Supplier Mapping: Biodegradable Material Sources And GMP Constraints

SEP 1, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biodegradable Materials Evolution and Objectives

Biodegradable materials have undergone significant evolution over the past decades, transitioning from simple natural polymers to sophisticated engineered compounds with tailored properties. Initially, the field was dominated by naturally occurring biodegradable materials such as cellulose, starch, and protein-based polymers. The 1990s marked a turning point with the commercial introduction of polylactic acid (PLA), which demonstrated that bio-based materials could achieve performance comparable to conventional plastics while maintaining biodegradability.

The 2000s witnessed accelerated development in polyhydroxyalkanoates (PHAs), which offered improved mechanical properties and processing capabilities. This period also saw increased research into blends and composites that combined biodegradable polymers with natural fibers or inorganic fillers to enhance performance characteristics. The 2010s brought significant advancements in material science techniques, enabling more precise control over degradation rates, mechanical properties, and biocompatibility.

Recent technological breakthroughs have focused on developing biodegradable materials specifically designed for medical applications, with stringent requirements for Good Manufacturing Practice (GMP) compliance. These materials must demonstrate consistent quality, controlled degradation profiles, and absence of toxic residues or byproducts. The integration of nanotechnology has further expanded the functionality of biodegradable materials, allowing for enhanced barrier properties, antimicrobial capabilities, and controlled release mechanisms.

The primary objective of current biodegradable material development is to create sustainable alternatives that can replace conventional plastics across multiple industries while meeting specific performance requirements. For medical and pharmaceutical applications, the goal is to identify reliable supplier networks that can provide GMP-compliant biodegradable materials with consistent quality and traceability throughout the supply chain.

Another critical objective is to develop standardized testing methodologies and certification processes that can accurately assess biodegradability across different environments and conditions. This standardization is essential for regulatory compliance and consumer confidence. Additionally, there is a growing focus on reducing production costs and scaling up manufacturing processes to make biodegradable materials economically competitive with traditional plastics.

Looking forward, the field aims to develop "smart" biodegradable materials with programmable degradation triggers and enhanced functionality. Research is also directed toward creating closed-loop systems where biodegradable materials can be efficiently composted or recycled, contributing to circular economy principles. The ultimate goal remains to establish robust supplier networks that can provide sustainable, GMP-compliant biodegradable materials that meet the increasingly stringent requirements of modern applications.

The 2000s witnessed accelerated development in polyhydroxyalkanoates (PHAs), which offered improved mechanical properties and processing capabilities. This period also saw increased research into blends and composites that combined biodegradable polymers with natural fibers or inorganic fillers to enhance performance characteristics. The 2010s brought significant advancements in material science techniques, enabling more precise control over degradation rates, mechanical properties, and biocompatibility.

Recent technological breakthroughs have focused on developing biodegradable materials specifically designed for medical applications, with stringent requirements for Good Manufacturing Practice (GMP) compliance. These materials must demonstrate consistent quality, controlled degradation profiles, and absence of toxic residues or byproducts. The integration of nanotechnology has further expanded the functionality of biodegradable materials, allowing for enhanced barrier properties, antimicrobial capabilities, and controlled release mechanisms.

The primary objective of current biodegradable material development is to create sustainable alternatives that can replace conventional plastics across multiple industries while meeting specific performance requirements. For medical and pharmaceutical applications, the goal is to identify reliable supplier networks that can provide GMP-compliant biodegradable materials with consistent quality and traceability throughout the supply chain.

Another critical objective is to develop standardized testing methodologies and certification processes that can accurately assess biodegradability across different environments and conditions. This standardization is essential for regulatory compliance and consumer confidence. Additionally, there is a growing focus on reducing production costs and scaling up manufacturing processes to make biodegradable materials economically competitive with traditional plastics.

Looking forward, the field aims to develop "smart" biodegradable materials with programmable degradation triggers and enhanced functionality. Research is also directed toward creating closed-loop systems where biodegradable materials can be efficiently composted or recycled, contributing to circular economy principles. The ultimate goal remains to establish robust supplier networks that can provide sustainable, GMP-compliant biodegradable materials that meet the increasingly stringent requirements of modern applications.

