V10 Engine Use in Construction Equipment Enhancements

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V10 Engine Evolution and Performance Objectives

The V10 engine represents a significant milestone in the evolution of high-performance power systems for construction equipment. Originating from automotive applications in the early 2000s, these engines have undergone substantial transformation to meet the unique demands of heavy-duty construction machinery. The evolution trajectory shows a clear shift from pure power delivery to a more balanced approach incorporating efficiency, durability, and environmental compliance.

Historical development indicates that early V10 implementations in construction equipment faced challenges related to weight distribution, fuel consumption, and maintenance complexity. By 2010, manufacturers had addressed many of these issues through redesigned cylinder configurations, improved materials science, and advanced electronic control systems. The technological progression demonstrates a consistent pattern of incremental improvements punctuated by occasional breakthrough innovations, particularly in combustion efficiency and emissions control.

Current V10 engines deployed in construction equipment typically deliver between 450-700 horsepower with torque outputs exceeding 1,500 Nm, representing a 30% increase in power density compared to previous generation engines. This performance enhancement has been achieved while simultaneously reducing fuel consumption by approximately 15-20% over the past decade, highlighting the dual-focus development approach.

The primary performance objectives for next-generation V10 engines in construction applications center around four key areas: further emissions reduction to meet increasingly stringent global regulations, enhanced durability to extend service intervals in extreme operating conditions, improved power-to-weight ratios to optimize equipment capabilities, and integration with hybrid systems to reduce overall environmental impact while maintaining performance levels.

Industry roadmaps suggest that future V10 development will likely focus on advanced materials implementation, including greater use of composite components and specialized alloys to reduce weight while maintaining structural integrity. Additionally, combustion optimization through variable valve timing, dynamic compression ratio adjustment, and precision fuel delivery systems represents a significant area for performance enhancement.

The integration of digital technologies presents another frontier, with predictive maintenance capabilities, real-time performance optimization, and adaptive power delivery systems becoming increasingly important objectives. These technological targets align with broader industry trends toward equipment autonomy and operational intelligence, positioning the V10 engine as a central component in the next generation of smart construction machinery.

Historical development indicates that early V10 implementations in construction equipment faced challenges related to weight distribution, fuel consumption, and maintenance complexity. By 2010, manufacturers had addressed many of these issues through redesigned cylinder configurations, improved materials science, and advanced electronic control systems. The technological progression demonstrates a consistent pattern of incremental improvements punctuated by occasional breakthrough innovations, particularly in combustion efficiency and emissions control.

Current V10 engines deployed in construction equipment typically deliver between 450-700 horsepower with torque outputs exceeding 1,500 Nm, representing a 30% increase in power density compared to previous generation engines. This performance enhancement has been achieved while simultaneously reducing fuel consumption by approximately 15-20% over the past decade, highlighting the dual-focus development approach.

The primary performance objectives for next-generation V10 engines in construction applications center around four key areas: further emissions reduction to meet increasingly stringent global regulations, enhanced durability to extend service intervals in extreme operating conditions, improved power-to-weight ratios to optimize equipment capabilities, and integration with hybrid systems to reduce overall environmental impact while maintaining performance levels.

Industry roadmaps suggest that future V10 development will likely focus on advanced materials implementation, including greater use of composite components and specialized alloys to reduce weight while maintaining structural integrity. Additionally, combustion optimization through variable valve timing, dynamic compression ratio adjustment, and precision fuel delivery systems represents a significant area for performance enhancement.

The integration of digital technologies presents another frontier, with predictive maintenance capabilities, real-time performance optimization, and adaptive power delivery systems becoming increasingly important objectives. These technological targets align with broader industry trends toward equipment autonomy and operational intelligence, positioning the V10 engine as a central component in the next generation of smart construction machinery.

Construction Equipment Market Demand Analysis

The global construction equipment market has been experiencing significant growth, driven by urbanization, infrastructure development, and technological advancements. The market size reached approximately $140 billion in 2022, with projections indicating growth to $175 billion by 2027, representing a compound annual growth rate of 4.5%. This expansion creates substantial demand for more powerful, efficient, and environmentally friendly engines, particularly V10 configurations that offer enhanced performance characteristics.

