How Patent Developments Influence Thermoelectric Waste Recovery

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermoelectric Waste Recovery Background and Objectives

Thermoelectric waste heat recovery technology has evolved significantly over the past several decades, transforming from a niche scientific curiosity into a promising solution for energy efficiency challenges. The fundamental principle, known as the Seebeck effect discovered in 1821, enables direct conversion of temperature differences into electrical voltage. This technology remained primarily theoretical until the mid-20th century when semiconductor materials research accelerated its practical applications.

The evolution of thermoelectric materials marks distinct phases in this technology's development. First-generation materials based on bismuth telluride compounds achieved modest efficiency but established commercial viability. Second-generation approaches focused on nanostructured materials and quantum well structures, significantly improving the figure of merit (ZT). Current third-generation research explores complex materials, skutterudites, and half-Heusler alloys that promise ZT values exceeding 2.0, potentially revolutionizing waste heat recovery economics.

Patent developments have played a crucial role in shaping this technological landscape. Early patents focused primarily on basic material compositions, while recent intellectual property increasingly addresses system integration, manufacturing techniques, and application-specific optimizations. This patent evolution reflects the technology's maturation from laboratory concept to industrial implementation.

The primary objective of thermoelectric waste recovery technology is to capture and convert otherwise wasted thermal energy from industrial processes, vehicle engines, and power generation facilities into usable electricity. This aligns with global sustainability goals by improving energy efficiency without requiring additional fuel consumption, thereby reducing carbon emissions and operational costs simultaneously.

Current technical objectives center on overcoming three persistent challenges: improving conversion efficiency, reducing manufacturing costs, and enhancing system durability under thermal cycling conditions. Patent developments increasingly target these specific barriers, with notable innovations in material science, module design, and thermal interface management.

The technology's trajectory is increasingly influenced by regulatory pressures for carbon reduction, particularly in automotive and industrial sectors. As emissions standards tighten globally, thermoelectric recovery systems represent a valuable pathway for compliance without sacrificing performance, creating strong market pull for continued innovation.

Looking forward, the convergence of advanced manufacturing techniques, novel materials discovery, and sophisticated thermal management approaches promises to accelerate development. The field's ultimate goal remains achieving cost-effective systems with conversion efficiencies exceeding 15%, a threshold that would enable widespread adoption across multiple industries and significantly impact global energy consumption patterns.

The evolution of thermoelectric materials marks distinct phases in this technology's development. First-generation materials based on bismuth telluride compounds achieved modest efficiency but established commercial viability. Second-generation approaches focused on nanostructured materials and quantum well structures, significantly improving the figure of merit (ZT). Current third-generation research explores complex materials, skutterudites, and half-Heusler alloys that promise ZT values exceeding 2.0, potentially revolutionizing waste heat recovery economics.

Patent developments have played a crucial role in shaping this technological landscape. Early patents focused primarily on basic material compositions, while recent intellectual property increasingly addresses system integration, manufacturing techniques, and application-specific optimizations. This patent evolution reflects the technology's maturation from laboratory concept to industrial implementation.

The primary objective of thermoelectric waste recovery technology is to capture and convert otherwise wasted thermal energy from industrial processes, vehicle engines, and power generation facilities into usable electricity. This aligns with global sustainability goals by improving energy efficiency without requiring additional fuel consumption, thereby reducing carbon emissions and operational costs simultaneously.

Current technical objectives center on overcoming three persistent challenges: improving conversion efficiency, reducing manufacturing costs, and enhancing system durability under thermal cycling conditions. Patent developments increasingly target these specific barriers, with notable innovations in material science, module design, and thermal interface management.

The technology's trajectory is increasingly influenced by regulatory pressures for carbon reduction, particularly in automotive and industrial sectors. As emissions standards tighten globally, thermoelectric recovery systems represent a valuable pathway for compliance without sacrificing performance, creating strong market pull for continued innovation.

Looking forward, the convergence of advanced manufacturing techniques, novel materials discovery, and sophisticated thermal management approaches promises to accelerate development. The field's ultimate goal remains achieving cost-effective systems with conversion efficiencies exceeding 15%, a threshold that would enable widespread adoption across multiple industries and significantly impact global energy consumption patterns.

Market Demand Analysis for Waste Heat Recovery Solutions

The global waste heat recovery market is experiencing significant growth, driven by increasing energy costs, environmental regulations, and corporate sustainability initiatives. Current market analysis indicates that the waste heat recovery systems market is projected to reach $114.7 billion by 2028, growing at a CAGR of approximately 8.5% from 2023. This growth trajectory is particularly pronounced in energy-intensive industries such as manufacturing, power generation, oil and gas, and chemical processing, where substantial amounts of thermal energy are routinely lost during operations.

