Evaluating Carbon Tetrachloride Alternatives in Modern Manufacturing

JUL 2, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CCl4 Alternatives Background and Objectives

Carbon tetrachloride (CCl4) has been widely used in various industrial processes for decades due to its unique chemical properties. However, its detrimental effects on the ozone layer and human health have led to a global phase-out under the Montreal Protocol. This has created an urgent need for alternative substances and technologies in modern manufacturing.

The evolution of CCl4 alternatives has been driven by environmental concerns and regulatory pressures. Early substitutes focused on other chlorinated solvents, but these too faced restrictions due to their ozone-depleting potential. The industry then shifted towards hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs), which offered improved environmental profiles. However, these compounds still contribute to global warming, leading to further regulatory constraints.

Recent technological trends in CCl4 alternatives have centered on developing more environmentally benign solutions. These include hydrofluoroolefins (HFOs), which have ultra-low global warming potential, as well as non-halogenated solvents and aqueous cleaning systems. Additionally, there is a growing interest in green chemistry approaches that minimize the use of hazardous substances altogether.

The primary objective of evaluating CCl4 alternatives is to identify substances or processes that can effectively replace CCl4 in various applications while minimizing environmental impact and maintaining or improving performance. This involves assessing the alternatives' efficacy in cleaning, degreasing, and other industrial processes where CCl4 was traditionally used.

Key considerations in this evaluation include the alternatives' ozone depletion potential, global warming potential, toxicity, flammability, and overall lifecycle environmental impact. Additionally, the assessment must consider the technical performance of these alternatives, their compatibility with existing manufacturing processes, and the economic feasibility of their implementation.

Another crucial objective is to ensure that the chosen alternatives comply with current and anticipated environmental regulations. This requires a forward-looking approach, anticipating future regulatory trends and selecting solutions that will remain viable in the long term. The evaluation must also consider the potential for scalability and widespread adoption across different industries and geographical regions.

Ultimately, the goal is to facilitate a smooth transition away from CCl4 in manufacturing processes, balancing environmental protection with industrial efficiency and economic viability. This transition represents a significant technological challenge and opportunity for innovation in the chemical industry and related manufacturing sectors.

The evolution of CCl4 alternatives has been driven by environmental concerns and regulatory pressures. Early substitutes focused on other chlorinated solvents, but these too faced restrictions due to their ozone-depleting potential. The industry then shifted towards hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs), which offered improved environmental profiles. However, these compounds still contribute to global warming, leading to further regulatory constraints.

Recent technological trends in CCl4 alternatives have centered on developing more environmentally benign solutions. These include hydrofluoroolefins (HFOs), which have ultra-low global warming potential, as well as non-halogenated solvents and aqueous cleaning systems. Additionally, there is a growing interest in green chemistry approaches that minimize the use of hazardous substances altogether.

The primary objective of evaluating CCl4 alternatives is to identify substances or processes that can effectively replace CCl4 in various applications while minimizing environmental impact and maintaining or improving performance. This involves assessing the alternatives' efficacy in cleaning, degreasing, and other industrial processes where CCl4 was traditionally used.

Key considerations in this evaluation include the alternatives' ozone depletion potential, global warming potential, toxicity, flammability, and overall lifecycle environmental impact. Additionally, the assessment must consider the technical performance of these alternatives, their compatibility with existing manufacturing processes, and the economic feasibility of their implementation.

Another crucial objective is to ensure that the chosen alternatives comply with current and anticipated environmental regulations. This requires a forward-looking approach, anticipating future regulatory trends and selecting solutions that will remain viable in the long term. The evaluation must also consider the potential for scalability and widespread adoption across different industries and geographical regions.

Ultimately, the goal is to facilitate a smooth transition away from CCl4 in manufacturing processes, balancing environmental protection with industrial efficiency and economic viability. This transition represents a significant technological challenge and opportunity for innovation in the chemical industry and related manufacturing sectors.

