Market Dynamics Influencing PLA's Growth Trajectory

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PLA Market Evolution

The PLA (Polylactic Acid) market has undergone significant evolution over the past decade, driven by increasing environmental concerns and the growing demand for sustainable alternatives to traditional plastics. Initially, PLA was primarily used in niche applications such as medical implants and specialty packaging. However, as production technologies improved and costs decreased, PLA has expanded into broader markets, including food packaging, textiles, and 3D printing filaments.

The market's growth trajectory has been influenced by several key factors. Firstly, government regulations and policies promoting biodegradable materials have created a favorable environment for PLA adoption. Countries implementing plastic bag bans and setting targets for reducing plastic waste have indirectly boosted the PLA market. Additionally, consumer awareness and demand for eco-friendly products have risen, pushing brands to seek sustainable packaging solutions.

Technological advancements have played a crucial role in PLA's market evolution. Improvements in fermentation processes and the development of more efficient catalysts have led to higher-quality PLA with enhanced properties, expanding its potential applications. The introduction of PLA blends and composites has further broadened its market reach, addressing limitations in heat resistance and mechanical properties.

The food packaging sector has been a significant driver of PLA market growth. As concerns over plastic pollution intensify, food and beverage companies have increasingly turned to PLA as a biodegradable alternative for disposable cutlery, cups, and containers. This shift has been particularly pronounced in quick-service restaurants and takeaway food services.

In the textile industry, PLA fibers have gained traction as a sustainable alternative to polyester. The apparel sector, especially sportswear and athleisure brands, has embraced PLA for its moisture-wicking properties and biodegradability. This trend aligns with the growing consumer preference for environmentally responsible fashion choices.

The 3D printing industry has also contributed to PLA's market evolution. PLA's ease of use, low warping, and biodegradability have made it a popular choice for hobbyists and professionals alike. As 3D printing technology becomes more accessible and widespread, the demand for PLA filaments continues to grow.

Despite these positive trends, challenges remain in PLA's market evolution. Competition from other bioplastics and traditional plastics, as well as concerns over end-of-life management and composting infrastructure, continue to impact market dynamics. However, ongoing research and development efforts aimed at improving PLA's properties and reducing production costs are expected to further drive market growth and diversification in the coming years.

The market's growth trajectory has been influenced by several key factors. Firstly, government regulations and policies promoting biodegradable materials have created a favorable environment for PLA adoption. Countries implementing plastic bag bans and setting targets for reducing plastic waste have indirectly boosted the PLA market. Additionally, consumer awareness and demand for eco-friendly products have risen, pushing brands to seek sustainable packaging solutions.

Technological advancements have played a crucial role in PLA's market evolution. Improvements in fermentation processes and the development of more efficient catalysts have led to higher-quality PLA with enhanced properties, expanding its potential applications. The introduction of PLA blends and composites has further broadened its market reach, addressing limitations in heat resistance and mechanical properties.

The food packaging sector has been a significant driver of PLA market growth. As concerns over plastic pollution intensify, food and beverage companies have increasingly turned to PLA as a biodegradable alternative for disposable cutlery, cups, and containers. This shift has been particularly pronounced in quick-service restaurants and takeaway food services.

In the textile industry, PLA fibers have gained traction as a sustainable alternative to polyester. The apparel sector, especially sportswear and athleisure brands, has embraced PLA for its moisture-wicking properties and biodegradability. This trend aligns with the growing consumer preference for environmentally responsible fashion choices.

The 3D printing industry has also contributed to PLA's market evolution. PLA's ease of use, low warping, and biodegradability have made it a popular choice for hobbyists and professionals alike. As 3D printing technology becomes more accessible and widespread, the demand for PLA filaments continues to grow.

Despite these positive trends, challenges remain in PLA's market evolution. Competition from other bioplastics and traditional plastics, as well as concerns over end-of-life management and composting infrastructure, continue to impact market dynamics. However, ongoing research and development efforts aimed at improving PLA's properties and reducing production costs are expected to further drive market growth and diversification in the coming years.

PLA Demand Analysis

The global demand for Polylactic Acid (PLA) has been experiencing significant growth in recent years, driven by increasing environmental concerns and a shift towards sustainable materials. This biodegradable and renewable polymer has found applications across various industries, particularly in packaging, textiles, and medical devices.

The packaging industry remains the largest consumer of PLA, accounting for a substantial portion of the market share. The growing awareness of plastic pollution and stringent regulations on single-use plastics have propelled the adoption of PLA in food packaging, disposable cutlery, and beverage bottles. Major food and beverage companies have been incorporating PLA into their packaging solutions to meet consumer demands for eco-friendly alternatives.

