Zirconia's Expansion in Emerging Technology Sectors

Zirconia Tech Evolution

Zirconia, a versatile ceramic material, has undergone significant technological evolution over the past few decades. Initially used primarily in dental and medical applications, zirconia has expanded its reach into various emerging technology sectors. This evolution can be traced through several key stages, each marked by advancements in material science and manufacturing processes.

In the 1960s and 1970s, zirconia's potential was first recognized in the field of ceramics. During this period, researchers focused on understanding its unique properties, such as high strength, toughness, and chemical inertness. The development of stabilized zirconia, particularly yttria-stabilized zirconia (YSZ), marked a crucial milestone in this era, enabling broader applications.

The 1980s and 1990s saw a surge in zirconia's use in medical and dental implants. This period was characterized by improvements in biocompatibility and the development of more refined manufacturing techniques. The introduction of computer-aided design and manufacturing (CAD/CAM) technologies in dentistry revolutionized the production of zirconia-based dental prosthetics, enhancing precision and efficiency.

As the new millennium dawned, zirconia found its way into advanced engineering applications. The early 2000s witnessed the material's integration into cutting-edge technologies such as solid oxide fuel cells (SOFCs) and oxygen sensors. This expansion was facilitated by advancements in nanomaterial science, allowing for the creation of zirconia with tailored properties at the nanoscale.

The past decade has seen zirconia's role in emerging technologies grow exponentially. In the field of electronics, zirconia-based thin films have gained prominence in the development of high-k dielectrics for next-generation semiconductor devices. Simultaneously, the material has found applications in advanced coatings for aerospace and automotive industries, leveraging its excellent thermal and wear-resistant properties.

Most recently, zirconia has been at the forefront of additive manufacturing innovations. The development of zirconia-based 3D printing materials has opened up new possibilities in rapid prototyping and custom manufacturing across various industries. This advancement has been particularly impactful in the medical field, enabling the production of patient-specific implants and prosthetics with unprecedented precision.

Looking ahead, the technological evolution of zirconia is poised to continue its upward trajectory. Ongoing research in areas such as nanostructured zirconia composites and zirconia-based energy storage materials promises to further expand its applications in emerging technology sectors. As material scientists and engineers continue to push the boundaries of zirconia's capabilities, we can expect to see this remarkable ceramic play an increasingly vital role in shaping the technologies of the future.

Market Demand Analysis

The market demand for zirconia in emerging technology sectors has been experiencing significant growth in recent years. This surge is primarily driven by the material's unique properties, including high strength, excellent thermal insulation, and biocompatibility, which make it suitable for a wide range of advanced applications.

In the electronics industry, zirconia is gaining traction as a crucial component in solid oxide fuel cells (SOFCs) and oxygen sensors. The global SOFC market is projected to expand rapidly, with a compound annual growth rate (CAGR) exceeding 20% over the next five years. This growth is fueled by increasing demand for clean energy solutions and the push towards decarbonization in various industries.

The medical and dental sectors represent another substantial market for zirconia. The material's biocompatibility and aesthetic properties have led to its widespread adoption in dental implants and prosthetics. The global dental zirconia market is expected to grow at a CAGR of around 8% through 2025, driven by the rising prevalence of dental disorders and the growing elderly population worldwide.

In the aerospace and automotive industries, zirconia is finding applications in thermal barrier coatings and high-performance components. The increasing focus on fuel efficiency and emission reduction in these sectors is driving the demand for advanced materials like zirconia. The global thermal barrier coatings market, where zirconia plays a significant role, is anticipated to grow at a CAGR of approximately 6% over the next five years.

The semiconductor industry is another emerging market for zirconia, particularly in the form of zirconium oxide thin films. These films are being explored for use in next-generation memory devices and high-k dielectrics. As the semiconductor industry continues to push the boundaries of miniaturization and performance, the demand for advanced materials like zirconia is expected to increase.

