Review of Global Regulations Impacting Perovskite Catalyst Industries

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Perovskite Catalyst Development History and Objectives

Perovskite catalysts have undergone significant evolution since their initial discovery in the mid-19th century. The term "perovskite" originally referred to calcium titanate (CaTiO₃), discovered by Gustav Rose in 1839 and named after Russian mineralogist Lev Perovski. However, the broader perovskite family, characterized by the ABX₃ crystal structure, has expanded considerably to include numerous compounds with diverse properties and applications.

The catalytic potential of perovskites remained largely unexplored until the 1970s when researchers began investigating their unique electronic and structural properties. The 1980s marked a pivotal period with the discovery that perovskite oxides could effectively catalyze oxidation reactions, particularly for automotive emissions control. This finding initiated a wave of research into perovskites as alternatives to precious metal catalysts.

By the early 2000s, perovskite catalysts had demonstrated promising performance in various applications, including fuel cells, water splitting, and CO₂ conversion. Their adaptability through compositional engineering became a key advantage, allowing researchers to tailor catalytic properties by substituting different elements in the A and B sites of the crystal structure.

The past decade has witnessed accelerated development in perovskite catalyst technology, driven by global sustainability initiatives and the push for green chemistry solutions. Researchers have focused on enhancing stability, activity, and selectivity while reducing reliance on rare or precious elements. Advanced synthesis methods, including sol-gel processes, hydrothermal techniques, and flame spray pyrolysis, have enabled precise control over perovskite composition and morphology.

Current technical objectives in perovskite catalyst development center on several key areas. First, improving thermal and chemical stability under harsh reaction conditions remains crucial for industrial applications. Second, researchers aim to develop perovskite catalysts with higher specific activity and selectivity to compete with traditional precious metal catalysts. Third, there is significant interest in designing perovskite catalysts that can operate effectively at lower temperatures to reduce energy consumption.

Another important objective is the development of sustainable manufacturing processes for perovskite catalysts that minimize environmental impact and resource consumption. This includes exploring earth-abundant elements as substitutes for rare or toxic components and optimizing synthesis methods to reduce waste and energy use.

Looking forward, the field is moving toward multifunctional perovskite catalysts capable of facilitating complex reaction cascades in a single process. Additionally, there is growing interest in understanding the fundamental mechanisms of perovskite catalysis through advanced characterization techniques and computational modeling, which will guide future rational design approaches.

The catalytic potential of perovskites remained largely unexplored until the 1970s when researchers began investigating their unique electronic and structural properties. The 1980s marked a pivotal period with the discovery that perovskite oxides could effectively catalyze oxidation reactions, particularly for automotive emissions control. This finding initiated a wave of research into perovskites as alternatives to precious metal catalysts.

By the early 2000s, perovskite catalysts had demonstrated promising performance in various applications, including fuel cells, water splitting, and CO₂ conversion. Their adaptability through compositional engineering became a key advantage, allowing researchers to tailor catalytic properties by substituting different elements in the A and B sites of the crystal structure.

The past decade has witnessed accelerated development in perovskite catalyst technology, driven by global sustainability initiatives and the push for green chemistry solutions. Researchers have focused on enhancing stability, activity, and selectivity while reducing reliance on rare or precious elements. Advanced synthesis methods, including sol-gel processes, hydrothermal techniques, and flame spray pyrolysis, have enabled precise control over perovskite composition and morphology.

Current technical objectives in perovskite catalyst development center on several key areas. First, improving thermal and chemical stability under harsh reaction conditions remains crucial for industrial applications. Second, researchers aim to develop perovskite catalysts with higher specific activity and selectivity to compete with traditional precious metal catalysts. Third, there is significant interest in designing perovskite catalysts that can operate effectively at lower temperatures to reduce energy consumption.

Another important objective is the development of sustainable manufacturing processes for perovskite catalysts that minimize environmental impact and resource consumption. This includes exploring earth-abundant elements as substitutes for rare or toxic components and optimizing synthesis methods to reduce waste and energy use.

