How to Align Industry Collaboration for PLA Advancement?

JUN 25, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PLA Advancement Background and Objectives

Poly(lactic acid) (PLA) has emerged as a promising biodegradable polymer with significant potential for sustainable applications across various industries. The advancement of PLA technology has been driven by increasing environmental concerns and the need for eco-friendly alternatives to conventional plastics. Over the past few decades, PLA has evolved from a niche material to a commercially viable option, with its production and applications expanding rapidly.

The primary objective of PLA advancement is to enhance its properties and broaden its applicability while maintaining its biodegradability and sustainability advantages. This involves improving PLA's mechanical strength, thermal stability, and processability to compete with traditional petroleum-based plastics in a wider range of applications. Additionally, there is a focus on reducing production costs and optimizing the entire lifecycle of PLA products, from raw material sourcing to end-of-life management.

Industry collaboration plays a crucial role in achieving these objectives. By aligning efforts across the value chain, from biomass producers to end-product manufacturers, the PLA industry can accelerate innovation and overcome technical challenges more effectively. Collaboration enables the sharing of knowledge, resources, and expertise, leading to faster development of new PLA grades, improved processing techniques, and novel applications.

Key areas of focus for PLA advancement through industry collaboration include:

1. Feedstock optimization: Developing more efficient and sustainable sources of lactic acid, the primary building block of PLA.

2. Polymer design: Creating new PLA formulations with enhanced properties tailored for specific applications.

3. Processing technologies: Improving manufacturing processes to increase production efficiency and reduce costs.

4. Application development: Exploring and expanding PLA's use in various sectors, including packaging, textiles, and medical devices.

5. Recycling and end-of-life solutions: Developing effective methods for PLA recycling and composting to close the loop on its lifecycle.

By aligning industry collaboration, stakeholders can address these challenges collectively, leveraging their respective strengths and resources. This collaborative approach is essential for overcoming technical barriers, achieving economies of scale, and ultimately realizing the full potential of PLA as a sustainable alternative to conventional plastics.

The primary objective of PLA advancement is to enhance its properties and broaden its applicability while maintaining its biodegradability and sustainability advantages. This involves improving PLA's mechanical strength, thermal stability, and processability to compete with traditional petroleum-based plastics in a wider range of applications. Additionally, there is a focus on reducing production costs and optimizing the entire lifecycle of PLA products, from raw material sourcing to end-of-life management.

Industry collaboration plays a crucial role in achieving these objectives. By aligning efforts across the value chain, from biomass producers to end-product manufacturers, the PLA industry can accelerate innovation and overcome technical challenges more effectively. Collaboration enables the sharing of knowledge, resources, and expertise, leading to faster development of new PLA grades, improved processing techniques, and novel applications.

Key areas of focus for PLA advancement through industry collaboration include:

1. Feedstock optimization: Developing more efficient and sustainable sources of lactic acid, the primary building block of PLA.

2. Polymer design: Creating new PLA formulations with enhanced properties tailored for specific applications.

3. Processing technologies: Improving manufacturing processes to increase production efficiency and reduce costs.

4. Application development: Exploring and expanding PLA's use in various sectors, including packaging, textiles, and medical devices.

5. Recycling and end-of-life solutions: Developing effective methods for PLA recycling and composting to close the loop on its lifecycle.

By aligning industry collaboration, stakeholders can address these challenges collectively, leveraging their respective strengths and resources. This collaborative approach is essential for overcoming technical barriers, achieving economies of scale, and ultimately realizing the full potential of PLA as a sustainable alternative to conventional plastics.

Market Analysis for PLA Applications

The market for Polylactic Acid (PLA) applications has been experiencing significant growth in recent years, driven by increasing environmental concerns and the shift towards sustainable materials. PLA, a biodegradable and renewable thermoplastic derived from plant-based sources, has found widespread adoption across various industries.

In the packaging sector, PLA has emerged as a viable alternative to traditional petroleum-based plastics. The food and beverage industry, in particular, has shown strong interest in PLA packaging due to its biodegradability and food-safe properties. This segment is expected to continue its growth trajectory as consumers become more environmentally conscious and regulations on single-use plastics tighten.