In the field of additive manufacturing, zirconia-based ceramics are gaining attention for their potential in producing complex, high-performance parts. The global ceramic 3D printing market, which includes zirconia-based materials, is projected to grow at a CAGR of over 25% in the coming years, driven by advancements in printing technologies and increasing adoption in industries such as healthcare and aerospace.

The water treatment sector is also showing increased interest in zirconia-based materials, particularly for membrane technologies. Zirconia membranes offer superior chemical and thermal stability compared to traditional polymeric membranes, making them attractive for challenging separation processes in industrial wastewater treatment and desalination applications.

Overall, the market demand for zirconia in emerging technology sectors is characterized by robust growth across multiple industries. This trend is expected to continue as new applications are developed and existing technologies are refined, positioning zirconia as a key material in the advancement of various high-tech fields.

Current Challenges

Zirconia's expansion into emerging technology sectors faces several significant challenges that need to be addressed for successful integration and widespread adoption. One of the primary obstacles is the high production cost associated with zirconia-based materials. The complex manufacturing processes and the need for specialized equipment contribute to elevated expenses, making it difficult for zirconia to compete with more established materials in terms of cost-effectiveness.

Another challenge lies in the limited understanding of zirconia's long-term performance in novel applications. While its properties are well-documented in traditional sectors like dentistry and ceramics, there is a lack of comprehensive data on its behavior in emerging fields such as aerospace, electronics, and energy storage. This knowledge gap creates uncertainty for potential adopters and slows down the integration process.

The scalability of zirconia production for large-scale industrial applications presents another hurdle. Current manufacturing methods may not be sufficient to meet the increasing demand in emerging sectors, necessitating the development of new, more efficient production techniques. This scaling challenge is particularly evident in areas requiring high-volume production, such as automotive and consumer electronics.

Zirconia's brittleness and susceptibility to low-temperature degradation (LTD) in certain environments pose technical challenges that limit its application in some emerging fields. Overcoming these inherent material limitations requires innovative approaches to material design and processing, which may involve the development of new composites or surface treatments.

The lack of standardization across different zirconia grades and applications is another significant challenge. The absence of universally accepted standards makes it difficult for manufacturers and end-users to ensure consistent quality and performance, particularly in emerging sectors where zirconia's use is still evolving. This standardization gap can lead to hesitation among potential adopters and slow down market penetration.

Furthermore, the integration of zirconia into existing manufacturing processes and supply chains presents logistical challenges. Many industries have established workflows optimized for traditional materials, and the introduction of zirconia may require significant modifications to equipment, processes, and quality control measures. This adaptation process can be time-consuming and costly, acting as a barrier to adoption in some sectors.

Lastly, there is a shortage of skilled professionals with expertise in working with zirconia in these new application areas. The specialized knowledge required for processing, characterizing, and implementing zirconia-based solutions in emerging technologies is not yet widespread, creating a skills gap that needs to be addressed through education and training initiatives.

Zirconia Applications

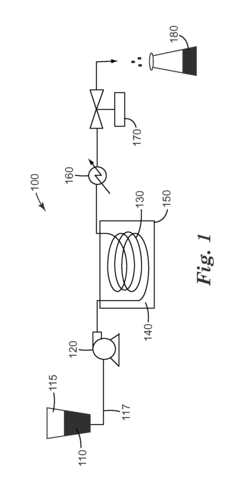

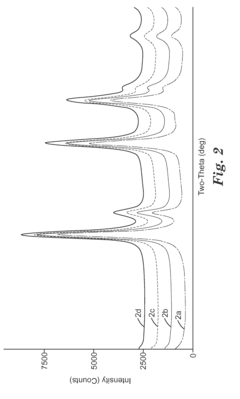

01 Zirconia synthesis and processing methods

Various methods for synthesizing and processing zirconia are described, including techniques for controlling particle size, crystalline structure, and purity. These methods aim to produce zirconia with specific properties for different applications, such as improved mechanical strength or thermal stability.- Zirconia synthesis and processing: Various methods for synthesizing and processing zirconia materials, including techniques for controlling particle size, crystalline structure, and purity. This encompasses sol-gel methods, hydrothermal synthesis, and other advanced processing techniques to produce zirconia with specific properties for different applications.