In the textile industry, PLA fibers are gaining traction as a sustainable alternative to traditional synthetic fibers. The apparel sector, in particular, has shown increased interest in PLA-based fabrics due to their biodegradability and comparable performance to conventional materials. This trend is expected to continue as more fashion brands commit to sustainability goals and consumers seek environmentally responsible clothing options.

The medical and healthcare sector represents another significant market for PLA, with applications in implants, drug delivery systems, and tissue engineering scaffolds. The biocompatibility and biodegradability of PLA make it an attractive material for various medical applications, driving demand in this sector.

Regionally, North America and Europe have been leading the PLA market, with established regulations promoting the use of biodegradable materials. However, the Asia-Pacific region is emerging as a key growth market, driven by rapid industrialization, increasing environmental awareness, and government initiatives to reduce plastic waste.

Despite the positive growth trajectory, several factors are influencing the PLA market dynamics. The cost of PLA production remains higher compared to conventional plastics, which can be a barrier to widespread adoption, especially in price-sensitive markets. Additionally, the limited availability of industrial composting facilities in many regions poses challenges to the end-of-life management of PLA products.

Technological advancements in PLA production and processing are expected to address some of these challenges. Ongoing research and development efforts are focused on improving PLA's properties, such as heat resistance and flexibility, to expand its application range. Furthermore, innovations in feedstock sourcing and production processes are aimed at reducing costs and enhancing the overall sustainability profile of PLA.

The market dynamics of PLA are also influenced by broader trends in the circular economy and bio-based materials. As governments and industries worldwide push for more sustainable practices, the demand for PLA is likely to see continued growth. However, the pace of this growth will depend on factors such as regulatory support, consumer acceptance, and the development of efficient recycling and composting infrastructure.

The packaging industry remains the largest consumer of PLA, accounting for a substantial portion of the market share. The growing awareness of plastic pollution and stringent regulations on single-use plastics have propelled the adoption of PLA in food packaging, disposable cutlery, and beverage bottles. Major food and beverage companies have been incorporating PLA into their packaging solutions to meet consumer demands for eco-friendly alternatives.

In the textile industry, PLA fibers are gaining traction as a sustainable alternative to traditional synthetic fibers. The apparel sector, in particular, has shown increased interest in PLA-based fabrics due to their biodegradability and comparable performance to conventional materials. This trend is expected to continue as more fashion brands commit to sustainability goals and consumers seek environmentally responsible clothing options.

The medical and healthcare sector represents another significant market for PLA, with applications in implants, drug delivery systems, and tissue engineering scaffolds. The biocompatibility and biodegradability of PLA make it an attractive material for various medical applications, driving demand in this sector.

Regionally, North America and Europe have been leading the PLA market, with established regulations promoting the use of biodegradable materials. However, the Asia-Pacific region is emerging as a key growth market, driven by rapid industrialization, increasing environmental awareness, and government initiatives to reduce plastic waste.

Despite the positive growth trajectory, several factors are influencing the PLA market dynamics. The cost of PLA production remains higher compared to conventional plastics, which can be a barrier to widespread adoption, especially in price-sensitive markets. Additionally, the limited availability of industrial composting facilities in many regions poses challenges to the end-of-life management of PLA products.

Technological advancements in PLA production and processing are expected to address some of these challenges. Ongoing research and development efforts are focused on improving PLA's properties, such as heat resistance and flexibility, to expand its application range. Furthermore, innovations in feedstock sourcing and production processes are aimed at reducing costs and enhancing the overall sustainability profile of PLA.

The market dynamics of PLA are also influenced by broader trends in the circular economy and bio-based materials. As governments and industries worldwide push for more sustainable practices, the demand for PLA is likely to see continued growth. However, the pace of this growth will depend on factors such as regulatory support, consumer acceptance, and the development of efficient recycling and composting infrastructure.

PLA Tech Challenges

Polylactic acid (PLA) has gained significant attention in recent years as a biodegradable and renewable alternative to traditional plastics. However, its widespread adoption faces several technical challenges that need to be addressed to ensure its continued growth trajectory.

One of the primary challenges is the relatively high production cost of PLA compared to conventional petroleum-based plastics. The complex fermentation and polymerization processes involved in PLA production contribute to its higher price point, making it less competitive in price-sensitive markets. Developing more efficient and cost-effective production methods is crucial for PLA's market expansion.

