Recycling Versus Controlled Biodegradation: Which Path For Single-Use Electronics

SEP 1, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Single-Use Electronics Evolution and Objectives

Single-use electronics have evolved significantly since their inception in the early 2000s, initially emerging as simple disposable devices like single-use cameras and basic medical monitoring equipment. The trajectory of development accelerated dramatically in the 2010s with advancements in miniaturization, cost-effective manufacturing processes, and the proliferation of Internet of Things (IoT) technologies. This evolution has been driven by increasing consumer demand for convenience, growing healthcare needs for sterile devices, and the expansion of temporary monitoring applications in various industries.

The technological progression of single-use electronics has been marked by several key innovations, including the development of ultra-thin flexible substrates, low-power microcontrollers, and energy-efficient communication protocols. These advancements have enabled the creation of increasingly sophisticated disposable electronic products while simultaneously reducing their unit costs. The market has expanded from niche applications to mainstream consumer products, medical devices, logistics tracking, and environmental monitoring systems.

Current single-use electronics face a critical sustainability challenge at the intersection of functionality and environmental impact. The primary objective in this technological domain is to develop electronic devices that fulfill their intended short-term purpose while minimizing long-term environmental consequences. This necessitates a balanced approach that considers both performance requirements and end-of-life management strategies.

The technical goals for next-generation single-use electronics focus on two potentially competing pathways: enhancing recyclability through design for disassembly and material recovery, or engineering controlled biodegradation that ensures safe decomposition after use. Both approaches aim to address the growing electronic waste crisis while maintaining the utility and economic viability of disposable electronic products.

Future development objectives include reducing the use of hazardous materials, increasing the proportion of bio-based components, improving energy efficiency, and extending functional lifespan where appropriate. Additionally, there is significant interest in creating hybrid systems that combine recyclable components (such as microprocessors and batteries) with biodegradable substrates and enclosures, potentially offering the benefits of both approaches.

The technical evolution trajectory suggests a growing convergence between electronic design principles and circular economy concepts, with increasing emphasis on life cycle assessment during the product development phase. This represents a fundamental shift from the traditional linear "take-make-dispose" model toward more sustainable approaches that consider environmental impacts from conception through disposal.

The technological progression of single-use electronics has been marked by several key innovations, including the development of ultra-thin flexible substrates, low-power microcontrollers, and energy-efficient communication protocols. These advancements have enabled the creation of increasingly sophisticated disposable electronic products while simultaneously reducing their unit costs. The market has expanded from niche applications to mainstream consumer products, medical devices, logistics tracking, and environmental monitoring systems.

Current single-use electronics face a critical sustainability challenge at the intersection of functionality and environmental impact. The primary objective in this technological domain is to develop electronic devices that fulfill their intended short-term purpose while minimizing long-term environmental consequences. This necessitates a balanced approach that considers both performance requirements and end-of-life management strategies.

The technical goals for next-generation single-use electronics focus on two potentially competing pathways: enhancing recyclability through design for disassembly and material recovery, or engineering controlled biodegradation that ensures safe decomposition after use. Both approaches aim to address the growing electronic waste crisis while maintaining the utility and economic viability of disposable electronic products.

Future development objectives include reducing the use of hazardous materials, increasing the proportion of bio-based components, improving energy efficiency, and extending functional lifespan where appropriate. Additionally, there is significant interest in creating hybrid systems that combine recyclable components (such as microprocessors and batteries) with biodegradable substrates and enclosures, potentially offering the benefits of both approaches.

The technical evolution trajectory suggests a growing convergence between electronic design principles and circular economy concepts, with increasing emphasis on life cycle assessment during the product development phase. This represents a fundamental shift from the traditional linear "take-make-dispose" model toward more sustainable approaches that consider environmental impacts from conception through disposal.

Market Analysis for Sustainable Electronic Solutions

The sustainable electronics market is experiencing unprecedented growth, driven by increasing environmental concerns and regulatory pressures. Currently valued at approximately $76 billion globally, this sector is projected to grow at a CAGR of 11.2% through 2028, significantly outpacing the broader electronics industry. This accelerated growth reflects shifting consumer preferences and corporate sustainability commitments across major markets including North America, Europe, and increasingly, Asia-Pacific regions.