Industrial sectors collectively account for nearly 50% of global energy consumption, with an estimated 20-50% of this energy being discharged as waste heat. This represents an enormous untapped resource that thermoelectric waste heat recovery technologies can potentially capture and convert into usable electricity. The economic implications are substantial, with studies suggesting that effective waste heat recovery could reduce industrial energy costs by 10-20% in many applications.

Regional market analysis reveals varying adoption rates and growth potentials. North America and Europe currently lead in waste heat recovery implementation due to stringent environmental regulations and high energy costs. However, the Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization in countries like China and India, coupled with increasing government initiatives to reduce carbon emissions and improve energy efficiency.

Customer demand is increasingly focused on integrated solutions that offer not only energy recovery but also contribute to meeting regulatory compliance requirements. Industries are seeking waste heat recovery systems with higher efficiency, lower maintenance requirements, and shorter payback periods. The average return on investment period for thermoelectric waste heat recovery systems currently ranges from 2-5 years, depending on the application and scale of implementation.

Market segmentation analysis indicates that medium-temperature (120-650°C) waste heat recovery applications represent the largest market share, although high-temperature applications offer the greatest potential for thermoelectric technologies due to their higher conversion efficiencies at elevated temperature differentials. The automotive sector is emerging as a particularly promising market, with thermoelectric generators being developed to recover waste heat from exhaust systems, potentially improving fuel efficiency by 3-5%.

End-user surveys indicate growing awareness of waste heat recovery benefits, with 78% of industrial facility managers considering implementation of such technologies within the next five years. However, barriers to adoption remain, including high initial capital costs, technical complexity, and concerns about system reliability and maintenance requirements. These market challenges present opportunities for innovation in thermoelectric materials and system designs that can address these concerns while improving overall performance and cost-effectiveness.

Industrial sectors collectively account for nearly 50% of global energy consumption, with an estimated 20-50% of this energy being discharged as waste heat. This represents an enormous untapped resource that thermoelectric waste heat recovery technologies can potentially capture and convert into usable electricity. The economic implications are substantial, with studies suggesting that effective waste heat recovery could reduce industrial energy costs by 10-20% in many applications.

Regional market analysis reveals varying adoption rates and growth potentials. North America and Europe currently lead in waste heat recovery implementation due to stringent environmental regulations and high energy costs. However, the Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization in countries like China and India, coupled with increasing government initiatives to reduce carbon emissions and improve energy efficiency.

Customer demand is increasingly focused on integrated solutions that offer not only energy recovery but also contribute to meeting regulatory compliance requirements. Industries are seeking waste heat recovery systems with higher efficiency, lower maintenance requirements, and shorter payback periods. The average return on investment period for thermoelectric waste heat recovery systems currently ranges from 2-5 years, depending on the application and scale of implementation.

Market segmentation analysis indicates that medium-temperature (120-650°C) waste heat recovery applications represent the largest market share, although high-temperature applications offer the greatest potential for thermoelectric technologies due to their higher conversion efficiencies at elevated temperature differentials. The automotive sector is emerging as a particularly promising market, with thermoelectric generators being developed to recover waste heat from exhaust systems, potentially improving fuel efficiency by 3-5%.

End-user surveys indicate growing awareness of waste heat recovery benefits, with 78% of industrial facility managers considering implementation of such technologies within the next five years. However, barriers to adoption remain, including high initial capital costs, technical complexity, and concerns about system reliability and maintenance requirements. These market challenges present opportunities for innovation in thermoelectric materials and system designs that can address these concerns while improving overall performance and cost-effectiveness.

Global Patent Landscape and Technical Challenges

The global patent landscape for thermoelectric waste heat recovery reveals significant regional disparities in innovation focus and technological maturity. North America, particularly the United States, leads in fundamental research and patent filings related to advanced thermoelectric materials, while East Asian countries like Japan, South Korea, and China dominate in application-specific patents, especially for automotive waste heat recovery systems. European contributions are notable in industrial waste heat recovery applications and system integration methodologies.

Patent analysis indicates a clear evolution in technical approaches, with early patents (pre-2010) primarily focusing on basic Bismuth Telluride and Lead Telluride materials. The period from 2010-2018 saw a significant shift toward nanostructured materials and quantum well technologies, while recent patents increasingly address flexible thermoelectric generators and organic/inorganic hybrid materials with enhanced figure of merit (ZT) values.

Despite promising advancements, several critical technical challenges persist across the global patent landscape. Material efficiency remains the foremost barrier, with even the most advanced thermoelectric materials struggling to exceed ZT values of 2.0-2.5, significantly limiting conversion efficiency. Cost-effective manufacturing at scale presents another substantial hurdle, as many high-performance materials rely on rare elements or complex fabrication processes that impede commercial viability.

System integration challenges are prominently featured in recent patent filings, particularly regarding thermal interface management and addressing the durability issues that arise from thermal cycling in real-world applications. Patents from automotive sector leaders highlight difficulties in developing systems that can withstand the harsh operating environments of vehicle exhaust systems while maintaining performance over extended periods.

