Thermoelectric Module Patent Landscape for Industrial Energy Applications

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermoelectric Technology Evolution and Objectives

Thermoelectric technology has evolved significantly since its discovery in the early 19th century when Thomas Johann Seebeck first observed the phenomenon in 1821. The Seebeck effect, which describes the direct conversion of temperature differences to electric voltage, laid the foundation for thermoelectric generators (TEGs). By the mid-20th century, the complementary Peltier effect was harnessed for cooling applications, expanding the technology's utility across various sectors.

The evolution of thermoelectric materials has been marked by three distinct generations. First-generation materials, primarily bismuth telluride (Bi2Te3) alloys, dominated commercial applications from the 1950s through the 1990s with ZT values (figure of merit) around 1. Second-generation materials emerged in the early 2000s, featuring nanostructured semiconductors and complex bulk materials that achieved ZT values approaching 1.7, significantly improving conversion efficiency.

Current third-generation materials represent the cutting edge, incorporating advanced quantum well structures, superlattices, and novel nanomaterials like skutterudites and half-Heusler alloys. These innovations have pushed theoretical ZT values above 2.5, though commercial implementation remains challenging due to manufacturing complexities and material stability issues.

In industrial energy applications, thermoelectric technology has transitioned from niche military and aerospace uses to broader industrial waste heat recovery systems. This shift has been driven by increasing energy costs and environmental regulations promoting energy efficiency. The industrial sector represents a particularly promising application domain due to the abundance of waste heat streams between 100-500°C, which align well with the optimal operating temperatures of modern thermoelectric materials.

The primary technical objectives for thermoelectric modules in industrial applications include improving conversion efficiency beyond the current 5-8% range to at least 12-15%, reducing manufacturing costs from the current $5-10/W to below $2/W, and enhancing durability to withstand harsh industrial environments for 10+ years without significant degradation.

Long-term research goals focus on developing materials with consistently high ZT values across wider temperature ranges, scaling manufacturing processes for cost-effective mass production, and creating modular, easily integrated systems that can be retrofitted to existing industrial equipment. Particular emphasis is being placed on reducing or eliminating rare and toxic elements like tellurium and lead, which pose sustainability and regulatory challenges.

The convergence of advanced materials science, nanotechnology, and industrial process optimization is expected to drive the next wave of innovation in thermoelectric technology, potentially revolutionizing waste heat recovery in energy-intensive industries such as steel, cement, glass, and chemical processing.

The evolution of thermoelectric materials has been marked by three distinct generations. First-generation materials, primarily bismuth telluride (Bi2Te3) alloys, dominated commercial applications from the 1950s through the 1990s with ZT values (figure of merit) around 1. Second-generation materials emerged in the early 2000s, featuring nanostructured semiconductors and complex bulk materials that achieved ZT values approaching 1.7, significantly improving conversion efficiency.

Current third-generation materials represent the cutting edge, incorporating advanced quantum well structures, superlattices, and novel nanomaterials like skutterudites and half-Heusler alloys. These innovations have pushed theoretical ZT values above 2.5, though commercial implementation remains challenging due to manufacturing complexities and material stability issues.

In industrial energy applications, thermoelectric technology has transitioned from niche military and aerospace uses to broader industrial waste heat recovery systems. This shift has been driven by increasing energy costs and environmental regulations promoting energy efficiency. The industrial sector represents a particularly promising application domain due to the abundance of waste heat streams between 100-500°C, which align well with the optimal operating temperatures of modern thermoelectric materials.

The primary technical objectives for thermoelectric modules in industrial applications include improving conversion efficiency beyond the current 5-8% range to at least 12-15%, reducing manufacturing costs from the current $5-10/W to below $2/W, and enhancing durability to withstand harsh industrial environments for 10+ years without significant degradation.

Long-term research goals focus on developing materials with consistently high ZT values across wider temperature ranges, scaling manufacturing processes for cost-effective mass production, and creating modular, easily integrated systems that can be retrofitted to existing industrial equipment. Particular emphasis is being placed on reducing or eliminating rare and toxic elements like tellurium and lead, which pose sustainability and regulatory challenges.

The convergence of advanced materials science, nanotechnology, and industrial process optimization is expected to drive the next wave of innovation in thermoelectric technology, potentially revolutionizing waste heat recovery in energy-intensive industries such as steel, cement, glass, and chemical processing.

