How to Conduct Comprehensive PLA Industry Analysis?

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PLA Industry Overview and Objectives

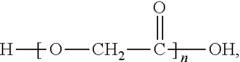

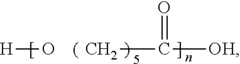

The PLA (Polylactic Acid) industry has experienced significant growth and evolution over the past decade, driven by increasing environmental concerns and the demand for sustainable alternatives to traditional plastics. As a biodegradable and compostable thermoplastic derived from renewable resources, PLA has gained traction across various sectors, including packaging, textiles, and medical applications.

The development of PLA technology can be traced back to the 1930s, but it wasn't until the late 1990s and early 2000s that commercial production became viable. Since then, advancements in fermentation processes, polymer science, and manufacturing techniques have propelled PLA into the mainstream of bioplastics. The industry has witnessed a steady increase in production capacity, with global PLA production reaching approximately 390,000 tonnes in 2020 and projected to exceed 1 million tonnes by 2025.

The primary objective of a comprehensive PLA industry analysis is to provide stakeholders with a holistic understanding of the market dynamics, technological advancements, and future prospects. This analysis aims to identify key growth drivers, challenges, and opportunities within the PLA value chain, from raw material sourcing to end-product applications and disposal.

One of the critical aspects of the PLA industry is its potential to address environmental concerns associated with conventional plastics. As governments worldwide implement stricter regulations on single-use plastics and promote circular economy initiatives, PLA is positioned as a viable alternative. However, the industry faces challenges in terms of cost competitiveness, performance limitations, and the need for appropriate end-of-life management infrastructure.

Technological innovation plays a crucial role in shaping the future of the PLA industry. Current research focuses on improving PLA's mechanical properties, thermal stability, and barrier characteristics to expand its application range. Additionally, efforts are being made to optimize production processes, reduce costs, and develop new grades of PLA tailored for specific end-use requirements.

The PLA industry landscape is characterized by a mix of established chemical companies, specialized bioplastics manufacturers, and emerging startups. Collaborations between industry players, research institutions, and end-users are driving innovation and market expansion. As the industry matures, consolidation and strategic partnerships are expected to reshape the competitive landscape.

In conducting a comprehensive PLA industry analysis, it is essential to consider the entire value chain, from feedstock production to waste management. This holistic approach enables a thorough assessment of the industry's sustainability credentials, economic viability, and potential for long-term growth. By examining market trends, technological developments, and regulatory frameworks, stakeholders can make informed decisions and develop strategies to capitalize on the opportunities presented by the evolving PLA industry.

The development of PLA technology can be traced back to the 1930s, but it wasn't until the late 1990s and early 2000s that commercial production became viable. Since then, advancements in fermentation processes, polymer science, and manufacturing techniques have propelled PLA into the mainstream of bioplastics. The industry has witnessed a steady increase in production capacity, with global PLA production reaching approximately 390,000 tonnes in 2020 and projected to exceed 1 million tonnes by 2025.

The primary objective of a comprehensive PLA industry analysis is to provide stakeholders with a holistic understanding of the market dynamics, technological advancements, and future prospects. This analysis aims to identify key growth drivers, challenges, and opportunities within the PLA value chain, from raw material sourcing to end-product applications and disposal.

One of the critical aspects of the PLA industry is its potential to address environmental concerns associated with conventional plastics. As governments worldwide implement stricter regulations on single-use plastics and promote circular economy initiatives, PLA is positioned as a viable alternative. However, the industry faces challenges in terms of cost competitiveness, performance limitations, and the need for appropriate end-of-life management infrastructure.

Technological innovation plays a crucial role in shaping the future of the PLA industry. Current research focuses on improving PLA's mechanical properties, thermal stability, and barrier characteristics to expand its application range. Additionally, efforts are being made to optimize production processes, reduce costs, and develop new grades of PLA tailored for specific end-use requirements.

The PLA industry landscape is characterized by a mix of established chemical companies, specialized bioplastics manufacturers, and emerging startups. Collaborations between industry players, research institutions, and end-users are driving innovation and market expansion. As the industry matures, consolidation and strategic partnerships are expected to reshape the competitive landscape.

