High-Throughput Experimentation in Glass Production Technologies

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Glass HTE Background and Objectives

High-throughput experimentation (HTE) represents a paradigm shift in materials science research, enabling rapid synthesis and characterization of multiple samples simultaneously. In glass production technologies, this approach has emerged as a critical methodology to accelerate innovation in an industry that has traditionally relied on empirical, time-consuming development cycles. The evolution of glass technology spans millennia, from ancient Egyptian and Mesopotamian craftsmen to modern industrial processes, yet the fundamental challenge remains: efficiently discovering optimal compositions and processing parameters for specific applications.

The glass industry faces mounting pressure to develop advanced materials with enhanced properties while reducing energy consumption and environmental impact. Traditional glass development approaches typically require weeks or months to iterate through composition variations, with each experiment demanding significant resources and specialized equipment. This methodical but slow approach has constrained innovation velocity in an era demanding rapid technological advancement.

HTE in glass production introduces automated, parallel processing techniques that can evaluate hundreds or thousands of compositional variations simultaneously. This technological approach originated in pharmaceutical research during the 1990s but has only recently been adapted for inorganic materials like glass. The convergence of robotics, advanced analytics, and machine learning has enabled this transition, creating unprecedented opportunities for glass innovation.

The primary objective of implementing HTE in glass production is to compress development timelines from years to months or even weeks. This acceleration aims to address urgent market demands for specialized glass products in sectors including electronics, healthcare, construction, and renewable energy. Secondary objectives include reducing energy consumption in glass development, minimizing material waste, and enabling the exploration of previously impractical compositional spaces.

Current technological trajectories suggest HTE will evolve toward increasingly autonomous systems that integrate artificial intelligence for experimental design and interpretation. The glass industry stands at an inflection point where computational modeling, physical experimentation, and data analytics converge to form a new innovation ecosystem. This convergence promises to transform not only how glass is developed but also what properties and applications become possible.

The global research landscape shows growing investment in HTE infrastructure for materials development, with significant initiatives in North America, Europe, and East Asia. These investments reflect recognition that mastering high-throughput methodologies represents a competitive advantage in advanced materials development, including next-generation glass technologies that will enable solutions for energy efficiency, telecommunications, and sustainable manufacturing.

The glass industry faces mounting pressure to develop advanced materials with enhanced properties while reducing energy consumption and environmental impact. Traditional glass development approaches typically require weeks or months to iterate through composition variations, with each experiment demanding significant resources and specialized equipment. This methodical but slow approach has constrained innovation velocity in an era demanding rapid technological advancement.

HTE in glass production introduces automated, parallel processing techniques that can evaluate hundreds or thousands of compositional variations simultaneously. This technological approach originated in pharmaceutical research during the 1990s but has only recently been adapted for inorganic materials like glass. The convergence of robotics, advanced analytics, and machine learning has enabled this transition, creating unprecedented opportunities for glass innovation.

The primary objective of implementing HTE in glass production is to compress development timelines from years to months or even weeks. This acceleration aims to address urgent market demands for specialized glass products in sectors including electronics, healthcare, construction, and renewable energy. Secondary objectives include reducing energy consumption in glass development, minimizing material waste, and enabling the exploration of previously impractical compositional spaces.

Current technological trajectories suggest HTE will evolve toward increasingly autonomous systems that integrate artificial intelligence for experimental design and interpretation. The glass industry stands at an inflection point where computational modeling, physical experimentation, and data analytics converge to form a new innovation ecosystem. This convergence promises to transform not only how glass is developed but also what properties and applications become possible.

The global research landscape shows growing investment in HTE infrastructure for materials development, with significant initiatives in North America, Europe, and East Asia. These investments reflect recognition that mastering high-throughput methodologies represents a competitive advantage in advanced materials development, including next-generation glass technologies that will enable solutions for energy efficiency, telecommunications, and sustainable manufacturing.