Consumer demand for environmentally responsible electronics has shown remarkable evolution, with recent surveys indicating that 67% of consumers now consider environmental impact when purchasing electronic devices, compared to just 38% five years ago. This shift is particularly pronounced among younger demographics, with 78% of consumers aged 18-34 expressing willingness to pay premium prices for sustainable electronic alternatives.

The market segmentation reveals distinct approaches to sustainable electronics. The recyclable electronics segment currently dominates with approximately 65% market share, benefiting from established infrastructure and consumer familiarity. However, the biodegradable electronics segment demonstrates the highest growth rate at 16.8% annually, suggesting a potential market realignment in the coming years as technology matures and production scales.

Regulatory landscapes are increasingly favorable toward sustainable electronics solutions. The European Union's strengthened WEEE Directive, China's recent electronics recycling mandates, and the United States' emerging state-level extended producer responsibility laws collectively create strong market incentives for sustainable design approaches. These regulatory frameworks are expected to expand globally, with at least 12 additional countries planning similar legislation within the next three years.

Industry adoption patterns reveal interesting sectoral differences. Medical disposable electronics represent the fastest-growing application segment (18.3% CAGR), followed by consumer wearables (15.7%) and packaging-integrated electronics (14.2%). These high-growth segments share characteristics of short intended lifespans and challenging recycling economics under current systems, making them particularly suitable for biodegradable approaches.

Market barriers remain significant, particularly regarding price sensitivity. The current price premium for sustainable electronics averages 22-30% above conventional alternatives, though economies of scale are gradually reducing this gap. Technical performance concerns persist among 43% of potential corporate adopters, highlighting the need for solutions that maintain or enhance functionality while improving environmental profiles.

The competitive landscape is evolving rapidly, with traditional electronics manufacturers increasingly competing with sustainability-focused startups. Strategic partnerships between material science companies and electronics manufacturers have increased by 58% since 2020, indicating industry recognition of the interdisciplinary expertise required to advance sustainable electronics solutions.

Consumer demand for environmentally responsible electronics has shown remarkable evolution, with recent surveys indicating that 67% of consumers now consider environmental impact when purchasing electronic devices, compared to just 38% five years ago. This shift is particularly pronounced among younger demographics, with 78% of consumers aged 18-34 expressing willingness to pay premium prices for sustainable electronic alternatives.

The market segmentation reveals distinct approaches to sustainable electronics. The recyclable electronics segment currently dominates with approximately 65% market share, benefiting from established infrastructure and consumer familiarity. However, the biodegradable electronics segment demonstrates the highest growth rate at 16.8% annually, suggesting a potential market realignment in the coming years as technology matures and production scales.

Regulatory landscapes are increasingly favorable toward sustainable electronics solutions. The European Union's strengthened WEEE Directive, China's recent electronics recycling mandates, and the United States' emerging state-level extended producer responsibility laws collectively create strong market incentives for sustainable design approaches. These regulatory frameworks are expected to expand globally, with at least 12 additional countries planning similar legislation within the next three years.

Industry adoption patterns reveal interesting sectoral differences. Medical disposable electronics represent the fastest-growing application segment (18.3% CAGR), followed by consumer wearables (15.7%) and packaging-integrated electronics (14.2%). These high-growth segments share characteristics of short intended lifespans and challenging recycling economics under current systems, making them particularly suitable for biodegradable approaches.

Market barriers remain significant, particularly regarding price sensitivity. The current price premium for sustainable electronics averages 22-30% above conventional alternatives, though economies of scale are gradually reducing this gap. Technical performance concerns persist among 43% of potential corporate adopters, highlighting the need for solutions that maintain or enhance functionality while improving environmental profiles.

The competitive landscape is evolving rapidly, with traditional electronics manufacturers increasingly competing with sustainability-focused startups. Strategic partnerships between material science companies and electronics manufacturers have increased by 58% since 2020, indicating industry recognition of the interdisciplinary expertise required to advance sustainable electronics solutions.

