How to Strategize PLA's Integration into Existing Industries?

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PLA Integration Background and Objectives

Polylactic acid (PLA), a biodegradable and biocompatible polymer derived from renewable resources, has gained significant attention in recent years due to its potential to address environmental concerns associated with traditional plastics. The integration of PLA into existing industries represents a crucial step towards sustainable manufacturing and consumption practices. This technological shift aligns with global efforts to reduce carbon footprints and promote circular economy principles.

The evolution of PLA technology can be traced back to the 1930s when Wallace Carothers first synthesized low molecular weight PLA. However, it wasn't until the 1990s that breakthroughs in polymerization techniques enabled the production of high molecular weight PLA suitable for commercial applications. Since then, the development of PLA has accelerated, driven by increasing environmental awareness and stricter regulations on plastic waste.

The primary objective of PLA integration is to replace conventional petroleum-based plastics in various industries, including packaging, textiles, automotive, and medical devices. This transition aims to mitigate the environmental impact of plastic production and disposal while maintaining or improving product performance. Additionally, PLA integration seeks to create new market opportunities and foster innovation in material science and manufacturing processes.

One of the key technological goals is to enhance PLA's properties to match or exceed those of traditional plastics. This includes improving its thermal stability, mechanical strength, and barrier properties. Researchers and industry players are also focusing on developing cost-effective production methods to make PLA more economically competitive with conventional plastics.

The integration of PLA into existing industries faces several challenges, including scalability of production, optimization of processing techniques, and adaptation of current manufacturing infrastructure. Overcoming these hurdles requires collaborative efforts between material scientists, engineers, and industry stakeholders to develop tailored solutions for specific applications.

As the technology continues to evolve, the integration strategy must consider the entire lifecycle of PLA products, from raw material sourcing to end-of-life management. This holistic approach ensures that the environmental benefits of PLA are maximized throughout its value chain. Furthermore, the strategy should address the development of efficient recycling and composting systems to fully realize PLA's potential as a sustainable alternative to traditional plastics.

In conclusion, the integration of PLA into existing industries represents a significant technological shift with far-reaching implications for sustainability and innovation. By understanding the background and setting clear objectives, stakeholders can effectively navigate the challenges and opportunities presented by this emerging technology.

The evolution of PLA technology can be traced back to the 1930s when Wallace Carothers first synthesized low molecular weight PLA. However, it wasn't until the 1990s that breakthroughs in polymerization techniques enabled the production of high molecular weight PLA suitable for commercial applications. Since then, the development of PLA has accelerated, driven by increasing environmental awareness and stricter regulations on plastic waste.

The primary objective of PLA integration is to replace conventional petroleum-based plastics in various industries, including packaging, textiles, automotive, and medical devices. This transition aims to mitigate the environmental impact of plastic production and disposal while maintaining or improving product performance. Additionally, PLA integration seeks to create new market opportunities and foster innovation in material science and manufacturing processes.

One of the key technological goals is to enhance PLA's properties to match or exceed those of traditional plastics. This includes improving its thermal stability, mechanical strength, and barrier properties. Researchers and industry players are also focusing on developing cost-effective production methods to make PLA more economically competitive with conventional plastics.

The integration of PLA into existing industries faces several challenges, including scalability of production, optimization of processing techniques, and adaptation of current manufacturing infrastructure. Overcoming these hurdles requires collaborative efforts between material scientists, engineers, and industry stakeholders to develop tailored solutions for specific applications.

As the technology continues to evolve, the integration strategy must consider the entire lifecycle of PLA products, from raw material sourcing to end-of-life management. This holistic approach ensures that the environmental benefits of PLA are maximized throughout its value chain. Furthermore, the strategy should address the development of efficient recycling and composting systems to fully realize PLA's potential as a sustainable alternative to traditional plastics.

In conclusion, the integration of PLA into existing industries represents a significant technological shift with far-reaching implications for sustainability and innovation. By understanding the background and setting clear objectives, stakeholders can effectively navigate the challenges and opportunities presented by this emerging technology.

Market Demand Analysis for PLA-Based Products

The market demand for PLA-based products has been steadily growing across various industries, driven by increasing environmental awareness and the push for sustainable alternatives to traditional petroleum-based plastics. The global PLA market size was valued at approximately $698 million in 2021 and is projected to reach $2.9 billion by 2030, with a compound annual growth rate (CAGR) of 17.1% during the forecast period.

