How to Optimize Polyurethane Formulations for Cost Reduction?

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PU Formulation Evolution

The evolution of polyurethane (PU) formulations has been driven by the constant need for cost reduction and performance improvement. In the early stages of PU development, formulations were relatively simple, consisting primarily of polyols, isocyanates, and basic catalysts. These initial formulations were often costly and limited in their application range.

As the industry progressed, formulators began to explore more complex systems, incorporating a wider variety of raw materials to enhance properties and reduce costs. The introduction of polyether polyols in the 1950s marked a significant milestone, offering a more cost-effective alternative to polyester polyols while maintaining desirable properties.

The 1960s and 1970s saw the development of more sophisticated catalysts and surfactants, allowing for better control over reaction kinetics and cell structure in foam applications. This period also witnessed the emergence of blowing agents as alternatives to chlorofluorocarbons (CFCs), driven by environmental concerns and regulations.

In the 1980s and 1990s, the focus shifted towards optimizing the balance between hard and soft segments in PU formulations. This led to the development of new polyol types, such as polymer polyols and polyester-polyether hybrids, which offered improved mechanical properties and cost-effectiveness.

The turn of the millennium brought increased attention to renewable resources and bio-based materials. Formulators began incorporating natural oil polyols (NOPs) derived from vegetable oils, providing a more sustainable and often cost-competitive alternative to petroleum-based polyols.

Recent years have seen a surge in the use of recycled and recovered materials in PU formulations. Post-consumer recycled (PCR) polyols and isocyanates have gained traction, offering both environmental benefits and potential cost savings. Additionally, advancements in additive technologies have allowed formulators to achieve desired properties with lower overall material costs.

The evolution of PU formulations has also been marked by the development of more efficient processing techniques. Reaction injection molding (RIM), spray application systems, and one-component moisture-cured formulations have all contributed to reducing production costs and expanding the application range of polyurethanes.

Today, the focus on cost reduction in PU formulations continues to drive innovation. Formulators are exploring novel raw materials, such as CO2-based polyols and bio-sourced isocyanates, which promise to further reduce costs while improving sustainability. Advanced computational modeling and high-throughput screening techniques are also being employed to accelerate the development of optimized, cost-effective formulations.

As the industry progressed, formulators began to explore more complex systems, incorporating a wider variety of raw materials to enhance properties and reduce costs. The introduction of polyether polyols in the 1950s marked a significant milestone, offering a more cost-effective alternative to polyester polyols while maintaining desirable properties.

The 1960s and 1970s saw the development of more sophisticated catalysts and surfactants, allowing for better control over reaction kinetics and cell structure in foam applications. This period also witnessed the emergence of blowing agents as alternatives to chlorofluorocarbons (CFCs), driven by environmental concerns and regulations.

In the 1980s and 1990s, the focus shifted towards optimizing the balance between hard and soft segments in PU formulations. This led to the development of new polyol types, such as polymer polyols and polyester-polyether hybrids, which offered improved mechanical properties and cost-effectiveness.

The turn of the millennium brought increased attention to renewable resources and bio-based materials. Formulators began incorporating natural oil polyols (NOPs) derived from vegetable oils, providing a more sustainable and often cost-competitive alternative to petroleum-based polyols.

Recent years have seen a surge in the use of recycled and recovered materials in PU formulations. Post-consumer recycled (PCR) polyols and isocyanates have gained traction, offering both environmental benefits and potential cost savings. Additionally, advancements in additive technologies have allowed formulators to achieve desired properties with lower overall material costs.

The evolution of PU formulations has also been marked by the development of more efficient processing techniques. Reaction injection molding (RIM), spray application systems, and one-component moisture-cured formulations have all contributed to reducing production costs and expanding the application range of polyurethanes.

Today, the focus on cost reduction in PU formulations continues to drive innovation. Formulators are exploring novel raw materials, such as CO2-based polyols and bio-sourced isocyanates, which promise to further reduce costs while improving sustainability. Advanced computational modeling and high-throughput screening techniques are also being employed to accelerate the development of optimized, cost-effective formulations.

Market Demand Analysis

The global polyurethane market has been experiencing steady growth, driven by increasing demand across various industries such as construction, automotive, furniture, and electronics. The market size was valued at approximately $70 billion in 2020 and is projected to reach $90 billion by 2025, with a compound annual growth rate of around 5%. This growth is primarily attributed to the versatility and superior properties of polyurethane materials, including their durability, flexibility, and insulation capabilities.