In conducting a comprehensive PLA industry analysis, it is essential to consider the entire value chain, from feedstock production to waste management. This holistic approach enables a thorough assessment of the industry's sustainability credentials, economic viability, and potential for long-term growth. By examining market trends, technological developments, and regulatory frameworks, stakeholders can make informed decisions and develop strategies to capitalize on the opportunities presented by the evolving PLA industry.

Market Demand Analysis for PLA Products

The market demand for PLA (Polylactic Acid) products has been steadily increasing in recent years, driven by growing environmental concerns and the shift towards sustainable materials. PLA, a biodegradable and renewable polymer derived from plant-based sources such as corn starch or sugarcane, has gained significant traction across various industries.

In the packaging sector, PLA has emerged as a viable alternative to traditional petroleum-based plastics. The food and beverage industry, in particular, has shown a strong interest in PLA packaging due to its biodegradability and food-safe properties. This demand is further bolstered by stringent regulations on single-use plastics in many countries, pushing manufacturers to adopt more eco-friendly solutions.

The medical and healthcare industry represents another significant market for PLA products. The biocompatibility and biodegradability of PLA make it an ideal material for medical implants, drug delivery systems, and tissue engineering scaffolds. As the healthcare sector continues to expand globally, the demand for PLA in medical applications is expected to grow substantially.

In the textile industry, PLA fibers are gaining popularity as a sustainable alternative to conventional synthetic fibers. The apparel and fashion sectors are increasingly incorporating PLA-based fabrics into their product lines, catering to environmentally conscious consumers. This trend is likely to continue as more brands commit to sustainability goals and circular economy principles.

The 3D printing industry has also contributed to the rising demand for PLA. As one of the most widely used materials in desktop 3D printing, PLA filaments are popular among hobbyists, educators, and small-scale manufacturers due to their ease of use and low environmental impact.

Agricultural applications of PLA, such as mulch films and controlled-release fertilizer coatings, are showing promise in reducing plastic pollution in farming practices. This sector is expected to see increased adoption of PLA products as sustainable agriculture gains momentum globally.

Despite the growing demand, challenges remain in scaling up PLA production to meet market needs while maintaining cost-competitiveness with traditional plastics. Improvements in production efficiency and the development of new PLA grades with enhanced properties are crucial to expanding market penetration across industries.

The automotive and electronics sectors present emerging opportunities for PLA products, particularly in interior components and disposable electronic devices. As these industries seek to improve their environmental footprint, the demand for bio-based materials like PLA is likely to increase.

In the packaging sector, PLA has emerged as a viable alternative to traditional petroleum-based plastics. The food and beverage industry, in particular, has shown a strong interest in PLA packaging due to its biodegradability and food-safe properties. This demand is further bolstered by stringent regulations on single-use plastics in many countries, pushing manufacturers to adopt more eco-friendly solutions.

The medical and healthcare industry represents another significant market for PLA products. The biocompatibility and biodegradability of PLA make it an ideal material for medical implants, drug delivery systems, and tissue engineering scaffolds. As the healthcare sector continues to expand globally, the demand for PLA in medical applications is expected to grow substantially.

In the textile industry, PLA fibers are gaining popularity as a sustainable alternative to conventional synthetic fibers. The apparel and fashion sectors are increasingly incorporating PLA-based fabrics into their product lines, catering to environmentally conscious consumers. This trend is likely to continue as more brands commit to sustainability goals and circular economy principles.

The 3D printing industry has also contributed to the rising demand for PLA. As one of the most widely used materials in desktop 3D printing, PLA filaments are popular among hobbyists, educators, and small-scale manufacturers due to their ease of use and low environmental impact.

Agricultural applications of PLA, such as mulch films and controlled-release fertilizer coatings, are showing promise in reducing plastic pollution in farming practices. This sector is expected to see increased adoption of PLA products as sustainable agriculture gains momentum globally.

Despite the growing demand, challenges remain in scaling up PLA production to meet market needs while maintaining cost-competitiveness with traditional plastics. Improvements in production efficiency and the development of new PLA grades with enhanced properties are crucial to expanding market penetration across industries.

The automotive and electronics sectors present emerging opportunities for PLA products, particularly in interior components and disposable electronic devices. As these industries seek to improve their environmental footprint, the demand for bio-based materials like PLA is likely to increase.