Another significant hurdle is PLA's limited thermal stability and mechanical properties. While suitable for many applications, PLA's low heat deflection temperature and brittleness restrict its use in high-temperature or high-stress environments. This limitation hinders its adoption in sectors such as automotive and electronics, where durability and heat resistance are critical.

The degradation rate and end-of-life management of PLA products also present challenges. Although biodegradable, PLA requires specific conditions for optimal decomposition, which are not always available in standard waste management facilities. This discrepancy between theoretical biodegradability and practical disposal methods can lead to misconceptions about PLA's environmental benefits.

PLA's moisture sensitivity is another technical obstacle. The material tends to absorb moisture from the environment, which can lead to hydrolysis and degradation of its properties over time. This characteristic affects both the processing of PLA and the long-term stability of PLA products, particularly in high-humidity applications.

The limited availability of high-quality, consistent feedstock for PLA production is a challenge that impacts both cost and quality. PLA is typically derived from corn or sugarcane, and fluctuations in crop yields or competition with food production can affect raw material supply and pricing.

Improving PLA's barrier properties, especially against oxygen and water vapor, remains a technical challenge. This limitation affects PLA's suitability for certain packaging applications, particularly in the food and beverage industry where extended shelf life is crucial.

Lastly, the development of effective and economically viable recycling systems for PLA is an ongoing challenge. While theoretically recyclable, the current infrastructure and processes for PLA recycling are not as well-established as those for conventional plastics, potentially limiting its circular economy potential.

Addressing these technical challenges is essential for PLA to realize its full market potential and contribute significantly to sustainable plastic alternatives. Ongoing research and development efforts are focused on enhancing PLA's properties, optimizing production processes, and improving end-of-life management to overcome these hurdles and drive PLA's growth trajectory in various market segments.

One of the primary challenges is the relatively high production cost of PLA compared to conventional petroleum-based plastics. The complex fermentation and polymerization processes involved in PLA production contribute to its higher price point, making it less competitive in price-sensitive markets. Developing more efficient and cost-effective production methods is crucial for PLA's market expansion.

Another significant hurdle is PLA's limited thermal stability and mechanical properties. While suitable for many applications, PLA's low heat deflection temperature and brittleness restrict its use in high-temperature or high-stress environments. This limitation hinders its adoption in sectors such as automotive and electronics, where durability and heat resistance are critical.

The degradation rate and end-of-life management of PLA products also present challenges. Although biodegradable, PLA requires specific conditions for optimal decomposition, which are not always available in standard waste management facilities. This discrepancy between theoretical biodegradability and practical disposal methods can lead to misconceptions about PLA's environmental benefits.

PLA's moisture sensitivity is another technical obstacle. The material tends to absorb moisture from the environment, which can lead to hydrolysis and degradation of its properties over time. This characteristic affects both the processing of PLA and the long-term stability of PLA products, particularly in high-humidity applications.

The limited availability of high-quality, consistent feedstock for PLA production is a challenge that impacts both cost and quality. PLA is typically derived from corn or sugarcane, and fluctuations in crop yields or competition with food production can affect raw material supply and pricing.

Improving PLA's barrier properties, especially against oxygen and water vapor, remains a technical challenge. This limitation affects PLA's suitability for certain packaging applications, particularly in the food and beverage industry where extended shelf life is crucial.

Lastly, the development of effective and economically viable recycling systems for PLA is an ongoing challenge. While theoretically recyclable, the current infrastructure and processes for PLA recycling are not as well-established as those for conventional plastics, potentially limiting its circular economy potential.

Addressing these technical challenges is essential for PLA to realize its full market potential and contribute significantly to sustainable plastic alternatives. Ongoing research and development efforts are focused on enhancing PLA's properties, optimizing production processes, and improving end-of-life management to overcome these hurdles and drive PLA's growth trajectory in various market segments.

PLA Production Methods

01 PLA production and processing methods

Various methods for producing and processing PLA are being developed to improve its properties and expand its applications. These include new polymerization techniques, blending with other materials, and innovative processing methods to enhance PLA's mechanical and thermal properties.- PLA production and processing methods: Various methods for producing and processing PLA are being developed to improve its properties and expand its applications. These include new polymerization techniques, blending with other materials, and innovative processing methods to enhance PLA's mechanical and thermal properties.

- PLA applications in packaging and consumer goods: PLA is increasingly being used in packaging and consumer goods due to its biodegradability and renewable sourcing. Research focuses on improving PLA's barrier properties, heat resistance, and durability for various packaging applications and consumer products.

