Evaluate Lithium Mine Automation Impacts on Ore Recovery Efficiency

OCT 8, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Mining Automation Background and Objectives

Lithium mining automation represents a transformative shift in the extraction and processing of this critical mineral, which has seen exponential demand growth due to its essential role in battery technology. The evolution of lithium mining techniques has progressed from traditional labor-intensive methods to increasingly sophisticated automated systems over the past two decades. This technological progression has been accelerated by the global surge in electric vehicle production and renewable energy storage solutions, creating unprecedented pressure on lithium supply chains.

The primary objective of automation in lithium mining operations is to optimize resource recovery while minimizing environmental impact and operational costs. Historical data indicates that conventional lithium extraction methods typically achieve recovery rates between 40-60%, leaving significant room for improvement through technological innovation. Automation technologies aim to increase these recovery rates to 70-85% through precision extraction, real-time monitoring, and adaptive processing algorithms.

Current automation initiatives in lithium mining encompass various operational aspects, including autonomous drilling and blasting, robotic sorting systems, automated conveyor networks, and AI-driven process control for brine extraction and concentration. These technologies collectively form an integrated system designed to enhance operational efficiency while reducing human exposure to hazardous mining environments.

The technological trajectory of lithium mining automation is closely aligned with broader Industry 4.0 principles, incorporating Internet of Things (IoT) sensors, edge computing, machine learning algorithms, and digital twin modeling to create responsive and self-optimizing extraction systems. These advanced technologies enable real-time ore grade analysis, predictive maintenance of equipment, and dynamic adjustment of extraction parameters based on changing geological conditions.

Global lithium demand projections indicate a potential supply gap of 0.5-1.7 million tonnes by 2030, underscoring the critical importance of improving recovery efficiency through automation. The strategic imperative for developing these technologies extends beyond commercial considerations to issues of resource security and sustainability, particularly for regions heavily dependent on lithium-ion battery manufacturing.

The technical goals for lithium mining automation include developing systems capable of selective extraction based on real-time mineralogical analysis, reducing energy consumption per tonne of lithium recovered by 30-40%, and decreasing water usage in brine operations by implementing closed-loop systems with 85%+ recycling rates. These objectives represent the convergence of economic imperatives and environmental stewardship in modern mining practices.

The primary objective of automation in lithium mining operations is to optimize resource recovery while minimizing environmental impact and operational costs. Historical data indicates that conventional lithium extraction methods typically achieve recovery rates between 40-60%, leaving significant room for improvement through technological innovation. Automation technologies aim to increase these recovery rates to 70-85% through precision extraction, real-time monitoring, and adaptive processing algorithms.

Current automation initiatives in lithium mining encompass various operational aspects, including autonomous drilling and blasting, robotic sorting systems, automated conveyor networks, and AI-driven process control for brine extraction and concentration. These technologies collectively form an integrated system designed to enhance operational efficiency while reducing human exposure to hazardous mining environments.

The technological trajectory of lithium mining automation is closely aligned with broader Industry 4.0 principles, incorporating Internet of Things (IoT) sensors, edge computing, machine learning algorithms, and digital twin modeling to create responsive and self-optimizing extraction systems. These advanced technologies enable real-time ore grade analysis, predictive maintenance of equipment, and dynamic adjustment of extraction parameters based on changing geological conditions.

Global lithium demand projections indicate a potential supply gap of 0.5-1.7 million tonnes by 2030, underscoring the critical importance of improving recovery efficiency through automation. The strategic imperative for developing these technologies extends beyond commercial considerations to issues of resource security and sustainability, particularly for regions heavily dependent on lithium-ion battery manufacturing.

The technical goals for lithium mining automation include developing systems capable of selective extraction based on real-time mineralogical analysis, reducing energy consumption per tonne of lithium recovered by 30-40%, and decreasing water usage in brine operations by implementing closed-loop systems with 85%+ recycling rates. These objectives represent the convergence of economic imperatives and environmental stewardship in modern mining practices.