Market Analysis for Advanced Glass Production

The global advanced glass production market is experiencing significant growth, driven by increasing demand across multiple sectors including construction, automotive, electronics, and healthcare. Currently valued at approximately 115 billion USD, the market is projected to reach 170 billion USD by 2028, representing a compound annual growth rate of 6.7% during the forecast period. This growth trajectory is primarily fueled by technological advancements in manufacturing processes and expanding applications of specialty glass products.

The construction industry remains the largest consumer of advanced glass products, accounting for nearly 40% of market share. The trend toward energy-efficient buildings has substantially increased demand for smart glass, low-emissivity glass, and other high-performance glazing solutions. Particularly in developed regions, stringent building codes and sustainability regulations are accelerating adoption of these advanced materials.

Automotive sector represents the second-largest market segment, with approximately 25% market share. The transition toward electric vehicles and autonomous driving technologies has created new requirements for specialized glass products, including heads-up displays, sensor-integrated windshields, and lightweight solutions to improve vehicle efficiency.

Electronics and display technologies constitute a rapidly growing segment, driven by innovations in consumer electronics, medical devices, and industrial applications. The demand for stronger, thinner, and more versatile glass substrates for displays and touch panels continues to expand, particularly with the proliferation of foldable and flexible devices.

Geographically, Asia-Pacific dominates the market with approximately 45% share, led by China, Japan, and South Korea. This regional dominance is attributed to robust manufacturing infrastructure, lower production costs, and significant investments in research and development. North America and Europe follow with 25% and 20% market shares respectively, with particular strength in high-value specialty glass segments.

Market challenges include high capital requirements for advanced production facilities, energy-intensive manufacturing processes, and environmental concerns related to emissions. These factors have created entry barriers for new market participants and have driven consolidation among established players seeking economies of scale.

Customer preferences are increasingly shifting toward customized glass solutions with multiple functionalities, creating opportunities for manufacturers who can efficiently deliver tailored products. This trend aligns well with high-throughput experimentation technologies, which enable rapid prototyping and testing of novel glass compositions and processing techniques.

The construction industry remains the largest consumer of advanced glass products, accounting for nearly 40% of market share. The trend toward energy-efficient buildings has substantially increased demand for smart glass, low-emissivity glass, and other high-performance glazing solutions. Particularly in developed regions, stringent building codes and sustainability regulations are accelerating adoption of these advanced materials.

Automotive sector represents the second-largest market segment, with approximately 25% market share. The transition toward electric vehicles and autonomous driving technologies has created new requirements for specialized glass products, including heads-up displays, sensor-integrated windshields, and lightweight solutions to improve vehicle efficiency.

Electronics and display technologies constitute a rapidly growing segment, driven by innovations in consumer electronics, medical devices, and industrial applications. The demand for stronger, thinner, and more versatile glass substrates for displays and touch panels continues to expand, particularly with the proliferation of foldable and flexible devices.

Geographically, Asia-Pacific dominates the market with approximately 45% share, led by China, Japan, and South Korea. This regional dominance is attributed to robust manufacturing infrastructure, lower production costs, and significant investments in research and development. North America and Europe follow with 25% and 20% market shares respectively, with particular strength in high-value specialty glass segments.

Market challenges include high capital requirements for advanced production facilities, energy-intensive manufacturing processes, and environmental concerns related to emissions. These factors have created entry barriers for new market participants and have driven consolidation among established players seeking economies of scale.

Customer preferences are increasingly shifting toward customized glass solutions with multiple functionalities, creating opportunities for manufacturers who can efficiently deliver tailored products. This trend aligns well with high-throughput experimentation technologies, which enable rapid prototyping and testing of novel glass compositions and processing techniques.

Current Challenges in Glass HTE Implementation

Despite the promising potential of High-Throughput Experimentation (HTE) in glass production, several significant challenges currently impede its widespread implementation. The complexity of glass composition represents a primary obstacle, as glass typically contains multiple components with intricate interactions that affect properties in non-linear ways. This compositional complexity makes it difficult to design efficient experimental matrices that can adequately explore the vast parameter space while maintaining statistical validity.

