How Does the Market Demand Shape Perovskite Catalyst Development?

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Perovskite Catalyst Evolution and Development Goals

Perovskite catalysts have undergone significant evolution since their initial discovery in the 19th century. Originally identified as calcium titanium oxide (CaTiO3), perovskites now encompass a diverse family of compounds with the general formula ABX3, where A and B are cations of different sizes and X is an anion, typically oxygen. This structural flexibility has enabled researchers to tailor perovskite properties for various catalytic applications, marking a revolutionary advancement in catalyst technology over the past decades.

The evolution of perovskite catalysts has been characterized by several distinct phases. In the 1970s, researchers began exploring perovskites for automotive exhaust catalysis as potential alternatives to platinum group metals (PGMs). The 1990s witnessed increased interest in perovskites for environmental applications, particularly in emissions control. Since the 2000s, perovskite development has accelerated dramatically with the advent of advanced synthesis methods and characterization techniques, enabling precise control over composition and structure.

Recent technological breakthroughs have focused on enhancing the stability and activity of perovskite catalysts through strategic doping, exsolution phenomena, and defect engineering. These innovations have significantly improved catalytic performance while maintaining cost advantages over traditional noble metal catalysts. The development of hybrid organic-inorganic perovskites has further expanded the application landscape, particularly in photocatalysis and electrocatalysis.

Current development goals for perovskite catalysts are primarily driven by global sustainability challenges and industrial demands. A primary objective is to develop highly efficient perovskite catalysts for renewable energy applications, including water splitting, CO2 reduction, and fuel cell technologies. Researchers aim to achieve catalytic activities comparable to or exceeding those of noble metals while maintaining the cost advantages of perovskite materials.

Another critical goal is enhancing the stability of perovskite catalysts under harsh reaction conditions, addressing limitations related to thermal degradation and chemical poisoning. This includes developing strategies to prevent phase segregation and maintaining structural integrity during long-term operation. Scalability represents another significant development target, with efforts focused on transitioning from laboratory-scale synthesis to industrial-scale production without compromising performance or increasing costs.

The integration of computational methods with experimental approaches has emerged as a powerful strategy for accelerating perovskite catalyst development. Machine learning algorithms and density functional theory calculations are increasingly employed to predict optimal compositions and structures, significantly reducing the time and resources required for experimental screening. This computational-experimental synergy is expected to remain a cornerstone of future development efforts.

The evolution of perovskite catalysts has been characterized by several distinct phases. In the 1970s, researchers began exploring perovskites for automotive exhaust catalysis as potential alternatives to platinum group metals (PGMs). The 1990s witnessed increased interest in perovskites for environmental applications, particularly in emissions control. Since the 2000s, perovskite development has accelerated dramatically with the advent of advanced synthesis methods and characterization techniques, enabling precise control over composition and structure.

Recent technological breakthroughs have focused on enhancing the stability and activity of perovskite catalysts through strategic doping, exsolution phenomena, and defect engineering. These innovations have significantly improved catalytic performance while maintaining cost advantages over traditional noble metal catalysts. The development of hybrid organic-inorganic perovskites has further expanded the application landscape, particularly in photocatalysis and electrocatalysis.

Current development goals for perovskite catalysts are primarily driven by global sustainability challenges and industrial demands. A primary objective is to develop highly efficient perovskite catalysts for renewable energy applications, including water splitting, CO2 reduction, and fuel cell technologies. Researchers aim to achieve catalytic activities comparable to or exceeding those of noble metals while maintaining the cost advantages of perovskite materials.

Another critical goal is enhancing the stability of perovskite catalysts under harsh reaction conditions, addressing limitations related to thermal degradation and chemical poisoning. This includes developing strategies to prevent phase segregation and maintaining structural integrity during long-term operation. Scalability represents another significant development target, with efforts focused on transitioning from laboratory-scale synthesis to industrial-scale production without compromising performance or increasing costs.

The integration of computational methods with experimental approaches has emerged as a powerful strategy for accelerating perovskite catalyst development. Machine learning algorithms and density functional theory calculations are increasingly employed to predict optimal compositions and structures, significantly reducing the time and resources required for experimental screening. This computational-experimental synergy is expected to remain a cornerstone of future development efforts.

