Future Trends in Polyurethane for Sustainable Applications

JUN 25, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PU Sustainability Goals

The polyurethane (PU) industry is increasingly focusing on sustainability goals to address environmental concerns and meet regulatory requirements. These goals are driven by the need to reduce the carbon footprint, minimize waste, and develop more eco-friendly products. One of the primary objectives is to transition towards bio-based raw materials, replacing petroleum-derived polyols with those derived from renewable sources such as vegetable oils, lignin, and cellulose. This shift aims to decrease dependence on fossil fuels and reduce greenhouse gas emissions associated with PU production.

Another crucial sustainability goal is to improve the recyclability and biodegradability of PU products. Efforts are being made to develop PU formulations that can be more easily recycled or that naturally degrade in the environment without leaving harmful residues. This includes research into chemical recycling methods that can break down PU into its original components for reuse, as well as the development of biodegradable PU materials for single-use applications.

Energy efficiency in the production process is also a key focus area. Manufacturers are investing in technologies and processes that reduce energy consumption during PU synthesis and processing. This includes the optimization of reaction conditions, the use of more efficient equipment, and the implementation of heat recovery systems. Additionally, there is a growing emphasis on reducing volatile organic compound (VOC) emissions during production and application of PU products, particularly in sectors such as coatings and adhesives.

Water-based PU systems are gaining traction as a more environmentally friendly alternative to solvent-based systems. These formulations significantly reduce VOC emissions and improve worker safety. The development of high-performance water-based PU systems that can match or exceed the properties of traditional solvent-based counterparts is a major sustainability goal for the industry.

Lastly, the PU industry is working towards extending the lifespan of PU products to reduce waste and resource consumption. This involves improving the durability and resistance of PU materials to factors such as UV radiation, moisture, and temperature fluctuations. By creating longer-lasting products, the industry aims to decrease the frequency of replacement and disposal, thereby reducing the overall environmental impact of PU use across various applications.

Another crucial sustainability goal is to improve the recyclability and biodegradability of PU products. Efforts are being made to develop PU formulations that can be more easily recycled or that naturally degrade in the environment without leaving harmful residues. This includes research into chemical recycling methods that can break down PU into its original components for reuse, as well as the development of biodegradable PU materials for single-use applications.

Energy efficiency in the production process is also a key focus area. Manufacturers are investing in technologies and processes that reduce energy consumption during PU synthesis and processing. This includes the optimization of reaction conditions, the use of more efficient equipment, and the implementation of heat recovery systems. Additionally, there is a growing emphasis on reducing volatile organic compound (VOC) emissions during production and application of PU products, particularly in sectors such as coatings and adhesives.

Water-based PU systems are gaining traction as a more environmentally friendly alternative to solvent-based systems. These formulations significantly reduce VOC emissions and improve worker safety. The development of high-performance water-based PU systems that can match or exceed the properties of traditional solvent-based counterparts is a major sustainability goal for the industry.

Lastly, the PU industry is working towards extending the lifespan of PU products to reduce waste and resource consumption. This involves improving the durability and resistance of PU materials to factors such as UV radiation, moisture, and temperature fluctuations. By creating longer-lasting products, the industry aims to decrease the frequency of replacement and disposal, thereby reducing the overall environmental impact of PU use across various applications.

Green PU Market Analysis

The global market for green polyurethane (PU) is experiencing significant growth, driven by increasing environmental awareness and stringent regulations on sustainable materials. This eco-friendly alternative to traditional polyurethane is gaining traction across various industries due to its reduced carbon footprint and improved recyclability.

Market analysts project a compound annual growth rate (CAGR) of over 7% for the green PU market from 2021 to 2026. This growth is primarily attributed to the rising demand for sustainable materials in construction, automotive, and packaging sectors. The construction industry, in particular, is emerging as a key driver for green PU adoption, with applications in insulation, sealants, and adhesives.

In the automotive sector, green PU is increasingly being used in interior components, seating, and under-the-hood applications. This shift is driven by automakers' efforts to reduce vehicle weight and improve fuel efficiency while meeting sustainability targets. The packaging industry is also embracing green PU for its biodegradable properties, especially in food packaging and protective packaging solutions.