Looking forward, the field is moving toward multifunctional perovskite catalysts capable of facilitating complex reaction cascades in a single process. Additionally, there is growing interest in understanding the fundamental mechanisms of perovskite catalysis through advanced characterization techniques and computational modeling, which will guide future rational design approaches.

Global Market Analysis for Perovskite Catalysts

The global perovskite catalyst market is experiencing significant growth, driven by increasing demand for sustainable and efficient catalytic solutions across various industries. Current market valuations indicate that perovskite catalysts represent a rapidly expanding segment within the broader catalyst industry, with particularly strong adoption in renewable energy applications, environmental remediation, and chemical manufacturing processes.

Regional analysis reveals distinct market dynamics across different geographical areas. North America currently holds a substantial market share due to extensive research infrastructure and early commercial adoption, particularly in the United States where government funding for clean energy technologies has bolstered development. The European market demonstrates robust growth rates, supported by stringent environmental regulations and the European Union's commitment to carbon neutrality by 2050, which has accelerated adoption of advanced catalytic technologies.

Asia-Pacific represents the fastest-growing regional market, with China, Japan, and South Korea emerging as key manufacturing and research hubs. China's dominance in rare earth element production, critical components in many perovskite formulations, provides strategic advantages in the supply chain. Meanwhile, developing economies in Southeast Asia and India are showing increasing interest in perovskite catalysts for addressing environmental challenges and industrial efficiency improvements.

Market segmentation by application reveals that energy conversion applications, particularly in fuel cells and electrolyzers, constitute the largest segment. Environmental applications, including photocatalytic water treatment and air purification, represent the second-largest market segment with projected annual growth exceeding that of traditional catalyst markets. Industrial chemical production applications are gaining traction as manufacturers seek more energy-efficient and selective catalytic processes.

Demand drivers include increasingly stringent environmental regulations worldwide, growing investment in hydrogen economy infrastructure, and the push for carbon-neutral industrial processes. The superior performance characteristics of perovskite catalysts—including higher activity, selectivity, and durability compared to conventional catalysts—continue to expand their potential applications and market penetration.

Supply chain analysis indicates potential vulnerabilities related to critical raw materials, particularly rare earth elements and precious metals used in certain perovskite formulations. These supply constraints may impact market growth and pricing stability, creating opportunities for alternative formulations and recycling technologies.

Market forecasts suggest compound annual growth rates significantly outpacing the broader catalyst industry, with particularly strong expansion expected in renewable energy applications and environmental remediation technologies as global sustainability initiatives accelerate adoption of advanced catalytic solutions.

Regional analysis reveals distinct market dynamics across different geographical areas. North America currently holds a substantial market share due to extensive research infrastructure and early commercial adoption, particularly in the United States where government funding for clean energy technologies has bolstered development. The European market demonstrates robust growth rates, supported by stringent environmental regulations and the European Union's commitment to carbon neutrality by 2050, which has accelerated adoption of advanced catalytic technologies.

Asia-Pacific represents the fastest-growing regional market, with China, Japan, and South Korea emerging as key manufacturing and research hubs. China's dominance in rare earth element production, critical components in many perovskite formulations, provides strategic advantages in the supply chain. Meanwhile, developing economies in Southeast Asia and India are showing increasing interest in perovskite catalysts for addressing environmental challenges and industrial efficiency improvements.

Market segmentation by application reveals that energy conversion applications, particularly in fuel cells and electrolyzers, constitute the largest segment. Environmental applications, including photocatalytic water treatment and air purification, represent the second-largest market segment with projected annual growth exceeding that of traditional catalyst markets. Industrial chemical production applications are gaining traction as manufacturers seek more energy-efficient and selective catalytic processes.

Demand drivers include increasingly stringent environmental regulations worldwide, growing investment in hydrogen economy infrastructure, and the push for carbon-neutral industrial processes. The superior performance characteristics of perovskite catalysts—including higher activity, selectivity, and durability compared to conventional catalysts—continue to expand their potential applications and market penetration.

Supply chain analysis indicates potential vulnerabilities related to critical raw materials, particularly rare earth elements and precious metals used in certain perovskite formulations. These supply constraints may impact market growth and pricing stability, creating opportunities for alternative formulations and recycling technologies.