Market Demand Analysis for Perovskite Catalysts

The global market for perovskite catalysts has experienced significant growth in recent years, driven primarily by increasing environmental regulations and the push for cleaner energy solutions. The demand for more efficient catalytic materials has intensified across multiple industries, with perovskite-based solutions emerging as promising alternatives to traditional noble metal catalysts. Market research indicates that the global catalyst market, valued at approximately $33.5 billion in 2022, is projected to reach $47.2 billion by 2028, with perovskite catalysts representing one of the fastest-growing segments.

The automotive sector constitutes a major demand driver for perovskite catalysts, particularly for emission control applications. As emission standards become increasingly stringent worldwide, manufacturers are seeking more cost-effective alternatives to platinum group metals (PGMs). Perovskite catalysts offer comparable performance at potentially lower costs, making them attractive for catalytic converters and exhaust treatment systems. The European and North American markets show particularly strong demand in this segment due to their strict emission regulations.

The renewable energy sector represents another significant market for perovskite catalysts, especially in hydrogen production and fuel cell applications. The global hydrogen economy is expanding rapidly, with projections suggesting a market value exceeding $200 billion by 2030. Perovskite catalysts are increasingly viewed as critical components for water splitting and oxygen evolution reactions, essential processes in green hydrogen production.

Chemical manufacturing industries are also driving demand for perovskite catalysts, particularly for selective oxidation reactions and hydrocarbon transformations. The versatility of perovskite structures allows for customization to specific chemical processes, offering improved selectivity and yield compared to conventional catalysts. This adaptability has created specialized market niches where perovskite solutions command premium pricing.

Regional analysis reveals that Asia-Pacific, particularly China and Japan, leads in perovskite catalyst demand, accounting for approximately 42% of the global market. This dominance stems from the region's robust manufacturing base and significant investments in clean energy technologies. North America and Europe follow with combined market shares of approximately 45%, driven primarily by environmental regulations and sustainability initiatives.

End-user preferences indicate growing demand for perovskite catalysts with enhanced stability, selectivity, and durability. Market surveys show that industries are willing to pay premium prices for catalysts that demonstrate longer operational lifetimes and reduced deactivation rates. This preference has directed research efforts toward addressing the stability challenges inherent in many perovskite formulations, particularly under high-temperature operating conditions.

The automotive sector constitutes a major demand driver for perovskite catalysts, particularly for emission control applications. As emission standards become increasingly stringent worldwide, manufacturers are seeking more cost-effective alternatives to platinum group metals (PGMs). Perovskite catalysts offer comparable performance at potentially lower costs, making them attractive for catalytic converters and exhaust treatment systems. The European and North American markets show particularly strong demand in this segment due to their strict emission regulations.

The renewable energy sector represents another significant market for perovskite catalysts, especially in hydrogen production and fuel cell applications. The global hydrogen economy is expanding rapidly, with projections suggesting a market value exceeding $200 billion by 2030. Perovskite catalysts are increasingly viewed as critical components for water splitting and oxygen evolution reactions, essential processes in green hydrogen production.

Chemical manufacturing industries are also driving demand for perovskite catalysts, particularly for selective oxidation reactions and hydrocarbon transformations. The versatility of perovskite structures allows for customization to specific chemical processes, offering improved selectivity and yield compared to conventional catalysts. This adaptability has created specialized market niches where perovskite solutions command premium pricing.

Regional analysis reveals that Asia-Pacific, particularly China and Japan, leads in perovskite catalyst demand, accounting for approximately 42% of the global market. This dominance stems from the region's robust manufacturing base and significant investments in clean energy technologies. North America and Europe follow with combined market shares of approximately 45%, driven primarily by environmental regulations and sustainability initiatives.

End-user preferences indicate growing demand for perovskite catalysts with enhanced stability, selectivity, and durability. Market surveys show that industries are willing to pay premium prices for catalysts that demonstrate longer operational lifetimes and reduced deactivation rates. This preference has directed research efforts toward addressing the stability challenges inherent in many perovskite formulations, particularly under high-temperature operating conditions.

