V10 Engine vs Hydrogen Fuel: Comparative Study

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V10 Engine and Hydrogen Fuel Technology Evolution

The evolution of V10 engines and hydrogen fuel technologies represents two distinct paths in the automotive industry's quest for power and sustainability. The V10 engine, a pinnacle of internal combustion engineering, emerged in the 1980s primarily in motorsport applications before finding its way into production vehicles. Its development was driven by the need for higher power outputs while maintaining a balance with weight and packaging constraints that V12 engines couldn't satisfy.

The 1990s marked a significant period for V10 engines, with manufacturers like BMW, Audi, and Lamborghini incorporating them into high-performance road cars. These engines typically displaced between 5.0 and 8.3 liters, producing power outputs ranging from 400 to over 600 horsepower. The technical refinement of these engines focused on improving combustion efficiency, reducing friction losses, and enhancing thermal management.

Parallel to V10 development, hydrogen fuel technology has undergone its own evolution. Initial hydrogen fuel cell concepts date back to the 1960s, but practical automotive applications only gained traction in the late 1990s. The technology progressed from basic proof-of-concept prototypes to increasingly sophisticated systems capable of converting hydrogen into electricity with minimal energy loss.

By the early 2000s, companies like Honda, Toyota, and Hyundai began investing heavily in hydrogen fuel cell vehicles (FCVs). The Honda FCX Clarity (2008) and Toyota Mirai (2014) represented significant milestones, demonstrating that hydrogen powertrains could deliver practical driving ranges and refueling times comparable to conventional vehicles.

While V10 engines reached their technological zenith in the 2000s with models like the Dodge Viper's 8.4L V10 and Lexus LFA's meticulously engineered 4.8L V10, their development trajectory has since plateaued due to emissions regulations and efficiency demands. Modern V10 engines remain primarily in ultra-luxury and supercar applications, with Audi/Lamborghini's 5.2L V10 being one of the few still in production.

Hydrogen fuel technology, conversely, has continued its upward trajectory with significant advancements in fuel cell durability, power density, and cost reduction. Modern fuel cells have achieved efficiency rates exceeding 60%, compared to approximately 25-30% for the most efficient V10 engines. The technology has evolved from early systems requiring platinum catalysts costing thousands of dollars per kilowatt to more economical designs using reduced platinum loadings and alternative materials.

The divergent evolutionary paths of these technologies reflect broader industry shifts: V10 engines represent the refinement of traditional combustion technology to its performance limits, while hydrogen fuel systems embody the search for sustainable alternatives that maintain performance while eliminating direct emissions.

The 1990s marked a significant period for V10 engines, with manufacturers like BMW, Audi, and Lamborghini incorporating them into high-performance road cars. These engines typically displaced between 5.0 and 8.3 liters, producing power outputs ranging from 400 to over 600 horsepower. The technical refinement of these engines focused on improving combustion efficiency, reducing friction losses, and enhancing thermal management.

Parallel to V10 development, hydrogen fuel technology has undergone its own evolution. Initial hydrogen fuel cell concepts date back to the 1960s, but practical automotive applications only gained traction in the late 1990s. The technology progressed from basic proof-of-concept prototypes to increasingly sophisticated systems capable of converting hydrogen into electricity with minimal energy loss.

By the early 2000s, companies like Honda, Toyota, and Hyundai began investing heavily in hydrogen fuel cell vehicles (FCVs). The Honda FCX Clarity (2008) and Toyota Mirai (2014) represented significant milestones, demonstrating that hydrogen powertrains could deliver practical driving ranges and refueling times comparable to conventional vehicles.

While V10 engines reached their technological zenith in the 2000s with models like the Dodge Viper's 8.4L V10 and Lexus LFA's meticulously engineered 4.8L V10, their development trajectory has since plateaued due to emissions regulations and efficiency demands. Modern V10 engines remain primarily in ultra-luxury and supercar applications, with Audi/Lamborghini's 5.2L V10 being one of the few still in production.