Market Analysis for GMP-Compliant Biodegradable Materials

The global market for GMP-compliant biodegradable materials is experiencing robust growth, driven by increasing environmental concerns, stringent regulations, and shifting consumer preferences toward sustainable products. Current market valuations indicate that the biodegradable materials sector is expanding at a compound annual growth rate of approximately 17% between 2021 and 2026, with the GMP-compliant segment representing a significant premium segment within this market.

Healthcare applications dominate the demand for GMP-compliant biodegradable materials, particularly in medical devices, pharmaceutical packaging, and drug delivery systems. This sector values materials that meet both biodegradability standards and strict regulatory requirements for patient safety. The pharmaceutical packaging segment alone is projected to grow substantially as companies transition away from conventional plastics.

Consumer goods manufacturers represent the second largest market segment, particularly in premium personal care and cosmetic products where brand reputation increasingly depends on sustainable sourcing practices. Food packaging applications are emerging rapidly, though regulatory hurdles remain more complex in this sector due to direct food contact requirements.

Regional analysis reveals that North America and Europe currently lead market consumption of GMP-compliant biodegradable materials, accounting for over 65% of global demand. However, Asia-Pacific markets, particularly Japan, South Korea, and China, are demonstrating the fastest growth rates as regulatory frameworks in these regions increasingly align with international standards.

Price sensitivity varies significantly across application segments. Healthcare applications demonstrate lower price elasticity due to regulatory requirements and patient safety concerns, while consumer goods applications remain more price-sensitive despite growing sustainability commitments.

Supply chain analysis indicates potential bottlenecks in raw material sourcing, particularly for specialized biodegradable polymers that meet GMP standards. Current production capacity for these materials lags behind projected demand growth, creating potential supply constraints within the next 3-5 years unless significant capacity expansion occurs.

Key market drivers include increasingly stringent regulations on single-use plastics, growing corporate sustainability commitments, and consumer willingness to pay premium prices for environmentally responsible products. The COVID-19 pandemic has accelerated interest in biodegradable materials for healthcare applications, though temporary disruptions to supply chains have occurred.

Market barriers include higher production costs compared to conventional materials, technical limitations in certain performance characteristics, and complex certification processes for GMP compliance. Additionally, inconsistent regulatory frameworks across different regions create market fragmentation that complicates global supply strategies.

Healthcare applications dominate the demand for GMP-compliant biodegradable materials, particularly in medical devices, pharmaceutical packaging, and drug delivery systems. This sector values materials that meet both biodegradability standards and strict regulatory requirements for patient safety. The pharmaceutical packaging segment alone is projected to grow substantially as companies transition away from conventional plastics.

Consumer goods manufacturers represent the second largest market segment, particularly in premium personal care and cosmetic products where brand reputation increasingly depends on sustainable sourcing practices. Food packaging applications are emerging rapidly, though regulatory hurdles remain more complex in this sector due to direct food contact requirements.

Regional analysis reveals that North America and Europe currently lead market consumption of GMP-compliant biodegradable materials, accounting for over 65% of global demand. However, Asia-Pacific markets, particularly Japan, South Korea, and China, are demonstrating the fastest growth rates as regulatory frameworks in these regions increasingly align with international standards.

Price sensitivity varies significantly across application segments. Healthcare applications demonstrate lower price elasticity due to regulatory requirements and patient safety concerns, while consumer goods applications remain more price-sensitive despite growing sustainability commitments.

Supply chain analysis indicates potential bottlenecks in raw material sourcing, particularly for specialized biodegradable polymers that meet GMP standards. Current production capacity for these materials lags behind projected demand growth, creating potential supply constraints within the next 3-5 years unless significant capacity expansion occurs.

Key market drivers include increasingly stringent regulations on single-use plastics, growing corporate sustainability commitments, and consumer willingness to pay premium prices for environmentally responsible products. The COVID-19 pandemic has accelerated interest in biodegradable materials for healthcare applications, though temporary disruptions to supply chains have occurred.