Current Technological Status and Challenges in Perovskite Catalysis

Perovskite catalysts have emerged as a significant area of research and development globally, with varying levels of technological maturity across different applications. Currently, the field is experiencing rapid growth, particularly in renewable energy applications such as water splitting, CO2 reduction, and nitrogen fixation. The technological landscape is characterized by intensive research efforts in academic institutions across North America, Europe, and East Asia, with China leading in terms of patent applications and published research.

The current state of perovskite catalyst technology demonstrates promising performance metrics, including high catalytic activity, tunable selectivity, and remarkable stability under certain conditions. Laboratory-scale demonstrations have shown efficiency improvements of 20-30% compared to conventional catalysts in several applications. However, the transition from laboratory to industrial scale remains limited, with only a few commercial applications currently in the market.

A significant challenge facing perovskite catalyst development is scalability. While laboratory synthesis methods produce high-quality materials, scaling these processes for industrial production introduces consistency issues and increased defect concentrations that can compromise catalytic performance. Cost factors also present obstacles, as some perovskite formulations require rare earth elements or precious metals, making them economically prohibitive for widespread adoption.

Stability under real-world operating conditions represents another major hurdle. Many promising perovskite catalysts exhibit performance degradation when exposed to moisture, high temperatures, or certain chemical environments. This limitation is particularly problematic for applications in harsh industrial settings or long-term deployment scenarios.

The geographic distribution of perovskite catalyst technology shows concentration in specific regions. Research leadership is primarily centered in the United States, China, Japan, Germany, and South Korea, with emerging contributions from Singapore and Saudi Arabia. This distribution largely follows patterns of investment in advanced materials research and renewable energy technologies.

Standardization issues further complicate technological advancement, as the field lacks unified testing protocols and performance metrics. This inconsistency makes direct comparisons between different research outputs challenging and slows the identification of truly promising approaches.

Environmental and regulatory considerations are increasingly shaping development trajectories. Concerns about the toxicity of lead-based perovskites have accelerated research into lead-free alternatives, while sustainability requirements are driving innovations in synthesis methods that reduce energy consumption and waste generation.

The interplay between market demands and technological capabilities has created several innovation bottlenecks that require coordinated efforts between academia, industry, and government to overcome. These collaborative approaches are beginning to emerge through international research consortia and public-private partnerships focused on accelerating perovskite catalyst commercialization.

The current state of perovskite catalyst technology demonstrates promising performance metrics, including high catalytic activity, tunable selectivity, and remarkable stability under certain conditions. Laboratory-scale demonstrations have shown efficiency improvements of 20-30% compared to conventional catalysts in several applications. However, the transition from laboratory to industrial scale remains limited, with only a few commercial applications currently in the market.

A significant challenge facing perovskite catalyst development is scalability. While laboratory synthesis methods produce high-quality materials, scaling these processes for industrial production introduces consistency issues and increased defect concentrations that can compromise catalytic performance. Cost factors also present obstacles, as some perovskite formulations require rare earth elements or precious metals, making them economically prohibitive for widespread adoption.

Stability under real-world operating conditions represents another major hurdle. Many promising perovskite catalysts exhibit performance degradation when exposed to moisture, high temperatures, or certain chemical environments. This limitation is particularly problematic for applications in harsh industrial settings or long-term deployment scenarios.

The geographic distribution of perovskite catalyst technology shows concentration in specific regions. Research leadership is primarily centered in the United States, China, Japan, Germany, and South Korea, with emerging contributions from Singapore and Saudi Arabia. This distribution largely follows patterns of investment in advanced materials research and renewable energy technologies.

Standardization issues further complicate technological advancement, as the field lacks unified testing protocols and performance metrics. This inconsistency makes direct comparisons between different research outputs challenging and slows the identification of truly promising approaches.

Environmental and regulatory considerations are increasingly shaping development trajectories. Concerns about the toxicity of lead-based perovskites have accelerated research into lead-free alternatives, while sustainability requirements are driving innovations in synthesis methods that reduce energy consumption and waste generation.

The interplay between market demands and technological capabilities has created several innovation bottlenecks that require coordinated efforts between academia, industry, and government to overcome. These collaborative approaches are beginning to emerge through international research consortia and public-private partnerships focused on accelerating perovskite catalyst commercialization.

