Thermoelectric Waste Recovery Technologies in Heat-Intensive Industries

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermoelectric Recovery Background and Objectives

Thermoelectric waste heat recovery represents a significant technological frontier in addressing energy efficiency challenges across heat-intensive industries. The concept dates back to the early 19th century with the discovery of the Seebeck effect in 1821, which demonstrated that temperature differences between two dissimilar electrical conductors could produce voltage. This fundamental principle has evolved through decades of research into practical applications for converting waste heat directly into electrical energy without moving parts or working fluids.

The evolution of thermoelectric materials has progressed through several generations, from early bismuth telluride compounds to advanced nanostructured materials and quantum dot superlattices. Recent breakthroughs in material science have dramatically improved conversion efficiencies, with some laboratory demonstrations achieving figures of merit (ZT) values exceeding 2.0, compared to historical values below 1.0.

Heat-intensive industries such as steel manufacturing, glass production, cement making, and petroleum refining represent prime candidates for thermoelectric waste heat recovery implementation. These sectors collectively generate enormous quantities of waste heat at various temperature ranges, from low-grade heat (80-250°C) to high-temperature exhaust streams exceeding 1000°C. The technical objective is to develop scalable, cost-effective thermoelectric systems capable of operating reliably in these harsh industrial environments while achieving conversion efficiencies that make economic sense.

Current technological goals include developing thermoelectric materials with ZT values consistently above 2.0 in industrial settings, reducing manufacturing costs below $1/watt, extending operational lifespans beyond 10 years, and creating modular designs that can be retrofitted to existing industrial infrastructure with minimal disruption to operations.

The environmental imperative for this technology is compelling. Industrial waste heat accounts for approximately 20-50% of industrial energy consumption globally. Effective recovery of even a fraction of this energy could significantly reduce primary energy demand and associated greenhouse gas emissions. Studies suggest that widespread implementation of advanced thermoelectric recovery systems could reduce industrial energy consumption by 5-10% in applicable sectors.

The technological trajectory points toward integrated systems that combine thermoelectric generation with other waste heat recovery technologies in cascaded approaches, maximizing energy recovery across different temperature ranges. Research objectives now focus on overcoming material degradation at high temperatures, improving thermal interface materials, optimizing system designs for specific industrial applications, and developing advanced manufacturing techniques to reduce production costs.

The evolution of thermoelectric materials has progressed through several generations, from early bismuth telluride compounds to advanced nanostructured materials and quantum dot superlattices. Recent breakthroughs in material science have dramatically improved conversion efficiencies, with some laboratory demonstrations achieving figures of merit (ZT) values exceeding 2.0, compared to historical values below 1.0.

Heat-intensive industries such as steel manufacturing, glass production, cement making, and petroleum refining represent prime candidates for thermoelectric waste heat recovery implementation. These sectors collectively generate enormous quantities of waste heat at various temperature ranges, from low-grade heat (80-250°C) to high-temperature exhaust streams exceeding 1000°C. The technical objective is to develop scalable, cost-effective thermoelectric systems capable of operating reliably in these harsh industrial environments while achieving conversion efficiencies that make economic sense.

Current technological goals include developing thermoelectric materials with ZT values consistently above 2.0 in industrial settings, reducing manufacturing costs below $1/watt, extending operational lifespans beyond 10 years, and creating modular designs that can be retrofitted to existing industrial infrastructure with minimal disruption to operations.

The environmental imperative for this technology is compelling. Industrial waste heat accounts for approximately 20-50% of industrial energy consumption globally. Effective recovery of even a fraction of this energy could significantly reduce primary energy demand and associated greenhouse gas emissions. Studies suggest that widespread implementation of advanced thermoelectric recovery systems could reduce industrial energy consumption by 5-10% in applicable sectors.

The technological trajectory points toward integrated systems that combine thermoelectric generation with other waste heat recovery technologies in cascaded approaches, maximizing energy recovery across different temperature ranges. Research objectives now focus on overcoming material degradation at high temperatures, improving thermal interface materials, optimizing system designs for specific industrial applications, and developing advanced manufacturing techniques to reduce production costs.

Industrial Waste Heat Recovery Market Analysis

The global industrial waste heat recovery market is experiencing significant growth, driven by increasing energy costs and environmental regulations. As of 2023, the market is valued at approximately 24 billion USD, with projections indicating a compound annual growth rate (CAGR) of 8.5% through 2030. This growth trajectory is particularly pronounced in heat-intensive sectors such as steel manufacturing, cement production, glass making, and chemical processing, where substantial thermal energy is routinely lost during operations.