The medical and pharmaceutical industries have also recognized the potential of PLA in biomedical applications. PLA's biocompatibility and biodegradability make it an excellent choice for implants, drug delivery systems, and tissue engineering scaffolds. The growing demand for personalized medicine and regenerative therapies is likely to further boost PLA adoption in this sector.

In the textile industry, PLA fibers are gaining traction as a sustainable alternative to conventional synthetic fibers. The apparel and fashion sectors are increasingly incorporating PLA-based fabrics into their product lines, appealing to eco-conscious consumers. This trend is expected to continue as brands focus on reducing their environmental footprint.

The 3D printing industry has also embraced PLA as a popular filament material. Its ease of use, low warping properties, and biodegradability have made it a preferred choice for both hobbyists and professional users. As 3D printing technology advances and finds more applications in prototyping and manufacturing, the demand for PLA filaments is projected to grow.

Agriculture represents another promising market for PLA applications. Biodegradable mulch films and plant pots made from PLA offer environmentally friendly alternatives to traditional plastic products. The increasing focus on sustainable farming practices is likely to drive further adoption in this sector.

However, challenges remain in the widespread adoption of PLA. The relatively higher cost compared to conventional plastics and limitations in certain performance characteristics, such as heat resistance and barrier properties, continue to be obstacles. Addressing these challenges through technological advancements and economies of scale will be crucial for expanding PLA's market share.

Overall, the market for PLA applications is poised for continued growth across multiple industries. The increasing emphasis on sustainability, circular economy principles, and regulatory support for bio-based materials are expected to drive further innovation and adoption of PLA in diverse applications.

In the packaging sector, PLA has emerged as a viable alternative to traditional petroleum-based plastics. The food and beverage industry, in particular, has shown strong interest in PLA packaging due to its biodegradability and food-safe properties. This segment is expected to continue its growth trajectory as consumers become more environmentally conscious and regulations on single-use plastics tighten.

The medical and pharmaceutical industries have also recognized the potential of PLA in biomedical applications. PLA's biocompatibility and biodegradability make it an excellent choice for implants, drug delivery systems, and tissue engineering scaffolds. The growing demand for personalized medicine and regenerative therapies is likely to further boost PLA adoption in this sector.

In the textile industry, PLA fibers are gaining traction as a sustainable alternative to conventional synthetic fibers. The apparel and fashion sectors are increasingly incorporating PLA-based fabrics into their product lines, appealing to eco-conscious consumers. This trend is expected to continue as brands focus on reducing their environmental footprint.

The 3D printing industry has also embraced PLA as a popular filament material. Its ease of use, low warping properties, and biodegradability have made it a preferred choice for both hobbyists and professional users. As 3D printing technology advances and finds more applications in prototyping and manufacturing, the demand for PLA filaments is projected to grow.

Agriculture represents another promising market for PLA applications. Biodegradable mulch films and plant pots made from PLA offer environmentally friendly alternatives to traditional plastic products. The increasing focus on sustainable farming practices is likely to drive further adoption in this sector.

However, challenges remain in the widespread adoption of PLA. The relatively higher cost compared to conventional plastics and limitations in certain performance characteristics, such as heat resistance and barrier properties, continue to be obstacles. Addressing these challenges through technological advancements and economies of scale will be crucial for expanding PLA's market share.

Overall, the market for PLA applications is poised for continued growth across multiple industries. The increasing emphasis on sustainability, circular economy principles, and regulatory support for bio-based materials are expected to drive further innovation and adoption of PLA in diverse applications.

Current PLA Technology Landscape

The current PLA (Polylactic Acid) technology landscape is characterized by significant advancements and growing industry adoption. PLA, a biodegradable and bioactive thermoplastic aliphatic polyester derived from renewable resources, has gained prominence in various sectors due to its eco-friendly properties and versatile applications.

In recent years, the PLA market has experienced substantial growth, driven by increasing environmental concerns and the shift towards sustainable materials. The global PLA market size was valued at approximately $1.2 billion in 2020 and is projected to reach $2.9 billion by 2026, growing at a CAGR of around 16% during the forecast period.

