Quantify Lithium Mine Greenhouse Gas Emissions per Operational Phase

OCT 8, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Mining GHG Emissions Background and Objectives

Lithium mining has emerged as a critical activity in the global transition to clean energy, primarily due to lithium's essential role in rechargeable batteries for electric vehicles and renewable energy storage systems. The greenhouse gas (GHG) emissions associated with lithium extraction operations have become increasingly significant as global demand for lithium continues to surge, with projections indicating a potential 40-fold increase by 2040 compared to 2020 levels.

Historically, lithium mining techniques have evolved from traditional hard rock mining to more efficient brine extraction methods. However, both approaches generate substantial carbon footprints across their operational lifecycles. The industry has lacked standardized methodologies for quantifying these emissions, leading to inconsistent reporting and challenges in establishing meaningful reduction targets.

Recent technological advancements have enabled more precise measurement of GHG emissions across different operational phases of lithium mining. These phases typically include exploration, site preparation, extraction, processing, and site rehabilitation. Each phase contributes differently to the overall carbon footprint, with processing generally representing the most energy-intensive stage.

The primary objective of quantifying lithium mine GHG emissions per operational phase is to establish a comprehensive baseline for the industry's carbon footprint. This baseline will enable mining companies, regulators, and stakeholders to identify specific high-emission processes within the lithium production chain and prioritize mitigation efforts accordingly.

Additionally, accurate emissions quantification aims to support the development of standardized reporting frameworks that can facilitate meaningful comparisons between different lithium production methods and sites. Such standardization is crucial for investors and consumers increasingly concerned with the environmental credentials of their supply chains.

From a technological evolution perspective, the quantification methodologies have progressed from basic estimation techniques to sophisticated life cycle assessment (LCA) approaches that incorporate direct and indirect emissions sources. Recent innovations in remote sensing, IoT monitoring systems, and artificial intelligence have further enhanced the precision and comprehensiveness of emissions tracking.

The ultimate goal of this technical research is to identify pathways toward lower-carbon lithium production that can support the clean energy transition without undermining its environmental benefits through excessive upstream emissions. This aligns with broader industry trends toward sustainability and transparency, as well as regulatory developments that increasingly mandate emissions disclosure and reduction.

Historically, lithium mining techniques have evolved from traditional hard rock mining to more efficient brine extraction methods. However, both approaches generate substantial carbon footprints across their operational lifecycles. The industry has lacked standardized methodologies for quantifying these emissions, leading to inconsistent reporting and challenges in establishing meaningful reduction targets.

Recent technological advancements have enabled more precise measurement of GHG emissions across different operational phases of lithium mining. These phases typically include exploration, site preparation, extraction, processing, and site rehabilitation. Each phase contributes differently to the overall carbon footprint, with processing generally representing the most energy-intensive stage.

The primary objective of quantifying lithium mine GHG emissions per operational phase is to establish a comprehensive baseline for the industry's carbon footprint. This baseline will enable mining companies, regulators, and stakeholders to identify specific high-emission processes within the lithium production chain and prioritize mitigation efforts accordingly.

Additionally, accurate emissions quantification aims to support the development of standardized reporting frameworks that can facilitate meaningful comparisons between different lithium production methods and sites. Such standardization is crucial for investors and consumers increasingly concerned with the environmental credentials of their supply chains.

From a technological evolution perspective, the quantification methodologies have progressed from basic estimation techniques to sophisticated life cycle assessment (LCA) approaches that incorporate direct and indirect emissions sources. Recent innovations in remote sensing, IoT monitoring systems, and artificial intelligence have further enhanced the precision and comprehensiveness of emissions tracking.

The ultimate goal of this technical research is to identify pathways toward lower-carbon lithium production that can support the clean energy transition without undermining its environmental benefits through excessive upstream emissions. This aligns with broader industry trends toward sustainability and transparency, as well as regulatory developments that increasingly mandate emissions disclosure and reduction.

Market Demand Analysis for Low-Carbon Lithium

The global lithium market is experiencing unprecedented growth driven by the rapid expansion of electric vehicle (EV) production and renewable energy storage systems. As environmental concerns intensify, there is a growing demand specifically for low-carbon lithium, with consumers, investors, and regulators increasingly scrutinizing the greenhouse gas (GHG) emissions associated with lithium extraction and processing.