- Zirconia-based dental materials: Development of zirconia-based materials for dental applications, including dental implants, crowns, and bridges. These materials are designed to combine high strength, biocompatibility, and aesthetic properties suitable for dental restorations.

- Zirconia in ceramic composites: Incorporation of zirconia into ceramic composites to enhance mechanical properties, such as strength and toughness. This includes the development of zirconia-toughened alumina (ZTA) and other zirconia-reinforced ceramic materials for various industrial and biomedical applications.

- Stabilized zirconia for high-temperature applications: Methods for stabilizing zirconia with various dopants to maintain its cubic or tetragonal crystal structure at high temperatures. This stabilized zirconia is used in applications such as thermal barrier coatings, solid oxide fuel cells, and oxygen sensors.

- Zirconia in catalysis and environmental applications: Utilization of zirconia as a catalyst support or active component in various catalytic processes, including emissions control, water treatment, and chemical synthesis. This involves the development of zirconia-based materials with high surface area and specific pore structures for enhanced catalytic performance.

02 Zirconia-based dental materials

Zirconia is widely used in dental applications due to its biocompatibility and aesthetic properties. Innovations in this field include the development of zirconia-based ceramics for dental implants, crowns, and bridges, as well as techniques for improving their durability and appearance.Expand Specific Solutions03 Zirconia in electronic and optical applications

Zirconia finds applications in electronic and optical devices due to its unique properties. Research in this area focuses on developing zirconia-based materials for use in sensors, solid oxide fuel cells, and optical coatings, among others.Expand Specific Solutions04 Zirconia composites and coatings

The development of zirconia composites and coatings aims to enhance the material's properties or combine them with other materials. This includes research on zirconia-reinforced ceramics, zirconia-based thermal barrier coatings, and nanocomposites for improved performance in various applications.Expand Specific Solutions05 Stabilization and phase transformation of zirconia

Research on stabilizing zirconia and controlling its phase transformations is crucial for many applications. This includes the use of dopants to stabilize specific crystal structures, as well as studies on the martensitic transformation of zirconia and its impact on material properties.Expand Specific Solutions

Key Industry Players

The expansion of zirconia in emerging technology sectors is characterized by a dynamic competitive landscape in a rapidly evolving market. The industry is in a growth phase, with increasing market size driven by applications in electronics, healthcare, and advanced materials. The global zirconia market is projected to reach significant value in the coming years, indicating substantial growth potential. Technologically, zirconia applications are at varying stages of maturity. Companies like 3M Innovative Properties Co. and Saint-Gobain Ceramics & Plastics, Inc. are leading in advanced applications, while emerging players such as Xidian University and BYD Co., Ltd. are focusing on innovative uses in electronics and energy sectors. The involvement of diverse entities, from established corporations to research institutions, suggests a competitive environment with ongoing technological advancements and market opportunities.

Saint-Gobain Ceramics & Plastics, Inc.

Kyocera Corp.

Innovative Research

- Zirconia-based particles with 0.02 to 20 mole percent lanthanide element oxide and 0 to 15 mole percent yttrium oxide are synthesized using a hydrothermal treatment method, resulting in crystalline particles with an average primary size of no greater than 100 nanometers, which are then used in sols, composites, and sintered bodies to enhance mechanical properties and refractive index.

- Zirconia-based particles with controlled doping levels of lanthanide elements (0.02-20 mole percent) and yttrium oxide (0-15 mole percent) are synthesized using a hydrothermal method, resulting in crystalline particles with average sizes less than 100 nanometers, which are then integrated into organic matrices to form stable composites and sintered bodies.

Environmental Impact

The expansion of zirconia in emerging technology sectors has significant environmental implications that warrant careful consideration. As this advanced ceramic material finds increasing applications across various industries, its environmental impact becomes a crucial factor in assessing its long-term sustainability and viability.