Current Recycling and Biodegradation Technologies

The current landscape of electronic waste management presents two primary technological approaches: recycling and biodegradation. Traditional recycling technologies for electronics involve mechanical processing, pyrometallurgical recovery, and hydrometallurgical methods. Mechanical processing typically includes disassembly, shredding, and sorting of components based on material properties. This approach recovers approximately 30-40% of valuable materials but often fails to capture rare earth elements and precious metals effectively.

Pyrometallurgical recovery, operating at temperatures exceeding 1000°C, efficiently extracts copper, gold, and silver with recovery rates of 85-95%. However, this energy-intensive process generates significant carbon emissions—approximately 2.2 kg CO2 per kg of processed e-waste—and produces toxic slag requiring further treatment.

Hydrometallurgical methods employ chemical leaching with acids or cyanide solutions to selectively dissolve and recover metals. While achieving recovery rates of 90-98% for certain metals, these processes consume substantial water resources and generate hazardous effluents requiring extensive treatment before discharge.

Emerging recycling technologies include bioleaching, which utilizes microorganisms to extract metals through oxidation processes. This approach reduces energy consumption by 40% compared to conventional methods but operates at significantly slower rates, requiring 10-15 days for optimal metal recovery.

In parallel, biodegradation technologies for electronics have advanced considerably. Transient electronics utilizing water-soluble substrates like silk fibroin and poly(vinyl alcohol) can dissolve under controlled conditions within 24-72 hours. These materials maintain functional stability in normal operating environments but degrade rapidly when exposed to specific triggers.

Enzyme-responsive polymers represent another biodegradation approach, where materials containing specific enzyme-cleavable bonds disintegrate when exposed to targeted biological catalysts. Current systems achieve complete degradation within 1-4 weeks under optimal conditions.

Photodegradable electronic materials incorporating light-sensitive components can break down when exposed to specific wavelengths of light. These materials typically degrade within 2-8 weeks depending on light intensity and material composition, offering controlled end-of-life scenarios.

The integration of biodegradable conductive materials, such as melanin-based conductors and carbon nanomaterials in cellulose matrices, provides functional electronic pathways that decompose naturally. These materials exhibit conductivity values of 10-100 S/cm and degradation periods of 3-12 months in composting conditions.

Despite these advances, significant challenges remain in both technological approaches. Current recycling systems recover only 15-20% of global e-waste, while biodegradable electronics face limitations in performance, durability, and cost-effectiveness compared to conventional electronics. The technological landscape continues to evolve as researchers seek optimal solutions balancing performance requirements with environmental sustainability.

Pyrometallurgical recovery, operating at temperatures exceeding 1000°C, efficiently extracts copper, gold, and silver with recovery rates of 85-95%. However, this energy-intensive process generates significant carbon emissions—approximately 2.2 kg CO2 per kg of processed e-waste—and produces toxic slag requiring further treatment.

Hydrometallurgical methods employ chemical leaching with acids or cyanide solutions to selectively dissolve and recover metals. While achieving recovery rates of 90-98% for certain metals, these processes consume substantial water resources and generate hazardous effluents requiring extensive treatment before discharge.

Emerging recycling technologies include bioleaching, which utilizes microorganisms to extract metals through oxidation processes. This approach reduces energy consumption by 40% compared to conventional methods but operates at significantly slower rates, requiring 10-15 days for optimal metal recovery.

In parallel, biodegradation technologies for electronics have advanced considerably. Transient electronics utilizing water-soluble substrates like silk fibroin and poly(vinyl alcohol) can dissolve under controlled conditions within 24-72 hours. These materials maintain functional stability in normal operating environments but degrade rapidly when exposed to specific triggers.

Enzyme-responsive polymers represent another biodegradation approach, where materials containing specific enzyme-cleavable bonds disintegrate when exposed to targeted biological catalysts. Current systems achieve complete degradation within 1-4 weeks under optimal conditions.

Photodegradable electronic materials incorporating light-sensitive components can break down when exposed to specific wavelengths of light. These materials typically degrade within 2-8 weeks depending on light intensity and material composition, offering controlled end-of-life scenarios.

The integration of biodegradable conductive materials, such as melanin-based conductors and carbon nanomaterials in cellulose matrices, provides functional electronic pathways that decompose naturally. These materials exhibit conductivity values of 10-100 S/cm and degradation periods of 3-12 months in composting conditions.