Material handling presents another substantial challenge, particularly at high temperatures. Glass melting often requires temperatures exceeding 1500°C, which creates difficulties in sample preparation, processing, and characterization under automated high-throughput conditions. The specialized equipment needed for such extreme conditions significantly increases implementation costs and technical complexity.

Characterization bottlenecks further complicate HTE adoption in glass production. While synthesis might be accelerated, the comprehensive analysis of multiple glass properties—optical, mechanical, chemical durability, and thermal characteristics—remains time-consuming. Many traditional glass characterization techniques were not designed for high-throughput workflows, creating a mismatch between production and analysis capabilities.

Data management and analysis pose increasingly significant challenges as experimental throughput increases. The massive datasets generated through HTE require sophisticated informatics infrastructure and advanced machine learning algorithms to extract meaningful patterns and correlations. Many glass manufacturers lack the computational expertise and infrastructure necessary to handle this data-intensive approach effectively.

Scale-up issues represent perhaps the most critical barrier to industrial implementation. Laboratory-scale HTE findings often fail to translate directly to production environments due to differences in melting dynamics, cooling rates, and processing conditions. This "valley of death" between research discoveries and commercial application requires additional validation steps that can negate the time advantages initially gained through HTE.

Regulatory and quality control considerations add another layer of complexity. The glass industry operates under strict quality and safety standards, particularly for applications in construction, automotive, and healthcare sectors. Demonstrating that HTE-developed materials meet these standards requires extensive validation testing that can slow the implementation process.

Cost justification remains challenging for many potential adopters. The significant upfront investment in specialized equipment, software, and expertise must be balanced against projected returns. For manufacturers of commodity glass products with thin profit margins, the business case for HTE implementation may be difficult to establish without clear demonstrations of substantial process improvements or novel product opportunities.

Material handling presents another substantial challenge, particularly at high temperatures. Glass melting often requires temperatures exceeding 1500°C, which creates difficulties in sample preparation, processing, and characterization under automated high-throughput conditions. The specialized equipment needed for such extreme conditions significantly increases implementation costs and technical complexity.

Characterization bottlenecks further complicate HTE adoption in glass production. While synthesis might be accelerated, the comprehensive analysis of multiple glass properties—optical, mechanical, chemical durability, and thermal characteristics—remains time-consuming. Many traditional glass characterization techniques were not designed for high-throughput workflows, creating a mismatch between production and analysis capabilities.

Data management and analysis pose increasingly significant challenges as experimental throughput increases. The massive datasets generated through HTE require sophisticated informatics infrastructure and advanced machine learning algorithms to extract meaningful patterns and correlations. Many glass manufacturers lack the computational expertise and infrastructure necessary to handle this data-intensive approach effectively.

Scale-up issues represent perhaps the most critical barrier to industrial implementation. Laboratory-scale HTE findings often fail to translate directly to production environments due to differences in melting dynamics, cooling rates, and processing conditions. This "valley of death" between research discoveries and commercial application requires additional validation steps that can negate the time advantages initially gained through HTE.

Regulatory and quality control considerations add another layer of complexity. The glass industry operates under strict quality and safety standards, particularly for applications in construction, automotive, and healthcare sectors. Demonstrating that HTE-developed materials meet these standards requires extensive validation testing that can slow the implementation process.

Cost justification remains challenging for many potential adopters. The significant upfront investment in specialized equipment, software, and expertise must be balanced against projected returns. For manufacturers of commodity glass products with thin profit margins, the business case for HTE implementation may be difficult to establish without clear demonstrations of substantial process improvements or novel product opportunities.

Current HTE Methodologies for Glass Manufacturing

01 Automated systems for high-throughput experimentation

Automated systems can significantly increase the throughput of experiments by reducing manual intervention and enabling parallel processing. These systems typically include robotic sample handling, automated data collection, and integrated analysis tools. By automating repetitive tasks, researchers can conduct more experiments in less time, accelerating the discovery and development process across various scientific fields.- Automated laboratory systems for high-throughput experimentation: Automated laboratory systems are designed to increase experimental throughput by integrating robotics, liquid handling systems, and data management tools. These systems can perform multiple experiments simultaneously, reducing manual intervention and increasing efficiency. They often include features like automated sample preparation, reagent dispensing, and result analysis, making them ideal for applications requiring large numbers of experiments such as drug discovery and materials science.