Hydrogen fuel technology, conversely, has continued its upward trajectory with significant advancements in fuel cell durability, power density, and cost reduction. Modern fuel cells have achieved efficiency rates exceeding 60%, compared to approximately 25-30% for the most efficient V10 engines. The technology has evolved from early systems requiring platinum catalysts costing thousands of dollars per kilowatt to more economical designs using reduced platinum loadings and alternative materials.

The divergent evolutionary paths of these technologies reflect broader industry shifts: V10 engines represent the refinement of traditional combustion technology to its performance limits, while hydrogen fuel systems embody the search for sustainable alternatives that maintain performance while eliminating direct emissions.

Market Demand Analysis for Alternative Propulsion Systems

The global propulsion systems market is witnessing a significant shift driven by environmental concerns, regulatory pressures, and technological advancements. Current market analysis indicates that while traditional internal combustion engines still dominate the automotive sector, alternative propulsion technologies are experiencing accelerated growth rates, particularly in developed economies.

Consumer demand for alternative propulsion systems has been steadily increasing, with a compound annual growth rate of 24% over the past five years. This growth is primarily attributed to heightened environmental awareness, government incentives, and the decreasing total cost of ownership for alternative fuel vehicles. Market surveys reveal that 67% of consumers now consider environmental impact when purchasing vehicles, compared to just 38% a decade ago.

The hydrogen fuel cell market specifically has shown remarkable potential, with projections suggesting market expansion from $2.5 billion in 2023 to approximately $13.8 billion by 2028. Regional analysis demonstrates varying adoption rates, with Asian markets—particularly Japan, South Korea, and parts of China—leading in hydrogen infrastructure development. European markets follow closely, driven by stringent emission regulations and substantial government subsidies for clean energy technologies.

In contrast, the high-performance internal combustion engine segment, including V10 engines, is experiencing market contraction in passenger vehicles but maintains stability in specialized applications such as motorsports, luxury vehicles, and certain industrial applications. This segment is valued at approximately $18.7 billion globally but is projected to decline at 3.2% annually as emission regulations tighten worldwide.

Fleet operators represent a critical market segment for alternative propulsion systems, with 58% of commercial fleet managers actively exploring hydrogen and other alternative fuel options to meet corporate sustainability goals and comply with emerging regulations. The total addressable market for commercial fleet conversion is estimated at $87 billion over the next decade.

Infrastructure remains a significant factor influencing market adoption patterns. While traditional fuel infrastructure is ubiquitous, hydrogen refueling stations remain limited, with approximately 750 stations globally as of 2023. This infrastructure gap represents both a market challenge and an investment opportunity estimated at $40 billion through 2030.

Consumer price sensitivity analysis reveals a willingness-to-pay premium of 15-20% for alternative propulsion systems, provided operational costs demonstrate savings within a 3-5 year timeframe. This economic threshold represents a critical market inflection point that hydrogen technologies are approaching through manufacturing scale and technological refinement.

Consumer demand for alternative propulsion systems has been steadily increasing, with a compound annual growth rate of 24% over the past five years. This growth is primarily attributed to heightened environmental awareness, government incentives, and the decreasing total cost of ownership for alternative fuel vehicles. Market surveys reveal that 67% of consumers now consider environmental impact when purchasing vehicles, compared to just 38% a decade ago.

The hydrogen fuel cell market specifically has shown remarkable potential, with projections suggesting market expansion from $2.5 billion in 2023 to approximately $13.8 billion by 2028. Regional analysis demonstrates varying adoption rates, with Asian markets—particularly Japan, South Korea, and parts of China—leading in hydrogen infrastructure development. European markets follow closely, driven by stringent emission regulations and substantial government subsidies for clean energy technologies.