Market barriers include higher production costs compared to conventional materials, technical limitations in certain performance characteristics, and complex certification processes for GMP compliance. Additionally, inconsistent regulatory frameworks across different regions create market fragmentation that complicates global supply strategies.

Current Landscape and Technical Barriers in Biodegradable Sourcing

The biodegradable materials sourcing landscape has evolved significantly over the past decade, with increasing demand driven by environmental regulations and consumer preferences. Currently, the market features a diverse ecosystem of suppliers ranging from established chemical companies to specialized startups focused exclusively on sustainable materials. North America and Europe dominate the high-quality biodegradable material production, while Asia-Pacific regions are rapidly expanding their manufacturing capabilities, particularly in PLA (Polylactic Acid) and starch-based compounds.

Despite market growth, several critical technical barriers persist in biodegradable material sourcing. Consistency in material properties remains a significant challenge, with batch-to-batch variations affecting downstream manufacturing processes. This inconsistency stems from the inherent variability of natural raw materials and differences in processing techniques among suppliers. For manufacturers requiring GMP (Good Manufacturing Practices) compliance, this variability presents substantial quality control challenges.

Cost competitiveness continues to be a major obstacle, with biodegradable materials typically commanding a 20-40% premium over conventional plastics. This price differential is particularly problematic for mass-market applications where thin profit margins prevail. The economic viability of biodegradable materials is further complicated by fluctuating agricultural commodity prices that directly impact raw material costs.

Supply chain resilience represents another significant barrier. Many biodegradable material suppliers lack the production scale and geographic redundancy of traditional plastic manufacturers. This limitation creates vulnerability to disruptions, as evidenced during recent global supply chain crises when lead times for specialized biodegradable materials extended from weeks to months.

GMP compliance presents particular challenges in the biodegradable materials sector. While pharmaceutical and medical device industries require stringent GMP adherence, many innovative biodegradable material suppliers lack experience with these regulatory frameworks. The documentation requirements, validation protocols, and quality management systems necessary for GMP compliance often exceed the capabilities of smaller, more innovative suppliers.

Technical compatibility issues further complicate the landscape. Many biodegradable materials exhibit processing windows significantly narrower than conventional plastics, requiring precise temperature control and specialized equipment. This technical limitation restricts the supplier base to those with advanced manufacturing capabilities and sophisticated quality control systems.

Traceability and sustainability verification have emerged as additional complexities. As regulations increasingly demand documented evidence of environmental claims, suppliers must implement comprehensive tracking systems from raw material sourcing through production. This requirement creates an additional barrier for smaller suppliers lacking sophisticated digital infrastructure.

Despite market growth, several critical technical barriers persist in biodegradable material sourcing. Consistency in material properties remains a significant challenge, with batch-to-batch variations affecting downstream manufacturing processes. This inconsistency stems from the inherent variability of natural raw materials and differences in processing techniques among suppliers. For manufacturers requiring GMP (Good Manufacturing Practices) compliance, this variability presents substantial quality control challenges.

Cost competitiveness continues to be a major obstacle, with biodegradable materials typically commanding a 20-40% premium over conventional plastics. This price differential is particularly problematic for mass-market applications where thin profit margins prevail. The economic viability of biodegradable materials is further complicated by fluctuating agricultural commodity prices that directly impact raw material costs.

Supply chain resilience represents another significant barrier. Many biodegradable material suppliers lack the production scale and geographic redundancy of traditional plastic manufacturers. This limitation creates vulnerability to disruptions, as evidenced during recent global supply chain crises when lead times for specialized biodegradable materials extended from weeks to months.

GMP compliance presents particular challenges in the biodegradable materials sector. While pharmaceutical and medical device industries require stringent GMP adherence, many innovative biodegradable material suppliers lack experience with these regulatory frameworks. The documentation requirements, validation protocols, and quality management systems necessary for GMP compliance often exceed the capabilities of smaller, more innovative suppliers.

Technical compatibility issues further complicate the landscape. Many biodegradable materials exhibit processing windows significantly narrower than conventional plastics, requiring precise temperature control and specialized equipment. This technical limitation restricts the supplier base to those with advanced manufacturing capabilities and sophisticated quality control systems.