- Parallel processing techniques for data analysis in high-throughput experiments: Parallel processing techniques enable the simultaneous analysis of large datasets generated by high-throughput experiments. These methods distribute computational tasks across multiple processors or computing nodes, significantly reducing analysis time. Advanced algorithms and data structures are employed to optimize resource utilization and ensure efficient processing of experimental results, allowing researchers to quickly identify patterns and draw conclusions from complex datasets.

- Microfluidic platforms for enhanced experimental throughput: Microfluidic platforms utilize miniaturized fluid handling systems to perform multiple experiments on a single chip. These platforms enable precise control over small volumes of reagents, reducing consumption of valuable materials while increasing experimental throughput. The integration of sensors and detection systems within these platforms allows for real-time monitoring and analysis of reactions, making them particularly valuable for applications in biochemistry, molecular biology, and pharmaceutical research.

- Cloud-based systems for managing high-throughput experimental data: Cloud-based systems provide scalable infrastructure for storing, processing, and analyzing the massive amounts of data generated by high-throughput experiments. These systems offer collaborative platforms where researchers can share data, methodologies, and results across different locations. Advanced data management tools, including machine learning algorithms, help in extracting meaningful insights from experimental data, while ensuring data security and accessibility for authorized users.

- Machine learning approaches for optimizing high-throughput experimental design: Machine learning approaches are increasingly being applied to optimize the design of high-throughput experiments. These techniques can predict experimental outcomes, identify the most promising experimental conditions, and suggest optimal parameters for investigation. By analyzing patterns in historical experimental data, machine learning algorithms can reduce the number of experiments needed to achieve desired results, thereby increasing effective throughput and accelerating discovery in fields such as materials science and drug development.

02 Data processing and management for high-throughput experiments

Efficient data processing and management systems are crucial for handling the large volumes of data generated in high-throughput experimentation. These systems include specialized software for data acquisition, storage, analysis, and visualization. Advanced algorithms and computational methods help researchers extract meaningful insights from complex datasets, enabling faster decision-making and increasing overall experimental throughput.Expand Specific Solutions03 Parallel processing techniques for increased throughput

Parallel processing techniques enable multiple experiments to be conducted simultaneously, dramatically increasing throughput. These approaches involve distributing computational tasks across multiple processors or conducting multiple physical experiments in parallel using specialized equipment. By performing operations concurrently rather than sequentially, researchers can achieve significant time savings and process more samples in a given timeframe.Expand Specific Solutions04 Miniaturization technologies for high-throughput screening

Miniaturization technologies, such as microfluidics and lab-on-a-chip systems, allow for the reduction in sample volume and experimental footprint while maintaining or improving analytical performance. These technologies enable the integration of multiple experimental steps on a single platform, reducing processing time and increasing throughput. The ability to perform thousands of reactions in parallel on miniaturized platforms has revolutionized fields such as drug discovery and materials science.Expand Specific Solutions05 Network-based systems for collaborative high-throughput research

Network-based systems facilitate collaborative high-throughput experimentation by enabling researchers to share resources, data, and expertise across different locations. These systems include cloud-based platforms, distributed computing infrastructures, and virtual laboratory environments. By leveraging collective capabilities and resources, research teams can conduct more experiments, analyze results more efficiently, and accelerate the pace of scientific discovery.Expand Specific Solutions

Leading Companies in Glass HTE Innovation

The high-throughput experimentation (HTE) in glass production technologies market is currently in a growth phase, characterized by increasing adoption across the industry. The global market size is estimated to be expanding at a CAGR of 7-9%, driven by demand for advanced materials in electronics, telecommunications, and healthcare sectors. Leading players like Corning, SCHOTT AG, and AGC demonstrate varying levels of technical maturity, with established companies investing heavily in R&D automation. Corning leads with comprehensive HTE platforms for specialty glass development, while SCHOTT AG focuses on high-precision optical glass applications. Companies like HOYA Corp and PPG Industries are advancing mid-stream technologies, integrating AI-driven experimental design with traditional glass manufacturing processes. The competitive landscape shows a clear stratification between innovation leaders and followers, with academic partnerships (Wuhan University of Technology, Colorado State University) playing crucial supporting roles.

