How to Approach Investment Opportunities in the PLA Sector?

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PLA Industry Overview

The Polylactic Acid (PLA) industry has experienced significant growth in recent years, driven by increasing environmental concerns and the shift towards sustainable materials. PLA, a biodegradable and renewable thermoplastic derived from plant-based sources such as corn starch or sugarcane, has emerged as a promising alternative to traditional petroleum-based plastics.

The global PLA market has been expanding rapidly, with a compound annual growth rate (CAGR) of around 15-20% projected over the next decade. This growth is primarily fueled by the rising demand for eco-friendly packaging solutions in various sectors, including food and beverage, consumer goods, and healthcare. The packaging segment currently dominates the PLA market, accounting for over 60% of the total demand.

Geographically, North America and Europe lead the PLA market, owing to stringent environmental regulations and growing consumer awareness. However, the Asia-Pacific region is expected to witness the fastest growth, driven by increasing industrialization, urbanization, and government initiatives promoting sustainable materials.

Key players in the PLA industry include NatureWorks LLC, Total Corbion PLA, Synbra Technology bv, and Futerro. These companies are investing heavily in research and development to improve PLA properties and expand its applications. Technological advancements have led to the development of high-performance PLA grades suitable for durable goods and automotive components, further broadening the market potential.

The PLA industry faces several challenges, including higher production costs compared to conventional plastics and limitations in certain performance characteristics. However, ongoing research and economies of scale are gradually addressing these issues. The industry is also witnessing increased collaboration between raw material suppliers, manufacturers, and end-users to develop innovative PLA-based products and improve the overall value chain.

Investment opportunities in the PLA sector are diverse, ranging from raw material production and processing to end-product manufacturing and recycling technologies. The industry's growth potential is further enhanced by supportive government policies, such as bans on single-use plastics and incentives for bio-based materials, creating a favorable environment for long-term investments.

As the world moves towards a circular economy, the PLA industry is poised to play a crucial role in sustainable material solutions. Investors should consider factors such as technological advancements, regulatory landscape, and market demand trends when evaluating opportunities in this sector. The PLA industry's ability to address environmental concerns while offering versatile material properties positions it as an attractive investment avenue in the evolving landscape of sustainable materials.

The global PLA market has been expanding rapidly, with a compound annual growth rate (CAGR) of around 15-20% projected over the next decade. This growth is primarily fueled by the rising demand for eco-friendly packaging solutions in various sectors, including food and beverage, consumer goods, and healthcare. The packaging segment currently dominates the PLA market, accounting for over 60% of the total demand.

Geographically, North America and Europe lead the PLA market, owing to stringent environmental regulations and growing consumer awareness. However, the Asia-Pacific region is expected to witness the fastest growth, driven by increasing industrialization, urbanization, and government initiatives promoting sustainable materials.

Key players in the PLA industry include NatureWorks LLC, Total Corbion PLA, Synbra Technology bv, and Futerro. These companies are investing heavily in research and development to improve PLA properties and expand its applications. Technological advancements have led to the development of high-performance PLA grades suitable for durable goods and automotive components, further broadening the market potential.

The PLA industry faces several challenges, including higher production costs compared to conventional plastics and limitations in certain performance characteristics. However, ongoing research and economies of scale are gradually addressing these issues. The industry is also witnessing increased collaboration between raw material suppliers, manufacturers, and end-users to develop innovative PLA-based products and improve the overall value chain.

Investment opportunities in the PLA sector are diverse, ranging from raw material production and processing to end-product manufacturing and recycling technologies. The industry's growth potential is further enhanced by supportive government policies, such as bans on single-use plastics and incentives for bio-based materials, creating a favorable environment for long-term investments.

As the world moves towards a circular economy, the PLA industry is poised to play a crucial role in sustainable material solutions. Investors should consider factors such as technological advancements, regulatory landscape, and market demand trends when evaluating opportunities in this sector. The PLA industry's ability to address environmental concerns while offering versatile material properties positions it as an attractive investment avenue in the evolving landscape of sustainable materials.

Market Demand Analysis

The PLA (Programmable Logic Array) sector has witnessed significant growth in recent years, driven by the increasing demand for customizable and efficient digital logic solutions across various industries. Market analysis indicates a robust expansion trajectory for PLA technologies, with applications spanning from consumer electronics to industrial automation and automotive systems.