Despite these advances, significant challenges remain in both technological approaches. Current recycling systems recover only 15-20% of global e-waste, while biodegradable electronics face limitations in performance, durability, and cost-effectiveness compared to conventional electronics. The technological landscape continues to evolve as researchers seek optimal solutions balancing performance requirements with environmental sustainability.

Comparative Analysis of Recycling vs Biodegradation

01 Disposable cameras and imaging devices

Single-use electronic cameras and imaging devices designed for one-time use before recycling or disposal. These devices typically feature simplified controls, pre-loaded film or digital storage, and limited functionality to keep costs low while providing convenient photography options for consumers. They are commonly used in special events, travel situations, or environments where expensive equipment might be at risk of damage.- Disposable cameras and imaging devices: Single-use electronic cameras and imaging devices designed for one-time use before disposal or recycling. These devices typically feature simplified controls, pre-loaded film or digital storage, and limited functionality to keep costs low while providing convenient photography options for consumers. They are commonly used in special events, travel situations, or environments where expensive equipment might be at risk of damage.

- Biodegradable and environmentally friendly electronic components: Development of single-use electronics with biodegradable or environmentally friendly components to reduce electronic waste. These innovations focus on creating circuits, batteries, and casings that can decompose naturally after use or be recycled more efficiently. The technology aims to minimize environmental impact while maintaining necessary functionality for short-term use applications.

- Medical and healthcare single-use devices: Electronic devices designed for one-time use in medical and healthcare settings to ensure sterility, prevent cross-contamination, and simplify disposal procedures. These include patient monitoring sensors, diagnostic tools, drug delivery systems, and point-of-care testing equipment. The single-use nature eliminates the need for sterilization between patients and reduces infection risks.

- Security and authentication single-use electronics: Electronic devices designed for one-time use in security applications, including authentication tokens, temporary access cards, and disposable communication devices. These products provide enhanced security through their limited lifespan, making them useful for temporary access control, secure transactions, or situations requiring untraceable communications.

- Consumer convenience electronics and smart packaging: Single-use electronic products designed for consumer convenience, including smart packaging with embedded electronics, disposable electronic tags, and temporary use devices. These innovations incorporate simple circuits, displays, or sensors into everyday items to enhance functionality, monitor product conditions, or improve user experience for a limited duration before disposal.

02 Biodegradable and environmentally friendly electronic components

Development of single-use electronics with biodegradable or environmentally friendly materials to reduce electronic waste. These innovations focus on creating components that can naturally decompose after their intended use period, minimizing environmental impact. The technologies include biodegradable substrates, water-soluble circuits, and components designed to break down under specific environmental conditions.Expand Specific Solutions03 Medical and healthcare single-use devices

Electronic devices designed for one-time medical or healthcare applications, including patient monitoring, diagnostic testing, and drug delivery systems. These devices prioritize sterility, accuracy, and ease of use while eliminating the need for cleaning and reprocessing. They help reduce cross-contamination risks in healthcare settings and provide convenient monitoring solutions for patients.Expand Specific Solutions04 Authentication and security applications

Single-use electronic systems for authentication, security tokens, and access control that function only once before becoming inoperable. These technologies provide enhanced security through physical limitations on reuse, making them valuable for high-security applications. They include one-time password generators, single-use access cards, and verification systems that prevent replay attacks.Expand Specific Solutions05 Consumer electronics with limited lifespan

Consumer-oriented single-use electronic products designed with intentionally limited lifespans for specific applications or events. These include disposable mobile phones, electronic payment cards, event-specific wearables, and promotional electronic devices. The products balance functionality with cost-effectiveness by limiting features and using simplified components while meeting specific short-term consumer needs.Expand Specific Solutions

Industry Leaders and Competitive Landscape

The single-use electronics market is at a critical inflection point, with recycling and controlled biodegradation emerging as competing sustainability pathways. Currently in the growth phase, this sector is projected to reach significant market size as consumer electronics proliferate globally. Technologically, major players demonstrate varying maturity levels: Sony Group and Micron Technology lead in recycling technologies with established infrastructure, while Eastman Chemical and Shin-Etsu Handotai are advancing biodegradable materials science. Research institutions like KIST, Shanghai Jiao Tong University, and The Rockefeller University are driving fundamental innovations, while companies like Xerox and Ricoh are implementing practical applications through their product development pipelines, creating a competitive landscape balanced between immediate recycling solutions and longer-term biodegradable alternatives.