Industrial Energy Recovery Market Analysis

The industrial waste heat recovery market has witnessed substantial growth in recent years, driven by increasing energy costs and stringent environmental regulations. Currently valued at approximately $53.8 billion globally, this market is projected to grow at a CAGR of 7.2% through 2028, reflecting the urgent need for energy efficiency solutions across manufacturing sectors. Industrial processes typically waste 20-50% of input energy as heat, representing both an environmental challenge and a significant economic opportunity.

The demand for thermoelectric waste heat recovery systems is particularly strong in energy-intensive industries including steel manufacturing, cement production, glass making, and chemical processing. These sectors collectively account for over 70% of industrial waste heat generation, with temperatures ranging from 100°C to over 1500°C depending on the specific process. The European market currently leads adoption rates, followed by North America and rapidly growing Asian markets, particularly China and India.

Market analysis indicates that medium-temperature waste heat recovery (230-650°C) represents the largest segment by application potential, constituting approximately 45% of recoverable industrial waste heat. This temperature range aligns well with advanced thermoelectric materials' optimal operating conditions, creating a natural market fit for thermoelectric module deployment.

Economic drivers for adoption include rising energy prices, with industrial electricity costs increasing by an average of 4.3% annually in developed markets. The payback period for industrial thermoelectric systems has decreased from 7-9 years a decade ago to 3-5 years today, significantly enhancing their commercial viability. Government incentives further strengthen the business case, with carbon pricing mechanisms in over 40 countries directly rewarding waste heat recovery implementations.

Regulatory frameworks are increasingly favorable, with the EU's Energy Efficiency Directive mandating energy audits and efficiency improvements for large enterprises. Similarly, China's 14th Five-Year Plan emphasizes industrial energy efficiency with specific targets for waste heat utilization rates. These regulatory trends are expected to accelerate market growth by creating compliance-driven demand.

Customer requirements analysis reveals that reliability and maintenance costs remain primary concerns for industrial adopters, often outweighing initial efficiency metrics. System integration capabilities and compatibility with existing industrial infrastructure are critical adoption factors, with turnkey solutions showing higher market penetration than component-level offerings.

The demand for thermoelectric waste heat recovery systems is particularly strong in energy-intensive industries including steel manufacturing, cement production, glass making, and chemical processing. These sectors collectively account for over 70% of industrial waste heat generation, with temperatures ranging from 100°C to over 1500°C depending on the specific process. The European market currently leads adoption rates, followed by North America and rapidly growing Asian markets, particularly China and India.

Market analysis indicates that medium-temperature waste heat recovery (230-650°C) represents the largest segment by application potential, constituting approximately 45% of recoverable industrial waste heat. This temperature range aligns well with advanced thermoelectric materials' optimal operating conditions, creating a natural market fit for thermoelectric module deployment.

Economic drivers for adoption include rising energy prices, with industrial electricity costs increasing by an average of 4.3% annually in developed markets. The payback period for industrial thermoelectric systems has decreased from 7-9 years a decade ago to 3-5 years today, significantly enhancing their commercial viability. Government incentives further strengthen the business case, with carbon pricing mechanisms in over 40 countries directly rewarding waste heat recovery implementations.

Regulatory frameworks are increasingly favorable, with the EU's Energy Efficiency Directive mandating energy audits and efficiency improvements for large enterprises. Similarly, China's 14th Five-Year Plan emphasizes industrial energy efficiency with specific targets for waste heat utilization rates. These regulatory trends are expected to accelerate market growth by creating compliance-driven demand.

Customer requirements analysis reveals that reliability and maintenance costs remain primary concerns for industrial adopters, often outweighing initial efficiency metrics. System integration capabilities and compatibility with existing industrial infrastructure are critical adoption factors, with turnkey solutions showing higher market penetration than component-level offerings.

Global Thermoelectric Module Development Status

Thermoelectric module technology has witnessed significant global development over the past decades, with varying degrees of advancement across different regions. The United States has maintained a leading position in fundamental research and patent applications, particularly through institutions like NASA, MIT, and companies such as Marlow Industries and II-VI Incorporated. These organizations have pioneered high-efficiency modules for aerospace, defense, and industrial applications, achieving ZT values (figure of merit) approaching 2.0 in laboratory settings.

