Thermoelectric Waste Recovery in Energy Regulation Compliance

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermoelectric Recovery Background and Objectives

Thermoelectric waste heat recovery technology has evolved significantly over the past several decades, transforming from theoretical concepts to practical applications across multiple industries. The fundamental principle behind this technology—the Seebeck effect discovered in 1821—enables direct conversion of temperature differentials into electrical energy without moving parts. This elegant solution addresses a critical inefficiency in modern industrial processes where approximately 20-50% of energy input is lost as waste heat.

The evolution of thermoelectric materials has been marked by three distinct generations. First-generation materials based on bismuth telluride (Bi₂Te₃) achieved conversion efficiencies of 4-6%. Second-generation materials incorporating advanced semiconductor alloys pushed efficiencies to 7-8%. Current third-generation materials utilizing nanostructuring techniques and quantum confinement effects are approaching the 10-12% efficiency threshold, making commercial applications increasingly viable.

Global energy consumption patterns and regulatory frameworks have created a compelling environment for thermoelectric recovery technologies. The International Energy Agency estimates that industrial waste heat represents an untapped resource of approximately 300 million terajoules annually. With increasingly stringent carbon emission regulations being implemented worldwide, particularly following the Paris Climate Agreement, industries face mounting pressure to improve energy efficiency and reduce environmental impact.

The primary technical objective for thermoelectric waste recovery systems is to achieve cost-effective conversion efficiency exceeding 15% in real-world industrial environments. This requires addressing challenges in material science, system integration, and thermal management. Secondary objectives include reducing manufacturing costs below $1/watt, extending operational lifespans beyond 10 years, and developing modular designs adaptable to diverse industrial settings.

Recent advancements in nanomaterials and manufacturing techniques have accelerated progress toward these goals. Specifically, skutterudite compounds, half-Heusler alloys, and silicon-germanium nanocomposites have demonstrated promising performance characteristics at temperatures ranging from 300°C to 800°C—precisely matching the waste heat profile of many industrial processes.

The convergence of environmental regulations, energy security concerns, and technological maturation has created a unique opportunity for thermoelectric waste recovery systems. As global industries seek pathways to regulatory compliance while maintaining economic competitiveness, these technologies offer a compelling value proposition: converting previously wasted energy into usable electricity while simultaneously reducing thermal pollution and carbon emissions.

The evolution of thermoelectric materials has been marked by three distinct generations. First-generation materials based on bismuth telluride (Bi₂Te₃) achieved conversion efficiencies of 4-6%. Second-generation materials incorporating advanced semiconductor alloys pushed efficiencies to 7-8%. Current third-generation materials utilizing nanostructuring techniques and quantum confinement effects are approaching the 10-12% efficiency threshold, making commercial applications increasingly viable.

Global energy consumption patterns and regulatory frameworks have created a compelling environment for thermoelectric recovery technologies. The International Energy Agency estimates that industrial waste heat represents an untapped resource of approximately 300 million terajoules annually. With increasingly stringent carbon emission regulations being implemented worldwide, particularly following the Paris Climate Agreement, industries face mounting pressure to improve energy efficiency and reduce environmental impact.

The primary technical objective for thermoelectric waste recovery systems is to achieve cost-effective conversion efficiency exceeding 15% in real-world industrial environments. This requires addressing challenges in material science, system integration, and thermal management. Secondary objectives include reducing manufacturing costs below $1/watt, extending operational lifespans beyond 10 years, and developing modular designs adaptable to diverse industrial settings.

Recent advancements in nanomaterials and manufacturing techniques have accelerated progress toward these goals. Specifically, skutterudite compounds, half-Heusler alloys, and silicon-germanium nanocomposites have demonstrated promising performance characteristics at temperatures ranging from 300°C to 800°C—precisely matching the waste heat profile of many industrial processes.

The convergence of environmental regulations, energy security concerns, and technological maturation has created a unique opportunity for thermoelectric waste recovery systems. As global industries seek pathways to regulatory compliance while maintaining economic competitiveness, these technologies offer a compelling value proposition: converting previously wasted energy into usable electricity while simultaneously reducing thermal pollution and carbon emissions.