Market forecasts suggest compound annual growth rates significantly outpacing the broader catalyst industry, with particularly strong expansion expected in renewable energy applications and environmental remediation technologies as global sustainability initiatives accelerate adoption of advanced catalytic solutions.

Technical Barriers and Regional Development Status

Perovskite catalysts face significant technical barriers that vary across regions globally. The primary technical challenge remains stability, as perovskite structures often degrade under industrial operating conditions, particularly in high-temperature or humid environments. This instability limits commercial viability despite promising laboratory performance. Manufacturing scalability presents another major hurdle, with current production methods struggling to maintain consistent quality and performance at industrial scales.

Toxicity concerns represent a critical regulatory barrier, as many high-performance perovskite formulations contain lead and other heavy metals, triggering strict regulatory oversight in environmentally conscious regions. The European Union has implemented the most comprehensive regulatory framework through REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), which imposes stringent documentation and safety assessment requirements for perovskite materials containing hazardous substances.

Regional development status shows significant variation in research focus and regulatory approaches. North America, particularly the United States, leads in fundamental research with substantial government funding through the Department of Energy and National Science Foundation, focusing on non-toxic alternatives and industrial applications. The regulatory environment remains moderately restrictive but emphasizes innovation.

The European Union maintains the strictest regulatory framework globally, with particular emphasis on environmental impact and circular economy principles. The European Green Deal has further accelerated requirements for sustainable catalytic materials, pushing researchers toward lead-free perovskite formulations. Despite regulatory challenges, European research institutions demonstrate strong collaboration networks advancing perovskite technology.

Asia presents a contrasting landscape, with China emerging as the dominant force in perovskite catalyst development and manufacturing capacity. Chinese regulations have historically been less restrictive, enabling faster commercialization pathways, though recent environmental policy shifts indicate tightening oversight. Japan and South Korea focus on high-precision applications with specialized regulatory frameworks for advanced materials.

Developing regions show growing interest in perovskite technology, particularly for renewable energy applications, but face significant barriers in technical expertise and regulatory infrastructure. Many adopt modified versions of established regulatory frameworks from developed regions, creating a complex global compliance landscape for industry participants.

Cross-border harmonization efforts remain limited, creating significant challenges for global supply chains and technology transfer in the perovskite catalyst sector. This regulatory fragmentation represents a substantial barrier to commercial deployment beyond technical limitations.

Toxicity concerns represent a critical regulatory barrier, as many high-performance perovskite formulations contain lead and other heavy metals, triggering strict regulatory oversight in environmentally conscious regions. The European Union has implemented the most comprehensive regulatory framework through REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), which imposes stringent documentation and safety assessment requirements for perovskite materials containing hazardous substances.

Regional development status shows significant variation in research focus and regulatory approaches. North America, particularly the United States, leads in fundamental research with substantial government funding through the Department of Energy and National Science Foundation, focusing on non-toxic alternatives and industrial applications. The regulatory environment remains moderately restrictive but emphasizes innovation.

The European Union maintains the strictest regulatory framework globally, with particular emphasis on environmental impact and circular economy principles. The European Green Deal has further accelerated requirements for sustainable catalytic materials, pushing researchers toward lead-free perovskite formulations. Despite regulatory challenges, European research institutions demonstrate strong collaboration networks advancing perovskite technology.

Asia presents a contrasting landscape, with China emerging as the dominant force in perovskite catalyst development and manufacturing capacity. Chinese regulations have historically been less restrictive, enabling faster commercialization pathways, though recent environmental policy shifts indicate tightening oversight. Japan and South Korea focus on high-precision applications with specialized regulatory frameworks for advanced materials.

Developing regions show growing interest in perovskite technology, particularly for renewable energy applications, but face significant barriers in technical expertise and regulatory infrastructure. Many adopt modified versions of established regulatory frameworks from developed regions, creating a complex global compliance landscape for industry participants.

Cross-border harmonization efforts remain limited, creating significant challenges for global supply chains and technology transfer in the perovskite catalyst sector. This regulatory fragmentation represents a substantial barrier to commercial deployment beyond technical limitations.

