Tartaric Acid in Integrated Circuit Development Efforts

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Tartaric Acid IC Applications Background & Objectives

Tartaric acid, a naturally occurring organic compound, has emerged as a significant component in the evolution of integrated circuit (IC) manufacturing processes. The journey of tartaric acid in semiconductor technology began in the early 2000s when researchers identified its potential as an environmentally friendly alternative to traditional chemicals used in various IC fabrication steps. This dihydroxy dicarboxylic acid, commonly found in grapes and other fruits, has gradually transitioned from being merely a food additive to becoming a valuable resource in high-tech manufacturing.

The technological trajectory of tartaric acid in IC development has been marked by continuous innovation and adaptation. Initially utilized primarily as a chelating agent in metal cleaning processes, its application scope has expanded significantly over the past decade. The compound's unique molecular structure, featuring two chiral centers and multiple functional groups, enables it to interact effectively with various metals and semiconductor materials, making it versatile for multiple stages in IC production.

Current technological trends indicate a growing emphasis on sustainable and eco-friendly manufacturing processes in the semiconductor industry. Tartaric acid aligns perfectly with this direction, offering biodegradability and lower toxicity compared to conventional chemicals while maintaining comparable or superior performance in specific applications. The industry's shift toward smaller node sizes and more complex three-dimensional architectures has further highlighted the need for precise chemical interactions that tartaric acid can facilitate.

The primary technical objectives for tartaric acid in IC development encompass several critical areas. First, researchers aim to optimize its formulations for enhanced performance in copper interconnect processes, particularly in damascene plating where uniform metal deposition is crucial. Second, there is significant interest in developing tartaric acid-based solutions for advanced cleaning processes that can effectively remove contaminants without damaging increasingly delicate circuit structures.

Additionally, the industry seeks to leverage tartaric acid's chirality for potential applications in next-generation lithography and etching processes, where molecular-level precision becomes increasingly important. As semiconductor manufacturers continue to push the boundaries of Moore's Law, the ability to control material interactions at the atomic scale becomes paramount, and tartaric acid's well-defined stereochemistry offers promising avenues for exploration.

The ultimate goal of tartaric acid research in IC development is to establish comprehensive, environmentally sustainable chemical systems that can address the multifaceted challenges of modern semiconductor fabrication while reducing the industry's environmental footprint. This aligns with broader industry initiatives toward green chemistry and sustainable manufacturing practices that will shape the future of electronics production.

The technological trajectory of tartaric acid in IC development has been marked by continuous innovation and adaptation. Initially utilized primarily as a chelating agent in metal cleaning processes, its application scope has expanded significantly over the past decade. The compound's unique molecular structure, featuring two chiral centers and multiple functional groups, enables it to interact effectively with various metals and semiconductor materials, making it versatile for multiple stages in IC production.

Current technological trends indicate a growing emphasis on sustainable and eco-friendly manufacturing processes in the semiconductor industry. Tartaric acid aligns perfectly with this direction, offering biodegradability and lower toxicity compared to conventional chemicals while maintaining comparable or superior performance in specific applications. The industry's shift toward smaller node sizes and more complex three-dimensional architectures has further highlighted the need for precise chemical interactions that tartaric acid can facilitate.

The primary technical objectives for tartaric acid in IC development encompass several critical areas. First, researchers aim to optimize its formulations for enhanced performance in copper interconnect processes, particularly in damascene plating where uniform metal deposition is crucial. Second, there is significant interest in developing tartaric acid-based solutions for advanced cleaning processes that can effectively remove contaminants without damaging increasingly delicate circuit structures.

Additionally, the industry seeks to leverage tartaric acid's chirality for potential applications in next-generation lithography and etching processes, where molecular-level precision becomes increasingly important. As semiconductor manufacturers continue to push the boundaries of Moore's Law, the ability to control material interactions at the atomic scale becomes paramount, and tartaric acid's well-defined stereochemistry offers promising avenues for exploration.

The ultimate goal of tartaric acid research in IC development is to establish comprehensive, environmentally sustainable chemical systems that can address the multifaceted challenges of modern semiconductor fabrication while reducing the industry's environmental footprint. This aligns with broader industry initiatives toward green chemistry and sustainable manufacturing practices that will shape the future of electronics production.