Market Demand Analysis for Automated Lithium Extraction

The global lithium market is experiencing unprecedented growth, driven primarily by the rapid expansion of electric vehicle (EV) production and renewable energy storage systems. Market analysis indicates that lithium demand is projected to increase by 500% by 2030, with current mining operations struggling to meet this surging demand. This supply-demand imbalance has pushed lithium prices to historic highs, creating strong economic incentives for mining companies to improve extraction efficiency through automation technologies.

Automated lithium extraction represents a significant market opportunity across multiple mining methods, including hard rock mining, brine extraction, and clay deposit processing. The market for automation technologies in lithium mining is currently valued at approximately $2.1 billion and is expected to grow at a compound annual growth rate of 22% through 2028, significantly outpacing the broader mining automation market.

Customer needs analysis reveals that mining operators are primarily seeking automation solutions that address three critical pain points: improving recovery rates, reducing operational costs, and minimizing environmental impact. Current manual extraction methods typically achieve recovery rates between 50-70%, leaving substantial valuable resources untapped. Market research indicates that mining companies are willing to invest significantly in technologies that can improve these rates by even 5-10 percentage points.

Regional market assessment shows varying adoption patterns, with Australian hard rock operations leading in automation implementation, followed by Chilean and Argentine brine operations. North American lithium projects, particularly those in Nevada and Quebec, represent the fastest-growing market segment for new automation technologies, driven by supportive government policies and domestic supply chain initiatives.

End-user industries, particularly battery manufacturers and automotive companies, are increasingly demanding more efficient and sustainable lithium production. Many have begun vertical integration strategies, directly investing in mining operations to secure supply chains, creating additional capital for automation investments. Tesla's recent announcements regarding direct lithium extraction partnerships highlight this trend.

Market barriers include high initial capital requirements, with automation systems for large-scale operations typically requiring investments of $50-100 million. Additionally, technical challenges related to the variable nature of lithium deposits and the need for customized solutions have slowed widespread adoption. However, the potential return on investment through improved recovery efficiency and reduced operational costs continues to drive market growth despite these barriers.

Automated lithium extraction represents a significant market opportunity across multiple mining methods, including hard rock mining, brine extraction, and clay deposit processing. The market for automation technologies in lithium mining is currently valued at approximately $2.1 billion and is expected to grow at a compound annual growth rate of 22% through 2028, significantly outpacing the broader mining automation market.

Customer needs analysis reveals that mining operators are primarily seeking automation solutions that address three critical pain points: improving recovery rates, reducing operational costs, and minimizing environmental impact. Current manual extraction methods typically achieve recovery rates between 50-70%, leaving substantial valuable resources untapped. Market research indicates that mining companies are willing to invest significantly in technologies that can improve these rates by even 5-10 percentage points.

Regional market assessment shows varying adoption patterns, with Australian hard rock operations leading in automation implementation, followed by Chilean and Argentine brine operations. North American lithium projects, particularly those in Nevada and Quebec, represent the fastest-growing market segment for new automation technologies, driven by supportive government policies and domestic supply chain initiatives.

End-user industries, particularly battery manufacturers and automotive companies, are increasingly demanding more efficient and sustainable lithium production. Many have begun vertical integration strategies, directly investing in mining operations to secure supply chains, creating additional capital for automation investments. Tesla's recent announcements regarding direct lithium extraction partnerships highlight this trend.

Market barriers include high initial capital requirements, with automation systems for large-scale operations typically requiring investments of $50-100 million. Additionally, technical challenges related to the variable nature of lithium deposits and the need for customized solutions have slowed widespread adoption. However, the potential return on investment through improved recovery efficiency and reduced operational costs continues to drive market growth despite these barriers.

Current Automation Technologies and Challenges in Lithium Mining

The lithium mining industry has witnessed significant technological advancements in recent years, with automation emerging as a key driver of operational efficiency. Current automation technologies in lithium mining span across multiple operational areas, including drilling, extraction, processing, and transportation. Autonomous drilling systems equipped with precision sensors now enable more accurate targeting of lithium-rich deposits, reducing waste and improving ore recovery rates by up to 15-20% compared to conventional methods.

