents and Technical Innovations in Electroless Nickel Coatings

Blackened composite electroless nickel coatings

PatentInactiveUS20140287208A1

Innovation

- A blackened composite electroless nickel coating process involving an ultrasonic blackening method to oxidize the surface, creating a smoother, darker finish that reduces friction and wear, and incorporates particulate matter like diamond or boron nitride to enhance wear resistance and lubricity, while maintaining the coating's mechanical properties.

Electroless nickel plating coat and pretreatment method for forming the electroless nickel plating coat

PatentActiveJP2021080513A

Innovation

- An electroless nickel plating film and pretreatment method using boron, phosphorus, and silver or copper catalysts, eliminating the need for palladium, with specific compositions and conditions to ensure good film properties.

Environmental Impact and Sustainability Considerations

The environmental impact of surface coating technologies has become increasingly important as industries strive for more sustainable manufacturing processes. In comparing Electroless Nickel Phosphorus (ENP) and Electroless Nickel Boron (ENB) coatings, several critical environmental considerations emerge that influence their adoption and long-term viability.

ENP processes traditionally utilize nickel sulfate or nickel chloride as metal sources, with sodium hypophosphite as the reducing agent. These baths often contain complexing agents, stabilizers, and buffers that can pose environmental challenges. The presence of phosphorus compounds in waste streams requires specialized treatment before discharge, as excessive phosphorus can contribute to eutrophication in aquatic ecosystems. Additionally, ENP baths typically operate at temperatures between 85-95°C, consuming significant energy over extended processing periods.

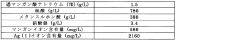

By contrast, ENB processes employ aminoborane or borohydride reducing agents, which present different environmental considerations. While boron compounds are generally less problematic for eutrophication than phosphorus, they can be toxic to aquatic organisms at certain concentrations. ENB baths typically operate at lower temperatures (55-75°C), potentially offering energy savings compared to ENP processes.

Waste management represents a significant sustainability challenge for both coating technologies. The disposal of spent plating solutions containing heavy metals, particularly nickel, requires careful handling and treatment. ENP waste streams contain phosphorus compounds that necessitate additional treatment steps, while ENB waste requires specialized handling of boron-containing compounds. Recent advancements in closed-loop recycling systems have shown promise for reducing the environmental footprint of both processes.

Life cycle assessment (LCA) studies comparing these technologies indicate that ENB may offer advantages in terms of energy consumption and carbon footprint, particularly when considering the lower operating temperatures and potentially longer bath life. However, ENP coatings often demonstrate superior durability in certain applications, which can translate to longer service life of coated components and reduced replacement frequency.

Regulatory frameworks worldwide are increasingly restricting the use of certain chemicals in industrial processes. The European Union's REACH regulations and similar initiatives globally have placed greater scrutiny on nickel compounds due to their potential carcinogenicity and allergenic properties. Both ENP and ENB processes must navigate these regulatory landscapes, with manufacturers investing in research to develop more environmentally benign formulations that maintain coating performance while reducing hazardous components.

ENP processes traditionally utilize nickel sulfate or nickel chloride as metal sources, with sodium hypophosphite as the reducing agent. These baths often contain complexing agents, stabilizers, and buffers that can pose environmental challenges. The presence of phosphorus compounds in waste streams requires specialized treatment before discharge, as excessive phosphorus can contribute to eutrophication in aquatic ecosystems. Additionally, ENP baths typically operate at temperatures between 85-95°C, consuming significant energy over extended processing periods.

By contrast, ENB processes employ aminoborane or borohydride reducing agents, which present different environmental considerations. While boron compounds are generally less problematic for eutrophication than phosphorus, they can be toxic to aquatic organisms at certain concentrations. ENB baths typically operate at lower temperatures (55-75°C), potentially offering energy savings compared to ENP processes.

Waste management represents a significant sustainability challenge for both coating technologies. The disposal of spent plating solutions containing heavy metals, particularly nickel, requires careful handling and treatment. ENP waste streams contain phosphorus compounds that necessitate additional treatment steps, while ENB waste requires specialized handling of boron-containing compounds. Recent advancements in closed-loop recycling systems have shown promise for reducing the environmental footprint of both processes.

Life cycle assessment (LCA) studies comparing these technologies indicate that ENB may offer advantages in terms of energy consumption and carbon footprint, particularly when considering the lower operating temperatures and potentially longer bath life. However, ENP coatings often demonstrate superior durability in certain applications, which can translate to longer service life of coated components and reduced replacement frequency.