The packaging industry remains the largest consumer of PLA, accounting for over 60% of the total market share. This is primarily due to the material's biodegradability and compostability, making it an attractive alternative to traditional petroleum-based plastics. Other significant application areas include textiles, automotive, electronics, and medical devices.

Technologically, PLA production has seen notable improvements in recent years. The development of more efficient fermentation processes and advanced polymerization techniques has led to enhanced product quality and reduced production costs. Additionally, innovations in PLA blending and compounding have expanded its range of properties, making it suitable for a wider array of applications.

Several key players dominate the PLA market, including NatureWorks LLC, Total Corbion PLA, and Futerro. These companies have been at the forefront of technological advancements and capacity expansions. For instance, NatureWorks recently announced plans to build a new PLA manufacturing facility in Thailand, which will significantly increase global production capacity.

Despite its growth, the PLA industry faces several challenges. The relatively high production cost compared to conventional plastics remains a significant barrier to widespread adoption. Additionally, limitations in PLA's thermal and mechanical properties restrict its use in certain high-performance applications.

Research and development efforts are ongoing to address these challenges. Current focus areas include improving PLA's heat resistance, enhancing its mechanical properties, and developing more cost-effective production methods. Collaborations between industry players and research institutions are playing a crucial role in driving these advancements.

In conclusion, the current PLA technology landscape is dynamic and evolving rapidly. While challenges persist, the industry's commitment to innovation and sustainability continues to drive progress, positioning PLA as a key player in the transition towards a more circular and bio-based economy.

In recent years, the PLA market has experienced substantial growth, driven by increasing environmental concerns and the shift towards sustainable materials. The global PLA market size was valued at approximately $1.2 billion in 2020 and is projected to reach $2.9 billion by 2026, growing at a CAGR of around 16% during the forecast period.

The packaging industry remains the largest consumer of PLA, accounting for over 60% of the total market share. This is primarily due to the material's biodegradability and compostability, making it an attractive alternative to traditional petroleum-based plastics. Other significant application areas include textiles, automotive, electronics, and medical devices.

Technologically, PLA production has seen notable improvements in recent years. The development of more efficient fermentation processes and advanced polymerization techniques has led to enhanced product quality and reduced production costs. Additionally, innovations in PLA blending and compounding have expanded its range of properties, making it suitable for a wider array of applications.

Several key players dominate the PLA market, including NatureWorks LLC, Total Corbion PLA, and Futerro. These companies have been at the forefront of technological advancements and capacity expansions. For instance, NatureWorks recently announced plans to build a new PLA manufacturing facility in Thailand, which will significantly increase global production capacity.

Despite its growth, the PLA industry faces several challenges. The relatively high production cost compared to conventional plastics remains a significant barrier to widespread adoption. Additionally, limitations in PLA's thermal and mechanical properties restrict its use in certain high-performance applications.

Research and development efforts are ongoing to address these challenges. Current focus areas include improving PLA's heat resistance, enhancing its mechanical properties, and developing more cost-effective production methods. Collaborations between industry players and research institutions are playing a crucial role in driving these advancements.

In conclusion, the current PLA technology landscape is dynamic and evolving rapidly. While challenges persist, the industry's commitment to innovation and sustainability continues to drive progress, positioning PLA as a key player in the transition towards a more circular and bio-based economy.

Existing Collaboration Models for PLA

01 PLA-based composite materials

Development of composite materials using PLA as a base polymer, incorporating various additives or fillers to enhance properties such as strength, durability, or biodegradability. These composites can be used in a wide range of applications, from packaging to medical devices.- PLA-based composite materials: Development of composite materials using PLA as a base polymer, incorporating various additives or reinforcing agents to enhance properties such as strength, durability, and biodegradability. These composites can be used in a wide range of applications, from packaging to medical devices.

- PLA processing techniques: Innovative methods for processing PLA, including extrusion, injection molding, and 3D printing. These techniques aim to improve the material's performance, reduce production costs, and expand its potential applications in various industries.

- PLA blends and copolymers: Creation of PLA blends and copolymers with other biodegradable or synthetic polymers to achieve specific properties or overcome limitations of pure PLA. These blends can offer improved mechanical properties, thermal stability, or processing characteristics.