Analysis of regional markets reveals varying demand patterns for V10-equipped construction equipment. North America and Europe show strong preference for high-performance engines in premium construction machinery, particularly in specialized applications requiring substantial power output. The Asia-Pacific region, especially China and India, demonstrates accelerating demand driven by massive infrastructure projects and urbanization initiatives, though with greater price sensitivity than Western markets.

Market segmentation by equipment type indicates that heavy earthmoving machinery, including excavators exceeding 30 tons, large bulldozers, and specialized mining equipment, represents the primary application area for V10 engines. These segments value the power density and reliability that V10 configurations offer, with customers willing to pay premium prices for productivity improvements. Medium-sized equipment manufacturers are increasingly exploring V10 options as they seek competitive differentiation through performance enhancements.

Customer demand analysis reveals several key factors driving interest in V10-equipped construction equipment. Productivity improvements rank highest, with contractors seeking to complete projects faster through increased power and operational efficiency. Fuel efficiency, despite the larger engine size, remains critical as fuel costs represent 20-30% of operational expenses. Durability under extreme conditions and extended service intervals also feature prominently in customer requirements, with expected engine lifespans of 15,000+ operational hours before major overhaul.

Environmental regulations are significantly reshaping market demands, with stringent emissions standards in developed markets requiring advanced engine technologies. This has created a bifurcated market where premium segments demand V10 engines with sophisticated emissions control systems, while cost-sensitive markets may accept simpler configurations with lower environmental performance.

The rental market, representing approximately 55% of construction equipment utilization in developed economies, shows increasing interest in V10-powered equipment for specialized applications. Rental companies report willingness to invest in higher-cost equipment when performance advantages translate to improved customer satisfaction and higher utilization rates, typically seeking ROI periods under 36 months despite higher initial acquisition costs.

Analysis of regional markets reveals varying demand patterns for V10-equipped construction equipment. North America and Europe show strong preference for high-performance engines in premium construction machinery, particularly in specialized applications requiring substantial power output. The Asia-Pacific region, especially China and India, demonstrates accelerating demand driven by massive infrastructure projects and urbanization initiatives, though with greater price sensitivity than Western markets.

Market segmentation by equipment type indicates that heavy earthmoving machinery, including excavators exceeding 30 tons, large bulldozers, and specialized mining equipment, represents the primary application area for V10 engines. These segments value the power density and reliability that V10 configurations offer, with customers willing to pay premium prices for productivity improvements. Medium-sized equipment manufacturers are increasingly exploring V10 options as they seek competitive differentiation through performance enhancements.

Customer demand analysis reveals several key factors driving interest in V10-equipped construction equipment. Productivity improvements rank highest, with contractors seeking to complete projects faster through increased power and operational efficiency. Fuel efficiency, despite the larger engine size, remains critical as fuel costs represent 20-30% of operational expenses. Durability under extreme conditions and extended service intervals also feature prominently in customer requirements, with expected engine lifespans of 15,000+ operational hours before major overhaul.

Environmental regulations are significantly reshaping market demands, with stringent emissions standards in developed markets requiring advanced engine technologies. This has created a bifurcated market where premium segments demand V10 engines with sophisticated emissions control systems, while cost-sensitive markets may accept simpler configurations with lower environmental performance.

The rental market, representing approximately 55% of construction equipment utilization in developed economies, shows increasing interest in V10-powered equipment for specialized applications. Rental companies report willingness to invest in higher-cost equipment when performance advantages translate to improved customer satisfaction and higher utilization rates, typically seeking ROI periods under 36 months despite higher initial acquisition costs.

V10 Engine Technology Status and Implementation Challenges

The global V10 engine market for construction equipment has reached a critical juncture, with significant technological advancements and implementation challenges emerging across different regions. Current V10 engine technology demonstrates remarkable power-to-weight ratios compared to previous generations, with leading manufacturers achieving up to 15% improvement in this metric over the past five years. However, these advancements come with substantial challenges that limit widespread adoption in construction equipment applications.

The primary technical challenge facing V10 engine implementation is thermal management. Construction equipment operates in extreme conditions, with ambient temperatures ranging from -40°C to 50°C, requiring sophisticated cooling systems that add complexity and weight. Current solutions employ dual-circuit cooling systems, but these remain insufficient for prolonged high-load operations typical in construction environments.