Eastman Chemical Co.

Technical Solution: Eastman Chemical has developed innovative molecular recycling technologies specifically targeting electronic waste components. Their carbon renewal technology breaks down plastic waste that traditional mechanical recycling cannot process, converting it back to molecular building blocks. For electronics applications, they've engineered specialized polyesters with both recyclability and controlled biodegradation properties, allowing for recovery of valuable materials first, with any unrecoverable portions designed to safely biodegrade in industrial composting facilities. Their Tritan Renew copolyester incorporates up to 50% certified recycled content derived from waste plastic, providing durability for electronic device casings while maintaining end-of-life management options.

Strengths: Advanced molecular recycling capabilities that can process complex electronic polymers; dual-approach technology allowing both recycling and controlled biodegradation. Weaknesses: Energy-intensive processes for molecular recycling; requires sophisticated waste sorting infrastructure; controlled biodegradation limited to specific environmental conditions.

Sony Group Corp.

Technical Solution: Sony has pioneered the SORPLAS (Sustainable Oriented Recycled Plastic) technology, specifically designed for electronic device applications. This proprietary recycled plastic material contains up to 99% recycled content and has been implemented across their product lines from televisions to audio equipment. For single-use electronic components, Sony has developed flame-retardant recycled plastics that maintain high durability while reducing virgin plastic usage. Their approach prioritizes a closed-loop recycling system where products are designed for disassembly and material recovery. Sony's research also extends to biodegradable bioplastics derived from renewable resources for components where recycling is impractical, though they maintain that recycling offers superior environmental benefits for most electronic applications.

Strengths: Extensive implementation of recycled materials in commercial products; established take-back programs; advanced flame-retardant recycled plastic technology suitable for electronics. Weaknesses: Biodegradable alternatives still in early development stages; recycling approach requires consumer participation in take-back programs; some specialized electronic components remain difficult to incorporate into recycling streams.

Key Patents and Research in Materials Science

Method of Recycling Single or Limited Use Items

PatentInactiveUS20180339323A1

Innovation

- A method involving the provision, collection, and recycling of these items by separating and sorting components to produce oil and petroleum-based products, such as fuel, from materials like polyethylene terephthalate and polypropylene, which reduces the need for extensive cleaning and minimizes environmental impact.

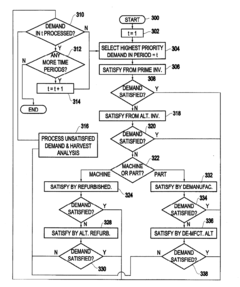

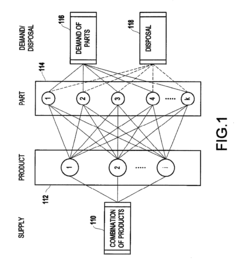

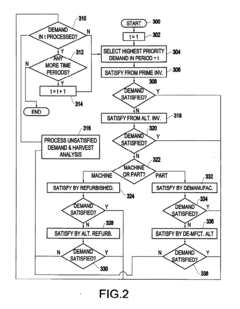

Method for optimal demanufacturing planning

PatentInactiveUS20090292573A1

Innovation

- A system and method that maintains databases for demand and supply of refurbished machines and parts, prioritizes demands based on economic value, and uses Advanced Planning Tools to model co-products and alternate parts, optimizing the refurbishing and demanufacturing schedule by selecting the highest priority demands first and utilizing available inventory and resources efficiently.

Environmental Impact Assessment

The environmental impact of electronic devices spans their entire lifecycle, from raw material extraction to end-of-life disposal. When comparing recycling versus controlled biodegradation for single-use electronics, comprehensive assessment reveals significant differences in ecological footprints.