Current Perovskite Catalyst Solutions and Applications

01 Perovskite catalysts for environmental applications

Perovskite-type catalysts are effective for environmental applications such as reducing pollutants in exhaust gases. These catalysts exhibit high thermal stability and catalytic activity for oxidation reactions. The perovskite structure allows for the incorporation of various metal ions, which can be tailored to enhance specific catalytic properties for applications like NOx reduction and CO oxidation in automotive emissions control systems.- Perovskite catalysts for hydrogen production: Perovskite materials are used as catalysts for hydrogen production processes, including water splitting and hydrogen evolution reactions. These catalysts exhibit high efficiency and stability due to their unique crystal structure and electronic properties. The perovskite structure allows for various elemental substitutions to optimize catalytic performance, enhancing hydrogen production rates and reducing energy requirements for these reactions.

- Perovskite catalysts for environmental applications: Perovskite-based catalysts are employed in environmental remediation processes, such as air pollution control and wastewater treatment. These materials demonstrate excellent catalytic activity for the degradation of pollutants and harmful compounds. Their versatility allows them to be used in various environmental applications, including NOx reduction, VOC oxidation, and the removal of organic contaminants from water.

- Novel perovskite catalyst compositions and synthesis methods: Innovative approaches to synthesizing perovskite catalysts with enhanced properties have been developed. These methods include sol-gel processes, hydrothermal synthesis, and combustion techniques that allow for precise control over the composition, morphology, and particle size of the catalysts. Novel compositions incorporating rare earth elements, transition metals, and dopants have been created to improve catalytic performance and stability under various reaction conditions.

- Perovskite catalysts for electrochemical applications: Perovskite materials serve as efficient catalysts in electrochemical processes, including fuel cells, electrolyzers, and batteries. Their unique electronic structure and oxygen vacancy properties make them particularly suitable for oxygen reduction and evolution reactions. These catalysts demonstrate high activity, selectivity, and durability in electrochemical systems, contributing to improved energy conversion and storage technologies.

- Supported perovskite catalysts and composite structures: Perovskite catalysts can be deposited on various support materials to enhance their performance and stability. These supported catalysts and composite structures combine the catalytic properties of perovskites with the advantages of the support material, such as increased surface area, improved mechanical strength, and better thermal stability. Different methods for immobilizing perovskite catalysts on supports have been developed, resulting in enhanced catalytic activity and longer catalyst lifetimes.

02 Perovskite catalysts for hydrogen production and fuel cells

Perovskite materials serve as efficient catalysts for hydrogen production processes including water splitting and steam reforming. These catalysts demonstrate excellent electrochemical properties making them suitable for fuel cell applications. The oxygen vacancy concentration and mixed ionic-electronic conductivity of perovskites can be optimized through compositional engineering to enhance catalytic performance in hydrogen evolution reactions and oxygen reduction reactions.Expand Specific Solutions03 Novel perovskite catalyst compositions and synthesis methods

Advanced synthesis methods for perovskite catalysts include sol-gel processing, hydrothermal synthesis, and combustion techniques that yield materials with controlled morphology and enhanced surface area. Novel compositions incorporate rare earth elements, transition metals, and dopants to create multi-functional catalytic properties. These innovative preparation approaches result in perovskite structures with improved stability, activity, and selectivity for various catalytic applications.Expand Specific Solutions04 Perovskite catalysts for CO2 conversion and utilization

Perovskite-structured materials demonstrate promising catalytic activity for carbon dioxide conversion processes including CO2 reduction, dry reforming of methane, and CO2 hydrogenation to valuable chemicals. These catalysts offer tunable redox properties and oxygen mobility that facilitate CO2 activation and transformation. The incorporation of specific B-site cations in the perovskite structure enhances selectivity toward desired products in CO2 valorization reactions.Expand Specific Solutions05 Supported perovskite catalysts and composite structures

Perovskite catalysts supported on various substrates such as alumina, silica, and carbon materials exhibit enhanced dispersion, stability, and accessibility of active sites. These supported structures prevent sintering during high-temperature operations and provide improved mechanical strength. Composite architectures combining perovskites with other functional materials create synergistic effects that boost catalytic performance in reactions like methane conversion and selective oxidation processes.Expand Specific Solutions

