Polyurethane Industry Trends: Driving Sustainable Growth

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PU Industry Evolution

The polyurethane (PU) industry has undergone significant evolution since its inception in the 1930s. Initially developed as a substitute for rubber, PU has grown into a versatile material with applications across numerous sectors. The industry's trajectory has been marked by continuous innovation and adaptation to changing market demands and environmental concerns.

In the early stages, PU was primarily used in coatings and adhesives. The 1950s and 1960s saw rapid expansion as new formulations and processing techniques were developed, leading to the widespread use of PU in flexible and rigid foams. This period laid the foundation for PU's dominance in insulation, furniture, and automotive applications.

The 1970s and 1980s brought increased focus on environmental and health concerns, prompting the industry to develop safer production methods and more sustainable formulations. This era saw the phasing out of chlorofluorocarbons (CFCs) as blowing agents and the introduction of water-blown foams, marking a significant shift towards more environmentally friendly practices.

The 1990s and early 2000s were characterized by globalization and consolidation within the industry. Major chemical companies expanded their PU operations globally, particularly in emerging markets. This period also saw advancements in high-performance PU materials, including thermoplastic polyurethanes (TPUs) and bio-based polyols, broadening the material's application scope.

In recent years, the PU industry has been at the forefront of sustainable innovation. The development of bio-based and recycled content polyols has gained momentum, driven by increasing environmental awareness and regulatory pressures. Additionally, advancements in recycling technologies for PU products are addressing end-of-life concerns and promoting circular economy principles.

The digital transformation has also impacted the PU industry, with the integration of smart manufacturing processes and the use of data analytics for product development and quality control. This has led to improved efficiency and customization capabilities, allowing manufacturers to meet increasingly specific customer requirements.

Looking ahead, the PU industry is poised for further evolution. Key trends shaping its future include the continued push for sustainability, the development of novel applications in emerging sectors such as 3D printing and wearable technology, and the ongoing refinement of PU formulations to enhance performance characteristics. The industry's ability to adapt to these trends while addressing environmental challenges will be crucial in driving sustainable growth and maintaining its position as a key player in the global materials market.

In the early stages, PU was primarily used in coatings and adhesives. The 1950s and 1960s saw rapid expansion as new formulations and processing techniques were developed, leading to the widespread use of PU in flexible and rigid foams. This period laid the foundation for PU's dominance in insulation, furniture, and automotive applications.

The 1970s and 1980s brought increased focus on environmental and health concerns, prompting the industry to develop safer production methods and more sustainable formulations. This era saw the phasing out of chlorofluorocarbons (CFCs) as blowing agents and the introduction of water-blown foams, marking a significant shift towards more environmentally friendly practices.

The 1990s and early 2000s were characterized by globalization and consolidation within the industry. Major chemical companies expanded their PU operations globally, particularly in emerging markets. This period also saw advancements in high-performance PU materials, including thermoplastic polyurethanes (TPUs) and bio-based polyols, broadening the material's application scope.

In recent years, the PU industry has been at the forefront of sustainable innovation. The development of bio-based and recycled content polyols has gained momentum, driven by increasing environmental awareness and regulatory pressures. Additionally, advancements in recycling technologies for PU products are addressing end-of-life concerns and promoting circular economy principles.

The digital transformation has also impacted the PU industry, with the integration of smart manufacturing processes and the use of data analytics for product development and quality control. This has led to improved efficiency and customization capabilities, allowing manufacturers to meet increasingly specific customer requirements.

Looking ahead, the PU industry is poised for further evolution. Key trends shaping its future include the continued push for sustainability, the development of novel applications in emerging sectors such as 3D printing and wearable technology, and the ongoing refinement of PU formulations to enhance performance characteristics. The industry's ability to adapt to these trends while addressing environmental challenges will be crucial in driving sustainable growth and maintaining its position as a key player in the global materials market.

Market Demand Analysis

The polyurethane industry has experienced significant growth in recent years, driven by increasing demand across various sectors. The global polyurethane market is projected to expand steadily, with a compound annual growth rate (CAGR) of around 5% over the next five years. This growth is primarily fueled by the versatility and superior properties of polyurethane materials, which find applications in construction, automotive, furniture, and electronics industries.