Market Analysis for Waste Heat Recovery Solutions

The global waste heat recovery market is experiencing significant growth, valued at approximately $54 billion in 2020 and projected to reach $80 billion by 2026, with a compound annual growth rate of 8.8%. This growth is primarily driven by stringent energy efficiency regulations across major economies, particularly in industrial sectors where thermal processes generate substantial waste heat. The European Union's Energy Efficiency Directive and the United States' Department of Energy standards have established frameworks that incentivize the implementation of waste heat recovery technologies.

Industrial sectors represent the largest market segment for thermoelectric waste recovery solutions, accounting for nearly 65% of the total market share. Within this segment, heavy industries such as steel, cement, glass, and chemical processing demonstrate the highest adoption rates due to their energy-intensive operations and significant waste heat generation. The automotive sector is emerging as a rapidly growing market, with waste heat recovery systems being integrated into vehicle exhaust systems to improve fuel efficiency and reduce emissions.

Geographically, Asia-Pacific dominates the market with approximately 40% share, led by China and India's expanding industrial base and increasing focus on energy efficiency. North America and Europe follow closely, with mature markets characterized by technology innovation and stringent regulatory frameworks. The Middle East and Africa represent emerging markets with growing potential, particularly in oil and gas operations where waste heat recovery can significantly improve operational efficiency.

Customer demand patterns reveal a preference for integrated solutions that offer minimal disruption to existing operations, low maintenance requirements, and demonstrable return on investment within 3-5 years. The market is increasingly segmented between high-temperature (>400°C) and medium-to-low temperature (<400°C) recovery solutions, with the latter showing faster growth due to technological advancements in thermoelectric materials.

Price sensitivity varies significantly across market segments, with large industrial customers focusing on long-term operational savings rather than initial capital expenditure. Small and medium enterprises demonstrate higher price sensitivity, creating demand for modular, scalable solutions with lower entry costs. Government incentives, carbon pricing mechanisms, and energy cost volatility are key factors influencing purchasing decisions across all segments.

Market barriers include high initial capital costs, technical complexity of integration with existing systems, and uncertainty regarding long-term performance and maintenance requirements. Additionally, the fragmented nature of the waste heat recovery market, with numerous specialized solutions for different temperature ranges and applications, creates challenges for standardization and economies of scale.

Industrial sectors represent the largest market segment for thermoelectric waste recovery solutions, accounting for nearly 65% of the total market share. Within this segment, heavy industries such as steel, cement, glass, and chemical processing demonstrate the highest adoption rates due to their energy-intensive operations and significant waste heat generation. The automotive sector is emerging as a rapidly growing market, with waste heat recovery systems being integrated into vehicle exhaust systems to improve fuel efficiency and reduce emissions.

Geographically, Asia-Pacific dominates the market with approximately 40% share, led by China and India's expanding industrial base and increasing focus on energy efficiency. North America and Europe follow closely, with mature markets characterized by technology innovation and stringent regulatory frameworks. The Middle East and Africa represent emerging markets with growing potential, particularly in oil and gas operations where waste heat recovery can significantly improve operational efficiency.

Customer demand patterns reveal a preference for integrated solutions that offer minimal disruption to existing operations, low maintenance requirements, and demonstrable return on investment within 3-5 years. The market is increasingly segmented between high-temperature (>400°C) and medium-to-low temperature (<400°C) recovery solutions, with the latter showing faster growth due to technological advancements in thermoelectric materials.

Price sensitivity varies significantly across market segments, with large industrial customers focusing on long-term operational savings rather than initial capital expenditure. Small and medium enterprises demonstrate higher price sensitivity, creating demand for modular, scalable solutions with lower entry costs. Government incentives, carbon pricing mechanisms, and energy cost volatility are key factors influencing purchasing decisions across all segments.

Market barriers include high initial capital costs, technical complexity of integration with existing systems, and uncertainty regarding long-term performance and maintenance requirements. Additionally, the fragmented nature of the waste heat recovery market, with numerous specialized solutions for different temperature ranges and applications, creates challenges for standardization and economies of scale.

Global Thermoelectric Technology Status and Barriers

Thermoelectric waste heat recovery technology has reached varying levels of maturity across different regions globally. In North America and Europe, significant advancements have been made in automotive applications, with companies like Gentherm and Faurecia developing systems that convert exhaust heat into usable electricity. Japan leads in industrial applications, with Panasonic and KELK demonstrating high-efficiency modules for factory settings. China has rapidly expanded its research capabilities, focusing primarily on cost reduction and mass production techniques.