The global PLA market is experiencing a surge in demand, primarily fueled by the rapid advancement of Internet of Things (IoT) devices and smart home technologies. These applications require flexible and power-efficient logic solutions, which PLAs can effectively provide. Additionally, the automotive industry's shift towards electric and autonomous vehicles has created a new avenue for PLA implementation, particularly in advanced driver assistance systems (ADAS) and in-vehicle infotainment systems.

In the industrial sector, PLAs are gaining traction due to their ability to offer customizable logic solutions for complex automation processes. The need for real-time data processing and control in smart factories has further amplified the demand for PLA-based systems. This trend is expected to continue as Industry 4.0 initiatives gain momentum globally.

The telecommunications industry represents another significant market for PLAs, with the ongoing rollout of 5G networks and the development of next-generation communication technologies. PLAs offer the flexibility and performance required for managing complex signal processing and network management tasks in these advanced systems.

Market research suggests that the Asia-Pacific region is poised to be the fastest-growing market for PLA technologies, driven by the rapid industrialization and technological adoption in countries like China, India, and South Korea. North America and Europe continue to be strong markets, with a focus on high-performance applications in aerospace, defense, and advanced computing sectors.

Emerging trends in edge computing and artificial intelligence are expected to create new opportunities for PLA technologies. The need for low-latency, energy-efficient computing at the edge aligns well with the strengths of PLAs, potentially opening up new market segments and applications.

However, potential investors should be aware of the competitive landscape, which includes established players in the semiconductor industry as well as emerging startups focusing on specialized PLA solutions. The market is characterized by rapid technological advancements, necessitating continuous innovation and R&D investments to maintain a competitive edge.

In conclusion, the PLA sector presents attractive investment opportunities, driven by strong market demand across multiple industries and geographical regions. The versatility and efficiency of PLA technologies position them well to address the evolving needs of digital systems in an increasingly connected world.

The global PLA market is experiencing a surge in demand, primarily fueled by the rapid advancement of Internet of Things (IoT) devices and smart home technologies. These applications require flexible and power-efficient logic solutions, which PLAs can effectively provide. Additionally, the automotive industry's shift towards electric and autonomous vehicles has created a new avenue for PLA implementation, particularly in advanced driver assistance systems (ADAS) and in-vehicle infotainment systems.

In the industrial sector, PLAs are gaining traction due to their ability to offer customizable logic solutions for complex automation processes. The need for real-time data processing and control in smart factories has further amplified the demand for PLA-based systems. This trend is expected to continue as Industry 4.0 initiatives gain momentum globally.

The telecommunications industry represents another significant market for PLAs, with the ongoing rollout of 5G networks and the development of next-generation communication technologies. PLAs offer the flexibility and performance required for managing complex signal processing and network management tasks in these advanced systems.

Market research suggests that the Asia-Pacific region is poised to be the fastest-growing market for PLA technologies, driven by the rapid industrialization and technological adoption in countries like China, India, and South Korea. North America and Europe continue to be strong markets, with a focus on high-performance applications in aerospace, defense, and advanced computing sectors.

Emerging trends in edge computing and artificial intelligence are expected to create new opportunities for PLA technologies. The need for low-latency, energy-efficient computing at the edge aligns well with the strengths of PLAs, potentially opening up new market segments and applications.

However, potential investors should be aware of the competitive landscape, which includes established players in the semiconductor industry as well as emerging startups focusing on specialized PLA solutions. The market is characterized by rapid technological advancements, necessitating continuous innovation and R&D investments to maintain a competitive edge.

In conclusion, the PLA sector presents attractive investment opportunities, driven by strong market demand across multiple industries and geographical regions. The versatility and efficiency of PLA technologies position them well to address the evolving needs of digital systems in an increasingly connected world.

Technical Challenges

Investing in the People's Liberation Army (PLA) sector presents unique technical challenges that require careful consideration. The primary obstacle lies in the opaque nature of military technology development and procurement processes in China. Limited public information and restricted access to key decision-makers make it difficult for investors to accurately assess the potential of specific technologies or companies within the PLA ecosystem.

One significant challenge is the rapid pace of technological advancement in military applications. The PLA is actively pursuing cutting-edge technologies such as artificial intelligence, quantum computing, and hypersonic weapons. These fields are characterized by high levels of uncertainty and require substantial research and development investments. Investors must navigate the complexities of these emerging technologies while considering their potential dual-use applications in both military and civilian sectors.