Market research indicates that the global lithium market is projected to grow at a CAGR of 14.8% from 2023 to 2030, with demand potentially exceeding 2 million metric tons of lithium carbonate equivalent (LCE) by 2030. This growth is primarily fueled by automotive manufacturers' commitments to electrification, with major companies pledging to convert significant portions of their fleets to electric vehicles within the next decade.

The demand for low-carbon lithium is emerging as a distinct segment within this broader market. Premium pricing for verifiably low-carbon lithium is becoming evident, with early indicators suggesting price premiums of 10-15% for lithium produced with significantly lower carbon footprints compared to industry averages. This trend is particularly strong in European and North American markets, where regulatory frameworks increasingly favor low-carbon materials.

Battery manufacturers and automotive OEMs are incorporating carbon footprint metrics into their procurement strategies. Companies like Tesla, Volkswagen, and BMW have publicly committed to reducing the embedded carbon in their supply chains, with specific targets for battery materials. These commitments are translating into concrete procurement preferences, with several major manufacturers now requiring carbon footprint disclosures from lithium suppliers.

Regulatory pressures are further accelerating this market shift. The EU Battery Regulation, for instance, will require carbon footprint declarations for batteries sold in the European market starting in 2024, with carbon intensity thresholds to follow. Similar regulations are being considered in other major markets, creating strong incentives for lithium producers to measure, report, and reduce their GHG emissions.

Investor sentiment is also driving demand for low-carbon lithium, with ESG-focused investment funds increasingly directing capital toward mining operations with superior environmental performance. This trend is reflected in the growing adoption of frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) among mining companies and their investors.

Consumer awareness of supply chain emissions is rising, particularly among EV buyers who are often environmentally conscious. Market research indicates that a significant percentage of potential EV buyers consider the environmental impact of battery production in their purchasing decisions, creating pull-through demand for low-carbon materials throughout the supply chain.

Market research indicates that the global lithium market is projected to grow at a CAGR of 14.8% from 2023 to 2030, with demand potentially exceeding 2 million metric tons of lithium carbonate equivalent (LCE) by 2030. This growth is primarily fueled by automotive manufacturers' commitments to electrification, with major companies pledging to convert significant portions of their fleets to electric vehicles within the next decade.

The demand for low-carbon lithium is emerging as a distinct segment within this broader market. Premium pricing for verifiably low-carbon lithium is becoming evident, with early indicators suggesting price premiums of 10-15% for lithium produced with significantly lower carbon footprints compared to industry averages. This trend is particularly strong in European and North American markets, where regulatory frameworks increasingly favor low-carbon materials.

Battery manufacturers and automotive OEMs are incorporating carbon footprint metrics into their procurement strategies. Companies like Tesla, Volkswagen, and BMW have publicly committed to reducing the embedded carbon in their supply chains, with specific targets for battery materials. These commitments are translating into concrete procurement preferences, with several major manufacturers now requiring carbon footprint disclosures from lithium suppliers.

Regulatory pressures are further accelerating this market shift. The EU Battery Regulation, for instance, will require carbon footprint declarations for batteries sold in the European market starting in 2024, with carbon intensity thresholds to follow. Similar regulations are being considered in other major markets, creating strong incentives for lithium producers to measure, report, and reduce their GHG emissions.

Investor sentiment is also driving demand for low-carbon lithium, with ESG-focused investment funds increasingly directing capital toward mining operations with superior environmental performance. This trend is reflected in the growing adoption of frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) among mining companies and their investors.

Consumer awareness of supply chain emissions is rising, particularly among EV buyers who are often environmentally conscious. Market research indicates that a significant percentage of potential EV buyers consider the environmental impact of battery production in their purchasing decisions, creating pull-through demand for low-carbon materials throughout the supply chain.