Europe has established itself as a hub for thermoelectric innovation, with Germany, France, and the UK leading research efforts. European development has focused on automotive waste heat recovery systems and industrial energy harvesting solutions. Companies like Laird Thermal Systems and European research consortiums have made substantial progress in developing modules capable of operating in harsh industrial environments with temperature differentials exceeding 300°C.

Japan and South Korea represent another significant development cluster, with companies like Komatsu, Panasonic, and Samsung advancing miniaturization and manufacturing efficiency. These nations have particularly excelled in developing mass-production techniques for thermoelectric modules, reducing costs while maintaining performance standards. Japanese manufacturers have achieved notable breakthroughs in module reliability, with some products demonstrating operational lifespans exceeding 15 years in industrial settings.

China has emerged as the fastest-growing player in the thermoelectric module landscape, with substantial government investment through initiatives like the "Made in China 2025" program. Chinese research institutions and companies have made remarkable progress in cost-effective manufacturing techniques and materials innovation, particularly in bismuth telluride and skutterudite-based modules. The country now accounts for approximately 35% of global thermoelectric module production volume.

Current global development challenges include efficiency limitations, with commercial modules typically achieving conversion efficiencies between 5-8%. Material constraints represent another significant hurdle, as high-performance thermoelectric materials often contain rare or toxic elements like tellurium and lead. Manufacturing scalability remains problematic, with precision assembly requirements limiting mass production capabilities.

Recent technological breakthroughs include the development of flexible thermoelectric modules, nanostructured materials achieving ZT values above 2.0, and hybrid systems combining thermoelectric generation with other energy recovery technologies. Global research collaboration has accelerated, with international consortiums working on next-generation modules utilizing quantum well structures and topological insulators to overcome traditional efficiency limitations.

The global market for industrial thermoelectric modules is projected to grow at a CAGR of 14.2% through 2028, driven by increasing focus on industrial energy efficiency and waste heat recovery applications. This growth trajectory is supported by strengthening regulatory frameworks promoting energy conservation and carbon emission reduction across major industrial economies.

Europe has established itself as a hub for thermoelectric innovation, with Germany, France, and the UK leading research efforts. European development has focused on automotive waste heat recovery systems and industrial energy harvesting solutions. Companies like Laird Thermal Systems and European research consortiums have made substantial progress in developing modules capable of operating in harsh industrial environments with temperature differentials exceeding 300°C.

Japan and South Korea represent another significant development cluster, with companies like Komatsu, Panasonic, and Samsung advancing miniaturization and manufacturing efficiency. These nations have particularly excelled in developing mass-production techniques for thermoelectric modules, reducing costs while maintaining performance standards. Japanese manufacturers have achieved notable breakthroughs in module reliability, with some products demonstrating operational lifespans exceeding 15 years in industrial settings.

China has emerged as the fastest-growing player in the thermoelectric module landscape, with substantial government investment through initiatives like the "Made in China 2025" program. Chinese research institutions and companies have made remarkable progress in cost-effective manufacturing techniques and materials innovation, particularly in bismuth telluride and skutterudite-based modules. The country now accounts for approximately 35% of global thermoelectric module production volume.

Current global development challenges include efficiency limitations, with commercial modules typically achieving conversion efficiencies between 5-8%. Material constraints represent another significant hurdle, as high-performance thermoelectric materials often contain rare or toxic elements like tellurium and lead. Manufacturing scalability remains problematic, with precision assembly requirements limiting mass production capabilities.

Recent technological breakthroughs include the development of flexible thermoelectric modules, nanostructured materials achieving ZT values above 2.0, and hybrid systems combining thermoelectric generation with other energy recovery technologies. Global research collaboration has accelerated, with international consortiums working on next-generation modules utilizing quantum well structures and topological insulators to overcome traditional efficiency limitations.

The global market for industrial thermoelectric modules is projected to grow at a CAGR of 14.2% through 2028, driven by increasing focus on industrial energy efficiency and waste heat recovery applications. This growth trajectory is supported by strengthening regulatory frameworks promoting energy conservation and carbon emission reduction across major industrial economies.