Geographically, Europe leads the green PU market, owing to stringent environmental regulations and a strong focus on sustainable development. North America follows closely, with rapid adoption in the construction and automotive sectors. The Asia-Pacific region is expected to witness the fastest growth, driven by increasing industrialization and growing awareness of environmental issues in countries like China and India.

Key players in the green PU market include BASF SE, Covestro AG, and Huntsman Corporation, who are investing heavily in research and development to improve the performance and cost-effectiveness of green PU formulations. These companies are also focusing on strategic partnerships and collaborations to expand their product portfolios and market reach.

Despite the positive outlook, challenges remain in the widespread adoption of green PU. The higher production costs compared to conventional PU and the need for specialized processing techniques are significant barriers. However, ongoing technological advancements and economies of scale are expected to gradually reduce these cost differentials.

Consumer preferences are shifting towards eco-friendly products, creating a pull factor for green PU adoption. This trend is particularly strong among millennials and Gen Z consumers, who prioritize sustainability in their purchasing decisions. As a result, brands across various industries are incorporating green PU into their products to appeal to this environmentally conscious demographic.

Market analysts project a compound annual growth rate (CAGR) of over 7% for the green PU market from 2021 to 2026. This growth is primarily attributed to the rising demand for sustainable materials in construction, automotive, and packaging sectors. The construction industry, in particular, is emerging as a key driver for green PU adoption, with applications in insulation, sealants, and adhesives.

In the automotive sector, green PU is increasingly being used in interior components, seating, and under-the-hood applications. This shift is driven by automakers' efforts to reduce vehicle weight and improve fuel efficiency while meeting sustainability targets. The packaging industry is also embracing green PU for its biodegradable properties, especially in food packaging and protective packaging solutions.

Geographically, Europe leads the green PU market, owing to stringent environmental regulations and a strong focus on sustainable development. North America follows closely, with rapid adoption in the construction and automotive sectors. The Asia-Pacific region is expected to witness the fastest growth, driven by increasing industrialization and growing awareness of environmental issues in countries like China and India.

Key players in the green PU market include BASF SE, Covestro AG, and Huntsman Corporation, who are investing heavily in research and development to improve the performance and cost-effectiveness of green PU formulations. These companies are also focusing on strategic partnerships and collaborations to expand their product portfolios and market reach.

Despite the positive outlook, challenges remain in the widespread adoption of green PU. The higher production costs compared to conventional PU and the need for specialized processing techniques are significant barriers. However, ongoing technological advancements and economies of scale are expected to gradually reduce these cost differentials.

Consumer preferences are shifting towards eco-friendly products, creating a pull factor for green PU adoption. This trend is particularly strong among millennials and Gen Z consumers, who prioritize sustainability in their purchasing decisions. As a result, brands across various industries are incorporating green PU into their products to appeal to this environmentally conscious demographic.

PU Tech Challenges

Polyurethane (PU) technology faces several significant challenges in its pursuit of sustainable applications. One of the primary concerns is the environmental impact of traditional PU production methods. The use of fossil fuel-based raw materials and the emission of volatile organic compounds (VOCs) during manufacturing processes contribute to carbon footprint and air pollution. Addressing these issues requires innovative approaches to sourcing renewable feedstocks and developing cleaner production techniques.

Another major challenge lies in the end-of-life management of PU products. The durability that makes PU attractive for many applications also makes it difficult to degrade naturally. Improving the recyclability and biodegradability of PU materials without compromising their performance characteristics is a complex task that demands advanced research in polymer chemistry and material science.

The toxicity of certain components used in PU production, particularly isocyanates, poses health risks to workers and consumers. Developing safer alternatives or improving handling processes to minimize exposure is crucial for the sustainable future of PU technology. This challenge intersects with regulatory pressures, as governments worldwide are implementing stricter guidelines on chemical use and disposal.

Energy efficiency in PU manufacturing is another area requiring significant improvement. The energy-intensive nature of current production methods contributes to both environmental impact and production costs. Innovations in process engineering and equipment design are needed to reduce energy consumption without affecting product quality or production rates.