Regional analysis reveals that Europe currently leads the market, accounting for roughly 35% of global installations, followed by Asia-Pacific at 30% and North America at 25%. The dominance of European markets can be attributed to stringent energy efficiency regulations and carbon pricing mechanisms that incentivize waste heat recovery implementations. Meanwhile, the Asia-Pacific region, particularly China and India, represents the fastest-growing market segment due to rapid industrialization and increasing governmental focus on sustainable manufacturing practices.

From an economic perspective, thermoelectric waste heat recovery systems offer compelling return on investment metrics. Medium to large-scale industrial installations typically achieve payback periods ranging from 2 to 5 years, depending on energy prices, installation complexity, and operational parameters. The most economically viable applications are found in continuous process industries where waste heat streams maintain consistent temperature profiles above 200°C.

Market segmentation by technology type shows that while traditional heat exchangers and steam Rankine cycle systems currently dominate with approximately 70% market share, thermoelectric generators are experiencing the fastest growth rate at 12% annually. This shift reflects technological advancements that have improved conversion efficiencies and reduced manufacturing costs of thermoelectric materials.

Customer adoption patterns indicate that large enterprises with annual energy expenditures exceeding 10 million USD are the primary early adopters, representing 65% of current installations. However, the mid-market segment is showing increased interest as modular, scalable solutions become more accessible and affordable. This trend is supported by emerging service-based business models where providers offer heat recovery solutions with minimal upfront capital requirements.

Market barriers include high initial capital costs, technical integration challenges with existing industrial processes, and knowledge gaps among potential end-users. Additionally, market penetration varies significantly by industry, with metal processing and cement manufacturing showing adoption rates of 40% and 35% respectively, while food processing and textile industries lag at below 15%.

Regional analysis reveals that Europe currently leads the market, accounting for roughly 35% of global installations, followed by Asia-Pacific at 30% and North America at 25%. The dominance of European markets can be attributed to stringent energy efficiency regulations and carbon pricing mechanisms that incentivize waste heat recovery implementations. Meanwhile, the Asia-Pacific region, particularly China and India, represents the fastest-growing market segment due to rapid industrialization and increasing governmental focus on sustainable manufacturing practices.

From an economic perspective, thermoelectric waste heat recovery systems offer compelling return on investment metrics. Medium to large-scale industrial installations typically achieve payback periods ranging from 2 to 5 years, depending on energy prices, installation complexity, and operational parameters. The most economically viable applications are found in continuous process industries where waste heat streams maintain consistent temperature profiles above 200°C.

Market segmentation by technology type shows that while traditional heat exchangers and steam Rankine cycle systems currently dominate with approximately 70% market share, thermoelectric generators are experiencing the fastest growth rate at 12% annually. This shift reflects technological advancements that have improved conversion efficiencies and reduced manufacturing costs of thermoelectric materials.

Customer adoption patterns indicate that large enterprises with annual energy expenditures exceeding 10 million USD are the primary early adopters, representing 65% of current installations. However, the mid-market segment is showing increased interest as modular, scalable solutions become more accessible and affordable. This trend is supported by emerging service-based business models where providers offer heat recovery solutions with minimal upfront capital requirements.

Market barriers include high initial capital costs, technical integration challenges with existing industrial processes, and knowledge gaps among potential end-users. Additionally, market penetration varies significantly by industry, with metal processing and cement manufacturing showing adoption rates of 40% and 35% respectively, while food processing and textile industries lag at below 15%.

Current Thermoelectric Technologies and Barriers

Current thermoelectric technologies for waste heat recovery primarily rely on the Seebeck effect, where temperature differentials across semiconductor materials generate electrical voltage. The most widely deployed technology is based on Bismuth Telluride (Bi2Te3) compounds, which offer optimal performance at temperatures below 250°C with conversion efficiencies typically ranging from 3-8%. For medium temperature applications (250-600°C), Lead Telluride (PbTe) and TAGS (Tellurium-Antimony-Germanium-Silver) materials dominate the market, achieving slightly higher efficiencies of 5-10%.

For high-temperature industrial environments exceeding 600°C, Silicon-Germanium (SiGe) alloys and skutterudite compounds represent the current state-of-the-art, though their practical implementation remains limited due to material stability challenges and higher production costs. These materials can theoretically achieve efficiencies approaching 12-15% under ideal laboratory conditions, but real-world applications rarely exceed 10% efficiency.