Another technical hurdle is the integration of civilian and military technologies, known as civil-military fusion. This strategy aims to leverage commercial innovations for military purposes, blurring the lines between civilian and defense industries. Investors must carefully evaluate the implications of this approach, as it may lead to unexpected regulatory challenges or export restrictions for companies involved in dual-use technologies.

The PLA's focus on indigenous innovation and self-reliance presents both opportunities and challenges for investors. While this strategy creates demand for domestic suppliers and technologies, it also limits foreign investment opportunities and increases competition among local players. Investors must assess the long-term viability of companies operating within this framework and their ability to meet the PLA's stringent technical requirements.

Cybersecurity and information protection pose significant technical challenges in the PLA sector. The military's emphasis on secure communication systems and data protection necessitates advanced encryption technologies and robust network infrastructure. Investors must consider the technical capabilities of companies in this space and their ability to meet evolving cybersecurity standards.

Furthermore, the PLA's modernization efforts encompass a wide range of technical domains, including aerospace, naval systems, and electronic warfare. Each of these areas presents unique technical challenges, from developing advanced materials for stealth technologies to creating sophisticated sensor systems for battlefield awareness. Investors must possess a deep understanding of these diverse technical fields to identify promising investment opportunities.

Lastly, the geopolitical landscape and international tensions surrounding military technology transfer create additional technical challenges. Investors must navigate complex export control regulations and potential sanctions that may impact the development and commercialization of certain technologies within the PLA sector. This requires a thorough understanding of both technical specifications and international legal frameworks governing military-related technologies.

One significant challenge is the rapid pace of technological advancement in military applications. The PLA is actively pursuing cutting-edge technologies such as artificial intelligence, quantum computing, and hypersonic weapons. These fields are characterized by high levels of uncertainty and require substantial research and development investments. Investors must navigate the complexities of these emerging technologies while considering their potential dual-use applications in both military and civilian sectors.

Another technical hurdle is the integration of civilian and military technologies, known as civil-military fusion. This strategy aims to leverage commercial innovations for military purposes, blurring the lines between civilian and defense industries. Investors must carefully evaluate the implications of this approach, as it may lead to unexpected regulatory challenges or export restrictions for companies involved in dual-use technologies.

The PLA's focus on indigenous innovation and self-reliance presents both opportunities and challenges for investors. While this strategy creates demand for domestic suppliers and technologies, it also limits foreign investment opportunities and increases competition among local players. Investors must assess the long-term viability of companies operating within this framework and their ability to meet the PLA's stringent technical requirements.

Cybersecurity and information protection pose significant technical challenges in the PLA sector. The military's emphasis on secure communication systems and data protection necessitates advanced encryption technologies and robust network infrastructure. Investors must consider the technical capabilities of companies in this space and their ability to meet evolving cybersecurity standards.

Furthermore, the PLA's modernization efforts encompass a wide range of technical domains, including aerospace, naval systems, and electronic warfare. Each of these areas presents unique technical challenges, from developing advanced materials for stealth technologies to creating sophisticated sensor systems for battlefield awareness. Investors must possess a deep understanding of these diverse technical fields to identify promising investment opportunities.

Lastly, the geopolitical landscape and international tensions surrounding military technology transfer create additional technical challenges. Investors must navigate complex export control regulations and potential sanctions that may impact the development and commercialization of certain technologies within the PLA sector. This requires a thorough understanding of both technical specifications and international legal frameworks governing military-related technologies.

Current PLA Solutions

01 PLA-based biodegradable materials

Development of biodegradable materials using polylactic acid (PLA) for various applications. These materials are environmentally friendly and can be used in packaging, textiles, and medical devices. Research focuses on improving PLA properties such as thermal stability, mechanical strength, and processability.- PLA-based biodegradable materials: Development of polylactic acid (PLA) based biodegradable materials for various applications. This includes improving the properties of PLA through blending, modification, or copolymerization to enhance its performance and expand its use in different sectors.

- PLA processing technologies: Advancements in processing technologies for PLA, including extrusion, injection molding, and 3D printing. These technologies focus on optimizing the production and shaping of PLA-based products to improve efficiency and quality in manufacturing processes.

- PLA applications in electronics: Utilization of PLA in the electronics sector, particularly in the development of biodegradable electronic components and packaging materials. This includes research on improving the electrical and thermal properties of PLA for use in electronic applications.