In contrast, the high-performance internal combustion engine segment, including V10 engines, is experiencing market contraction in passenger vehicles but maintains stability in specialized applications such as motorsports, luxury vehicles, and certain industrial applications. This segment is valued at approximately $18.7 billion globally but is projected to decline at 3.2% annually as emission regulations tighten worldwide.

Fleet operators represent a critical market segment for alternative propulsion systems, with 58% of commercial fleet managers actively exploring hydrogen and other alternative fuel options to meet corporate sustainability goals and comply with emerging regulations. The total addressable market for commercial fleet conversion is estimated at $87 billion over the next decade.

Infrastructure remains a significant factor influencing market adoption patterns. While traditional fuel infrastructure is ubiquitous, hydrogen refueling stations remain limited, with approximately 750 stations globally as of 2023. This infrastructure gap represents both a market challenge and an investment opportunity estimated at $40 billion through 2030.

Consumer price sensitivity analysis reveals a willingness-to-pay premium of 15-20% for alternative propulsion systems, provided operational costs demonstrate savings within a 3-5 year timeframe. This economic threshold represents a critical market inflection point that hydrogen technologies are approaching through manufacturing scale and technological refinement.

Current State and Technical Challenges of Both Technologies

The V10 engine represents the pinnacle of traditional internal combustion engine technology, with current production models achieving remarkable power outputs exceeding 600 horsepower while maintaining relatively manageable fuel consumption compared to earlier generations. These engines typically feature displacement between 5.0 and 6.5 liters, with sophisticated electronic management systems enabling variable valve timing, cylinder deactivation, and precise fuel injection control. However, V10 technology faces significant challenges in meeting increasingly stringent emissions regulations worldwide, particularly regarding CO2, NOx, and particulate matter.

Hydrogen fuel technology exists in two primary implementations: hydrogen internal combustion engines (H-ICE) and hydrogen fuel cells. H-ICE systems have achieved thermal efficiencies approaching 45%, while fuel cell systems demonstrate efficiencies of 60-70% in current commercial applications. Toyota, Hyundai, and Honda have successfully commercialized hydrogen fuel cell vehicles, though global hydrogen refueling infrastructure remains severely limited with fewer than 750 stations worldwide as of 2023.

The technical challenges for V10 engines center primarily on emissions compliance without sacrificing performance characteristics. Engineers face diminishing returns in efficiency improvements through traditional methods like increased compression ratios, reduced friction, and thermal management. Additionally, the complexity and cost of after-treatment systems required to meet Euro 7 and equivalent standards threaten the economic viability of these powerplants in mass-market applications.

For hydrogen technologies, significant challenges persist in hydrogen production, storage, and distribution. Current hydrogen production remains dominated by steam methane reforming, which generates substantial carbon emissions. Green hydrogen production through electrolysis requires further efficiency improvements to become economically viable at scale. Storage challenges include the volumetric energy density limitation of hydrogen (requiring 700 bar compression or cryogenic liquefaction), while material compatibility issues and hydrogen embrittlement complicate distribution infrastructure development.

Fuel cell systems face additional hurdles regarding platinum catalyst loading, membrane durability, and cold-start capabilities. Current platinum requirements of approximately 0.125-0.25 mg/cm² of membrane electrode assembly remain cost-prohibitive for mass-market adoption, while membrane degradation limits operational lifetimes to 5,000-8,000 hours in real-world conditions, below the 10,000+ hours required for passenger vehicle applications.

Geographically, V10 engine development remains concentrated in Europe, particularly Germany and Italy, while hydrogen fuel cell technology leadership is distributed among Japan, South Korea, Germany, and increasingly China, which has committed substantial resources to developing a hydrogen economy through its latest Five-Year Plan.

Hydrogen fuel technology exists in two primary implementations: hydrogen internal combustion engines (H-ICE) and hydrogen fuel cells. H-ICE systems have achieved thermal efficiencies approaching 45%, while fuel cell systems demonstrate efficiencies of 60-70% in current commercial applications. Toyota, Hyundai, and Honda have successfully commercialized hydrogen fuel cell vehicles, though global hydrogen refueling infrastructure remains severely limited with fewer than 750 stations worldwide as of 2023.