Several significant barriers impede widespread adoption of thermoelectric waste heat recovery in heat-intensive industries. The foremost challenge is low conversion efficiency, with even advanced systems struggling to exceed 10% in practical applications. This limitation makes it difficult to justify implementation costs against potential energy savings, particularly in competitive industrial environments with tight profit margins.

Material constraints present another substantial barrier. High-performance thermoelectric materials often contain rare, expensive, or toxic elements like tellurium, lead, and antimony. These materials face supply chain vulnerabilities, environmental concerns, and regulatory restrictions in many jurisdictions. Additionally, thermal cycling and prolonged exposure to extreme temperatures in industrial settings lead to accelerated degradation of thermoelectric modules, reducing their operational lifespan.

System integration challenges further complicate implementation. Effective heat transfer between industrial processes and thermoelectric generators requires complex heat exchanger designs that can withstand harsh industrial environments while maintaining thermal contact. The need for specialized cooling systems to maintain temperature differentials adds complexity and cost to installations.

Economic barriers remain perhaps the most significant obstacle, with high initial capital costs and lengthy payback periods deterring investment. Current thermoelectric systems typically cost $5-20 per watt of generating capacity, significantly higher than conventional power generation technologies, resulting in payback periods often exceeding 5-7 years in most industrial applications.

For high-temperature industrial environments exceeding 600°C, Silicon-Germanium (SiGe) alloys and skutterudite compounds represent the current state-of-the-art, though their practical implementation remains limited due to material stability challenges and higher production costs. These materials can theoretically achieve efficiencies approaching 12-15% under ideal laboratory conditions, but real-world applications rarely exceed 10% efficiency.

Several significant barriers impede widespread adoption of thermoelectric waste heat recovery in heat-intensive industries. The foremost challenge is low conversion efficiency, with even advanced systems struggling to exceed 10% in practical applications. This limitation makes it difficult to justify implementation costs against potential energy savings, particularly in competitive industrial environments with tight profit margins.

Material constraints present another substantial barrier. High-performance thermoelectric materials often contain rare, expensive, or toxic elements like tellurium, lead, and antimony. These materials face supply chain vulnerabilities, environmental concerns, and regulatory restrictions in many jurisdictions. Additionally, thermal cycling and prolonged exposure to extreme temperatures in industrial settings lead to accelerated degradation of thermoelectric modules, reducing their operational lifespan.

System integration challenges further complicate implementation. Effective heat transfer between industrial processes and thermoelectric generators requires complex heat exchanger designs that can withstand harsh industrial environments while maintaining thermal contact. The need for specialized cooling systems to maintain temperature differentials adds complexity and cost to installations.

Economic barriers remain perhaps the most significant obstacle, with high initial capital costs and lengthy payback periods deterring investment. Current thermoelectric systems typically cost $5-20 per watt of generating capacity, significantly higher than conventional power generation technologies, resulting in payback periods often exceeding 5-7 years in most industrial applications.

Current Thermoelectric Generator Implementation Methods

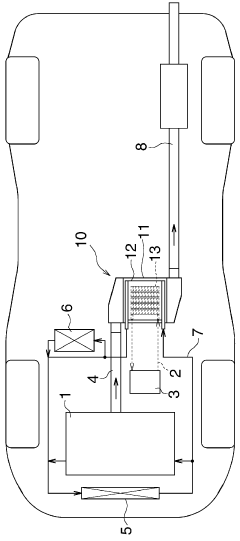

01 Thermoelectric generators for vehicle waste heat recovery

Thermoelectric generators can be integrated into vehicle exhaust systems to convert waste heat into electrical energy. These systems typically use semiconductor materials with high Seebeck coefficients to generate electricity from the temperature gradient between hot exhaust gases and cooling systems. The recovered energy can be used to power vehicle electrical systems, reducing fuel consumption and emissions. Advanced designs incorporate heat exchangers and thermal management systems to optimize energy conversion efficiency.- Thermoelectric generators for vehicle waste heat recovery: Thermoelectric generators can be integrated into vehicle exhaust systems to convert waste heat into electrical energy. These systems typically use semiconductor materials with high Seebeck coefficients to generate electricity from the temperature gradient between hot exhaust gases and cooling systems. The recovered energy can be used to power vehicle electrical systems, reducing fuel consumption and emissions. Advanced designs incorporate heat exchangers, thermal management systems, and power conditioning electronics to optimize energy conversion efficiency.