In the construction sector, polyurethane-based insulation materials are gaining traction due to their excellent thermal insulation properties and energy efficiency benefits. As governments worldwide implement stricter building energy codes and regulations, the demand for high-performance insulation materials is expected to rise, further boosting the polyurethane market.

The automotive industry represents another significant driver of polyurethane demand. With the increasing focus on lightweight materials to improve fuel efficiency and reduce emissions, polyurethane components are becoming more prevalent in vehicle manufacturing. From seat cushions and headrests to bumpers and interior trim, polyurethane's ability to combine comfort, durability, and weight reduction makes it an attractive choice for automakers.

The furniture industry continues to be a major consumer of polyurethane foam, particularly in mattresses and upholstered furniture. As consumer preferences shift towards more comfortable and ergonomic designs, the demand for high-quality polyurethane foam is expected to grow. Additionally, the rise of e-commerce and bed-in-a-box concepts has further accelerated the adoption of polyurethane foam in the mattress industry.

In the electronics sector, polyurethane's excellent electrical insulation properties and ability to protect sensitive components from moisture and environmental factors drive its increasing use in electronic encapsulation and potting applications. The rapid growth of the electronics industry, particularly in emerging markets, is expected to contribute significantly to the overall demand for polyurethane.

Sustainability concerns are shaping market dynamics, with growing interest in bio-based and recycled polyurethanes. Consumers and regulatory bodies are pushing for more environmentally friendly alternatives, driving innovation in the industry. Manufacturers are investing in research and development to create sustainable polyurethane products, which is likely to open new market opportunities and drive long-term growth.

However, challenges such as volatile raw material prices and environmental concerns regarding the use of certain chemicals in polyurethane production may impact market growth. The industry is responding by developing new formulations and production processes that address these issues, aiming to ensure sustainable growth in the long term.

In the construction sector, polyurethane-based insulation materials are gaining traction due to their excellent thermal insulation properties and energy efficiency benefits. As governments worldwide implement stricter building energy codes and regulations, the demand for high-performance insulation materials is expected to rise, further boosting the polyurethane market.

The automotive industry represents another significant driver of polyurethane demand. With the increasing focus on lightweight materials to improve fuel efficiency and reduce emissions, polyurethane components are becoming more prevalent in vehicle manufacturing. From seat cushions and headrests to bumpers and interior trim, polyurethane's ability to combine comfort, durability, and weight reduction makes it an attractive choice for automakers.

The furniture industry continues to be a major consumer of polyurethane foam, particularly in mattresses and upholstered furniture. As consumer preferences shift towards more comfortable and ergonomic designs, the demand for high-quality polyurethane foam is expected to grow. Additionally, the rise of e-commerce and bed-in-a-box concepts has further accelerated the adoption of polyurethane foam in the mattress industry.

In the electronics sector, polyurethane's excellent electrical insulation properties and ability to protect sensitive components from moisture and environmental factors drive its increasing use in electronic encapsulation and potting applications. The rapid growth of the electronics industry, particularly in emerging markets, is expected to contribute significantly to the overall demand for polyurethane.

Sustainability concerns are shaping market dynamics, with growing interest in bio-based and recycled polyurethanes. Consumers and regulatory bodies are pushing for more environmentally friendly alternatives, driving innovation in the industry. Manufacturers are investing in research and development to create sustainable polyurethane products, which is likely to open new market opportunities and drive long-term growth.

However, challenges such as volatile raw material prices and environmental concerns regarding the use of certain chemicals in polyurethane production may impact market growth. The industry is responding by developing new formulations and production processes that address these issues, aiming to ensure sustainable growth in the long term.

Technical Challenges

The polyurethane industry faces several significant technical challenges as it strives to drive sustainable growth. One of the primary concerns is the reliance on fossil fuel-based raw materials, particularly polyols and isocyanates. This dependence not only contributes to environmental issues but also exposes the industry to price volatility and supply chain disruptions. Developing bio-based alternatives that can match or exceed the performance of traditional polyurethanes remains a complex technical hurdle.