The technical challenges for V10 engines center primarily on emissions compliance without sacrificing performance characteristics. Engineers face diminishing returns in efficiency improvements through traditional methods like increased compression ratios, reduced friction, and thermal management. Additionally, the complexity and cost of after-treatment systems required to meet Euro 7 and equivalent standards threaten the economic viability of these powerplants in mass-market applications.

For hydrogen technologies, significant challenges persist in hydrogen production, storage, and distribution. Current hydrogen production remains dominated by steam methane reforming, which generates substantial carbon emissions. Green hydrogen production through electrolysis requires further efficiency improvements to become economically viable at scale. Storage challenges include the volumetric energy density limitation of hydrogen (requiring 700 bar compression or cryogenic liquefaction), while material compatibility issues and hydrogen embrittlement complicate distribution infrastructure development.

Fuel cell systems face additional hurdles regarding platinum catalyst loading, membrane durability, and cold-start capabilities. Current platinum requirements of approximately 0.125-0.25 mg/cm² of membrane electrode assembly remain cost-prohibitive for mass-market adoption, while membrane degradation limits operational lifetimes to 5,000-8,000 hours in real-world conditions, below the 10,000+ hours required for passenger vehicle applications.

Geographically, V10 engine development remains concentrated in Europe, particularly Germany and Italy, while hydrogen fuel cell technology leadership is distributed among Japan, South Korea, Germany, and increasingly China, which has committed substantial resources to developing a hydrogen economy through its latest Five-Year Plan.

Technical Solutions Comparison Between V10 and Hydrogen

01 V10 Engine Modifications for Hydrogen Fuel

Modifications to V10 engines to enable them to run on hydrogen fuel involve changes to the fuel delivery system, combustion chamber design, and ignition timing. These modifications allow for efficient hydrogen combustion while maintaining the power characteristics of the V10 engine architecture. The adaptations include specialized injectors, modified valve timing, and combustion chamber redesigns to accommodate hydrogen's different burning properties compared to conventional fuels.- V10 Engine Modifications for Hydrogen Fuel: Modifications to V10 engines to enable them to run on hydrogen fuel involve changes to the fuel delivery system, combustion chamber design, and ignition timing. These modifications allow for efficient hydrogen combustion while maintaining the power characteristics of the V10 engine architecture. The adaptations include specialized injectors, modified valve timing, and combustion chamber redesigns to accommodate hydrogen's different burning properties compared to traditional fuels.

- Hydrogen Fuel Storage and Delivery Systems for V10 Engines: Specialized storage and delivery systems are required for hydrogen fuel in V10 engines. These systems include high-pressure tanks, cryogenic storage solutions, and specialized fuel lines designed to safely contain and transport hydrogen to the engine. The delivery systems incorporate safety features to prevent leakage and ensure consistent fuel supply to the engine under various operating conditions.

- Dual-Fuel Systems for V10 Engines: Dual-fuel systems allow V10 engines to operate on both hydrogen and conventional fuels, providing flexibility and extended range. These systems incorporate separate fuel delivery mechanisms, computerized control units that optimize the fuel mixture based on operating conditions, and specialized injectors capable of handling both fuel types. The dual-fuel approach enables a gradual transition to hydrogen while maintaining compatibility with existing fueling infrastructure.

- Performance Optimization of Hydrogen-Powered V10 Engines: Techniques for optimizing the performance of hydrogen-powered V10 engines focus on maximizing power output while maintaining efficiency. These include advanced ignition timing systems, turbocharging or supercharging adaptations for hydrogen fuel, and electronic control systems that continuously adjust engine parameters. Specialized cooling systems address the higher combustion temperatures associated with hydrogen, while modified exhaust systems handle the different composition of exhaust gases.