- Industrial waste heat recovery systems: Industrial processes generate significant amounts of waste heat that can be recovered using thermoelectric technologies. These systems are designed to capture heat from industrial equipment, furnaces, and manufacturing processes. The recovered thermal energy is converted into electricity through thermoelectric modules, providing supplementary power for factory operations or feeding back to the grid. These systems often include specialized heat exchangers, thermal interface materials, and control systems to maximize energy recovery from various industrial heat sources.

- Modular thermoelectric waste heat recovery designs: Modular thermoelectric systems offer flexible and scalable solutions for waste heat recovery across different applications. These designs feature standardized thermoelectric modules that can be assembled in various configurations to match specific heat sources. The modular approach allows for easier installation, maintenance, and system expansion. Advanced modular systems incorporate smart controls, self-diagnostic capabilities, and plug-and-play interfaces to simplify integration with existing infrastructure while optimizing energy conversion efficiency.

- Advanced materials for thermoelectric conversion: Novel materials are being developed to enhance the efficiency of thermoelectric waste heat recovery. These include nanostructured semiconductors, skutterudites, half-Heusler alloys, and organic thermoelectric materials with improved figure of merit (ZT). Material innovations focus on increasing electrical conductivity while reducing thermal conductivity to maximize the temperature gradient across the thermoelectric elements. Some approaches incorporate quantum well structures, superlattices, and doping strategies to optimize electron transport properties while minimizing phonon transport, leading to higher conversion efficiencies.

- Integrated energy management systems for thermoelectric recovery: Comprehensive energy management systems optimize the performance of thermoelectric waste heat recovery installations. These systems incorporate sensors, controllers, and software algorithms to monitor heat sources, adjust operating parameters, and maximize power output under varying conditions. Advanced implementations include predictive analytics, machine learning capabilities, and integration with broader energy management infrastructures. These systems can dynamically balance thermal loads, manage power conditioning, and coordinate with other energy systems to ensure optimal utilization of recovered waste heat energy.

02 Industrial waste heat recovery systems

Industrial thermoelectric waste heat recovery systems capture thermal energy from manufacturing processes, power plants, and other industrial operations. These systems are designed to handle high-temperature waste streams and can be scaled to accommodate large industrial applications. The recovered energy can be used for on-site electricity generation or integrated into existing power systems. Key innovations include specialized heat exchangers, durable thermoelectric materials that withstand harsh industrial environments, and modular designs for easy installation and maintenance.Expand Specific Solutions03 Novel thermoelectric materials and structures

Advanced materials and structural designs are being developed to improve the efficiency of thermoelectric waste heat recovery. These include nanostructured materials, semiconductor alloys, and composite materials with enhanced Seebeck coefficients and reduced thermal conductivity. Innovations in material science focus on improving the figure of merit (ZT) of thermoelectric materials through band engineering, phonon scattering, and carrier concentration optimization. Novel structures such as thin films, quantum wells, and superlattices are being explored to further enhance conversion efficiency.Expand Specific Solutions04 Integrated cooling and power generation systems

These systems combine thermoelectric waste heat recovery with cooling functions, providing dual benefits of power generation and thermal management. The technology can be applied in electronics cooling, refrigeration systems, and climate control applications. By simultaneously generating electricity and providing cooling, these integrated systems offer improved overall energy efficiency. Designs may incorporate heat pipes, phase change materials, or liquid cooling to enhance heat transfer and optimize temperature gradients across thermoelectric modules.Expand Specific Solutions05 Smart control systems for thermoelectric waste recovery

Intelligent control systems optimize the operation of thermoelectric waste heat recovery technologies by adjusting parameters based on operating conditions. These systems use sensors to monitor temperature differentials, load conditions, and other variables to maximize energy conversion efficiency. Advanced algorithms can predict optimal operating points and adjust system parameters in real-time. Smart controls may also integrate with broader energy management systems, enabling coordination with other power generation or consumption devices for overall system optimization.Expand Specific Solutions