Traceability and sustainability verification have emerged as additional complexities. As regulations increasingly demand documented evidence of environmental claims, suppliers must implement comprehensive tracking systems from raw material sourcing through production. This requirement creates an additional barrier for smaller suppliers lacking sophisticated digital infrastructure.

Current GMP-Compliant Sourcing Methodologies

01 Biodegradable polymers for medical applications

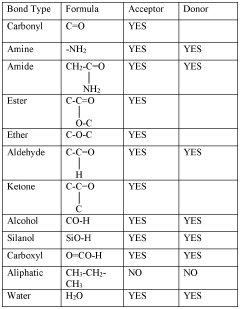

Biodegradable polymers are increasingly used in medical applications such as implants, drug delivery systems, and tissue engineering scaffolds. These materials provide temporary support while gradually breaking down in the body, eliminating the need for removal surgeries. Common biodegradable polymers include polylactic acid (PLA), polyglycolic acid (PGA), and their copolymers, which can be engineered to have specific degradation rates matching tissue healing timelines.- Biodegradable polymers for medical applications: Biodegradable polymers are increasingly used in medical applications such as implants, drug delivery systems, and tissue engineering scaffolds. These materials provide temporary support while gradually breaking down in the body, eliminating the need for removal surgeries. Common biodegradable polymers include polylactic acid (PLA), polyglycolic acid (PGA), and their copolymers, which can be engineered to have specific degradation rates matching tissue healing timelines.

- Biodegradable packaging materials: Innovative biodegradable packaging materials are being developed to replace conventional plastics and reduce environmental impact. These materials are designed to decompose naturally under specific conditions while maintaining necessary properties like moisture resistance, durability, and food safety. Formulations often incorporate plant-based polymers, cellulose derivatives, or starch compounds that provide comparable performance to traditional packaging while ensuring complete biodegradation after disposal.

- Biodegradable agricultural products: Biodegradable materials are revolutionizing agricultural practices through products like mulch films, plant pots, and controlled-release fertilizer coatings. These materials perform their intended functions during the growing season while naturally decomposing afterward, reducing plastic waste and labor costs associated with removal. The formulations typically combine natural polymers with additives that enhance performance while ensuring complete breakdown into non-toxic components that can benefit soil health.

- Composite biodegradable materials: Advanced composite biodegradable materials combine multiple biodegradable components to achieve enhanced properties not possible with single materials. These composites often incorporate natural fibers (like hemp, flax, or bamboo) with biodegradable polymer matrices to create materials with improved strength, flexibility, and durability while maintaining complete biodegradability. Applications include automotive components, construction materials, and consumer goods that require specific mechanical properties while ensuring environmental sustainability.

- Marine-degradable materials: Specialized biodegradable materials designed specifically for marine environments address the critical issue of ocean plastic pollution. These materials are engineered to safely degrade in seawater conditions, breaking down into non-toxic components without harming marine ecosystems. Applications include fishing gear, marine construction materials, and coastal tourism products. The formulations typically incorporate polymers that can be metabolized by marine microorganisms while maintaining necessary performance characteristics during their intended use period.

02 Biodegradable packaging materials

Innovative biodegradable packaging materials are being developed to replace conventional plastics and reduce environmental impact. These materials are designed to decompose naturally under composting conditions while maintaining necessary barrier properties and mechanical strength during use. Formulations often incorporate plant-based polymers, cellulose derivatives, or starch compounds that provide functionality while ensuring end-of-life biodegradability.Expand Specific Solutions03 Biodegradable agricultural products

Biodegradable materials are increasingly utilized in agricultural applications, including mulch films, seed coatings, and controlled-release fertilizer carriers. These materials perform their intended functions during the growing season while naturally decomposing afterward, reducing plastic waste in agricultural settings. The formulations typically combine biodegradable polymers with additives that enhance performance while ensuring complete breakdown under field conditions.Expand Specific Solutions04 Composite biodegradable materials