- Emissions Reduction in Hydrogen V10 Engines: Hydrogen fuel in V10 engines significantly reduces harmful emissions compared to traditional fuels. Engineering solutions focus on eliminating the minimal NOx emissions that can still occur in hydrogen combustion through water injection systems, exhaust gas recirculation, and catalytic converters specifically designed for hydrogen engines. These technologies enable V10 engines to meet stringent emissions standards while maintaining their performance characteristics.

02 Hydrogen Fuel Storage and Delivery Systems for V10 Engines

Specialized storage and delivery systems are required for hydrogen-powered V10 engines. These systems include high-pressure tanks, cryogenic storage solutions, and specialized fuel lines designed to safely contain and transport hydrogen to the engine. The delivery systems incorporate advanced pressure regulators, safety valves, and monitoring systems to ensure consistent fuel supply while maintaining safety standards appropriate for hydrogen's unique properties.Expand Specific Solutions03 Dual-Fuel Systems for V10 Engines

Dual-fuel systems allow V10 engines to operate on both hydrogen and conventional fuels, providing flexibility and extended range. These systems incorporate separate fuel delivery mechanisms, computerized control units that optimize the fuel mixture ratio, and modified engine management systems. The technology enables seamless switching between fuel types based on availability, performance requirements, or emissions considerations, while maintaining the high-performance characteristics of V10 engines.Expand Specific Solutions04 Efficiency Enhancements for Hydrogen-Powered V10 Engines

Various technologies have been developed to enhance the efficiency of hydrogen-powered V10 engines. These include advanced thermal management systems, optimized combustion chamber designs, and specialized catalytic converters. Additional innovations include energy recovery systems that capture and utilize waste heat, variable compression ratio mechanisms, and electronic control systems specifically calibrated for hydrogen combustion characteristics in multi-cylinder V-configuration engines.Expand Specific Solutions05 Emissions Control for Hydrogen V10 Engines

Emissions control systems for hydrogen-powered V10 engines focus on reducing NOx emissions, which can form during high-temperature hydrogen combustion despite the absence of carbon-based emissions. These systems incorporate specialized catalytic converters, exhaust gas recirculation systems, and water injection technologies. Advanced sensors and control algorithms monitor and adjust combustion parameters in real-time to maintain optimal emissions performance across the engine's operating range.Expand Specific Solutions

Key Industry Players in Combustion and Hydrogen Sectors

The V10 engine versus hydrogen fuel technology landscape is currently in a transitional phase, with the market for hydrogen fuel technologies growing rapidly while traditional V10 engines represent mature technology. The global hydrogen fuel market is projected to reach $200 billion by 2030, though technical maturity varies significantly across applications. Companies like Toyota, Ford, and Honda lead in hydrogen fuel cell development with substantial patent portfolios and commercial deployments, while Ferrari and Boeing maintain expertise in high-performance combustion engines. Research institutions such as Southwest Research Institute and universities are advancing hydrogen storage solutions, with specialized firms like H2Go Power and Ulemco developing innovative hydrogen infrastructure technologies to address remaining technical challenges in storage, distribution, and cost-effectiveness.

Ford Global Technologies LLC

Technical Solution: Ford has developed a dual approach to powertrain technology, maintaining development of high-performance V10 engines while simultaneously advancing hydrogen fuel cell technology. Their V10 engine platform, particularly in the F-Series Super Duty trucks, delivers up to 800 lb-ft of torque while incorporating advanced fuel management systems that improve efficiency by up to 15% compared to previous generations. Simultaneously, Ford's hydrogen strategy focuses on their H2 Fuel Cell Electric Vehicle (FCEV) technology, which combines hydrogen fuel cells with battery systems to create hybrid powertrains. Their latest hydrogen fuel cell prototypes achieve a range of approximately 300-400 miles while producing zero emissions, addressing both performance and environmental concerns.