Current Emissions Quantification Challenges

The quantification of greenhouse gas (GHG) emissions from lithium mining operations faces significant methodological and practical challenges that impede accurate assessment. Current measurement approaches suffer from inconsistent boundaries and scope definitions, with companies often applying different parameters when calculating their carbon footprint. This lack of standardization makes it difficult to compare emissions data across different mining operations or to establish industry benchmarks.

Data collection presents another substantial hurdle, particularly for operational phases that occur in remote locations. Many lithium extraction sites are situated in challenging environments such as high-altitude salt flats or remote deserts, where continuous monitoring infrastructure is limited. The variability in extraction methods—from traditional hard rock mining to brine evaporation and direct lithium extraction—further complicates the development of universal measurement protocols.

Emissions allocation between different operational phases remains problematic, with significant uncertainty in attributing GHG contributions to specific activities within the mining lifecycle. For instance, distinguishing between emissions from exploration, site preparation, active extraction, and processing stages often relies on estimation rather than direct measurement, introducing potential inaccuracies into phase-specific assessments.

Technical limitations in measurement equipment also contribute to quantification challenges. Current sensor technologies may not be optimized for the unique conditions of lithium mining environments, such as high dust levels in open-pit operations or the chemical complexity of brine processing. This leads to data gaps and reduced confidence in emissions figures, particularly for non-CO2 greenhouse gases that may require specialized detection methods.

The temporal dimension of emissions adds another layer of complexity. Many significant GHG releases occur during irregular or non-continuous activities, such as land clearing, construction phases, or maintenance operations. These episodic emissions are frequently underrepresented in standard monitoring protocols that focus on continuous production processes.

Indirect emissions, particularly those associated with energy consumption, present accounting difficulties due to varying grid compositions across different mining regions. The emissions intensity of electricity used in lithium processing can fluctuate significantly based on local energy infrastructure, creating challenges for consistent reporting and comparison between operations in different countries or regions.

Finally, there is a notable absence of sector-specific guidance for lithium mining within existing GHG accounting frameworks. While general protocols like the Greenhouse Gas Protocol provide broad principles, they lack the granular, process-specific direction needed for the unique characteristics of lithium extraction operations, leaving companies to develop proprietary methodologies that may not align with broader industry practices.

Data collection presents another substantial hurdle, particularly for operational phases that occur in remote locations. Many lithium extraction sites are situated in challenging environments such as high-altitude salt flats or remote deserts, where continuous monitoring infrastructure is limited. The variability in extraction methods—from traditional hard rock mining to brine evaporation and direct lithium extraction—further complicates the development of universal measurement protocols.

Emissions allocation between different operational phases remains problematic, with significant uncertainty in attributing GHG contributions to specific activities within the mining lifecycle. For instance, distinguishing between emissions from exploration, site preparation, active extraction, and processing stages often relies on estimation rather than direct measurement, introducing potential inaccuracies into phase-specific assessments.

Technical limitations in measurement equipment also contribute to quantification challenges. Current sensor technologies may not be optimized for the unique conditions of lithium mining environments, such as high dust levels in open-pit operations or the chemical complexity of brine processing. This leads to data gaps and reduced confidence in emissions figures, particularly for non-CO2 greenhouse gases that may require specialized detection methods.

The temporal dimension of emissions adds another layer of complexity. Many significant GHG releases occur during irregular or non-continuous activities, such as land clearing, construction phases, or maintenance operations. These episodic emissions are frequently underrepresented in standard monitoring protocols that focus on continuous production processes.

Indirect emissions, particularly those associated with energy consumption, present accounting difficulties due to varying grid compositions across different mining regions. The emissions intensity of electricity used in lithium processing can fluctuate significantly based on local energy infrastructure, creating challenges for consistent reporting and comparison between operations in different countries or regions.

Finally, there is a notable absence of sector-specific guidance for lithium mining within existing GHG accounting frameworks. While general protocols like the Greenhouse Gas Protocol provide broad principles, they lack the granular, process-specific direction needed for the unique characteristics of lithium extraction operations, leaving companies to develop proprietary methodologies that may not align with broader industry practices.