Technical Challenges in PLA Production

PLA (Polylactic Acid) production faces several technical challenges that hinder its widespread adoption and efficiency. One of the primary issues is the high production cost compared to conventional petroleum-based plastics. The fermentation process used to produce lactic acid, the precursor to PLA, is energy-intensive and requires significant optimization to become more economically viable.

Another challenge lies in the limited availability of raw materials. PLA is primarily derived from corn or sugarcane, which can compete with food production and raise ethical concerns. Developing alternative feedstocks and improving the efficiency of converting biomass to lactic acid are crucial areas for research and development.

The mechanical properties of PLA also present challenges in certain applications. While it offers good strength and stiffness, its brittleness and low impact resistance can limit its use in durable goods. Enhancing PLA's toughness and heat resistance without compromising its biodegradability is a key focus for material scientists and engineers.

PLA's sensitivity to moisture during processing and its tendency to degrade at relatively low temperatures pose difficulties in manufacturing and storage. Improving PLA's thermal stability and developing more robust processing techniques are essential for expanding its industrial applications.

The biodegradation rate of PLA is another area of concern. While its biodegradability is a key selling point, controlling and predicting the degradation process in various environments remains challenging. This is particularly important for applications where long-term stability is required, such as in automotive or construction industries.

Recycling PLA effectively is also a technical hurdle. The material's sensitivity to heat and moisture can make traditional recycling methods less effective. Developing specialized recycling processes that can handle PLA without significant quality loss is crucial for creating a circular economy for this bioplastic.

Lastly, scaling up PLA production to meet growing demand while maintaining consistent quality and properties is a significant challenge. This requires advancements in process engineering, quality control, and the development of more efficient catalysts and polymerization techniques.

Another challenge lies in the limited availability of raw materials. PLA is primarily derived from corn or sugarcane, which can compete with food production and raise ethical concerns. Developing alternative feedstocks and improving the efficiency of converting biomass to lactic acid are crucial areas for research and development.

The mechanical properties of PLA also present challenges in certain applications. While it offers good strength and stiffness, its brittleness and low impact resistance can limit its use in durable goods. Enhancing PLA's toughness and heat resistance without compromising its biodegradability is a key focus for material scientists and engineers.

PLA's sensitivity to moisture during processing and its tendency to degrade at relatively low temperatures pose difficulties in manufacturing and storage. Improving PLA's thermal stability and developing more robust processing techniques are essential for expanding its industrial applications.

The biodegradation rate of PLA is another area of concern. While its biodegradability is a key selling point, controlling and predicting the degradation process in various environments remains challenging. This is particularly important for applications where long-term stability is required, such as in automotive or construction industries.

Recycling PLA effectively is also a technical hurdle. The material's sensitivity to heat and moisture can make traditional recycling methods less effective. Developing specialized recycling processes that can handle PLA without significant quality loss is crucial for creating a circular economy for this bioplastic.

Lastly, scaling up PLA production to meet growing demand while maintaining consistent quality and properties is a significant challenge. This requires advancements in process engineering, quality control, and the development of more efficient catalysts and polymerization techniques.

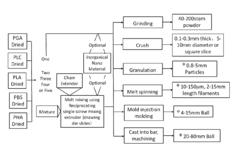

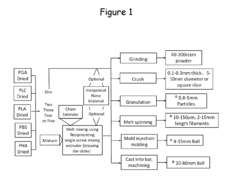

Current PLA Production Methods

01 PLA production and processing techniques

This category focuses on various methods and technologies for producing and processing polylactic acid (PLA). It includes innovations in PLA synthesis, polymerization processes, and techniques for improving PLA properties during manufacturing. These advancements aim to enhance the efficiency of PLA production and the quality of the final product.- PLA production and processing techniques: Various methods and techniques for producing and processing polylactic acid (PLA), including improvements in polymerization processes, extrusion techniques, and material formulations to enhance PLA properties for industrial applications.

- PLA-based composites and blends: Development of PLA-based composites and blends with other materials to improve mechanical properties, thermal stability, and biodegradability for use in diverse industrial applications such as packaging, automotive, and consumer goods.

- PLA applications in 3D printing and additive manufacturing: Utilization of PLA in 3D printing and additive manufacturing processes, including the development of specialized PLA filaments and optimization of printing parameters for various industrial and consumer applications.