The packaging industry represents the largest market segment for PLA, accounting for over 40% of the total market share. This is primarily due to the material's biodegradability and compostability, making it an attractive option for single-use packaging applications. The food and beverage sector, in particular, has shown significant interest in PLA-based packaging solutions, as consumers increasingly demand eco-friendly alternatives.

The textile industry is another key market for PLA-based products, with growing demand for sustainable fibers in apparel and home textiles. PLA fibers offer properties similar to traditional synthetic fibers but with a lower environmental impact. The market for PLA in textiles is expected to grow at a CAGR of 15.2% from 2022 to 2030.

In the medical and healthcare sector, PLA's biocompatibility and biodegradability have led to increased adoption in applications such as surgical sutures, implants, and drug delivery systems. The market for PLA in medical applications is projected to grow at a CAGR of 18.3% from 2022 to 2030, driven by advancements in tissue engineering and regenerative medicine.

The automotive industry is also exploring PLA-based materials for interior components, aiming to reduce vehicle weight and improve fuel efficiency while meeting sustainability goals. Although currently a smaller market segment, it is expected to show significant growth in the coming years.

Geographically, North America and Europe lead the market for PLA-based products, owing to stringent environmental regulations and higher consumer awareness. However, the Asia-Pacific region is expected to witness the highest growth rate in the forecast period, driven by rapid industrialization and increasing adoption of sustainable materials in countries like China and India.

Despite the positive market outlook, challenges such as higher production costs compared to conventional plastics and limitations in certain performance characteristics still hinder widespread adoption. However, ongoing research and development efforts are focused on improving PLA's properties and reducing production costs, which is expected to further drive market growth and expand applications across industries.

The packaging industry represents the largest market segment for PLA, accounting for over 40% of the total market share. This is primarily due to the material's biodegradability and compostability, making it an attractive option for single-use packaging applications. The food and beverage sector, in particular, has shown significant interest in PLA-based packaging solutions, as consumers increasingly demand eco-friendly alternatives.

The textile industry is another key market for PLA-based products, with growing demand for sustainable fibers in apparel and home textiles. PLA fibers offer properties similar to traditional synthetic fibers but with a lower environmental impact. The market for PLA in textiles is expected to grow at a CAGR of 15.2% from 2022 to 2030.

In the medical and healthcare sector, PLA's biocompatibility and biodegradability have led to increased adoption in applications such as surgical sutures, implants, and drug delivery systems. The market for PLA in medical applications is projected to grow at a CAGR of 18.3% from 2022 to 2030, driven by advancements in tissue engineering and regenerative medicine.

The automotive industry is also exploring PLA-based materials for interior components, aiming to reduce vehicle weight and improve fuel efficiency while meeting sustainability goals. Although currently a smaller market segment, it is expected to show significant growth in the coming years.

Geographically, North America and Europe lead the market for PLA-based products, owing to stringent environmental regulations and higher consumer awareness. However, the Asia-Pacific region is expected to witness the highest growth rate in the forecast period, driven by rapid industrialization and increasing adoption of sustainable materials in countries like China and India.

Despite the positive market outlook, challenges such as higher production costs compared to conventional plastics and limitations in certain performance characteristics still hinder widespread adoption. However, ongoing research and development efforts are focused on improving PLA's properties and reducing production costs, which is expected to further drive market growth and expand applications across industries.

Current PLA Technology Status and Challenges

Polylactic acid (PLA) has gained significant traction in recent years as a biodegradable and renewable alternative to traditional petroleum-based plastics. However, its integration into existing industries faces several challenges and technological hurdles that need to be addressed.

The current status of PLA technology shows promising advancements in production methods and material properties. Manufacturers have successfully scaled up PLA production, with global capacity reaching over 360,000 tons per year. Improvements in fermentation processes and purification techniques have led to higher-quality PLA resins with enhanced mechanical properties and thermal stability.

Despite these achievements, PLA still faces limitations in terms of its performance characteristics compared to conventional plastics. The material's relatively low heat resistance and brittleness restrict its use in certain high-temperature applications and products requiring high impact strength. Additionally, PLA's moisture sensitivity and slower degradation rate in ambient conditions pose challenges for long-term storage and end-of-life management.