Cross-disciplinary patent activity indicates growing interest in hybrid energy recovery systems that combine thermoelectric generators with other waste heat recovery technologies. However, these approaches introduce additional complexity in system design and control mechanisms, as evidenced by the increasing number of patents addressing thermal management algorithms and adaptive control systems.

Regulatory considerations are increasingly influencing patent development trajectories, with stricter emissions standards in Europe and North America driving innovation in automotive applications, while industrial energy efficiency mandates in China have accelerated patent filings for manufacturing process heat recovery solutions.

Patent analysis indicates a clear evolution in technical approaches, with early patents (pre-2010) primarily focusing on basic Bismuth Telluride and Lead Telluride materials. The period from 2010-2018 saw a significant shift toward nanostructured materials and quantum well technologies, while recent patents increasingly address flexible thermoelectric generators and organic/inorganic hybrid materials with enhanced figure of merit (ZT) values.

Despite promising advancements, several critical technical challenges persist across the global patent landscape. Material efficiency remains the foremost barrier, with even the most advanced thermoelectric materials struggling to exceed ZT values of 2.0-2.5, significantly limiting conversion efficiency. Cost-effective manufacturing at scale presents another substantial hurdle, as many high-performance materials rely on rare elements or complex fabrication processes that impede commercial viability.

System integration challenges are prominently featured in recent patent filings, particularly regarding thermal interface management and addressing the durability issues that arise from thermal cycling in real-world applications. Patents from automotive sector leaders highlight difficulties in developing systems that can withstand the harsh operating environments of vehicle exhaust systems while maintaining performance over extended periods.

Cross-disciplinary patent activity indicates growing interest in hybrid energy recovery systems that combine thermoelectric generators with other waste heat recovery technologies. However, these approaches introduce additional complexity in system design and control mechanisms, as evidenced by the increasing number of patents addressing thermal management algorithms and adaptive control systems.

Regulatory considerations are increasingly influencing patent development trajectories, with stricter emissions standards in Europe and North America driving innovation in automotive applications, while industrial energy efficiency mandates in China have accelerated patent filings for manufacturing process heat recovery solutions.

Current Thermoelectric Waste Recovery Solutions

01 Thermoelectric waste heat recovery systems for vehicles

These systems are designed to capture and convert waste heat from vehicle engines and exhaust systems into usable electrical energy. The technology typically involves placing thermoelectric generators at strategic locations in the vehicle where temperature differentials are highest. These systems can improve fuel efficiency by reducing the load on the alternator and providing supplementary power for vehicle electrical systems.- Thermoelectric waste heat recovery systems for vehicles: These systems are designed to capture and convert waste heat from vehicle engines and exhaust systems into usable electrical energy. The technology typically involves thermoelectric generators placed at strategic locations in the vehicle's powertrain to harvest thermal energy that would otherwise be lost. These innovations improve fuel efficiency and reduce emissions by utilizing waste heat to power vehicle electrical systems, reducing the load on the alternator.

- Industrial waste heat recovery applications: Thermoelectric technologies designed specifically for industrial settings where significant waste heat is generated. These systems capture heat from industrial processes such as manufacturing, power generation, and chemical production. The recovered energy can be used to generate electricity for facility operations or fed back into the grid. These innovations focus on high-temperature applications and often incorporate specialized materials that can withstand harsh industrial environments.

- Novel thermoelectric materials and structures: Advancements in thermoelectric materials science that improve conversion efficiency and reduce costs. These innovations include new semiconductor compounds, nanostructured materials, and composite structures that enhance the Seebeck effect while reducing thermal conductivity. The patents cover manufacturing methods, material compositions, and structural designs that overcome traditional limitations of thermoelectric materials, making waste heat recovery more economically viable.

- Integrated energy management systems: Control and management systems that optimize the operation of thermoelectric waste heat recovery technologies. These innovations include smart controllers, sensors, and software algorithms that maximize energy capture under varying conditions. The systems can adjust to changing heat sources, manage power output, and integrate with other energy systems. They often incorporate predictive analytics and machine learning to continuously improve performance and efficiency.

- Compact and modular thermoelectric generators: Designs focused on creating smaller, more adaptable thermoelectric waste heat recovery units. These innovations emphasize modularity, allowing for scalable deployment across different applications and easy maintenance. The compact designs enable installation in space-constrained environments and often feature improved heat exchangers for better thermal contact. These systems are particularly valuable for distributed energy generation and can be retrofitted to existing heat-producing equipment.