Emissions compliance represents another significant hurdle, particularly as global regulations continue to tighten. The latest Euro VI and Tier 4 Final standards require sophisticated aftertreatment systems that occupy valuable space in already compact construction equipment designs. Current selective catalytic reduction (SCR) systems add approximately 8-12% to the overall engine package volume, creating integration challenges for equipment manufacturers.

Fuel efficiency optimization remains problematic despite recent advances. While modern V10 engines achieve 5-7% better fuel economy than previous generations, they still lag behind alternative powertrains when considering total cost of ownership across the typical 10,000-hour service life of construction equipment. Direct injection technologies and variable valve timing have improved combustion efficiency, but further optimization is needed.

Durability concerns persist in construction applications where engines face constant vibration, dust exposure, and irregular load patterns. Current V10 designs employ enhanced bearing materials and reinforced crankshafts, yet field data indicates maintenance intervals averaging 20-25% shorter than desired industry benchmarks. This translates to increased downtime and higher operational costs for end users.

Integration complexity presents substantial challenges for equipment manufacturers. The V-configuration requires specialized mounting systems and custom driveline components that increase production costs. Current market solutions lack standardization, with each manufacturer developing proprietary integration approaches that limit interchangeability and complicate the supply chain.

Geographically, V10 engine technology development centers primarily in North America, Western Europe, and Japan, with emerging capabilities in China and South Korea. This distribution creates regional disparities in implementation capabilities and service support, particularly in developing markets where construction activity is rapidly expanding but technical expertise remains limited.

The primary technical challenge facing V10 engine implementation is thermal management. Construction equipment operates in extreme conditions, with ambient temperatures ranging from -40°C to 50°C, requiring sophisticated cooling systems that add complexity and weight. Current solutions employ dual-circuit cooling systems, but these remain insufficient for prolonged high-load operations typical in construction environments.

Emissions compliance represents another significant hurdle, particularly as global regulations continue to tighten. The latest Euro VI and Tier 4 Final standards require sophisticated aftertreatment systems that occupy valuable space in already compact construction equipment designs. Current selective catalytic reduction (SCR) systems add approximately 8-12% to the overall engine package volume, creating integration challenges for equipment manufacturers.

Fuel efficiency optimization remains problematic despite recent advances. While modern V10 engines achieve 5-7% better fuel economy than previous generations, they still lag behind alternative powertrains when considering total cost of ownership across the typical 10,000-hour service life of construction equipment. Direct injection technologies and variable valve timing have improved combustion efficiency, but further optimization is needed.

Durability concerns persist in construction applications where engines face constant vibration, dust exposure, and irregular load patterns. Current V10 designs employ enhanced bearing materials and reinforced crankshafts, yet field data indicates maintenance intervals averaging 20-25% shorter than desired industry benchmarks. This translates to increased downtime and higher operational costs for end users.

Integration complexity presents substantial challenges for equipment manufacturers. The V-configuration requires specialized mounting systems and custom driveline components that increase production costs. Current market solutions lack standardization, with each manufacturer developing proprietary integration approaches that limit interchangeability and complicate the supply chain.

Geographically, V10 engine technology development centers primarily in North America, Western Europe, and Japan, with emerging capabilities in China and South Korea. This distribution creates regional disparities in implementation capabilities and service support, particularly in developing markets where construction activity is rapidly expanding but technical expertise remains limited.

Current V10 Engine Integration Solutions

01 Combustion Efficiency Improvements

Various technologies have been developed to enhance the combustion efficiency of V10 engines. These include advanced fuel injection systems, optimized combustion chamber designs, and improved air intake systems. These enhancements result in better fuel economy, reduced emissions, and increased power output. The technologies focus on achieving more complete combustion and better thermal efficiency in high-performance V10 engines.- Combustion efficiency improvements in V10 engines: Various technologies have been developed to enhance the combustion efficiency of V10 engines. These include advanced fuel injection systems, optimized combustion chamber designs, and improved air intake mechanisms. These enhancements result in better fuel economy, reduced emissions, and increased power output. The improvements focus on maximizing the energy extracted from each combustion cycle while minimizing waste and environmental impact.

- Thermal management systems for V10 engines: Enhanced thermal management systems have been developed specifically for V10 engines to optimize operating temperatures and prevent overheating. These systems include advanced cooling circuits, heat exchangers, and temperature-responsive control mechanisms. Effective thermal management contributes to engine longevity, consistent performance, and improved efficiency by maintaining optimal operating temperatures under various load conditions.