Market Demand Analysis for CCl4 Substitutes

The market demand for Carbon Tetrachloride (CCl4) alternatives in modern manufacturing has been steadily increasing due to environmental concerns and regulatory pressures. CCl4, once widely used in various industrial applications, has been phased out in many countries due to its ozone-depleting properties and potential health hazards. This shift has created a significant market opportunity for safer and more environmentally friendly substitutes.

The global market for CCl4 alternatives is primarily driven by the chemical, pharmaceutical, and electronics industries. In the chemical sector, these substitutes are used as solvents, cleaning agents, and in the production of various compounds. The pharmaceutical industry requires alternatives for drug synthesis and as extraction solvents, while the electronics industry uses them in cleaning and degreasing applications.

Market research indicates that the demand for CCl4 alternatives is expected to grow at a compound annual growth rate (CAGR) of over 5% in the coming years. This growth is attributed to stringent environmental regulations, increasing awareness of workplace safety, and the push for sustainable manufacturing practices. The Asia-Pacific region, particularly China and India, is anticipated to be the fastest-growing market for these alternatives due to rapid industrialization and the implementation of stricter environmental policies.

Key market segments for CCl4 alternatives include hydrofluorocarbons (HFCs), hydrofluoroolefins (HFOs), hydrocarbons, and other chlorinated solvents. Among these, HFOs are gaining traction due to their low global warming potential and ozone depletion potential. The market for HFOs is expected to witness substantial growth, driven by their increasing adoption in refrigeration, air conditioning, and foam blowing applications.

The demand for CCl4 alternatives is also influenced by industry-specific requirements. For instance, the semiconductor industry requires ultra-pure solvents for cleaning and etching processes, creating a niche market for high-purity alternatives. Similarly, the aerospace and automotive sectors are seeking alternatives for precision cleaning of components, further diversifying the market landscape.

Despite the growing demand, challenges remain in the widespread adoption of CCl4 alternatives. These include higher costs compared to traditional solvents, the need for process modifications in existing manufacturing setups, and varying performance characteristics of substitutes across different applications. However, ongoing research and development efforts are focused on addressing these challenges, potentially leading to more cost-effective and versatile alternatives in the future.

The global market for CCl4 alternatives is primarily driven by the chemical, pharmaceutical, and electronics industries. In the chemical sector, these substitutes are used as solvents, cleaning agents, and in the production of various compounds. The pharmaceutical industry requires alternatives for drug synthesis and as extraction solvents, while the electronics industry uses them in cleaning and degreasing applications.

Market research indicates that the demand for CCl4 alternatives is expected to grow at a compound annual growth rate (CAGR) of over 5% in the coming years. This growth is attributed to stringent environmental regulations, increasing awareness of workplace safety, and the push for sustainable manufacturing practices. The Asia-Pacific region, particularly China and India, is anticipated to be the fastest-growing market for these alternatives due to rapid industrialization and the implementation of stricter environmental policies.

Key market segments for CCl4 alternatives include hydrofluorocarbons (HFCs), hydrofluoroolefins (HFOs), hydrocarbons, and other chlorinated solvents. Among these, HFOs are gaining traction due to their low global warming potential and ozone depletion potential. The market for HFOs is expected to witness substantial growth, driven by their increasing adoption in refrigeration, air conditioning, and foam blowing applications.

The demand for CCl4 alternatives is also influenced by industry-specific requirements. For instance, the semiconductor industry requires ultra-pure solvents for cleaning and etching processes, creating a niche market for high-purity alternatives. Similarly, the aerospace and automotive sectors are seeking alternatives for precision cleaning of components, further diversifying the market landscape.

Despite the growing demand, challenges remain in the widespread adoption of CCl4 alternatives. These include higher costs compared to traditional solvents, the need for process modifications in existing manufacturing setups, and varying performance characteristics of substitutes across different applications. However, ongoing research and development efforts are focused on addressing these challenges, potentially leading to more cost-effective and versatile alternatives in the future.