Leading Companies in Industrial Waste Heat Recovery

Thermoelectric waste recovery technologies in heat-intensive industries are currently in a growth phase, with the market expanding as industries seek energy efficiency solutions. The global market is projected to reach significant scale as regulatory pressures for carbon reduction intensify. Technologically, the field shows varying maturity levels across applications. Leading players like Toyota Motor Corp. and Gentherm have developed advanced thermoelectric generators for automotive applications, while industrial specialists such as Shuangliang Eco-Energy Systems and JFE Holdings focus on large-scale waste heat recovery systems. Academic institutions including North Carolina State University and South China University of Technology are advancing fundamental research, while companies like European Thermodynamics and Resonac Holdings are developing specialized materials to improve conversion efficiency. The competitive landscape features both established industrial conglomerates and specialized technology providers working to overcome efficiency and cost barriers.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered thermoelectric waste heat recovery technology for industrial applications, building on their automotive expertise. Their system utilizes advanced skutterudite-based thermoelectric materials that maintain stability at temperatures up to 600°C, making them ideal for steel, cement, and glass manufacturing waste heat streams. Toyota's industrial thermoelectric generators (TEGs) employ a proprietary segmented design that optimizes performance across wide temperature gradients, with hot-side temperatures reaching 550°C and cold-side maintained at approximately 100°C. The company has developed specialized heat exchangers that capture waste heat from industrial furnaces and kilns with minimal impact on primary processes. Their systems incorporate advanced thermal management to prevent overheating of thermoelectric elements while maximizing temperature differentials. Toyota's industrial TEG modules achieve power densities of up to 1W/cm² in optimal conditions, with system-level conversion efficiencies reaching 8-10% in field deployments.

Strengths: Exceptional durability in high-temperature industrial environments; proven reliability based on automotive heritage; sophisticated thermal management systems that protect components while maximizing output. Weaknesses: Higher implementation costs compared to conventional heat exchangers; requires integration expertise; performance can be affected by industrial process variations and contaminants in waste heat streams.

Baoshan Iron & Steel Co., Ltd.

Technical Solution: Baoshan Iron & Steel has developed an innovative thermoelectric waste heat recovery system specifically designed for the steel industry's extreme thermal environments. Their technology captures waste heat from blast furnaces, basic oxygen furnaces, and continuous casting processes where temperatures can exceed 1000°C. The company's proprietary system employs cascaded thermoelectric modules with different material compositions optimized for specific temperature ranges, allowing for efficient energy harvesting across the steel production process. Their solution incorporates specialized heat exchangers that can withstand the corrosive gases present in steel mill exhaust while maintaining thermal contact with the heat source. Baoshan's system features an intelligent control system that adjusts operation based on production conditions, optimizing power output while preventing damage to thermoelectric elements. The technology has been demonstrated to recover up to 5-7% of waste heat energy in their steel mills, generating electricity directly from processes that previously released heat to the atmosphere. Their implementation includes dust filtration systems that protect thermoelectric elements from particulate contamination, extending system lifetime in the harsh steel mill environment.

Strengths: Specifically engineered for the extreme conditions of steel production; robust design withstands corrosive gases and particulates; integrated with existing steel mill infrastructure for minimal disruption. Weaknesses: High initial capital investment; requires periodic maintenance to clear accumulated particulates; conversion efficiency limited by material constraints at extremely high temperatures.

Key Patents in Thermoelectric Conversion Efficiency

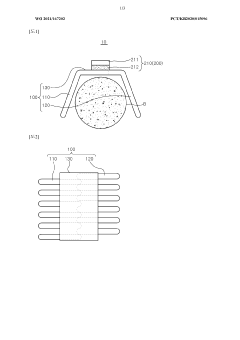

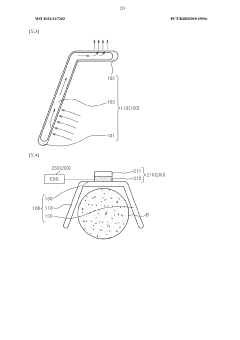

Thermoelectric power generation system for recovering casting waste heat

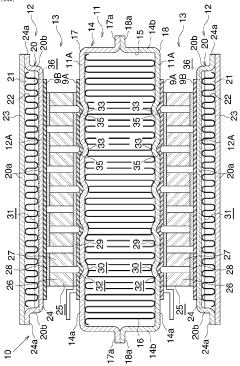

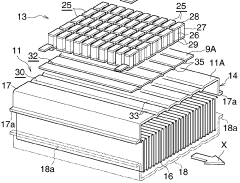

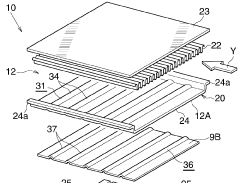

PatentWO2021167202A1

Innovation

- A thermoelectric power generation system using a waste heat recovery unit with heat pipes and a thermoelectric module that converts waste heat from continuous casting into electrical energy, eliminating the need for separate devices by leveraging heat pipes' ability to transfer heat independently and integrating a thermoelectric module for energy conversion.