- PLA degradation and recycling technologies: Advancements in PLA degradation and recycling technologies, including enzymatic degradation, chemical recycling, and the development of closed-loop systems for PLA waste management in industrial settings.

- PLA industry market analysis and trends: Analysis of PLA industry market trends, including production capacity, demand forecasts, and emerging applications across various sectors such as packaging, textiles, and medical devices.

02 PLA applications in 3D printing and additive manufacturing

This point covers the use of PLA in 3D printing and additive manufacturing industries. It includes developments in PLA-based filaments, optimization of printing parameters for PLA materials, and innovations in 3D printing technologies specifically designed for PLA. These advancements aim to improve the quality and performance of 3D printed PLA products.Expand Specific Solutions03 PLA blends and composites

This category encompasses the development of PLA blends and composites with other materials to enhance its properties. It includes research on combining PLA with natural fibers, nanoparticles, or other polymers to improve mechanical strength, thermal stability, or biodegradability. These innovations aim to expand the range of applications for PLA-based materials.Expand Specific Solutions04 PLA biodegradation and environmental impact

This point focuses on the biodegradability of PLA and its environmental impact. It includes research on improving PLA's degradation rate in various environments, developing eco-friendly additives to enhance biodegradability, and assessing the lifecycle and environmental footprint of PLA products. These studies aim to position PLA as a sustainable alternative to traditional plastics.Expand Specific Solutions05 PLA in packaging and consumer goods

This category covers the application of PLA in packaging materials and consumer goods. It includes innovations in PLA-based films, containers, and disposable products. The focus is on developing PLA formulations that meet the requirements of various packaging applications, such as improved barrier properties, heat resistance, and clarity, while maintaining biodegradability.Expand Specific Solutions

Key Players in PLA Industry

The PLA industry analysis landscape is characterized by a diverse range of players at various stages of technological maturity. The market is experiencing steady growth, driven by increasing demand for sustainable materials across multiple sectors. Companies like Total Research Corp and 3M Innovative Properties Co. are leading the charge in innovation, while academic institutions such as Brown University and the University of Milan contribute significant research. The involvement of major corporations like DuPont de Nemours, Inc. and Life Technologies Corp. indicates the industry's potential for large-scale commercialization. Emerging players from Asia, including Ningbo Michi Technology Co., Ltd and Changzhou University, are also making notable advancements, suggesting a global shift in the competitive landscape.

Council of Scientific & Industrial Research

Technical Solution: The Council of Scientific & Industrial Research (CSIR) has developed a comprehensive approach to PLA industry analysis. Their method involves a multi-faceted examination of the PLA sector, including market trends, technological advancements, and environmental impacts. CSIR utilizes advanced data analytics tools to process large volumes of industry data, enabling them to identify emerging patterns and potential growth areas. They also conduct in-depth research on PLA production processes, focusing on improving efficiency and reducing environmental footprint. Additionally, CSIR collaborates with industry partners to develop innovative applications for PLA in various sectors, such as packaging, medical devices, and 3D printing.

Strengths: Extensive research capabilities, strong industry partnerships, and a holistic approach to analysis. Weaknesses: May face challenges in rapidly commercializing research findings and adapting to fast-changing market dynamics.

DuPont de Nemours, Inc.

Technical Solution: DuPont's approach to PLA industry analysis leverages its extensive experience in materials science and biotechnology. The company employs a comprehensive strategy that combines market research, technological innovation, and sustainability considerations. DuPont's analysis includes detailed assessments of PLA production methods, focusing on improving yield and reducing costs. They also conduct extensive studies on PLA's performance characteristics and potential applications across various industries. DuPont's analysis extends to the entire PLA value chain, from feedstock sourcing to end-product manufacturing and recycling. Their approach also incorporates predictive modeling to forecast future market trends and identify potential disruptive technologies in the PLA space.

Strengths: Strong R&D capabilities, global market presence, and expertise in materials science. Weaknesses: May face challenges in balancing traditional petrochemical business with bio-based alternatives like PLA.

Innovations in PLA Synthesis

Synthesis method of lactide by confinement effect catalysis of crystalline porous polymer material

PatentActiveUS11987567B2

Innovation

- A synthesis method using confinement effect catalysis with crystalline porous polymer materials, involving the synthesis of specific catalysts from compounds A and B, followed by reaction with lactic acid and solvents, and subsequent purification to achieve high yield and purity of lactide.