Balancing performance with sustainability is perhaps the most overarching challenge. As industries push for more environmentally friendly materials, there is a risk of compromising the unique properties that make PU valuable in various applications. Finding ways to maintain or enhance performance while incorporating sustainable practices requires a delicate balance of material science, chemical engineering, and application-specific research.

Water-based PU systems present a promising direction for sustainability but face challenges in achieving properties comparable to solvent-based systems. Improving the performance and expanding the application range of water-based PUs is a key focus area for researchers and manufacturers alike.

Lastly, the variability in feedstock quality when using bio-based or recycled materials for PU production presents challenges in maintaining consistent product quality. Developing robust processes that can accommodate this variability while ensuring reliable performance is essential for the widespread adoption of sustainable PU technologies.

Another major challenge lies in the end-of-life management of PU products. The durability that makes PU attractive for many applications also makes it difficult to degrade naturally. Improving the recyclability and biodegradability of PU materials without compromising their performance characteristics is a complex task that demands advanced research in polymer chemistry and material science.

The toxicity of certain components used in PU production, particularly isocyanates, poses health risks to workers and consumers. Developing safer alternatives or improving handling processes to minimize exposure is crucial for the sustainable future of PU technology. This challenge intersects with regulatory pressures, as governments worldwide are implementing stricter guidelines on chemical use and disposal.

Energy efficiency in PU manufacturing is another area requiring significant improvement. The energy-intensive nature of current production methods contributes to both environmental impact and production costs. Innovations in process engineering and equipment design are needed to reduce energy consumption without affecting product quality or production rates.

Balancing performance with sustainability is perhaps the most overarching challenge. As industries push for more environmentally friendly materials, there is a risk of compromising the unique properties that make PU valuable in various applications. Finding ways to maintain or enhance performance while incorporating sustainable practices requires a delicate balance of material science, chemical engineering, and application-specific research.

Water-based PU systems present a promising direction for sustainability but face challenges in achieving properties comparable to solvent-based systems. Improving the performance and expanding the application range of water-based PUs is a key focus area for researchers and manufacturers alike.

Lastly, the variability in feedstock quality when using bio-based or recycled materials for PU production presents challenges in maintaining consistent product quality. Developing robust processes that can accommodate this variability while ensuring reliable performance is essential for the widespread adoption of sustainable PU technologies.

Current Green PU Tech

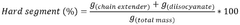

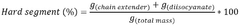

01 Polyurethane synthesis and composition

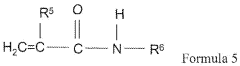

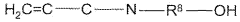

This category focuses on the synthesis and composition of polyurethane materials. It includes various methods for producing polyurethane with specific properties, such as improved durability, flexibility, or chemical resistance. The synthesis may involve different types of isocyanates, polyols, and additives to achieve desired characteristics.- Polyurethane synthesis and composition: This category focuses on the synthesis and composition of polyurethane materials. It includes various methods for producing polyurethane with specific properties, such as improved durability, flexibility, or chemical resistance. The synthesis may involve different types of isocyanates, polyols, and additives to achieve desired characteristics.

- Polyurethane applications in coatings and adhesives: This category covers the use of polyurethane in coatings and adhesives. It includes formulations for various applications such as automotive coatings, industrial adhesives, and protective finishes. The focus is on developing polyurethane-based products with enhanced adhesion, durability, and resistance to environmental factors.

- Polyurethane foam technology: This category encompasses innovations in polyurethane foam technology. It includes methods for producing various types of foam, such as flexible, rigid, or spray foams, with specific properties like improved insulation, fire resistance, or biodegradability. The focus is on optimizing foam formulations and manufacturing processes.

- Polyurethane in textile and fiber applications: This category focuses on the use of polyurethane in textile and fiber applications. It includes methods for incorporating polyurethane into fabrics, fibers, and other textile materials to enhance properties such as elasticity, moisture-wicking, or durability. The innovations may cover spinning techniques, coating processes, or composite materials.