Another critical challenge lies in improving the recyclability and biodegradability of polyurethane products. The cross-linked structure of many polyurethanes makes them difficult to break down and reprocess, leading to significant waste and environmental impact. Researchers are grappling with the task of designing polyurethanes that maintain their desirable properties while being easier to recycle or biodegrade at the end of their lifecycle.

Energy efficiency in the production process presents another technical obstacle. The synthesis of polyurethanes often requires high temperatures and pressures, resulting in substantial energy consumption. Developing catalysts and processes that can operate under milder conditions without compromising product quality is an ongoing challenge for the industry.

The reduction of volatile organic compounds (VOCs) and other harmful emissions during production and application of polyurethanes is also a pressing issue. This is particularly relevant in sectors such as construction and automotive, where large volumes of polyurethane-based products are used. Formulating low-VOC or VOC-free polyurethanes that maintain the required performance characteristics demands significant research and development efforts.

Furthermore, the industry faces challenges in enhancing the fire resistance of polyurethane products without resorting to halogenated flame retardants, which have raised environmental and health concerns. Developing effective, environmentally friendly flame retardants that do not compromise the material's other properties is a complex technical problem.

Lastly, the integration of smart and responsive properties into polyurethanes represents both an opportunity and a challenge. Creating polyurethanes that can self-heal, change shape, or respond to environmental stimuli requires innovative approaches in polymer chemistry and material science. These advanced functionalities could open new applications but present significant technical hurdles in terms of design, production, and scalability.

Another critical challenge lies in improving the recyclability and biodegradability of polyurethane products. The cross-linked structure of many polyurethanes makes them difficult to break down and reprocess, leading to significant waste and environmental impact. Researchers are grappling with the task of designing polyurethanes that maintain their desirable properties while being easier to recycle or biodegrade at the end of their lifecycle.

Energy efficiency in the production process presents another technical obstacle. The synthesis of polyurethanes often requires high temperatures and pressures, resulting in substantial energy consumption. Developing catalysts and processes that can operate under milder conditions without compromising product quality is an ongoing challenge for the industry.

The reduction of volatile organic compounds (VOCs) and other harmful emissions during production and application of polyurethanes is also a pressing issue. This is particularly relevant in sectors such as construction and automotive, where large volumes of polyurethane-based products are used. Formulating low-VOC or VOC-free polyurethanes that maintain the required performance characteristics demands significant research and development efforts.

Furthermore, the industry faces challenges in enhancing the fire resistance of polyurethane products without resorting to halogenated flame retardants, which have raised environmental and health concerns. Developing effective, environmentally friendly flame retardants that do not compromise the material's other properties is a complex technical problem.

Lastly, the integration of smart and responsive properties into polyurethanes represents both an opportunity and a challenge. Creating polyurethanes that can self-heal, change shape, or respond to environmental stimuli requires innovative approaches in polymer chemistry and material science. These advanced functionalities could open new applications but present significant technical hurdles in terms of design, production, and scalability.

Current PU Solutions

01 Bio-based polyurethane materials

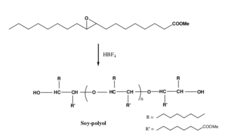

Development of sustainable polyurethane materials using bio-based raw materials, such as plant-derived polyols or isocyanates. This approach reduces dependence on fossil fuels and decreases the carbon footprint of polyurethane production, contributing to more environmentally friendly and renewable solutions.- Bio-based polyurethane materials: Development of sustainable polyurethane materials using bio-based raw materials, such as plant-derived polyols or isocyanates. These materials aim to reduce dependence on fossil fuels and decrease the carbon footprint of polyurethane production.

- Recycling and upcycling of polyurethane waste: Innovative methods for recycling and upcycling polyurethane waste, including chemical and mechanical processes. These techniques aim to reduce landfill waste and create a circular economy for polyurethane products.

- Energy-efficient polyurethane production: Development of energy-efficient processes for polyurethane production, including improved catalysts, reaction conditions, and manufacturing techniques. These advancements aim to reduce energy consumption and greenhouse gas emissions in the production process.

- Polyurethane with enhanced durability and performance: Creation of polyurethane materials with improved durability, weather resistance, and overall performance. These advancements aim to extend the lifespan of polyurethane products, reducing the need for frequent replacements and promoting sustainability.