Current Perovskite Catalyst Synthesis and Application Methods

01 Perovskite catalysts for environmental applications

Perovskite-type catalysts are utilized in environmental applications such as exhaust gas purification, NOx reduction, and air pollution control. These catalysts demonstrate high efficiency in converting harmful emissions into less harmful substances. The perovskite structure allows for excellent thermal stability and catalytic activity at high temperatures, making them suitable for automotive catalytic converters and industrial emission control systems.- Perovskite catalysts for environmental applications: Perovskite catalysts are utilized in various environmental applications, particularly for reducing emissions and pollutants. These catalysts demonstrate high efficiency in converting harmful gases into less harmful substances. Their unique crystal structure allows for excellent catalytic activity in processes such as NOx reduction, CO oxidation, and hydrocarbon conversion. The environmental applications of perovskite catalysts make them valuable components in emission control systems and pollution reduction technologies.

- Perovskite catalysts in energy conversion and storage: Perovskite materials serve as effective catalysts in various energy conversion and storage applications. Their versatile structure allows for excellent performance in fuel cells, electrolyzers, and photovoltaic systems. These catalysts facilitate efficient energy conversion processes by lowering activation energy barriers and enhancing reaction rates. The ability to tailor their composition makes them adaptable for specific energy applications, including hydrogen production, oxygen reduction reactions, and solar energy conversion.

- Synthesis methods for perovskite catalysts: Various synthesis methods are employed to produce perovskite catalysts with specific properties and performance characteristics. These methods include sol-gel processing, hydrothermal synthesis, solid-state reactions, and combustion synthesis. Each technique offers different advantages in terms of controlling particle size, morphology, surface area, and compositional homogeneity. The synthesis parameters significantly influence the catalytic activity, selectivity, and stability of the resulting perovskite materials, allowing for customization based on the intended application.

- Perovskite catalysts for hydrocarbon processing: Perovskite catalysts demonstrate significant efficacy in hydrocarbon processing applications, including reforming, cracking, and conversion processes. Their unique structure provides high thermal stability and catalytic activity for transforming hydrocarbons into valuable products. These catalysts can be optimized for specific reactions such as methane reforming, partial oxidation of hydrocarbons, and conversion of heavy oils. The ability to withstand harsh reaction conditions makes perovskite catalysts particularly valuable in petrochemical and refining industries.

- Modified perovskite catalysts with enhanced performance: Perovskite catalysts can be modified through doping, substitution, or surface modification to enhance their catalytic performance. These modifications can improve activity, selectivity, stability, and resistance to poisoning. Incorporating specific elements into the perovskite structure can create oxygen vacancies, alter redox properties, or introduce new active sites. Surface modifications can increase the number of accessible active sites or improve interaction with reactants. These enhancements make modified perovskite catalysts suitable for more demanding applications and reaction conditions.

02 Perovskite catalysts for energy conversion processes

Perovskite materials serve as effective catalysts in various energy conversion processes including fuel cells, water splitting, and hydrogen production. Their unique crystal structure enables efficient electron transfer and oxygen ion mobility, which are crucial for electrochemical reactions. These catalysts demonstrate promising performance in renewable energy applications, offering alternatives to precious metal catalysts while maintaining high catalytic activity and stability.Expand Specific Solutions03 Synthesis methods for perovskite catalysts

Various synthesis methods are employed to prepare perovskite catalysts with controlled composition, morphology, and particle size. These methods include sol-gel processing, hydrothermal synthesis, co-precipitation, and solid-state reactions. The synthesis parameters significantly influence the catalytic properties of the resulting perovskite materials. Advanced preparation techniques focus on creating high surface area catalysts with enhanced activity and selectivity for specific reactions.Expand Specific Solutions04 Perovskite catalysts for hydrocarbon processing

Perovskite-structured materials are employed as catalysts in various hydrocarbon processing applications, including reforming, cracking, and oxidation reactions. These catalysts demonstrate high selectivity and activity for converting hydrocarbons into value-added products. The ability to tailor the composition of perovskites by substituting different cations allows for optimization of catalytic performance for specific hydrocarbon transformation processes.Expand Specific Solutions05 Novel perovskite compositions and structures