Current Status and Challenges of CCl4 Alternatives

The current status of Carbon Tetrachloride (CCl4) alternatives in modern manufacturing is characterized by a complex landscape of technological advancements and regulatory pressures. As global efforts to phase out ozone-depleting substances intensify, industries have been compelled to seek viable substitutes for CCl4, which has long been used in various applications due to its unique properties.

In the chemical industry, several alternatives have emerged as potential replacements for CCl4. Hydrofluorocarbons (HFCs) and hydrofluoroolefins (HFOs) have gained traction in refrigeration and foam blowing applications. These compounds offer similar performance characteristics without the ozone-depleting effects of CCl4. However, their widespread adoption faces challenges related to cost, efficiency, and long-term environmental impact.

The semiconductor industry, which historically relied on CCl4 for cleaning and etching processes, has made significant strides in developing alternative technologies. Plasma cleaning and supercritical CO2 cleaning have shown promise in replacing CCl4-based methods. These techniques offer improved precision and reduced environmental impact, but their implementation often requires substantial capital investment and process modifications.

One of the primary challenges in adopting CCl4 alternatives is the need for comprehensive safety and environmental assessments. Many potential substitutes, while addressing the ozone depletion issue, may present other environmental or health concerns. For instance, some HFCs have high global warming potential, leading to a new set of regulatory challenges and potential future phase-outs.

Performance parity remains a significant hurdle for many CCl4 alternatives. In certain specialized applications, such as analytical chemistry and pharmaceutical manufacturing, finding substitutes that match the unique properties of CCl4 has proven difficult. This has led to ongoing research into novel compounds and process innovations to bridge the performance gap.

Cost considerations also play a crucial role in the adoption of CCl4 alternatives. Many substitutes are more expensive to produce or require significant modifications to existing manufacturing processes. This economic barrier has slowed the transition in some sectors, particularly in regions where environmental regulations are less stringent.

The global regulatory landscape surrounding CCl4 alternatives is evolving rapidly, creating a complex compliance environment for manufacturers. Different regions have implemented varying timelines and restrictions for CCl4 phase-out, leading to challenges in global supply chains and product standardization. This regulatory patchwork necessitates adaptive strategies for companies operating in multiple markets.

In conclusion, while significant progress has been made in developing and implementing CCl4 alternatives, the transition remains an ongoing process fraught with technical, economic, and regulatory challenges. The path forward requires continued innovation, collaborative research efforts, and a balanced approach to addressing both immediate manufacturing needs and long-term environmental sustainability.

In the chemical industry, several alternatives have emerged as potential replacements for CCl4. Hydrofluorocarbons (HFCs) and hydrofluoroolefins (HFOs) have gained traction in refrigeration and foam blowing applications. These compounds offer similar performance characteristics without the ozone-depleting effects of CCl4. However, their widespread adoption faces challenges related to cost, efficiency, and long-term environmental impact.

The semiconductor industry, which historically relied on CCl4 for cleaning and etching processes, has made significant strides in developing alternative technologies. Plasma cleaning and supercritical CO2 cleaning have shown promise in replacing CCl4-based methods. These techniques offer improved precision and reduced environmental impact, but their implementation often requires substantial capital investment and process modifications.

One of the primary challenges in adopting CCl4 alternatives is the need for comprehensive safety and environmental assessments. Many potential substitutes, while addressing the ozone depletion issue, may present other environmental or health concerns. For instance, some HFCs have high global warming potential, leading to a new set of regulatory challenges and potential future phase-outs.

Performance parity remains a significant hurdle for many CCl4 alternatives. In certain specialized applications, such as analytical chemistry and pharmaceutical manufacturing, finding substitutes that match the unique properties of CCl4 has proven difficult. This has led to ongoing research into novel compounds and process innovations to bridge the performance gap.

Cost considerations also play a crucial role in the adoption of CCl4 alternatives. Many substitutes are more expensive to produce or require significant modifications to existing manufacturing processes. This economic barrier has slowed the transition in some sectors, particularly in regions where environmental regulations are less stringent.