Current Thermoelectric Module Solutions

01 Thermoelectric module structure and materials

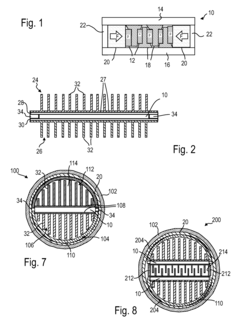

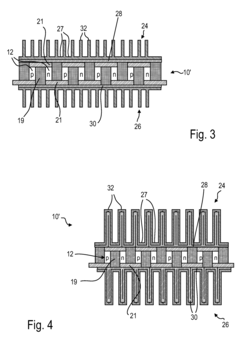

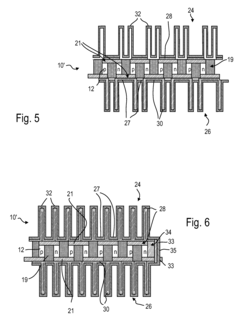

Thermoelectric modules are constructed with specific materials and structural designs to optimize energy conversion efficiency. These modules typically consist of p-type and n-type semiconductor materials arranged in pairs and connected electrically in series and thermally in parallel. The selection of semiconductor materials with high Seebeck coefficients and low thermal conductivity is crucial for maximizing the thermoelectric figure of merit (ZT). Advanced structural designs may include multi-layer configurations or nano-structured materials to enhance performance.- Thermoelectric module structure and materials: Thermoelectric modules are constructed with specific materials and structural designs to optimize energy conversion efficiency. These modules typically consist of p-type and n-type semiconductor materials arranged in pairs and connected electrically in series and thermally in parallel. The selection of semiconductor materials with high Seebeck coefficients and low thermal conductivity is crucial for maximizing the thermoelectric figure of merit (ZT). Advanced structural designs may include multi-layer configurations or nano-structured materials to enhance performance.

- Cooling and temperature control applications: Thermoelectric modules are widely used for precise temperature control and cooling applications. By applying an electric current to the module, heat can be pumped from one side to the other, creating a temperature differential (Peltier effect). This enables applications in electronic device cooling, refrigeration without moving parts, temperature-controlled scientific instruments, and medical devices. These solid-state cooling solutions offer advantages such as compact size, no moving parts, and precise temperature control capabilities.

- Power generation from waste heat: Thermoelectric modules can convert waste heat into useful electrical energy through the Seebeck effect. When a temperature gradient is applied across the module, it generates an electrical voltage that can be harnessed. This technology is particularly valuable for recovering waste heat from industrial processes, vehicle exhaust systems, and other heat-generating applications. The efficiency of power generation depends on the temperature differential and the thermoelectric properties of the materials used in the module.

- Manufacturing and assembly techniques: Advanced manufacturing and assembly techniques are essential for producing high-performance thermoelectric modules. These include methods for creating reliable electrical and thermal connections between thermoelectric elements, substrate bonding techniques, and approaches to minimize contact resistance. Precision assembly is critical as it affects the module's reliability, durability, and overall efficiency. Innovations in manufacturing processes focus on improving production scalability while maintaining tight tolerances and quality control.

- Integration with other systems and performance enhancement: Thermoelectric modules can be integrated with other systems to enhance overall performance and functionality. This includes combining modules with heat exchangers, thermal management systems, or renewable energy sources. Advanced control systems can optimize the operation of thermoelectric modules under varying conditions. Additionally, hybrid systems that combine thermoelectric technology with other energy conversion methods can achieve higher overall efficiency. Research focuses on improving integration techniques to maximize energy utilization and system performance.

02 Cooling and temperature control applications

Thermoelectric modules are widely used for precise temperature control and cooling applications. By applying an electric current to the module, heat can be pumped from one side to the other based on the Peltier effect, creating a temperature differential. These modules offer advantages such as no moving parts, compact size, and precise temperature control capabilities. Applications include electronic device cooling, portable refrigeration, temperature-controlled scientific equipment, and medical devices requiring stable temperatures.Expand Specific Solutions03 Power generation from waste heat

Thermoelectric modules can convert waste heat into useful electrical energy through the Seebeck effect. When a temperature gradient is applied across the module, it generates an electrical voltage that can be harnessed. This capability makes thermoelectric modules valuable for energy harvesting applications, particularly in industrial settings, automotive exhaust systems, and remote power generation. The efficiency of power generation depends on the temperature differential and the thermoelectric properties of the materials used in the module.Expand Specific Solutions04 Manufacturing and assembly techniques