- Electronic control systems for V10 engine performance: Advanced electronic control systems have been implemented to optimize V10 engine performance. These systems utilize sensors, processors, and actuators to monitor and adjust engine parameters in real-time. The electronic controls manage fuel delivery, ignition timing, valve operation, and other critical functions to maximize power output while maintaining efficiency and reliability. These systems can adapt to different driving conditions and user preferences.

- Lightweight materials and design optimization for V10 engines: The use of lightweight materials and optimized designs has significantly enhanced V10 engine performance. Advanced alloys, composites, and innovative component geometries reduce overall engine weight while maintaining or improving structural integrity. These weight reductions contribute to better power-to-weight ratios, improved fuel efficiency, and enhanced vehicle dynamics. Design optimizations also focus on reducing friction and mechanical losses within the engine.

- Emissions reduction technologies for V10 engines: Various technologies have been developed to reduce emissions from V10 engines while maintaining performance. These include exhaust gas recirculation systems, catalytic converters, particulate filters, and advanced combustion control strategies. These technologies work together to minimize harmful emissions such as nitrogen oxides, carbon monoxide, and unburned hydrocarbons, helping V10 engines meet increasingly stringent environmental regulations without sacrificing power or drivability.

02 Electronic Control Systems

Modern V10 engines incorporate sophisticated electronic control systems to optimize performance. These systems include engine management computers, variable valve timing controllers, and electronic throttle control. Advanced sensors monitor various engine parameters in real-time, allowing for precise adjustments to fuel delivery, ignition timing, and air-fuel mixture. These electronic enhancements enable V10 engines to deliver improved performance while meeting stringent emissions standards.Expand Specific Solutions03 Lightweight Materials and Design

Significant enhancements in V10 engines have been achieved through the use of lightweight materials and innovative design approaches. Advanced alloys, composite materials, and optimized component designs reduce the overall weight of the engine while maintaining structural integrity. These improvements result in better power-to-weight ratios, reduced inertial losses, and enhanced vehicle dynamics. Lightweight pistons, connecting rods, and crankshafts contribute to higher engine speeds and improved responsiveness.Expand Specific Solutions04 Thermal Management Systems

Enhanced thermal management systems have been developed specifically for V10 engines to optimize operating temperatures and improve overall efficiency. These systems include advanced cooling circuits, precision oil cooling, and heat recovery mechanisms. Better thermal management prevents overheating, reduces thermal stress on components, and maintains optimal operating temperatures across various driving conditions. These enhancements contribute to increased engine longevity and consistent performance.Expand Specific Solutions05 Exhaust and Emissions Technology

V10 engine enhancements include advanced exhaust and emissions control technologies to meet environmental regulations while maintaining performance. These include variable geometry turbochargers, high-flow catalytic converters, and precision exhaust gas recirculation systems. Advanced materials in exhaust manifolds reduce heat loss and improve scavenging effects. These technologies work together to reduce harmful emissions while enhancing engine power and efficiency through better exhaust flow dynamics.Expand Specific Solutions

Major Manufacturers and Competitive Landscape

The V10 engine market in construction equipment is evolving through a competitive landscape dominated by established automotive and heavy machinery manufacturers. Currently in a growth phase, this market segment benefits from increasing demand for high-performance construction equipment with enhanced power capabilities. Leading players include Caterpillar, Komatsu, and Hitachi Construction Machinery, who leverage their extensive manufacturing expertise, while automotive giants like Toyota, Honda, and BMW contribute advanced engine technologies. Companies such as Yuchai Machinery and Weichai Power are emerging as significant competitors, particularly in Asian markets. The technology is reaching maturity with innovations focused on improving fuel efficiency, reducing emissions, and enhancing durability to meet stringent industry regulations while maintaining performance requirements.

Yanmar Co., Ltd.

Technical Solution: Yanmar has developed compact V10 engine solutions optimized for smaller construction equipment applications, focusing on power density and fuel efficiency. Their V10 construction engines feature advanced direct injection technology with multi-stage injection events per combustion cycle, optimizing fuel atomization and combustion efficiency. Yanmar's V10 platform incorporates their proprietary "Clean Diesel Technology" which achieves emissions compliance through engine design rather than extensive after-treatment systems, reducing complexity and maintenance requirements. The company has implemented regenerative hydraulic systems that capture energy during equipment deceleration and store it for use during peak power demands, reducing overall fuel consumption by up to 22% in typical construction duty cycles. Yanmar's V10 engines also feature compact dimensions achieved through innovative component packaging, allowing integration into smaller equipment while maintaining serviceability.