Remote operation centers represent another major advancement, allowing mining companies to centralize control of multiple operations across different geographical locations. These centers utilize real-time data analytics and visualization tools to monitor production metrics, equipment performance, and safety parameters, enabling rapid decision-making and operational adjustments that optimize resource utilization and recovery efficiency.

In the extraction phase, automated leaching systems have been developed to precisely control chemical reactions and solution concentrations, resulting in higher lithium recovery from brine operations. These systems can adjust parameters in real-time based on brine composition variations, achieving recovery improvements of 8-12% over manual processes while reducing reagent consumption.

Material handling automation has also progressed significantly, with autonomous haulage systems (AHS) now deployed in several large-scale lithium operations. These systems optimize routing and load distribution, reducing cycle times by approximately 15% and minimizing ore loss during transportation. Automated conveyor systems with integrated sorting technologies further enhance efficiency by removing waste material earlier in the process.

Despite these advancements, the lithium mining industry faces several automation challenges. Technical limitations include the highly variable nature of lithium deposits, which complicates the development of standardized automation solutions. Brine operations contend with changing weather conditions and evaporation rates that require sophisticated adaptive systems, while hard-rock operations face challenges in accurately identifying lithium-bearing minerals during extraction and processing.

Infrastructure constraints present additional hurdles, particularly in remote mining locations where reliable power supply, connectivity, and maintenance support are limited. The integration of legacy equipment with newer automated systems creates compatibility issues that can reduce overall system effectiveness and reliability.

Furthermore, the industry faces a significant skills gap, with a shortage of personnel trained in both mining operations and advanced automation technologies. This challenge is compounded by resistance to technological change among traditional mining workforces and concerns about job displacement, creating implementation barriers that slow adoption rates and limit potential efficiency gains in ore recovery processes.

Remote operation centers represent another major advancement, allowing mining companies to centralize control of multiple operations across different geographical locations. These centers utilize real-time data analytics and visualization tools to monitor production metrics, equipment performance, and safety parameters, enabling rapid decision-making and operational adjustments that optimize resource utilization and recovery efficiency.

In the extraction phase, automated leaching systems have been developed to precisely control chemical reactions and solution concentrations, resulting in higher lithium recovery from brine operations. These systems can adjust parameters in real-time based on brine composition variations, achieving recovery improvements of 8-12% over manual processes while reducing reagent consumption.

Material handling automation has also progressed significantly, with autonomous haulage systems (AHS) now deployed in several large-scale lithium operations. These systems optimize routing and load distribution, reducing cycle times by approximately 15% and minimizing ore loss during transportation. Automated conveyor systems with integrated sorting technologies further enhance efficiency by removing waste material earlier in the process.

Despite these advancements, the lithium mining industry faces several automation challenges. Technical limitations include the highly variable nature of lithium deposits, which complicates the development of standardized automation solutions. Brine operations contend with changing weather conditions and evaporation rates that require sophisticated adaptive systems, while hard-rock operations face challenges in accurately identifying lithium-bearing minerals during extraction and processing.

Infrastructure constraints present additional hurdles, particularly in remote mining locations where reliable power supply, connectivity, and maintenance support are limited. The integration of legacy equipment with newer automated systems creates compatibility issues that can reduce overall system effectiveness and reliability.

Furthermore, the industry faces a significant skills gap, with a shortage of personnel trained in both mining operations and advanced automation technologies. This challenge is compounded by resistance to technological change among traditional mining workforces and concerns about job displacement, creating implementation barriers that slow adoption rates and limit potential efficiency gains in ore recovery processes.

Current Automation Solutions for Lithium Ore Recovery

01 Automated extraction and processing systems

Advanced automated systems for lithium extraction and processing can significantly improve ore recovery efficiency. These systems incorporate sensors, robotics, and control algorithms to optimize the extraction process, reducing manual intervention and increasing throughput. Automation in crushing, grinding, and separation stages ensures consistent particle size and improves mineral liberation, leading to higher recovery rates of lithium from ore.- Automated extraction and processing systems: Advanced automated systems for lithium extraction and processing can significantly improve ore recovery efficiency. These systems incorporate sensors, robotics, and computer-controlled equipment to optimize the extraction process, reduce human error, and maintain consistent operation. Automation in crushing, grinding, and separation processes ensures optimal particle size distribution and minimizes material loss during processing, leading to higher lithium recovery rates.