- Sustainable and bio-based polyurethane: This category addresses the development of sustainable and bio-based polyurethane materials. It includes innovations in using renewable resources, such as plant-based polyols, to replace petroleum-based components. The focus is on creating environmentally friendly polyurethane products with reduced carbon footprint and improved biodegradability.

02 Polyurethane applications in coatings and films

This point covers the use of polyurethane in various coating and film applications. It includes formulations for protective coatings, adhesive films, and surface treatments. The polyurethane-based coatings and films may offer properties such as weather resistance, chemical resistance, and improved adhesion to different substrates.Expand Specific Solutions03 Polyurethane foam production and modification

This category focuses on the production and modification of polyurethane foams. It includes techniques for creating various types of foams, such as flexible, rigid, or semi-rigid foams, with specific properties like improved insulation, fire resistance, or biodegradability. The modification may involve the use of additives or novel processing methods.Expand Specific Solutions04 Polyurethane in textile and fiber applications

This point covers the use of polyurethane in textile and fiber applications. It includes methods for incorporating polyurethane into fabrics, creating polyurethane fibers, and developing polyurethane-based materials for clothing, upholstery, and other textile products. The focus is on improving properties such as elasticity, durability, and moisture management.Expand Specific Solutions05 Polyurethane in medical and biomedical applications

This category focuses on the use of polyurethane in medical and biomedical applications. It includes the development of biocompatible polyurethane materials for implants, wound dressings, drug delivery systems, and other medical devices. The emphasis is on creating materials with specific properties such as controlled degradation, antimicrobial activity, or tissue compatibility.Expand Specific Solutions

Key PU Industry Players

The polyurethane industry for sustainable applications is in a growth phase, driven by increasing demand for eco-friendly materials. The market size is expanding rapidly, with major players like Dow Global Technologies, Covestro, and DuPont de Nemours leading innovation. Technological maturity varies across applications, with companies such as 3M Innovative Properties and Croda International advancing bio-based polyurethanes. Emerging players like PolyNovo Biomaterials and Algenesis Corp are focusing on niche sustainable solutions. The competitive landscape is characterized by a mix of established chemical giants and specialized startups, all striving to develop more sustainable polyurethane technologies for diverse applications.

Dow Global Technologies LLC

Technical Solution: Dow has developed bio-based polyols for sustainable polyurethane applications. Their RENUVA™ program focuses on recycling end-of-life mattresses into new polyols, contributing to a circular economy. They also offer VORASTAR™ 7000, a novel polyurethane dispersion technology for more sustainable coatings with improved performance and reduced environmental impact. Dow's innovations extend to AQUACHILL™ cooling technology for bedding, which uses phase change materials in polyurethane foam to regulate temperature.

Strengths: Strong R&D capabilities, diverse product portfolio, and commitment to sustainability. Weaknesses: Dependence on petrochemical feedstocks for some products, potential regulatory challenges in certain markets.

DuPont de Nemours, Inc.

Technical Solution: DuPont has focused on developing sustainable polyurethane technologies across various applications. Their Susterra® propanediol, derived from corn sugar, serves as a bio-based building block for polyurethanes. DuPont's Sorona® partially bio-based polymer can be used in polyurethane applications, offering improved performance and reduced environmental impact. They've also developed water-based polyurethane dispersions for more sustainable coatings and adhesives. DuPont's research extends to polyurethane foams with enhanced flame retardancy using renewable resources.

Strengths: Strong intellectual property portfolio, diverse product range, and established market position. Weaknesses: Complex corporate structure after mergers and spin-offs may affect focus on specific technologies, potential challenges in scaling up some bio-based solutions.

Bio-based PU Advances

Biodegradable BIO-based polyurethanes

PatentWO2025072565A2

Innovation

- Development of biodegradable polyurethanes comprising subunits from an aliphatic diisocyanate, a chain extender, and a polyester-polyol, where the polyester-polyol includes subunits from 2,5-furandicarboxylic acid, derived from photosynthetic sources such as algae or plants.

Aqueous polymer compositions obtained from epoxidized natural oils

PatentWO2009105400A1

Innovation

- Development of aqueous polyurethane compositions using poly-ketone polyols derived from epoxidized natural oils like soybean and linseed oil, combined with hydrazine functional moieties for self-crosslinking at ambient temperatures, reducing volatile organic compounds and increasing renewable content.