- Surface modification of PLA: Techniques for modifying the surface properties of PLA to enhance its compatibility with other materials, improve adhesion, or add functionality. This can include chemical treatments, plasma treatments, or the application of coatings to PLA surfaces.

- PLA degradation and recycling: Research into the degradation mechanisms of PLA and development of efficient recycling processes. This includes studies on composting, chemical recycling, and the development of additives to control the rate of biodegradation in various environments.

02 PLA processing techniques

Innovative methods for processing PLA, including extrusion, injection molding, and 3D printing. These techniques aim to improve the material's performance, reduce production costs, and expand its potential applications in various industries.Expand Specific Solutions03 PLA modification for improved properties

Chemical or physical modification of PLA to enhance its properties, such as thermal stability, mechanical strength, or barrier properties. This includes techniques like blending with other polymers, crosslinking, or surface treatments to tailor PLA for specific applications.Expand Specific Solutions04 Biodegradable PLA formulations

Development of PLA formulations with enhanced biodegradability for environmentally friendly applications. This includes research into additives that accelerate decomposition, as well as strategies to control the rate of biodegradation for various use cases.Expand Specific Solutions05 PLA in medical and pharmaceutical applications

Utilization of PLA in medical devices, drug delivery systems, and tissue engineering. This includes the development of biocompatible PLA formulations, controlled release mechanisms, and scaffolds for regenerative medicine applications.Expand Specific Solutions

Key Stakeholders in PLA Advancement

The advancement of PLA (Polylactic Acid) technology is currently in a growth phase, with increasing market size and evolving technical maturity. The global PLA market is expanding rapidly, driven by growing demand for sustainable materials. Technologically, PLA is progressing from basic applications to more sophisticated uses, with companies like NatureWorks LLC, LG Chem Ltd., and Total Research Corp leading innovation. Universities such as Nanjing University and Tongji University are contributing to research advancements. The competitive landscape is diverse, including chemical giants, specialized biotech firms like Galatea Biotech SRL, and academic institutions, indicating a collaborative yet competitive environment for PLA development.

LG Chem Ltd.

Technical Solution: LG Chem has developed a bio-based polybutylene adipate-co-terephthalate (PBAT) technology, which combines renewable resources with petrochemical-based materials. This hybrid approach allows for the production of biodegradable plastics with enhanced performance characteristics. The company has also invested in the development of bio-based succinic acid, a key building block for various bioplastics. LG Chem's strategy involves collaborating with agricultural and biotechnology firms to secure a stable supply of bio-based raw materials and optimize their conversion processes.

Strengths: Strong R&D capabilities, diverse product portfolio, and established market presence. Weaknesses: Dependency on both renewable and non-renewable resources, and potential challenges in scaling up production.

Arkema France SA

Technical Solution: Arkema has developed a range of bio-based polyamides under the Rilsan brand, derived from castor oil. Their technology involves the chemical conversion of castor oil into 11-aminoundecanoic acid, which is then polymerized to form high-performance bio-based nylons. Arkema has also invested in the development of other bio-based monomers and polymers, including Pebax Rnew thermoplastic elastomers. The company's strategy includes vertical integration in the castor oil supply chain and continuous improvement of their polymerization processes to enhance material properties and reduce environmental impact.

Strengths: High-performance materials, established supply chain, and diverse application potential. Weaknesses: Reliance on a single bio-based feedstock (castor oil) and potential land use concerns.

Innovative Approaches to PLA Partnerships

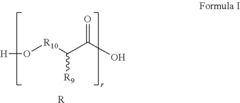

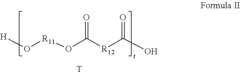

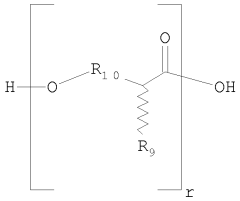

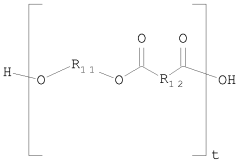

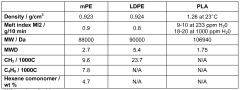

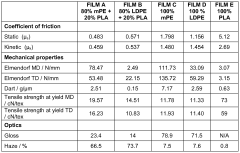

Blends of polar low density ethylene copolymers and poly(hydroxy carboxylic acid)s

PatentInactiveUS8324320B2

Innovation

- A resin composition comprising 0.1-50% by weight of poly(hydroxy carboxylic acid) and 50-99.9% by weight of polar low-density polyethylene (pLDPE) with a polar comonomer content of 0.5-25%, eliminating the need for compatibilizers and enhancing mechanical and gas barrier properties.