However, the polyurethane industry faces significant challenges related to raw material costs and price volatility. The two main components of polyurethane, polyols and isocyanates, are derived from petroleum-based feedstocks, making them susceptible to fluctuations in oil prices. This has created a strong market demand for cost-effective polyurethane formulations that can maintain or improve product performance while reducing overall production expenses.

The construction sector represents the largest end-use market for polyurethane, accounting for approximately 30% of total consumption. In this sector, there is a growing demand for energy-efficient building materials, driving the need for optimized polyurethane formulations in insulation products. The automotive industry, the second-largest consumer of polyurethane, is seeking lightweight materials to improve fuel efficiency and reduce emissions, creating opportunities for cost-effective polyurethane solutions in vehicle components.

Emerging trends in the market include a shift towards bio-based and recycled polyurethane materials, driven by increasing environmental concerns and regulatory pressures. This trend aligns with the need for cost reduction, as bio-based alternatives can potentially offer more stable pricing compared to petroleum-based raw materials. Additionally, there is a growing demand for water-based polyurethane systems, which can reduce volatile organic compound (VOC) emissions and potentially lower production costs.

The Asia-Pacific region dominates the global polyurethane market, accounting for over 40% of total consumption. This region also presents the highest growth potential, driven by rapid industrialization, urbanization, and increasing disposable incomes in countries like China and India. North America and Europe follow as significant markets, with a focus on high-performance and specialized polyurethane applications.

In conclusion, the market demand for optimized polyurethane formulations that can reduce costs while maintaining or improving performance is strong and growing. This demand is driven by the need to mitigate raw material price volatility, meet stringent regulatory requirements, and address the evolving needs of key end-use industries. Manufacturers who can successfully develop cost-effective formulations while addressing sustainability concerns are likely to gain a significant competitive advantage in this dynamic market landscape.

However, the polyurethane industry faces significant challenges related to raw material costs and price volatility. The two main components of polyurethane, polyols and isocyanates, are derived from petroleum-based feedstocks, making them susceptible to fluctuations in oil prices. This has created a strong market demand for cost-effective polyurethane formulations that can maintain or improve product performance while reducing overall production expenses.

The construction sector represents the largest end-use market for polyurethane, accounting for approximately 30% of total consumption. In this sector, there is a growing demand for energy-efficient building materials, driving the need for optimized polyurethane formulations in insulation products. The automotive industry, the second-largest consumer of polyurethane, is seeking lightweight materials to improve fuel efficiency and reduce emissions, creating opportunities for cost-effective polyurethane solutions in vehicle components.

Emerging trends in the market include a shift towards bio-based and recycled polyurethane materials, driven by increasing environmental concerns and regulatory pressures. This trend aligns with the need for cost reduction, as bio-based alternatives can potentially offer more stable pricing compared to petroleum-based raw materials. Additionally, there is a growing demand for water-based polyurethane systems, which can reduce volatile organic compound (VOC) emissions and potentially lower production costs.

The Asia-Pacific region dominates the global polyurethane market, accounting for over 40% of total consumption. This region also presents the highest growth potential, driven by rapid industrialization, urbanization, and increasing disposable incomes in countries like China and India. North America and Europe follow as significant markets, with a focus on high-performance and specialized polyurethane applications.

In conclusion, the market demand for optimized polyurethane formulations that can reduce costs while maintaining or improving performance is strong and growing. This demand is driven by the need to mitigate raw material price volatility, meet stringent regulatory requirements, and address the evolving needs of key end-use industries. Manufacturers who can successfully develop cost-effective formulations while addressing sustainability concerns are likely to gain a significant competitive advantage in this dynamic market landscape.

Current PU Challenges

The polyurethane (PU) industry currently faces several significant challenges in its pursuit of cost reduction and optimization. One of the primary issues is the volatility of raw material prices, particularly for isocyanates and polyols, which are the main components of PU formulations. These price fluctuations can significantly impact production costs and make long-term planning difficult for manufacturers.

Another major challenge is the increasing regulatory pressure on certain chemicals used in PU production. Environmental and health concerns have led to restrictions on some additives and blowing agents, forcing manufacturers to seek alternatives that may be more expensive or less effective. This regulatory landscape is constantly evolving, requiring continuous adaptation and reformulation efforts.