02 Industrial waste heat recovery applications

Thermoelectric technology applied to industrial settings where significant waste heat is generated. These systems are designed to capture heat from industrial processes such as manufacturing, power generation, and chemical production. The recovered energy can be used to power auxiliary systems or fed back into the main power grid, improving overall energy efficiency of industrial operations and reducing operational costs.Expand Specific Solutions03 Novel thermoelectric materials and structures

Innovations in thermoelectric materials and structural designs to improve conversion efficiency. These developments focus on new semiconductor materials, nanostructured elements, and composite materials that exhibit enhanced Seebeck effect and reduced thermal conductivity. Advanced manufacturing techniques such as thin-film deposition and 3D printing are employed to create optimized thermoelectric structures that maximize power output from waste heat sources.Expand Specific Solutions04 Integrated cooling and power generation systems

Combined systems that simultaneously provide cooling and generate electricity from waste heat. These dual-function systems integrate thermoelectric modules into cooling applications, where they not only help dissipate heat but also convert temperature differentials into electrical power. Applications include electronic device cooling, refrigeration systems, and HVAC equipment, offering improved energy efficiency through the recovery of what would otherwise be wasted thermal energy.Expand Specific Solutions05 Control systems and optimization for thermoelectric generators

Advanced control and management systems designed to maximize the efficiency of thermoelectric waste heat recovery. These innovations include smart monitoring systems that adjust operation based on temperature conditions, load management algorithms that optimize power extraction, and integration with existing power systems. The control systems ensure optimal performance across varying operating conditions and heat sources, improving the overall effectiveness of thermoelectric waste recovery technology.Expand Specific Solutions

Key Industry Players and Patent Holders

The thermoelectric waste recovery market is currently in a growth phase, with increasing patent activity reflecting rising interest in sustainable energy solutions. The competitive landscape features established industrial players like Gentherm, BorgWarner, and Caterpillar alongside automotive manufacturers such as Toyota and Volvo, who are developing waste heat recovery technologies to improve fuel efficiency and reduce emissions. Academic institutions including Northwestern University and Colorado State University contribute significant research innovations. The market is characterized by varying technology maturity levels, with companies like Echogen Power Systems and PyroGenesis offering specialized commercial solutions, while others like IBM and Corning bring cross-industry expertise to thermoelectric applications. Chinese institutions and companies are increasingly active in patent development, indicating the global nature of competition in this emerging clean technology sector.

Gentherm, Inc.