Composite biodegradable materials combine natural fibers or fillers with biodegradable polymer matrices to create materials with enhanced properties. These composites often utilize agricultural byproducts or waste materials as reinforcement, improving mechanical properties while maintaining biodegradability. The resulting materials can be tailored for specific applications by adjusting composition ratios and processing methods, offering sustainable alternatives to conventional composites.Expand Specific Solutions05 Biodegradable materials with enhanced functionality

Advanced biodegradable materials are being engineered with enhanced functionality beyond simple degradation properties. These include materials with antimicrobial properties, controlled drug release capabilities, stimuli-responsive behavior, or self-healing characteristics. By incorporating functional additives or through innovative molecular design, these materials maintain their biodegradability while offering additional performance benefits for specialized applications.Expand Specific Solutions

Leading Suppliers and Competitive Ecosystem

The biodegradable materials market is currently in a growth phase, with increasing regulatory pressure and consumer demand driving adoption across industries. The global market size is estimated to reach $10-12 billion by 2025, growing at a CAGR of approximately 15-18%. From a technological maturity perspective, the landscape shows varying degrees of development. Companies like B4Plastics and Arkema France are pioneering specialized biomaterials with advanced properties, while established players such as Henkel and Nestlé are integrating biodegradable solutions into existing product lines. Academic institutions including Nanyang Technological University and Clemson University are contributing fundamental research, while medical-focused entities like Ethicon and Warsaw Orthopedic face stricter GMP constraints when implementing biodegradable materials. The competitive landscape features a mix of specialized material developers, large industrial conglomerates, and research institutions collaborating to overcome technical and regulatory challenges.

Ethicon, Inc.

Technical Solution: Ethicon, a Johnson & Johnson subsidiary, has pioneered biodegradable materials for medical applications, particularly in surgical sutures and implantable medical devices. Their technology platform centers on biodegradable polymers like polydioxanone (PDS) and polyglactin 910 that provide controlled degradation profiles within the human body. Ethicon maintains extensive GMP-compliant manufacturing facilities specifically designed for medical-grade biodegradable materials production. Their supplier qualification program is particularly rigorous, incorporating not only GMP requirements but also specialized biocompatibility and sterility considerations essential for implantable materials. Ethicon has developed proprietary processes for purification and sterilization of biodegradable raw materials to ensure they meet the exceptionally high standards required for internal medical use, while maintaining their biodegradable properties and functional performance.

Strengths: Unparalleled expertise in medical-grade biodegradable materials; extensive regulatory approval history; sophisticated quality control systems; advanced sterilization capabilities. Weaknesses: Extremely high production costs; limited application beyond medical field; complex and lengthy supplier qualification process; stringent storage and handling requirements.

Zhangjiagang Oasis New Material Technology, Co., Ltd.

Technical Solution: Zhangjiagang Oasis specializes in biodegradable materials production with a focus on PLA (Polylactic Acid), PBAT (Polybutylene Adipate Terephthalate), and PBS (Polybutylene Succinate) compounds. Their manufacturing facilities are designed to meet international GMP standards, particularly for materials destined for food packaging and medical applications. The company has developed proprietary blending technologies that enhance the mechanical properties and processing characteristics of biodegradable polymers while maintaining their end-of-life biodegradability. Their vertical integration includes partnerships with local agricultural producers to source plant-based feedstocks, creating a regionally optimized supply chain that reduces carbon footprint while meeting GMP requirements for material traceability and consistency.

Strengths: Cost-competitive production; strong position in Asian markets; integrated supply chain with local feedstock sources; advanced compounding capabilities. Weaknesses: Limited global presence compared to Western competitors; less extensive third-party certifications; potential challenges with consistent raw material quality from agricultural sources.

Key Innovations in Biodegradable Material Certification

Biodegradable material, preparation method and application thereof

PatentInactiveUS20230303829A1

Innovation

- A biodegradable material composition comprising polybutylene adipate-terephthalate, polyhydroxybutyrate-co-hydroxyvalerate copolymer, polylactic acid, and a bio-based epoxidation modifier, combined using twin-screw extrusion, to create drinking straws with enhanced mechanical properties, heat resistance, and moisture resistance.