The global regulatory landscape surrounding CCl4 alternatives is evolving rapidly, creating a complex compliance environment for manufacturers. Different regions have implemented varying timelines and restrictions for CCl4 phase-out, leading to challenges in global supply chains and product standardization. This regulatory patchwork necessitates adaptive strategies for companies operating in multiple markets.

In conclusion, while significant progress has been made in developing and implementing CCl4 alternatives, the transition remains an ongoing process fraught with technical, economic, and regulatory challenges. The path forward requires continued innovation, collaborative research efforts, and a balanced approach to addressing both immediate manufacturing needs and long-term environmental sustainability.

Existing CCl4 Substitute Solutions

01 Halogenated hydrocarbon alternatives

Various halogenated hydrocarbons can serve as alternatives to carbon tetrachloride. These compounds often have similar properties but with reduced environmental impact and toxicity. They can be used in applications such as solvents, cleaning agents, and refrigerants.- Halogenated hydrocarbon alternatives: Various halogenated hydrocarbons are proposed as alternatives to carbon tetrachloride. These compounds maintain similar properties while reducing environmental impact. They can be used in applications such as solvents, cleaning agents, and refrigerants.

- Non-halogenated organic solvents: Non-halogenated organic solvents are explored as environmentally friendly alternatives to carbon tetrachloride. These include alcohols, ketones, and esters, which can be used in various industrial processes and cleaning applications.

- Aqueous-based solutions: Water-based formulations are developed to replace carbon tetrachloride in certain applications. These solutions may include surfactants, detergents, or other additives to enhance their effectiveness while maintaining environmental safety.

- Supercritical fluid technology: Supercritical fluids, particularly supercritical carbon dioxide, are investigated as alternatives to carbon tetrachloride. This technology offers similar solvent properties with reduced environmental impact and can be used in extraction and cleaning processes.

- Green chemistry approaches: Innovative green chemistry techniques are developed to replace carbon tetrachloride in various applications. These may include bio-based solvents, ionic liquids, or other environmentally friendly alternatives that minimize toxicity and environmental impact.

02 Non-halogenated organic solvents

Non-halogenated organic solvents offer environmentally friendly alternatives to carbon tetrachloride. These may include alcohols, ketones, esters, and hydrocarbons. They can be used in various industrial processes, cleaning applications, and as extraction solvents.Expand Specific Solutions03 Aqueous-based solutions

Water-based solutions and formulations can replace carbon tetrachloride in many applications. These may include surfactants, detergents, and other water-soluble compounds that can effectively clean or dissolve substances without the environmental concerns associated with carbon tetrachloride.Expand Specific Solutions04 Supercritical fluid technology

Supercritical fluids, particularly supercritical carbon dioxide, can be used as alternatives to carbon tetrachloride in extraction processes. This technology offers a more environmentally friendly approach for applications in the food, pharmaceutical, and chemical industries.Expand Specific Solutions05 Novel synthetic compounds

New synthetic compounds are being developed as alternatives to carbon tetrachloride. These may include custom-designed molecules that mimic the desired properties of carbon tetrachloride while minimizing negative environmental and health impacts. Such compounds can be tailored for specific industrial applications.Expand Specific Solutions

Key Players in CCl4 Alternative Development

The market for Carbon Tetrachloride Alternatives in Modern Manufacturing is in a transitional phase, with growing demand driven by environmental regulations and sustainability concerns. The global market size is expanding, though exact figures vary by specific alternative. Technologically, the field is advancing rapidly, with companies like DuPont de Nemours, Occidental Chemical Corp., and Honeywell International Technologies leading innovation. These firms, along with others like Teijin Chemicals and Wacker Chemie AG, are developing more efficient and environmentally friendly alternatives. The technology's maturity varies across different alternatives, with some well-established solutions and others still in developmental stages, indicating a dynamic and competitive landscape.

DuPont de Nemours, Inc.