Research focuses on developing novel perovskite compositions and structures with enhanced catalytic properties. These innovations include doped perovskites, layered perovskites, and perovskite-supported nanoparticles. By incorporating different elements into the perovskite structure or creating composite materials, researchers can tune the electronic properties, surface characteristics, and stability of the catalysts. These novel compositions offer improved performance in various catalytic applications.Expand Specific Solutions

Leading Companies and Research Institutions in Perovskite Catalysis

The perovskite catalyst industry is currently in a growth phase, with global regulations significantly shaping its competitive landscape. Market size is expanding rapidly due to increasing applications in clean energy and emissions control, projected to reach substantial value by 2030. Technologically, the field shows varying maturity levels across applications, with automotive catalysts being more established than newer energy applications. Leading players include traditional catalyst manufacturers like Johnson Matthey, BASF Catalysts, and Cataler Corp, alongside emerging competition from Asian entities such as LG Chem and SABIC. Academic institutions like Tsinghua University and KAIST are driving innovation through research partnerships with automotive giants including Honda, Nissan, and Ford, creating a dynamic ecosystem balancing established expertise with emerging technologies under evolving regulatory frameworks.

Johnson Matthey Plc

Technical Solution: Johnson Matthey has pioneered regulatory-compliant perovskite catalyst technologies through their PGM (Platinum Group Metals) conservation program. Their approach integrates perovskite structures with minimal PGM loading to address both performance requirements and regulatory concerns about critical materials usage. The company has developed specialized manufacturing protocols that comply with the EU's Industrial Emissions Directive and similar global standards. Their perovskite catalysts are designed with end-of-life recovery in mind, featuring structures that facilitate easier separation and recycling of valuable components to meet circular economy regulations. Johnson Matthey actively participates in international standards development for catalyst materials and emissions control technologies, helping shape the regulatory landscape. Their global regulatory affairs team maintains comprehensive compliance documentation for different markets, enabling rapid adaptation to regional regulatory changes affecting perovskite catalyst deployment.

Strengths: Industry-leading expertise in PGM catalysis and materials science; established recycling infrastructure for catalyst materials recovery. Weaknesses: Higher production costs due to stringent compliance measures; potential challenges in scaling production while maintaining regulatory compliance across diverse global markets.

SABIC Global Technologies BV

Technical Solution: SABIC has developed a regulatory-focused approach to perovskite catalyst technologies that emphasizes compliance with global chemical registration requirements. Their perovskite formulations are specifically engineered to avoid substances of very high concern (SVHCs) under EU REACH regulations while maintaining catalytic performance. SABIC's manufacturing processes for perovskite catalysts incorporate real-time emissions monitoring systems that ensure compliance with increasingly stringent air quality regulations across multiple jurisdictions. The company has implemented a comprehensive product stewardship program that tracks regulatory developments affecting perovskite materials in over 40 countries, allowing for proactive formulation adjustments. Their perovskite catalysts feature modular designs that can be adapted to meet varying regulatory requirements in different markets without complete reformulation, providing flexibility in a complex global regulatory environment.

Strengths: Strong chemical registration expertise across multiple jurisdictions; advanced manufacturing capabilities that enable rapid adaptation to regulatory changes. Weaknesses: Less established position in traditional catalyst markets compared to specialized catalyst manufacturers; potential challenges in balancing performance with increasingly strict regulatory requirements.

Key Patents and Scientific Breakthroughs in Perovskite Catalysis

Improved perovskite catalysts for synthesis gas production with variable hydrogen to carbon monoxide ratios

PatentInactiveIN201713014438A

Innovation

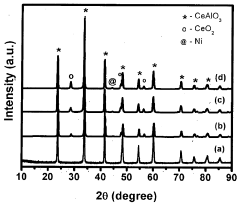

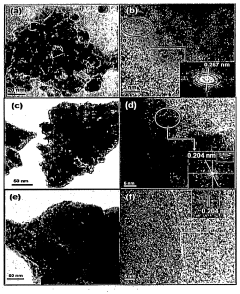

- A Ruthenium-promoted nickel-based CeAlO3 perovskite catalyst with specific doping levels is developed, providing stability at high temperatures and in the presence of steam and reducing gases, and is synthesized using the citrate gel method to maintain catalytic activity over extended periods.