Energy consumption during PU production and processing is also a significant cost factor. The industry is grappling with the need to develop more energy-efficient processes without compromising product quality or production speed. This challenge is particularly acute in the production of foam products, where curing and shaping processes can be energy-intensive.

The demand for customized PU formulations across various industries presents another hurdle. While customization can lead to higher-value products, it also increases complexity in production and inventory management, potentially driving up costs. Balancing the need for specialized formulations with cost-effective production processes remains a key challenge.

Waste reduction and recycling present both challenges and opportunities for cost optimization. The cross-linked nature of PU makes it difficult to recycle, and the industry is still working on developing economically viable recycling technologies. Minimizing production waste and finding ways to reuse or repurpose PU materials could significantly impact overall costs.

Quality control is another critical area where challenges persist. Ensuring consistent product quality while implementing cost-saving measures requires sophisticated monitoring and control systems. The investment in such systems can be substantial, but is often necessary to maintain product integrity and customer satisfaction.

Lastly, the industry faces challenges in scaling up new technologies and formulations. Innovations that show promise in laboratory settings may encounter unforeseen difficulties when implemented at industrial scales. This scaling issue can lead to unexpected costs and delays in bringing optimized formulations to market.

Another major challenge is the increasing regulatory pressure on certain chemicals used in PU production. Environmental and health concerns have led to restrictions on some additives and blowing agents, forcing manufacturers to seek alternatives that may be more expensive or less effective. This regulatory landscape is constantly evolving, requiring continuous adaptation and reformulation efforts.

Energy consumption during PU production and processing is also a significant cost factor. The industry is grappling with the need to develop more energy-efficient processes without compromising product quality or production speed. This challenge is particularly acute in the production of foam products, where curing and shaping processes can be energy-intensive.

The demand for customized PU formulations across various industries presents another hurdle. While customization can lead to higher-value products, it also increases complexity in production and inventory management, potentially driving up costs. Balancing the need for specialized formulations with cost-effective production processes remains a key challenge.

Waste reduction and recycling present both challenges and opportunities for cost optimization. The cross-linked nature of PU makes it difficult to recycle, and the industry is still working on developing economically viable recycling technologies. Minimizing production waste and finding ways to reuse or repurpose PU materials could significantly impact overall costs.

Quality control is another critical area where challenges persist. Ensuring consistent product quality while implementing cost-saving measures requires sophisticated monitoring and control systems. The investment in such systems can be substantial, but is often necessary to maintain product integrity and customer satisfaction.

Lastly, the industry faces challenges in scaling up new technologies and formulations. Innovations that show promise in laboratory settings may encounter unforeseen difficulties when implemented at industrial scales. This scaling issue can lead to unexpected costs and delays in bringing optimized formulations to market.

Cost-Effective Solutions

01 Cost-effective polyurethane formulations

Developing cost-effective polyurethane formulations involves optimizing raw material selection, processing methods, and production techniques. This can include using alternative, less expensive components or improving manufacturing efficiency to reduce overall costs while maintaining desired properties.- Cost-effective polyurethane formulations: Developing cost-effective polyurethane formulations involves optimizing raw material selection, processing methods, and production techniques. This can include using alternative, less expensive components or improving manufacturing efficiency to reduce overall costs while maintaining desired properties.

- Sustainable and bio-based polyurethane formulations: Incorporating sustainable and bio-based materials in polyurethane formulations can potentially reduce costs while improving environmental impact. This approach involves using renewable resources and developing eco-friendly production processes, which may lead to long-term cost savings and market advantages.

- Polyurethane formulation optimization for specific applications: Tailoring polyurethane formulations for specific applications can help optimize costs by focusing on essential properties and eliminating unnecessary components. This approach involves careful selection of raw materials and additives to achieve the desired performance at the lowest possible cost.

- Recycling and reuse of polyurethane materials: Implementing recycling and reuse strategies for polyurethane materials can significantly reduce overall costs. This includes developing methods for breaking down and repurposing used polyurethane products, as well as incorporating recycled content into new formulations.

- Advanced manufacturing techniques for polyurethane production: Utilizing advanced manufacturing techniques, such as automation, continuous processing, and precision mixing, can help reduce production costs for polyurethane formulations. These methods can improve efficiency, reduce waste, and enhance product consistency, leading to overall cost savings.