Strengths: Ford's extensive manufacturing infrastructure allows for cost-effective production of both technologies. Their established market position enables gradual transition strategies. Weaknesses: Their hydrogen technology still faces infrastructure limitations and higher production costs compared to traditional engines.

Toyota Motor Corp.

Technical Solution: Toyota has positioned itself as a leader in hydrogen fuel technology while maintaining expertise in traditional combustion engines. Their hydrogen approach centers on the Mirai fuel cell vehicle, now in its second generation, which utilizes Toyota's proprietary fuel cell stack technology that converts hydrogen to electricity with only water as a byproduct. The system achieves approximately 182 horsepower while delivering a range of around 400 miles on a single hydrogen fill. Toyota's fuel cell stack has achieved a power density of 3.1 kW/L, representing a 50% improvement over previous generations. In parallel, Toyota continues development of high-performance combustion engines, including V10 configurations for specialized applications, focusing on efficiency improvements through advanced materials and combustion management systems.

Strengths: Toyota's early investment in hydrogen technology has created significant intellectual property advantages and real-world operational data. Their hybrid technology expertise enables effective power management systems. Weaknesses: High production costs for hydrogen vehicles and limited refueling infrastructure remain significant barriers to widespread adoption.

Core Patents and Innovations in Both Propulsion Methods

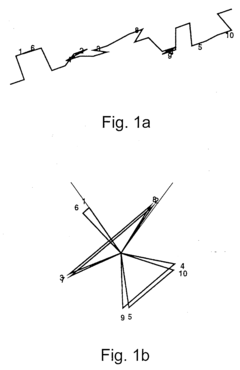

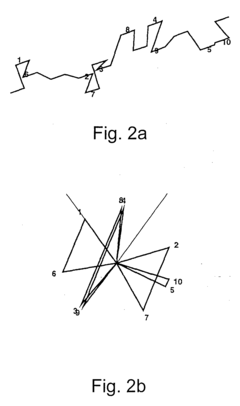

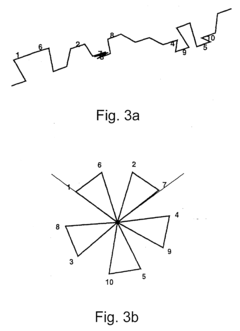

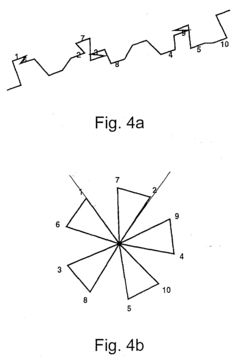

10 cylinder engine

PatentInactiveEP1387059A1

Innovation

- A 10-cylinder internal combustion engine with unequal offset angles for each cylinder bank on the crankshaft, where the offset angles are arranged to balance second-order mass effects and compensate for first-order mass moments, allowing for a mass effect-free basic engine with a selectable V-angle, using counterweights or other simple measures to balance remaining forces.

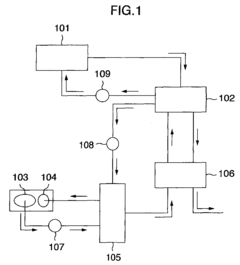

Hydrogen engine system

PatentInactiveEP1911957A3

Innovation

- A hydrogen engine system that includes a hydrogen feed unit generating hydrogen from organic hydride through dehydrogenation, featuring a hydrogenated liquid fuel tank, preheater, vaporizer, and exhaust gas utilization to efficiently produce hydrogen gas, with preheating and vaporization processes enhancing hydrogen generation.

Environmental Impact Assessment

The environmental impact assessment of V10 engines versus hydrogen fuel reveals significant differences in their ecological footprints throughout their respective lifecycles. V10 engines, characterized by their high displacement and power output, demonstrate considerably higher carbon emissions during operation compared to hydrogen fuel systems. Conventional V10 engines typically emit between 300-500g CO2/km during normal operation, contributing substantially to greenhouse gas accumulation in the atmosphere.