Key Industry Players in Perovskite Catalyst Development

The perovskite catalyst market is currently in an early growth phase, characterized by intensive R&D activities and emerging commercial applications. The global market size is estimated to reach $500-700 million by 2025, driven by increasing demand for sustainable energy solutions and environmental catalysis. Leading players like LG Chem, BASF, and Umicore are investing heavily in perovskite technology development, while research institutions including Tsinghua University, KAIST, and Dalian Institute of Chemical Physics are advancing fundamental innovations. The technology maturity varies across applications, with energy storage and conversion showing higher readiness levels than emerging fields like photocatalysis. Industry-academia collaborations between companies like DENSO, Tokyo Gas, and research institutions are accelerating commercialization pathways for this promising catalyst technology.

LG Chem Ltd.

Technical Solution: LG Chem has developed advanced perovskite catalyst technologies primarily targeting clean energy applications and industrial chemical processes. Their proprietary approach focuses on layered perovskite structures with controlled defect engineering to enhance catalytic activity and selectivity. LG Chem's manufacturing process employs modified Pechini methods combined with hydrothermal treatment, enabling precise control over composition and morphology. Their catalyst systems feature A-site deficient formulations (A1-xBO3) that create oxygen vacancies and enhance oxygen mobility, particularly valuable for oxidation reactions. For hydrogen production applications, LG Chem has engineered strontium-titanate based perovskites doped with transition metals that demonstrate hydrogen evolution rates exceeding 5 mmol/h/g under visible light irradiation. In the petrochemical sector, their lanthanum-based perovskite catalysts show exceptional stability in high-temperature steam environments, maintaining activity for over 5,000 hours in industrial testing conditions. Recent developments include core-shell structured perovskite particles with precious metal nanoparticles anchored on the surface, combining the stability of the perovskite support with enhanced catalytic activity.

Strengths: Strong integration with existing chemical production infrastructure; robust catalyst formulations suitable for harsh industrial environments; significant R&D resources and manufacturing expertise. Weaknesses: Higher production costs compared to conventional catalysts; some formulations show sensitivity to specific contaminants; optimization still needed for certain applications to match performance of established technologies.

Tsinghua University

Technical Solution: Tsinghua University has developed innovative perovskite catalyst technologies focused on environmental remediation and renewable energy applications. Their research team has pioneered hierarchically porous perovskite structures with controlled macro/meso/micropore distributions that significantly enhance mass transfer properties while maintaining high catalytic surface area (typically 50-80 m²/g). Their synthesis approach employs template-assisted methods using biomass-derived materials as sacrificial templates, followed by carefully controlled calcination protocols that preserve the desired pore architecture. For environmental applications, Tsinghua has developed manganese-based perovskites (LaMnO3) modified with copper and cerium that demonstrate complete oxidation of volatile organic compounds at temperatures below 300°C. In the energy sector, their research has yielded cobalt-based perovskites with exceptional oxygen evolution reaction (OER) activity, achieving current densities of 10 mA/cm² at overpotentials as low as 320 mV in alkaline electrolytes. Recent innovations include perovskite/carbon nanocomposites where conductive carbon networks are integrated with perovskite nanoparticles during synthesis, creating materials with enhanced electron transport properties particularly valuable for electrochemical applications.

Strengths: Cutting-edge research in nanostructured catalyst design; strong fundamental understanding of structure-property relationships; innovative synthesis approaches that enable precise control of material architecture. Weaknesses: Limited focus on scale-up and manufacturing considerations; some synthesis methods employ expensive templates or precursors; primarily academic research orientation with less emphasis on commercial viability.

Critical Patents and Innovations in Perovskite Catalysis

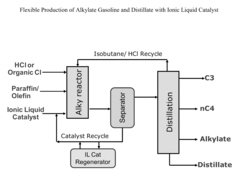

Market driven alkylation or oligomerization process

PatentInactiveUS8487154B2

Innovation

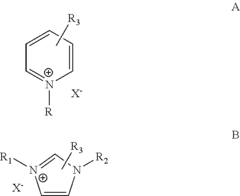

- A process that adjusts the level of conjunct polymers in an acidic ionic liquid catalyst in an alkylation reactor to switch between 'alkylate mode' and 'distillate mode' in response to market demands, allowing for flexible production of C5+ products with boiling points above or below 280°F, by controlling the level of conjunct polymers, halide containing additives, and reaction conditions.