02 Sustainable and bio-based polyurethane formulations

Incorporating sustainable and bio-based materials in polyurethane formulations can potentially reduce costs while improving environmental impact. This approach involves using renewable resources and developing new synthesis methods to create more economical and eco-friendly polyurethane products.Expand Specific Solutions03 Recycling and reprocessing of polyurethane materials

Implementing recycling and reprocessing techniques for polyurethane materials can significantly reduce raw material costs and waste. This involves developing methods to break down and reuse polyurethane waste in new formulations, creating a more circular and cost-effective production cycle.Expand Specific Solutions04 Optimizing polyurethane foam formulations

Improving polyurethane foam formulations can lead to cost savings through reduced material usage and enhanced performance. This includes developing new blowing agents, optimizing catalyst systems, and fine-tuning the balance of components to achieve desired properties at lower overall costs.Expand Specific Solutions05 Additive manufacturing for polyurethane products

Utilizing additive manufacturing techniques, such as 3D printing, for polyurethane products can potentially reduce production costs. This approach allows for more efficient use of materials, customization of products, and reduction in tooling expenses, leading to overall cost savings in polyurethane formulation and production.Expand Specific Solutions

Key PU Industry Players

The polyurethane formulation optimization market is in a mature stage, with a global market size exceeding $50 billion. Major players like BASF, Covestro, Dow, and Evonik dominate the industry, leveraging advanced R&D capabilities to develop cost-effective solutions. These companies are focusing on bio-based raw materials and recycling technologies to address sustainability concerns. Emerging players such as Jiangsu Hengli Chemical Fiber and Zhejiang Huafon New Materials are gaining traction by offering specialized formulations for niche applications. The technology maturity varies across different segments, with continuous innovations in areas like low-density foams and high-performance coatings driving market growth and cost reduction efforts.

BASF Corp.

Technical Solution: BASF has developed a novel approach to optimize polyurethane formulations for cost reduction. Their method involves using a combination of bio-based polyols and advanced catalysts to reduce the overall raw material costs. The company has also implemented a proprietary mixing technology that ensures uniform distribution of components, leading to improved product quality and reduced waste. Additionally, BASF has introduced a range of low-density fillers that can be incorporated into polyurethane formulations without compromising performance, further reducing material costs.

Strengths: Extensive R&D capabilities, wide range of raw materials, and global presence. Weaknesses: Higher initial investment costs for new technologies and potential resistance to change from traditional formulations.

Covestro Deutschland AG

Technical Solution: Covestro has developed a cost-effective polyurethane optimization strategy focusing on process efficiency and raw material selection. Their approach includes the use of CO2-based polyols, which reduces the reliance on petroleum-based raw materials. They have also implemented advanced process control systems that optimize reaction conditions, reducing energy consumption and improving yield. Covestro's formulation experts have developed algorithms to predict and fine-tune material properties, allowing for rapid prototyping and reduced development time.

Strengths: Innovative use of CO2 technology, strong focus on sustainability, and advanced process control. Weaknesses: Limited availability of CO2-based polyols and potential higher costs for specialized equipment.

Innovative PU Patents

Container modifications to minimize defects during reactive polyurethane flow

PatentActiveUS20160207231A1

Innovation

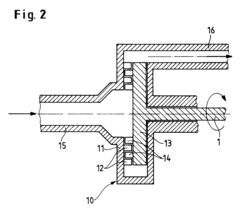

- Modifying the inner surface of containers or using a liner with profiling features or a mesh to reduce shear forces, increasing the surface area contact and altering flow dynamics, thereby minimizing voids in the formed polyurethane.

Process for the glycolytic decomposition of polyurethane plastics

PatentInactiveEP0714930A2

Innovation

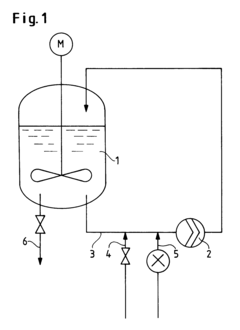

- A process involving high-speed mixing and comminution using a rotor-stator pump to generate high shear forces, processing polyurethane plastics with low molecular weight compounds containing isocyanate-reactive hydrogen atoms in a weight ratio of 2:1 to 5:1, at temperatures from 100 to 220°C, to achieve rapid and efficient decomposition and recycling.