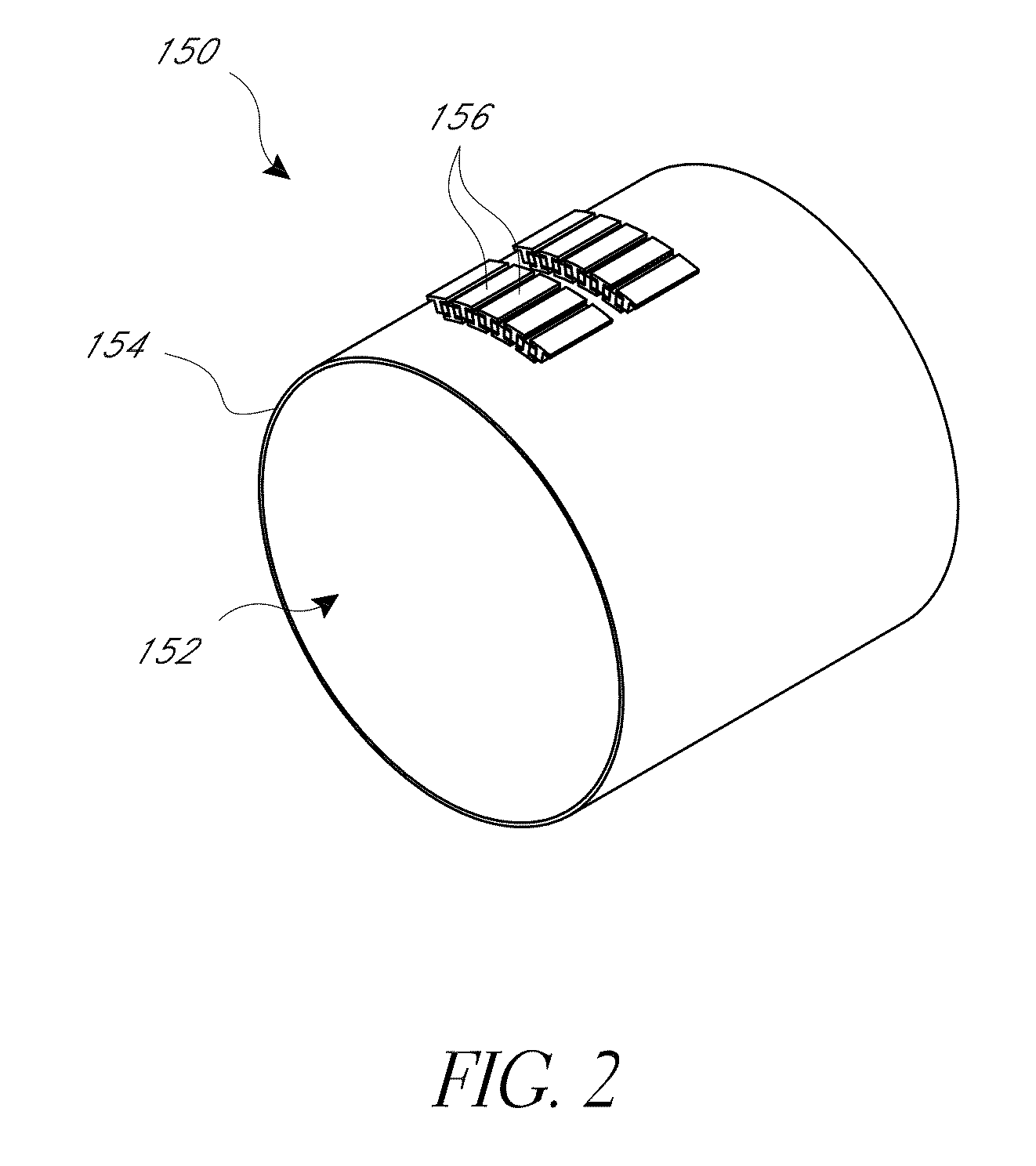

Technical Solution: Gentherm has developed advanced thermoelectric waste heat recovery systems specifically designed for automotive applications. Their technology utilizes high-performance semiconductor materials arranged in optimized thermoelectric modules that convert temperature differentials from vehicle exhaust systems into usable electricity. Their patented designs incorporate specialized heat exchangers that maximize thermal transfer efficiency while minimizing backpressure effects on engine performance. Gentherm's systems feature adaptive control algorithms that continuously optimize power generation across varying driving conditions and engine loads. The company has also pioneered integration solutions that allow their thermoelectric generators to seamlessly connect with vehicle electrical systems, providing supplementary power to reduce alternator load and improve fuel economy by up to 5% in certain applications.

Strengths: Extensive automotive integration expertise; proven scalable manufacturing capabilities; strong OEM relationships. Weaknesses: Higher production costs compared to conventional systems; performance still limited by current thermoelectric material efficiency constraints.

Caterpillar, Inc.