Degradable materials for oil and gas field operations and their synthesis method

PatentActiveUS20170015889A1

Innovation

- A degradable material synthesized through melt mixing of polymers like polyglycolic acid (PGA), polycaprolactone (PCL), polylactic acid (PLA), polybutylene succinate (PBS), and polyhydroxybutyrate (PHA) with a chain extender, capable of degrading under reservoir temperatures to temporarily plug formations without causing damage, and can be formulated into various shapes for specific operations.

Environmental Impact of PLA

The environmental impact of PLA (Polylactic Acid) is a crucial aspect to consider when conducting a comprehensive industry analysis. PLA, a biodegradable and compostable bioplastic derived from renewable resources, has gained significant attention as an eco-friendly alternative to traditional petroleum-based plastics. However, its environmental footprint extends beyond its end-of-life characteristics.

One of the primary environmental benefits of PLA is its biodegradability. Under proper composting conditions, PLA can break down into carbon dioxide, water, and biomass within a few months, significantly reducing long-term environmental pollution compared to conventional plastics. This characteristic makes PLA particularly attractive for single-use applications and packaging materials, potentially mitigating the plastic waste crisis.

The production of PLA also offers environmental advantages. As it is derived from renewable resources such as corn starch or sugarcane, PLA production can potentially reduce dependency on fossil fuels. Studies have shown that PLA production generates fewer greenhouse gas emissions compared to the production of many traditional plastics, contributing to a lower carbon footprint.

However, the environmental impact of PLA is not without complexities. The agricultural practices used to grow the raw materials for PLA production can have significant environmental implications. Intensive farming methods, including the use of pesticides and fertilizers, can lead to soil degradation, water pollution, and loss of biodiversity. Additionally, the land use for growing PLA feedstock may compete with food production, raising concerns about food security and land-use change.

The end-of-life management of PLA products also presents challenges. While biodegradable, PLA requires specific industrial composting conditions to break down efficiently. In many regions, the infrastructure for proper PLA disposal and composting is limited, potentially leading to improper disposal and negating its environmental benefits. Moreover, the mixing of PLA with conventional plastic recycling streams can contaminate the recycling process, highlighting the need for improved waste management systems.

Energy consumption during PLA production is another factor to consider. While generally lower than that of petroleum-based plastics, the energy requirements for PLA production can still be substantial, particularly in the polymerization and processing stages. Efforts to optimize production processes and increase the use of renewable energy sources in PLA manufacturing are ongoing to further reduce its environmental impact.

In conclusion, while PLA offers several environmental advantages over traditional plastics, a comprehensive analysis of its industry must consider the full lifecycle impact, from raw material sourcing to end-of-life management. Balancing the benefits of biodegradability and renewable sourcing against the challenges of agricultural impacts and disposal infrastructure is crucial for accurately assessing PLA's role in sustainable material solutions.

One of the primary environmental benefits of PLA is its biodegradability. Under proper composting conditions, PLA can break down into carbon dioxide, water, and biomass within a few months, significantly reducing long-term environmental pollution compared to conventional plastics. This characteristic makes PLA particularly attractive for single-use applications and packaging materials, potentially mitigating the plastic waste crisis.

The production of PLA also offers environmental advantages. As it is derived from renewable resources such as corn starch or sugarcane, PLA production can potentially reduce dependency on fossil fuels. Studies have shown that PLA production generates fewer greenhouse gas emissions compared to the production of many traditional plastics, contributing to a lower carbon footprint.

However, the environmental impact of PLA is not without complexities. The agricultural practices used to grow the raw materials for PLA production can have significant environmental implications. Intensive farming methods, including the use of pesticides and fertilizers, can lead to soil degradation, water pollution, and loss of biodiversity. Additionally, the land use for growing PLA feedstock may compete with food production, raising concerns about food security and land-use change.

The end-of-life management of PLA products also presents challenges. While biodegradable, PLA requires specific industrial composting conditions to break down efficiently. In many regions, the infrastructure for proper PLA disposal and composting is limited, potentially leading to improper disposal and negating its environmental benefits. Moreover, the mixing of PLA with conventional plastic recycling streams can contaminate the recycling process, highlighting the need for improved waste management systems.