Existing GHG Measurement Methodologies

01 Monitoring and measuring greenhouse gas emissions in lithium mining

Systems and methods for monitoring and measuring greenhouse gas emissions specifically in lithium mining operations. These technologies include sensors, data collection frameworks, and analytical tools that provide real-time or periodic measurements of carbon dioxide, methane, and other greenhouse gases released during extraction, processing, and refining of lithium. The monitoring systems help mining companies track their environmental impact and identify opportunities for emission reduction.- Monitoring and measuring greenhouse gas emissions in lithium mining: Systems and methods for monitoring and measuring greenhouse gas emissions specifically in lithium mining operations. These technologies include sensors, data collection frameworks, and analytical tools that provide real-time or periodic measurements of carbon dioxide, methane, and other greenhouse gases released during extraction, processing, and transportation phases of lithium production. These monitoring systems help mining companies establish baseline emissions data and track progress toward reduction targets.

- Emission reduction technologies for lithium extraction processes: Innovative technologies specifically designed to reduce greenhouse gas emissions in lithium extraction processes. These include energy-efficient extraction methods, alternative processing techniques that minimize carbon footprint, and technologies that capture or utilize emissions generated during lithium production. These approaches focus on modifying the core extraction and refining processes to be inherently less emission-intensive while maintaining production efficiency.

- Carbon accounting and reporting frameworks for lithium mining: Specialized carbon accounting methodologies and reporting frameworks developed for the lithium mining industry. These systems help quantify, track, and report greenhouse gas emissions throughout the lithium supply chain, enabling companies to comply with regulatory requirements and sustainability standards. The frameworks include lifecycle assessment tools, emission factor databases specific to lithium operations, and standardized reporting protocols that enhance transparency and accountability.

- Renewable energy integration in lithium mining operations: Methods and systems for integrating renewable energy sources into lithium mining operations to reduce greenhouse gas emissions. These include solar and wind power installations at mining sites, energy storage solutions to manage intermittent renewable generation, and smart grid technologies that optimize energy use. By replacing fossil fuel-powered equipment and processes with renewable alternatives, these innovations significantly reduce the carbon footprint of lithium production.

- Life cycle assessment and sustainability certification for lithium production: Comprehensive life cycle assessment methodologies and sustainability certification systems specifically designed for lithium production. These approaches evaluate the environmental impact, including greenhouse gas emissions, across the entire value chain from extraction to end-of-life. The systems provide frameworks for certifying low-carbon lithium products, enabling producers to demonstrate environmental performance and helping consumers and downstream industries make informed choices about the carbon footprint of lithium-based products.

02 Carbon footprint reduction technologies for lithium extraction

Innovative technologies and methods specifically designed to reduce the carbon footprint of lithium extraction processes. These include energy-efficient extraction techniques, renewable energy integration in mining operations, and process optimizations that minimize greenhouse gas emissions. The technologies focus on reducing the environmental impact of lithium mining while maintaining production efficiency and economic viability.Expand Specific Solutions03 Life cycle assessment and environmental impact analysis of lithium production

Methodologies and systems for conducting comprehensive life cycle assessments of lithium production, focusing on greenhouse gas emissions throughout the entire supply chain. These approaches analyze environmental impacts from extraction to processing, including energy consumption, water usage, and emissions. The assessments provide valuable data for improving sustainability practices and meeting regulatory requirements in the lithium mining industry.Expand Specific Solutions04 Carbon offsetting and emissions trading for lithium mining operations

Frameworks and mechanisms for implementing carbon offsetting programs and participating in emissions trading systems specifically for lithium mining companies. These approaches include carbon credit generation, verification protocols, and trading platforms that allow mining operations to offset their greenhouse gas emissions. The systems help lithium producers achieve carbon neutrality goals while potentially creating additional revenue streams through carbon market participation.Expand Specific Solutions05 Sustainable lithium mining practices and green certification

Methods and standards for implementing sustainable mining practices and obtaining green certifications for lithium extraction operations. These include best practice frameworks, certification protocols, and sustainability reporting systems that focus on minimizing greenhouse gas emissions. The approaches help lithium producers demonstrate environmental responsibility, meet regulatory requirements, and respond to market demands for sustainably sourced materials.Expand Specific Solutions