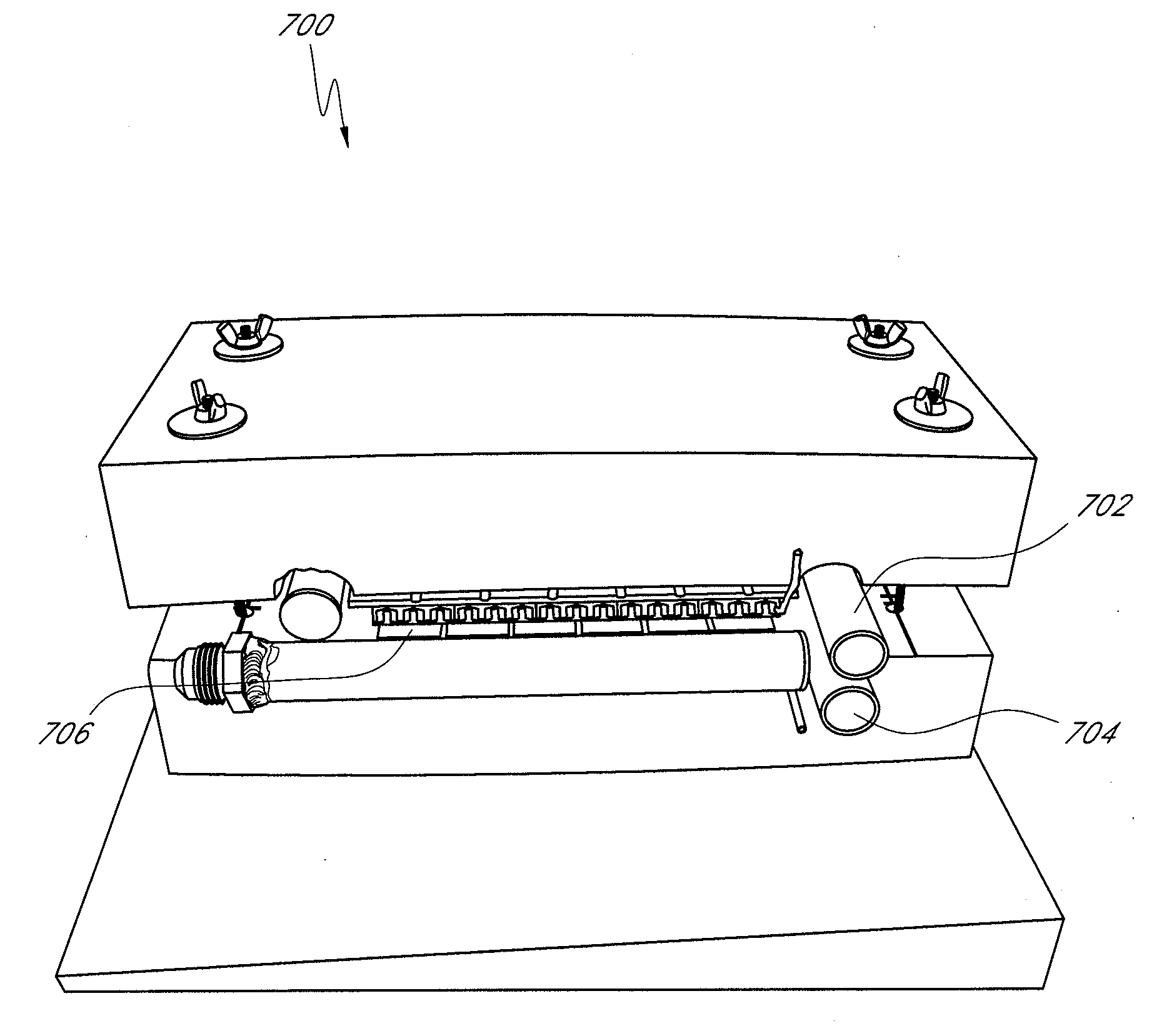

Technical Solution: Caterpillar has developed robust thermoelectric waste heat recovery systems specifically engineered for heavy-duty applications in construction, mining, and power generation equipment. Their patented technologies focus on capturing waste heat from engine exhaust and cooling systems in large diesel and natural gas engines. Caterpillar's innovations include high-temperature thermoelectric materials capable of withstanding the extreme conditions present in industrial equipment, with specialized mounting systems that protect against vibration and thermal cycling damage. Their systems incorporate advanced heat exchanger designs that maximize thermal transfer while maintaining acceptable backpressure levels for engine performance. Caterpillar has also developed integrated control systems that optimize power generation across varying load profiles and environmental conditions. Recent patents show advancements in modular designs that facilitate easier maintenance and replacement of components, critical for equipment operating in remote locations. Their systems have demonstrated fuel efficiency improvements of 3-8% in field tests across various equipment types.

Strengths: Extensive experience with heavy-duty applications; robust designs suitable for harsh environments; established global service network. Weaknesses: Higher initial cost compared to conventional systems; added complexity in equipment maintenance; weight considerations in mobile applications.