Polyethylene and poly(hydroxy carboxylic acid) blends

PatentWO2009027377A1

Innovation

- A resin composition comprising 0.1% to 50% by weight of poly(hydroxy carboxylic acid) blended with 50% to 99.9% by weight of polyethylene prepared using single-site metallocene catalysts, which achieves homogeneous blends without the need for compatibilizing agents, enhancing mechanical, gas barrier, and surface tension properties.

Regulatory Framework for PLA Industry Alliances

The regulatory framework for PLA industry alliances plays a crucial role in fostering collaboration and advancing the development of polylactic acid (PLA) technology. To ensure effective and ethical cooperation, a comprehensive set of guidelines and regulations must be established.

At the core of this framework is the need for clear intellectual property (IP) policies. These policies should outline how patents, trade secrets, and other forms of IP are shared, protected, and commercialized within the alliance. Establishing fair and transparent IP agreements encourages innovation while safeguarding individual company interests.

Environmental regulations form another critical component of the framework. As PLA is promoted as a biodegradable alternative to traditional plastics, industry alliances must adhere to strict environmental standards. This includes guidelines for sustainable production processes, waste management, and end-of-life disposal of PLA products.

Quality control standards are essential to maintain consistency and reliability across the industry. The regulatory framework should define minimum quality requirements for PLA products, ensuring that all alliance members meet these standards. This helps build consumer trust and promotes the widespread adoption of PLA materials.

Antitrust regulations must also be carefully considered to prevent anti-competitive behavior within the alliance. Clear guidelines on information sharing, pricing strategies, and market allocation help maintain a healthy competitive environment while fostering collaboration.

Safety regulations are paramount, particularly in applications where PLA is used in food packaging or medical devices. The framework should outline safety testing protocols, certification processes, and traceability requirements to ensure consumer protection and regulatory compliance.

To facilitate international collaboration, the regulatory framework should address cross-border issues such as import/export regulations, tariffs, and compliance with different regional standards. Harmonizing these regulations can help streamline global PLA industry cooperation.

Lastly, the framework should include provisions for regular review and updates. As PLA technology evolves and new challenges emerge, the regulatory landscape must adapt accordingly. Establishing a mechanism for periodic assessment and revision ensures that the framework remains relevant and effective in supporting industry collaboration and advancement.

At the core of this framework is the need for clear intellectual property (IP) policies. These policies should outline how patents, trade secrets, and other forms of IP are shared, protected, and commercialized within the alliance. Establishing fair and transparent IP agreements encourages innovation while safeguarding individual company interests.

Environmental regulations form another critical component of the framework. As PLA is promoted as a biodegradable alternative to traditional plastics, industry alliances must adhere to strict environmental standards. This includes guidelines for sustainable production processes, waste management, and end-of-life disposal of PLA products.

Quality control standards are essential to maintain consistency and reliability across the industry. The regulatory framework should define minimum quality requirements for PLA products, ensuring that all alliance members meet these standards. This helps build consumer trust and promotes the widespread adoption of PLA materials.

Antitrust regulations must also be carefully considered to prevent anti-competitive behavior within the alliance. Clear guidelines on information sharing, pricing strategies, and market allocation help maintain a healthy competitive environment while fostering collaboration.

Safety regulations are paramount, particularly in applications where PLA is used in food packaging or medical devices. The framework should outline safety testing protocols, certification processes, and traceability requirements to ensure consumer protection and regulatory compliance.

To facilitate international collaboration, the regulatory framework should address cross-border issues such as import/export regulations, tariffs, and compliance with different regional standards. Harmonizing these regulations can help streamline global PLA industry cooperation.