Advanced manufacturing and assembly techniques are essential for producing high-performance thermoelectric modules. These techniques include precision bonding methods, electrode deposition processes, and thermal interface optimization. Manufacturing challenges include ensuring good electrical contacts while minimizing thermal resistance between components. Novel assembly approaches may incorporate flexible substrates, printed electronics techniques, or automated production methods to improve reliability and reduce costs while maintaining performance characteristics.Expand Specific Solutions05 Integration with other systems and performance enhancement

Thermoelectric modules can be integrated with other systems to enhance overall performance and functionality. This includes combining modules with heat exchangers, thermal management systems, or renewable energy sources. Performance enhancement strategies involve optimizing thermal interfaces, implementing cascaded module arrangements, or developing hybrid systems that combine thermoelectric effects with other energy conversion mechanisms. Advanced control systems may also be employed to maximize efficiency under varying operating conditions.Expand Specific Solutions

Leading Companies in Thermoelectric Industry

The thermoelectric module market for industrial energy applications is currently in a growth phase, with increasing demand driven by waste heat recovery opportunities and energy efficiency initiatives. The market is projected to expand significantly as industries seek sustainable energy solutions. Technologically, the landscape shows varying maturity levels, with established players like Kyocera Corp., Laird Technologies, and KELK Ltd. leading with comprehensive patent portfolios in core thermoelectric technologies. Japanese and Korean manufacturers dominate, including Panasonic, Toshiba, and LG Innotek, while automotive companies such as Hyundai, Kia, and Robert Bosch are increasingly active in vehicle-specific applications. Research institutions like Fraunhofer-Gesellschaft and Industrial Technology Research Institute are advancing next-generation materials, suggesting continued innovation potential in this field.

Laird Technologies, Inc.

Technical Solution: Laird Technologies has pioneered a comprehensive thermoelectric module portfolio specifically designed for industrial energy applications. Their patented Tunnel Series™ modules incorporate advanced semiconductor materials with optimized thermal interfaces that maximize heat transfer efficiency. Laird's innovations include specialized ceramic substrates with enhanced mechanical strength and thermal conductivity, allowing their modules to withstand harsh industrial environments. Their PowerCycling™ technology addresses thermal fatigue issues through proprietary interconnect designs that accommodate thermal expansion differences between materials. Laird has also developed hybrid thermoelectric systems that combine waste heat recovery with active cooling capabilities, enabling dual-function applications in industrial settings. Their modules feature power densities up to 14W/cm² and can operate effectively in temperature differentials ranging from 20°C to 200°C, with specialized high-temperature variants for specific industrial applications.

Strengths: Exceptional reliability in high-vibration environments; superior thermal cycling resistance; comprehensive design support ecosystem including thermal modeling software. Weaknesses: Higher initial cost compared to passive heat recovery systems; requires sophisticated control systems for optimal performance; efficiency drops significantly at lower temperature differentials.

KELK Ltd.

Technical Solution: KELK Ltd. has developed advanced bismuth telluride-based thermoelectric modules specifically optimized for industrial waste heat recovery applications. Their patented technology focuses on improving the figure of merit (ZT) of thermoelectric materials through nano-structuring and interface engineering techniques. KELK's modules feature proprietary electrode designs that minimize contact resistance and enhance thermal cycling durability, critical for industrial environments with temperature fluctuations. Their latest generation modules achieve conversion efficiencies of up to 7-8% in the 100-300°C temperature range, with specialized high-temperature variants capable of operating continuously at hot-side temperatures up to 350°C. KELK has also patented unique module assembly methods that reduce thermal stress during operation, extending service life in harsh industrial settings.

Strengths: Superior material quality control and manufacturing precision resulting in higher conversion efficiency; excellent reliability under thermal cycling conditions; specialized designs for specific industrial applications. Weaknesses: Higher cost compared to competitors; limited temperature range compared to some newer materials; requires precise installation parameters for optimal performance.