Regulatory Framework Analysis Across Major Markets

The regulatory landscape governing perovskite catalyst industries varies significantly across major global markets, creating a complex compliance environment for manufacturers, researchers, and distributors. In the European Union, the regulatory framework is primarily shaped by REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations, which require extensive safety data and environmental impact assessments for new catalytic materials. The EU has recently implemented additional provisions specifically addressing nanomaterials in catalysts, requiring specialized testing protocols for perovskite nanostructures.

The United States approaches regulation through multiple agencies, with the Environmental Protection Agency (EPA) under the Toxic Substances Control Act (TSCA) serving as the primary regulatory body. Recent amendments to TSCA have strengthened the EPA's authority to evaluate and regulate new chemical substances, including novel perovskite formulations. Additionally, the Occupational Safety and Health Administration (OSHA) imposes workplace safety standards for handling these materials.

In Asia, regulatory frameworks demonstrate significant regional variation. Japan maintains stringent chemical substance regulations through their Chemical Substances Control Law (CSCL), requiring extensive pre-market notification for new perovskite catalysts. China has recently strengthened its environmental protection laws, implementing the Measures for Environmental Management of New Chemical Substances, which specifically addresses catalytic materials with potential environmental impacts.

Emerging markets present a different regulatory picture. India's chemical regulation system is undergoing significant transformation with the proposed Chemicals Management and Safety Rules, which would establish more comprehensive oversight of advanced catalytic materials. Brazil and South Africa have less developed regulatory frameworks specifically addressing advanced catalysts, creating both opportunities and compliance uncertainties.

A critical cross-market trend is the increasing focus on life-cycle assessment requirements. Regulations increasingly demand comprehensive analysis of environmental impacts from raw material extraction through disposal. For perovskite catalysts, this presents particular challenges due to the presence of lead and other potentially toxic elements in many formulations.

International harmonization efforts through organizations like the OECD are attempting to standardize testing protocols and safety assessments for advanced materials, though significant regulatory divergence persists. This creates compliance challenges for global operators in the perovskite catalyst space, necessitating market-specific regulatory strategies and product formulations.

The United States approaches regulation through multiple agencies, with the Environmental Protection Agency (EPA) under the Toxic Substances Control Act (TSCA) serving as the primary regulatory body. Recent amendments to TSCA have strengthened the EPA's authority to evaluate and regulate new chemical substances, including novel perovskite formulations. Additionally, the Occupational Safety and Health Administration (OSHA) imposes workplace safety standards for handling these materials.

In Asia, regulatory frameworks demonstrate significant regional variation. Japan maintains stringent chemical substance regulations through their Chemical Substances Control Law (CSCL), requiring extensive pre-market notification for new perovskite catalysts. China has recently strengthened its environmental protection laws, implementing the Measures for Environmental Management of New Chemical Substances, which specifically addresses catalytic materials with potential environmental impacts.

Emerging markets present a different regulatory picture. India's chemical regulation system is undergoing significant transformation with the proposed Chemicals Management and Safety Rules, which would establish more comprehensive oversight of advanced catalytic materials. Brazil and South Africa have less developed regulatory frameworks specifically addressing advanced catalysts, creating both opportunities and compliance uncertainties.

A critical cross-market trend is the increasing focus on life-cycle assessment requirements. Regulations increasingly demand comprehensive analysis of environmental impacts from raw material extraction through disposal. For perovskite catalysts, this presents particular challenges due to the presence of lead and other potentially toxic elements in many formulations.

International harmonization efforts through organizations like the OECD are attempting to standardize testing protocols and safety assessments for advanced materials, though significant regulatory divergence persists. This creates compliance challenges for global operators in the perovskite catalyst space, necessitating market-specific regulatory strategies and product formulations.

