How to Scale Lithium Phosphate Production for High Demand

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Phosphate Production Background and Objectives

Lithium phosphate has emerged as a critical material in the energy storage revolution, particularly for lithium iron phosphate (LFP) batteries that power electric vehicles and renewable energy systems. The technology's evolution began in the 1990s with initial research into phosphate-based cathode materials, followed by commercial adoption in the early 2000s. Recent years have witnessed exponential growth in demand, driven primarily by the electric vehicle industry's rapid expansion and increasing adoption of stationary energy storage systems.

The global transition toward sustainable energy solutions has accelerated the need for safer, more cost-effective battery technologies. LFP batteries, with their thermal stability, longer cycle life, and cobalt-free composition, represent a significant advancement in addressing these requirements. Current production methods, however, face scalability challenges that must be overcome to meet projected demand increases of 300-400% by 2030.

Technical objectives for scaling lithium phosphate production include developing more efficient synthesis processes that reduce energy consumption and processing time. Current solid-state and hydrothermal methods require substantial optimization to achieve industrial-scale efficiency. Additionally, improving precursor quality control and reaction kinetics represents a critical path toward higher throughput manufacturing.

Environmental considerations form another key objective, as traditional production methods generate significant waste and consume large quantities of water. Developing closed-loop systems and more sustainable precursor sourcing strategies will be essential for responsible scaling. The industry must also address the geographical concentration of production capabilities, currently dominated by Chinese manufacturers.

Cost reduction remains a paramount goal, with current production economics heavily influenced by energy costs, raw material pricing, and process inefficiencies. Achieving price points below $5,000 per ton will be necessary to maintain LFP's competitive advantage against other battery chemistries. This requires innovations in both process technology and supply chain management.

The technical evolution trajectory suggests several promising directions, including continuous flow processing to replace batch production, advanced precipitation control mechanisms, and novel doping strategies to enhance material performance. These developments must be pursued in parallel with scaling efforts to ensure that increased production volume does not compromise material quality or electrochemical performance.

The global transition toward sustainable energy solutions has accelerated the need for safer, more cost-effective battery technologies. LFP batteries, with their thermal stability, longer cycle life, and cobalt-free composition, represent a significant advancement in addressing these requirements. Current production methods, however, face scalability challenges that must be overcome to meet projected demand increases of 300-400% by 2030.

Technical objectives for scaling lithium phosphate production include developing more efficient synthesis processes that reduce energy consumption and processing time. Current solid-state and hydrothermal methods require substantial optimization to achieve industrial-scale efficiency. Additionally, improving precursor quality control and reaction kinetics represents a critical path toward higher throughput manufacturing.

Environmental considerations form another key objective, as traditional production methods generate significant waste and consume large quantities of water. Developing closed-loop systems and more sustainable precursor sourcing strategies will be essential for responsible scaling. The industry must also address the geographical concentration of production capabilities, currently dominated by Chinese manufacturers.

Cost reduction remains a paramount goal, with current production economics heavily influenced by energy costs, raw material pricing, and process inefficiencies. Achieving price points below $5,000 per ton will be necessary to maintain LFP's competitive advantage against other battery chemistries. This requires innovations in both process technology and supply chain management.

The technical evolution trajectory suggests several promising directions, including continuous flow processing to replace batch production, advanced precipitation control mechanisms, and novel doping strategies to enhance material performance. These developments must be pursued in parallel with scaling efforts to ensure that increased production volume does not compromise material quality or electrochemical performance.

Market Demand Analysis for Lithium Phosphate

The global lithium phosphate market is experiencing unprecedented growth, primarily driven by the rapid expansion of the electric vehicle (EV) industry. Current market valuations place the lithium phosphate sector at approximately $45 billion as of 2023, with projections indicating a compound annual growth rate (CAGR) of 12.7% through 2030. This remarkable growth trajectory is substantially outpacing earlier industry forecasts, creating both opportunities and challenges for producers.