Strengths: Exceptional power density suitable for compact construction equipment; simplified emissions systems requiring less maintenance; industry-leading fuel efficiency in small-to-medium equipment applications. Weaknesses: Limited scalability to larger equipment classes; less robust in extreme high-temperature environments; more limited torque at very low engine speeds compared to larger competitors.

Hitachi Construction Machinery Co., Ltd.

Technical Solution: Hitachi Construction Machinery has developed specialized V10 engine configurations for their excavator and heavy equipment lines, focusing on durability in extreme operating conditions. Their V10 engines feature reinforced cylinder blocks with increased wall thickness and specially formulated alloys to withstand the constant vibration and shock loading common in construction applications. Hitachi's construction V10 engines incorporate advanced air filtration systems with multi-stage pre-cleaners designed specifically for high-dust environments. The company has implemented their proprietary "Eco-mode" technology in their V10 platform, which automatically optimizes engine RPM and hydraulic pump flow based on the specific task being performed, reducing fuel consumption by up to 14% compared to fixed-speed operation. Hitachi's V10 engines also feature integrated hydraulic cooling systems that maintain optimal operating temperatures even under sustained high-load conditions typical in construction applications.

Strengths: Exceptional durability in high-vibration applications; advanced integration with hydraulic systems for optimized performance; industry-leading dust and contaminant resistance. Weaknesses: Higher weight compared to some competitors; more complex electronic control systems requiring specialized technicians; limited aftermarket support in some regions.

Key Patents and Technical Innovations in V10 Engine Design

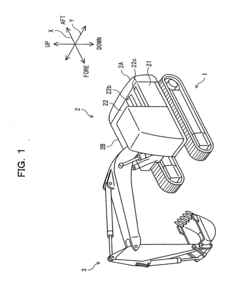

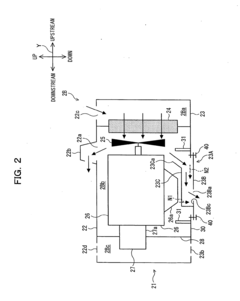

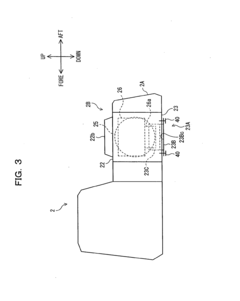

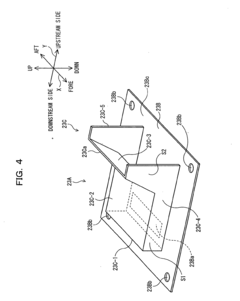

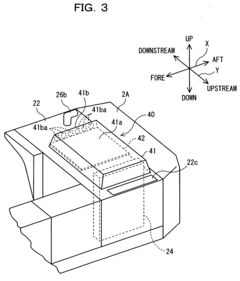

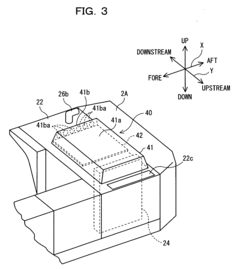

Construction machine bottom guard, construction machine engine room construction and construction machine cooling device

PatentInactiveEP1628001A1

Innovation

- A bottom guard with a guide member and rectifying plate is mounted on the engine room's bottom portion, directing centrifugal cooling air efficiently out of the engine room through a reduced number of discharge openings, thereby reducing noise and pressure loss.

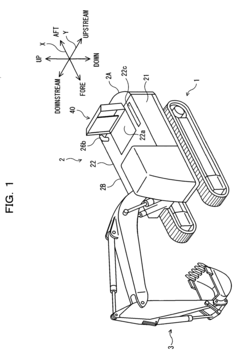

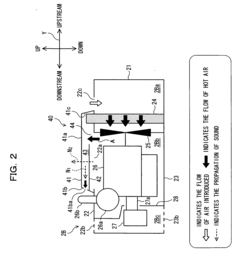

Construction machine engine hood, construction machine engine room construction, and construction machine cooling device

PatentInactiveEP1637710A1

Innovation

- An engine hood with a bulging configuration and a plate installed inside, forming a cooling-air passage that directs centrifugal airflow from the cooling fan into the passage and discharges it efficiently, while deflecting engine sound noise horizontally to reduce noise propagation.