Despite these advancements, thermoelectric technology faces substantial barriers to widespread adoption. The primary technical limitation remains conversion efficiency, with most commercial thermoelectric generators (TEGs) operating at only 5-8% efficiency. This low conversion rate makes economic justification difficult, particularly in applications where alternative recovery methods exist. Material constraints present another significant challenge, as high-performance thermoelectric materials often rely on rare or toxic elements like tellurium, bismuth, and lead.

Manufacturing scalability represents a persistent obstacle, with precision requirements for module assembly driving up production costs. The interface between hot surfaces and thermoelectric modules frequently suffers from thermal contact resistance issues, reducing real-world performance compared to laboratory conditions. Additionally, durability concerns emerge in applications with thermal cycling, where coefficient of thermal expansion mismatches can lead to mechanical stress and premature failure.

Regulatory frameworks vary significantly by region, creating a fragmented market landscape. While the European Union has established incentives for waste heat recovery under its Energy Efficiency Directive, implementation remains inconsistent across member states. The United States lacks comprehensive federal policies, though certain states offer tax incentives for industrial waste heat recovery projects. In Asia, Japan and South Korea have integrated thermoelectric recovery into their industrial energy efficiency standards, while China's policies primarily focus on manufacturing capacity development.

Cost-benefit considerations continue to limit adoption, with typical payback periods ranging from 3-7 years depending on application and energy prices. This timeline often exceeds corporate investment thresholds, particularly in industries with thin profit margins. The absence of standardized testing protocols and performance metrics further complicates market development, making it difficult for end-users to compare competing technologies and verify manufacturer claims.

Despite these advancements, thermoelectric technology faces substantial barriers to widespread adoption. The primary technical limitation remains conversion efficiency, with most commercial thermoelectric generators (TEGs) operating at only 5-8% efficiency. This low conversion rate makes economic justification difficult, particularly in applications where alternative recovery methods exist. Material constraints present another significant challenge, as high-performance thermoelectric materials often rely on rare or toxic elements like tellurium, bismuth, and lead.

Manufacturing scalability represents a persistent obstacle, with precision requirements for module assembly driving up production costs. The interface between hot surfaces and thermoelectric modules frequently suffers from thermal contact resistance issues, reducing real-world performance compared to laboratory conditions. Additionally, durability concerns emerge in applications with thermal cycling, where coefficient of thermal expansion mismatches can lead to mechanical stress and premature failure.

Regulatory frameworks vary significantly by region, creating a fragmented market landscape. While the European Union has established incentives for waste heat recovery under its Energy Efficiency Directive, implementation remains inconsistent across member states. The United States lacks comprehensive federal policies, though certain states offer tax incentives for industrial waste heat recovery projects. In Asia, Japan and South Korea have integrated thermoelectric recovery into their industrial energy efficiency standards, while China's policies primarily focus on manufacturing capacity development.

Cost-benefit considerations continue to limit adoption, with typical payback periods ranging from 3-7 years depending on application and energy prices. This timeline often exceeds corporate investment thresholds, particularly in industries with thin profit margins. The absence of standardized testing protocols and performance metrics further complicates market development, making it difficult for end-users to compare competing technologies and verify manufacturer claims.

Current Thermoelectric Conversion Implementation Methods

01 Thermoelectric generators for waste heat recovery

Thermoelectric generators (TEGs) can convert waste heat directly into electrical energy through the Seebeck effect. These systems are particularly effective for recovering energy from industrial processes, vehicle exhaust systems, and other high-temperature waste heat sources. The efficiency of TEGs depends on the temperature difference between the hot and cold sides, as well as the properties of the thermoelectric materials used.- Thermoelectric generators for waste heat recovery: Thermoelectric generators (TEGs) can convert waste heat directly into electrical energy through the Seebeck effect. These systems are particularly effective for recovering energy from industrial processes, vehicle exhaust systems, and other high-temperature waste heat sources. The efficiency of TEGs depends on the temperature gradient and the properties of the thermoelectric materials used. Advanced thermoelectric materials with high figure of merit (ZT) values can significantly improve the conversion efficiency.