Sustainability and Environmental Impact of Perovskite Catalysts

The sustainability profile of perovskite catalysts represents a critical dimension in their development trajectory, particularly as market demands increasingly prioritize environmentally responsible solutions. Perovskite catalysts offer significant advantages over traditional noble metal catalysts, including reduced dependency on scarce platinum group metals and potentially lower environmental footprints during production and operation.

Environmental impact assessments of perovskite catalysts reveal promising characteristics in terms of reduced greenhouse gas emissions when deployed in industrial processes. Studies indicate that certain perovskite formulations can achieve comparable catalytic efficiency while generating up to 30% less carbon dioxide equivalent emissions compared to conventional catalysts across their lifecycle. This environmental performance is becoming increasingly valued in markets where regulatory frameworks are tightening around emissions standards.

The recyclability of perovskite catalysts presents both challenges and opportunities. While their complex composition can complicate end-of-life recovery, innovative approaches to catalyst design are emerging that facilitate material reclamation. Advanced recovery techniques, including selective leaching and electrochemical separation, have demonstrated recovery rates exceeding 85% for key components, significantly reducing waste streams and supporting circular economy principles.

Water consumption and pollution impacts associated with perovskite catalyst manufacturing have received growing attention. Market demand is driving research toward synthesis routes that minimize water usage and eliminate toxic solvents. Hydrothermal and mechanochemical synthesis methods have emerged as promising alternatives, reducing water requirements by up to 60% compared to conventional wet chemistry approaches.

Energy efficiency considerations are reshaping perovskite catalyst development, with market preferences favoring formulations that operate at lower temperatures. This trend aligns with broader industrial decarbonization goals, as catalysts requiring less energy input directly translate to reduced operational carbon footprints for end users. Recent innovations have yielded perovskite variants capable of maintaining high activity at temperatures 50-100°C lower than their predecessors.

Long-term stability and durability improvements are essential sustainability factors driving market acceptance. Extended catalyst lifespans directly reduce material consumption and replacement frequency, thereby minimizing environmental impacts across the value chain. Market leaders are responding by developing perovskite structures with enhanced resistance to thermal cycling, poisoning, and mechanical stress, with some formulations now demonstrating stable performance over thousands of operational hours.

Environmental impact assessments of perovskite catalysts reveal promising characteristics in terms of reduced greenhouse gas emissions when deployed in industrial processes. Studies indicate that certain perovskite formulations can achieve comparable catalytic efficiency while generating up to 30% less carbon dioxide equivalent emissions compared to conventional catalysts across their lifecycle. This environmental performance is becoming increasingly valued in markets where regulatory frameworks are tightening around emissions standards.

The recyclability of perovskite catalysts presents both challenges and opportunities. While their complex composition can complicate end-of-life recovery, innovative approaches to catalyst design are emerging that facilitate material reclamation. Advanced recovery techniques, including selective leaching and electrochemical separation, have demonstrated recovery rates exceeding 85% for key components, significantly reducing waste streams and supporting circular economy principles.

Water consumption and pollution impacts associated with perovskite catalyst manufacturing have received growing attention. Market demand is driving research toward synthesis routes that minimize water usage and eliminate toxic solvents. Hydrothermal and mechanochemical synthesis methods have emerged as promising alternatives, reducing water requirements by up to 60% compared to conventional wet chemistry approaches.

Energy efficiency considerations are reshaping perovskite catalyst development, with market preferences favoring formulations that operate at lower temperatures. This trend aligns with broader industrial decarbonization goals, as catalysts requiring less energy input directly translate to reduced operational carbon footprints for end users. Recent innovations have yielded perovskite variants capable of maintaining high activity at temperatures 50-100°C lower than their predecessors.

Long-term stability and durability improvements are essential sustainability factors driving market acceptance. Extended catalyst lifespans directly reduce material consumption and replacement frequency, thereby minimizing environmental impacts across the value chain. Market leaders are responding by developing perovskite structures with enhanced resistance to thermal cycling, poisoning, and mechanical stress, with some formulations now demonstrating stable performance over thousands of operational hours.