Raw Material Sourcing

Raw material sourcing plays a crucial role in optimizing polyurethane formulations for cost reduction. The selection and procurement of raw materials significantly impact the overall production costs and final product quality. To achieve cost-effective sourcing, manufacturers must consider various factors and implement strategic approaches.

One key aspect of raw material sourcing is diversifying suppliers. By establishing relationships with multiple suppliers, manufacturers can mitigate supply chain risks and negotiate better prices. This approach also allows for greater flexibility in sourcing, enabling companies to adapt to market fluctuations and take advantage of competitive pricing.

Quality control is paramount in raw material sourcing. Implementing rigorous quality assurance processes ensures that the materials meet the required specifications, reducing the likelihood of production issues and waste. Regular supplier audits and material testing can help maintain consistent quality standards while identifying opportunities for cost savings.

Bulk purchasing and long-term contracts are effective strategies for reducing raw material costs. By committing to larger volumes or extended supply agreements, manufacturers can often secure more favorable pricing and terms. However, it is essential to balance these commitments with market demand forecasts to avoid excess inventory and associated carrying costs.

Exploring alternative raw materials and formulations can lead to significant cost reductions. This may involve substituting expensive components with more affordable alternatives or optimizing the ratio of ingredients without compromising product performance. Collaboration between procurement, research and development, and production teams is crucial for identifying and implementing these cost-saving opportunities.

Leveraging technology in the sourcing process can enhance efficiency and reduce costs. Implementing digital procurement platforms and analytics tools can streamline supplier management, improve forecasting accuracy, and identify cost-saving opportunities. These technologies can also facilitate real-time monitoring of market trends and price fluctuations, enabling more informed purchasing decisions.

Sustainable sourcing practices can contribute to long-term cost reduction. While initially more expensive, environmentally friendly raw materials may offer benefits such as improved product performance, reduced waste, and enhanced brand reputation. Additionally, sustainable sourcing can help mitigate future risks associated with environmental regulations and resource scarcity.

Vertical integration or strategic partnerships with raw material suppliers can provide greater control over the supply chain and potentially reduce costs. This approach may involve investing in production capabilities for key raw materials or collaborating closely with suppliers to develop custom formulations that optimize both performance and cost.

In conclusion, optimizing raw material sourcing for polyurethane formulations requires a multifaceted approach that balances cost reduction with quality, sustainability, and supply chain resilience. By implementing these strategies, manufacturers can achieve significant cost savings while maintaining or improving product performance and market competitiveness.

One key aspect of raw material sourcing is diversifying suppliers. By establishing relationships with multiple suppliers, manufacturers can mitigate supply chain risks and negotiate better prices. This approach also allows for greater flexibility in sourcing, enabling companies to adapt to market fluctuations and take advantage of competitive pricing.

Quality control is paramount in raw material sourcing. Implementing rigorous quality assurance processes ensures that the materials meet the required specifications, reducing the likelihood of production issues and waste. Regular supplier audits and material testing can help maintain consistent quality standards while identifying opportunities for cost savings.

Bulk purchasing and long-term contracts are effective strategies for reducing raw material costs. By committing to larger volumes or extended supply agreements, manufacturers can often secure more favorable pricing and terms. However, it is essential to balance these commitments with market demand forecasts to avoid excess inventory and associated carrying costs.

Exploring alternative raw materials and formulations can lead to significant cost reductions. This may involve substituting expensive components with more affordable alternatives or optimizing the ratio of ingredients without compromising product performance. Collaboration between procurement, research and development, and production teams is crucial for identifying and implementing these cost-saving opportunities.

Leveraging technology in the sourcing process can enhance efficiency and reduce costs. Implementing digital procurement platforms and analytics tools can streamline supplier management, improve forecasting accuracy, and identify cost-saving opportunities. These technologies can also facilitate real-time monitoring of market trends and price fluctuations, enabling more informed purchasing decisions.

Sustainable sourcing practices can contribute to long-term cost reduction. While initially more expensive, environmentally friendly raw materials may offer benefits such as improved product performance, reduced waste, and enhanced brand reputation. Additionally, sustainable sourcing can help mitigate future risks associated with environmental regulations and resource scarcity.

Vertical integration or strategic partnerships with raw material suppliers can provide greater control over the supply chain and potentially reduce costs. This approach may involve investing in production capabilities for key raw materials or collaborating closely with suppliers to develop custom formulations that optimize both performance and cost.