Corning, Inc.

Technical Solution: Corning has developed an advanced high-throughput experimentation (HTE) platform specifically for glass production that integrates robotics, automation, and machine learning. Their system can simultaneously test hundreds of glass compositions using miniaturized melting and forming processes. The platform employs parallel processing techniques where multiple small-scale glass samples (typically 10-50g) are prepared and characterized simultaneously, dramatically reducing the time required for material discovery. Corning's approach includes automated composition preparation, high-temperature processing in multi-zone furnaces, and rapid property characterization using spectroscopic methods. Their system incorporates machine learning algorithms that analyze the relationships between glass composition, processing conditions, and resulting properties, enabling predictive modeling for future formulations. This technology has reportedly accelerated Corning's glass innovation cycle by up to 3x compared to traditional methods.

Strengths: Industry-leading integration of automation and AI for glass formulation discovery; exceptional throughput capacity; proven commercial success with products like Gorilla Glass. Weaknesses: High capital investment requirements; system complexity requires specialized expertise; primarily optimized for specialty glass applications rather than bulk commodity glass production.

SCHOTT AG

Technical Solution: SCHOTT AG has implemented a comprehensive high-throughput experimentation system for glass production that focuses on precision optical and technical glasses. Their approach combines miniaturized melting technology with high-precision analytical methods to rapidly screen and optimize glass compositions. SCHOTT's system features multi-chamber melting units capable of processing up to 64 different glass compositions simultaneously under precisely controlled temperature profiles. The company has developed specialized rapid cooling techniques that simulate production conditions at laboratory scale, ensuring lab-to-manufacturing transferability. Their HTE platform incorporates in-line measurement of optical properties, including refractive index, dispersion, and transmission characteristics. SCHOTT has particularly advanced capabilities in characterizing glass-ceramic transitions and controlled crystallization processes, allowing them to develop specialized materials like ZERODUR® with near-zero thermal expansion. The system is supported by a comprehensive materials database and machine learning tools that help predict glass properties based on composition.

Strengths: Exceptional precision in optical glass development; sophisticated characterization capabilities; strong integration between R&D and manufacturing processes. Weaknesses: System is highly specialized for technical glasses rather than high-volume commodity products; requires significant technical expertise to operate effectively.

Key Patents and Research in Glass HTE

Producing glass using outgassed frit

PatentWO2004020351A1

Innovation

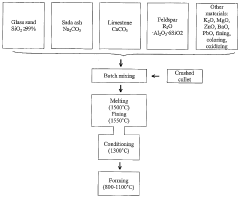

- The process involves producing frits from outgassing materials (Group A) that are pre-melted and allowed to outgas, then mixed with non-outgassing materials (Group B) and melted together under normal glass melting conditions, reducing gas release and scum formation, thereby improving heat transfer and melting efficiency.

The use of arsenic-free chalcogenide glasses for hot-melt processing

PatentWO2018017406A1

Innovation

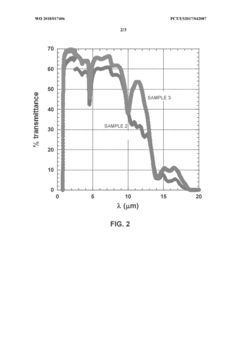

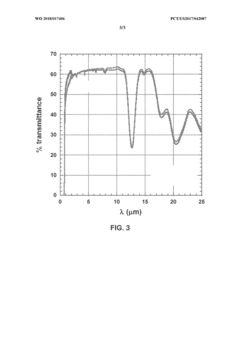

- The development of arsenic-free chalcogenide glasses that can be processed using hot-melt techniques like injection molding, extrusion, and hot embossing, allowing for the production of optical devices with fine microstructures and IR transparency without the risks associated with arsenic exposure.