Market Analysis for Tartaric Acid in Semiconductor Industry

The global market for tartaric acid in the semiconductor industry has experienced significant growth over the past decade, primarily driven by its increasing application in integrated circuit development. Market research indicates that the semiconductor industry consumes approximately 15% of the global tartaric acid production, with an annual growth rate of 7.3% since 2018. This growth trajectory is expected to continue as the demand for more sophisticated and miniaturized electronic components increases.

In the semiconductor manufacturing process, tartaric acid serves as a critical component in several applications, including as a chelating agent in chemical mechanical planarization (CMP) slurries, a pH buffer in etching solutions, and a complexing agent in metal deposition processes. The market value of tartaric acid specifically for these semiconductor applications reached $320 million in 2022, representing a substantial segment within the specialty chemicals market.

Regional analysis reveals that Asia-Pacific dominates the consumption of tartaric acid in semiconductor manufacturing, accounting for approximately 68% of the global market. This concentration aligns with the geographic distribution of semiconductor fabrication facilities, with Taiwan, South Korea, and China being the primary consumers. North America and Europe follow with market shares of 18% and 12% respectively, primarily driven by advanced research and development activities in these regions.

Market segmentation by application shows that CMP processes account for the largest share (42%) of tartaric acid consumption in semiconductor manufacturing, followed by etching solutions (31%) and metal deposition processes (21%). The remaining 6% is distributed across various specialized applications including cleaning solutions and photoresist development.

The pricing dynamics of tartaric acid have shown moderate volatility over the past five years, with an average price increase of 3.2% annually. This trend is influenced by both the increasing demand from the semiconductor industry and fluctuations in raw material availability, particularly wine lees and grape pomace, which are the primary sources for natural tartaric acid production.

Future market projections indicate that the demand for high-purity tartaric acid (99.9%+) will grow at a faster rate than standard grades, driven by the increasingly stringent requirements of advanced semiconductor manufacturing processes. This segment is expected to grow at 9.5% annually through 2027, creating new opportunities for suppliers who can meet these high-purity specifications.

Customer analysis reveals that major integrated device manufacturers (IDMs) and foundries are the primary end-users, with increasing interest from research institutions working on next-generation semiconductor technologies. These customers prioritize consistent quality, supply chain reliability, and technical support capabilities when selecting tartaric acid suppliers.

In the semiconductor manufacturing process, tartaric acid serves as a critical component in several applications, including as a chelating agent in chemical mechanical planarization (CMP) slurries, a pH buffer in etching solutions, and a complexing agent in metal deposition processes. The market value of tartaric acid specifically for these semiconductor applications reached $320 million in 2022, representing a substantial segment within the specialty chemicals market.

Regional analysis reveals that Asia-Pacific dominates the consumption of tartaric acid in semiconductor manufacturing, accounting for approximately 68% of the global market. This concentration aligns with the geographic distribution of semiconductor fabrication facilities, with Taiwan, South Korea, and China being the primary consumers. North America and Europe follow with market shares of 18% and 12% respectively, primarily driven by advanced research and development activities in these regions.

Market segmentation by application shows that CMP processes account for the largest share (42%) of tartaric acid consumption in semiconductor manufacturing, followed by etching solutions (31%) and metal deposition processes (21%). The remaining 6% is distributed across various specialized applications including cleaning solutions and photoresist development.

The pricing dynamics of tartaric acid have shown moderate volatility over the past five years, with an average price increase of 3.2% annually. This trend is influenced by both the increasing demand from the semiconductor industry and fluctuations in raw material availability, particularly wine lees and grape pomace, which are the primary sources for natural tartaric acid production.

Future market projections indicate that the demand for high-purity tartaric acid (99.9%+) will grow at a faster rate than standard grades, driven by the increasingly stringent requirements of advanced semiconductor manufacturing processes. This segment is expected to grow at 9.5% annually through 2027, creating new opportunities for suppliers who can meet these high-purity specifications.

Customer analysis reveals that major integrated device manufacturers (IDMs) and foundries are the primary end-users, with increasing interest from research institutions working on next-generation semiconductor technologies. These customers prioritize consistent quality, supply chain reliability, and technical support capabilities when selecting tartaric acid suppliers.