PU Lifecycle Assessment

Lifecycle assessment (LCA) is becoming increasingly crucial in evaluating the environmental impact of polyurethane (PU) products throughout their entire lifecycle. This comprehensive approach considers all stages, from raw material extraction to end-of-life disposal, providing valuable insights into the sustainability of PU applications.

In the production phase, recent advancements focus on reducing the carbon footprint of PU manufacturing processes. Bio-based polyols derived from renewable resources such as vegetable oils are gaining traction as alternatives to petroleum-based raw materials. These bio-based polyols can significantly lower greenhouse gas emissions and decrease dependence on fossil fuels. Additionally, innovative catalysts and processing techniques are being developed to enhance energy efficiency during production.

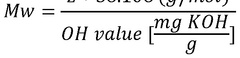

The use phase of PU products is characterized by their durability and performance. Sustainable PU formulations are being engineered to extend product lifespan, reducing the need for frequent replacements. This is particularly evident in applications such as insulation materials, where improved thermal properties contribute to energy savings in buildings over extended periods.

End-of-life management presents both challenges and opportunities for sustainable PU applications. Recycling technologies for PU products are advancing, with mechanical and chemical recycling methods showing promise. Mechanical recycling involves grinding and reprocessing PU waste into new products, while chemical recycling breaks down PU into its chemical components for reuse. These approaches aim to close the loop in PU lifecycle, reducing waste and conserving resources.

Biodegradable PU formulations are emerging as a potential solution for products with shorter lifespans. These materials are designed to decompose naturally under specific environmental conditions, minimizing their long-term impact on ecosystems. However, balancing biodegradability with performance remains a challenge that researchers are actively addressing.

Water-based PU systems are gaining prominence as environmentally friendly alternatives to solvent-based formulations. These systems reduce volatile organic compound (VOC) emissions during application and curing, contributing to improved air quality and worker safety. The development of high-performance water-based PU coatings and adhesives is expanding their potential applications across various industries.

As sustainability becomes a key driver in material selection, PU manufacturers are increasingly adopting LCA methodologies to guide product development and improvement. This holistic approach enables the identification of hotspots in the PU lifecycle where environmental impacts can be most effectively mitigated. By integrating LCA insights into decision-making processes, the PU industry is poised to make significant strides towards more sustainable and circular production models.

In the production phase, recent advancements focus on reducing the carbon footprint of PU manufacturing processes. Bio-based polyols derived from renewable resources such as vegetable oils are gaining traction as alternatives to petroleum-based raw materials. These bio-based polyols can significantly lower greenhouse gas emissions and decrease dependence on fossil fuels. Additionally, innovative catalysts and processing techniques are being developed to enhance energy efficiency during production.

The use phase of PU products is characterized by their durability and performance. Sustainable PU formulations are being engineered to extend product lifespan, reducing the need for frequent replacements. This is particularly evident in applications such as insulation materials, where improved thermal properties contribute to energy savings in buildings over extended periods.

End-of-life management presents both challenges and opportunities for sustainable PU applications. Recycling technologies for PU products are advancing, with mechanical and chemical recycling methods showing promise. Mechanical recycling involves grinding and reprocessing PU waste into new products, while chemical recycling breaks down PU into its chemical components for reuse. These approaches aim to close the loop in PU lifecycle, reducing waste and conserving resources.

Biodegradable PU formulations are emerging as a potential solution for products with shorter lifespans. These materials are designed to decompose naturally under specific environmental conditions, minimizing their long-term impact on ecosystems. However, balancing biodegradability with performance remains a challenge that researchers are actively addressing.

Water-based PU systems are gaining prominence as environmentally friendly alternatives to solvent-based formulations. These systems reduce volatile organic compound (VOC) emissions during application and curing, contributing to improved air quality and worker safety. The development of high-performance water-based PU coatings and adhesives is expanding their potential applications across various industries.