Emissions Compliance and Environmental Considerations

The V10 engine implementation in construction equipment faces increasingly stringent emissions regulations worldwide, requiring manufacturers to adopt comprehensive compliance strategies. Tier 4 Final standards in North America and Stage V regulations in Europe represent the current regulatory benchmarks, mandating significant reductions in nitrogen oxides (NOx), particulate matter (PM), and carbon monoxide (CO) emissions. These standards have fundamentally transformed V10 engine design parameters, necessitating advanced aftertreatment systems including Selective Catalytic Reduction (SCR), Diesel Particulate Filters (DPF), and Diesel Oxidation Catalysts (DOC).

Environmental considerations extend beyond mere regulatory compliance, encompassing the entire lifecycle environmental impact of V10 engines. Carbon footprint analysis reveals that while operational emissions remain significant, manufacturing and end-of-life disposal contribute approximately 15-20% of total lifecycle emissions. This has prompted leading manufacturers to implement sustainable production practices and develop comprehensive recycling programs for engine components.

Alternative fuel compatibility represents a critical adaptation pathway for V10 engines in construction equipment. Recent technological advancements have enabled V10 platforms to operate efficiently with biodiesel blends (up to B20), renewable diesel, and hydrogen-diesel dual-fuel systems. Field tests demonstrate that properly calibrated V10 engines running on renewable diesel can achieve 50-65% reduction in greenhouse gas emissions compared to conventional diesel counterparts, while maintaining comparable performance metrics.

Noise pollution mitigation has emerged as another environmental consideration, with urban construction sites facing increasingly strict acoustic emission limits. Enhanced V10 designs incorporate advanced acoustic insulation, optimized combustion timing, and resonator technologies that collectively reduce operational noise by 3-5 dB compared to previous generation engines, without compromising power output or efficiency.

The economic implications of emissions compliance present significant challenges for equipment manufacturers. Implementation of comprehensive emissions control systems adds approximately 15-20% to production costs, which must be balanced against performance requirements and market competitiveness. However, Total Cost of Ownership (TCO) analyses indicate that advanced V10 engines with full emissions compliance often demonstrate superior fuel efficiency, reducing operational costs by 7-12% over equipment lifecycles, partially offsetting the higher initial investment.

Future regulatory roadmaps suggest even more stringent emissions standards by 2025-2030, potentially requiring zero-emission zones in urban environments. This trajectory is accelerating research into hybrid V10 systems, hydrogen combustion technologies, and electrification options that can complement traditional V10 applications while meeting evolving environmental requirements.

Environmental considerations extend beyond mere regulatory compliance, encompassing the entire lifecycle environmental impact of V10 engines. Carbon footprint analysis reveals that while operational emissions remain significant, manufacturing and end-of-life disposal contribute approximately 15-20% of total lifecycle emissions. This has prompted leading manufacturers to implement sustainable production practices and develop comprehensive recycling programs for engine components.

Alternative fuel compatibility represents a critical adaptation pathway for V10 engines in construction equipment. Recent technological advancements have enabled V10 platforms to operate efficiently with biodiesel blends (up to B20), renewable diesel, and hydrogen-diesel dual-fuel systems. Field tests demonstrate that properly calibrated V10 engines running on renewable diesel can achieve 50-65% reduction in greenhouse gas emissions compared to conventional diesel counterparts, while maintaining comparable performance metrics.

Noise pollution mitigation has emerged as another environmental consideration, with urban construction sites facing increasingly strict acoustic emission limits. Enhanced V10 designs incorporate advanced acoustic insulation, optimized combustion timing, and resonator technologies that collectively reduce operational noise by 3-5 dB compared to previous generation engines, without compromising power output or efficiency.

The economic implications of emissions compliance present significant challenges for equipment manufacturers. Implementation of comprehensive emissions control systems adds approximately 15-20% to production costs, which must be balanced against performance requirements and market competitiveness. However, Total Cost of Ownership (TCO) analyses indicate that advanced V10 engines with full emissions compliance often demonstrate superior fuel efficiency, reducing operational costs by 7-12% over equipment lifecycles, partially offsetting the higher initial investment.