Key Patent Analysis in Thermoelectric Technology

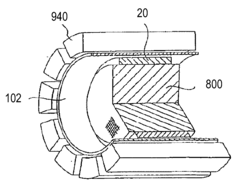

Module, assembly with module, thermoelectric generator unit and exhaust gas conduit device with generator unit

PatentInactiveUS20120297755A1

Innovation

- A thermoelectric module design featuring series-connected elements between housing plates with elastic compensating elements, such as fiber mats, to maintain thermal contact and flexibility, combined with an adhesive bond between thermoelectric modules and heat exchanger elements for enhanced heat transfer and mechanical stability.

Fuel cell electrical power source for portable electronic device with thermoelectric module

PatentActiveEP2463945A1

Innovation

- Incorporating thermoelectric modules that are sized and shaped to exchange heat with fuel cells and fuel tanks, allowing for thermal contact through conduction, convection, or radiation, to generate electrical power or provide heating/cooling, thereby maintaining optimal operating temperatures and preventing icing.

Environmental Impact Assessment

The environmental impact of thermoelectric modules in industrial energy applications represents a critical consideration in their widespread adoption. These solid-state devices offer significant environmental advantages compared to conventional energy recovery systems, primarily through their zero-emission operation during the energy conversion process. Unlike combustion-based technologies, thermoelectric modules produce no direct pollutants, greenhouse gases, or particulate matter when converting waste heat into usable electricity.

The life cycle assessment of thermoelectric modules reveals both positive and negative environmental implications. On the positive side, these modules can significantly reduce industrial carbon footprints by capturing waste heat that would otherwise be released into the atmosphere. Studies indicate that large-scale implementation across energy-intensive industries could potentially reduce global CO2 emissions by 1-3% annually, representing a substantial contribution to climate change mitigation efforts.

However, the manufacturing process presents notable environmental challenges. The production of high-performance thermoelectric materials often requires rare earth elements and heavy metals such as bismuth, tellurium, and lead. Mining and processing these materials generate significant environmental impacts, including habitat destruction, water pollution, and energy-intensive refinement processes. Recent patent trends show increasing focus on developing alternative materials with reduced environmental footprints.

End-of-life considerations for thermoelectric modules are increasingly addressed in recent patents. The recyclability of these devices varies significantly depending on material composition and manufacturing techniques. Advanced designs featuring modular construction and easily separable components demonstrate improved recyclability rates of up to 85%, compared to approximately 40% for conventional designs.

Water usage represents another important environmental dimension. Unlike many cooling technologies that require substantial water resources, thermoelectric waste heat recovery systems typically operate with closed-loop cooling systems that minimize water consumption. This characteristic makes them particularly valuable in water-stressed regions where industrial operations face increasing water-use restrictions.

The environmental payback period—the time required for environmental benefits to outweigh manufacturing impacts—ranges from 1.5 to 4 years for most industrial applications, according to recent life cycle analyses. This relatively short period supports the environmental case for widespread implementation, particularly in facilities with expected operational lifespans exceeding 10 years.

The life cycle assessment of thermoelectric modules reveals both positive and negative environmental implications. On the positive side, these modules can significantly reduce industrial carbon footprints by capturing waste heat that would otherwise be released into the atmosphere. Studies indicate that large-scale implementation across energy-intensive industries could potentially reduce global CO2 emissions by 1-3% annually, representing a substantial contribution to climate change mitigation efforts.

However, the manufacturing process presents notable environmental challenges. The production of high-performance thermoelectric materials often requires rare earth elements and heavy metals such as bismuth, tellurium, and lead. Mining and processing these materials generate significant environmental impacts, including habitat destruction, water pollution, and energy-intensive refinement processes. Recent patent trends show increasing focus on developing alternative materials with reduced environmental footprints.

End-of-life considerations for thermoelectric modules are increasingly addressed in recent patents. The recyclability of these devices varies significantly depending on material composition and manufacturing techniques. Advanced designs featuring modular construction and easily separable components demonstrate improved recyclability rates of up to 85%, compared to approximately 40% for conventional designs.

Water usage represents another important environmental dimension. Unlike many cooling technologies that require substantial water resources, thermoelectric waste heat recovery systems typically operate with closed-loop cooling systems that minimize water consumption. This characteristic makes them particularly valuable in water-stressed regions where industrial operations face increasing water-use restrictions.