Common contact surfaces for use in the manufacture, packaging, delivery, and assessment of biopharmaceutical products

PatentWO2022026798A1

Innovation

- Implementing a system with common contact surfaces on vessels and connectors featuring a tie coating, barrier coating, and optional pH protective coating, composed of SiOx or SiNxCyHz, to minimize interactions and ensure compatibility, reducing the need for multiple surface validations and streamlining regulatory processes.

Regulatory Framework for Biodegradable Materials

The regulatory landscape governing biodegradable materials spans multiple jurisdictions and encompasses various standards that manufacturers must navigate to ensure compliance. At the international level, ISO 17088 and ASTM D6400 serve as primary standards for biodegradability certification, establishing testing protocols and performance criteria that materials must meet to be classified as biodegradable. These standards evaluate factors such as disintegration rate, ecotoxicity, and ultimate biodegradation under composting conditions.

In the United States, the FDA regulates biodegradable materials intended for food contact through 21 CFR 175-178, requiring extensive safety assessments and migration testing. The EPA additionally oversees environmental impact considerations through the Toxic Substances Control Act (TSCA), which may require pre-manufacturing notifications for novel biodegradable polymers. State-level regulations, particularly California's SB 270 and Washington's HB 1569, have established stricter requirements for biodegradability claims and material composition.

European regulations present a more comprehensive framework through the EU Packaging Directive (94/62/EC) and the EN 13432 standard, which specifies requirements for packaging recoverable through composting and biodegradation. The REACH regulation further requires registration and safety assessment of chemical substances used in biodegradable material production, imposing significant documentation requirements on suppliers and manufacturers.

For pharmaceutical and medical applications, Good Manufacturing Practice (GMP) guidelines from ICH Q7 and FDA 21 CFR Part 211 impose additional constraints on biodegradable material sourcing. These regulations mandate rigorous supplier qualification processes, material traceability systems, and validation of consistent quality attributes. Material suppliers must demonstrate robust quality management systems and provide comprehensive documentation of raw material origins and processing methods.

Emerging markets like China and India have developed their own regulatory frameworks, with China's GB/T 20197 standard and India's IS/ISO 17088 adaptation establishing regional certification requirements. These variations create compliance challenges for global supply chains and necessitate market-specific material formulations.

Certification bodies such as TÜV Austria (OK Compost), BPI (Compostable), and DIN CERTCO play crucial roles in verifying compliance with these standards. Their certification marks have become essential market access tools, though the cost and duration of certification processes can present barriers to smaller suppliers and innovative materials.

In the United States, the FDA regulates biodegradable materials intended for food contact through 21 CFR 175-178, requiring extensive safety assessments and migration testing. The EPA additionally oversees environmental impact considerations through the Toxic Substances Control Act (TSCA), which may require pre-manufacturing notifications for novel biodegradable polymers. State-level regulations, particularly California's SB 270 and Washington's HB 1569, have established stricter requirements for biodegradability claims and material composition.

European regulations present a more comprehensive framework through the EU Packaging Directive (94/62/EC) and the EN 13432 standard, which specifies requirements for packaging recoverable through composting and biodegradation. The REACH regulation further requires registration and safety assessment of chemical substances used in biodegradable material production, imposing significant documentation requirements on suppliers and manufacturers.

For pharmaceutical and medical applications, Good Manufacturing Practice (GMP) guidelines from ICH Q7 and FDA 21 CFR Part 211 impose additional constraints on biodegradable material sourcing. These regulations mandate rigorous supplier qualification processes, material traceability systems, and validation of consistent quality attributes. Material suppliers must demonstrate robust quality management systems and provide comprehensive documentation of raw material origins and processing methods.

Emerging markets like China and India have developed their own regulatory frameworks, with China's GB/T 20197 standard and India's IS/ISO 17088 adaptation establishing regional certification requirements. These variations create compliance challenges for global supply chains and necessitate market-specific material formulations.

Certification bodies such as TÜV Austria (OK Compost), BPI (Compostable), and DIN CERTCO play crucial roles in verifying compliance with these standards. Their certification marks have become essential market access tools, though the cost and duration of certification processes can present barriers to smaller suppliers and innovative materials.