Recycling pathways for electronics typically involve collection, disassembly, and material recovery processes. These operations consume substantial energy—approximately 10-15% of the original manufacturing energy—but still represent significant savings compared to virgin material production. However, recycling efficiency remains problematic, with global e-waste recycling rates hovering around 17.4% according to recent UN reports. The process generates secondary pollution through chemical leaching and emissions during material separation and processing.

Controlled biodegradation presents an alternative approach with distinct environmental implications. Biodegradable electronics utilize materials designed to decompose under specific environmental conditions, potentially reducing persistent waste. Laboratory studies indicate that properly engineered biodegradable components can decompose by 80-95% within 6-24 months in industrial composting facilities. However, incomplete degradation may release microplastics and potentially toxic compounds into ecosystems.

Carbon footprint analysis reveals notable differences between these approaches. Life cycle assessments indicate that recycling pathways typically generate 0.8-1.2 kg CO2 equivalent per kilogram of processed electronics, while biodegradation pathways produce 0.3-0.7 kg CO2 equivalent, primarily during the manufacturing phase when incorporating biodegradable materials.

Water resource impacts also differ significantly. Recycling processes consume 40-60 liters of water per kilogram of electronics processed, primarily for cleaning and separation processes. Biodegradation requires minimal water during disposal but may introduce higher water consumption during manufacturing of specialized biodegradable components.

Land use considerations reveal that recycling infrastructure requires dedicated industrial facilities, while biodegradation may require specialized composting facilities or controlled disposal environments to ensure proper decomposition. Improper disposal of biodegradable electronics in conventional landfills negates many environmental benefits, as anaerobic conditions significantly slow decomposition rates.

Chemical pollution profiles differ substantially between approaches. Recycling processes may release heavy metals, flame retardants, and processing chemicals, while biodegradation can potentially introduce novel compounds into ecosystems as materials break down. Recent studies have identified concerns regarding the environmental persistence of certain biodegradable polymers and their degradation byproducts in aquatic environments.

The environmental calculus ultimately depends on regional infrastructure, energy sources, and implementation efficiency. Neither approach represents a perfect solution, highlighting the need for complementary strategies tailored to specific electronic applications and regional waste management capabilities.

Recycling pathways for electronics typically involve collection, disassembly, and material recovery processes. These operations consume substantial energy—approximately 10-15% of the original manufacturing energy—but still represent significant savings compared to virgin material production. However, recycling efficiency remains problematic, with global e-waste recycling rates hovering around 17.4% according to recent UN reports. The process generates secondary pollution through chemical leaching and emissions during material separation and processing.

Controlled biodegradation presents an alternative approach with distinct environmental implications. Biodegradable electronics utilize materials designed to decompose under specific environmental conditions, potentially reducing persistent waste. Laboratory studies indicate that properly engineered biodegradable components can decompose by 80-95% within 6-24 months in industrial composting facilities. However, incomplete degradation may release microplastics and potentially toxic compounds into ecosystems.

Carbon footprint analysis reveals notable differences between these approaches. Life cycle assessments indicate that recycling pathways typically generate 0.8-1.2 kg CO2 equivalent per kilogram of processed electronics, while biodegradation pathways produce 0.3-0.7 kg CO2 equivalent, primarily during the manufacturing phase when incorporating biodegradable materials.

Water resource impacts also differ significantly. Recycling processes consume 40-60 liters of water per kilogram of electronics processed, primarily for cleaning and separation processes. Biodegradation requires minimal water during disposal but may introduce higher water consumption during manufacturing of specialized biodegradable components.

Land use considerations reveal that recycling infrastructure requires dedicated industrial facilities, while biodegradation may require specialized composting facilities or controlled disposal environments to ensure proper decomposition. Improper disposal of biodegradable electronics in conventional landfills negates many environmental benefits, as anaerobic conditions significantly slow decomposition rates.

Chemical pollution profiles differ substantially between approaches. Recycling processes may release heavy metals, flame retardants, and processing chemicals, while biodegradation can potentially introduce novel compounds into ecosystems as materials break down. Recent studies have identified concerns regarding the environmental persistence of certain biodegradable polymers and their degradation byproducts in aquatic environments.