The environmental payback period—the time required for environmental benefits to outweigh manufacturing impacts—ranges from 1.5 to 4 years for most industrial applications, according to recent life cycle analyses. This relatively short period supports the environmental case for widespread implementation, particularly in facilities with expected operational lifespans exceeding 10 years.

Standardization and Certification Requirements

The standardization and certification landscape for thermoelectric modules in industrial energy applications has evolved significantly in recent years, reflecting the growing importance of these technologies in waste heat recovery and energy efficiency initiatives. Currently, several key international standards govern the testing, performance evaluation, and safety requirements for thermoelectric devices, including IEC 62830-5 for thermoelectric energy harvesting and IEEE 1834 for thermoelectric generator performance metrics.

Industry stakeholders must navigate a complex certification ecosystem that varies by region and application domain. In North America, UL certification (particularly UL 1995 for heating and cooling equipment) often applies to thermoelectric systems integrated into industrial processes. The European market requires CE marking, with specific attention to the RoHS Directive for hazardous substance restrictions and the ATEX Directive for equipment used in potentially explosive atmospheres—particularly relevant for thermoelectric applications in oil, gas, and chemical processing industries.

Performance testing standards represent another critical area, with ASTM E2781 providing guidelines for measuring the figure of merit (ZT) of thermoelectric materials. For industrial energy applications, additional standards like ISO 50001 for energy management systems may apply when thermoelectric modules are implemented as part of broader energy efficiency initiatives. The lack of harmonized global standards specifically for industrial thermoelectric applications remains a significant challenge for manufacturers and implementers.

Emerging certification requirements increasingly focus on lifecycle assessment and environmental impact. The IEC 62474 database for material declaration in products and the ISO 14040 series for lifecycle assessment are becoming more relevant as sustainability considerations gain prominence. Patent analysis reveals that leading companies are increasingly filing for technologies that address compliance with these evolving standards, particularly regarding material composition and safety features.

Reliability testing frameworks represent another critical standardization area, with accelerated life testing protocols being developed specifically for thermoelectric modules in high-temperature industrial environments. The JEDEC standards for electronic component reliability testing are often adapted for this purpose, though industry-specific modifications are common to account for the unique thermal cycling and mechanical stress conditions in industrial settings.

The certification landscape is further complicated by application-specific requirements. For instance, thermoelectric modules used in food processing industries must comply with FDA regulations and food-grade material standards, while those deployed in maritime applications must meet additional corrosion resistance and vibration tolerance standards set by organizations like the International Maritime Organization.

Industry stakeholders must navigate a complex certification ecosystem that varies by region and application domain. In North America, UL certification (particularly UL 1995 for heating and cooling equipment) often applies to thermoelectric systems integrated into industrial processes. The European market requires CE marking, with specific attention to the RoHS Directive for hazardous substance restrictions and the ATEX Directive for equipment used in potentially explosive atmospheres—particularly relevant for thermoelectric applications in oil, gas, and chemical processing industries.

Performance testing standards represent another critical area, with ASTM E2781 providing guidelines for measuring the figure of merit (ZT) of thermoelectric materials. For industrial energy applications, additional standards like ISO 50001 for energy management systems may apply when thermoelectric modules are implemented as part of broader energy efficiency initiatives. The lack of harmonized global standards specifically for industrial thermoelectric applications remains a significant challenge for manufacturers and implementers.

Emerging certification requirements increasingly focus on lifecycle assessment and environmental impact. The IEC 62474 database for material declaration in products and the ISO 14040 series for lifecycle assessment are becoming more relevant as sustainability considerations gain prominence. Patent analysis reveals that leading companies are increasingly filing for technologies that address compliance with these evolving standards, particularly regarding material composition and safety features.

Reliability testing frameworks represent another critical standardization area, with accelerated life testing protocols being developed specifically for thermoelectric modules in high-temperature industrial environments. The JEDEC standards for electronic component reliability testing are often adapted for this purpose, though industry-specific modifications are common to account for the unique thermal cycling and mechanical stress conditions in industrial settings.

The certification landscape is further complicated by application-specific requirements. For instance, thermoelectric modules used in food processing industries must comply with FDA regulations and food-grade material standards, while those deployed in maritime applications must meet additional corrosion resistance and vibration tolerance standards set by organizations like the International Maritime Organization.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!