Technical Solution: DuPont has developed several alternatives to carbon tetrachloride in manufacturing processes. One of their key innovations is the Opteon™ line of low global warming potential (GWP) refrigerants and foam expansion agents. These products are based on hydrofluoroolefin (HFO) technology, which provides similar performance to carbon tetrachloride but with significantly reduced environmental impact[1]. DuPont's Opteon™ YF (HFO-1234yf) is particularly notable for its use in automotive air conditioning systems, replacing R-134a which has a much higher GWP[2]. In addition, DuPont has developed non-ozone depleting solvents like Vertrel™ specialty fluids, which can replace carbon tetrachloride in cleaning and degreasing applications[3]. These alternatives are designed to meet stringent environmental regulations while maintaining or improving performance in various industrial processes.

Strengths: Extensive R&D capabilities, global market presence, and a diverse product portfolio. Weaknesses: Higher costs associated with developing and implementing new technologies, potential regulatory challenges in different markets.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has been at the forefront of developing alternatives to carbon tetrachloride, particularly in the refrigerants and solvents sectors. Their Solstice® line of products, based on hydrofluoroolefin (HFO) technology, offers low global warming potential (GWP) alternatives for various applications. Solstice® yf (HFO-1234yf) is widely adopted in automotive air conditioning systems, replacing high-GWP refrigerants[4]. For industrial cleaning and precision cleaning applications, Honeywell has developed Solstice® Performance Fluid (PF), a non-ozone depleting and low-GWP alternative to carbon tetrachloride and other chlorinated solvents[5]. These products not only comply with environmental regulations but also offer improved energy efficiency and safety profiles. Honeywell's commitment to sustainable chemistry is further demonstrated by their development of Solstice® Propellant, an HFO-based aerosol propellant with ultra-low GWP, suitable for various consumer and industrial products[6].

Strengths: Strong focus on sustainable technologies, extensive global distribution network, and continuous innovation in chemical alternatives. Weaknesses: High R&D costs, potential market resistance to new technologies due to implementation costs.

Core Innovations in CCl4 Replacement

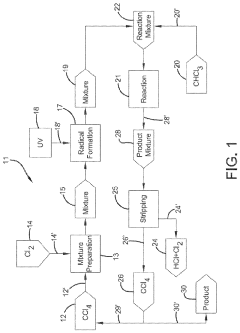

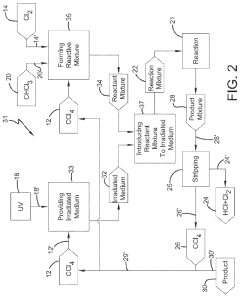

Photochlorination of partially-chlorinated chloromethanes to carbon tetrachloride

PatentActiveUS20240025823A1

Innovation

- A method involving the photochlorination of a chloromethanes stream containing chloroform, methyl chloride, and methylene chloride, combined with chlorine and additional carbon tetrachloride, and subjected to electromagnetic radiation to form carbon tetrachloride, achieving high conversion rates with reduced levels of unwanted chlorinated hydrocarbons.

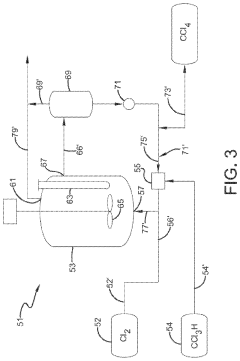

Method for producing carbonyl chloride

PatentWO2010007926A1

Innovation

- A method involving the use of two types of water with different surface areas to optimize the distribution of carbon tetrachloride and chlorine, combined with specific catalyst conditions and reaction parameters, such as contact surfaces and pressures, to minimize impurities and enhance the quality and longevity of polycarbonate production.

Environmental Impact Assessment

The environmental impact assessment of carbon tetrachloride alternatives in modern manufacturing is a critical aspect of evaluating their viability and sustainability. Carbon tetrachloride, once widely used in various industrial processes, has been phased out due to its ozone-depleting properties and potential health hazards. The alternatives being considered must undergo rigorous environmental scrutiny to ensure they do not pose similar or new environmental risks.