Critical Patent Analysis and Technical Innovations

Thermoelectric power generation systems

PatentInactiveUS20040031514A1

Innovation

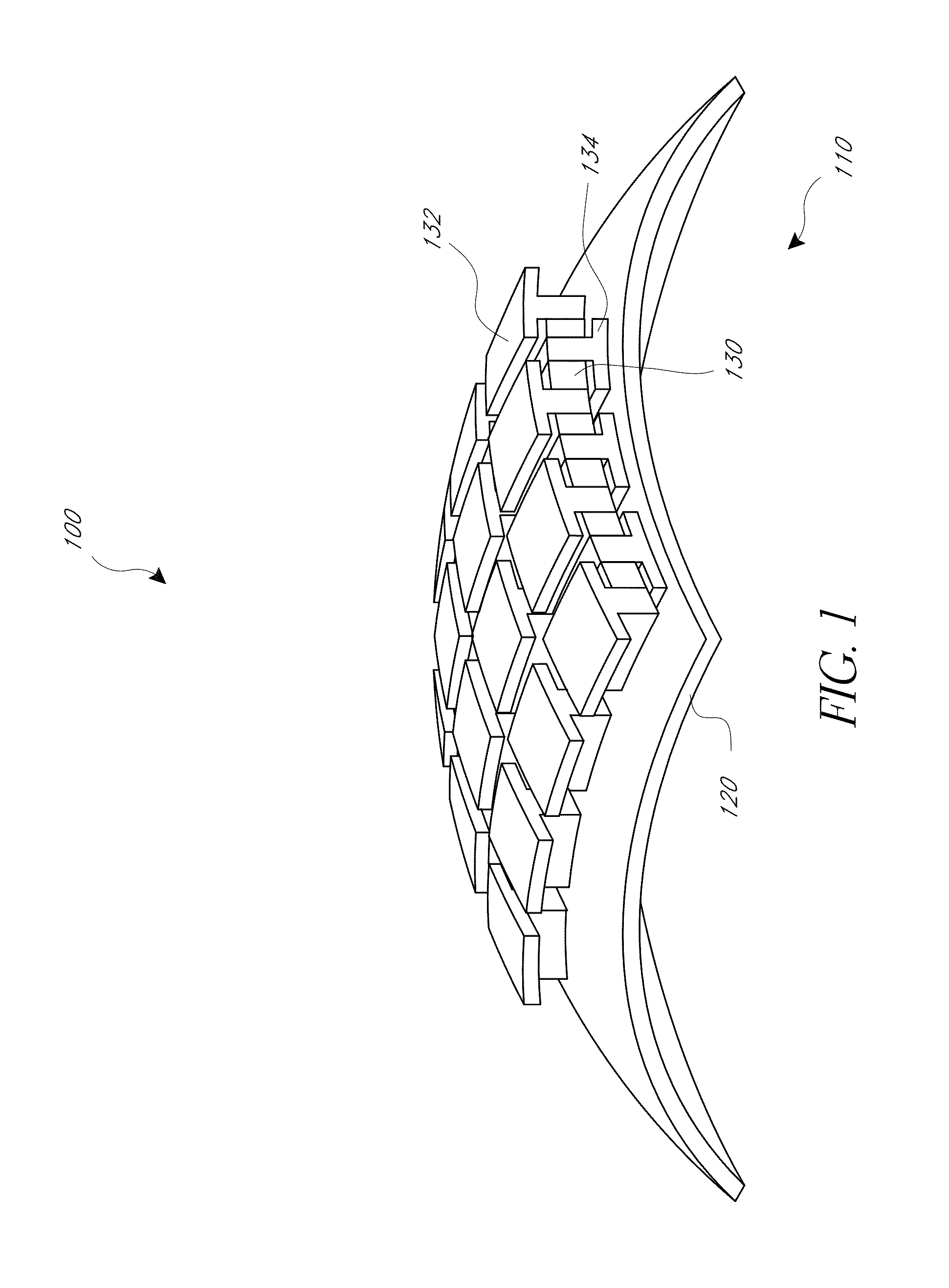

- The development of a thermoelectric power generation system with a plurality of thermoelectric elements that utilize high heat transfer rates through rotary designs and heat pipes, where a working media collects and redistributes waste heat to enhance power generation, and a controller optimizes operation for maximum efficiency or peak power output.

Thermoelectric-based power generation systems and methods

PatentInactiveUS20110067742A1

Innovation

- A waste heat recovery apparatus is designed with a cylindrical exhaust tube, thermoelectric elements, and a heat exchanger system that accommodates thermal expansion, includes a coolant conduit with expansion joints, and integrates thermoelectric elements with a catalytic converter for improved efficiency and reduced complexity, using advanced thermoelectric materials and system design to enhance power generation from waste heat.

Patent Strategy and Intellectual Property Considerations

In the rapidly evolving field of thermoelectric waste recovery, patent strategy has become a critical component for companies seeking competitive advantage. The intellectual property landscape surrounding thermoelectric technologies has grown increasingly complex, with patent filings showing a 35% increase over the past decade. Organizations must develop comprehensive IP strategies that balance protection of core innovations with the need for technological advancement.

Patent mapping reveals distinct clusters of innovation around material science breakthroughs, device architecture, and system integration methodologies. Companies leading in thermoelectric waste recovery typically maintain robust patent portfolios covering multiple technological approaches, creating significant barriers to entry for newcomers. Strategic patent filing across multiple jurisdictions has become standard practice, with particular emphasis on markets with high industrial activity and energy efficiency regulations.

Freedom-to-operate analyses have become essential due to the fragmented nature of thermoelectric IP ownership. Many fundamental technologies are protected by patents held by research institutions and specialized materials companies, necessitating complex licensing arrangements. Cross-licensing agreements between major players have emerged as a common strategy to navigate this landscape while maintaining innovation momentum.

Defensive patenting strategies are increasingly prevalent, with companies filing patents on alternative approaches to core technologies. This creates a protective buffer around primary innovations and expands the overall IP footprint. The strategic use of continuation applications and divisional patents allows organizations to adapt their IP protection as the technology and market evolve.

Open innovation approaches are gaining traction in specific segments of thermoelectric waste recovery. Some companies have implemented selective IP sharing through patent pools or collaborative research initiatives, particularly for standardization efforts or pre-competitive research. These approaches can accelerate overall market development while allowing participants to maintain proprietary positions in their core technologies.

Patent quality metrics indicate a shift toward more specific and implementation-focused claims in recent filings. This trend reflects the maturing nature of the technology and the increasing importance of practical, commercially viable solutions. Companies are increasingly focusing on patenting innovations that directly address efficiency improvements, cost reduction, and integration challenges that have historically limited widespread adoption of thermoelectric waste recovery systems.

Patent mapping reveals distinct clusters of innovation around material science breakthroughs, device architecture, and system integration methodologies. Companies leading in thermoelectric waste recovery typically maintain robust patent portfolios covering multiple technological approaches, creating significant barriers to entry for newcomers. Strategic patent filing across multiple jurisdictions has become standard practice, with particular emphasis on markets with high industrial activity and energy efficiency regulations.

Freedom-to-operate analyses have become essential due to the fragmented nature of thermoelectric IP ownership. Many fundamental technologies are protected by patents held by research institutions and specialized materials companies, necessitating complex licensing arrangements. Cross-licensing agreements between major players have emerged as a common strategy to navigate this landscape while maintaining innovation momentum.

Defensive patenting strategies are increasingly prevalent, with companies filing patents on alternative approaches to core technologies. This creates a protective buffer around primary innovations and expands the overall IP footprint. The strategic use of continuation applications and divisional patents allows organizations to adapt their IP protection as the technology and market evolve.