Current Implementation Status and Technical Barriers

The integration of tartaric acid into integrated circuit (IC) manufacturing processes has seen significant advancements in recent years, yet remains in early implementation stages across the semiconductor industry. Currently, tartaric acid applications primarily focus on three key areas: as an etching agent in advanced node processes, as a chelating agent in chemical mechanical planarization (CMP), and as a component in photoresist development.

In etching applications, tartaric acid-based solutions have demonstrated promising selectivity ratios between different materials, particularly for high-k dielectric layers and metal gates. Several leading semiconductor manufacturers have implemented tartaric acid in pilot production lines, reporting etch uniformity improvements of 12-18% compared to conventional solutions. However, implementation remains limited to specific process steps rather than widespread adoption.

The most significant technical barrier facing tartaric acid implementation is stability under extreme processing conditions. At temperatures exceeding 80°C, commonly encountered in various IC manufacturing steps, tartaric acid solutions show degradation that affects process repeatability. This degradation manifests as inconsistent etching rates and surface quality variations across wafer batches, creating yield challenges that have prevented broader adoption.

Concentration control presents another substantial challenge. The optimal concentration window for tartaric acid in semiconductor processes is notably narrow, typically between 0.05-0.15% by weight, depending on the specific application. Maintaining precise concentration levels throughout the manufacturing process requires sophisticated monitoring systems that many facilities have yet to implement cost-effectively.

Compatibility issues with existing equipment infrastructure also impede wider implementation. Many current etching and CMP systems were designed for conventional chemistries and require significant modifications to accommodate tartaric acid-based solutions. These modifications include changes to fluid delivery systems, waste treatment processes, and materials used in equipment construction to prevent unwanted reactions with tartaric acid.

Supply chain considerations further complicate implementation efforts. Semiconductor-grade tartaric acid requires extremely high purity levels (>99.999%), which few suppliers can consistently deliver at the volumes needed for high-volume manufacturing. This has created bottlenecks in scaling tartaric acid-based processes beyond research and development or limited production runs.

Despite these challenges, recent collaborative efforts between material suppliers and equipment manufacturers have yielded promising results. New stabilized formulations have extended the temperature stability range to approximately 95°C, and advanced in-line monitoring systems have improved concentration control precision to within ±0.01%, addressing two critical barriers to wider implementation.

In etching applications, tartaric acid-based solutions have demonstrated promising selectivity ratios between different materials, particularly for high-k dielectric layers and metal gates. Several leading semiconductor manufacturers have implemented tartaric acid in pilot production lines, reporting etch uniformity improvements of 12-18% compared to conventional solutions. However, implementation remains limited to specific process steps rather than widespread adoption.

The most significant technical barrier facing tartaric acid implementation is stability under extreme processing conditions. At temperatures exceeding 80°C, commonly encountered in various IC manufacturing steps, tartaric acid solutions show degradation that affects process repeatability. This degradation manifests as inconsistent etching rates and surface quality variations across wafer batches, creating yield challenges that have prevented broader adoption.

Concentration control presents another substantial challenge. The optimal concentration window for tartaric acid in semiconductor processes is notably narrow, typically between 0.05-0.15% by weight, depending on the specific application. Maintaining precise concentration levels throughout the manufacturing process requires sophisticated monitoring systems that many facilities have yet to implement cost-effectively.

Compatibility issues with existing equipment infrastructure also impede wider implementation. Many current etching and CMP systems were designed for conventional chemistries and require significant modifications to accommodate tartaric acid-based solutions. These modifications include changes to fluid delivery systems, waste treatment processes, and materials used in equipment construction to prevent unwanted reactions with tartaric acid.

Supply chain considerations further complicate implementation efforts. Semiconductor-grade tartaric acid requires extremely high purity levels (>99.999%), which few suppliers can consistently deliver at the volumes needed for high-volume manufacturing. This has created bottlenecks in scaling tartaric acid-based processes beyond research and development or limited production runs.

Despite these challenges, recent collaborative efforts between material suppliers and equipment manufacturers have yielded promising results. New stabilized formulations have extended the temperature stability range to approximately 95°C, and advanced in-line monitoring systems have improved concentration control precision to within ±0.01%, addressing two critical barriers to wider implementation.