- PLA in medical and pharmaceutical applications: Development of PLA-based materials for medical and pharmaceutical applications, including drug delivery systems, tissue engineering scaffolds, and biodegradable implants. This involves research on biocompatibility, controlled release mechanisms, and tailoring PLA properties for specific medical uses.

- PLA composites and blends: Research and development of PLA-based composites and blends to enhance its mechanical, thermal, and barrier properties. This includes incorporating natural fibers, nanoparticles, or other polymers to create hybrid materials with improved performance for various industrial applications.

02 PLA production and processing methods

Innovative techniques for producing and processing PLA, including polymerization methods, extrusion processes, and modification strategies. These advancements aim to enhance PLA production efficiency, reduce costs, and improve the material's overall performance for industrial applications.Expand Specific Solutions03 PLA composites and blends

Creation of PLA-based composites and blends with other materials to enhance specific properties. This includes incorporating natural fibers, nanoparticles, or other polymers to improve mechanical strength, barrier properties, or biodegradability of PLA-based products.Expand Specific Solutions04 PLA applications in electronics

Utilization of PLA in electronic applications, such as circuit boards, sensors, and electronic packaging. Research focuses on developing PLA-based materials with suitable electrical and thermal properties for use in electronic components and devices.Expand Specific Solutions05 PLA in medical and pharmaceutical applications

Development of PLA-based materials for medical and pharmaceutical uses, including drug delivery systems, tissue engineering scaffolds, and biomedical implants. Research aims to improve biocompatibility, controlled release properties, and degradation rates of PLA for these specialized applications.Expand Specific Solutions

Key Industry Players

The PLA (Polylactic Acid) sector is currently in a growth phase, with increasing market size driven by demand for sustainable materials. The global PLA market is projected to expand significantly in the coming years, fueled by environmental concerns and regulatory support for biodegradable plastics. Technologically, PLA is relatively mature, but ongoing research focuses on improving its properties and production efficiency. Companies like NatureWorks LLC, Total Research Corp, and Avantium Knowledge Centre BV are at the forefront of PLA innovation, while academic institutions such as the University of Milan and King Abdullah University of Science & Technology contribute to advancing the technology. The competitive landscape is diverse, with both established chemical companies and specialized bioplastics firms vying for market share.

Total Research Corp

Technical Solution: Total Research Corp has developed a proprietary investment screening tool specifically designed to identify potential PLA-linked entities. This tool combines big data analytics with human intelligence to create a comprehensive risk profile for each investment opportunity. It incorporates data from various sources, including satellite imagery analysis, supply chain mapping, and social network analysis, to uncover hidden connections to military entities.

Strengths: Innovative approach combining technology and human expertise, focus on uncovering hidden connections. Weaknesses: Relatively new in the field, may lack the extensive track record of larger firms.

Industrial & Commercial Bank of China Ltd.

Technical Solution: ICBC has implemented a comprehensive due diligence system for evaluating investment opportunities, particularly in sectors that may have connections to the PLA. This system includes a multi-layered approval process, involving both automated risk assessment tools and expert human analysis. The bank maintains a regularly updated database of companies and individuals with known or suspected military ties, which is cross-referenced during the investment evaluation process.

Strengths: Deep understanding of Chinese business landscape, extensive domestic network. Weaknesses: Potential conflicts of interest due to state ownership, international scrutiny of its practices.

Innovative PLA Research

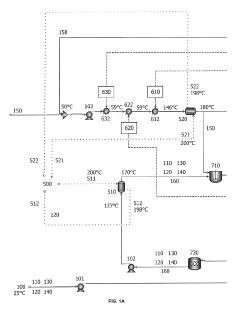

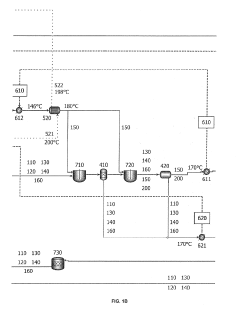

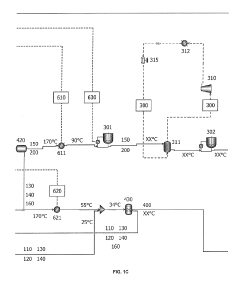

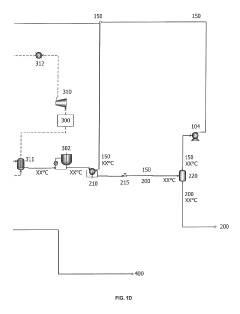

Single Step Lactide Production Process with Heat Recovery

PatentInactiveUS20190161466A1

Innovation

- A single-step industrial process that converts lactic acid into lactide and water, using thermal energy added to a solvent before it enters the reactor, allowing for independent solvent and feed entry, and incorporating a decantation step for water recovery, which reduces energy consumption and simplifies reactor design.