The demand surge is most pronounced in the battery manufacturing sector, which now accounts for over 65% of global lithium phosphate consumption. This is a significant shift from just five years ago when batteries represented less than 40% of market demand. The transition to lithium iron phosphate (LFP) batteries in particular has accelerated, with major automakers including Tesla, BYD, and Volkswagen incorporating these batteries into their mass-market EV models due to their superior safety profile and lower production costs compared to nickel-based alternatives.

Regional analysis reveals that Asia-Pacific dominates current demand, accounting for approximately 70% of global consumption, with China alone representing 45% of the worldwide market. However, the most rapid growth is occurring in North America and Europe, where demand is increasing at rates of 18% and 16% respectively, driven by aggressive EV adoption targets and government incentives for domestic battery production.

Beyond the EV sector, emerging applications in grid-scale energy storage systems are creating a secondary demand wave. Utility companies worldwide are increasingly deploying large-scale lithium phosphate battery installations, with installed capacity growing at 25% annually. This diversification of end-use applications is contributing to market resilience but also intensifying supply pressures.

Supply-demand gap analysis indicates a critical shortfall beginning in 2025, with projected demand exceeding current production capacity by approximately 30%. This imbalance is already triggering price volatility, with lithium phosphate prices increasing by 35% in the past 18 months. Industry analysts predict continued upward price pressure unless significant production scaling occurs within the next 24-36 months.

Customer requirements are also evolving, with battery manufacturers increasingly demanding higher purity grades (99.5%+) and more consistent particle morphology to improve battery performance metrics. This quality shift is creating additional technical challenges for producers beyond mere volume scaling, necessitating process innovations alongside capacity expansions.

The market landscape is further complicated by emerging sustainability requirements, with customers increasingly demanding carbon footprint data and preferring suppliers with demonstrable environmental credentials. This trend is particularly strong in European markets, where regulatory frameworks are beginning to mandate sustainability metrics for battery materials.

The demand surge is most pronounced in the battery manufacturing sector, which now accounts for over 65% of global lithium phosphate consumption. This is a significant shift from just five years ago when batteries represented less than 40% of market demand. The transition to lithium iron phosphate (LFP) batteries in particular has accelerated, with major automakers including Tesla, BYD, and Volkswagen incorporating these batteries into their mass-market EV models due to their superior safety profile and lower production costs compared to nickel-based alternatives.

Regional analysis reveals that Asia-Pacific dominates current demand, accounting for approximately 70% of global consumption, with China alone representing 45% of the worldwide market. However, the most rapid growth is occurring in North America and Europe, where demand is increasing at rates of 18% and 16% respectively, driven by aggressive EV adoption targets and government incentives for domestic battery production.

Beyond the EV sector, emerging applications in grid-scale energy storage systems are creating a secondary demand wave. Utility companies worldwide are increasingly deploying large-scale lithium phosphate battery installations, with installed capacity growing at 25% annually. This diversification of end-use applications is contributing to market resilience but also intensifying supply pressures.

Supply-demand gap analysis indicates a critical shortfall beginning in 2025, with projected demand exceeding current production capacity by approximately 30%. This imbalance is already triggering price volatility, with lithium phosphate prices increasing by 35% in the past 18 months. Industry analysts predict continued upward price pressure unless significant production scaling occurs within the next 24-36 months.

Customer requirements are also evolving, with battery manufacturers increasingly demanding higher purity grades (99.5%+) and more consistent particle morphology to improve battery performance metrics. This quality shift is creating additional technical challenges for producers beyond mere volume scaling, necessitating process innovations alongside capacity expansions.

The market landscape is further complicated by emerging sustainability requirements, with customers increasingly demanding carbon footprint data and preferring suppliers with demonstrable environmental credentials. This trend is particularly strong in European markets, where regulatory frameworks are beginning to mandate sustainability metrics for battery materials.