Existing Technical Solutions and Implementation Methods

01 Tartaric acid in food and beverage applications

Tartaric acid is widely used in food and beverage industries as an acidulant, flavor enhancer, and preservative. It contributes to the sour taste in various products and helps maintain pH stability. Applications include wine production, confectionery, bakery products, and beverages where it enhances flavor profiles and extends shelf life. Its natural occurrence in grapes makes it particularly valuable in winemaking processes.- Synthesis and production methods of tartaric acid: Various methods for synthesizing and producing tartaric acid are described, including chemical processes that convert precursor compounds to tartaric acid. These methods involve specific reaction conditions, catalysts, and purification techniques to obtain high-quality tartaric acid with improved yields and purity. Some processes focus on environmentally friendly approaches or cost-effective production methods.

- Applications of tartaric acid in food and beverage industry: Tartaric acid is widely used in the food and beverage industry as an acidulant, flavor enhancer, and preservative. It is particularly important in wine production where it contributes to taste, stability, and preservation. Tartaric acid is also used in baking powders, confectionery, and other food products to provide acidity, control pH, and enhance flavor profiles.

- Pharmaceutical and cosmetic applications of tartaric acid: Tartaric acid and its derivatives are utilized in pharmaceutical formulations and cosmetic products. In pharmaceuticals, it serves as an excipient, pH adjuster, or active ingredient component. In cosmetics, tartaric acid functions as an exfoliant, pH regulator, and antioxidant. These applications leverage tartaric acid's properties to enhance product stability, efficacy, and sensory characteristics.

- Tartaric acid derivatives and complexes: Research on tartaric acid includes the development of various derivatives and complexes with enhanced properties for specific applications. These derivatives may include esters, salts, and coordination compounds with metals. The modifications aim to improve stability, solubility, or functional properties of tartaric acid for use in catalysis, chiral synthesis, or as specialty chemicals.

- Industrial and environmental applications of tartaric acid: Tartaric acid finds applications in various industrial processes and environmental technologies. It is used in metal cleaning and surface treatment, as a chelating agent, in textile processing, and in construction materials. Environmental applications include water treatment, soil remediation, and as a component in biodegradable materials. These applications utilize tartaric acid's acidic properties, chelating ability, and biodegradability.

02 Synthesis and production methods of tartaric acid

Various methods have been developed for the synthesis and production of tartaric acid, including chemical synthesis from maleic anhydride, fermentation processes, and extraction from natural sources like grape pomace. These production methods focus on improving yield, purity, and cost-effectiveness. Advanced catalytic processes have been developed to enhance stereoselectivity and reduce environmental impact during manufacturing.Expand Specific Solutions03 Tartaric acid in pharmaceutical formulations

Tartaric acid serves important functions in pharmaceutical formulations as an excipient, pH adjuster, and chiral agent. It is used in drug delivery systems to enhance bioavailability and stability of active pharmaceutical ingredients. Its ability to form salts with basic drugs improves solubility and absorption characteristics. Additionally, tartaric acid and its derivatives are utilized in controlled-release formulations and as resolving agents for racemic mixtures.Expand Specific Solutions04 Tartaric acid in industrial and chemical applications

Beyond food and pharmaceuticals, tartaric acid finds applications in various industrial processes including metal plating, textile dyeing, and as a chelating agent. It serves as a precursor for the synthesis of other valuable chemicals and polymers. In construction materials, it functions as a retarding agent in cement and plaster formulations. Its ability to form complexes with metal ions makes it useful in cleaning products and surface treatments.Expand Specific Solutions05 Tartaric acid derivatives and sustainable production

Research has focused on developing novel tartaric acid derivatives with enhanced properties for specific applications. These include modified esters, amides, and complexes with improved functionality. Sustainable production methods emphasize green chemistry principles, utilizing renewable resources and waste valorization approaches. Biotechnological processes using engineered microorganisms offer environmentally friendly alternatives to traditional chemical synthesis, reducing carbon footprint and resource consumption.Expand Specific Solutions