Key Industry Players and Emission Profiles

The lithium mining greenhouse gas emissions quantification market is in its early growth stage, characterized by increasing demand driven by sustainability regulations and electric vehicle industry expansion. The market size is projected to grow significantly as lithium production scales up to meet global battery demand. Technologically, this field remains moderately mature with established methodologies for emissions accounting, though phase-specific quantification tools are still evolving. Key players include academic institutions (Shanghai Jiao Tong University, Central South University) conducting foundational research, while industrial entities like TotalEnergies OneTech and Jingmen Gem Co. are developing practical implementation frameworks. State Grid affiliates are increasingly involved in emissions monitoring technology development, indicating growing cross-sector interest in standardizing lithium mining emissions quantification across operational phases.

China National Building Material Group Co., Ltd.

Technical Solution: China National Building Material Group has developed the "LithiumCarbon" framework for quantifying greenhouse gas emissions across lithium mining operational phases. Their approach divides mining activities into pre-production (exploration and construction), production (extraction and processing), and post-production (closure and rehabilitation) phases. For the pre-production phase, they've created a specialized inventory methodology that accounts for emissions from exploratory drilling, road construction, and site preparation activities. During the production phase, their system employs a combination of direct measurement and calculation methods, with particular focus on energy consumption in extraction (typically accounting for 25-30% of operational emissions) and chemical reagent use in processing (contributing approximately 40-45% of emissions). The framework incorporates China-specific emission factors for electricity generation, which enhances accuracy for domestic operations. Their methodology also includes a temporal analysis component that tracks emissions intensity changes throughout a mine's lifecycle, typically showing highest intensity during initial production years before stabilizing. The system includes specialized accounting for different lithium extraction methods, with separate protocols for hard rock mining and brine operations.

Strengths: Comprehensive coverage of all operational phases with China-specific emission factors enhances regional accuracy; specialized protocols for different extraction methods provide tailored assessment capabilities. Weaknesses: Framework may have limited applicability outside Chinese regulatory context; system focuses primarily on CO2 emissions with less detailed accounting for other greenhouse gases like methane.

Jingmen Gem Co., Ltd.

Technical Solution: Jingmen Gem has developed a comprehensive greenhouse gas (GHG) accounting methodology specifically for lithium mining operations that divides emissions into distinct operational phases: exploration, construction, extraction, processing, and site rehabilitation. Their approach incorporates real-time monitoring systems using IoT sensors deployed throughout mining operations to collect continuous emissions data across different phases. The company has implemented a carbon footprint analysis tool that quantifies emissions from energy consumption, chemical reagents usage, and transportation activities specific to each operational phase. Their methodology accounts for both direct (Scope 1) and indirect (Scope 2) emissions, with particular attention to the processing phase which typically generates 60-70% of total lifecycle emissions in lithium production. Jingmen Gem's system also incorporates regional grid emission factors to accurately calculate electricity-related emissions across different geographical operations.

Strengths: Provides granular phase-specific emissions data enabling targeted mitigation strategies; IoT integration allows for real-time monitoring and quick intervention when emissions exceed thresholds. Weaknesses: System requires significant initial investment in monitoring infrastructure; methodology may not fully account for Scope 3 emissions throughout the supply chain.

Critical Emissions Accounting Standards and Protocols

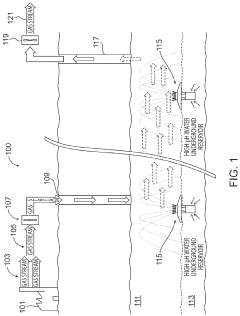

Systems and methods for sequestering carbon dioxide and other pollutants

PatentInactiveUS20210187437A1

Innovation

- A system utilizing an alkaline mine space with a body of water to react with exhaust gas pollutants, including carbon dioxide, to form precipitates that can be vented out, reducing the pollutant load through particulate formation and alkalinity enhancement with calcium carbonate or calcium oxide.

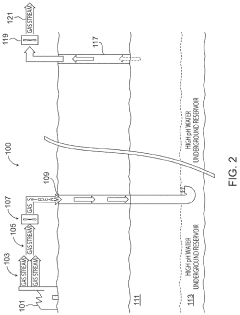

System and method for the calcination of minerals

PatentActiveEP2004319A1

Innovation

- A system and method utilizing superheated steam to catalyze the calcination of finely ground minerals in a reactor with external heat transfer, separating the combustion and calcination processes to reduce carbon dioxide concentration and temperature, thereby minimizing emissions and energy loss.