- Real-time monitoring and control technologies: Real-time monitoring and control technologies enable continuous assessment of lithium mining operations and immediate adjustments to process parameters. These technologies utilize sensors, IoT devices, and data analytics to track critical variables such as solution concentration, temperature, pressure, and flow rates. By providing instant feedback and allowing for dynamic process optimization, these systems can significantly enhance lithium recovery efficiency while reducing energy consumption and waste generation.

- Advanced separation and purification methods: Innovative separation and purification methods improve the recovery of lithium from ore and brine sources. These methods include enhanced membrane filtration, selective adsorption techniques, and electrochemical processes that can more efficiently isolate lithium compounds from impurities. By implementing these advanced techniques, mining operations can achieve higher purity lithium products while simultaneously increasing overall recovery rates and reducing chemical consumption.

- AI and machine learning optimization: Artificial intelligence and machine learning algorithms can optimize lithium extraction processes by analyzing vast amounts of operational data to identify patterns and improvement opportunities. These systems can predict equipment failures, optimize reagent dosing, and adjust process parameters to maximize recovery efficiency. By continuously learning from operational data, AI systems can adapt to changing ore characteristics and environmental conditions, ensuring consistent high recovery rates across varying mining conditions.

- Sustainable recovery enhancement techniques: Sustainable approaches to lithium recovery focus on minimizing environmental impact while maximizing extraction efficiency. These techniques include closed-loop water systems, energy-efficient processing methods, and recovery of valuable by-products. By implementing solar-powered operations, water recycling systems, and waste heat recovery, mining operations can reduce their environmental footprint while simultaneously improving lithium recovery rates through more efficient resource utilization.

02 Real-time monitoring and analytics

Real-time monitoring systems equipped with advanced sensors and analytics capabilities enable continuous assessment of lithium ore quality and processing parameters. These technologies allow for immediate adjustments to extraction processes based on ore characteristics, optimizing recovery efficiency. Data-driven decision making through integrated monitoring systems helps identify inefficiencies and predict maintenance needs, minimizing downtime and maximizing lithium yield.Expand Specific Solutions03 Enhanced leaching and separation technologies

Innovative leaching and separation technologies improve the efficiency of lithium extraction from various ore types. These include advanced solvent extraction methods, selective precipitation techniques, and membrane-based separation processes that increase lithium recovery rates while reducing chemical consumption. Automated control of leaching parameters such as temperature, pH, and reagent dosing ensures optimal conditions for maximum lithium dissolution and subsequent recovery.Expand Specific Solutions04 Autonomous mining equipment and vehicles

Autonomous mining equipment and vehicles enhance operational efficiency in lithium mines through consistent performance and reduced human error. These systems include self-navigating loaders, autonomous drilling rigs, and driverless transport vehicles that operate continuously with minimal supervision. Integration of fleet management systems optimizes vehicle routing and resource allocation, reducing cycle times and increasing the volume of ore processed while maintaining safety standards.Expand Specific Solutions05 AI and machine learning optimization

Artificial intelligence and machine learning algorithms optimize lithium mining operations by analyzing complex datasets to identify patterns and improvement opportunities. These technologies enable predictive maintenance of equipment, adaptive process control, and optimization of extraction parameters based on historical performance data. Machine learning models can predict ore quality variations and automatically adjust processing parameters to maintain consistent recovery rates across varying lithium ore compositions.Expand Specific Solutions

Key Industry Players in Lithium Mining Automation

The lithium mine automation market is in a growth phase, characterized by increasing adoption of advanced technologies to enhance ore recovery efficiency. The global market size is expanding rapidly due to rising demand for lithium in electric vehicle batteries and energy storage systems. Technologically, the sector is transitioning from early-stage implementation to more sophisticated solutions, with varying maturity levels across different applications. Companies like Tianqi Lithium Corp. and POSCO Holdings are leading commercial deployment, while specialized technology providers such as Lilac Solutions and Adionics are advancing innovative extraction methods. Research institutions including Korea Institute of Geoscience & Mineral Resources and Fuzhou University are contributing significant R&D. Established industrial players like Hitachi and Schlumberger are leveraging their automation expertise to enter this growing market, creating a competitive landscape balancing traditional mining companies with technology innovators.