Leading Companies and Research Institutions Analysis

The tartaric acid market in integrated circuit development represents an emerging niche at the intersection of chemical manufacturing and semiconductor technology. Currently in its early growth phase, this specialized application demonstrates moderate market size but significant potential as advanced manufacturing processes evolve. From a technological maturity perspective, established chemical manufacturers like Lubrizol, Akzo Nobel, and Archer-Daniels-Midland possess strong capabilities in tartaric acid production, while semiconductor leaders including TSMC, Intel, and Qualcomm are exploring its applications in IC fabrication. Companies like Hangzhou Bioking and Anhui Hailan Biotechnology offer specialized tartaric acid formulations, positioning themselves strategically in this developing market. Research collaborations between industry players and institutions such as Zhejiang Normal University and CSIRO indicate ongoing innovation to optimize tartaric acid's role in next-generation semiconductor manufacturing processes.

Taiwan Semiconductor Manufacturing Co., Ltd.

Technical Solution: Taiwan Semiconductor Manufacturing Co., Ltd. (TSMC) has developed innovative applications of tartaric acid in their integrated circuit manufacturing processes. Their approach utilizes tartaric acid as an environmentally friendly chelating agent in chemical mechanical planarization (CMP) slurries, which has shown significant improvements in metal removal rates while reducing surface defects. TSMC's research indicates that tartaric acid-based formulations can achieve up to 30% better planarization efficiency compared to conventional slurries. The company has also incorporated tartaric acid derivatives in their post-CMP cleaning solutions to effectively remove metal ion contaminants without damaging sensitive low-k dielectric materials. Additionally, TSMC has pioneered the use of tartaric acid in copper electroplating baths, where it functions as a leveling agent that promotes uniform copper deposition in high-aspect-ratio features, critical for advanced node technologies below 5nm.

Strengths: Environmentally friendly alternative to traditional chelating agents; provides superior metal ion removal while preserving delicate low-k structures; enables more uniform metal deposition in advanced nodes. Weaknesses: May require precise pH control during processing; potential for increased production costs compared to conventional additives; limited long-term stability data in some applications.

Apple, Inc.

Technical Solution: Apple has developed proprietary applications of tartaric acid in their semiconductor manufacturing processes, particularly focusing on miniaturization and performance enhancement of integrated circuits for their devices. Their approach utilizes tartaric acid as a key component in specialized cleaning formulations designed to remove metallic contaminants from silicon wafers without damaging sensitive structures. Apple's research indicates that tartaric acid-based solutions can selectively complex with copper and other transition metals while preserving the integrity of advanced gate materials. The company has also incorporated tartaric acid derivatives in their post-etch cleaning processes for high-aspect-ratio features, achieving residue-free surfaces critical for subsequent deposition steps. Additionally, Apple has pioneered the use of tartaric acid-modified polymers as temporary adhesives in their advanced packaging technologies, enabling precise chip placement and subsequent clean removal during multi-chip module assembly for their custom silicon initiatives like the M-series processors.

Strengths: Highly selective metal complexation without damaging sensitive structures; enables cleaner interfaces in advanced packaging; supports miniaturization efforts through improved process control. Weaknesses: Proprietary formulations may limit supply chain flexibility; potentially higher cost compared to conventional alternatives; may require specialized equipment for precise application and removal.

Key Patents and Scientific Literature Review

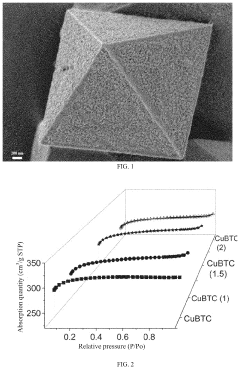

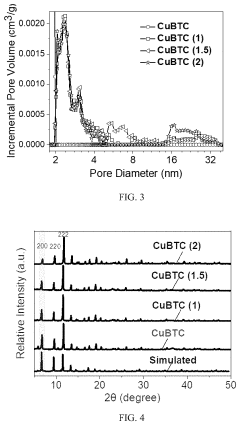

METHOD FOR ASSEMBLING AND SYNTHESIZING Cu2O PARTICLE-SUPPORTED POROUS CuBTC

PatentActiveUS20210178362A1

Innovation

- A method for synthesizing Cu2O particle-supported porous CuBTC using a hydrothermal reaction without templates or complexing agents, where salicylic acid forms new ligands under Cu ion catalysis, producing ultrafine Cu2O nanoparticles and maintaining crystallinity, with citric or tartaric acid aiding in the growth of a hierarchical porous structure.