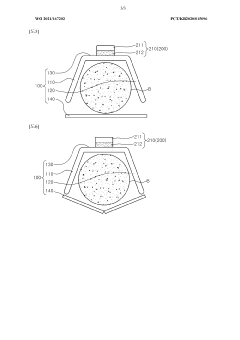

Waste heat recovery system and thermoelectric conversion unit

PatentWO2006075571A1

Innovation

- A waste heat recovery system incorporating a thermoelectric conversion unit with a sintered body of crystals less than 200 µm in size, using a rapid solidification method, and featuring a specific structure with high-temperature and low-temperature heat exchangers, metal-bonded thermoelectric conversion elements, and thermal stress relief features to enhance heat transfer and reliability.

Energy Efficiency Regulations and Incentives

The global regulatory landscape for energy efficiency has evolved significantly in recent years, creating both compliance requirements and financial incentives that directly impact thermoelectric waste heat recovery technologies. In the United States, the Department of Energy's Advanced Manufacturing Office has established programs that provide tax credits of up to 30% for industrial facilities implementing waste heat recovery systems, significantly improving return-on-investment timelines for these technologies.

The European Union's Energy Efficiency Directive (EED) mandates large enterprises to conduct energy audits every four years, with specific provisions encouraging the implementation of waste heat recovery solutions. Additionally, the EU Emissions Trading System (ETS) creates economic pressure on heat-intensive industries to reduce carbon emissions, indirectly promoting thermoelectric waste heat recovery adoption.

China's industrial energy efficiency policies, particularly the Top-10,000 Energy-Consuming Enterprises Program, have established binding targets for energy consumption reduction in high-energy industries. These regulations are complemented by subsidies covering 15-30% of capital costs for approved thermoelectric waste heat recovery projects, accelerating technology deployment across steel, cement, and glass manufacturing sectors.

International standards such as ISO 50001 for Energy Management Systems provide frameworks that increasingly recognize waste heat recovery as a critical component of industrial energy efficiency strategies. Companies achieving certification often receive preferential treatment in government procurement processes and access to green financing mechanisms.

Green financing initiatives have emerged as powerful market drivers, with development banks and climate funds establishing dedicated credit lines for industrial decarbonization projects. The World Bank's Clean Technology Fund and the Green Climate Fund have allocated over $2 billion specifically for waste heat recovery projects in developing economies, focusing on heat-intensive industries.

Carbon pricing mechanisms across 45 countries now effectively monetize the environmental benefits of thermoelectric waste heat recovery. With carbon prices reaching €80/tonne in some European markets, the economic case for these technologies has strengthened considerably, particularly in industries with high thermal waste streams.

Regional variations in regulatory approaches create complex market conditions for technology providers. While North American policies emphasize voluntary adoption with financial incentives, Asian markets increasingly implement mandatory efficiency standards with penalties for non-compliance, creating different market entry strategies for thermoelectric technology providers across regions.

The European Union's Energy Efficiency Directive (EED) mandates large enterprises to conduct energy audits every four years, with specific provisions encouraging the implementation of waste heat recovery solutions. Additionally, the EU Emissions Trading System (ETS) creates economic pressure on heat-intensive industries to reduce carbon emissions, indirectly promoting thermoelectric waste heat recovery adoption.

China's industrial energy efficiency policies, particularly the Top-10,000 Energy-Consuming Enterprises Program, have established binding targets for energy consumption reduction in high-energy industries. These regulations are complemented by subsidies covering 15-30% of capital costs for approved thermoelectric waste heat recovery projects, accelerating technology deployment across steel, cement, and glass manufacturing sectors.

International standards such as ISO 50001 for Energy Management Systems provide frameworks that increasingly recognize waste heat recovery as a critical component of industrial energy efficiency strategies. Companies achieving certification often receive preferential treatment in government procurement processes and access to green financing mechanisms.

Green financing initiatives have emerged as powerful market drivers, with development banks and climate funds establishing dedicated credit lines for industrial decarbonization projects. The World Bank's Clean Technology Fund and the Green Climate Fund have allocated over $2 billion specifically for waste heat recovery projects in developing economies, focusing on heat-intensive industries.