Technical Challenges in Large-Scale LFP Production

Large-scale LFP (Lithium Iron Phosphate) production faces numerous technical challenges that must be addressed to meet growing market demands. The primary obstacle lies in achieving consistent quality across high-volume production batches. Current manufacturing processes struggle to maintain uniform particle size distribution, crystallinity, and stoichiometry when scaled beyond certain thresholds, resulting in performance variations in the final battery products.

Raw material processing presents another significant hurdle. The purity requirements for iron, phosphate, and lithium precursors are extremely stringent, with impurity levels needing to remain below parts per million. As production scales up, maintaining this purity becomes increasingly difficult, particularly when sourcing larger quantities of raw materials from diverse suppliers with varying quality standards.

Energy consumption during synthesis represents a major cost and sustainability challenge. Traditional solid-state reactions for LFP production require high-temperature calcination (typically 600-800°C) for extended periods. When scaled to industrial levels, this translates to enormous energy requirements, significantly impacting production costs and carbon footprint. Alternative lower-temperature synthesis routes often compromise on material performance or introduce other processing complexities.

Reaction kinetics and thermodynamics behave differently at industrial scales compared to laboratory conditions. Heat and mass transfer limitations become pronounced in large reactors, leading to temperature gradients and composition inhomogeneities. These variations can trigger unwanted side reactions or incomplete conversion, necessitating complex reactor designs and precise control systems that are difficult to implement at scale.

Water management presents another critical challenge. Many LFP synthesis routes involve aqueous processing steps, generating substantial volumes of wastewater containing dissolved metals and phosphates. Treatment and recycling of this water become increasingly complex and costly at industrial scales, with environmental regulations imposing strict discharge limits.

Process automation and quality control systems face significant technical barriers when adapting to high-throughput production. In-line monitoring technologies for real-time assessment of particle morphology, composition, and electrochemical properties are still evolving and often cannot keep pace with industrial production rates.

Finally, the integration of recycled materials into the production process introduces additional complexities. As the battery industry moves toward circular economy principles, incorporating recovered lithium and iron from spent batteries while maintaining quality standards becomes a technical challenge that current large-scale processes are not fully equipped to handle.

Raw material processing presents another significant hurdle. The purity requirements for iron, phosphate, and lithium precursors are extremely stringent, with impurity levels needing to remain below parts per million. As production scales up, maintaining this purity becomes increasingly difficult, particularly when sourcing larger quantities of raw materials from diverse suppliers with varying quality standards.

Energy consumption during synthesis represents a major cost and sustainability challenge. Traditional solid-state reactions for LFP production require high-temperature calcination (typically 600-800°C) for extended periods. When scaled to industrial levels, this translates to enormous energy requirements, significantly impacting production costs and carbon footprint. Alternative lower-temperature synthesis routes often compromise on material performance or introduce other processing complexities.

Reaction kinetics and thermodynamics behave differently at industrial scales compared to laboratory conditions. Heat and mass transfer limitations become pronounced in large reactors, leading to temperature gradients and composition inhomogeneities. These variations can trigger unwanted side reactions or incomplete conversion, necessitating complex reactor designs and precise control systems that are difficult to implement at scale.

Water management presents another critical challenge. Many LFP synthesis routes involve aqueous processing steps, generating substantial volumes of wastewater containing dissolved metals and phosphates. Treatment and recycling of this water become increasingly complex and costly at industrial scales, with environmental regulations imposing strict discharge limits.

Process automation and quality control systems face significant technical barriers when adapting to high-throughput production. In-line monitoring technologies for real-time assessment of particle morphology, composition, and electrochemical properties are still evolving and often cannot keep pace with industrial production rates.

Finally, the integration of recycled materials into the production process introduces additional complexities. As the battery industry moves toward circular economy principles, incorporating recovered lithium and iron from spent batteries while maintaining quality standards becomes a technical challenge that current large-scale processes are not fully equipped to handle.