- Water-based and solvent-free polyurethane systems: Development of water-based and solvent-free polyurethane systems to reduce volatile organic compound (VOC) emissions and improve environmental friendliness. These systems aim to minimize the use of harmful solvents while maintaining or enhancing product performance.

02 Recycling and upcycling of polyurethane waste

Implementation of innovative recycling and upcycling techniques for polyurethane waste, including chemical and mechanical recycling methods. These processes aim to reduce landfill waste and create a circular economy for polyurethane materials, promoting sustainable growth in the industry.Expand Specific Solutions03 Energy-efficient polyurethane production

Development of energy-efficient manufacturing processes for polyurethane production, including optimized reaction conditions, improved catalysts, and advanced equipment designs. These innovations reduce energy consumption and greenhouse gas emissions, contributing to the sustainable growth of the polyurethane industry.Expand Specific Solutions04 Water-based and solvent-free polyurethane systems

Formulation of water-based and solvent-free polyurethane systems to reduce volatile organic compound (VOC) emissions and improve worker safety. These environmentally friendly alternatives contribute to sustainable growth by minimizing the use of harmful chemicals and reducing air pollution.Expand Specific Solutions05 Polyurethane with enhanced durability and performance

Development of polyurethane materials with improved durability, weather resistance, and overall performance. These advancements extend the lifespan of polyurethane products, reducing the need for frequent replacements and contributing to sustainable growth through resource conservation and waste reduction.Expand Specific Solutions

Key Industry Players

The polyurethane industry is experiencing a transformative phase, driven by the demand for sustainable solutions. The market is in a growth stage, with an expanding global market size due to increasing applications in construction, automotive, and consumer goods sectors. Technological maturity varies across different segments, with bio-based polyurethanes emerging as a key focus area. Companies like BASF Corp., Covestro Deutschland AG, and Dow Global Technologies LLC are at the forefront of developing eco-friendly polyurethane technologies. Evonik Operations GmbH and Mitsui Chemicals, Inc. are investing in innovative production processes to reduce environmental impact. The competitive landscape is characterized by a mix of established players and new entrants, with collaborations between industry and research institutions like Zhejiang University and the University of California driving technological advancements in sustainable polyurethane solutions.

BASF Corp.

Technical Solution: BASF has developed a range of bio-based polyurethanes derived from renewable raw materials. Their Elastollan® ECO series incorporates polyols made from castor oil, reducing the carbon footprint of the final product. They have also introduced water-based polyurethane dispersions that significantly lower VOC emissions. BASF's latest innovation includes recyclable thermoplastic polyurethanes (TPUs) designed for a circular economy, allowing for easier material recovery and reuse.

Strengths: Strong R&D capabilities, wide product portfolio, and global presence. Weaknesses: High dependence on petrochemical feedstocks for some products, potential regulatory challenges in certain markets.

Dow Global Technologies LLC

Technical Solution: Dow has developed VORASTAR™ 7000, a novel polyurethane elastomer system that combines high performance with sustainability. This system uses bio-based content and offers improved abrasion resistance and durability. Dow has also introduced AQUACHILL™, a water-based polyurethane coating for textiles that provides cooling properties while reducing environmental impact. Their VORALAST™ H2 polyurethane foam systems incorporate recycled content and are designed for automotive applications, promoting circular economy principles.

Strengths: Innovative product development, strong focus on sustainability, extensive industry partnerships. Weaknesses: Complex supply chain management, potential cost implications of sustainable raw materials.

Innovative PU Tech

Bio-based polyurethane dispersion compositions and methods

PatentActiveUS20120214938A1

Innovation

- The development of water-dispersible polyurethane polymers incorporating hydrophobic oligomeric polyether soft segments derived from epoxidized vegetable oil fatty acid esters, combined with hydrophilic hard segments and chain extending hard segments, to create a bio-based polymer with up to 70% carbon content, offering enhanced mechanical and chemical resistance.