In conclusion, optimizing raw material sourcing for polyurethane formulations requires a multifaceted approach that balances cost reduction with quality, sustainability, and supply chain resilience. By implementing these strategies, manufacturers can achieve significant cost savings while maintaining or improving product performance and market competitiveness.

Sustainability in PU

Sustainability has become a crucial aspect in the polyurethane (PU) industry, driven by increasing environmental concerns and regulatory pressures. As manufacturers seek to optimize PU formulations for cost reduction, integrating sustainable practices has emerged as a key strategy. This approach not only addresses environmental issues but also offers potential cost savings through improved resource efficiency and waste reduction.

One of the primary focus areas for sustainability in PU is the development of bio-based polyols. These renewable alternatives to petroleum-based polyols can be derived from various natural sources such as vegetable oils, lignin, and cellulose. By incorporating bio-based polyols into PU formulations, manufacturers can reduce their reliance on fossil fuels and potentially lower raw material costs, especially as economies of scale improve for these sustainable alternatives.

Another significant trend is the use of recycled and reclaimed materials in PU production. Post-consumer and post-industrial PU waste can be chemically or mechanically recycled to produce polyols for new PU formulations. This circular economy approach not only reduces waste but also offers a cost-effective source of raw materials, contributing to overall cost reduction in PU manufacturing.

Water-based PU systems have gained traction as a more environmentally friendly alternative to solvent-based systems. These formulations reduce volatile organic compound (VOC) emissions and improve workplace safety. While initial costs may be higher, the long-term benefits include reduced regulatory compliance costs and improved sustainability profiles, which can lead to cost savings and increased market competitiveness.

Energy efficiency in PU production processes is another key area for sustainable cost reduction. Implementing advanced process control systems, optimizing reaction conditions, and utilizing energy-efficient equipment can significantly reduce energy consumption and associated costs. Additionally, the development of low-temperature curing PU systems can further decrease energy requirements in manufacturing processes.

Lastly, the adoption of life cycle assessment (LCA) methodologies in PU formulation development enables manufacturers to evaluate the environmental impact of their products from cradle to grave. This holistic approach helps identify opportunities for sustainability improvements and cost reductions throughout the product lifecycle, from raw material selection to end-of-life management.

By integrating these sustainable practices into PU formulation optimization, manufacturers can achieve both environmental and economic benefits. The synergy between sustainability and cost reduction in PU production demonstrates that environmental responsibility and financial performance can be mutually reinforcing objectives in the modern chemical industry.

One of the primary focus areas for sustainability in PU is the development of bio-based polyols. These renewable alternatives to petroleum-based polyols can be derived from various natural sources such as vegetable oils, lignin, and cellulose. By incorporating bio-based polyols into PU formulations, manufacturers can reduce their reliance on fossil fuels and potentially lower raw material costs, especially as economies of scale improve for these sustainable alternatives.

Another significant trend is the use of recycled and reclaimed materials in PU production. Post-consumer and post-industrial PU waste can be chemically or mechanically recycled to produce polyols for new PU formulations. This circular economy approach not only reduces waste but also offers a cost-effective source of raw materials, contributing to overall cost reduction in PU manufacturing.

Water-based PU systems have gained traction as a more environmentally friendly alternative to solvent-based systems. These formulations reduce volatile organic compound (VOC) emissions and improve workplace safety. While initial costs may be higher, the long-term benefits include reduced regulatory compliance costs and improved sustainability profiles, which can lead to cost savings and increased market competitiveness.

Energy efficiency in PU production processes is another key area for sustainable cost reduction. Implementing advanced process control systems, optimizing reaction conditions, and utilizing energy-efficient equipment can significantly reduce energy consumption and associated costs. Additionally, the development of low-temperature curing PU systems can further decrease energy requirements in manufacturing processes.

Lastly, the adoption of life cycle assessment (LCA) methodologies in PU formulation development enables manufacturers to evaluate the environmental impact of their products from cradle to grave. This holistic approach helps identify opportunities for sustainability improvements and cost reductions throughout the product lifecycle, from raw material selection to end-of-life management.

By integrating these sustainable practices into PU formulation optimization, manufacturers can achieve both environmental and economic benefits. The synergy between sustainability and cost reduction in PU production demonstrates that environmental responsibility and financial performance can be mutually reinforcing objectives in the modern chemical industry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!