- PLA in medical and pharmaceutical applications: The growth trajectory of PLA in medical and pharmaceutical fields is expanding. Research is focused on developing PLA-based materials for drug delivery systems, tissue engineering scaffolds, and bioabsorbable medical devices, leveraging PLA's biocompatibility and biodegradability.

- PLA composites and blends: To overcome some limitations of pure PLA, research is directed towards developing PLA composites and blends. These involve combining PLA with other polymers, natural fibers, or nanoparticles to enhance its properties such as toughness, heat resistance, and processability.

- Sustainable production and recycling of PLA: The growth trajectory of PLA is closely tied to sustainability efforts. Research is focused on developing more efficient and eco-friendly production methods, as well as improving PLA recycling and end-of-life management to enhance its circular economy potential.

02 PLA applications in packaging and consumer goods

PLA is increasingly being used in packaging and consumer goods due to its biodegradability and renewable sourcing. Research focuses on improving PLA's barrier properties, durability, and compatibility with various packaging formats and consumer product applications.Expand Specific Solutions03 PLA composites and blends

Researchers are developing PLA composites and blends to overcome some of the material's limitations. These include combining PLA with natural fibers, nanoparticles, or other polymers to enhance its mechanical strength, thermal stability, and processability.Expand Specific Solutions04 PLA in medical and pharmaceutical applications

The biocompatibility and biodegradability of PLA make it attractive for medical and pharmaceutical applications. Research is ongoing to develop PLA-based drug delivery systems, tissue engineering scaffolds, and biomedical implants with improved performance and controlled degradation rates.Expand Specific Solutions05 PLA recycling and end-of-life management

As PLA usage grows, there is increasing focus on developing effective recycling and end-of-life management strategies. This includes research into chemical recycling methods, composting technologies, and the development of PLA grades with improved recyclability and biodegradability.Expand Specific Solutions

PLA Industry Players

The market for Polylactic Acid (PLA) is experiencing dynamic growth, driven by increasing environmental concerns and demand for sustainable materials. The industry is in a rapid expansion phase, with the global PLA market expected to reach significant size in the coming years. Technological maturity varies among key players, with companies like NatureWorks (a subsidiary of Total Research Corp) and DuPont de Nemours, Inc. leading in production capacity and innovation. Research institutions such as Tongji University and Sichuan University are contributing to advancements in PLA technology. The competitive landscape is evolving, with new entrants like Avantium Knowledge Centre BV and established chemical companies like Arkema France SA expanding their presence in the biodegradable plastics sector.

DuPont de Nemours, Inc.

Technical Solution: DuPont has developed a range of bio-based and biodegradable PLA products under its Biomax® line. Their technology focuses on enhancing PLA's properties through copolymerization and blending techniques. They have introduced PLA-based packaging solutions that offer improved heat resistance and flexibility, addressing some of the material's traditional limitations. DuPont's approach also includes the development of PLA composites for durable applications, expanding the material's market potential beyond packaging.

Strengths: Strong R&D capabilities, established market presence, and diverse product portfolio. Weaknesses: High production costs compared to traditional plastics, limited biodegradability in certain environments.

Industrial Technology Research Institute

Technical Solution: ITRI has developed advanced PLA processing technologies, including a proprietary stereocomplex PLA (scPLA) production method. This technology creates PLA with enhanced thermal and mechanical properties, making it suitable for high-performance applications. ITRI's research also extends to PLA nanocomposites and PLA-based foams, aiming to broaden the material's application range in industries such as automotive and electronics.

Strengths: Cutting-edge research in PLA modifications, strong focus on industrial applications. Weaknesses: Limited commercial scale production, potential challenges in technology transfer to industry.

PLA Patent Landscape

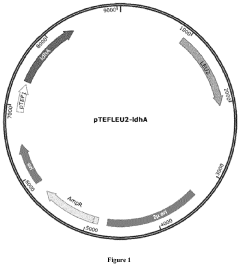

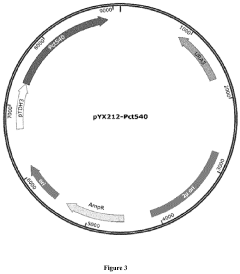

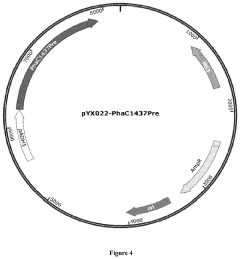

Process for cellular biosynthesis of poly d-lactic acid and poly l-lactic acid

PatentActiveUS20210324429A1

Innovation

- Engineering eukaryotic cells, such as yeast strains, to redirect metabolic pathways for the direct biological synthesis of PLLA and PDLA from carbon sources like glucose, using enzymes like D-lactate dehydrogenase, propionyl-CoA transferase, and polyhydroxyalkanoate synthase to convert pyruvate into lactyl-CoA and subsequently polymerize it into the desired polymers.