One of the primary technological challenges is the need for improved PLA formulations and blends to expand its applicability across various industries. Researchers are actively working on developing PLA composites and copolymers to enhance its mechanical properties, thermal resistance, and barrier properties. However, achieving the right balance between performance and biodegradability remains a significant hurdle.

Another critical challenge lies in the optimization of PLA processing techniques. While PLA can be processed using conventional plastic manufacturing methods, such as injection molding and extrusion, adjustments are often necessary to accommodate its unique properties. This includes fine-tuning processing parameters, modifying equipment, and developing specialized additives to improve processability and prevent degradation during manufacturing.

The integration of PLA into existing supply chains and manufacturing infrastructure presents logistical challenges. Many industries have established systems optimized for traditional plastics, and transitioning to PLA may require significant investments in new equipment, training, and quality control measures. Furthermore, the higher cost of PLA compared to conventional plastics remains a barrier to widespread adoption, particularly in price-sensitive markets.

From a geographical perspective, PLA technology development and production are concentrated in North America, Europe, and parts of Asia. This distribution pattern reflects the locations of major research institutions and bioplastics manufacturers. However, the uneven global distribution of PLA technology and production capabilities creates challenges for its integration into industries in other regions, particularly in developing countries.

In conclusion, while PLA technology has made significant strides, several challenges must be overcome to facilitate its seamless integration into existing industries. Addressing these technological and logistical hurdles will be crucial for realizing the full potential of PLA as a sustainable alternative to conventional plastics across diverse industrial applications.

The current status of PLA technology shows promising advancements in production methods and material properties. Manufacturers have successfully scaled up PLA production, with global capacity reaching over 360,000 tons per year. Improvements in fermentation processes and purification techniques have led to higher-quality PLA resins with enhanced mechanical properties and thermal stability.

Despite these achievements, PLA still faces limitations in terms of its performance characteristics compared to conventional plastics. The material's relatively low heat resistance and brittleness restrict its use in certain high-temperature applications and products requiring high impact strength. Additionally, PLA's moisture sensitivity and slower degradation rate in ambient conditions pose challenges for long-term storage and end-of-life management.

One of the primary technological challenges is the need for improved PLA formulations and blends to expand its applicability across various industries. Researchers are actively working on developing PLA composites and copolymers to enhance its mechanical properties, thermal resistance, and barrier properties. However, achieving the right balance between performance and biodegradability remains a significant hurdle.

Another critical challenge lies in the optimization of PLA processing techniques. While PLA can be processed using conventional plastic manufacturing methods, such as injection molding and extrusion, adjustments are often necessary to accommodate its unique properties. This includes fine-tuning processing parameters, modifying equipment, and developing specialized additives to improve processability and prevent degradation during manufacturing.

The integration of PLA into existing supply chains and manufacturing infrastructure presents logistical challenges. Many industries have established systems optimized for traditional plastics, and transitioning to PLA may require significant investments in new equipment, training, and quality control measures. Furthermore, the higher cost of PLA compared to conventional plastics remains a barrier to widespread adoption, particularly in price-sensitive markets.

From a geographical perspective, PLA technology development and production are concentrated in North America, Europe, and parts of Asia. This distribution pattern reflects the locations of major research institutions and bioplastics manufacturers. However, the uneven global distribution of PLA technology and production capabilities creates challenges for its integration into industries in other regions, particularly in developing countries.

In conclusion, while PLA technology has made significant strides, several challenges must be overcome to facilitate its seamless integration into existing industries. Addressing these technological and logistical hurdles will be crucial for realizing the full potential of PLA as a sustainable alternative to conventional plastics across diverse industrial applications.

Existing PLA Integration Solutions

01 PLA-based composite materials

Development of composite materials using PLA as a base polymer, incorporating various additives or fillers to enhance properties such as strength, durability, or biodegradability. These composites can be used in a wide range of applications, from packaging to medical devices.- PLA-based composite materials: Development of composite materials using PLA as a matrix, incorporating various fillers or reinforcements to enhance mechanical properties, thermal stability, or functionality. These composites can be used in applications ranging from packaging to automotive parts.

- PLA processing techniques: Advancements in processing techniques for PLA, including extrusion, injection molding, and 3D printing. These methods aim to improve the material's performance, reduce processing time, and expand its applicability in various industries.