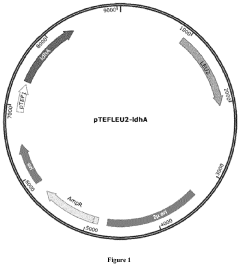

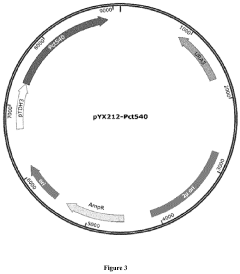

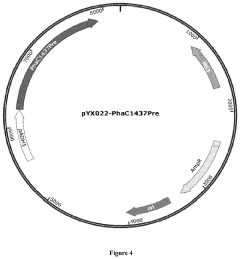

Process for cellular biosynthesis of poly d-lactic acid and poly l-lactic acid

PatentActiveUS20210324429A1

Innovation

- Engineering eukaryotic cells, such as yeast strains, to redirect metabolic pathways for the direct biological synthesis of PLLA and PDLA from carbon sources like glucose, using enzymes like D-lactate dehydrogenase, propionyl-CoA transferase, and polyhydroxyalkanoate synthase to convert pyruvate into lactyl-CoA and subsequently polymerize it into the desired polymers.

Regulatory Environment

The regulatory environment surrounding investment opportunities in the People's Liberation Army (PLA) sector is complex and multifaceted, requiring careful navigation and understanding. At the forefront of this landscape are the stringent regulations imposed by the Chinese government to control foreign investment in defense-related industries. These regulations are designed to protect national security interests and maintain strategic control over critical technologies and resources.

One of the key regulatory frameworks governing this sector is the Foreign Investment Law, which came into effect in 2020. This law, while aimed at promoting foreign investment in China, also includes provisions that restrict or prohibit foreign investment in certain sectors, including those related to national defense and security. The PLA sector falls squarely within these restricted areas, making direct foreign investment challenging, if not impossible, in many cases.

Additionally, the National Security Law of China plays a crucial role in shaping the regulatory environment for PLA-related investments. This law empowers authorities to scrutinize and potentially block investments that are deemed to pose risks to national security. The broad definition of national security under this law allows for significant discretion in its application, creating uncertainty for potential investors.

Furthermore, the Military-Civil Fusion strategy pursued by the Chinese government adds another layer of complexity to the regulatory landscape. This strategy aims to integrate civilian research and commercial sectors with military technology development, blurring the lines between civilian and military applications. As a result, even investments in seemingly civilian technologies may face regulatory scrutiny if they are perceived to have potential military applications.

Export control regulations, both from China and other countries, also significantly impact investment opportunities in the PLA sector. These regulations restrict the transfer of sensitive technologies and can limit the ability of foreign companies to participate in joint ventures or technology partnerships related to military applications.

Investors must also be aware of the evolving nature of these regulations. The Chinese government frequently updates its policies and regulations in response to geopolitical developments and changing national priorities. This dynamic regulatory environment necessitates ongoing monitoring and adaptation of investment strategies.

Given these regulatory challenges, potential investors in the PLA sector must conduct thorough due diligence, engage with legal experts familiar with Chinese defense industry regulations, and maintain open communication channels with relevant regulatory bodies. Developing a deep understanding of the regulatory landscape is crucial for identifying viable investment opportunities and mitigating regulatory risks in this highly sensitive sector.

One of the key regulatory frameworks governing this sector is the Foreign Investment Law, which came into effect in 2020. This law, while aimed at promoting foreign investment in China, also includes provisions that restrict or prohibit foreign investment in certain sectors, including those related to national defense and security. The PLA sector falls squarely within these restricted areas, making direct foreign investment challenging, if not impossible, in many cases.

Additionally, the National Security Law of China plays a crucial role in shaping the regulatory environment for PLA-related investments. This law empowers authorities to scrutinize and potentially block investments that are deemed to pose risks to national security. The broad definition of national security under this law allows for significant discretion in its application, creating uncertainty for potential investors.