- Integrated waste heat recovery systems: Integrated systems combine multiple technologies to maximize energy recovery from waste heat sources. These systems may incorporate thermoelectric generators alongside other recovery methods such as Organic Rankine Cycle (ORC), heat exchangers, or heat pumps. By integrating complementary technologies, these systems can address different temperature ranges and operating conditions, improving overall energy recovery efficiency and providing flexibility for various industrial applications.

- Vehicle exhaust energy recovery systems: Specialized systems designed to recover waste heat from vehicle exhaust gases can improve fuel efficiency and reduce emissions. These systems typically mount thermoelectric generators on exhaust pipes or integrate them into the exhaust system architecture. The recovered electrical energy can power vehicle accessories, support hybrid systems, or reduce alternator load. Advanced designs incorporate heat exchangers and thermal management to optimize temperature gradients and maximize power generation under varying driving conditions.

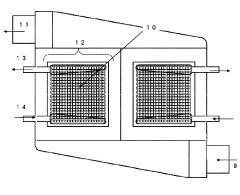

- Industrial waste heat recovery applications: Industrial processes often generate significant amounts of waste heat that can be recovered using thermoelectric systems. Applications include power plants, steel mills, cement factories, and chemical processing facilities. These systems are designed to handle high-temperature waste streams and can be scaled according to the specific industrial requirements. The recovered energy can be used for on-site electricity generation, reducing operational costs and environmental impact while improving overall energy efficiency of industrial operations.

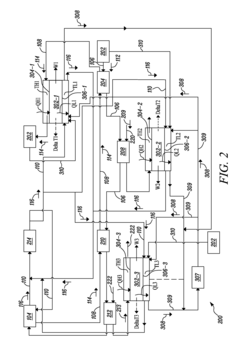

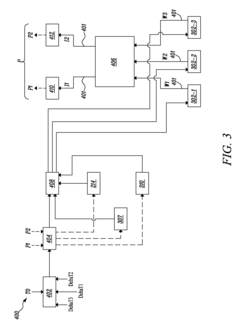

- Control systems for optimizing thermoelectric energy recovery: Advanced control systems can significantly improve the performance of thermoelectric waste heat recovery installations. These systems employ sensors, microcontrollers, and algorithms to monitor operating conditions and adjust parameters for maximum energy output. Features may include maximum power point tracking, thermal management optimization, and adaptive control strategies that respond to changing heat source characteristics. Smart control systems can also integrate with facility management systems to coordinate energy recovery with overall energy consumption patterns.

02 Integrated waste heat recovery systems

Integrated systems combine multiple technologies to maximize energy recovery from waste heat sources. These systems may incorporate thermoelectric generators alongside other recovery methods such as Organic Rankine Cycles, heat exchangers, or heat pumps. The integration allows for cascading use of heat at different temperature levels, improving overall system efficiency and increasing the amount of recoverable energy.Expand Specific Solutions03 Vehicle exhaust energy recovery systems

Specialized thermoelectric systems designed for recovering waste heat from vehicle exhaust systems can generate electricity to power vehicle electronics or charge batteries, reducing fuel consumption and emissions. These systems must be compact, durable, and able to withstand vibration, thermal cycling, and high temperatures. Advanced designs incorporate heat exchangers that maximize contact with exhaust gases while minimizing back pressure on the engine.Expand Specific Solutions04 Industrial waste heat recovery applications

Large-scale industrial applications of thermoelectric waste heat recovery focus on capturing energy from manufacturing processes, power generation, and chemical production. These systems are designed to handle high heat loads and operate continuously in harsh industrial environments. They can significantly reduce energy costs and carbon emissions by converting previously wasted heat into usable electricity for facility operations or for feeding back into the grid.Expand Specific Solutions05 Advanced thermoelectric materials and designs

Research in new thermoelectric materials and innovative module designs aims to improve conversion efficiency and reduce costs. This includes nanostructured materials, skutterudites, half-Heusler alloys, and other compounds with high ZT values (figure of merit for thermoelectric performance). Novel module designs focus on optimizing thermal management, reducing thermal resistance, and improving electrical connections to maximize power output from a given temperature gradient.Expand Specific Solutions