Environmental Impact Assessment

The environmental impact of High-Throughput Experimentation (HTE) in glass production technologies represents a critical area of assessment as the industry moves toward more efficient and innovative manufacturing processes. Traditional glass production methods are known for their high energy consumption, significant carbon emissions, and substantial waste generation. HTE approaches offer potential pathways to mitigate these environmental concerns through optimized formulations and processing conditions.

When evaluating the environmental footprint of HTE in glass production, energy efficiency emerges as a primary consideration. The miniaturization of experiments allows for reduced energy requirements per test, with some HTE systems demonstrating energy savings of 60-85% compared to conventional batch testing methods. This reduction stems from smaller material volumes requiring less heating energy and shorter processing times, contributing to lower greenhouse gas emissions across the research and development phase.

Resource utilization represents another significant environmental dimension. HTE methodologies typically require substantially smaller material quantities for each experimental iteration, reducing raw material consumption by up to 90% during the formulation development stage. This efficiency extends to water usage in processing and cooling systems, with advanced HTE platforms incorporating closed-loop water systems that minimize consumption and contamination risks.

Waste reduction constitutes a third environmental benefit of HTE implementation. The precision of automated systems minimizes experimental failures and material losses, while the smaller scale of operations generates proportionally less waste per data point. Some leading glass manufacturers have reported waste reduction of 40-70% in their R&D operations after implementing HTE protocols, particularly valuable for experiments involving toxic or environmentally persistent components.

Life cycle assessment (LCA) studies comparing traditional and HTE-based glass development processes indicate potential environmental advantages across multiple impact categories. These include reduced global warming potential, decreased acidification potential, and lower resource depletion indices. However, these benefits must be balanced against the environmental costs of manufacturing, maintaining, and eventually disposing of sophisticated HTE equipment.

Regulatory compliance considerations are increasingly important as environmental standards become more stringent worldwide. HTE facilities generally produce lower emissions of regulated air pollutants such as NOx, SOx, and particulate matter compared to conventional glass melting operations. This advantage may become more significant as carbon pricing mechanisms and emissions trading systems expand globally, potentially creating economic incentives that align with environmental benefits.

When evaluating the environmental footprint of HTE in glass production, energy efficiency emerges as a primary consideration. The miniaturization of experiments allows for reduced energy requirements per test, with some HTE systems demonstrating energy savings of 60-85% compared to conventional batch testing methods. This reduction stems from smaller material volumes requiring less heating energy and shorter processing times, contributing to lower greenhouse gas emissions across the research and development phase.

Resource utilization represents another significant environmental dimension. HTE methodologies typically require substantially smaller material quantities for each experimental iteration, reducing raw material consumption by up to 90% during the formulation development stage. This efficiency extends to water usage in processing and cooling systems, with advanced HTE platforms incorporating closed-loop water systems that minimize consumption and contamination risks.

Waste reduction constitutes a third environmental benefit of HTE implementation. The precision of automated systems minimizes experimental failures and material losses, while the smaller scale of operations generates proportionally less waste per data point. Some leading glass manufacturers have reported waste reduction of 40-70% in their R&D operations after implementing HTE protocols, particularly valuable for experiments involving toxic or environmentally persistent components.

Life cycle assessment (LCA) studies comparing traditional and HTE-based glass development processes indicate potential environmental advantages across multiple impact categories. These include reduced global warming potential, decreased acidification potential, and lower resource depletion indices. However, these benefits must be balanced against the environmental costs of manufacturing, maintaining, and eventually disposing of sophisticated HTE equipment.

Regulatory compliance considerations are increasingly important as environmental standards become more stringent worldwide. HTE facilities generally produce lower emissions of regulated air pollutants such as NOx, SOx, and particulate matter compared to conventional glass melting operations. This advantage may become more significant as carbon pricing mechanisms and emissions trading systems expand globally, potentially creating economic incentives that align with environmental benefits.