Solvent-free polyurethane-polymer-hybrid-dispersion and use thereof

PatentInactiveEP1228113A1

Innovation

- A solvent-free polyurethane-polyurethane polymer dispersion is developed through a multi-stage process involving the production of a polyurethane base dispersion, followed by chain extension and radical polymerization within the micelles, achieving high solids content and excellent mechanical properties without the need for solvents.

Environmental Impact

The environmental impact of the polyurethane industry has become a critical concern as the sector strives for sustainable growth. Traditional polyurethane production processes have been associated with significant environmental challenges, including high energy consumption, greenhouse gas emissions, and the use of potentially harmful chemicals. However, recent trends indicate a shift towards more sustainable practices and eco-friendly alternatives.

One of the primary environmental issues facing the polyurethane industry is the use of fossil fuel-based raw materials. The production of polyols and isocyanates, key components in polyurethane manufacturing, typically relies on petroleum-derived feedstocks. This dependence contributes to carbon emissions and resource depletion. In response, the industry is increasingly exploring bio-based alternatives, such as plant-derived polyols, which can reduce the carbon footprint of polyurethane products.

Energy consumption during production is another significant environmental factor. Polyurethane manufacturing processes often require high temperatures and pressures, leading to substantial energy use and associated emissions. To address this, companies are investing in energy-efficient technologies and process optimizations. Advanced heat recovery systems, improved insulation, and the integration of renewable energy sources are being implemented to reduce overall energy consumption and minimize environmental impact.

The end-of-life management of polyurethane products presents additional environmental challenges. Many polyurethane materials are not easily biodegradable and can persist in the environment for extended periods. To tackle this issue, the industry is focusing on developing more recyclable and biodegradable polyurethane formulations. Innovative recycling technologies, such as chemical recycling and mechanical recycling, are being explored to recover valuable materials from polyurethane waste and reduce landfill disposal.

Water pollution is another environmental concern associated with polyurethane production. The use of solvents and other chemicals in manufacturing processes can lead to wastewater contamination. To mitigate this, companies are implementing advanced wastewater treatment systems and exploring water-based polyurethane technologies that reduce the need for harmful solvents.

As the industry moves towards sustainability, there is a growing emphasis on life cycle assessment (LCA) to evaluate the environmental impact of polyurethane products from cradle to grave. This holistic approach helps identify areas for improvement throughout the product lifecycle and guides the development of more environmentally friendly solutions.

Regulatory pressures and consumer demand for sustainable products are driving the polyurethane industry to adopt greener practices. Many companies are setting ambitious sustainability targets, including reducing carbon emissions, increasing the use of recycled content, and improving overall environmental performance. These efforts are not only beneficial for the environment but also contribute to long-term business sustainability and competitiveness in an increasingly eco-conscious market.

One of the primary environmental issues facing the polyurethane industry is the use of fossil fuel-based raw materials. The production of polyols and isocyanates, key components in polyurethane manufacturing, typically relies on petroleum-derived feedstocks. This dependence contributes to carbon emissions and resource depletion. In response, the industry is increasingly exploring bio-based alternatives, such as plant-derived polyols, which can reduce the carbon footprint of polyurethane products.

Energy consumption during production is another significant environmental factor. Polyurethane manufacturing processes often require high temperatures and pressures, leading to substantial energy use and associated emissions. To address this, companies are investing in energy-efficient technologies and process optimizations. Advanced heat recovery systems, improved insulation, and the integration of renewable energy sources are being implemented to reduce overall energy consumption and minimize environmental impact.

The end-of-life management of polyurethane products presents additional environmental challenges. Many polyurethane materials are not easily biodegradable and can persist in the environment for extended periods. To tackle this issue, the industry is focusing on developing more recyclable and biodegradable polyurethane formulations. Innovative recycling technologies, such as chemical recycling and mechanical recycling, are being explored to recover valuable materials from polyurethane waste and reduce landfill disposal.

Water pollution is another environmental concern associated with polyurethane production. The use of solvents and other chemicals in manufacturing processes can lead to wastewater contamination. To mitigate this, companies are implementing advanced wastewater treatment systems and exploring water-based polyurethane technologies that reduce the need for harmful solvents.