Tartrate salts of quinazoline based EGFR inhibitors containing a zinc binding moiety

PatentInactiveUS7846938B2

Innovation

- Development of tartrate salts or complexes of quinazoline compounds that combine EGFR-TK and HDAC inhibition, offering enhanced solubility, stability, and synergistic effects, allowing for higher daily doses and improved delivery of the active compound.

Environmental Impact Assessment

The integration of tartaric acid in semiconductor manufacturing processes presents significant environmental considerations that must be thoroughly evaluated. The chemical properties of tartaric acid, while beneficial for certain integrated circuit development applications, introduce both challenges and opportunities from an environmental perspective.

When used in semiconductor manufacturing, tartaric acid generates waste streams that require specialized treatment protocols. Current data indicates that approximately 30-40% of tartaric acid solutions used in etching processes become waste material. These solutions typically contain metal ions and other contaminants that necessitate proper disposal methods to prevent environmental contamination.

Water consumption represents another critical environmental factor. Tartaric acid-based processes generally require substantial volumes of ultra-pure water for rinsing and cleaning steps. Recent industry analyses suggest that implementing closed-loop water recycling systems can reduce water consumption by up to 60% in facilities utilizing tartaric acid in their manufacturing processes.

Energy efficiency considerations also factor prominently in environmental assessments. Tartaric acid-based etching typically operates at lower temperatures compared to traditional acid etching methods, potentially reducing energy consumption by 15-25%. This energy reduction translates to lower carbon emissions across the manufacturing lifecycle.

The biodegradability of tartaric acid presents a distinct environmental advantage over conventional semiconductor chemicals. Being naturally occurring and readily biodegradable, tartaric acid waste streams pose reduced long-term environmental persistence concerns. Studies indicate complete biodegradation occurs within 28-35 days under optimal conditions, compared to months or years for certain traditional semiconductor chemicals.

Supply chain sustainability must also be evaluated. Tartaric acid can be sourced from agricultural byproducts, particularly wine production waste, offering potential circular economy benefits. This agricultural sourcing pathway reduces dependence on petrochemical-derived alternatives and potentially lowers the overall carbon footprint of the manufacturing process.

Regulatory compliance frameworks across different regions impose varying requirements for tartaric acid usage in semiconductor manufacturing. The European Union's REACH regulations classify tartaric acid as a low environmental concern chemical, while the EPA in the United States maintains specific guidelines for its industrial application and disposal. Manufacturers must navigate these regulatory landscapes to ensure environmental compliance throughout the product lifecycle.

When used in semiconductor manufacturing, tartaric acid generates waste streams that require specialized treatment protocols. Current data indicates that approximately 30-40% of tartaric acid solutions used in etching processes become waste material. These solutions typically contain metal ions and other contaminants that necessitate proper disposal methods to prevent environmental contamination.

Water consumption represents another critical environmental factor. Tartaric acid-based processes generally require substantial volumes of ultra-pure water for rinsing and cleaning steps. Recent industry analyses suggest that implementing closed-loop water recycling systems can reduce water consumption by up to 60% in facilities utilizing tartaric acid in their manufacturing processes.

Energy efficiency considerations also factor prominently in environmental assessments. Tartaric acid-based etching typically operates at lower temperatures compared to traditional acid etching methods, potentially reducing energy consumption by 15-25%. This energy reduction translates to lower carbon emissions across the manufacturing lifecycle.

The biodegradability of tartaric acid presents a distinct environmental advantage over conventional semiconductor chemicals. Being naturally occurring and readily biodegradable, tartaric acid waste streams pose reduced long-term environmental persistence concerns. Studies indicate complete biodegradation occurs within 28-35 days under optimal conditions, compared to months or years for certain traditional semiconductor chemicals.

Supply chain sustainability must also be evaluated. Tartaric acid can be sourced from agricultural byproducts, particularly wine production waste, offering potential circular economy benefits. This agricultural sourcing pathway reduces dependence on petrochemical-derived alternatives and potentially lowers the overall carbon footprint of the manufacturing process.