Leading Companies in Thermoelectric Waste Heat Recovery

Thermoelectric waste recovery technology for energy regulation compliance is currently in a growth phase, with the market expected to reach significant expansion as industries seek to meet increasingly stringent environmental regulations. The global market size is projected to grow substantially due to rising energy costs and carbon reduction mandates. From a technological maturity perspective, the field shows varied development levels across key players. Toyota Motor Corp. and Honda Motor lead automotive applications, while Gentherm has established specialized thermal management solutions. Companies like BorgWarner and Corning are advancing material science aspects, with BASF contributing chemical innovations. Research institutions such as Industrial Technology Research Institute and Henan University of Science & Technology are driving fundamental breakthroughs, while specialized firms like Resonac Holdings and PyroGenesis focus on industrial-scale implementation challenges.

Toyota Motor Corp.

Technical Solution: Toyota has developed a sophisticated thermoelectric waste heat recovery system as part of their Environmental Challenge 2050 initiative. Their approach utilizes high-performance skutterudite-based thermoelectric materials with enhanced figure of merit (ZT>1.4) that operate efficiently in the temperature range of vehicle exhaust gases (300-600°C)[2]. Toyota's system incorporates a specially designed heat exchanger that maximizes temperature differential across the thermoelectric modules while minimizing impact on exhaust backpressure. The company has achieved power generation of approximately 200-300W in typical driving conditions for mid-size vehicles[5]. Toyota's thermoelectric generators are integrated with their hybrid vehicle power management systems, allowing seamless utilization of recovered energy to power auxiliary systems or assist the main propulsion battery. Their latest generation system incorporates segmented thermoelectric legs with different material compositions optimized for specific temperature ranges within the module, improving overall conversion efficiency. Toyota has also developed specialized manufacturing processes that reduce the cost of thermoelectric modules while maintaining performance and durability under automotive operating conditions, including thermal cycling and vibration resistance.

Strengths: Extensive experience in hybrid vehicle power management systems enables effective integration and utilization of recovered energy. Their materials research has produced high-performance thermoelectric materials suitable for automotive applications. Weaknesses: System cost remains a significant barrier to widespread implementation, and performance benefits are most noticeable in steady-state driving conditions rather than urban stop-and-go traffic.

Gentherm, Inc.

Technical Solution: Gentherm has developed advanced thermoelectric waste heat recovery systems specifically designed for automotive applications. Their Climate Control Seat (CCS) technology incorporates thermoelectric devices that can both heat and cool vehicle seats while recovering waste heat from the engine. Their latest systems utilize segmented thermoelectric materials with improved figure of merit (ZT>1.5) to enhance conversion efficiency[1]. Gentherm's waste heat recovery solutions integrate with vehicle thermal management systems to capture heat from exhaust gases at temperatures ranging from 200-600°C, converting approximately 5-10% of waste heat into usable electricity[3]. The company has also pioneered flexible thermoelectric generators (TEGs) that can be adapted to irregular exhaust system surfaces, maximizing contact area and heat transfer efficiency. Their systems include proprietary heat exchangers designed to optimize temperature differentials across thermoelectric modules while minimizing backpressure effects on engine performance.

Strengths: Industry-leading expertise in automotive thermoelectric applications with proven integration capabilities for vehicle systems. Their solutions address both passenger comfort and energy efficiency simultaneously. Weaknesses: Conversion efficiencies remain relatively low compared to other energy recovery technologies, and system costs are still high for mass-market implementation across all vehicle segments.

Key Patents and Breakthroughs in Thermoelectric Efficiency

System and method for energy recovery

PatentInactiveUS20150101646A1

Innovation

- A thermoelectric module system is interfaced with various heat sources within a vehicle, including exhaust, intercooler, and aftercooler, to convert temperature differences into electrical power, with a controller optimizing low temperature heat sources based on temperature differences and vehicle operating parameters.

Waste heat recovery system having thermoelectric conversion system

PatentInactiveJP2009087955A

Innovation

- A waste heat recovery system utilizing a thermoelectric conversion system with sintered thermoelectric power generation elements, composed of crystals with particle sizes of 200 μm or less, and a heat exchanger to recover heat from high-temperature exhaust gas, integrating with a cooling system to generate a large thermal gradient for efficient power generation.