Lastly, the framework should include provisions for regular review and updates. As PLA technology evolves and new challenges emerge, the regulatory landscape must adapt accordingly. Establishing a mechanism for periodic assessment and revision ensures that the framework remains relevant and effective in supporting industry collaboration and advancement.

Economic Impact of PLA Advancements

The economic impact of PLA (Polylactic Acid) advancements is multifaceted and far-reaching, with implications for various industries and global sustainability efforts. As PLA technology continues to evolve, it is poised to reshape manufacturing processes, consumer goods production, and environmental practices across sectors.

One of the most significant economic impacts of PLA advancements is the potential for job creation and industry growth. As demand for biodegradable and sustainable materials increases, companies specializing in PLA production and application are likely to expand, leading to new employment opportunities in research, manufacturing, and related fields. This growth could stimulate local economies and contribute to the development of green technology hubs.

The agricultural sector stands to benefit substantially from PLA advancements. As PLA is derived from renewable resources such as corn starch or sugarcane, increased demand for these raw materials could provide new revenue streams for farmers and agricultural businesses. This shift could lead to more sustainable farming practices and potentially revitalize rural economies.

In the manufacturing sector, PLA advancements are driving innovation and cost reduction. As production techniques improve and economies of scale are achieved, the cost of PLA-based products is expected to decrease, making them more competitive with traditional petroleum-based plastics. This could lead to widespread adoption across industries, from packaging to textiles, and stimulate investment in new manufacturing technologies.

The healthcare industry is another area where PLA advancements could have significant economic implications. PLA's biocompatibility and biodegradability make it an attractive material for medical implants, drug delivery systems, and tissue engineering. As these applications develop, they could reduce healthcare costs and improve patient outcomes, potentially leading to substantial economic benefits in terms of reduced medical expenses and improved quality of life.

Environmental considerations also play a crucial role in the economic impact of PLA advancements. As governments worldwide implement stricter regulations on plastic use and waste management, industries adopting PLA-based solutions may gain competitive advantages and avoid potential fines or penalties. This regulatory landscape could drive further investment in PLA research and development, creating a positive feedback loop for economic growth in the sector.

The global market for PLA is projected to grow significantly in the coming years, with some estimates suggesting a compound annual growth rate of over 15%. This growth is expected to create new market opportunities, attract foreign investment, and potentially shift trade balances as countries with strong PLA industries become exporters of high-value, sustainable materials and products.

One of the most significant economic impacts of PLA advancements is the potential for job creation and industry growth. As demand for biodegradable and sustainable materials increases, companies specializing in PLA production and application are likely to expand, leading to new employment opportunities in research, manufacturing, and related fields. This growth could stimulate local economies and contribute to the development of green technology hubs.

The agricultural sector stands to benefit substantially from PLA advancements. As PLA is derived from renewable resources such as corn starch or sugarcane, increased demand for these raw materials could provide new revenue streams for farmers and agricultural businesses. This shift could lead to more sustainable farming practices and potentially revitalize rural economies.

In the manufacturing sector, PLA advancements are driving innovation and cost reduction. As production techniques improve and economies of scale are achieved, the cost of PLA-based products is expected to decrease, making them more competitive with traditional petroleum-based plastics. This could lead to widespread adoption across industries, from packaging to textiles, and stimulate investment in new manufacturing technologies.

The healthcare industry is another area where PLA advancements could have significant economic implications. PLA's biocompatibility and biodegradability make it an attractive material for medical implants, drug delivery systems, and tissue engineering. As these applications develop, they could reduce healthcare costs and improve patient outcomes, potentially leading to substantial economic benefits in terms of reduced medical expenses and improved quality of life.

Environmental considerations also play a crucial role in the economic impact of PLA advancements. As governments worldwide implement stricter regulations on plastic use and waste management, industries adopting PLA-based solutions may gain competitive advantages and avoid potential fines or penalties. This regulatory landscape could drive further investment in PLA research and development, creating a positive feedback loop for economic growth in the sector.

The global market for PLA is projected to grow significantly in the coming years, with some estimates suggesting a compound annual growth rate of over 15%. This growth is expected to create new market opportunities, attract foreign investment, and potentially shift trade balances as countries with strong PLA industries become exporters of high-value, sustainable materials and products.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!