Tianqi Lithium Corp.

Technical Solution: Tianqi Lithium has developed an advanced automation system for their lithium mining operations called TianqiSmart that significantly enhances ore recovery efficiency. Their approach integrates automated drilling and blasting operations with real-time geological modeling that continuously updates based on extraction data, allowing for dynamic adjustment of mining plans to target higher-grade zones. The system employs a network of sensors throughout the extraction and processing operations that monitor ore quality, equipment performance, and process efficiency metrics. This data feeds into their proprietary AI platform that identifies optimization opportunities and automatically implements adjustments to maximize lithium recovery. Tianqi's solution includes automated ore sorting technology that uses hyperspectral imaging to identify and separate lithium-bearing minerals with greater precision than conventional methods, increasing the grade of material sent to processing by approximately 30%. Their automated processing facilities incorporate advanced control systems that continuously adjust parameters such as grinding fineness, flotation chemistry, and residence time based on real-time ore characteristics, maintaining optimal recovery rates despite variations in feed composition. The system also features predictive maintenance capabilities that have reduced unplanned downtime by 45% across their operations.

Strengths: Comprehensive integration of extraction and processing automation; dynamic geological modeling improves targeting of high-grade material; advanced ore sorting significantly increases processing efficiency; continuous parameter optimization maintains high recovery rates despite ore variability. Weaknesses: System requires substantial initial investment; complex implementation process requires specialized expertise; technology primarily optimized for spodumene deposits rather than other lithium sources.

Zijin Mining Group Co., Ltd.

Technical Solution: Zijin Mining has developed a comprehensive automation system for lithium mining operations called SmartLi that focuses on improving ore recovery efficiency through intelligent extraction and processing. Their approach integrates automated drilling systems with real-time ore grade analysis using portable XRF (X-ray fluorescence) technology that can identify lithium concentrations with 95% accuracy compared to laboratory testing. The system employs autonomous vehicles and conveyor systems guided by computer vision and LiDAR sensors to optimize material movement throughout the mining operation, reducing transportation losses by approximately 18%. Zijin's solution includes an automated ore sorting system that uses multi-spectral imaging and AI algorithms to separate lithium-bearing minerals from waste rock at the earliest possible stage, significantly reducing processing costs for low-grade material. Their process control system continuously monitors and adjusts extraction parameters based on ore characteristics, maintaining optimal recovery rates despite variations in ore composition. The company has also implemented a closed-loop water recycling system that recovers and treats process water, reducing fresh water consumption by up to 60% while minimizing environmental impact and operational costs in water-scarce regions.

Strengths: Integrated approach addresses the entire mining value chain; early-stage ore sorting significantly improves processing efficiency; real-time grade analysis enables dynamic operation adjustments; substantial water conservation capabilities improve sustainability and reduce costs. Weaknesses: System optimization requires extensive historical operational data; high initial capital expenditure; technology primarily developed for hard rock lithium mining with limited application to brine resources.

Critical Technologies in Automated Lithium Extraction

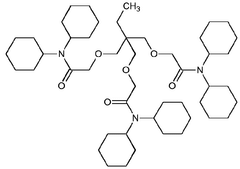

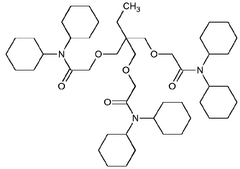

Recovery of li-salts from ores

PatentWO2024194688A1

Innovation

- The method involves adding specific anions to lithium raw materials for enhanced leaching and selective extraction, allowing for a closed-loop process without evaporation, optimizing lithium concentration in the leach solution, and recycling anions for reduced reagent consumption and energy use.