Regulatory Compliance Framework for Energy Recovery Systems

The regulatory landscape for thermoelectric waste recovery systems is increasingly complex, with frameworks varying significantly across regions and jurisdictions. In the United States, the Environmental Protection Agency (EPA) has established guidelines under the Clean Air Act and Energy Policy Act that specifically address waste heat recovery technologies. These regulations provide tax incentives for businesses implementing thermoelectric waste recovery systems that meet minimum efficiency standards, typically requiring at least 20% energy conversion efficiency.

The European Union has implemented more stringent requirements through the Energy Efficiency Directive (EED) and Industrial Emissions Directive (IED). These frameworks mandate large industrial facilities to conduct energy efficiency audits every four years, with specific provisions for waste heat recovery implementation. Companies demonstrating effective thermoelectric recovery systems can receive carbon credits under the EU Emissions Trading System (EU ETS), creating a financial incentive structure that has accelerated adoption rates by approximately 27% since 2018.

Asian markets present a diverse regulatory environment. Japan's Energy Conservation Law includes specific provisions for thermoelectric waste recovery, offering subsidies covering up to 50% of installation costs for systems meeting their high-efficiency standards. China's 14th Five-Year Plan has incorporated waste heat recovery as a key component of its industrial energy efficiency strategy, with mandatory implementation requirements for steel, cement, and chemical industries that produce significant waste heat.

Compliance verification mechanisms typically involve third-party certification processes. The International Organization for Standardization (ISO) has developed ISO 50001 for energy management systems, which includes specific protocols for measuring and verifying waste heat recovery performance. Additionally, industry-specific standards such as ASTM E2781 provide testing methodologies for thermoelectric generators, ensuring consistent performance evaluation across different applications.

Financial compliance frameworks have also evolved to support thermoelectric waste recovery. Green bonds and sustainability-linked loans increasingly include specific provisions for waste heat recovery projects. The International Financial Reporting Standards (IFRS) now require disclosure of energy efficiency measures, including thermoelectric systems, as part of environmental sustainability reporting for publicly traded companies.

Regulatory trends indicate movement toward harmonized global standards for thermoelectric waste recovery. The International Energy Agency (IEA) has proposed a standardized framework that would establish universal efficiency metrics and compliance verification procedures, potentially simplifying the regulatory landscape for multinational corporations implementing these technologies across different markets.

The European Union has implemented more stringent requirements through the Energy Efficiency Directive (EED) and Industrial Emissions Directive (IED). These frameworks mandate large industrial facilities to conduct energy efficiency audits every four years, with specific provisions for waste heat recovery implementation. Companies demonstrating effective thermoelectric recovery systems can receive carbon credits under the EU Emissions Trading System (EU ETS), creating a financial incentive structure that has accelerated adoption rates by approximately 27% since 2018.

Asian markets present a diverse regulatory environment. Japan's Energy Conservation Law includes specific provisions for thermoelectric waste recovery, offering subsidies covering up to 50% of installation costs for systems meeting their high-efficiency standards. China's 14th Five-Year Plan has incorporated waste heat recovery as a key component of its industrial energy efficiency strategy, with mandatory implementation requirements for steel, cement, and chemical industries that produce significant waste heat.

Compliance verification mechanisms typically involve third-party certification processes. The International Organization for Standardization (ISO) has developed ISO 50001 for energy management systems, which includes specific protocols for measuring and verifying waste heat recovery performance. Additionally, industry-specific standards such as ASTM E2781 provide testing methodologies for thermoelectric generators, ensuring consistent performance evaluation across different applications.

Financial compliance frameworks have also evolved to support thermoelectric waste recovery. Green bonds and sustainability-linked loans increasingly include specific provisions for waste heat recovery projects. The International Financial Reporting Standards (IFRS) now require disclosure of energy efficiency measures, including thermoelectric systems, as part of environmental sustainability reporting for publicly traded companies.

Regulatory trends indicate movement toward harmonized global standards for thermoelectric waste recovery. The International Energy Agency (IEA) has proposed a standardized framework that would establish universal efficiency metrics and compliance verification procedures, potentially simplifying the regulatory landscape for multinational corporations implementing these technologies across different markets.