Regulatory frameworks worldwide are increasingly restricting the use of certain chemicals in industrial processes. The European Union's REACH regulations and similar initiatives globally have placed greater scrutiny on nickel compounds due to their potential carcinogenicity and allergenic properties. Both ENP and ENB processes must navigate these regulatory landscapes, with manufacturers investing in research to develop more environmentally benign formulations that maintain coating performance while reducing hazardous components.

Cost-Benefit Analysis of EN-P vs Ni-B Implementation

When evaluating the implementation of Electroless Nickel Phosphorus (EN-P) versus Nickel Boron (Ni-B) coatings, a comprehensive cost-benefit analysis reveals significant economic considerations that influence industrial adoption decisions.

Initial investment costs for Ni-B implementation typically exceed those of EN-P by 15-25%, primarily due to higher chemical costs and more complex bath maintenance requirements. The boron-based reducing agents used in Ni-B plating (sodium borohydride or DMAB) are considerably more expensive than the sodium hypophosphite used in EN-P processes. Additionally, Ni-B baths generally require more sophisticated monitoring and control systems to maintain stability.

Operational expenses also differ substantially between these technologies. While Ni-B baths typically have shorter lifespans (approximately 4-6 metal turnovers compared to 8-10 for EN-P), they often operate at lower temperatures (60-70°C vs. 85-95°C for EN-P), potentially reducing energy consumption by 10-15%. However, waste treatment costs for Ni-B can be 20-30% higher due to the environmental considerations of boron-containing effluents.

Maintenance requirements represent another significant cost differential. Ni-B baths demand more frequent analytical monitoring and chemical adjustments, increasing labor costs by approximately 15-20% compared to EN-P processes. The higher sensitivity of Ni-B baths to contamination also necessitates more stringent filtration systems and process controls.

Performance benefits must be weighed against these increased costs. Ni-B coatings typically offer superior hardness (up to 750-850 HV as-deposited, reaching 1100+ HV after heat treatment) compared to EN-P (500-550 HV as-deposited, 900-1000 HV after heat treatment). This translates to extended component life cycles, with field tests indicating 20-35% longer service life for high-wear applications, potentially offsetting the higher initial investment through reduced replacement frequency.

Return on investment (ROI) calculations indicate that Ni-B becomes economically advantageous primarily in high-performance applications where wear resistance and hardness are critical. For standard corrosion protection or general engineering applications, EN-P typically maintains a cost advantage with an estimated 15-25% lower total cost of ownership over a five-year operational period.

Market analysis suggests that industries with high-value components experiencing significant wear issues—such as aerospace, precision machinery, and high-performance automotive applications—achieve positive ROI with Ni-B implementation within 2-3 years, while more cost-sensitive sectors may require 4+ years to realize economic benefits.

Initial investment costs for Ni-B implementation typically exceed those of EN-P by 15-25%, primarily due to higher chemical costs and more complex bath maintenance requirements. The boron-based reducing agents used in Ni-B plating (sodium borohydride or DMAB) are considerably more expensive than the sodium hypophosphite used in EN-P processes. Additionally, Ni-B baths generally require more sophisticated monitoring and control systems to maintain stability.

Operational expenses also differ substantially between these technologies. While Ni-B baths typically have shorter lifespans (approximately 4-6 metal turnovers compared to 8-10 for EN-P), they often operate at lower temperatures (60-70°C vs. 85-95°C for EN-P), potentially reducing energy consumption by 10-15%. However, waste treatment costs for Ni-B can be 20-30% higher due to the environmental considerations of boron-containing effluents.

Maintenance requirements represent another significant cost differential. Ni-B baths demand more frequent analytical monitoring and chemical adjustments, increasing labor costs by approximately 15-20% compared to EN-P processes. The higher sensitivity of Ni-B baths to contamination also necessitates more stringent filtration systems and process controls.

Performance benefits must be weighed against these increased costs. Ni-B coatings typically offer superior hardness (up to 750-850 HV as-deposited, reaching 1100+ HV after heat treatment) compared to EN-P (500-550 HV as-deposited, 900-1000 HV after heat treatment). This translates to extended component life cycles, with field tests indicating 20-35% longer service life for high-wear applications, potentially offsetting the higher initial investment through reduced replacement frequency.

Return on investment (ROI) calculations indicate that Ni-B becomes economically advantageous primarily in high-performance applications where wear resistance and hardness are critical. For standard corrosion protection or general engineering applications, EN-P typically maintains a cost advantage with an estimated 15-25% lower total cost of ownership over a five-year operational period.

Market analysis suggests that industries with high-value components experiencing significant wear issues—such as aerospace, precision machinery, and high-performance automotive applications—achieve positive ROI with Ni-B implementation within 2-3 years, while more cost-sensitive sectors may require 4+ years to realize economic benefits.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!