Life Cycle Assessment Frameworks

Life Cycle Assessment (LCA) frameworks provide structured methodologies for evaluating the environmental impacts of lithium mining operations across their entire operational lifecycle. These frameworks typically follow ISO 14040 and 14044 standards, which establish principles, requirements, and guidelines for conducting comprehensive environmental assessments. When applied to lithium mining, these frameworks enable systematic quantification of greenhouse gas (GHG) emissions from extraction through processing and site remediation.

The most widely adopted LCA frameworks for mining operations include the Greenhouse Gas Protocol, which offers sector-specific guidance for resource extraction industries. This protocol distinguishes between Scope 1 (direct emissions from owned sources), Scope 2 (indirect emissions from purchased electricity), and Scope 3 (all other indirect emissions in the value chain), providing a comprehensive accounting structure for lithium mining operations.

Another significant framework is the Global Reporting Initiative (GRI) Mining and Metals Sector Supplement, which includes specific indicators for measuring and reporting environmental impacts in mining contexts. This framework emphasizes transparency in emissions reporting and standardizes the methodology for calculating emissions across different operational phases.

The Intergovernmental Panel on Climate Change (IPCC) guidelines for national greenhouse gas inventories also offer methodological approaches applicable to mining operations, particularly for calculating emissions from land-use changes associated with mine development and energy consumption during extraction and processing.

For lithium-specific assessments, specialized frameworks have emerged, such as the Lithium-Ion Battery LCA Framework developed by Argonne National Laboratory, which includes upstream mining activities in its scope. This framework accounts for regional variations in extraction methods (brine operations versus hard rock mining) and their corresponding emissions profiles.

Recent advancements in LCA frameworks include the integration of water footprint assessments alongside carbon accounting, recognizing the significant water-energy nexus in lithium extraction processes. These integrated frameworks provide more holistic environmental impact assessments, particularly relevant for water-intensive brine extraction operations in arid regions.

Implementation of these frameworks requires robust data collection systems across operational phases, standardized emission factors for mining equipment and processes, and consistent boundary definitions to ensure comparability between different lithium production facilities and extraction methodologies.

The most widely adopted LCA frameworks for mining operations include the Greenhouse Gas Protocol, which offers sector-specific guidance for resource extraction industries. This protocol distinguishes between Scope 1 (direct emissions from owned sources), Scope 2 (indirect emissions from purchased electricity), and Scope 3 (all other indirect emissions in the value chain), providing a comprehensive accounting structure for lithium mining operations.

Another significant framework is the Global Reporting Initiative (GRI) Mining and Metals Sector Supplement, which includes specific indicators for measuring and reporting environmental impacts in mining contexts. This framework emphasizes transparency in emissions reporting and standardizes the methodology for calculating emissions across different operational phases.

The Intergovernmental Panel on Climate Change (IPCC) guidelines for national greenhouse gas inventories also offer methodological approaches applicable to mining operations, particularly for calculating emissions from land-use changes associated with mine development and energy consumption during extraction and processing.

For lithium-specific assessments, specialized frameworks have emerged, such as the Lithium-Ion Battery LCA Framework developed by Argonne National Laboratory, which includes upstream mining activities in its scope. This framework accounts for regional variations in extraction methods (brine operations versus hard rock mining) and their corresponding emissions profiles.

Recent advancements in LCA frameworks include the integration of water footprint assessments alongside carbon accounting, recognizing the significant water-energy nexus in lithium extraction processes. These integrated frameworks provide more holistic environmental impact assessments, particularly relevant for water-intensive brine extraction operations in arid regions.

Implementation of these frameworks requires robust data collection systems across operational phases, standardized emission factors for mining equipment and processes, and consistent boundary definitions to ensure comparability between different lithium production facilities and extraction methodologies.