- PLA modification and blending: Chemical and physical modification of PLA to enhance its properties, such as impact resistance, flexibility, or barrier properties. This includes blending PLA with other polymers or additives to create materials with tailored characteristics for specific applications.

- Biodegradable PLA applications: Exploration of new applications for biodegradable PLA in various fields, including medical devices, agricultural products, and consumer goods. The focus is on leveraging PLA's biodegradability to address environmental concerns and promote sustainability.

- PLA production and synthesis: Innovations in PLA production methods and synthesis techniques, aiming to improve efficiency, reduce costs, and enhance the material's properties. This includes new catalysts, polymerization processes, and raw material sources for PLA manufacturing.

02 PLA processing techniques

Innovative methods for processing PLA, including extrusion, injection molding, and 3D printing. These techniques aim to improve the material's performance, reduce production costs, and expand its potential applications in various industries.Expand Specific Solutions03 PLA blends and copolymers

Creation of PLA blends and copolymers with other biodegradable or non-biodegradable polymers to achieve specific properties. These blends can offer improved mechanical properties, thermal stability, or biodegradation rates compared to pure PLA.Expand Specific Solutions04 Surface modification of PLA

Techniques for modifying the surface properties of PLA materials, such as improving hydrophilicity, adhesion, or biocompatibility. These modifications can enhance the material's performance in specific applications, particularly in the medical and packaging fields.Expand Specific Solutions05 PLA-based biodegradable products

Development of various biodegradable products using PLA, including packaging materials, disposable items, and agricultural films. These products aim to reduce environmental impact by offering alternatives to traditional petroleum-based plastics.Expand Specific Solutions

Key Players in PLA Industry

The integration of PLA (Polylactic Acid) into existing industries is at a critical juncture, with the market showing significant growth potential. The industry is in a transitional phase, moving from early adoption to mainstream acceptance. Market size is expanding rapidly, driven by increasing environmental concerns and regulatory pressures. Technologically, PLA is maturing, with companies like Total Research Corp, International Business Machines Corp., and NatureWorks LLC leading innovation. Research institutions such as the University of Houston and Xi'an Jiaotong University are contributing to advancements in PLA technology. The competitive landscape is diverse, with both established players and emerging startups vying for market share, indicating a dynamic and evolving industry poised for further growth and technological breakthroughs.

International Business Machines Corp.

Technical Solution: IBM has developed a comprehensive strategy for integrating PLA (Polylactic Acid) into existing industries. Their approach focuses on leveraging their expertise in materials science and advanced manufacturing processes. IBM's solution involves creating a hybrid material that combines PLA with other biodegradable polymers to enhance its properties. They have also developed AI-driven algorithms to optimize the production process, reducing waste and improving efficiency. Additionally, IBM has created a blockchain-based supply chain management system to ensure traceability and quality control of PLA products throughout their lifecycle.

Strengths: Advanced technology integration, global reach, and strong R&D capabilities. Weaknesses: High implementation costs and potential resistance from traditional industries.

Zeus Industrial Products, Inc.

Technical Solution: Zeus Industrial Products has developed a comprehensive strategy for integrating PLA into various industrial applications. Their approach involves creating specialized PLA formulations tailored for specific industries, such as medical devices, automotive, and electronics. Zeus has invested in advanced extrusion technologies to produce PLA fibers and tubes with enhanced mechanical properties. They have also developed a proprietary surface treatment process that improves the adhesion and biocompatibility of PLA materials. Additionally, Zeus offers custom compounding services to create PLA blends that meet specific industry requirements.

Strengths: Specialized expertise in polymer processing and diverse industry applications. Weaknesses: Limited brand recognition compared to larger competitors and potential scalability challenges.

Core PLA Integration Innovations

Chemical blends of polyolefins and poly(hydroxy carboxylic acid)s

PatentInactiveEP2328945A1

Innovation

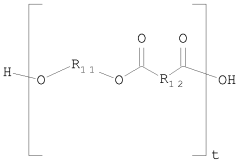

- A chemical blending process using a compatibilizing compound with a polymerizable double bond and electrophilic functional groups, such as glycidyl acrylate or methacrylate, is employed to create homogeneous blends of polyolefins and poly(hydroxy carboxylic acid)s, specifically with polyolefins prepared using single-site catalysts like metallocene catalysts, allowing for controlled grafting and improved melt strength.