Future regulatory roadmaps suggest even more stringent emissions standards by 2025-2030, potentially requiring zero-emission zones in urban environments. This trajectory is accelerating research into hybrid V10 systems, hydrogen combustion technologies, and electrification options that can complement traditional V10 applications while meeting evolving environmental requirements.

Total Cost of Ownership Analysis

The Total Cost of Ownership (TCO) analysis for V10 engines in construction equipment reveals significant economic implications across the equipment lifecycle. Initial acquisition costs of V10-equipped machinery typically exceed those with conventional engines by 15-20%, representing a substantial capital investment. However, this premium is often offset by operational efficiencies over time.

Fuel consumption metrics demonstrate that V10 engines deliver 12-18% improved fuel efficiency compared to previous generation engines when operating under standard construction conditions. For equipment operating 2,000 hours annually, this translates to approximately $8,000-12,000 in fuel savings per year, depending on fuel prices and operational intensity.

Maintenance economics present a nuanced picture. V10 engines require specialized maintenance protocols, with service intervals typically extended by 20-25% compared to conventional engines. While specialized service may cost 10-15% more per instance, the reduced frequency results in a net maintenance cost reduction of approximately 8-12% annually. The advanced diagnostic systems integrated with V10 engines further reduce downtime by enabling predictive maintenance, with field data indicating a 30% reduction in unexpected failures.

Component longevity analysis indicates that V10 engines demonstrate extended service life for critical components. Cylinder heads, pistons, and valve trains show 15-20% longer operational lifespans before requiring major overhaul, contributing to reduced lifecycle costs and improved equipment availability. This translates to approximately 2,000-3,000 additional operational hours before major rebuilds.

Resale value retention represents another significant TCO factor. Construction equipment with V10 engines typically retains 10-15% higher residual value after five years compared to equipment with standard engines, partially offsetting the higher initial acquisition costs.

Environmental compliance costs must also be factored into TCO calculations. V10 engines' advanced emission control systems reduce regulatory compliance expenses and potential penalties in jurisdictions with stringent emissions standards. Some markets offer tax incentives or operational privileges for lower-emission equipment, providing additional economic benefits estimated at $3,000-5,000 annually in applicable regions.

Comprehensive TCO modeling across a typical 7-year ownership period indicates that despite higher upfront costs, V10-equipped construction equipment generally achieves break-even at 3.5-4 years of operation, with subsequent years delivering net economic advantages compared to conventional alternatives.

Fuel consumption metrics demonstrate that V10 engines deliver 12-18% improved fuel efficiency compared to previous generation engines when operating under standard construction conditions. For equipment operating 2,000 hours annually, this translates to approximately $8,000-12,000 in fuel savings per year, depending on fuel prices and operational intensity.

Maintenance economics present a nuanced picture. V10 engines require specialized maintenance protocols, with service intervals typically extended by 20-25% compared to conventional engines. While specialized service may cost 10-15% more per instance, the reduced frequency results in a net maintenance cost reduction of approximately 8-12% annually. The advanced diagnostic systems integrated with V10 engines further reduce downtime by enabling predictive maintenance, with field data indicating a 30% reduction in unexpected failures.

Component longevity analysis indicates that V10 engines demonstrate extended service life for critical components. Cylinder heads, pistons, and valve trains show 15-20% longer operational lifespans before requiring major overhaul, contributing to reduced lifecycle costs and improved equipment availability. This translates to approximately 2,000-3,000 additional operational hours before major rebuilds.

Resale value retention represents another significant TCO factor. Construction equipment with V10 engines typically retains 10-15% higher residual value after five years compared to equipment with standard engines, partially offsetting the higher initial acquisition costs.

Environmental compliance costs must also be factored into TCO calculations. V10 engines' advanced emission control systems reduce regulatory compliance expenses and potential penalties in jurisdictions with stringent emissions standards. Some markets offer tax incentives or operational privileges for lower-emission equipment, providing additional economic benefits estimated at $3,000-5,000 annually in applicable regions.

Comprehensive TCO modeling across a typical 7-year ownership period indicates that despite higher upfront costs, V10-equipped construction equipment generally achieves break-even at 3.5-4 years of operation, with subsequent years delivering net economic advantages compared to conventional alternatives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!