Cost-Benefit Analysis of HTE Glass Production

The implementation of High-Throughput Experimentation (HTE) in glass production technologies represents a significant capital investment that requires thorough financial analysis. Initial setup costs for HTE systems in glass manufacturing typically range from $2-5 million, encompassing specialized equipment, automation systems, and analytical instruments. However, these substantial upfront investments can yield considerable returns through accelerated innovation cycles and reduced material waste.

Operational cost reductions present a compelling case for HTE adoption. Traditional glass development methods require large-scale melting operations that consume significant energy and raw materials. In contrast, HTE approaches can reduce material usage by up to 90% during the experimental phase, with energy consumption decreases of 60-75% per experiment. These efficiencies translate to annual operational savings of $300,000-500,000 for mid-sized glass manufacturers.

Time-to-market advantages provide another critical economic benefit. HTE methodologies can compress development timelines by 40-60%, allowing manufacturers to respond more rapidly to market demands. This acceleration typically results in a 15-25% increase in new product revenue capture during the critical early market entry period, representing millions in additional revenue for specialty glass products.

Risk mitigation factors significantly into the cost-benefit equation. HTE's parallel testing capabilities reduce the likelihood of late-stage development failures by identifying non-viable formulations earlier in the process. Industry data suggests this approach can decrease costly reformulation cycles by 30-50%, avoiding expenses that average $1.2 million per failed product launch in the specialty glass sector.

Return on investment calculations indicate that most glass manufacturers achieve breakeven on HTE investments within 2.5-4 years, with specialty glass producers seeing faster returns due to higher margins. The long-term ROI typically ranges from 150-300% over a five-year period, depending on the application focus and market positioning.

Scalability considerations reveal that HTE systems can be implemented incrementally, allowing companies to manage investment risk while gradually expanding capabilities. This phased approach enables smaller manufacturers to begin with targeted HTE applications requiring $500,000-1 million in initial investment, then scale as positive returns materialize.

Human factors must also be quantified in the analysis. While HTE systems reduce labor requirements for repetitive experimental tasks, they create demand for higher-skilled positions in data science and automation. This workforce transformation typically results in 15-20% higher personnel costs but delivers productivity improvements of 200-300% in research output per employee.

Operational cost reductions present a compelling case for HTE adoption. Traditional glass development methods require large-scale melting operations that consume significant energy and raw materials. In contrast, HTE approaches can reduce material usage by up to 90% during the experimental phase, with energy consumption decreases of 60-75% per experiment. These efficiencies translate to annual operational savings of $300,000-500,000 for mid-sized glass manufacturers.

Time-to-market advantages provide another critical economic benefit. HTE methodologies can compress development timelines by 40-60%, allowing manufacturers to respond more rapidly to market demands. This acceleration typically results in a 15-25% increase in new product revenue capture during the critical early market entry period, representing millions in additional revenue for specialty glass products.

Risk mitigation factors significantly into the cost-benefit equation. HTE's parallel testing capabilities reduce the likelihood of late-stage development failures by identifying non-viable formulations earlier in the process. Industry data suggests this approach can decrease costly reformulation cycles by 30-50%, avoiding expenses that average $1.2 million per failed product launch in the specialty glass sector.

Return on investment calculations indicate that most glass manufacturers achieve breakeven on HTE investments within 2.5-4 years, with specialty glass producers seeing faster returns due to higher margins. The long-term ROI typically ranges from 150-300% over a five-year period, depending on the application focus and market positioning.

Scalability considerations reveal that HTE systems can be implemented incrementally, allowing companies to manage investment risk while gradually expanding capabilities. This phased approach enables smaller manufacturers to begin with targeted HTE applications requiring $500,000-1 million in initial investment, then scale as positive returns materialize.

Human factors must also be quantified in the analysis. While HTE systems reduce labor requirements for repetitive experimental tasks, they create demand for higher-skilled positions in data science and automation. This workforce transformation typically results in 15-20% higher personnel costs but delivers productivity improvements of 200-300% in research output per employee.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!