Supply Chain Resilience Strategies

In the face of increasing global supply chain disruptions, building resilience into biodegradable material sourcing has become a strategic imperative. Supply chain resilience strategies for biodegradable materials must address both the unique characteristics of these materials and the stringent GMP (Good Manufacturing Practices) requirements that govern their production and handling.

Multi-sourcing approaches represent a fundamental strategy, where organizations identify and qualify multiple suppliers of key biodegradable materials across diverse geographical regions. This geographical diversification helps mitigate risks associated with regional disruptions such as natural disasters, political instability, or localized resource constraints. For critical biodegradable components, maintaining relationships with at least three qualified suppliers has emerged as an industry best practice.

Buffer inventory management tailored specifically for biodegradable materials presents unique challenges due to their limited shelf life and degradation characteristics. Advanced inventory modeling that accounts for material degradation rates, seasonal availability of bio-based feedstocks, and production lead times can optimize safety stock levels while minimizing waste. Companies leading in this space have implemented dynamic inventory policies that adjust based on real-time supplier risk assessments.

Vertical integration strategies have gained traction, with some manufacturers investing in their own biodegradable material production capabilities. This approach provides greater control over material quality and availability, particularly important for meeting GMP requirements. However, the capital investment and specialized expertise required make this viable primarily for larger organizations or through strategic partnerships.

Digital supply chain technologies offer significant resilience benefits through enhanced visibility and predictive capabilities. Blockchain-based traceability systems can verify sustainable sourcing claims and GMP compliance throughout the supply chain. AI-powered predictive analytics can forecast supply disruptions before they occur, allowing for proactive mitigation measures. These technologies are particularly valuable for biodegradable materials where source verification and quality consistency are paramount.

Collaborative supplier development programs focused on capacity building and technical assistance can strengthen the overall ecosystem for biodegradable materials. By investing in supplier capabilities to meet GMP standards and scale production sustainably, organizations can expand the available supplier base while ensuring quality compliance. Industry consortiums have emerged to share best practices and collectively address common challenges in biodegradable material sourcing.

Regulatory navigation strategies must account for the complex and evolving landscape governing biodegradable materials across different markets. Developing expertise in international standards and certification requirements enables more agile responses to regulatory changes that might impact material availability or compliance status.

Multi-sourcing approaches represent a fundamental strategy, where organizations identify and qualify multiple suppliers of key biodegradable materials across diverse geographical regions. This geographical diversification helps mitigate risks associated with regional disruptions such as natural disasters, political instability, or localized resource constraints. For critical biodegradable components, maintaining relationships with at least three qualified suppliers has emerged as an industry best practice.

Buffer inventory management tailored specifically for biodegradable materials presents unique challenges due to their limited shelf life and degradation characteristics. Advanced inventory modeling that accounts for material degradation rates, seasonal availability of bio-based feedstocks, and production lead times can optimize safety stock levels while minimizing waste. Companies leading in this space have implemented dynamic inventory policies that adjust based on real-time supplier risk assessments.

Vertical integration strategies have gained traction, with some manufacturers investing in their own biodegradable material production capabilities. This approach provides greater control over material quality and availability, particularly important for meeting GMP requirements. However, the capital investment and specialized expertise required make this viable primarily for larger organizations or through strategic partnerships.

Digital supply chain technologies offer significant resilience benefits through enhanced visibility and predictive capabilities. Blockchain-based traceability systems can verify sustainable sourcing claims and GMP compliance throughout the supply chain. AI-powered predictive analytics can forecast supply disruptions before they occur, allowing for proactive mitigation measures. These technologies are particularly valuable for biodegradable materials where source verification and quality consistency are paramount.

Collaborative supplier development programs focused on capacity building and technical assistance can strengthen the overall ecosystem for biodegradable materials. By investing in supplier capabilities to meet GMP standards and scale production sustainably, organizations can expand the available supplier base while ensuring quality compliance. Industry consortiums have emerged to share best practices and collectively address common challenges in biodegradable material sourcing.

Regulatory navigation strategies must account for the complex and evolving landscape governing biodegradable materials across different markets. Developing expertise in international standards and certification requirements enables more agile responses to regulatory changes that might impact material availability or compliance status.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!