Polyethylene and poly(hydroxy carboxylic acid) blends

PatentWO2009027377A1

Innovation

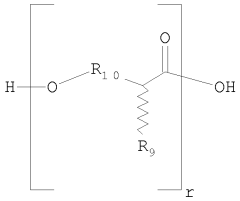

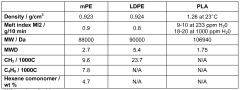

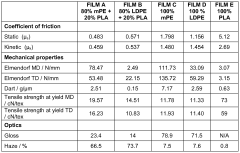

- A resin composition comprising 0.1% to 50% by weight of poly(hydroxy carboxylic acid) blended with 50% to 99.9% by weight of polyethylene prepared using single-site metallocene catalysts, which achieves homogeneous blends without the need for compatibilizing agents, enhancing mechanical, gas barrier, and surface tension properties.

Environmental Impact of PLA Integration

The integration of Polylactic Acid (PLA) into existing industries presents both opportunities and challenges from an environmental perspective. PLA, a biodegradable and renewable polymer derived from plant-based sources, offers a promising alternative to traditional petroleum-based plastics. Its adoption across various sectors can significantly reduce carbon footprint and mitigate the environmental impact of plastic waste.

One of the primary environmental benefits of PLA integration is its biodegradability. Unlike conventional plastics that persist in the environment for hundreds of years, PLA can decompose within months to years under proper composting conditions. This characteristic substantially reduces the long-term accumulation of plastic waste in landfills and oceans, addressing a critical global environmental concern.

Furthermore, the production of PLA consumes less energy compared to traditional petroleum-based plastics, resulting in lower greenhouse gas emissions. The renewable nature of its raw materials, typically corn starch or sugarcane, also contributes to a more sustainable production cycle. This shift towards bio-based materials aligns with circular economy principles and supports the transition away from fossil fuel dependence.

However, the environmental impact of PLA integration is not without complexities. The increased demand for PLA could lead to expanded agricultural production of its feedstock crops, potentially causing land-use changes and competition with food production. This raises concerns about indirect impacts on biodiversity and food security, necessitating careful management of agricultural practices and land allocation.

Additionally, while PLA is biodegradable, it requires specific industrial composting conditions to break down efficiently. The lack of widespread industrial composting facilities in many regions could limit the realization of PLA's environmental benefits. Improper disposal of PLA products in conventional waste streams may lead to contamination of recycling processes for traditional plastics.

The environmental footprint of PLA also extends to its end-of-life management. While biodegradation offers advantages, the process still releases carbon dioxide. Developing efficient recycling systems for PLA products could further enhance its environmental profile by enabling material recovery and reuse, thus reducing the need for virgin material production.

As industries adopt PLA, considerations must be given to the entire lifecycle of products. This includes optimizing production processes, improving product design for recyclability, and establishing appropriate waste management infrastructure. Collaborative efforts between manufacturers, policymakers, and waste management sectors are crucial to maximize the environmental benefits of PLA integration while mitigating potential drawbacks.

One of the primary environmental benefits of PLA integration is its biodegradability. Unlike conventional plastics that persist in the environment for hundreds of years, PLA can decompose within months to years under proper composting conditions. This characteristic substantially reduces the long-term accumulation of plastic waste in landfills and oceans, addressing a critical global environmental concern.

Furthermore, the production of PLA consumes less energy compared to traditional petroleum-based plastics, resulting in lower greenhouse gas emissions. The renewable nature of its raw materials, typically corn starch or sugarcane, also contributes to a more sustainable production cycle. This shift towards bio-based materials aligns with circular economy principles and supports the transition away from fossil fuel dependence.

However, the environmental impact of PLA integration is not without complexities. The increased demand for PLA could lead to expanded agricultural production of its feedstock crops, potentially causing land-use changes and competition with food production. This raises concerns about indirect impacts on biodiversity and food security, necessitating careful management of agricultural practices and land allocation.

Additionally, while PLA is biodegradable, it requires specific industrial composting conditions to break down efficiently. The lack of widespread industrial composting facilities in many regions could limit the realization of PLA's environmental benefits. Improper disposal of PLA products in conventional waste streams may lead to contamination of recycling processes for traditional plastics.