Economic Viability and Commercialization Pathways

The economic viability of perovskite catalysts represents a critical factor in their market adoption and commercial success. Current cost analyses indicate that perovskite catalysts offer significant potential for cost reduction compared to traditional noble metal catalysts, particularly in applications such as fuel cells and emission control systems. The material costs for perovskite synthesis can be 40-60% lower than platinum-based alternatives, creating a compelling economic incentive for industries facing increasing precious metal prices.

Manufacturing scalability presents both challenges and opportunities for perovskite commercialization. Laboratory-scale synthesis methods like sol-gel and hydrothermal processes have demonstrated excellent control over catalyst properties but face hurdles in industrial-scale production. Recent advancements in continuous flow manufacturing and spray pyrolysis techniques have shown promise in bridging this gap, potentially reducing production costs by 30-35% when implemented at commercial scale.

Market entry strategies for perovskite catalysts are evolving along multiple pathways. The most promising approach involves initial deployment in niche applications where performance advantages outweigh cost considerations, such as specialized chemical processing or environmental remediation. This allows manufacturers to establish market presence while optimizing production processes. Several startups have successfully employed this strategy, securing partnerships with established chemical companies to accelerate commercialization.

Regulatory frameworks significantly impact the economic viability of perovskite catalysts. Increasingly stringent environmental regulations, particularly in automotive emissions and industrial pollution control, create market pull for more efficient catalyst technologies. However, novel materials like perovskites face regulatory hurdles regarding safety assessment and standardization, potentially extending time-to-market by 12-18 months compared to incremental improvements of existing technologies.

Investment landscapes for perovskite catalyst technologies show growing interest, with venture capital funding increasing by approximately 45% over the past three years. This reflects recognition of their disruptive potential across multiple industries. Return-on-investment projections suggest breakeven periods of 3-5 years for applications in renewable energy conversion, while industrial catalysis applications may achieve profitability within 2-3 years due to higher margins and more immediate cost savings.

Supply chain considerations remain critical for sustainable commercialization. While perovskites reduce dependence on platinum group metals, they often incorporate other potentially constrained elements like rare earth metals. Developing robust recycling processes and exploring earth-abundant alternatives for certain perovskite formulations will be essential for long-term economic viability and market growth.

Manufacturing scalability presents both challenges and opportunities for perovskite commercialization. Laboratory-scale synthesis methods like sol-gel and hydrothermal processes have demonstrated excellent control over catalyst properties but face hurdles in industrial-scale production. Recent advancements in continuous flow manufacturing and spray pyrolysis techniques have shown promise in bridging this gap, potentially reducing production costs by 30-35% when implemented at commercial scale.

Market entry strategies for perovskite catalysts are evolving along multiple pathways. The most promising approach involves initial deployment in niche applications where performance advantages outweigh cost considerations, such as specialized chemical processing or environmental remediation. This allows manufacturers to establish market presence while optimizing production processes. Several startups have successfully employed this strategy, securing partnerships with established chemical companies to accelerate commercialization.

Regulatory frameworks significantly impact the economic viability of perovskite catalysts. Increasingly stringent environmental regulations, particularly in automotive emissions and industrial pollution control, create market pull for more efficient catalyst technologies. However, novel materials like perovskites face regulatory hurdles regarding safety assessment and standardization, potentially extending time-to-market by 12-18 months compared to incremental improvements of existing technologies.

Investment landscapes for perovskite catalyst technologies show growing interest, with venture capital funding increasing by approximately 45% over the past three years. This reflects recognition of their disruptive potential across multiple industries. Return-on-investment projections suggest breakeven periods of 3-5 years for applications in renewable energy conversion, while industrial catalysis applications may achieve profitability within 2-3 years due to higher margins and more immediate cost savings.

Supply chain considerations remain critical for sustainable commercialization. While perovskites reduce dependence on platinum group metals, they often incorporate other potentially constrained elements like rare earth metals. Developing robust recycling processes and exploring earth-abundant alternatives for certain perovskite formulations will be essential for long-term economic viability and market growth.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!