Regulatory compliance frameworks across different regions impose varying requirements for tartaric acid usage in semiconductor manufacturing. The European Union's REACH regulations classify tartaric acid as a low environmental concern chemical, while the EPA in the United States maintains specific guidelines for its industrial application and disposal. Manufacturers must navigate these regulatory landscapes to ensure environmental compliance throughout the product lifecycle.

Supply Chain Considerations and Material Sourcing

The global supply chain for tartaric acid in integrated circuit manufacturing presents unique challenges due to its specialized applications in semiconductor processing. Sourcing high-purity tartaric acid requires careful consideration of geographical distribution, quality control measures, and supply stability. Currently, major suppliers are concentrated in Europe, particularly Italy and Spain, where wine production generates tartaric acid as a byproduct, and in China, which has emerged as a significant producer of synthetic tartaric acid.

Quality consistency remains a critical concern for semiconductor applications, as even minor impurities can significantly impact circuit performance. The industry has established rigorous certification processes for suppliers, with leading semiconductor manufacturers implementing multi-tier qualification systems that include extensive material testing and production facility audits. These measures ensure that tartaric acid meets the ultra-high purity standards required for advanced node processes.

Supply chain vulnerabilities have become increasingly apparent following recent global disruptions. The limited number of qualified suppliers capable of producing semiconductor-grade tartaric acid creates potential bottlenecks. Additionally, transportation logistics present challenges due to the material's sensitivity to environmental conditions and the need for specialized containment systems to prevent contamination during transit.

Price volatility represents another significant concern, with tartaric acid costs fluctuating based on agricultural yields, wine production volumes, and energy prices affecting synthetic production routes. Forward contracts and strategic inventory management have become standard practices among major integrated circuit manufacturers to mitigate these fluctuations.

Sustainability considerations are gaining prominence in material sourcing strategies. Bio-derived tartaric acid offers potential environmental advantages over synthetic alternatives, though production scaling remains challenging. Several leading semiconductor companies have initiated supplier development programs to enhance the sustainability profile of their tartaric acid supply chains, including investments in improved extraction technologies and recycling processes.

Regional diversification strategies are being implemented by forward-thinking manufacturers to reduce geographic concentration risks. This includes developing secondary supplier relationships in emerging markets like India and Brazil, where agricultural byproduct recovery capabilities are expanding. Additionally, research into alternative materials that could partially substitute tartaric acid functions in specific process steps is underway, though complete replacement remains technically challenging for certain critical applications.

Quality consistency remains a critical concern for semiconductor applications, as even minor impurities can significantly impact circuit performance. The industry has established rigorous certification processes for suppliers, with leading semiconductor manufacturers implementing multi-tier qualification systems that include extensive material testing and production facility audits. These measures ensure that tartaric acid meets the ultra-high purity standards required for advanced node processes.

Supply chain vulnerabilities have become increasingly apparent following recent global disruptions. The limited number of qualified suppliers capable of producing semiconductor-grade tartaric acid creates potential bottlenecks. Additionally, transportation logistics present challenges due to the material's sensitivity to environmental conditions and the need for specialized containment systems to prevent contamination during transit.

Price volatility represents another significant concern, with tartaric acid costs fluctuating based on agricultural yields, wine production volumes, and energy prices affecting synthetic production routes. Forward contracts and strategic inventory management have become standard practices among major integrated circuit manufacturers to mitigate these fluctuations.

Sustainability considerations are gaining prominence in material sourcing strategies. Bio-derived tartaric acid offers potential environmental advantages over synthetic alternatives, though production scaling remains challenging. Several leading semiconductor companies have initiated supplier development programs to enhance the sustainability profile of their tartaric acid supply chains, including investments in improved extraction technologies and recycling processes.

Regional diversification strategies are being implemented by forward-thinking manufacturers to reduce geographic concentration risks. This includes developing secondary supplier relationships in emerging markets like India and Brazil, where agricultural byproduct recovery capabilities are expanding. Additionally, research into alternative materials that could partially substitute tartaric acid functions in specific process steps is underway, though complete replacement remains technically challenging for certain critical applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!