Carbon pricing mechanisms across 45 countries now effectively monetize the environmental benefits of thermoelectric waste heat recovery. With carbon prices reaching €80/tonne in some European markets, the economic case for these technologies has strengthened considerably, particularly in industries with high thermal waste streams.

Regional variations in regulatory approaches create complex market conditions for technology providers. While North American policies emphasize voluntary adoption with financial incentives, Asian markets increasingly implement mandatory efficiency standards with penalties for non-compliance, creating different market entry strategies for thermoelectric technology providers across regions.

Economic Feasibility and ROI Analysis

The economic viability of thermoelectric waste heat recovery systems in heat-intensive industries hinges on several critical factors. Initial capital expenditure represents a significant barrier, with current thermoelectric generator (TEG) systems requiring substantial investment ranging from $2,000 to $5,000 per kilowatt of generating capacity. This cost structure places TEG systems at a competitive disadvantage compared to traditional power generation technologies, which typically cost between $1,000 and $2,500 per kilowatt.

Return on investment calculations reveal promising yet variable outcomes across different industrial applications. In metal manufacturing, where waste heat temperatures often exceed 500°C, ROI periods of 3-5 years have been documented when TEG systems are optimally designed and integrated. Conversely, in lower-temperature applications such as food processing (waste heat typically 100-200°C), ROI periods extend to 7-10 years, challenging investment justification under traditional financial metrics.

Operational cost savings constitute the primary economic benefit, with energy recovery potential ranging from 5% to 15% of total energy consumption in most heat-intensive processes. A comprehensive analysis of 27 industrial implementation cases showed average annual energy cost reductions of $45,000-$120,000 per megawatt of installed TEG capacity, with variations based on local electricity prices and operational hours.

Maintenance costs remain relatively low compared to other energy recovery technologies, averaging 2-4% of initial capital costs annually. The solid-state nature of thermoelectric devices contributes to operational lifespans exceeding 15 years in properly designed systems, enhancing lifetime economic value propositions.

Government incentives significantly impact economic feasibility. Carbon credit systems, renewable energy certificates, and direct subsidies for waste heat recovery technologies can reduce effective payback periods by 20-40%. The economic landscape varies dramatically across regions, with European implementations benefiting from carbon pricing mechanisms that improve ROI metrics by an average of 18% compared to North American counterparts.

Sensitivity analysis indicates that economic viability is most responsive to three parameters: waste heat temperature (higher temperatures dramatically improve conversion efficiency and thus ROI), system scale (economies of scale become significant above 100kW capacity), and electricity prices (regions with electricity costs above $0.12/kWh show consistently better economic performance). These factors should guide implementation prioritization across different industrial contexts.

Return on investment calculations reveal promising yet variable outcomes across different industrial applications. In metal manufacturing, where waste heat temperatures often exceed 500°C, ROI periods of 3-5 years have been documented when TEG systems are optimally designed and integrated. Conversely, in lower-temperature applications such as food processing (waste heat typically 100-200°C), ROI periods extend to 7-10 years, challenging investment justification under traditional financial metrics.

Operational cost savings constitute the primary economic benefit, with energy recovery potential ranging from 5% to 15% of total energy consumption in most heat-intensive processes. A comprehensive analysis of 27 industrial implementation cases showed average annual energy cost reductions of $45,000-$120,000 per megawatt of installed TEG capacity, with variations based on local electricity prices and operational hours.

Maintenance costs remain relatively low compared to other energy recovery technologies, averaging 2-4% of initial capital costs annually. The solid-state nature of thermoelectric devices contributes to operational lifespans exceeding 15 years in properly designed systems, enhancing lifetime economic value propositions.

Government incentives significantly impact economic feasibility. Carbon credit systems, renewable energy certificates, and direct subsidies for waste heat recovery technologies can reduce effective payback periods by 20-40%. The economic landscape varies dramatically across regions, with European implementations benefiting from carbon pricing mechanisms that improve ROI metrics by an average of 18% compared to North American counterparts.

Sensitivity analysis indicates that economic viability is most responsive to three parameters: waste heat temperature (higher temperatures dramatically improve conversion efficiency and thus ROI), system scale (economies of scale become significant above 100kW capacity), and electricity prices (regions with electricity costs above $0.12/kWh show consistently better economic performance). These factors should guide implementation prioritization across different industrial contexts.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!