Environmental Impact and Sustainability Considerations

Perovskite catalysts, while offering revolutionary potential for clean energy applications, present significant environmental considerations that must be addressed through comprehensive regulatory frameworks. The manufacturing processes for perovskite materials often involve toxic substances such as lead, tin, and various solvents that pose environmental hazards if improperly managed. Current regulations across major markets increasingly focus on limiting these substances' environmental footprint throughout the product lifecycle.

The extraction of raw materials for perovskite production raises sustainability concerns, particularly regarding rare earth elements and precious metals that face supply constraints. Mining operations associated with these materials can result in habitat destruction, water pollution, and significant carbon emissions. Regulatory bodies in the EU, North America, and parts of Asia have implemented stringent requirements for responsible sourcing and supply chain transparency that directly impact perovskite catalyst manufacturers.

Waste management represents another critical environmental dimension, with end-of-life disposal of perovskite-containing products requiring specialized handling. The EU's Waste Electrical and Electronic Equipment (WEEE) Directive and similar regulations in other jurisdictions mandate specific recycling protocols for materials containing potentially hazardous substances. Industry stakeholders are increasingly required to demonstrate circular economy approaches, including design for recyclability and established take-back programs.

Carbon footprint considerations have gained regulatory prominence, with several jurisdictions implementing carbon pricing mechanisms that affect perovskite manufacturing economics. The energy-intensive production processes for high-quality perovskite catalysts face growing scrutiny under climate change mitigation policies. Companies leading in this space have begun adopting renewable energy for manufacturing operations to address these concerns and comply with emerging carbon reporting requirements.

Water usage and contamination risks present additional regulatory challenges, particularly in water-stressed regions where manufacturing facilities operate. Discharge permits for industrial processes involving perovskite production typically include strict limitations on heavy metals and organic solvents. Advanced water treatment technologies are becoming standard requirements in many jurisdictions to prevent environmental contamination.

The sustainability profile of perovskite catalysts ultimately depends on balancing their environmental impacts against their potential benefits in enabling clean energy technologies. Regulatory frameworks increasingly adopt lifecycle assessment approaches that consider both production impacts and use-phase benefits. Companies demonstrating superior environmental performance through reduced toxicity, improved resource efficiency, and circular business models are gaining competitive advantages as regulations continue to evolve toward more comprehensive sustainability standards.

The extraction of raw materials for perovskite production raises sustainability concerns, particularly regarding rare earth elements and precious metals that face supply constraints. Mining operations associated with these materials can result in habitat destruction, water pollution, and significant carbon emissions. Regulatory bodies in the EU, North America, and parts of Asia have implemented stringent requirements for responsible sourcing and supply chain transparency that directly impact perovskite catalyst manufacturers.

Waste management represents another critical environmental dimension, with end-of-life disposal of perovskite-containing products requiring specialized handling. The EU's Waste Electrical and Electronic Equipment (WEEE) Directive and similar regulations in other jurisdictions mandate specific recycling protocols for materials containing potentially hazardous substances. Industry stakeholders are increasingly required to demonstrate circular economy approaches, including design for recyclability and established take-back programs.

Carbon footprint considerations have gained regulatory prominence, with several jurisdictions implementing carbon pricing mechanisms that affect perovskite manufacturing economics. The energy-intensive production processes for high-quality perovskite catalysts face growing scrutiny under climate change mitigation policies. Companies leading in this space have begun adopting renewable energy for manufacturing operations to address these concerns and comply with emerging carbon reporting requirements.

Water usage and contamination risks present additional regulatory challenges, particularly in water-stressed regions where manufacturing facilities operate. Discharge permits for industrial processes involving perovskite production typically include strict limitations on heavy metals and organic solvents. Advanced water treatment technologies are becoming standard requirements in many jurisdictions to prevent environmental contamination.

The sustainability profile of perovskite catalysts ultimately depends on balancing their environmental impacts against their potential benefits in enabling clean energy technologies. Regulatory frameworks increasingly adopt lifecycle assessment approaches that consider both production impacts and use-phase benefits. Companies demonstrating superior environmental performance through reduced toxicity, improved resource efficiency, and circular business models are gaining competitive advantages as regulations continue to evolve toward more comprehensive sustainability standards.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!