Current Production Scaling Methodologies

01 Production methods for lithium phosphate

Various methods for producing lithium phosphate at scale have been developed, including precipitation reactions, hydrothermal synthesis, and solid-state reactions. These methods typically involve the reaction of lithium sources with phosphate precursors under controlled conditions to yield high-purity lithium phosphate. Process parameters such as temperature, pressure, reaction time, and pH are carefully controlled to optimize yield and product quality.- Synthesis methods for lithium phosphate production: Various synthesis methods can be employed for the production of lithium phosphate at scale. These methods include solid-state reactions, hydrothermal synthesis, sol-gel processes, and precipitation techniques. Each method offers different advantages in terms of particle morphology, purity, and production efficiency. The choice of synthesis route significantly impacts the final product's properties and performance, particularly when used in battery applications.

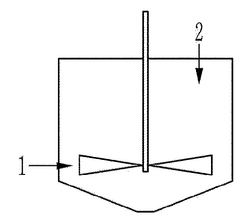

- Industrial scale production equipment and systems: Specialized equipment and systems are required for the industrial-scale production of lithium phosphate. This includes continuous flow reactors, large-scale batch reactors, specialized mixing and precipitation tanks, and automated production lines. These systems are designed to maintain consistent quality while achieving high throughput. Advanced monitoring and control systems ensure precise temperature, pressure, and reaction conditions throughout the production process.

- Purification and quality control processes: Purification and quality control are critical aspects of lithium phosphate production at scale. Various techniques such as recrystallization, filtration, washing, and drying are employed to achieve high-purity products. Advanced analytical methods including X-ray diffraction, particle size analysis, and chemical composition testing are used to ensure consistent quality. These processes help remove impurities that could negatively impact the performance of lithium phosphate in battery applications.

- Precursor materials and raw material processing: The selection and processing of precursor materials significantly impact the quality and cost-effectiveness of lithium phosphate production. Various lithium sources (lithium carbonate, lithium hydroxide) and phosphate sources (phosphoric acid, ammonium phosphate) can be used. Pre-treatment processes such as grinding, mixing, and pre-reaction steps help ensure homogeneity and reactivity of raw materials. Recycled materials can also be incorporated to improve sustainability and reduce production costs.

- Optimization for battery applications: Lithium phosphate production can be specifically optimized for battery applications, particularly for lithium iron phosphate (LFP) cathodes. This involves controlling particle size distribution, crystallinity, and surface properties to enhance electrochemical performance. Doping with elements such as manganese, cobalt, or nickel can improve specific capacity and cycling stability. Coating techniques using carbon or other conductive materials can enhance electronic conductivity, which is crucial for battery performance.

02 Equipment and systems for large-scale production

Specialized equipment and systems have been designed for the industrial-scale production of lithium phosphate. These include continuous flow reactors, crystallization systems, filtration equipment, and drying systems. Automated control systems are often implemented to maintain precise process conditions and ensure consistent product quality. The design of these systems focuses on efficiency, scalability, and minimizing energy consumption.Expand Specific Solutions03 Purification and quality control techniques

Various purification techniques are employed to achieve high-purity lithium phosphate suitable for battery applications. These include recrystallization, washing procedures, and advanced separation methods. Quality control measures involve analytical techniques to verify chemical composition, crystal structure, particle size distribution, and impurity levels. These processes are critical for ensuring that the lithium phosphate meets the stringent requirements for use in lithium-ion batteries.Expand Specific Solutions04 Precursor materials and raw material processing

The selection and processing of raw materials significantly impact the quality and properties of the final lithium phosphate product. Various lithium sources (such as lithium carbonate, lithium hydroxide, or lithium salts) and phosphate sources (phosphoric acid, ammonium phosphate, etc.) can be used. Preprocessing steps may include purification of raw materials, size reduction, and chemical conversion to suitable precursors. The choice of precursors affects reaction kinetics, energy requirements, and product characteristics.Expand Specific Solutions05 Innovations for enhanced battery performance