Energy consumption during PLA production is another factor to consider. While generally lower than that of petroleum-based plastics, the energy requirements for PLA production can still be substantial, particularly in the polymerization and processing stages. Efforts to optimize production processes and increase the use of renewable energy sources in PLA manufacturing are ongoing to further reduce its environmental impact.

In conclusion, while PLA offers several environmental advantages over traditional plastics, a comprehensive analysis of its industry must consider the full lifecycle impact, from raw material sourcing to end-of-life management. Balancing the benefits of biodegradability and renewable sourcing against the challenges of agricultural impacts and disposal infrastructure is crucial for accurately assessing PLA's role in sustainable material solutions.

Regulatory Framework for Bioplastics

The regulatory framework for bioplastics is a complex and evolving landscape that plays a crucial role in shaping the PLA (Polylactic Acid) industry. As the demand for sustainable alternatives to traditional plastics grows, governments and regulatory bodies worldwide are developing and implementing policies to support the adoption of bioplastics while ensuring environmental protection and consumer safety.

At the international level, organizations such as the United Nations Environment Programme (UNEP) and the European Union (EU) have been instrumental in setting guidelines and standards for bioplastics. The EU, in particular, has been at the forefront of regulatory efforts with its Circular Economy Action Plan and the European Strategy for Plastics in a Circular Economy. These initiatives aim to promote the use of biodegradable and compostable plastics while addressing concerns related to waste management and environmental impact.

In the United States, the regulatory framework for bioplastics is primarily governed by the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA). The EPA oversees the environmental aspects of bioplastics production and disposal, while the FDA regulates their use in food packaging and other consumer products. The Sustainable Materials Management (SMM) program, implemented by the EPA, encourages the development and use of sustainable materials, including bioplastics.

Many countries have introduced specific regulations and standards for bioplastics, focusing on aspects such as biodegradability, compostability, and recycling. For instance, the European Standard EN 13432 sets requirements for packaging recoverable through composting and biodegradation. Similarly, the American Society for Testing and Materials (ASTM) has developed standards like ASTM D6400 for compostable plastics.

Labeling and certification schemes have also emerged as important components of the regulatory framework. These schemes, such as the "OK compost" certification in Europe and the Biodegradable Products Institute (BPI) certification in North America, help consumers identify genuine bioplastic products and ensure compliance with relevant standards.

As the PLA industry continues to grow, regulatory bodies are adapting their frameworks to address emerging challenges and opportunities. This includes developing more comprehensive life cycle assessment methodologies, establishing clearer end-of-life management guidelines, and harmonizing standards across different regions to facilitate global trade and adoption of bioplastics.

At the international level, organizations such as the United Nations Environment Programme (UNEP) and the European Union (EU) have been instrumental in setting guidelines and standards for bioplastics. The EU, in particular, has been at the forefront of regulatory efforts with its Circular Economy Action Plan and the European Strategy for Plastics in a Circular Economy. These initiatives aim to promote the use of biodegradable and compostable plastics while addressing concerns related to waste management and environmental impact.

In the United States, the regulatory framework for bioplastics is primarily governed by the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA). The EPA oversees the environmental aspects of bioplastics production and disposal, while the FDA regulates their use in food packaging and other consumer products. The Sustainable Materials Management (SMM) program, implemented by the EPA, encourages the development and use of sustainable materials, including bioplastics.

Many countries have introduced specific regulations and standards for bioplastics, focusing on aspects such as biodegradability, compostability, and recycling. For instance, the European Standard EN 13432 sets requirements for packaging recoverable through composting and biodegradation. Similarly, the American Society for Testing and Materials (ASTM) has developed standards like ASTM D6400 for compostable plastics.

Labeling and certification schemes have also emerged as important components of the regulatory framework. These schemes, such as the "OK compost" certification in Europe and the Biodegradable Products Institute (BPI) certification in North America, help consumers identify genuine bioplastic products and ensure compliance with relevant standards.

As the PLA industry continues to grow, regulatory bodies are adapting their frameworks to address emerging challenges and opportunities. This includes developing more comprehensive life cycle assessment methodologies, establishing clearer end-of-life management guidelines, and harmonizing standards across different regions to facilitate global trade and adoption of bioplastics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!