As sustainability becomes a key driver in material selection, PU manufacturers are increasingly adopting LCA methodologies to guide product development and improvement. This holistic approach enables the identification of hotspots in the PU lifecycle where environmental impacts can be most effectively mitigated. By integrating LCA insights into decision-making processes, the PU industry is poised to make significant strides towards more sustainable and circular production models.

Circular Economy for PU

The circular economy for polyurethane (PU) represents a paradigm shift in the industry, moving away from the traditional linear model of "take-make-dispose" towards a more sustainable approach. This concept aims to maximize resource efficiency, minimize waste, and reduce environmental impact throughout the PU lifecycle. The implementation of circular economy principles in the PU sector involves several key strategies and innovations.

One of the primary focuses is on the development of recyclable and biodegradable PU materials. Researchers are exploring novel chemical structures and formulations that allow for easier decomposition or recycling at the end of the product's life. This includes the use of bio-based polyols derived from renewable resources such as vegetable oils, which can replace petroleum-based components and improve the overall sustainability profile of PU products.

Another crucial aspect of the circular economy for PU is the establishment of efficient collection and recycling systems. This involves creating infrastructure for the recovery of PU waste from various sources, including construction, automotive, and consumer goods sectors. Advanced sorting technologies are being developed to separate different types of PU materials, enabling more effective recycling processes.

Chemical recycling techniques are gaining prominence in the PU circular economy. These methods break down PU materials into their chemical building blocks, which can then be used to produce new PU products with properties comparable to those made from virgin materials. Glycolysis, hydrolysis, and pyrolysis are among the most promising chemical recycling approaches being explored and refined for PU.

The concept of design for circularity is becoming increasingly important in the PU industry. This involves creating products that are inherently easier to disassemble, recycle, or repurpose at the end of their useful life. Manufacturers are incorporating modular designs and using easily separable components to facilitate the recovery and reuse of PU materials.

Collaboration across the value chain is essential for implementing a successful circular economy for PU. This includes partnerships between raw material suppliers, manufacturers, recyclers, and end-users to create closed-loop systems. Such collaborations are driving innovation in areas like material traceability, reverse logistics, and the development of new business models that prioritize product longevity and reuse.

As the circular economy for PU continues to evolve, it is expected to drive significant changes in product design, manufacturing processes, and consumer behavior. The adoption of these principles not only addresses environmental concerns but also presents opportunities for cost reduction and the creation of new revenue streams within the PU industry.

One of the primary focuses is on the development of recyclable and biodegradable PU materials. Researchers are exploring novel chemical structures and formulations that allow for easier decomposition or recycling at the end of the product's life. This includes the use of bio-based polyols derived from renewable resources such as vegetable oils, which can replace petroleum-based components and improve the overall sustainability profile of PU products.

Another crucial aspect of the circular economy for PU is the establishment of efficient collection and recycling systems. This involves creating infrastructure for the recovery of PU waste from various sources, including construction, automotive, and consumer goods sectors. Advanced sorting technologies are being developed to separate different types of PU materials, enabling more effective recycling processes.

Chemical recycling techniques are gaining prominence in the PU circular economy. These methods break down PU materials into their chemical building blocks, which can then be used to produce new PU products with properties comparable to those made from virgin materials. Glycolysis, hydrolysis, and pyrolysis are among the most promising chemical recycling approaches being explored and refined for PU.

The concept of design for circularity is becoming increasingly important in the PU industry. This involves creating products that are inherently easier to disassemble, recycle, or repurpose at the end of their useful life. Manufacturers are incorporating modular designs and using easily separable components to facilitate the recovery and reuse of PU materials.

Collaboration across the value chain is essential for implementing a successful circular economy for PU. This includes partnerships between raw material suppliers, manufacturers, recyclers, and end-users to create closed-loop systems. Such collaborations are driving innovation in areas like material traceability, reverse logistics, and the development of new business models that prioritize product longevity and reuse.

As the circular economy for PU continues to evolve, it is expected to drive significant changes in product design, manufacturing processes, and consumer behavior. The adoption of these principles not only addresses environmental concerns but also presents opportunities for cost reduction and the creation of new revenue streams within the PU industry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!