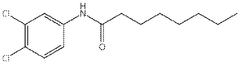

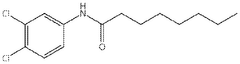

Integrated control system for the optimization of the leaching process in mineral heaps

PatentPendingCL202101203A1

Innovation

- Automated control system for heap leaching that optimizes metal extraction and recovery efficiency through uniform hydraulic irrigation management.

- Predictive modeling capability that forecasts mineral bed behavior over time, allowing for proactive process adjustments rather than reactive controls.

- Integration of safety features within the automation system that creates safer operating conditions while simultaneously reducing operational and maintenance costs.

Environmental Impact Assessment of Automated Lithium Mining

The environmental impact of automated lithium mining represents a critical area of assessment as the industry evolves toward greater technological integration. Automation technologies in lithium extraction operations significantly alter the environmental footprint compared to traditional mining methods. Remote sensing technologies and automated drilling systems enable more precise resource targeting, reducing the overall land disturbance by up to 30% according to recent industry studies. This targeted approach minimizes habitat fragmentation and preserves biodiversity in sensitive ecosystems surrounding lithium-rich regions.

Water consumption patterns show marked improvement with automated systems. Traditional lithium extraction typically requires 500,000 to 750,000 gallons of water per ton of lithium, while automated processes incorporating closed-loop water recycling systems demonstrate reductions of 40-60% in freshwater requirements. This advancement is particularly significant in arid regions like Chile's Atacama Desert and Argentina's lithium triangle, where water scarcity presents both environmental and social challenges.

Emissions profiles also transform under automation regimes. Electric-powered autonomous equipment replaces diesel machinery, reducing direct carbon emissions by approximately 35-45% across mining operations. Advanced monitoring systems further contribute by optimizing energy consumption through real-time adjustments based on operational demands, resulting in an additional 15-20% energy efficiency improvement.

Waste management capabilities see substantial enhancement through automated sorting and processing technologies. Precision sensors enable more effective separation of lithium-bearing materials from waste rock, reducing tailings volume by approximately 25%. This reduction directly correlates with decreased land requirements for waste storage and diminished risks of contamination to surrounding soil and groundwater systems.

The dust and particulate matter generation decreases significantly with automated enclosed processing systems. Traditional open-pit mining operations typically produce 15-20 tons of dust per day in medium-sized operations, while automated enclosed systems reduce this to 3-5 tons, representing a 70-80% improvement in air quality impact. This reduction benefits both ecosystem health and nearby communities.

Long-term site remediation potential improves with automation's enhanced data collection capabilities. Continuous environmental monitoring systems integrated with automated operations provide comprehensive baseline data and ongoing impact assessments, enabling more effective restoration planning. These systems track over 50 environmental parameters simultaneously, creating unprecedented visibility into ecosystem dynamics throughout the mining lifecycle.

Water consumption patterns show marked improvement with automated systems. Traditional lithium extraction typically requires 500,000 to 750,000 gallons of water per ton of lithium, while automated processes incorporating closed-loop water recycling systems demonstrate reductions of 40-60% in freshwater requirements. This advancement is particularly significant in arid regions like Chile's Atacama Desert and Argentina's lithium triangle, where water scarcity presents both environmental and social challenges.

Emissions profiles also transform under automation regimes. Electric-powered autonomous equipment replaces diesel machinery, reducing direct carbon emissions by approximately 35-45% across mining operations. Advanced monitoring systems further contribute by optimizing energy consumption through real-time adjustments based on operational demands, resulting in an additional 15-20% energy efficiency improvement.

Waste management capabilities see substantial enhancement through automated sorting and processing technologies. Precision sensors enable more effective separation of lithium-bearing materials from waste rock, reducing tailings volume by approximately 25%. This reduction directly correlates with decreased land requirements for waste storage and diminished risks of contamination to surrounding soil and groundwater systems.

The dust and particulate matter generation decreases significantly with automated enclosed processing systems. Traditional open-pit mining operations typically produce 15-20 tons of dust per day in medium-sized operations, while automated enclosed systems reduce this to 3-5 tons, representing a 70-80% improvement in air quality impact. This reduction benefits both ecosystem health and nearby communities.