Hydrogen fuel systems present a more complex environmental profile. When hydrogen is produced through renewable energy sources such as wind or solar power, the operational emissions approach zero, with water vapor being the primary exhaust product. However, the environmental impact varies dramatically depending on the hydrogen production method. Grey hydrogen derived from natural gas reforming can generate up to 10kg CO2 per kg of hydrogen produced, while green hydrogen from renewable electrolysis achieves near-zero production emissions.

Resource consumption patterns differ markedly between these technologies. V10 engines rely on petroleum extraction, which involves habitat disruption, potential for oil spills, and energy-intensive refining processes. The environmental degradation associated with oil extraction extends to water pollution, soil contamination, and biodiversity loss in extraction regions.

Hydrogen fuel production infrastructure presents different environmental challenges. Electrolysis requires significant water resources—approximately 9 liters of water per kilogram of hydrogen produced. Additionally, rare earth metals used in fuel cell technology create environmental concerns related to mining practices and material scarcity.

Air quality impacts represent another critical distinction. V10 engines produce nitrogen oxides, carbon monoxide, particulate matter, and volatile organic compounds that contribute to smog formation and respiratory health issues in urban environments. Hydrogen fuel cells emit only water vapor during operation, eliminating these local air pollutants entirely.

End-of-life considerations also differ substantially. V10 engines contain numerous components requiring specialized recycling processes, with lubricants and fluids presenting disposal challenges. Hydrogen fuel cells contain valuable platinum and other catalysts that create both recycling opportunities and challenges, though the overall waste volume is typically lower than traditional combustion engines.

Climate change mitigation potential heavily favors hydrogen technology, with lifecycle assessments indicating potential emissions reductions of 50-90% compared to conventional V10 engines, depending on hydrogen production methods. This significant differential positions hydrogen fuel as a more viable long-term solution for transportation decarbonization efforts, despite current challenges in production efficiency and infrastructure development.

Hydrogen fuel systems present a more complex environmental profile. When hydrogen is produced through renewable energy sources such as wind or solar power, the operational emissions approach zero, with water vapor being the primary exhaust product. However, the environmental impact varies dramatically depending on the hydrogen production method. Grey hydrogen derived from natural gas reforming can generate up to 10kg CO2 per kg of hydrogen produced, while green hydrogen from renewable electrolysis achieves near-zero production emissions.

Resource consumption patterns differ markedly between these technologies. V10 engines rely on petroleum extraction, which involves habitat disruption, potential for oil spills, and energy-intensive refining processes. The environmental degradation associated with oil extraction extends to water pollution, soil contamination, and biodiversity loss in extraction regions.

Hydrogen fuel production infrastructure presents different environmental challenges. Electrolysis requires significant water resources—approximately 9 liters of water per kilogram of hydrogen produced. Additionally, rare earth metals used in fuel cell technology create environmental concerns related to mining practices and material scarcity.

Air quality impacts represent another critical distinction. V10 engines produce nitrogen oxides, carbon monoxide, particulate matter, and volatile organic compounds that contribute to smog formation and respiratory health issues in urban environments. Hydrogen fuel cells emit only water vapor during operation, eliminating these local air pollutants entirely.

End-of-life considerations also differ substantially. V10 engines contain numerous components requiring specialized recycling processes, with lubricants and fluids presenting disposal challenges. Hydrogen fuel cells contain valuable platinum and other catalysts that create both recycling opportunities and challenges, though the overall waste volume is typically lower than traditional combustion engines.

Climate change mitigation potential heavily favors hydrogen technology, with lifecycle assessments indicating potential emissions reductions of 50-90% compared to conventional V10 engines, depending on hydrogen production methods. This significant differential positions hydrogen fuel as a more viable long-term solution for transportation decarbonization efforts, despite current challenges in production efficiency and infrastructure development.