Recent innovations in lithium phosphate production focus on enhancing its performance in battery applications. These include methods to control particle morphology, size distribution, and surface properties. Doping with other elements, surface modifications, and composite formation are strategies to improve conductivity, capacity, and cycling stability. Advanced synthesis routes aim to produce lithium phosphate with optimized electrochemical properties for next-generation energy storage applications.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The lithium phosphate production market is experiencing rapid growth due to escalating demand for lithium-ion batteries in electric vehicles and energy storage systems. Currently in an expansion phase, the global market is projected to reach multi-billion dollar valuation by 2030. While the technology is relatively mature, companies are racing to scale production efficiently. Key players include POSCO Holdings and its research arm RIST, which are developing advanced production methods, alongside Guangdong Bangpu and Hubei Wanrun focusing on recycling and sustainable manufacturing. Tsinghua University collaborates with Jiangsu East China Lithium Technology Research Institute to bridge academic research with industrial applications. Western companies like Cytec Industries and BK Giulini are competing with Asian manufacturers Shenzhen Dynanonic and Guoxuan High-Tech to optimize production processes for higher yields and lower costs.

POSCO Holdings, Inc.

Technical Solution: POSCO has developed a proprietary PosLX technology for lithium phosphate production that utilizes a direct extraction process from brine resources. Their approach involves selective adsorption of lithium using specialized adsorbents, followed by precipitation with phosphate compounds to form high-purity lithium phosphate. The company has implemented a continuous flow production system that can be scaled modularly, with each production unit capable of producing 25,000 tons of lithium phosphate annually. POSCO's Lake Resources partnership demonstrates their commitment to scaling production, with plans to process 25,000 tons of lithium annually from Argentina's Kachi project. Their technology reduces water consumption by approximately 90% compared to traditional evaporation methods and decreases production time from 18 months to just 30 days.

Strengths: Proprietary extraction technology with significantly reduced production time; modular scaling approach allows for incremental capacity expansion; environmentally superior with minimal water usage. Weaknesses: Requires substantial capital investment for large-scale implementation; dependent on specific brine chemistry profiles for optimal efficiency.

Guangdong Bangpu Recycling Technology Co., Ltd.

Technical Solution: Guangdong Bangpu has pioneered a circular economy approach to lithium phosphate production by developing advanced battery recycling technologies that recover lithium phosphate from spent LFP batteries. Their process involves mechanical separation, hydrometallurgical leaching, and direct synthesis of battery-grade lithium phosphate from recycled materials. The company has implemented a continuous production line capable of processing 100,000 tons of spent batteries annually, recovering over 95% of lithium content. Their proprietary "regenerative precipitation" technique allows for the production of high-purity lithium phosphate with consistent particle size distribution, crucial for battery performance. Bangpu has also developed a modular production system that can be rapidly deployed to increase production capacity in response to market demand, with each module designed to produce 5,000-10,000 tons of lithium phosphate annually.

Strengths: Sustainable production method reducing dependency on raw material mining; established recycling infrastructure provides stable feedstock supply; lower production costs compared to traditional mining operations. Weaknesses: Quality consistency challenges when processing varied battery waste streams; scaling limited by availability of end-of-life batteries in the short term.

Critical Patents and Innovations in LFP Synthesis

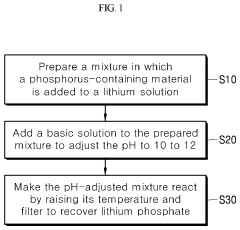

Method for producing lithium phosphate from a lithium solution

PatentActiveUS10566664B2

Innovation

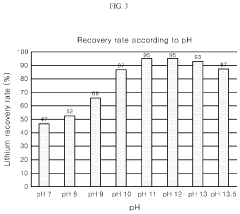

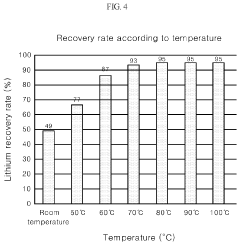

- A method involving the addition of a phosphorus-containing material, such as phosphoric acid, to a lithium solution, followed by pH adjustment with a basic solution and temperature increase, to recover lithium phosphate efficiently, reducing environmental impact and costs.