Furthermore, the Military-Civil Fusion strategy pursued by the Chinese government adds another layer of complexity to the regulatory landscape. This strategy aims to integrate civilian research and commercial sectors with military technology development, blurring the lines between civilian and military applications. As a result, even investments in seemingly civilian technologies may face regulatory scrutiny if they are perceived to have potential military applications.

Export control regulations, both from China and other countries, also significantly impact investment opportunities in the PLA sector. These regulations restrict the transfer of sensitive technologies and can limit the ability of foreign companies to participate in joint ventures or technology partnerships related to military applications.

Investors must also be aware of the evolving nature of these regulations. The Chinese government frequently updates its policies and regulations in response to geopolitical developments and changing national priorities. This dynamic regulatory environment necessitates ongoing monitoring and adaptation of investment strategies.

Given these regulatory challenges, potential investors in the PLA sector must conduct thorough due diligence, engage with legal experts familiar with Chinese defense industry regulations, and maintain open communication channels with relevant regulatory bodies. Developing a deep understanding of the regulatory landscape is crucial for identifying viable investment opportunities and mitigating regulatory risks in this highly sensitive sector.

Investment Strategies

Investing in the PLA (People's Liberation Army) sector requires a strategic approach due to its unique characteristics and potential risks. A comprehensive investment strategy should consider multiple factors to maximize returns while mitigating risks.

One key strategy is to focus on companies that supply critical technologies and equipment to the PLA. These firms often benefit from long-term contracts and stable revenue streams. Investors should conduct thorough due diligence on these companies, analyzing their financial health, technological capabilities, and relationships with military decision-makers.

Diversification is crucial when investing in the PLA sector. A balanced portfolio should include a mix of established defense contractors and emerging technology companies. This approach helps spread risk and capitalize on both current and future opportunities within the sector.

Timing is another critical factor. Investors should closely monitor geopolitical developments, defense budget allocations, and military modernization plans. These factors can significantly impact the performance of PLA-related investments. Aligning investment decisions with major policy shifts or procurement cycles can lead to substantial returns.

Long-term investment horizons are often more suitable for the PLA sector. Given the nature of military contracts and development cycles, patience is key. Investors should be prepared to hold positions for extended periods to realize the full potential of their investments.

Regulatory compliance is paramount when investing in the PLA sector. Investors must navigate complex legal frameworks, including export controls and sanctions. Partnering with legal experts who specialize in defense-related investments can help ensure compliance and mitigate legal risks.

Continuous monitoring and adaptation of investment strategies are essential. The PLA sector is dynamic, with rapidly evolving technologies and changing strategic priorities. Investors should regularly reassess their portfolios and adjust their strategies based on new information and market trends.

Lastly, considering ethical implications is increasingly important. Some investors may have concerns about supporting military activities. Developing a clear ethical framework and potentially focusing on dual-use technologies can help address these concerns while still capitalizing on investment opportunities in the sector.

One key strategy is to focus on companies that supply critical technologies and equipment to the PLA. These firms often benefit from long-term contracts and stable revenue streams. Investors should conduct thorough due diligence on these companies, analyzing their financial health, technological capabilities, and relationships with military decision-makers.

Diversification is crucial when investing in the PLA sector. A balanced portfolio should include a mix of established defense contractors and emerging technology companies. This approach helps spread risk and capitalize on both current and future opportunities within the sector.

Timing is another critical factor. Investors should closely monitor geopolitical developments, defense budget allocations, and military modernization plans. These factors can significantly impact the performance of PLA-related investments. Aligning investment decisions with major policy shifts or procurement cycles can lead to substantial returns.

Long-term investment horizons are often more suitable for the PLA sector. Given the nature of military contracts and development cycles, patience is key. Investors should be prepared to hold positions for extended periods to realize the full potential of their investments.

Regulatory compliance is paramount when investing in the PLA sector. Investors must navigate complex legal frameworks, including export controls and sanctions. Partnering with legal experts who specialize in defense-related investments can help ensure compliance and mitigate legal risks.

Continuous monitoring and adaptation of investment strategies are essential. The PLA sector is dynamic, with rapidly evolving technologies and changing strategic priorities. Investors should regularly reassess their portfolios and adjust their strategies based on new information and market trends.

Lastly, considering ethical implications is increasingly important. Some investors may have concerns about supporting military activities. Developing a clear ethical framework and potentially focusing on dual-use technologies can help address these concerns while still capitalizing on investment opportunities in the sector.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!