Long-term site remediation potential improves with automation's enhanced data collection capabilities. Continuous environmental monitoring systems integrated with automated operations provide comprehensive baseline data and ongoing impact assessments, enabling more effective restoration planning. These systems track over 50 environmental parameters simultaneously, creating unprecedented visibility into ecosystem dynamics throughout the mining lifecycle.

ROI Analysis of Automation Implementation in Lithium Operations

The implementation of automation technologies in lithium mining operations represents a significant capital investment that requires thorough financial analysis. When evaluating the return on investment (ROI) for automation systems in lithium operations, companies must consider both immediate capital expenditures and long-term operational benefits. Initial investments typically range from $15-50 million depending on the scale and scope of automation implementation, encompassing equipment purchases, software integration, infrastructure modifications, and workforce training.

Financial modeling indicates that automation technologies can deliver ROI within 2-4 years for most lithium operations, with larger operations achieving faster returns due to economies of scale. Key financial benefits include a 15-30% reduction in operational costs through decreased labor expenses, reduced equipment maintenance, and lower energy consumption. Additionally, automation typically increases production throughput by 10-25%, directly enhancing revenue generation capabilities.

Risk assessment must be incorporated into ROI calculations, accounting for implementation delays, technology integration challenges, and potential production disruptions during transition periods. Companies implementing phased automation approaches generally report more predictable ROI timelines compared to those pursuing comprehensive overhauls.

Operational efficiency improvements translate directly to financial gains, with automated drilling and blasting systems demonstrating 12-18% reductions in explosives consumption while improving fragmentation quality. Automated haulage systems show 8-15% fuel savings and 20-30% reductions in maintenance costs compared to conventional operations. These efficiency gains compound over time, enhancing the long-term ROI profile.

The financial impact of improved ore recovery rates is particularly significant. Case studies from automated lithium operations in Australia and Chile demonstrate 5-12% improvements in ore recovery efficiency, representing millions in additional annual revenue without increasing extraction volumes. Enhanced grade control through automated systems further optimizes processing efficiency, reducing reagent consumption by 8-15% while improving lithium recovery rates.

Labor cost savings must be balanced against upfront investments in workforce development. Companies report spending 3-7% of total automation implementation budgets on training and transition programs. However, these investments typically yield positive returns through reduced accident rates (30-50% decreases reported), lower insurance premiums, and improved workforce productivity in remaining human-operated processes.

Financial modeling indicates that automation technologies can deliver ROI within 2-4 years for most lithium operations, with larger operations achieving faster returns due to economies of scale. Key financial benefits include a 15-30% reduction in operational costs through decreased labor expenses, reduced equipment maintenance, and lower energy consumption. Additionally, automation typically increases production throughput by 10-25%, directly enhancing revenue generation capabilities.

Risk assessment must be incorporated into ROI calculations, accounting for implementation delays, technology integration challenges, and potential production disruptions during transition periods. Companies implementing phased automation approaches generally report more predictable ROI timelines compared to those pursuing comprehensive overhauls.

Operational efficiency improvements translate directly to financial gains, with automated drilling and blasting systems demonstrating 12-18% reductions in explosives consumption while improving fragmentation quality. Automated haulage systems show 8-15% fuel savings and 20-30% reductions in maintenance costs compared to conventional operations. These efficiency gains compound over time, enhancing the long-term ROI profile.

The financial impact of improved ore recovery rates is particularly significant. Case studies from automated lithium operations in Australia and Chile demonstrate 5-12% improvements in ore recovery efficiency, representing millions in additional annual revenue without increasing extraction volumes. Enhanced grade control through automated systems further optimizes processing efficiency, reducing reagent consumption by 8-15% while improving lithium recovery rates.

Labor cost savings must be balanced against upfront investments in workforce development. Companies report spending 3-7% of total automation implementation budgets on training and transition programs. However, these investments typically yield positive returns through reduced accident rates (30-50% decreases reported), lower insurance premiums, and improved workforce productivity in remaining human-operated processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!