Manufacturing method for lithium phosphate

PatentWO2025127691A1

Innovation

- A method involving introducing a lithium-containing solution into a reactor, followed by adding an alkaline substance and a phosphorus supplying substance, creating a pH gradient to control particle size and separate nucleation and growth sections, resulting in lithium phosphate with low moisture and impurity content.

Supply Chain Optimization Strategies

Optimizing the supply chain for lithium phosphate production requires a comprehensive approach that addresses raw material sourcing, manufacturing efficiency, distribution networks, and inventory management. The current surge in demand for lithium phosphate, primarily driven by the electric vehicle and energy storage sectors, has created significant pressure points throughout the supply chain.

Strategic partnerships with raw material suppliers represent a critical optimization strategy. By establishing long-term contracts with multiple suppliers across different geographical regions, manufacturers can mitigate supply risks and potentially secure preferential pricing. These partnerships should include provisions for quality assurance and delivery schedules to ensure consistent production flow.

Vertical integration presents another viable approach, where manufacturers acquire or develop their own lithium mining operations and processing facilities. Companies like CATL and BYD have successfully implemented this strategy, reducing their dependency on external suppliers and gaining greater control over quality and costs. However, this approach requires substantial capital investment and geological expertise.

Just-in-time manufacturing principles can be adapted for lithium phosphate production to reduce inventory costs while maintaining production efficiency. This requires sophisticated demand forecasting systems that utilize machine learning algorithms to predict market fluctuations and adjust production accordingly. Real-time monitoring of inventory levels across the supply chain enables more responsive production scheduling.

Transportation optimization represents a significant opportunity for cost reduction and environmental impact minimization. Multimodal transportation strategies that combine rail, sea, and road transport can reduce both costs and carbon footprint. Additionally, strategic placement of production facilities closer to either raw material sources or end markets can significantly reduce logistics expenses.

Digital transformation of supply chain management through blockchain technology and IoT sensors enables end-to-end visibility and traceability. This transparency helps identify bottlenecks, reduce lead times, and ensure regulatory compliance. Advanced analytics can further optimize routing decisions and predict potential disruptions before they impact production.

Circular economy principles should be incorporated into supply chain design, focusing on recycling and reusing lithium phosphate materials from end-of-life products. This approach not only reduces dependency on primary raw materials but also addresses environmental concerns and potentially creates additional revenue streams through recycling operations.

Strategic partnerships with raw material suppliers represent a critical optimization strategy. By establishing long-term contracts with multiple suppliers across different geographical regions, manufacturers can mitigate supply risks and potentially secure preferential pricing. These partnerships should include provisions for quality assurance and delivery schedules to ensure consistent production flow.

Vertical integration presents another viable approach, where manufacturers acquire or develop their own lithium mining operations and processing facilities. Companies like CATL and BYD have successfully implemented this strategy, reducing their dependency on external suppliers and gaining greater control over quality and costs. However, this approach requires substantial capital investment and geological expertise.

Just-in-time manufacturing principles can be adapted for lithium phosphate production to reduce inventory costs while maintaining production efficiency. This requires sophisticated demand forecasting systems that utilize machine learning algorithms to predict market fluctuations and adjust production accordingly. Real-time monitoring of inventory levels across the supply chain enables more responsive production scheduling.

Transportation optimization represents a significant opportunity for cost reduction and environmental impact minimization. Multimodal transportation strategies that combine rail, sea, and road transport can reduce both costs and carbon footprint. Additionally, strategic placement of production facilities closer to either raw material sources or end markets can significantly reduce logistics expenses.