As the industry moves towards sustainability, there is a growing emphasis on life cycle assessment (LCA) to evaluate the environmental impact of polyurethane products from cradle to grave. This holistic approach helps identify areas for improvement throughout the product lifecycle and guides the development of more environmentally friendly solutions.

Regulatory pressures and consumer demand for sustainable products are driving the polyurethane industry to adopt greener practices. Many companies are setting ambitious sustainability targets, including reducing carbon emissions, increasing the use of recycled content, and improving overall environmental performance. These efforts are not only beneficial for the environment but also contribute to long-term business sustainability and competitiveness in an increasingly eco-conscious market.

Regulatory Landscape

The regulatory landscape for the polyurethane industry is evolving rapidly, driven by increasing environmental concerns and the push for sustainable practices. Governments and international organizations are implementing stricter regulations to address the environmental impact of polyurethane production and use.

One of the key areas of focus is the reduction of volatile organic compounds (VOCs) emissions. Many countries have introduced stringent limits on VOC content in polyurethane products, particularly in coatings and adhesives. This has led to the development of low-VOC and zero-VOC formulations, pushing the industry towards more environmentally friendly solutions.

Another significant regulatory trend is the phase-out of certain chemicals used in polyurethane production. For instance, the Montreal Protocol has mandated the gradual elimination of hydrochlorofluorocarbons (HCFCs) as blowing agents in foam production. This has spurred innovation in alternative blowing agents with lower global warming potential.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation has had a profound impact on the polyurethane industry. It requires manufacturers to register and assess the safety of chemicals used in their products, promoting transparency and safer chemical management practices.

In response to growing concerns about plastic waste, many jurisdictions are implementing extended producer responsibility (EPR) programs. These regulations hold manufacturers responsible for the entire lifecycle of their products, including disposal and recycling. This is driving the development of more easily recyclable polyurethane formulations and improved end-of-life management strategies.

Energy efficiency regulations are also shaping the industry. Building codes in many countries now mandate higher insulation standards, creating opportunities for polyurethane foam insulation products. However, these regulations also often include fire safety requirements, necessitating the development of flame-retardant formulations that meet both insulation and safety standards.

The automotive sector, a major consumer of polyurethane products, is subject to increasingly stringent fuel efficiency and emissions standards. This is driving demand for lightweight polyurethane components that can help reduce vehicle weight and improve fuel economy.

As sustainability becomes a central focus, some regions are introducing regulations to promote the use of bio-based and recycled content in polyurethane products. These initiatives are encouraging investment in research and development of sustainable raw materials and recycling technologies.

One of the key areas of focus is the reduction of volatile organic compounds (VOCs) emissions. Many countries have introduced stringent limits on VOC content in polyurethane products, particularly in coatings and adhesives. This has led to the development of low-VOC and zero-VOC formulations, pushing the industry towards more environmentally friendly solutions.

Another significant regulatory trend is the phase-out of certain chemicals used in polyurethane production. For instance, the Montreal Protocol has mandated the gradual elimination of hydrochlorofluorocarbons (HCFCs) as blowing agents in foam production. This has spurred innovation in alternative blowing agents with lower global warming potential.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation has had a profound impact on the polyurethane industry. It requires manufacturers to register and assess the safety of chemicals used in their products, promoting transparency and safer chemical management practices.

In response to growing concerns about plastic waste, many jurisdictions are implementing extended producer responsibility (EPR) programs. These regulations hold manufacturers responsible for the entire lifecycle of their products, including disposal and recycling. This is driving the development of more easily recyclable polyurethane formulations and improved end-of-life management strategies.

Energy efficiency regulations are also shaping the industry. Building codes in many countries now mandate higher insulation standards, creating opportunities for polyurethane foam insulation products. However, these regulations also often include fire safety requirements, necessitating the development of flame-retardant formulations that meet both insulation and safety standards.

The automotive sector, a major consumer of polyurethane products, is subject to increasingly stringent fuel efficiency and emissions standards. This is driving demand for lightweight polyurethane components that can help reduce vehicle weight and improve fuel economy.

As sustainability becomes a central focus, some regions are introducing regulations to promote the use of bio-based and recycled content in polyurethane products. These initiatives are encouraging investment in research and development of sustainable raw materials and recycling technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!