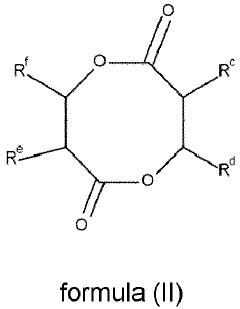

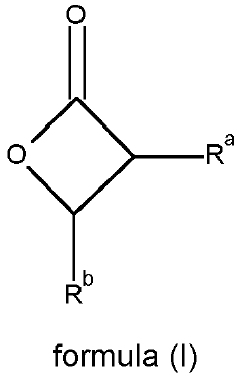

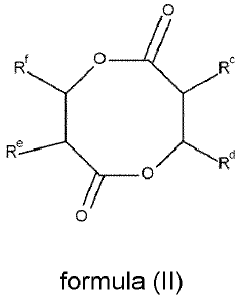

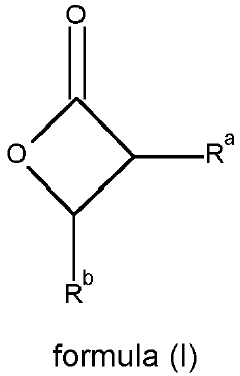

Process for preparing tailor-made lactide copolymers and lactide copolymers thereby obtained

PatentInactiveEP4092067A1

Innovation

- A process involving the copolymerization of lactide monomers with beta-lactones and diolides, in the presence of catalysts and optionally initiators, to produce lactide copolymers with tailored properties, including improved biodegradability and controlled physicochemical properties.

PLA Sustainability

The sustainability of Polylactic Acid (PLA) is a critical factor influencing its growth trajectory in the global market. As a biodegradable and renewable polymer derived from plant-based sources, PLA offers significant environmental advantages over traditional petroleum-based plastics. This sustainability aspect has become increasingly important as consumers and businesses alike prioritize eco-friendly alternatives in response to growing environmental concerns.

The production of PLA typically involves lower greenhouse gas emissions compared to conventional plastics, contributing to its appeal in a carbon-conscious market. Additionally, PLA's biodegradability in industrial composting facilities addresses the issue of plastic waste accumulation, aligning with circular economy principles and waste reduction initiatives. These factors have positioned PLA as a promising material in various industries, including packaging, textiles, and medical applications.

However, the sustainability narrative of PLA is not without challenges. The agricultural practices involved in producing the raw materials for PLA, such as corn or sugarcane, raise questions about land use, water consumption, and potential competition with food crops. The energy-intensive processes required for PLA production also impact its overall environmental footprint, necessitating ongoing improvements in manufacturing efficiency.

The end-of-life management of PLA products presents both opportunities and hurdles. While PLA can biodegrade under specific conditions, the lack of widespread industrial composting infrastructure in many regions limits its practical biodegradability. This gap between theoretical and practical end-of-life scenarios has led to increased focus on developing more robust recycling systems for PLA, as well as enhancing its compatibility with existing waste management infrastructure.

Market dynamics are increasingly shaped by regulatory frameworks and corporate sustainability commitments. Policies promoting bio-based materials and restrictions on single-use plastics in various countries have created favorable conditions for PLA adoption. Simultaneously, companies across industries are setting ambitious sustainability targets, driving demand for materials like PLA that can help reduce their environmental impact.

The economic viability of PLA remains a key factor in its market growth. As production scales up and technologies improve, the cost competitiveness of PLA compared to traditional plastics continues to evolve. This economic aspect, coupled with its sustainability credentials, will play a crucial role in determining PLA's long-term market position and growth trajectory.

The production of PLA typically involves lower greenhouse gas emissions compared to conventional plastics, contributing to its appeal in a carbon-conscious market. Additionally, PLA's biodegradability in industrial composting facilities addresses the issue of plastic waste accumulation, aligning with circular economy principles and waste reduction initiatives. These factors have positioned PLA as a promising material in various industries, including packaging, textiles, and medical applications.