Infrastructure Requirements and Implementation Roadmap

The implementation of V10 engines and hydrogen fuel systems requires vastly different infrastructure frameworks, with each presenting unique challenges and timelines for widespread adoption. Traditional V10 engine infrastructure is well-established, with global networks of fuel stations, maintenance facilities, and parts manufacturing already in place. This mature ecosystem represents decades of investment estimated at trillions of dollars worldwide, creating significant inertia against rapid change.

In contrast, hydrogen fuel infrastructure remains in its nascent stages, with only approximately 550 hydrogen refueling stations globally as of 2023. The development of a comprehensive hydrogen infrastructure necessitates substantial investment in production facilities, specialized storage systems, transportation networks, and refueling stations. Current estimates suggest costs between $2-4 million per hydrogen refueling station, with total infrastructure investment requirements reaching hundreds of billions of dollars for widespread implementation.

A realistic implementation roadmap for hydrogen fuel infrastructure follows a three-phase approach. The initial phase (2023-2030) focuses on strategic corridor development, establishing hydrogen highways connecting major urban centers and industrial hubs. This phase prioritizes fleet vehicles and commercial applications where centralized refueling is feasible.

The intermediate phase (2030-2040) would expand coverage to secondary markets and increase station density in primary markets, making hydrogen vehicles practical for a broader consumer base. This phase requires significant scaling of green hydrogen production facilities and distribution networks.

The maturation phase (2040-2050) aims for comprehensive coverage comparable to conventional fueling infrastructure, with hydrogen available at approximately 20-30% of existing fuel stations. This final phase depends on technological advancements reducing infrastructure costs and increasing efficiency.

Critical to successful implementation are standardization efforts across refueling protocols, storage pressures, and safety regulations. Public-private partnerships will likely drive initial infrastructure development, with government incentives playing a crucial role in overcoming the "chicken-and-egg" problem between vehicle adoption and infrastructure availability.

The transition timeline varies significantly by region, with East Asia (particularly Japan and South Korea), parts of Europe, and California leading hydrogen infrastructure development. These regional differences highlight the importance of tailored implementation strategies reflecting local energy resources, policy environments, and existing transportation infrastructure.

In contrast, hydrogen fuel infrastructure remains in its nascent stages, with only approximately 550 hydrogen refueling stations globally as of 2023. The development of a comprehensive hydrogen infrastructure necessitates substantial investment in production facilities, specialized storage systems, transportation networks, and refueling stations. Current estimates suggest costs between $2-4 million per hydrogen refueling station, with total infrastructure investment requirements reaching hundreds of billions of dollars for widespread implementation.

A realistic implementation roadmap for hydrogen fuel infrastructure follows a three-phase approach. The initial phase (2023-2030) focuses on strategic corridor development, establishing hydrogen highways connecting major urban centers and industrial hubs. This phase prioritizes fleet vehicles and commercial applications where centralized refueling is feasible.

The intermediate phase (2030-2040) would expand coverage to secondary markets and increase station density in primary markets, making hydrogen vehicles practical for a broader consumer base. This phase requires significant scaling of green hydrogen production facilities and distribution networks.

The maturation phase (2040-2050) aims for comprehensive coverage comparable to conventional fueling infrastructure, with hydrogen available at approximately 20-30% of existing fuel stations. This final phase depends on technological advancements reducing infrastructure costs and increasing efficiency.

Critical to successful implementation are standardization efforts across refueling protocols, storage pressures, and safety regulations. Public-private partnerships will likely drive initial infrastructure development, with government incentives playing a crucial role in overcoming the "chicken-and-egg" problem between vehicle adoption and infrastructure availability.

The transition timeline varies significantly by region, with East Asia (particularly Japan and South Korea), parts of Europe, and California leading hydrogen infrastructure development. These regional differences highlight the importance of tailored implementation strategies reflecting local energy resources, policy environments, and existing transportation infrastructure.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!