Regulatory Compliance and ESG Reporting

Regulatory compliance frameworks for lithium mining operations are becoming increasingly stringent worldwide, with particular focus on greenhouse gas (GHG) emissions reporting. The European Union's Corporate Sustainability Reporting Directive (CSRD) and the proposed Carbon Border Adjustment Mechanism (CBAM) directly impact lithium producers by requiring detailed emissions accounting across operational phases. Similarly, the U.S. Securities and Exchange Commission's climate disclosure rules mandate public companies to report Scope 1, 2, and 3 emissions, creating significant implications for lithium mining companies.

International standards such as the Greenhouse Gas Protocol and ISO 14064 provide methodological frameworks for quantifying emissions, while industry-specific guidelines from the International Council on Mining and Metals (ICMM) offer tailored approaches for mining operations. These frameworks increasingly require phase-specific emissions reporting, distinguishing between exploration, construction, extraction, processing, and site rehabilitation activities.

Environmental, Social, and Governance (ESG) reporting has evolved from voluntary disclosure to mandatory requirements in many jurisdictions. Investors now routinely evaluate lithium mining companies based on their emissions intensity per ton of lithium carbonate equivalent (LCE) produced. The Sustainability Accounting Standards Board (SASB) and Global Reporting Initiative (GRI) have developed specific metrics for mining operations that include phase-segregated emissions reporting.

Compliance challenges are particularly acute for lithium operations in developing regions where regulatory frameworks may be less established. Companies operating across multiple jurisdictions face the additional complexity of reconciling different reporting requirements and methodologies. Forward-thinking lithium producers are implementing digital monitoring systems that track real-time emissions data across operational phases, enabling more accurate compliance reporting and facilitating verification by third-party auditors.

The financial implications of regulatory compliance extend beyond potential penalties for non-compliance. Access to capital is increasingly tied to emissions performance, with green bonds and sustainability-linked loans offering preferential terms for companies demonstrating lower emissions intensity. Major financial institutions have incorporated emissions metrics into their lending criteria, with phase-specific emissions data becoming a key component of risk assessment.

Looking ahead, regulatory frameworks are expected to evolve toward greater harmonization of reporting standards and increased emphasis on life-cycle emissions accounting. Companies that develop robust systems for quantifying phase-specific emissions will be better positioned to navigate this evolving regulatory landscape and meet the growing expectations of investors, customers, and other stakeholders regarding environmental performance.

International standards such as the Greenhouse Gas Protocol and ISO 14064 provide methodological frameworks for quantifying emissions, while industry-specific guidelines from the International Council on Mining and Metals (ICMM) offer tailored approaches for mining operations. These frameworks increasingly require phase-specific emissions reporting, distinguishing between exploration, construction, extraction, processing, and site rehabilitation activities.

Environmental, Social, and Governance (ESG) reporting has evolved from voluntary disclosure to mandatory requirements in many jurisdictions. Investors now routinely evaluate lithium mining companies based on their emissions intensity per ton of lithium carbonate equivalent (LCE) produced. The Sustainability Accounting Standards Board (SASB) and Global Reporting Initiative (GRI) have developed specific metrics for mining operations that include phase-segregated emissions reporting.

Compliance challenges are particularly acute for lithium operations in developing regions where regulatory frameworks may be less established. Companies operating across multiple jurisdictions face the additional complexity of reconciling different reporting requirements and methodologies. Forward-thinking lithium producers are implementing digital monitoring systems that track real-time emissions data across operational phases, enabling more accurate compliance reporting and facilitating verification by third-party auditors.

The financial implications of regulatory compliance extend beyond potential penalties for non-compliance. Access to capital is increasingly tied to emissions performance, with green bonds and sustainability-linked loans offering preferential terms for companies demonstrating lower emissions intensity. Major financial institutions have incorporated emissions metrics into their lending criteria, with phase-specific emissions data becoming a key component of risk assessment.

Looking ahead, regulatory frameworks are expected to evolve toward greater harmonization of reporting standards and increased emphasis on life-cycle emissions accounting. Companies that develop robust systems for quantifying phase-specific emissions will be better positioned to navigate this evolving regulatory landscape and meet the growing expectations of investors, customers, and other stakeholders regarding environmental performance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!