The environmental calculus ultimately depends on regional infrastructure, energy sources, and implementation efficiency. Neither approach represents a perfect solution, highlighting the need for complementary strategies tailored to specific electronic applications and regional waste management capabilities.

Regulatory Framework and Compliance

The regulatory landscape for electronic waste management is rapidly evolving to address the growing environmental challenges posed by single-use electronics. Currently, major jurisdictions including the European Union, United States, and China have established distinct regulatory frameworks that significantly impact the decision between recycling and biodegradation approaches. The EU's Waste Electrical and Electronic Equipment (WEEE) Directive and Restriction of Hazardous Substances (RoHS) Directive represent the most comprehensive regulatory structure, mandating collection targets and restricting hazardous materials in electronic products.

In the United States, regulation remains fragmented with only 25 states having enacted e-waste legislation, creating a complex compliance environment for manufacturers operating nationwide. The lack of federal standardization presents significant challenges for companies pursuing biodegradable electronics strategies, as these novel materials may not fit neatly into existing regulatory categories.

Emerging economies are increasingly implementing extended producer responsibility (EPR) frameworks, shifting the burden of waste management back to manufacturers. This regulatory trend incentivizes design-for-environment approaches, potentially accelerating the development of controlled biodegradation technologies. However, the regulatory classification of biodegradable electronics remains ambiguous in many jurisdictions, creating uncertainty for innovators and investors in this space.

Compliance requirements vary substantially across markets, with documentation, material declaration, and end-of-life management obligations differing significantly. For biodegradable electronics, this regulatory heterogeneity presents particular challenges as certification standards for biodegradability are still evolving. The International Electrotechnical Commission (IEC) and IEEE are working to develop standards specifically addressing biodegradable electronic components, but widespread adoption remains years away.

Recent regulatory developments indicate a shift toward circular economy principles, with the EU's Circular Economy Action Plan and similar initiatives in Asia-Pacific economies establishing more stringent requirements for product longevity and repairability. These frameworks increasingly incorporate life cycle assessment methodologies that could potentially favor biodegradable approaches for certain single-use applications.

Regulatory compliance costs represent a significant factor in the recycling versus biodegradation decision matrix. Traditional recycling pathways benefit from established compliance mechanisms, while biodegradable electronics face uncertain regulatory treatment and potential certification hurdles. Forward-looking companies are actively engaging with regulatory bodies to help shape emerging frameworks for biodegradable electronics, recognizing that favorable regulatory treatment could significantly impact market adoption.

In the United States, regulation remains fragmented with only 25 states having enacted e-waste legislation, creating a complex compliance environment for manufacturers operating nationwide. The lack of federal standardization presents significant challenges for companies pursuing biodegradable electronics strategies, as these novel materials may not fit neatly into existing regulatory categories.

Emerging economies are increasingly implementing extended producer responsibility (EPR) frameworks, shifting the burden of waste management back to manufacturers. This regulatory trend incentivizes design-for-environment approaches, potentially accelerating the development of controlled biodegradation technologies. However, the regulatory classification of biodegradable electronics remains ambiguous in many jurisdictions, creating uncertainty for innovators and investors in this space.

Compliance requirements vary substantially across markets, with documentation, material declaration, and end-of-life management obligations differing significantly. For biodegradable electronics, this regulatory heterogeneity presents particular challenges as certification standards for biodegradability are still evolving. The International Electrotechnical Commission (IEC) and IEEE are working to develop standards specifically addressing biodegradable electronic components, but widespread adoption remains years away.

Recent regulatory developments indicate a shift toward circular economy principles, with the EU's Circular Economy Action Plan and similar initiatives in Asia-Pacific economies establishing more stringent requirements for product longevity and repairability. These frameworks increasingly incorporate life cycle assessment methodologies that could potentially favor biodegradable approaches for certain single-use applications.

Regulatory compliance costs represent a significant factor in the recycling versus biodegradation decision matrix. Traditional recycling pathways benefit from established compliance mechanisms, while biodegradable electronics face uncertain regulatory treatment and potential certification hurdles. Forward-looking companies are actively engaging with regulatory bodies to help shape emerging frameworks for biodegradable electronics, recognizing that favorable regulatory treatment could significantly impact market adoption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!