However, the sustainability narrative of PLA is not without challenges. The agricultural practices involved in producing the raw materials for PLA, such as corn or sugarcane, raise questions about land use, water consumption, and potential competition with food crops. The energy-intensive processes required for PLA production also impact its overall environmental footprint, necessitating ongoing improvements in manufacturing efficiency.

The end-of-life management of PLA products presents both opportunities and hurdles. While PLA can biodegrade under specific conditions, the lack of widespread industrial composting infrastructure in many regions limits its practical biodegradability. This gap between theoretical and practical end-of-life scenarios has led to increased focus on developing more robust recycling systems for PLA, as well as enhancing its compatibility with existing waste management infrastructure.

Market dynamics are increasingly shaped by regulatory frameworks and corporate sustainability commitments. Policies promoting bio-based materials and restrictions on single-use plastics in various countries have created favorable conditions for PLA adoption. Simultaneously, companies across industries are setting ambitious sustainability targets, driving demand for materials like PLA that can help reduce their environmental impact.

The economic viability of PLA remains a key factor in its market growth. As production scales up and technologies improve, the cost competitiveness of PLA compared to traditional plastics continues to evolve. This economic aspect, coupled with its sustainability credentials, will play a crucial role in determining PLA's long-term market position and growth trajectory.

PLA Policy Landscape

The PLA policy landscape plays a crucial role in shaping the growth trajectory of the polylactic acid (PLA) market. Governments worldwide are increasingly recognizing the importance of sustainable materials and implementing policies to promote their adoption. These policies are primarily driven by environmental concerns, particularly the need to reduce plastic waste and greenhouse gas emissions.

In the European Union, the Single-Use Plastics Directive has been a significant catalyst for PLA adoption. This directive aims to reduce the impact of certain plastic products on the environment by banning single-use plastics and promoting the use of biodegradable alternatives. As a result, many European countries have introduced incentives and regulations favoring biodegradable plastics like PLA, stimulating market growth in the region.

The United States has also seen a shift in policy towards supporting biodegradable materials. Several states, including California and New York, have implemented bans on single-use plastic bags and are encouraging the use of compostable alternatives. These policies have created new opportunities for PLA manufacturers and have driven increased investment in research and development of PLA-based products.

In Asia, countries like Japan and South Korea have introduced comprehensive plastic waste management strategies that include support for biodegradable plastics. China, a major player in the global plastics industry, has also announced plans to phase out single-use plastics, potentially opening up significant opportunities for PLA in the world's most populous country.

However, the policy landscape is not without challenges. The lack of standardization in biodegradability certifications and disposal infrastructure can create confusion and hinder widespread adoption. Some regions have stricter requirements for biodegradability claims, which can impact the marketability of PLA products across different jurisdictions.

Looking ahead, the policy landscape is expected to continue evolving in favor of sustainable materials like PLA. Many countries are setting ambitious targets for reducing plastic waste and carbon emissions, which is likely to result in more stringent regulations on traditional plastics and increased support for biodegradable alternatives. This evolving policy environment is expected to be a key driver of PLA market growth in the coming years, influencing investment decisions, product development, and consumer behavior across various industries.

In the European Union, the Single-Use Plastics Directive has been a significant catalyst for PLA adoption. This directive aims to reduce the impact of certain plastic products on the environment by banning single-use plastics and promoting the use of biodegradable alternatives. As a result, many European countries have introduced incentives and regulations favoring biodegradable plastics like PLA, stimulating market growth in the region.

The United States has also seen a shift in policy towards supporting biodegradable materials. Several states, including California and New York, have implemented bans on single-use plastic bags and are encouraging the use of compostable alternatives. These policies have created new opportunities for PLA manufacturers and have driven increased investment in research and development of PLA-based products.

In Asia, countries like Japan and South Korea have introduced comprehensive plastic waste management strategies that include support for biodegradable plastics. China, a major player in the global plastics industry, has also announced plans to phase out single-use plastics, potentially opening up significant opportunities for PLA in the world's most populous country.

However, the policy landscape is not without challenges. The lack of standardization in biodegradability certifications and disposal infrastructure can create confusion and hinder widespread adoption. Some regions have stricter requirements for biodegradability claims, which can impact the marketability of PLA products across different jurisdictions.

Looking ahead, the policy landscape is expected to continue evolving in favor of sustainable materials like PLA. Many countries are setting ambitious targets for reducing plastic waste and carbon emissions, which is likely to result in more stringent regulations on traditional plastics and increased support for biodegradable alternatives. This evolving policy environment is expected to be a key driver of PLA market growth in the coming years, influencing investment decisions, product development, and consumer behavior across various industries.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!