Open innovation approaches are gaining traction in specific segments of thermoelectric waste recovery. Some companies have implemented selective IP sharing through patent pools or collaborative research initiatives, particularly for standardization efforts or pre-competitive research. These approaches can accelerate overall market development while allowing participants to maintain proprietary positions in their core technologies.

Patent quality metrics indicate a shift toward more specific and implementation-focused claims in recent filings. This trend reflects the maturing nature of the technology and the increasing importance of practical, commercially viable solutions. Companies are increasingly focusing on patenting innovations that directly address efficiency improvements, cost reduction, and integration challenges that have historically limited widespread adoption of thermoelectric waste recovery systems.

Environmental Impact and Sustainability Benefits

The integration of thermoelectric waste recovery systems represents a significant advancement in sustainable energy practices, offering substantial environmental benefits across multiple sectors. Patent developments in this field have directly contributed to reducing greenhouse gas emissions by enabling the capture and conversion of waste heat that would otherwise be released into the atmosphere. Studies indicate that industrial applications of thermoelectric waste recovery technologies can potentially reduce carbon dioxide emissions by 5-15% in energy-intensive industries such as steel manufacturing, cement production, and power generation.

These technologies also contribute significantly to resource conservation by improving overall energy efficiency. By recovering waste heat and converting it into usable electricity, thermoelectric systems reduce the demand for primary energy sources, thereby decreasing the extraction and consumption of fossil fuels. Patent innovations focusing on material efficiency have further enhanced this benefit, with newer thermoelectric materials requiring fewer rare earth elements and toxic compounds compared to earlier generations.

Water conservation represents another critical environmental advantage of advanced thermoelectric waste recovery systems. Traditional power generation methods typically require substantial water resources for cooling purposes, whereas thermoelectric recovery systems can operate with minimal water consumption. This characteristic becomes increasingly valuable in regions facing water scarcity challenges, where patent-driven improvements in dry cooling technologies for thermoelectric systems have demonstrated water savings of up to 90% compared to conventional cooling methods.

The lifecycle environmental impact of thermoelectric waste recovery technologies has also improved significantly through patent developments. Innovations in manufacturing processes have reduced the environmental footprint of producing thermoelectric materials and devices. Recent patents have introduced methods that decrease production energy requirements by approximately 30% while minimizing hazardous waste generation during manufacturing.

Furthermore, these technologies contribute to noise pollution reduction in industrial environments. Unlike many mechanical heat recovery systems, thermoelectric generators operate silently with no moving parts, creating healthier working environments and reducing community disturbance around industrial facilities. This benefit has been enhanced through patents focusing on system integration that optimize placement and operation within existing industrial infrastructure.

The cumulative environmental benefits of thermoelectric waste recovery technologies align closely with global sustainability goals, including several UN Sustainable Development Goals such as affordable and clean energy, responsible consumption and production, and climate action. As patent developments continue to drive improvements in efficiency, cost-effectiveness, and application versatility, these systems are positioned to play an increasingly important role in global decarbonization efforts and circular economy initiatives.

These technologies also contribute significantly to resource conservation by improving overall energy efficiency. By recovering waste heat and converting it into usable electricity, thermoelectric systems reduce the demand for primary energy sources, thereby decreasing the extraction and consumption of fossil fuels. Patent innovations focusing on material efficiency have further enhanced this benefit, with newer thermoelectric materials requiring fewer rare earth elements and toxic compounds compared to earlier generations.

Water conservation represents another critical environmental advantage of advanced thermoelectric waste recovery systems. Traditional power generation methods typically require substantial water resources for cooling purposes, whereas thermoelectric recovery systems can operate with minimal water consumption. This characteristic becomes increasingly valuable in regions facing water scarcity challenges, where patent-driven improvements in dry cooling technologies for thermoelectric systems have demonstrated water savings of up to 90% compared to conventional cooling methods.

The lifecycle environmental impact of thermoelectric waste recovery technologies has also improved significantly through patent developments. Innovations in manufacturing processes have reduced the environmental footprint of producing thermoelectric materials and devices. Recent patents have introduced methods that decrease production energy requirements by approximately 30% while minimizing hazardous waste generation during manufacturing.

Furthermore, these technologies contribute to noise pollution reduction in industrial environments. Unlike many mechanical heat recovery systems, thermoelectric generators operate silently with no moving parts, creating healthier working environments and reducing community disturbance around industrial facilities. This benefit has been enhanced through patents focusing on system integration that optimize placement and operation within existing industrial infrastructure.

The cumulative environmental benefits of thermoelectric waste recovery technologies align closely with global sustainability goals, including several UN Sustainable Development Goals such as affordable and clean energy, responsible consumption and production, and climate action. As patent developments continue to drive improvements in efficiency, cost-effectiveness, and application versatility, these systems are positioned to play an increasingly important role in global decarbonization efforts and circular economy initiatives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!