One of the primary considerations in this assessment is the global warming potential (GWP) of the alternative substances. Many of the proposed replacements for carbon tetrachloride are fluorinated compounds, which can have significant GWP values. The assessment must quantify the potential contribution of these alternatives to climate change over their entire lifecycle, from production to disposal.

Ozone depletion potential (ODP) is another crucial factor in the environmental impact assessment. While the alternatives are generally chosen for their lower ODP compared to carbon tetrachloride, it is essential to verify that they do not contribute significantly to stratospheric ozone depletion. This evaluation involves analyzing the chemical structure and atmospheric lifetime of the proposed substances.

The assessment also focuses on the potential for air, water, and soil pollution. This includes examining the volatility, solubility, and persistence of the alternative compounds in different environmental compartments. The potential for bioaccumulation in aquatic and terrestrial ecosystems is evaluated to understand the long-term ecological impacts.

Toxicity to various organisms, including humans, is a key component of the environmental impact assessment. This involves studying both acute and chronic effects on different species, as well as potential carcinogenicity and mutagenicity. The assessment considers exposure pathways and potential risks to workers, nearby communities, and ecosystems.

The lifecycle analysis of these alternatives is crucial in understanding their overall environmental footprint. This includes assessing the energy requirements and emissions associated with their production, transportation, use, and disposal. The potential for recycling or safe destruction at the end of life is also evaluated to minimize long-term environmental impacts.

Regulatory compliance is an integral part of the environmental impact assessment. The alternatives must meet current and anticipated environmental regulations in various jurisdictions. This includes adherence to international agreements such as the Montreal Protocol and national environmental protection laws.

Finally, the assessment considers the potential for accidental releases and the environmental consequences of such events. This involves evaluating the stability of the alternatives under various conditions and their behavior in the event of spills or leaks. Emergency response protocols and mitigation strategies are developed based on these assessments to minimize environmental damage in case of accidents.

One of the primary considerations in this assessment is the global warming potential (GWP) of the alternative substances. Many of the proposed replacements for carbon tetrachloride are fluorinated compounds, which can have significant GWP values. The assessment must quantify the potential contribution of these alternatives to climate change over their entire lifecycle, from production to disposal.

Ozone depletion potential (ODP) is another crucial factor in the environmental impact assessment. While the alternatives are generally chosen for their lower ODP compared to carbon tetrachloride, it is essential to verify that they do not contribute significantly to stratospheric ozone depletion. This evaluation involves analyzing the chemical structure and atmospheric lifetime of the proposed substances.

The assessment also focuses on the potential for air, water, and soil pollution. This includes examining the volatility, solubility, and persistence of the alternative compounds in different environmental compartments. The potential for bioaccumulation in aquatic and terrestrial ecosystems is evaluated to understand the long-term ecological impacts.

Toxicity to various organisms, including humans, is a key component of the environmental impact assessment. This involves studying both acute and chronic effects on different species, as well as potential carcinogenicity and mutagenicity. The assessment considers exposure pathways and potential risks to workers, nearby communities, and ecosystems.

The lifecycle analysis of these alternatives is crucial in understanding their overall environmental footprint. This includes assessing the energy requirements and emissions associated with their production, transportation, use, and disposal. The potential for recycling or safe destruction at the end of life is also evaluated to minimize long-term environmental impacts.

Regulatory compliance is an integral part of the environmental impact assessment. The alternatives must meet current and anticipated environmental regulations in various jurisdictions. This includes adherence to international agreements such as the Montreal Protocol and national environmental protection laws.

Finally, the assessment considers the potential for accidental releases and the environmental consequences of such events. This involves evaluating the stability of the alternatives under various conditions and their behavior in the event of spills or leaks. Emergency response protocols and mitigation strategies are developed based on these assessments to minimize environmental damage in case of accidents.

Regulatory Compliance for CCl4 Alternatives

The regulatory landscape for Carbon Tetrachloride (CCl4) alternatives in modern manufacturing is complex and evolving. As industries seek to replace CCl4 due to its ozone-depleting properties and health risks, they must navigate a web of international, national, and regional regulations. The Montreal Protocol, a global agreement to protect the ozone layer, has been instrumental in phasing out CCl4 and other ozone-depleting substances. Signatories to the protocol are required to implement measures to reduce and eventually eliminate the production and consumption of CCl4.