One of the primary environmental concerns associated with zirconia production is the energy-intensive manufacturing process. The high temperatures required for sintering and processing zirconia contribute to increased carbon emissions and energy consumption. However, ongoing research and development efforts are focused on optimizing production techniques to reduce energy requirements and minimize the carbon footprint of zirconia manufacturing.

The mining and extraction of zirconium, the primary raw material for zirconia production, also pose environmental challenges. Open-pit mining operations can lead to habitat destruction, soil erosion, and water pollution if not managed properly. Sustainable mining practices and responsible resource management are essential to mitigate these negative impacts and ensure the long-term availability of zirconium resources.

On the positive side, zirconia's exceptional durability and resistance to wear and corrosion contribute to extended product lifespans in various applications. This longevity reduces the need for frequent replacements, ultimately decreasing waste generation and resource consumption. Additionally, zirconia's biocompatibility and inertness make it an environmentally friendly alternative to certain toxic materials in medical and dental applications.

The use of zirconia in emerging clean energy technologies presents an opportunity for positive environmental impact. Its application in solid oxide fuel cells and other energy-efficient systems can contribute to reduced greenhouse gas emissions and improved energy efficiency across various sectors. Furthermore, zirconia's potential in catalytic converters and emissions control systems can help mitigate air pollution from industrial processes and transportation.

As zirconia expands into new technological domains, its role in promoting sustainability becomes increasingly important. Research into recyclability and end-of-life management for zirconia-based products is crucial to minimize waste and maximize resource efficiency. Developing closed-loop systems for zirconia recycling and reuse could significantly reduce the environmental footprint of this material throughout its lifecycle.

In conclusion, while the expansion of zirconia in emerging technology sectors presents some environmental challenges, particularly in production and raw material extraction, its potential benefits in terms of product longevity, clean energy applications, and pollution control offer promising avenues for sustainable development. Balancing these factors and continuously improving manufacturing and recycling processes will be key to ensuring that zirconia's technological advancements align with environmental stewardship goals.

Regulatory Framework

The regulatory framework surrounding zirconia's expansion in emerging technology sectors is complex and multifaceted, reflecting the diverse applications of this versatile material. As zirconia finds its way into advanced electronics, medical devices, and energy technologies, regulatory bodies worldwide are adapting their guidelines to ensure safety, efficacy, and environmental sustainability.

In the electronics sector, regulations focus on the use of zirconia in semiconductor manufacturing and advanced packaging. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations in other regions set strict limits on potentially harmful substances in electronic equipment. While zirconia itself is generally considered safe, its production processes and potential interactions with other materials in electronic devices are subject to scrutiny.

For medical applications, zirconia-based products face rigorous approval processes. In the United States, the Food and Drug Administration (FDA) classifies zirconia dental implants and other medical devices containing zirconia under specific regulatory pathways. The FDA's 510(k) clearance process and CE marking in Europe are critical for bringing zirconia-based medical devices to market. These regulations emphasize biocompatibility, mechanical properties, and long-term stability of zirconia materials in the human body.

In the energy sector, particularly for solid oxide fuel cells and other clean energy technologies, zirconia's use is governed by a combination of energy efficiency standards and environmental regulations. The U.S. Department of Energy and the European Commission have established guidelines for the development and deployment of fuel cell technologies, which include specifications for zirconia-based components.

Environmental regulations also play a significant role in shaping zirconia's expansion. The mining and processing of zirconium minerals, from which zirconia is derived, are subject to environmental impact assessments and sustainability requirements. Countries rich in zirconium resources, such as Australia and South Africa, have implemented specific mining regulations that affect the global supply chain of zirconia.

As nanotechnology applications of zirconia emerge, regulatory bodies are developing new frameworks to address potential risks. The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation and similar initiatives in other countries are evolving to encompass nanomaterials, including nanostructured zirconia.

Intellectual property regulations also influence zirconia's technological expansion. Patent laws and trade secret protections govern the development and commercialization of novel zirconia-based technologies. International agreements on technology transfer and intellectual property rights impact the global diffusion of zirconia innovations across emerging sectors.