Digital transformation of supply chain management through blockchain technology and IoT sensors enables end-to-end visibility and traceability. This transparency helps identify bottlenecks, reduce lead times, and ensure regulatory compliance. Advanced analytics can further optimize routing decisions and predict potential disruptions before they impact production.

Circular economy principles should be incorporated into supply chain design, focusing on recycling and reusing lithium phosphate materials from end-of-life products. This approach not only reduces dependency on primary raw materials but also addresses environmental concerns and potentially creates additional revenue streams through recycling operations.

Environmental Impact and Sustainability Considerations

The scaling of lithium phosphate production to meet high demand presents significant environmental challenges that must be addressed through comprehensive sustainability strategies. Mining operations for lithium and phosphate raw materials cause substantial land disturbance, habitat destruction, and biodiversity loss. Open-pit mining methods, commonly used for lithium extraction, can permanently alter landscapes and disrupt local ecosystems. Additionally, conventional extraction processes consume enormous quantities of water—approximately 500,000 gallons per ton of lithium—creating severe strain on water resources in already arid regions where lithium deposits are typically found.

Chemical processing of lithium phosphate generates considerable waste streams containing heavy metals, acids, and other contaminants that require proper treatment to prevent soil and groundwater contamination. The carbon footprint associated with production is equally concerning, with energy-intensive processes contributing significantly to greenhouse gas emissions. Current estimates suggest that producing one ton of lithium carbonate equivalent generates approximately 15 tons of CO2 emissions.

Sustainable scaling strategies must incorporate closed-loop water systems to reduce freshwater consumption by 40-60% through advanced filtration and recycling technologies. Dry processing methods, though still emerging, show promise in reducing water requirements by up to 90% compared to traditional methods. Energy efficiency improvements and renewable energy integration in manufacturing facilities can potentially reduce carbon emissions by 30-50%, with several leading producers already implementing solar and wind power at production sites.

Waste valorization represents another critical sustainability pathway, with research demonstrating that processing residues can be repurposed for construction materials or soil amendments. Direct lithium extraction technologies, which selectively remove lithium from brine without extensive evaporation, reduce land footprint by 70% while improving recovery rates from 40% to over 90% in pilot projects.

Regulatory frameworks are evolving globally to mandate stricter environmental standards for lithium production. The EU Battery Directive and similar regulations in North America are establishing requirements for carbon footprint disclosure, responsible sourcing, and end-of-life recycling. Companies scaling production must anticipate these regulatory trends and implement proactive environmental management systems that exceed compliance requirements to ensure long-term operational viability.

Chemical processing of lithium phosphate generates considerable waste streams containing heavy metals, acids, and other contaminants that require proper treatment to prevent soil and groundwater contamination. The carbon footprint associated with production is equally concerning, with energy-intensive processes contributing significantly to greenhouse gas emissions. Current estimates suggest that producing one ton of lithium carbonate equivalent generates approximately 15 tons of CO2 emissions.

Sustainable scaling strategies must incorporate closed-loop water systems to reduce freshwater consumption by 40-60% through advanced filtration and recycling technologies. Dry processing methods, though still emerging, show promise in reducing water requirements by up to 90% compared to traditional methods. Energy efficiency improvements and renewable energy integration in manufacturing facilities can potentially reduce carbon emissions by 30-50%, with several leading producers already implementing solar and wind power at production sites.

Waste valorization represents another critical sustainability pathway, with research demonstrating that processing residues can be repurposed for construction materials or soil amendments. Direct lithium extraction technologies, which selectively remove lithium from brine without extensive evaporation, reduce land footprint by 70% while improving recovery rates from 40% to over 90% in pilot projects.

Regulatory frameworks are evolving globally to mandate stricter environmental standards for lithium production. The EU Battery Directive and similar regulations in North America are establishing requirements for carbon footprint disclosure, responsible sourcing, and end-of-life recycling. Companies scaling production must anticipate these regulatory trends and implement proactive environmental management systems that exceed compliance requirements to ensure long-term operational viability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!