In the United States, the Environmental Protection Agency (EPA) regulates CCl4 alternatives under the Significant New Alternatives Policy (SNAP) program. This program evaluates substitutes for ozone-depleting substances to ensure they reduce overall risk to human health and the environment. Manufacturers must submit detailed information about proposed alternatives, including toxicity data, environmental impact assessments, and exposure scenarios. The EPA then reviews this information and either approves or restricts the use of the alternative based on its findings.

The European Union has implemented the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation, which applies to many CCl4 alternatives. Under REACH, manufacturers must register chemicals produced or imported in quantities over one tonne per year and provide safety data. For substances of very high concern, authorization may be required before they can be used. This process ensures that the risks associated with new chemicals are thoroughly assessed before they enter the market.

In addition to these overarching regulations, specific industry sectors may have their own compliance requirements. For instance, the pharmaceutical industry must adhere to Good Manufacturing Practice (GMP) guidelines, which may influence the selection of CCl4 alternatives in drug production processes. Similarly, the electronics industry must comply with the Restriction of Hazardous Substances (RoHS) directive, which limits the use of certain hazardous substances in electrical and electronic equipment.

Compliance with these regulations often requires significant investment in research, testing, and documentation. Companies must conduct thorough risk assessments, develop safety data sheets, and implement proper handling and disposal procedures for CCl4 alternatives. Moreover, they must stay informed about regulatory changes and be prepared to adapt their processes accordingly. This may involve ongoing monitoring of regulatory developments, participation in industry associations, and engagement with regulatory bodies to ensure continued compliance.

As global awareness of environmental and health issues grows, regulations surrounding CCl4 alternatives are likely to become more stringent. Manufacturers must therefore not only focus on finding effective replacements for CCl4 but also ensure that these alternatives are sustainable and compliant with current and future regulatory frameworks. This proactive approach to regulatory compliance is essential for long-term success in modern manufacturing.

In the United States, the Environmental Protection Agency (EPA) regulates CCl4 alternatives under the Significant New Alternatives Policy (SNAP) program. This program evaluates substitutes for ozone-depleting substances to ensure they reduce overall risk to human health and the environment. Manufacturers must submit detailed information about proposed alternatives, including toxicity data, environmental impact assessments, and exposure scenarios. The EPA then reviews this information and either approves or restricts the use of the alternative based on its findings.

The European Union has implemented the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation, which applies to many CCl4 alternatives. Under REACH, manufacturers must register chemicals produced or imported in quantities over one tonne per year and provide safety data. For substances of very high concern, authorization may be required before they can be used. This process ensures that the risks associated with new chemicals are thoroughly assessed before they enter the market.

In addition to these overarching regulations, specific industry sectors may have their own compliance requirements. For instance, the pharmaceutical industry must adhere to Good Manufacturing Practice (GMP) guidelines, which may influence the selection of CCl4 alternatives in drug production processes. Similarly, the electronics industry must comply with the Restriction of Hazardous Substances (RoHS) directive, which limits the use of certain hazardous substances in electrical and electronic equipment.

Compliance with these regulations often requires significant investment in research, testing, and documentation. Companies must conduct thorough risk assessments, develop safety data sheets, and implement proper handling and disposal procedures for CCl4 alternatives. Moreover, they must stay informed about regulatory changes and be prepared to adapt their processes accordingly. This may involve ongoing monitoring of regulatory developments, participation in industry associations, and engagement with regulatory bodies to ensure continued compliance.

As global awareness of environmental and health issues grows, regulations surrounding CCl4 alternatives are likely to become more stringent. Manufacturers must therefore not only focus on finding effective replacements for CCl4 but also ensure that these alternatives are sustainable and compliant with current and future regulatory frameworks. This proactive approach to regulatory compliance is essential for long-term success in modern manufacturing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!