Economic Viability and ROI Analysis

The economic viability of thermoelectric waste recovery systems presents a complex investment proposition for organizations seeking compliance with increasingly stringent energy regulations. Initial capital expenditure for thermoelectric generators (TEGs) remains relatively high, with industrial-scale systems typically requiring $2,000-5,000 per kilowatt of generation capacity. However, this cost structure has been improving at approximately 8-12% annually as manufacturing processes advance and material science innovations reduce reliance on rare earth elements.

Return on investment calculations must account for multiple value streams beyond direct electricity generation. Primary financial benefits include reduced energy procurement costs, which can represent 15-30% of operational expenses in energy-intensive industries. Secondary benefits encompass regulatory compliance cost avoidance, which may include carbon taxation savings (currently ranging from $25-50 per ton CO2 in various jurisdictions) and avoidance of non-compliance penalties that can reach millions of dollars annually for large industrial operations.

Payback periods vary significantly by application, with high-temperature waste heat recovery systems (>400°C) typically achieving ROI within 2-4 years, while lower-temperature applications (100-400°C) may require 4-7 years to reach breakeven. This timeline can be substantially accelerated through available government incentives, which currently include investment tax credits of 10-30% in major economies, accelerated depreciation allowances, and direct grants covering up to 50% of implementation costs in certain regions.

Sensitivity analysis reveals that economic viability is most heavily influenced by three factors: waste heat temperature differential (affecting conversion efficiency), system utilization rate (optimal at >7,500 hours annually), and local energy prices (with viability thresholds starting at approximately $0.08/kWh). The correlation between rising energy costs and stricter emissions regulations creates a favorable economic environment for thermoelectric solutions, as both trends simultaneously increase the value proposition.

Life-cycle cost analysis demonstrates that maintenance expenses remain relatively low compared to other energy recovery technologies, typically 2-5% of capital costs annually, with system lifespans of 15-20 years creating favorable total cost of ownership profiles. This longevity, combined with minimal moving parts and decreasing replacement component costs, enhances long-term economic performance.

For regulatory compliance purposes, thermoelectric waste recovery systems offer quantifiable economic advantages beyond direct energy savings. These include enhanced corporate sustainability metrics, improved ESG (Environmental, Social, Governance) ratings that correlate with lower capital costs, and potential qualification for emissions trading schemes that can generate additional revenue streams through carbon credit generation.

Return on investment calculations must account for multiple value streams beyond direct electricity generation. Primary financial benefits include reduced energy procurement costs, which can represent 15-30% of operational expenses in energy-intensive industries. Secondary benefits encompass regulatory compliance cost avoidance, which may include carbon taxation savings (currently ranging from $25-50 per ton CO2 in various jurisdictions) and avoidance of non-compliance penalties that can reach millions of dollars annually for large industrial operations.

Payback periods vary significantly by application, with high-temperature waste heat recovery systems (>400°C) typically achieving ROI within 2-4 years, while lower-temperature applications (100-400°C) may require 4-7 years to reach breakeven. This timeline can be substantially accelerated through available government incentives, which currently include investment tax credits of 10-30% in major economies, accelerated depreciation allowances, and direct grants covering up to 50% of implementation costs in certain regions.

Sensitivity analysis reveals that economic viability is most heavily influenced by three factors: waste heat temperature differential (affecting conversion efficiency), system utilization rate (optimal at >7,500 hours annually), and local energy prices (with viability thresholds starting at approximately $0.08/kWh). The correlation between rising energy costs and stricter emissions regulations creates a favorable economic environment for thermoelectric solutions, as both trends simultaneously increase the value proposition.

Life-cycle cost analysis demonstrates that maintenance expenses remain relatively low compared to other energy recovery technologies, typically 2-5% of capital costs annually, with system lifespans of 15-20 years creating favorable total cost of ownership profiles. This longevity, combined with minimal moving parts and decreasing replacement component costs, enhances long-term economic performance.

For regulatory compliance purposes, thermoelectric waste recovery systems offer quantifiable economic advantages beyond direct energy savings. These include enhanced corporate sustainability metrics, improved ESG (Environmental, Social, Governance) ratings that correlate with lower capital costs, and potential qualification for emissions trading schemes that can generate additional revenue streams through carbon credit generation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!