The environmental footprint of PLA also extends to its end-of-life management. While biodegradation offers advantages, the process still releases carbon dioxide. Developing efficient recycling systems for PLA products could further enhance its environmental profile by enabling material recovery and reuse, thus reducing the need for virgin material production.

As industries adopt PLA, considerations must be given to the entire lifecycle of products. This includes optimizing production processes, improving product design for recyclability, and establishing appropriate waste management infrastructure. Collaborative efforts between manufacturers, policymakers, and waste management sectors are crucial to maximize the environmental benefits of PLA integration while mitigating potential drawbacks.

Regulatory Framework for PLA Use

The regulatory framework for PLA (Polylactic Acid) use is a critical aspect of its integration into existing industries. As PLA gains traction as a sustainable alternative to traditional plastics, governments and regulatory bodies worldwide are developing and refining guidelines to ensure its safe and responsible use across various sectors.

At the forefront of PLA regulation is the food packaging industry, where the material's biodegradability and non-toxicity have made it particularly attractive. In the United States, the Food and Drug Administration (FDA) has approved PLA for food contact applications, provided it meets specific purity and manufacturing standards. Similarly, the European Food Safety Authority (EFSA) has issued positive opinions on the use of PLA in food packaging, subject to certain restrictions and migration limits.

Beyond food packaging, the regulatory landscape for PLA extends to other industries, including textiles, medical devices, and consumer goods. In the European Union, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation applies to PLA, requiring manufacturers and importers to register the substance and provide safety information. This ensures that potential risks associated with PLA production and use are identified and managed appropriately.

In the medical field, regulatory bodies such as the FDA and the European Medicines Agency (EMA) have established guidelines for the use of PLA in biomedical applications, including implants and drug delivery systems. These regulations focus on biocompatibility, degradation profiles, and long-term safety considerations.

As PLA production scales up, environmental regulations are also coming into play. Many countries are implementing or considering policies to promote the use of biodegradable plastics like PLA as part of their broader strategies to reduce plastic waste. For instance, some regions have introduced tax incentives or mandates for the use of biodegradable materials in certain products.

However, the regulatory framework for PLA is still evolving, with ongoing discussions about standardization of biodegradability claims, end-of-life management, and recycling infrastructure. As the material becomes more prevalent, it is likely that regulations will continue to be refined to address emerging concerns and opportunities.

Businesses looking to integrate PLA into their products must navigate this complex regulatory landscape, staying abreast of regional variations and emerging standards. Compliance with these regulations not only ensures legal operation but also builds consumer trust and supports the broader adoption of sustainable materials across industries.

At the forefront of PLA regulation is the food packaging industry, where the material's biodegradability and non-toxicity have made it particularly attractive. In the United States, the Food and Drug Administration (FDA) has approved PLA for food contact applications, provided it meets specific purity and manufacturing standards. Similarly, the European Food Safety Authority (EFSA) has issued positive opinions on the use of PLA in food packaging, subject to certain restrictions and migration limits.

Beyond food packaging, the regulatory landscape for PLA extends to other industries, including textiles, medical devices, and consumer goods. In the European Union, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation applies to PLA, requiring manufacturers and importers to register the substance and provide safety information. This ensures that potential risks associated with PLA production and use are identified and managed appropriately.

In the medical field, regulatory bodies such as the FDA and the European Medicines Agency (EMA) have established guidelines for the use of PLA in biomedical applications, including implants and drug delivery systems. These regulations focus on biocompatibility, degradation profiles, and long-term safety considerations.

As PLA production scales up, environmental regulations are also coming into play. Many countries are implementing or considering policies to promote the use of biodegradable plastics like PLA as part of their broader strategies to reduce plastic waste. For instance, some regions have introduced tax incentives or mandates for the use of biodegradable materials in certain products.

However, the regulatory framework for PLA is still evolving, with ongoing discussions about standardization of biodegradability claims, end-of-life management, and recycling infrastructure. As the material becomes more prevalent, it is likely that regulations will continue to be refined to address emerging concerns and opportunities.

Businesses looking to integrate PLA into their products must navigate this complex regulatory landscape, staying abreast of regional variations and emerging standards. Compliance with these regulations not only ensures legal operation but also builds consumer trust and supports the broader adoption of sustainable materials across industries.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!